RenovoRx, INC. (NASDAQ: RNXT)

7 Reasons Why RenovoRx, Inc. (NASDAQ: RNXT) Could Witness Unprecedented Growth In 2023

LATEST NEWS

RenovoRx Announces Initial Results in Pharmacokinetic (PK) Substudy: Data on RenovoGem™ Supports Potential for RenovoTAMP® Therapy Platform to Increase Local Gemcitabine (Chemotherapy) Delivery and Decrease Side Effects of Pancreatic Cancer Treatment.

RenovoRx, Inc. (Nasdaq: RNXT) Receives $9.00 Target Which Could Mean a Potential 500% Upside For This Tiny Biotech That Just Bounced Off Its 52-Week Low of $1.50

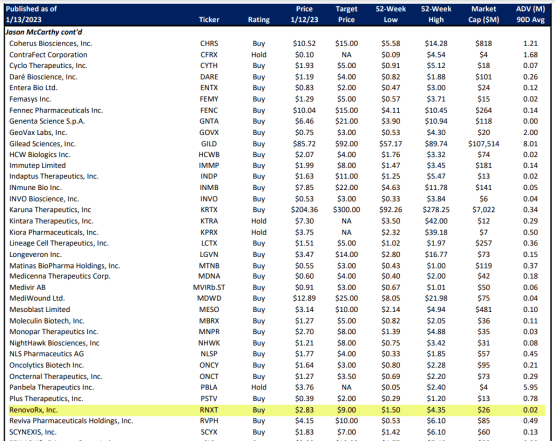

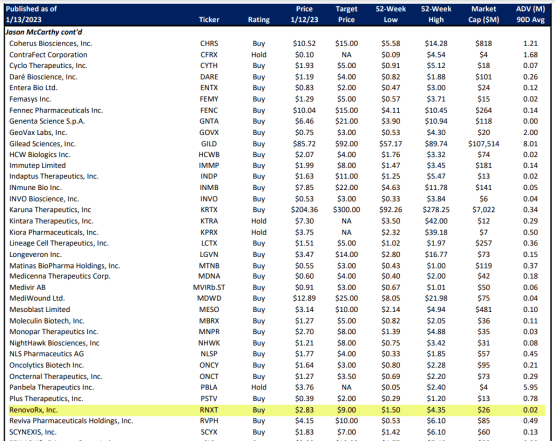

Jason McCarthy, Ph.D.

Senior Managing Director & Head of Biotechnology Research, Maxim Group

Jason McCarthy, Ph.D. joined Maxim Group in 2014 and he’s a Senior Managing Director & Head of Biotechnology Research. Prior to joining Maxim he received his doctoral degree in Biomedical Sciences at the Albert Einstein College of Medicine. Dr. McCarthy also holds Master’s degree in both Biomedical Research (Albert Einstein College of Medicine) and Molecular Biology (Adelphi University), as well as a B.S. in Biochemistry from Stony Brook University.

Generally speaking, when it comes to Wall Street, a target is a range at which an analyst believes a stock to be fairly valued relative to its projected and historical earnings. When an analyst raises their target for a stock, they generally expect the stock price to rise.

A target is an analyst’s projection of a security’s future range. Targets can pertain to all types of securities, from complex financial products to stocks and bonds. When setting a stock’s target, an analyst is trying to determine what the stock is worth and what the range could be in 12 or 18 months. Ultimately, targets depend on the valuation of the company that’s issuing the stock.

Analysts generally publish their targets in research reports on specific companies, along with their buy, sell, and hold recommendations for the company’s stock. Stock targets are often quoted in the financial news media.

But this time, buried in the Maxim Research Coverage Universe, as you can see in the screenshot below, you will see that Maxim’s analyst, Jason McCarthy, has a $9.00 target on RenovoRx, Inc. (Nasdaq: RNXT).

What does Maxim Group analyst Jason McCarthy know about Biotechnology Research that you don’t?

Probably a lot…

In fact, he’s actually Jason McCarthy, “Ph.D.” Senior Managing Director, Head of Biotechnology Research Maxim Group.

For those who don’t know, Maxim Group is a leading full-service investment bank, securities and wealth management firm headquartered in midtown Manhattan.

Maxim formed in 2002 as a spin-off of the U.S. subsidiary of the global investment firm Investec. They provide a comprehensive array of financial services including investment banking, global institutional sales, equity research, fixed income and derivative sales & trading, merchant capital, private wealth management, and prime brokerage services to a diverse range of corporate clients, institutional investors and high-net-worth individuals.

