With $500M+ Potential by 2026, Worksport Ltd. Could Be Your Top ESG and Sustainable Energy Play

Build your watchlist with us

Get the latest stock ideas direct to your inbox. 100% free and your information stays with us.

Top 5 Reasons to Consider Worksport Ltd.

Climate Change and Soaring Energy Costs

Oil’s price over the past year has more than doubled, gas prices hit their highest ever recorded average price, (8) and U.S. consumers face some of the priciest electric bills they’ve ever encountered.

WKSPT Is Tightly Held and at the Heart of an ESG Boom

With a Float of 12.76M, 30.10% of shares held by Insiders, and 4.77% of shares held by Institutions, as of Mar 24, 2022, (13) this stock is tightly held and can move fast when catalysts work in its favor- namely the boom in ESG investing.

Game-Changing Products That Could Benefit From Government Initiatives

Supportive government initiatives, both in the infrastructure bill and beyond, could significantly contribute to the growth of Worksport’s products.

Its Tonneau Covers Conquered the Industry Early...And Led to Bigger Things

Since 2011, Worksport has used its transformative tonneau covers to conquer the market. Its tonneau covers fit a variety of uses and budgets and provide game-changing features.

Terravis Could Completely Revolutionize Sustainable Energy and Energy Storage

The Terravis System is a mobile panel and solar generator system. You can use it to power your life or extend your electric vehicle range wherever you are.

Cracking A Potential $2 Trillion Market

The global renewable energy market could skyrocket from roughly $881.7 billion in 2020 to nearly $2 trillion by 2030. (Source 10)

While there are many different ways to play this market, Nasdaq-listed renewable energy innovator Worksport Ltd. (NASDAQ:WKSP) could be the most disruptive force to penetrate this industry yet.

Worksport Ltd. (NASDAQ:WKSP) cut its teeth in the auto accessories industry after its founding in 2011 and began producing and selling tonneau covers. Since then, it has expanded its offerings and built itself into a green energy solutions company specializing in off-grid, green power. Worksport took what worked with its automotive tonneau covers and added portable COR energy storage systems and hydrogen charging stations for EVs to its product suite.

Most notably, its mobile panel and solar generator system, Terravis, is in its final development stages. By enabling people to power day-to-day activities or extend the battery life of an EV, it may take renewable power to the next level.

With a brand new HQ opened in Mississauga, ON, Canada, a new 222,000 sq ft U.S.-based manufacturing facility purchased, significant OEM partnerships forged, and its Terravis System potentially weeks away from launch, Worksport Ltd. (NASDAQ:WKSP) finds itself at the apex of a potential revolution.

A revolution that, by 2026, could give it $500M+ potential. (Source 1)

Worksport Ltd. (NASDAQ:WKSP) could be a company to watch very very closely in this environment, and there are five primary reasons why.

Reason 1- Climate Change and Soaring Energy Costs

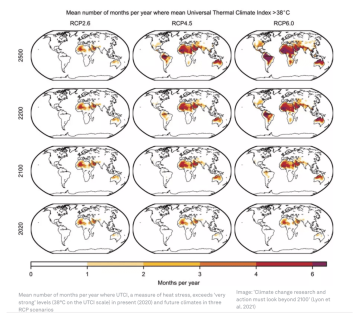

First and foremost, climate change will worsen unless human activity drastically adapts. Existing oil, gas, and coal demand caused global CO2 emissions to rise by nearly 5% in 2021.

CO2 also reached its highest-ever concentration in the atmosphere- roughly 50% higher than the start of the industrial revolution. (Source 2)

As the U.N. says, climate change is “Code Red” for humanity. (Source 3) Within the next 18 years, it could make the world “sicker, hungrier, poorer, gloomier and way more dangerous”. (Source 4)

According to the World Economic Forum, if we fail to meet the Paris Agreement goals ASAP, much of the Earth could become uninhabitable by 2500. (Source 5)

With higher and more volatile energy prices burning holes in people’s wallets, what better time than now for Worksport Ltd. (NASDAQ:WKSP) to spearhead the drastic changes needed to decarbonize energy and adopt renewable solutions?

