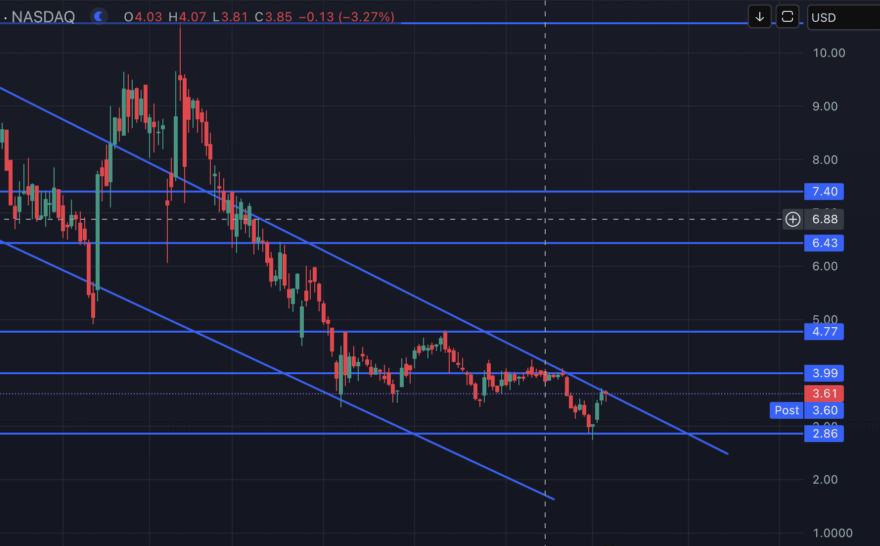

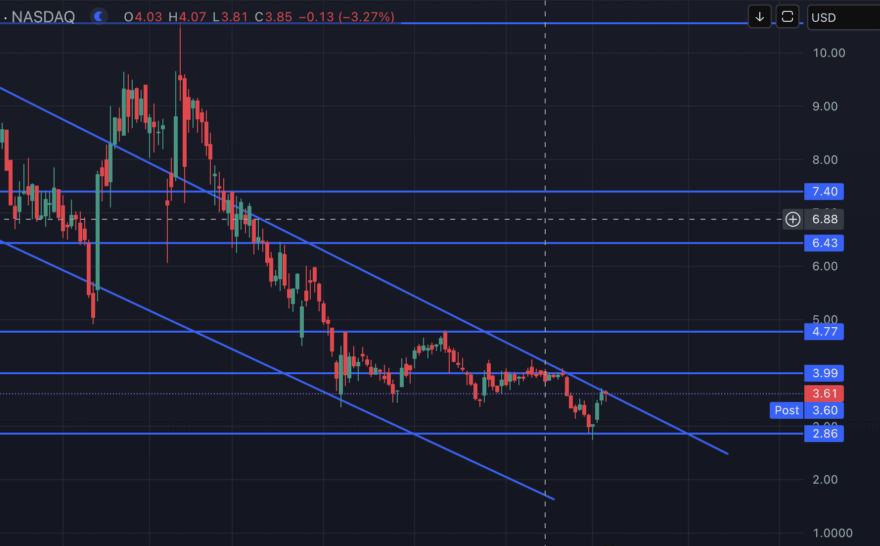

Potential support at 3.99

LATEST NEWS

About Prairie

Prairie Operating Co. (NASDAQ: PROP) is an independent energy company focused on the development of oil and natural gas assets across the United States, with a primary focus on Colorado’s Denver-Julesburg (DJ) Basin.

The company now holds approximately 60,000 net acres, significantly expanded by its $12.5 million acquisition of Edge Energy II’s assets in July 2025. This deal added around 11,000 net acres, over 190 barrels of oil equivalent per day (boepd) in production, and more than 40 future drilling locations — strengthening Prairie’s position in one of the country’s most active oil basins.

Prairie continues to build its operations around capital efficiency, environmental awareness, and technical innovation. Its leadership team has emphasized the use of modern drilling techniques and resource management approaches that align with evolving regulatory and environmental standards.

On the capital side, Prairie recently announced an expansion of its financial structure. The company confirmed access to a reserve-based lending facility totaling $1 billion, with a current borrowing base of $475 million set to mature in 2029. This facility now includes participation from Bank of America and West Texas National Bank, providing Prairie with increased financial flexibility for continued development and potential M&A activity.