In 2022, Maxim celebrated its 20th year anniversary, completed 111 transactions, raised $6 billion dollars, and managed over $2 billion in M&A transactions. Not to mention, Maxim served as the lead in 83% of the transactions.

Maxim Group is a financial powerhouse, we trust their analysis...

IDENTIFYING THE OPPORTUNITY

This Cup-and-Handle Is Ready to Overflow!

Lets Pour our Profits into the Bank with this Perfect Cup and Handle setup forming on RNXT

TRADE CONFIRMATION

Watching for volume to push 50k plus daily for our impulsive push break, and sustained 75k daily volume for continuation. At the $5 level is when there is strong squeeze potential. We have strong support at the $3.80 level.

TARGETS

$4.98 (+30%)

$6.34 (+65%)

$8.82 (+130%)

$10.24 (+165%)

RenovoRx Inc. (nasdaq: rnxt) has an incredibly low float

Low float stocks refer to the securities that remain after a company’s stock has been issued to its controlling investors — meaning there are relatively few shares for the public to buy.

Market participants typically consider a float of 10-to-20 million shares as a low float. Some larger corporations have very high floats in the billions.

Companies with a low float frequently have a large portion of their equity held by controlling investors such as directors and employees, which leaves only a tiny percentage of the stock available for public trading.

That limited supply can cause dramatic price swings if demand changes quickly.

Because low-float stocks have fewer shares available, market participants may have difficulty finding shares available.

Low float stocks have the potential to present significant swings as active market participants take notice.

RenovoRx, Inc. (Nasdaq: RNXT) has less than 7.3M shares available in float as of 1/18/23 according to FinViz.com. A low-float stock can make significant moves due to volatility from so few shares being available, so this could be one interesting situation to watch closely.

RenovoRx, Inc. (Nasdaq: RNXT) is also considered a nano-cap. In general, nano-cap companies have market capitalizations of less than $50 million. Because nano-cap stocks are significantly smaller than mid cap or large cap companies, they have a higher potential to change valuation quickly.

As of 1/18/23 RenovoRx, Inc. (Nasdaq: RNXT) has a market cap of just around $33.73M according to Finviz.com.

Which is why things could get very interesting and also why you need to start your research on RenovoRx, Inc. (Nasdaq: RNXT).

RenovoRx, Inc. (Nasdaq: RNXT) Strengthens Its Intellectual Property (IP) Portfolio with Their 8th US Patent.

7-Year Patent Allows Orphan Drug Exclusivity in Market

RenovoRx, Inc. (Nasdaq: RNXT) Strengthens Its Intellectual Property (IP) Portfolio with Their 8th US Patent. bolstering the 7 years of Post-Approval Market Exclusivity That they Currently have with their Lead Oncology Product Candidate, RenovoGem™, Through the Orphan Drug Designation granted by the FDA for their first two indications…

On January 05, 2023 RenovoRx, Inc. (Nasdaq: RNXT) announced that on January 3, 2023 the United States Patent and Trademark Office issued US patent number 11,541,211 broadly covering methods for treating cholangiocarcinoma (bile duct cancer) by selectively delivering one or more therapeutic agents into targeted regions of the bile duct.

THIS IS RenovoRx’s eighth US patent

“Our newest patent builds upon our strong IP portfolio, which now consists of eight US method and device patents, one EU delivery system patent, and eight additional pending patents in the US, EU, and Asia,” said Shaun Bagai, CEO of RenovoRx.

“Additionally, this additional patent bolsters the seven years of post-approval market exclusivity that we currently have with our lead oncology product candidate, RenovoGem™, through the Orphan Drug designation granted by the FDA for our first two indications.”

Let's take a closer look at Their first and second indications

Locally Advanced Pancreatic Cancer and Extrahepatic Cholangiocarcinoma

First Indication: Pancreatic Cancer (Orphan Designation)

- One of the deadliest cancers, with poor outcomes.

- Pancreatic cancer is expected to quickly become the second leading cause of cancer-related deaths.

- 5-year overall survival rate of 5-10% (Stages I-IV).

In 2021, it is estimated that…

- 60,000+Americans were be diagnosed with pancreatic cancer

- More than 48,000 died of the disease

- Approximately 30% of patients have locally advanced pancreatic cancer (LAPC) and are not candidates for surgery

Current Standard of Care:

- Gemcitabine with Abraxanewas approved in 2013 based on an 8-week survival benefit.