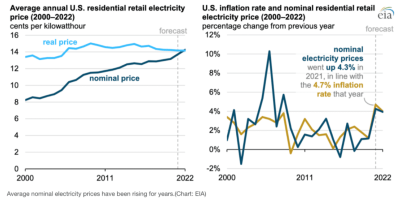

Oil’s price over the past year has more than doubled, and soon, it could touch $200 (Source 6) or even $300 a barrel if the status quo remains. (Source 7) As recently as Mar 11, 2022, gas prices, both regular unleaded and diesel, hit their highest ever recorded average price. (Source 8)

By tapping into the vitality of clean energy in modern times, Worksport has innovated products more effectively and efficiently to confront these issues head-on.

Reason 2: WKSPT Is Tightly Held and at the Heart of an ESG Boom

Despite what certain politicians claim, the Russia-Ukraine war isn’t the only reason energy costs are through the roof. But it’s undeniably a reason why already inflated prices further skyrocketed.

It shouldn’t be a surprise then why in the month since the full-scale invasion began on Feb 24, 2022, the WKSP stock soared 18.13% from $1.93 on the day of the invasion to its Mar 23, 2022 close of $2.28. (Source 11)

With a Float of 12.76M, 30.10% of shares held by Insiders, and 4.77% of shares held by Institutions, as of Mar 24, 2022, (Source 13) this stock is tightly held and can move fast when catalysts work in its favor.

More recent news beyond geopolitics and related climate change and ESG could work in Worksport’s favor too. The SEC just made a landmark decision in approving a proposal to require all publicly traded companies to disclose their greenhouse gas emissions and exposure to climate change risks. Companies will have to incorporate climate change into their financial reporting for the first time. (Source 14)

Even before the SEC threw down the hammer, many of the world’s largest companies had no other choice but to adopt lofty carbon neutrality climate goals. (Source 15) The number of institutional investors using ESG as “an integral part of sound investing” also rose 18% from 2019 to 2021, while fund selectors using ESG strategies rose from 65% to 77%. (Source 16)

More and more activist investors are also trying to force companies to adopt better ESG principles. Harvard Law notes that 2021 saw U.S.-based activist campaigns increase 14% year-over-year. ExxonMobil also lost a proxy fight when an activist hedge fund forced them to nominate at least two climate-friendly directors to its board. (Source 17)

Worksport Ltd. (NASDAQ:WKSP) and its solutions have been well ahead of the curve for over a decade and could thrive in this environment.

Reason 3: Game-Changing Products That Could Benefit From Government Initiatives

Worksport’s flagship tonneau covers have expanded into the ESS and Solar Energy space. We will go into further detail as to what makes Worksport’s products so unique and special, but supportive government initiatives could significantly contribute to their growth.

Consider the following:

- The $1 trillion infrastructure bill includes $65 billion of investments in the power grid to accommodate rising renewable energy capacity and cleantech projects. (Source 21)

- The infrastructure bill plans to fund thousands of miles of new transmission lines for wind and solar projects. (Source 21)

- The infrastructure bill plans to allocate $5 billion towards building an EV charging network (Source 22)

- A $7,500 EV tax credit (Source 23)

- The State of the Union called for more investment in renewables and tax incentives to speed up solar deployment. (Source 24)

Get the latest stock ideas direct to your inbox.

100% free and your information stays with us.

Throughout its countless production stages, development cycles, and technological expertise, Worksport has discovered multiple ways to utilize solar technology to generate power, with or without electric pickup trucks. The underlying concept is universal to job sites, homes, vehicles, and more.

Worksport strives to take its innovative product offerings global while adapting them for further mobile usage and elevating the way people live and think about clean energy.

That just scratches the surface of why it’s so well-positioned for these government incentives.

Reason 4: Its Tonneau Covers Conquered the Industry Early...And Led to Bigger Things

11 million pickup trucks were sold in 2020, and by 2030, EVs could take up 32% of the market share. (Source 1)

Worksport was early to the party in 2011 and has used its transformative tonneau covers to conquer the market.