Earlier this year, the company completed a $43.8 million equity raise, alongside $148.3 million in preferred equity and warrants, which supported its $602.75 million asset acquisition from Bayswater E&P, a major move reinforcing Prairie’s growth strategy.

As domestic energy production regains political and strategic momentum, Prairie’s expanded acreage, bolstered capital position, and disciplined operating strategy may make it an increasingly notable name in the U.S. energy space.

4 Reasons why Prairie Operating Co. (NASDAQ: PROP) is in prime position to experience a surge in growth and shareholder value:

IDENTIFYING THE OPPORTUNITY

PRICE HAS HISTORICALLY FAVORED THIS PRICE RANGE

With a low float and solid pipeline, a little bit of investor interest could send this soaring!

KEY LEVELS

Key Level #1: $4.77 (+24.32%)

Key Level #2: $6.09 (+78.11%)

Key Level #3: $7.40 (105.3%)

Support: $3.99

Prairie Operating Co.

(NASDAQ: PROP)

Meet the Team Behind Prairie Operating Co. (NASDAQ: PROP)

The Prairie senior management team has a long record of commitment to responsible investment and safe operations. Management has over 100 years of operational experience around the world and applies best practices from the board room to field operations.

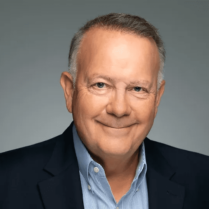

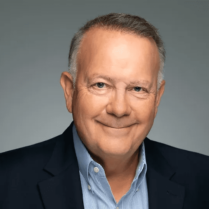

Edward Kovalik - Chairman and Chief Executive Officer

Ed was the founder and managing member of KLR Group, a merchant bank focused on the Energy sector. KLR founded numerous oil & gas portfolio companies including River Bend, a JV in the Bakken with Blackstone/GSO. KLR also founded KLR Energy, a SPAC that acquired and built Rosehill Resources into a $750M enterprise value Permian company. In addition, KLR founded Seawolf Water Resources to provide for and dispose of water in the Permian basin, and Prairie Partners, to roll up ground leases under utility scale solar and wind farms.

Gary Hanna - President

Gary has over 40 years of public workout and start-up experience in exploration and production, having focused primarily in the Permian, Mid-Continent and the Gulf of Mexico. Gary served as the Chairman, President, and CEO of KLR Energy, having successfully acquired Tema to form Rosehill Resources, a pureplay Permian company that grew to 22,000 Boe/D of production. Before that, Gary was the Chairman, President and CEO of EPL Oil & Gas, which was sold to EXXI for $2.4B in an all-cash transaction. Prior to EPL, Gary served as the President of Maritech/SVP TTI whose market capitalization grew from $150M to $2.5B during his tenure. He served as the President and CEO of Gulfport Energy and the Chief Operating Offering of DLB Oil & Gas from its IPO through the eventual sale to Chesapeake.

Gregory S. Patton - Executive Vice President and Chief Financial Officer

Gregory S. Patton has served as the Executive Vice President and Chief Financial Officer of the Company since April 2025. Prior to that, Mr Patton served as the Company’s Executive Vice President, Commercial Development from November 2024 through March 2025, and he began his employment with the Company in March 2024. Prior to joining the Company, Mr. Patton served as CFO of Trigger Energy, LLC, an oil field service company, from November 2022 until March 2024. Prior to that, Mr. Patton served as Senior Vice President, Corporate Development and Finance of Great Western Petroleum, LLC, a private oil and gas company, from May 2015 until its sale to PDC Energy Inc. in May 2022, and afterwards, pursued personal ventures until he began serving as CFO for Trigger Energy in November 2022. Prior to that, Mr. Patton served as Manager at Opportune, LLP., a consulting firm, from May 2011 to May 2015, and Ernst and Young, prior to May 2011. Mr. Patton received his Bachelor’s and Masters Degree in Accounting from University of Denver.