- LAPC has approximately 12-15 month median overall survival.

Second Indication: extrahepatic Cholangiocarcinoma (eCCA), Bile Duct Cancer (Orphan Designation)

- Extrahepatic Cholangiocarcinoma (eCCA) is a disease with an exceptionally poor prognosis.

- 7,000 new cases diagnosed annually in the US.

- Based on the tumor location, eCCAis defined as either intra-hepatic (within the liver) or extrahepatic (extrahepatic Cholangiocarcinoma, or eCCA)

Current Standard of Care:

- Due to toxicity of the standard of care, a practice standard of care has not been established for eCCA.

- Gemcitabine with cisplatin used in ABC-2 clinical trial.

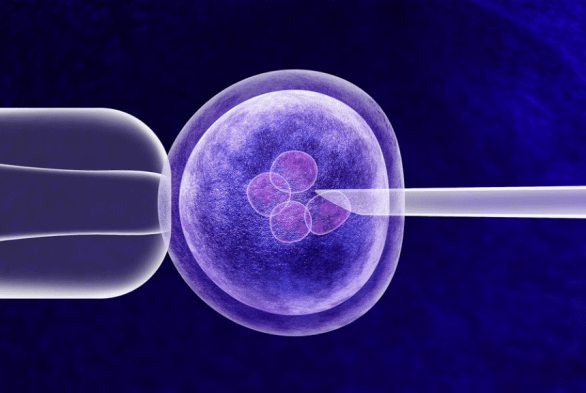

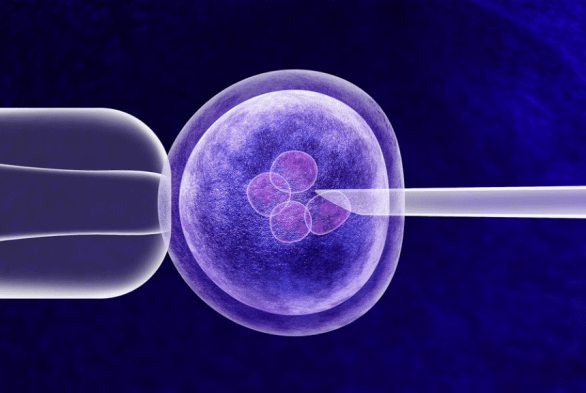

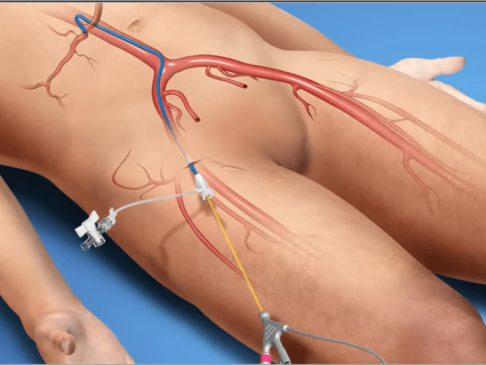

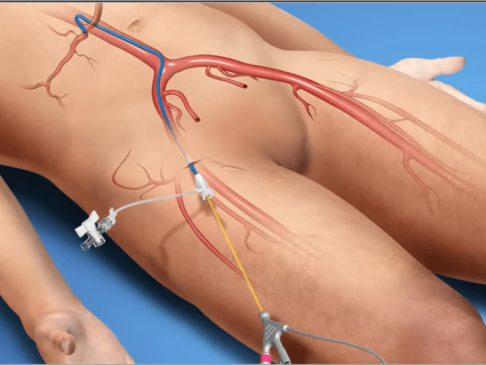

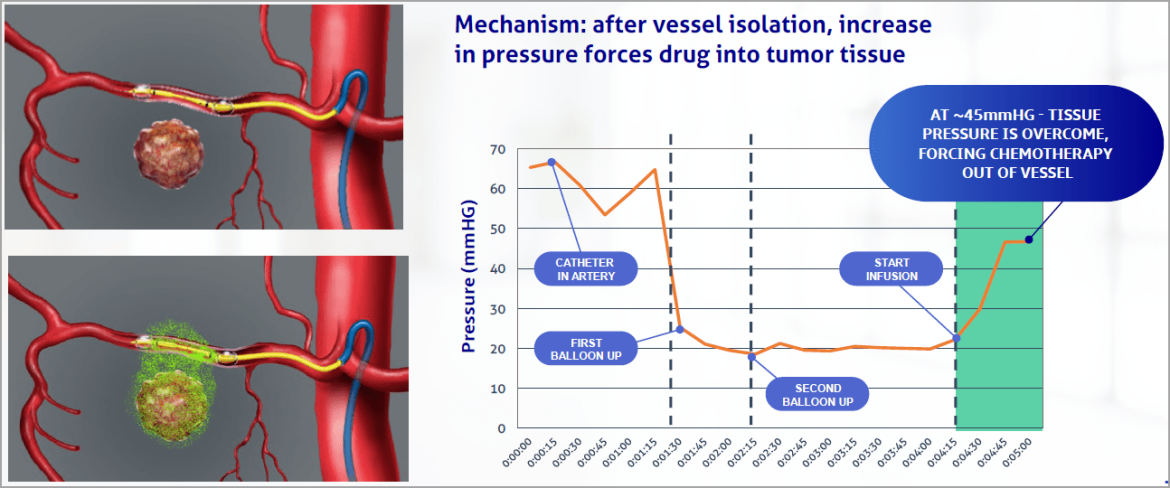

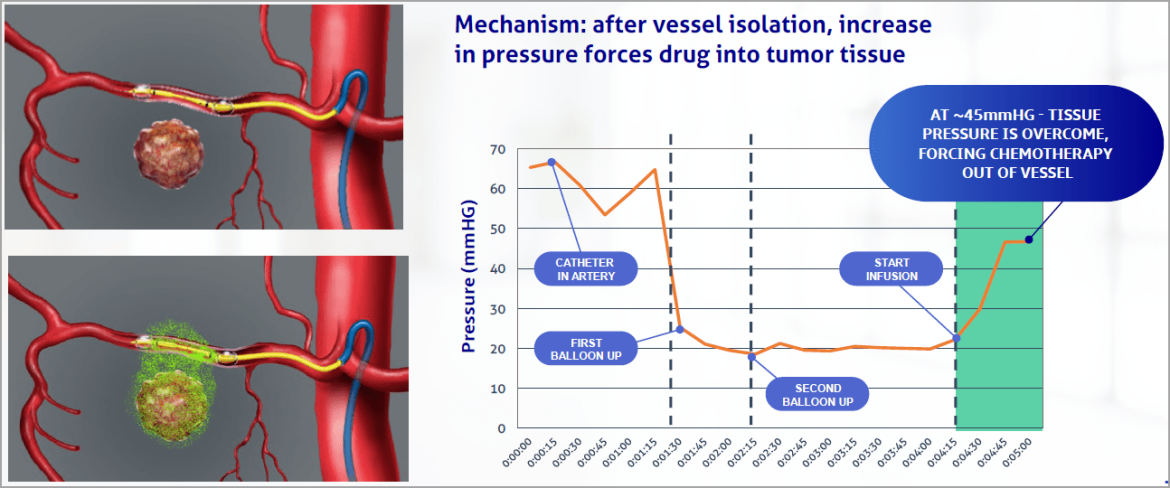

How Patients and Physicians Experience RenovoTAMPTherapy

- Interventional Radiology Lab-based procedure.

- Patient under local anesthetic/conscious sedation.

- RenovoCathinserted through femoral artery.

- Using a contrast agent under x-ray fluoroscopy, blood vessel segment adjacent to the tumor is isolated by adjusting balloon placement.

- 120mL of gemcitabine/saline delivered over 20 minutes.

- RenovoTAMP Procedure takes approximately 90 minutes.

- Catheter placement.

- Drug infusion.

- Catheter removal and access site hemostasis.

- Patient moved to the recovery room and was discharged the same day.

- RenovoTAMP Procedure repeated every 2 weeks over 4 months (8 treatments).

- Procedure easy to learn:physicians are proctored for the first 2-3 procedures.

RenovoRx, Inc. (Nasdaq: RNXT) Employs De-risked Small Molecule Chemotherapy Drugs First Drug Candidate: Intra-Arterial Gemcitabine.

Gemcitabine

- IV (systemic) gemcitabine has been marketed in the US since 1996.

- Established as part of the current standard of care for pancreatic cancer and other solid tumors.

- Potent anti-tumor agent: cell phase specificity primarily killing cells undergoing DNA synthesis (S-phase).