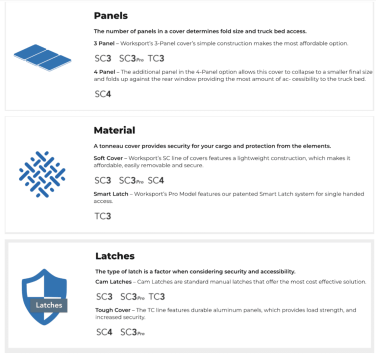

Its tonneau covers fit a variety of uses and budgets and provide game-changing features.

Worksport then leveraged this to become a sustainable energy company focused on creating solutions to help not only the automotive marketplace but also off-grid operations.

And that’s how Terravis was born.

Reason 5: Terravis Could Completely Revolutionize Sustainable Energy and Energy Storage

The Terravis System is the next evolution of Worksport’s (NASDAQ:WKSP) mission to capitalize on the growing shift of consumer mindsets towards clean energy with its proprietary solar and green hydrogen-based technologies.

The Terravis System is a mobile panel and solar generator system. You can use it to power your life or extend your electric vehicle range wherever you are. The integrated solar panels in the rugged tonneau cover collect the sun’s rays and store them in the high-capacity battery bank.

The system provides off-grid power using replaceable batteries. Batteries then can be charged using standard wall outlets, solar panels, 12V batteries, or patented Terravis SOLIS tonneau cover. (Source 27)

Terravis has successfully undergone multiple testing phases with minimal changes needed. Production is on track to begin by the end of March 2022, with subsequent deliveries to reservation holders in Q2 2022. (Source 29)

Key Takeaways

Renewable energy is crucial to battling climate change and inflated energy costs. It is integral towards evolving towards a far more sustainable way of living.

Worksport takes the practicality of standardized energy products and elevates them to increase storage and expenditure capacities and functionalities. The company is living proof that disrupting the standard way of life to meet the needs of both the consumer and the planet is beneficial to everyone.

So many catalysts are working in this company’s favor, both on the large-scale and company-specific scale.

Although nobody loves to see the planet burn due to human activity, companies like Worksport exist to do something about it. As the Terravis System prepares for its potential launch, it will be quite exciting to see how this company progresses.

Sources

Source 1: https://investworksport.com/

Source 2: https://www.iea.org/reports/global-energy-review-2021/co2-emissions

Source 3: https://www.cnbc.com/2021/08/09/ipcc-report-un-climate-report-delivers-starkest-warning-yet.html?__source=iosappshare%7Ccom.apple.UIKit.activity.CopyToPasteboard

Source 4: https://fox8.com/news/parts-of-the-planet-will-become-inhabitable-says-climate-change-report/

Source 5: https://www.weforum.org/agenda/2021/10/climate-change-could-make-some-areas-of-earth-uninhabitable-by-2500/

Source 6: https://www.msn.com/en-us/money/markets/oil-prices-at-24200-is-no-longer-crazy-analyst-says-in-dire-warning/ar-AAUQiLT

Source 7: https://www.cnbc.com/2022/03/08/russia-warns-of-300-oil-if-ban-goes-ahead-threatens-to-cut-off-european-gas.html

Source 8: https://gasprices.aaa.com/page/2/

Source 9: https://www.eia.gov/todayinenergy/detail.php?id=51438

Source 10: https://www.alliedmarketresearch.com/renewable-energy-market

Source 11: https://schrts.co/WpswwxCf

Source 12: https://finance.yahoo.com/news/goldman-sachs-sees-the-risk-of-us-entering-a-recession-114156355.html?fr=yhssrp_catchall

Source 13: https://finance.yahoo.com/quote/WKSP/key-statistics?p=WKSP

Source 14: https://news.yahoo.com/sec-proposes-first-mandatory-climate-150054083.html?fr=yhssrp_catchall

Source 15: https://www.visualcapitalist.com/ranked-the-50-companies-that-use-the-highest-percentage-of-green-energy/

