CULT Food Science, Corp. (OTCMKTS: CULTF)

5 Reasons Why CULT Food Science, Corp. (OTCMKTS: CULTF) Should Be On Your Radar

This is CULT's largest investor. He owns 15%, and it was recently made public in a press release and insider filing.

After being part of one of the biggest cannabis acquisitions ever, Marc Lustig is ready to catch the next big opportunity.

The chief executive officer of Origin House, the trade name of CannaRoyalty Corp., isn’t sitting idle after U.S. cannabis operator Cresco Labs Inc. acquired his company, in a friendly, all-stock deal worth $1.1 billion.

Founder of CannaRoyalty Corp., Trichome Financial Corp. and Cannabis Royalties & Holdings Corp., Marc Lustig is an entrepreneur and businessperson who has been at the head of 7 different companies and currently occupies the position of Executive Chairman of IM Cannabis Corp. and Chairman of Wellfield Technologies, Inc. Mr. Lustig is also on the board of 7 other companies.

With an impressive resume and significant bankroll, he continues to pursue large growth opportunities in burgeoning sectors.

His resume includes the following positions:

- In the past he was Head-Capital Markets at Merck & Co., Inc.

- Principal at KES 7 Capital, Inc.

- Executive Chairman & Chief Executive Officer at CannaRoyalty Corp.

- Chairman of Meta Growth Corp.

- Chairman of Trichome Financial Corp.

- Chairman for Trichome Financial Corp.

- Chief Executive Officer & Director at Cannabis Royalties & Holdings Corp.

- Head-Capital Markets at Dundee Capital Markets, Inc.

- Vice President at Orion Securities, Inc.

- Principal at Griffiths McBurney Corp. and Sales Associate of GMP Securities LP.

He received an MBA and a graduate degree from McGill University.

IDENTIFYING THE OPPORTUNITY

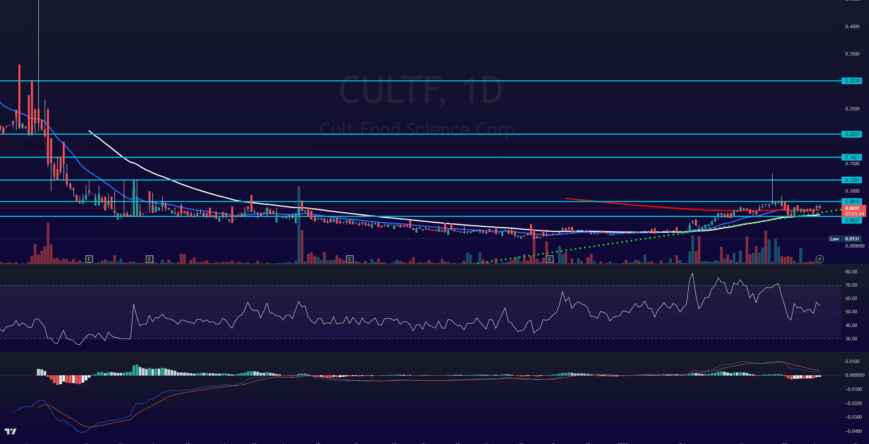

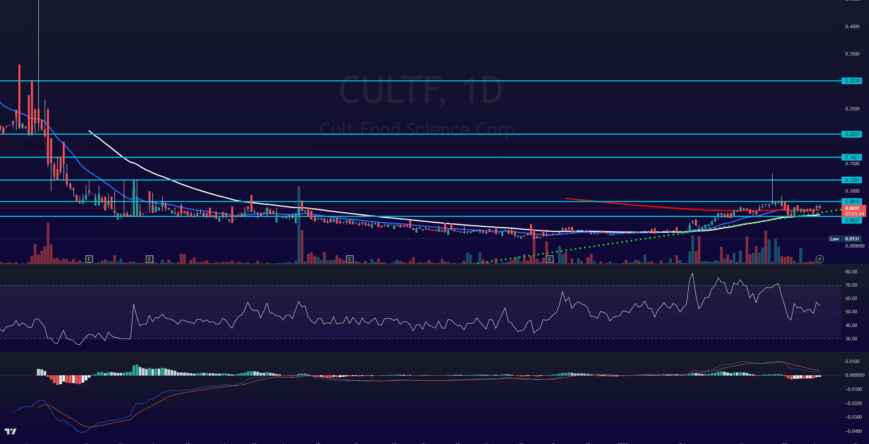

Upward Trend Strength and New Technology

We are already seeing strong volume, before the market appreciates this company's value

TRADE CONFIRMATION

Watch for a volume over 400k the first hour of market open for possible move, and over 600k on daily close.