- Preclinical studies: inhibits 80-100% of tumor growth with subsequent increases in lifespan.

- Limitations of IV/systemic delivery of gemcitabine include poor tumor tissue penetration and high systemic toxicity.

RenovoGem (Intra-arterial Gemcitabine + RenovoCath)

- Intra-arterial gemcitabine for treatment of solid tumors.

- FDA Orphan Drug Designation (7 years marketing exclusivity post-approval) for pancreatic cancer and CCA.

- Phase 1/2 and observational registry trial data demonstrated an increase in overall survival time in patients with LAPC.

- Median survival of 27.9 months (including radiation pre-treatment) vs. 12-15 months historical control.

About RenovoRx, Inc. (Nasdaq: RNXT)

RenovoRx is a clinical-stage biopharmaceutical company with a vision to disrupt the current paradigm of cancer treatment. The company’s mission is to lead a revolution in oncology therapy by delivering its innovative and targeted intra-arterial (IA) delivery of chemotherapy directly to solid tumors.

The proprietary RenovoRx Trans-Arterial Micro-Perfusion (RenovoTAMP®) therapy platform aims to avoid the harsh side effects typical of the current standard of care, thus improving patient well-being and extension of life so more time may be enjoyed with loved ones.

RenovoTAMP utilizes approved chemotherapeutics with validated mechanisms of action and well-established safety and side effect profiles, with the goal of increasing their efficacy, improving their safety, and widening their therapeutic window.

RenovoRx’s lead product candidate, RenovoGemTM, is a combination of gemcitabine and its patented delivery system, RenovoCath®, and is regulated by the FDA.

RenovoRx’s lead product candidate, RenovoGemTM, is a combination of gemcitabine and its patented delivery system, RenovoCath®, and is regulated by the FDA as a novel oncology drug product to treat unresectable locally advanced pancreatic cancer (LAPC).

