LATEST NEWS

DiaMedica Therapeutics Announces Inclusion in the Russell 2000® and Russell 3000® Indexes

5 Reasons Why DiaMedica Therapeutics (NSDQ: DMAC) Could Be Poised For Significant Upside Potential

IDENTIFYING THE OPPORTUNITY

INSTITUTIONAL SUPPORT IS IN PLACE AND READY TO RUN

We are in a significant blast zone and are seeing sparks

TARGETS

Key Level #1: $4.49 (+17.32%)

Key Level #2: $5.09 (+33.88%)

Key Level #3: $5.91 (+54.73%)

Key Level #4: $7.20 (+88.98%)

Potential Support: $3.75

Data written by Virtus Media on 6/27/2025: Not Financial Advice

DiaMedica Therapeutics

(NSDQ: dmac)

Reimagining Stroke Recovery Through KLK1-Driven Therapeutics

DiaMedica Therapeutics (Nasdaq: DMAC) is a clinical-stage biotechnology company focused on developing recombinant protein therapies for conditions involving vascular dysfunction. The company’s lead therapeutic candidate, DM199, is a synthetic version of KLK1 (kallikrein-1), a protein known to support blood flow, reduce inflammation, and maintain vascular integrity.

What Sets DiaMedica Therapeutics apart: DM199

A New Approach to Stroke Treatment

Current stroke therapies—such as tissue plasminogen activator (tPA)—are limited to patients who can be treated within a very short window after onset. DiaMedica is evaluating DM199 in a broader stroke population, including those who fall outside this treatment window. By enhancing natural blood flow pathways and potentially protecting brain tissue, KLK1-based therapies may offer a complementary strategy. This approach could help address a critical gap in stroke care by reaching patients who currently have limited or no treatment options under existing standards of care.

The Science of KLK1

KLK1 is a naturally occurring protein in the human body that helps regulate vascular tone and reduce inflammation. In preclinical and clinical research, it has shown promise in improving outcomes where blood flow is impaired, for example:

- Stroke,

- Hypertension,

- Kidney disorders

DiaMedica’s recombinant version, DM199, is designed for reliable dosing, safety, and scalability.

Developed through recombinant technology, DM199 is produced under controlled, clinical-grade conditions to ensure purity, consistency, and scalability for therapeutic use. This scientific foundation underscores the company’s focus on biologic precision and the rigorous processes that support its development pipeline.

Therapeutic Areas of Focus:

DM199 is being studied in:

- Acute Ischemic Stroke: Aimed at improving blood flow and post-stroke recovery.

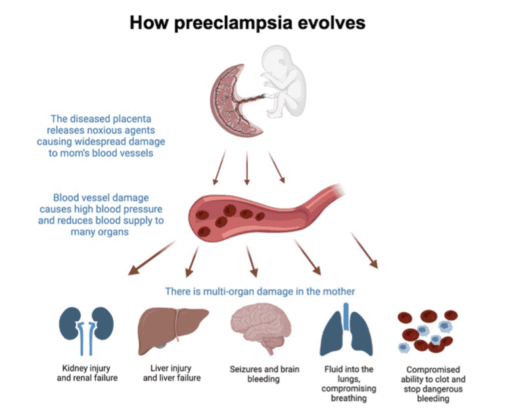

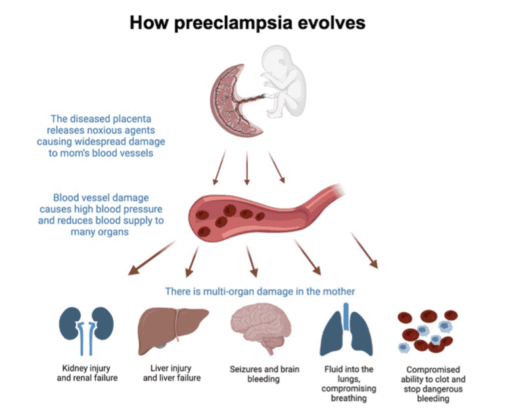

- Preeclampsia: Investigating potential to stabilize vascular function during pregnancy.

The company may explore further applications in vascular dementia, kidney disease, and other ischemic conditions based on KLK1’s mechanism of action.

DiaMedica Therapeutics

(NSDQ: DMAC)

Where Innovation Meets Evidence: DM199 in Clinical Development

Clinical Pipeline Overview

DiaMedica’s clinical development program is centered on DM199, a recombinant form of the KLK1 protein, currently being investigated in two major therapeutic areas: acute ischemic stroke and preeclampsia. The company’s lead trial, ReMEDy2, is a Phase 2/3 study designed to evaluate the safety and efficacy of DM199 in stroke patients, including those who are ineligible for existing treatments like tPA.