Volume will precede the move, key indication of our push coming and an impulsive break to the upside.

TARGETS

$0.1201 (+74%)

$0.1621 (+134%)

$0.2037 (+194%)

$0.3010 (+335%)

CULT Food Science CORP. (OTCMKTS: CULTF) is One Of First Ever Public Companies Pursuing Lab Grown Meat, The Best Kept Secret in Silicon Valley

Lab grown meat has attracted the world's wealthiest and wisest investors, including Bill Gates, Richard Branson and Jeff Bezos.

Lab grown meat is not plant-based.

It is real meat, made through fermentation science.

The United States government recently declared it is of significant importance for them to be a leader in cultivated proteins, also known as lab grown meat.

The FDA just recently gave two ground breaking to usher in lab grown meat into North America.

Why Is This The Next Mega Trend?

Polarization Creates Opportunity, Let's Look At The Process

CULTF is Pioneering the $25 Billion Dollar Agricultural Revolution

CULT Food Science (OTC:CULTF) is launching some of the world's first branded food products that include lab grown meat. CULT is positioned as a first mover in this industry that McKinsey estimates will be worth $25 billion by 2030.

This topic is extremely polarizing, as most progressive shifts in culture and tradition are. Some people love this concept (animal lovers, vegetarians, environmentalists) and some people hate it. Polarization creates opportunity for those with the self awareness to put ego and emotion aside and look at the facts.

For those who aren't familiar with the topic, lab grown meat is created through a biotech process called cellular agriculture.

As an example, rather than raising a cow for 2 years just to slaughter and butcher it, the meat can be made by taking a cell biopsy from the cow, and then having those cells proliferate in a controlled environment.

The result is the same protein and meat structure, but much quicker, and without the environmental, ethical, and time costs.

The main problem currently is that this process is still more expensive than farming a cow.

But a lot is happening to change this, and bring more capital to the space to scale the production and make the process economically feasible. Many from the industry assume that the costs will follow a pattern similar to Moore’s Law in computing, in which the cost to produce lab grown meat will drop significantly every 2 years.

Here is a short summary on the sector without getting too granular. If you google ‘Lab Grown Meat’ you will find new developments happening nearly every week (just last week a company used DNA from an extinct woolly mammoth to produce a ‘Mammoth Meatball’. The implications of this alone are staggering.

- Bill Gates, Richard Branson and Jeff Bezos have all invested in Lab Grown Meat companies.

- McKinsey published a research report on the sector, anticipating a $25 billion industry by 2030.

- In November 2022, the FDA granted its first safety approval for lab grown chicken.

- In March 2023, the FDA granted their second approval for lab grown chicken, further setting the precedent of safety for human consumption.

- Lab grown meat has been consumed in Singapore, the only country in the world it is currently regulated for sale, since 2020.

- Traditional meat companies Tyson Foods, Cargill, and Archer Daniels Midland have all made investments in cellular agriculture companies.

The benefits of lab grown meat are clear to many large investors

The scaling issue will inevitably be solved, enabling significant revenues.

For investors withoutties to silicon valley or the Asia Pacific foodtech startup scene, options are limited to what is currently available on public markets in North America.

Even though there are over 100 private companies that are well know in the cellular agriculture industry, there are, by our count, only 3 publicly traded companies in North America.

Each company has a unique business model. With that comes unique opportunities that we can capitalize on for huge profits.

WHAT's on the menu for North American investors?