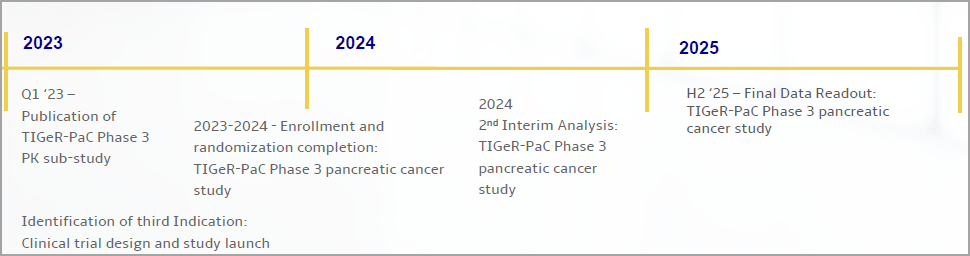

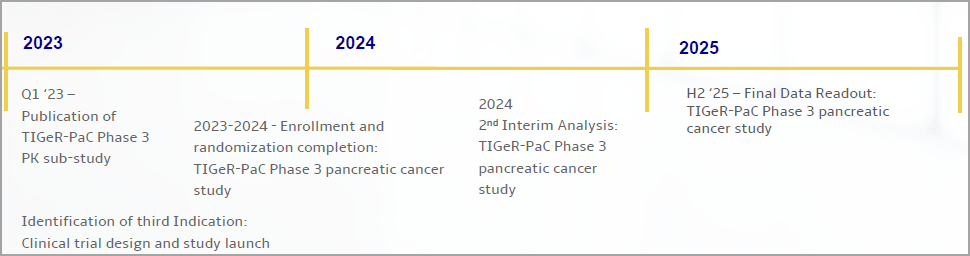

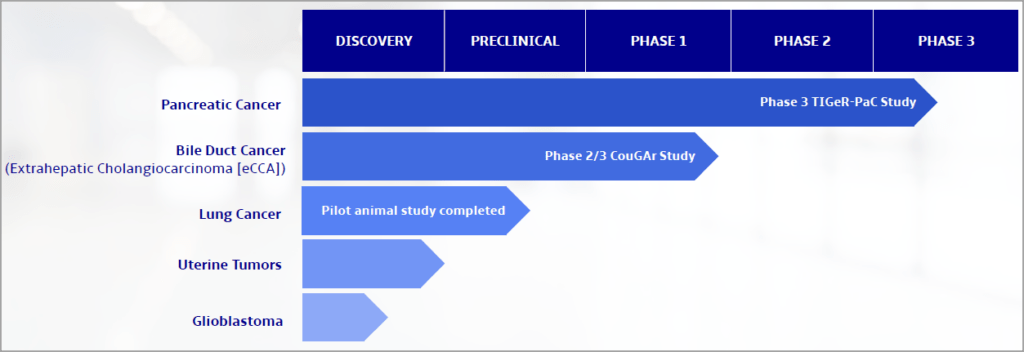

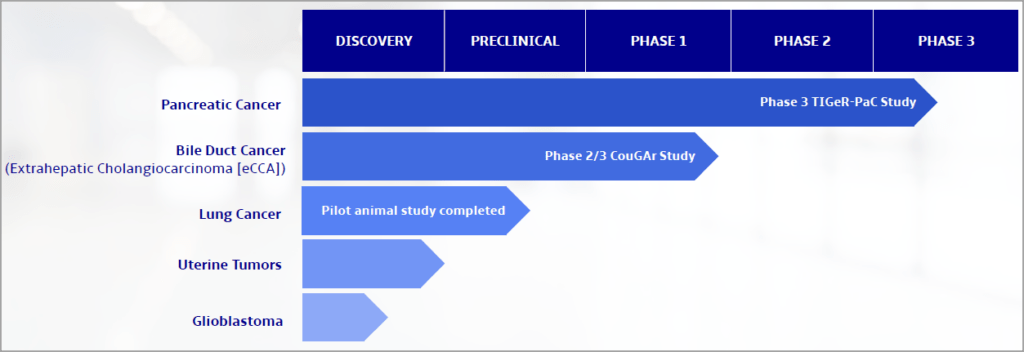

RenovoGem is currently being studied in the Phase III TIGeR-PaC trial for the treatment of LAPC.

RenovoRx’s patent portfolio for its therapy platform and product candidates includes eight issued U.S. patents, one issued European patent, and several additional patents pending in the US, EU and Asia.

RenovoRx has been granted Orphan Drug Designation for intra-arterial delivery of gemcitabine for the treatment of both pancreatic cancer and bile duct cancer (cholangiocarcinoma).

Meet the Management Team Leading RenovoRx, Inc. (NASDAQ: RNXT) Into 2023

Shaun R. Bagai

Chief Executive Officer

Mr. Bagai has served as our Chief Executive Officer and director since June 2014. Prior to joining us, Mr. Bagai led Global Market Development for HeartFlow, Inc. from 2011 to 2014, which included directing Japanese market research, regulatory/payer collaboration, and Key Opinion Leader development to create value resulting in a company investment to form HeartFlow-Japan. During his tenure at HeartFlow, he successfully orchestrated their largest clinical trial to date and contracted HeartFlow’s first global customers. In addition, Mr. Bagai has launched innovative technologies into regional and global marketplaces in both large corporations and growth-phase novel technology companies. He was instrumental in developing the European market for renal denervation for the treatment of hypertension leading to the acquisition of the first renal denervation company — Ardian, Inc. by Medtronic in 2011. Mr. Bagai is a graduate from the University of California, Santa Barbara with a BSc. in Biology/Pre-Med.

Ramtin Agah, MD

Chief Medical Officer, Founder

Dr. Agah has served as our Chief Medical Officer and Co-Founder since December 2009, and as Chairman of the Board since May 2018. Dr. Agah is currently an Interventional Cardiologist at El Camino Hospital, Mountain View, a role he began in September 2005. He also has acted as a physician consultant for Abbott Vascular since July 2012. Previously, Dr. Agah was an Assistant Professor of Internal Medicine with the Division of Cardiology, University of Utah. Dr. Agah completed a Fellowship in Interventional Cardiology with Cleveland Clinic Foundation, a Residency in Internal Medicine with Baylor College of Medicine and a Fellowship in Cardiology with University of California, San Francisco. He received his MD from the University of Texas Southwestern Medical School.

Angela Gill Nelms

Chief Operating Officer

Ms. Nelms is an accomplished leader with diverse experience including as a company founder, entrepreneur, board member, research professional, medical device technologist, and educator. She previously served as COO at Florence Healthcare, a company that streamlines clinical trial management through web-based solutions. As COO, Ms. Nelms led operational and product direction for the company and grew the business to support more than 10,000 clinical researchers in 44 countries. Additionally, during her tenure, the company grew from four to over 100 employees. Ms. Nelms earned a Bachelor of Science in Biomedical Engineering from the College of Engineering at the Georgia Institute of Technology. In April 2022, she was inducted into the College’s Academy of Distinguished Engineering Alumni.