Source 16: https://www.usgbc.org/articles/infrastructure-bill-could-pave-way-more-green-building-job-opportunities

Source 17: https://corpgov.law.harvard.edu/2022/01/26/annual-review-of-shareholder-activism-2/

Source 18: https://www.bloomberg.com/professional/blog/esg-assets-may-hit-53-trillion-by-2025-a-third-of-global-aum/

Source 19: https://www.businesswire.com/news/home/20201117006059/en/United-States-Renewable-Energy-Market-Report-2020-Growth-Trends-and-Forecast-to-2025—ResearchAndMarkets.com

Source 20: https://goterravis.com/wp-content/uploads/2021/11/Worksport_Terravis_Product-Design-and-specs-1.pdf?inf_contact_key=733acd0bbac412b9eaf99fad27e9a0f5680f8914173f9191b1c0223e68310bb1

Source 21: https://www.reutersevents.com/renewables/solar-pv/us-congress-passes-1-trillion-infrastructure-bill-spending-bill-tax-credits-could-hike#:~:text=US%20Congress%20passes%20bill%20to%20upgrade%20power%20grid,rising%20renewable%20energy%20capacity%20and%20demonstration%20cleantech%20projects.

Source 22: https://www.forbes.com/sites/stacynoblet/2021/11/24/ev-charging-and-the-infrastructure-bill-converting-federal-investments-into-local-impact/?sh=7fe009866385

Source 23: https://www.findthebestcarprice.com/electric-car-incentives/

Source 24: https://www.pv-tech.org/biden-calls-for-tax-incentives-to-accelerate-solar-deployment/

Source 25: https://worksport.com/?inf_contact_key=b6e607d893e36ce4a7c986919340dfc4680f8914173f9191b1c0223e68310bb1

Source 26: https://worksport.com/terravis/

Source 27: https://goterravis.com/

Source 28: https://goterravis.com/wp-content/uploads/2021/11/Worksport_Terravis_Product-Design-and-specs-1.pdf?inf_contact_key=733acd0bbac412b9eaf99fad27e9a0f5680f8914173f9191b1c0223e68310bb1

Source 29: https://investworksport.com/worksport-pre-production-terravis-system-moves-to-final-stages-of-development/

Disclaimer

Stock Research Today is a project of Dadmin Capital LLC and intended solely for entertainment and informational purposes. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/. This website / media webpage is owned, operated and edited by Dadmin Capital LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Dadmin Capital” refers to Dadmin Capital LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and promote small public companies. By reading our website / media webpage you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our website / media webpage .We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website / media webpage are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. Dadmin Capital business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Dadmin Capital. often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Compensation – Pursuant to an agreement between Dadmin Capital LLC and TD Media LLC, Dadmin Capital LLC has been hired for a period beginning on 3/31/22 and ending after 5 business days to publicly disseminate information about (NASDAQ: WKSP) via digital communications. We have been paid eleven thousand five hundred USD via ACH Bank Transfer. Social Media Compensation – Pursuant to an agreement between Dadmin Capital LLC and Social Media Outlet, Dadmin Capital LLC has hired Social Media Outlet for a period beginning on 3/31/22 and ending after one business day to publicly disseminate information about (NASDAQ: WKSP) via digital communications. We have paid this Social Media Outlet six thousand USD via ACH Bank Transfer. Pursuant to an agreement between Dadmin Capital LLC and Social Media Outlet, Dadmin Capital LLC has hired Social Media Outlet for a period beginning on 3/31/22 and ending after one business day to publicly disseminate information about (NASDAQ: WKSP) via digital communications. We have paid this Social Media Outlet one thousand USD via ACH Bank Transfer. Pursuant to an agreement between Dadmin Capital LLC and Social Media Outlet, Dadmin Capital LLC has hired Social Media Outlet for a period beginning on 3/31/22 and ending after one business day to publicly disseminate information about (NASDAQ: WKSP) via digital communications. We have paid this Social Media Outlet one thousand USD via ACH Bank Transfer.