Agronomics: primary listing is in London, but they do have a US listing (AGNMF) and trade at a $153 million valuation. As a simplified description, they act as a publicly traded cellular agriculture fund, and hold equity in many different companies in the space. Shareholders of Agronomics are benefactors of Agronomics' DD expertise and portfolio appreciation.

CULT Food Science: primary listing in Canada (CULT) and also trades in the US (CULTF). Similar to Agronomics, CULT also has a portfolio of private cellular agriculture companies. Where they differentiate, is that they have publicly announced their ambitions to work with these portfolio companies to develop consumer products in a venture studio model, and have acquired product formulations such as Because Animals, a pet food line that is well known in alternative protein circles. The company is currently trading at a $12.5 million valuation.

Steakholder Foods: listed on Nasdaq (STKH). Unlike Agronomics and CULT, Steakholder is an operating company fully focused on their own product development. Specifically, they 'specialize in 3D printed meat'. The company is currently trading at a $12 million valuation.

Agronomics is the clear leader in general market exposure, but for investors with a higher risk tolerance and experience in wholesale and retail sales, the greatest near term upside in CULT Food Science is right here, right now. Brands command value, and it appears they understand this and are working to be first-movers in the space. Accompanying the recent focus on pet food, this has become a great launch point for consumer adoption. People are much more likely to try a new food product on their pet than on themselves, and many vegans and vegetarians would be interested in ensuring their pet gets proper nutrition without needing to slaughter animals to do so.

Larger investors have taken notice and positions. In March 2023 alone, CULT has traded over 55 million shares, and the stock price is up over 150% since January 1st.

Further, a prominent entrepreneur (Marc Lustig, whom sold his last CPG company for $1.1 billion) has acquired 15% of the company - this is very rare for companies at this low of a valuation. Entrepreneurs of this stature can legitimize early stage companies like CULT, and get them in to meetings and boardrooms that they wouldn't have had a chance at without them.

The house positions and recent trading volumes of CULT lead us to believe the majority of accumulation is from these large investors, likely some close friends of current investors in the company. There is still minimal awareness of CULT in trading chat rooms and investor communities such as Stockhouse, CEO.ca, and even Reddit. That can change quickly, but for now the opportunity to acquire a meaningful position at these levels is still possible.

This window of opportunity before the market appreciates the value of this company is the sweet spot for many growth traders. When the attention from majority traders kicks in, there is not only potential for a massive price run, but also of potential interest from larger companies like Nabisco, General Mills, as well as traditional meat companies.

Sources

- Source 1: https://www.cultfoodscience.com/

- Source 2: https://www.marketscreener.com/business-leaders/Marc-Lustig-06VF6C-E/biography/

- Source 3: https://www.bnnbloomberg.ca/after-1-1b-origin-house-sale-founder-lustig-wants-to-catch-another-wave-1.1260780

- Source 4: https://assets-global.website-files.com/63d4a1923f3f555433828827/63d4a1923f3f556e9a82885b_Logo-WhiteRed.svg

- Source 5: https://finance.yahoo.com/news/cult-food-science-announces-cultured-110000828.html

- Source 6: https://finance.yahoo.com/news/cult-food-science-announces-marc-110000305.html

- Source 7: https://www.sedar.com/DisplayProfile.do?lang=EN&issuerType=03&issuerNo=00009158

- Source 8: https://s22.q4cdn.com/545881950/files/images/board/2021/Marc-Lustig-Headshot.jpg

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and promote small public companies. By reading our website / media webpage you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our website / media webpage .We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website / media webpage are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. Virtus Media business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company's website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers' works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer's communications regarding the profiled company(s). You should assume all information in all of our communications in incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Compensation: Pursuant to an agreement between Virtus Media LLC and West Coast media , Virtus Media has been hired for a period beginning on 2023-04-06 and ending after one business day to publicly disseminate information about OTC: CULTF. We have been paid Four thousand dollars USD via ACH Bank Transfer. Pursuant to an agreement between Virtus Media LLC and West Coast media , Virtus Media has been hired for a period beginning on 2023-04-12 and ending after 2023-04-13 to publicly disseminate information about OTC: CULTF. We have been paid Four thousand dollars USD via ACH Bank Transfer.