James Ahlers

Chief Financial Officer

Mr. Ahlers is an accomplished finance leader with over 25 years of experience building life science businesses, both public and private. He served as Chief Financial Officer of Intarcia Therapeutics, Inc. and has held senior finance roles with Titan Pharmaceuticals, Inc. and Ansan Pharmaceuticals Inc. Additionally, Mr. Ahlers has provided consulting services to multiple public and private life science companies. During his career, he has managed capital raising transactions, including IPOs, which have raised in excess of $2 billion. In addition, he has developed and implemented international operations and global tax strategies. Since December 2021, Mr. Ahlers has served as a consulting CFO and provided finance advisory services through Danforth Advisors, LLC, a company that provides strategic and operational finance and accounting consulting services to life science companies. He is assuming his role at RenovoRx as a consultant through Danforth. Mr. Ahlers holds a Bachelor of Science in accounting from the University of San Francisco.

Ronald B. Kocak, CPA

Vice President and Controller

Mr. Kocak is a seasoned financial reporting and accounting professional with extensive public company experience in the life sciences industry. Mr. Kocak has served as RenovoRx’s interim controller in a consulting capacity since October 2021. Prior to joining RenovoRx, Mr. Kocak was Controller and Senior Director of Finance at Sensei Biotherapeutics, Inc., where he successfully led the finance and accounting activities, including the IT operations. He holds a Bachelor of Science in accounting from Duquesne University and a CPA license in the Commonwealth of Virginia. Mr. Kocak is also a member of the American Institute of Certified Public Accountants and Association of Bioscience Financial Officers, and a Chartered Global Management Accountant.

Imtiaz Qureshi, MD

Director of Imaging

Dr. Qureshi went to the prestigious Aga Khan University School of Medicine and graduated with honors. He completed a post-doctoral Fellowship in Molecular Biology and Physiology at Yale University. He completed an internship at Yale School of Medicine in General Surgery and subsequently joined Hartford Hospital for Diagnostic Radiology Residency. He was the Chief Resident during his Residency. Subsequently, he went to Stanford University where he completed a Fellowship in Neuroradiology. He is currently at El Camino Hospital where he has been the Medical Director and Chief of Radiology for the last 10 years.

Dr. Qureshi’s research interests include Artificial Intelligence and Machine Learning in Imaging. He serves as an adviser to several keys companies developing new imaging platforms for Breast Imaging, Neuroimaging and Oncologic Imaging using Artificial Intelligence.

RenovoRx, Inc. (Nasdaq: RNXT) Highlights & Pipeline Overview

De-risked drug development and validated RenovoTAMP approach.

Large first indication market ($1B) and platform broadly applicable to locally advanced solid tumors.

Capital efficient: <$750,000 average monthly burn.

Talented and experienced Leadership Team and Board of Directors.

Making a meaningful impact

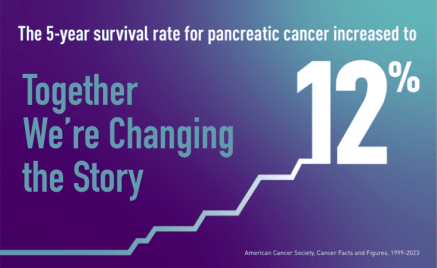

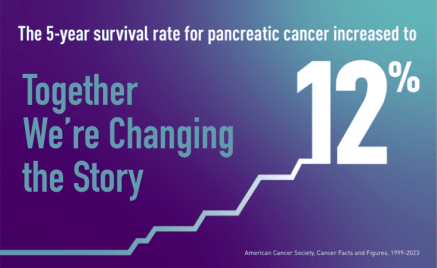

Five-Year Pancreatic Cancer Survival Rate Increases to 12%

American Cancer Society’s Cancer Facts & Figures 2023, released on 1/12/2023, reported that the five-year survival rate for pancreatic cancer is now 12%, an increase of one percentage point from last year.

This is the first time since 2017 that the survival rate has gone up two years in a row, a promising upward trend that points to continued progress in the fight against this tough disease.

It also represents lives saved: A one percentage point increase means 641 more loved ones who will enjoy life’s moments five years after their pancreatic cancer diagnosis.