In parallel, a Phase 2 trial is underway to assess DM199’s potential in preeclampsia, a life-threatening pregnancy complication with no approved drug therapies. These studies reflect a strategic focus on high-need conditions where vascular dysfunction plays a central role, and they aim to generate clinical evidence that supports both safety and therapeutic value across diverse patient populations.

DiaMedica Therapeutics

(NSDQ: DMAC)

DiaMedica's Leadership: Experienced and Committed

Rick Pauls

President & CEO

Rick Pauls was appointed our President and Chief Executive Officer in 2009. Mr. Pauls has served as a member of our board of directors since 2005 and as the Chairman of the Board from 2008 to 2014.

Before joining DiaMedica, Mr. Pauls was the Co-Founder and Managing Director of CentreStone Ventures, an early-stage life sciences venture capital fund, from 2002 until 2010. Mr. Pauls was an analyst for Centara Corporation, an early-stage venture capital fund, from 2000 until 2002. From 1997 until 1999, Mr. Pauls worked for General Motors Acceptation Corporation specializing in asset-backed securitization and structured finance. Additionally, Mr. Pauls has served on the board of directors of several public and private companies. Mr. Pauls received his B.A. in Economics from the University of Manitoba and his M.B.A. in Finance from the University of North Dakota.

Lorianne Masuoka, Md.d

Chief Medical Officer

Dr. Masuoka was appointed our Chief Medical Officer effective as of January 2024.

Dr. Masuoka has more than 25 years of experience building and expanding high value pipelines in the biopharmaceutical industry that have resulted in drug approvals and strategic alliances. She is a board-certified neurologist who has successfully created and overseen high performing teams to lead the clinical development of new medicines, with a focus in multiple sclerosis, oncology and epilepsy. Dr. Masuoka served as Chief Medical Officer of Epygenix Therapeutics, Marinus Pharmaceuticals, Cubist Pharmaceuticals (now Merck) and Nektar Therapeutics where, as a member of executive management, she managed teams in the areas of clinical research, pharmacovigilance, biostatistics and data management, regulatory affairs and clinical operations. Previously, she held various roles of increasing responsibility at FivePrime Therapeutics (now Amgen) and Chiron (now Novartis). In addition to her executive roles, Dr. Masuoka most recently served as a Board member at Pfenex Inc. (now Ligand) and served as a Board member at Opiant Pharmaceuticals (now Indivior).

Scott Kellen

Chief Financial Officer

Scott Kellen joined us in January 2018 as our Vice President of Finance and was appointed our Chief Financial Officer and Secretary in April 2018.

Before joining DiaMedica, Mr. Kellen served as Vice President and Chief Financial Officer of Sun BioPharma, Inc., a publicly-traded clinical-stage drug development company, from 2015 until 2018. From 2010 to 2015, Mr. Kellen served as Chief Financial Officer and Secretary of Kips Bay Medical, Inc., a publicly-traded medical device company. He became Chief Operating Officer of Kips Bay in 2012. From 2007 to 2009, Mr. Kellen served as Finance Director of Transoma Medical, Inc. From 2005 to 2007, Mr. Kellen served as a Corporate Controller of ev3 Inc. From 2003 to 2005, Mr. Kellen served as Senior Manager, Audit and Advisory Services of Deloitte & Touche, L.L.P. Altogether, Mr. Kellen has spent more than 25 years in the life sciences industry, focusing on publicly traded early stage and growth companies. Mr. Kellen has a B.S. in Business Administration from the University of South Dakota and is a Certified Public Accountant (inactive).

Sources

- Source 1: https://www.diamedica.com/

- Source 2: https://www.diamedica.com/clinical-trials

- Source 3: https://www.diamedica.com/investors

- Source 4: https://www.diamedica.com/company

- Source 5: https://finance.yahoo.com/quote/DMAC/

- Source 6: https://finance.yahoo.com/quote/DMAC/news/

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Pursuant to an agreement between Virtus Media LLC and JRZ Capital, Virtus Media LLC has been hired by JRZ Capital for a period beginning on 2025-06-30 and ending 2025-07-18 to publicly disseminate information about NASDAQ: DMAC via digital communications. We have been paid sixty thousand dollars USD.