Bryan Freeman - Executive Vice President, Operations

Bryan was the SVP of Drilling and Completions at Rosehill Resources, where he managed the execution of the company’s $750M capital expenditures program over three years. Prior to that, Bryan was the Production & Operation Engineering Manager for SM Energy for the Eagle Ford and Gulf Coast region where he led an 82-person team and three frac fleets.

Before SM, Bryan served as a Senior Production Engineer at Hess, and Chevron before that. At Chevron, Bryan served as the team lead in Artificial Lift while overseeing a 300 well optimization project in the Gulf of Mexico. Bryan began his career in the service sector in roles at Schlumberger & Weatherford. He earned his engineering degree from UT, Austin, and is the author of a number of patents covering oil & gas production technologies.

Sources

- https://prairieopco.com/

- https://prairieopco.com/governance/leadership

- https://prairieopco.com/investor-overview

- https://prairieopco.com/press-releases

- https://prairieopco.com/events-presentations

- https://prairieopco.com/sec-filings

- https://prairieopco.com/stock-info

- https://prairieopco.com/governance/leadership

- https://prairieopco.com/pr/prairie-operating-co-issues-2025-guidance

- https://prairieopco.com/pr/prairie-operating-co-completes-shelduck-south-pad-prepares-for-new-developments

- https://prairieopco.com/pr/prairie-operating-co-announces-1-billion-reserve-based-lending-facility-with-citibank-na

- https://prairieopco.com/pr/prairie-operating-co-to-host-yearend-update-call-highlighting-current-operations-and-key-achievements-in-2024

- https://prairieopco.com/pr/prairie-operating-co-welcomes-energy-industry-veteran-richard-n-frommer-to-its-board-of-directors

- https://prairieopco.com/pr/prairie-operating-co-secures-takeaway-and-water-disposal-solutions-for-fullfield-development-through-strategic-midstream-partnerships

- https://prairieopco.com/pr/prairie-operating-co-partners-with-profrac-holding-corp-to-launch-electric-frac-fleet-in-colorado

- https://prairieopco.com/pr/prairie-operating-co-announces-board-resignation

- https://prairieopco.com/pr/prairie-operating-co-completes-acquisition-of-oilweighted-dj-basin-assets-from-nickel-road-operating

- https://prairieopco.com/pr/prairie-operating-co-spuds-its-first-well-at-shelduck-south-in-the-dj-basin

- https://finance.yahoo.com/news/prairie-operating-co-issues-2025-123000546.html

- https://finance.yahoo.com/news/prairie-operating-co-completes-shelduck-123000870.html

- https://finance.yahoo.com/news/owning-60-prairie-operating-co-111440521.html

- https://finance.yahoo.com/news/prairie-operating-co-announces-1-210100968.html

- https://finance.yahoo.com/news/prairie-operating-co-host-end-123000986.html

- https://finance.yahoo.com/news/infinitii-ai-reports-strong-35-133000858.html

- https://finance.yahoo.com/news/prairie-operating-co-welcomes-energy-211500265.html

- https://finance.yahoo.com/news/prairie-operating-co-secures-takeaway-120000184.html

- https://finance.yahoo.com/news/profrac-holding-prairie-operating-co-121821201.html

- https://finance.yahoo.com/news/profrac-holding-corp-partners-prairie-120000894.html

- https://finance.yahoo.com/news/prairie-operating-co-partners-profrac-120000134.html

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media LLC and The Investing Authority LLC, Virtus Media LLC has been hired by The Investing Authority LLC for a period beginning on 2025-06-30 and ending 2025-09-30 to publicly disseminate information about NASDAQ:PROP via digital communications. The Investing Authority was compensated two-hundred fifty thousand dollars USD by Prairie Operating Co. for a stock awareness campaign starting on 2025-06-30 and ending on 2025-09-30. We have been paid one hundred and ninety-five thousand dollars USD. for Virtus Media Group LLC.

Social Media Influencer Compensation: Influencer has been hired by Virtus Media Group LLC to publicly disseminate information about NASDAQ: PROP. They have been paid two thousand USD. Influencer has been hired by Virtus Media Group LLC to publicly disseminate information about NASDAQ: PROP. They have been paid one thousand USD. Influencer has been hired by Virtus Media Group LLC to publicly disseminate information about NASDAQ: PROP. They have been paid on thousand two hundred USD.