“We are heartened by another increase in five-year survival,” said PanCAN President and CEO Julie Fleshman, JD, MBA.

“It’s an important milestone that shows we’re headed in the right direction – and this means so much to all those affected by pancreatic cancer.”

Still, there’s more work to be done, as the Facts & Figures report also reveals that an estimated 64,050 Americans will be diagnosed with pancreatic cancer in 2023, more people than ever before. Approximately 50,550 Americans are expected to die from the disease this year.

And while pancreatic cancer is currently the 10th most commonly diagnosed cancer in the U.S., it remains the third-leading cause of cancer-related deaths. Pancreatic cancer is on track to become the second leading cause of cancer-related deaths before 2030.

Taken together, these new statistics mean that PanCAN’s work is more vital than ever, said Fleshman.

“Our bold goal is to drive five-year survival to 20% by 2030,” she said. “We have the pieces in place to get there. Our research, our advocacy work, our dedicated volunteers, our Patient Services team – this comprehensive approach fuels progress. And our generous donors make it all possible.”

RenovoRx, Inc. (Nasdaq: RNXT)’s lead product candidate, RenovoGemTM, is a combination of gemcitabine and its patented delivery system, RenovoCath®, and is regulated by the FDA as a novel oncology drug product to treat unresectable locally advanced pancreatic cancer (LAPC). RenovoGem is currently being studied in the Phase III TIGeR-PaC trial for the treatment of LAPC.

Sources

- Source 1: https://www.maximgrp.com/wp-content/uploads/2023/01/Research-Universe_1.13.23.pdf

- Source 2: https://www.barchart.com/stocks/quotes/RNXT/price-history/historical

- Source 3: https://www.sofi.com/learn/content/understanding-low-float-stocks/

- Source 4: https://finviz.com/quote.ashx?t=RNXT&p=d

- Source 5: https://www.investopedia.com/terms/n/nanocap.asp

- Source 6: https://www.benzinga.com/money/best-nano-cap-stocks

- Source 7: https://finance.yahoo.com/news/renovorx-strengthens-intellectual-property-ip-133000702.html

- Source 8: https://finance.yahoo.com/news/renovorx-announces-acceptance-four-clinical-133000761.html

- Source 9: https://d1io3yog0oux5.cloudfront.net/_1d96d190e8991d232bc78061453ed92f/renovorx/db/2223/20884/pdf/RNXT+IR+Deck_2022-10-06_roth+v3.pdf

- Source 10: https://pbs.twimg.com/media/EDrTVVFXYAA5EFj.jpg

- Source 11: https://www.forbes.com/advisor/wp-content/uploads/2021/04/nyse.jpg

- Source 12: https://www.investopedia.com/terms/p/pricetarget.asp

- Source 13: https://www.maximgrp.com/team_members/jason-mccarthy-ph-d/

- Source 14: https://www.maximgrp.com/about-us/

- Source 15: https://www.linkedin.com/posts/maxim-group_maxim-group-2022-year-end-review-activity-7019388769157967872-lTRd/?originalSubdomain=gr

- Source 16: https://schrts.co/zAGgvMtJ

- Source 17: https://www.thebalancemoney.com/triangle-chart-patterns-and-day-trading-strategies-4111224

- Source 18: https://investmentu.com/low-float-stocks/

- Source 19: https://www.raps.org/RAPS/media/news-images/news-images/FDA-Logo.jpg

- Source 20: https://renovorx.com/wp-content/uploads/2021/05/square-catheter.jpg

- Source 21: https://pancan.org/news/five-year-pancreatic-cancer-survival-rate-increases-to-12

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and promote small public companies. By reading our website / media webpage you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our website / media webpage .We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website / media webpage are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. Virtus Media business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company's website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers' works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer's communications regarding the profiled company(s). You should assume all information in all of our communications in incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Compensation: Pursuant to an agreement between Virtus Media LLC and Lifewater, Virtus Media has been hired for a period beginning on 2023-02-28 and ending after 2023-03-03 to publicly disseminate information about NASDAQ: RNXT. We have been paid fifteen thousand dollars USD via ACH Bank Transfer. Pursuant to an agreement between Virtus Media LLC and Lifewater media LLC, Virtus Media has been hired for a period beginning on 2023-03-28 and ending after 2023-03-31 to publicly disseminate information about NASDAQ: RNXT. We have been paid thirteen thousand eight hundred dollars USD via ACH Bank Transfer.