7 Reasons Why iMetal Resources Inc. (OTCQB: IMRFF) (TSXV: IMR) Could Be Poised For Significant Upside Potential in 2023

IDENTIFYING THE OPPORTUNITY

THIS BATTERING RAM IS READY TO BREAK THROUGH

With a float of 48M and few restricted shares, a little bit of investor interest could send this soaring!

TRADE CONFIRMATION

Ideally, we would see a strong open and sustain a volume push over 10k. We need to see it push through this local resistance trendline and maintain this longer-term support in doing so. Once we see that, we should see some nice confirmations and can ride the wave.

TARGETS

Target #1: $0.28 (+64.71%)

Target #2: $0.48 (+182.35%)

Target #3: $0.68 (+300.00%)

Support: $0.06

iMetal Resources Inc.

(OTCQB: IMRFF) (TSXV: IMR)

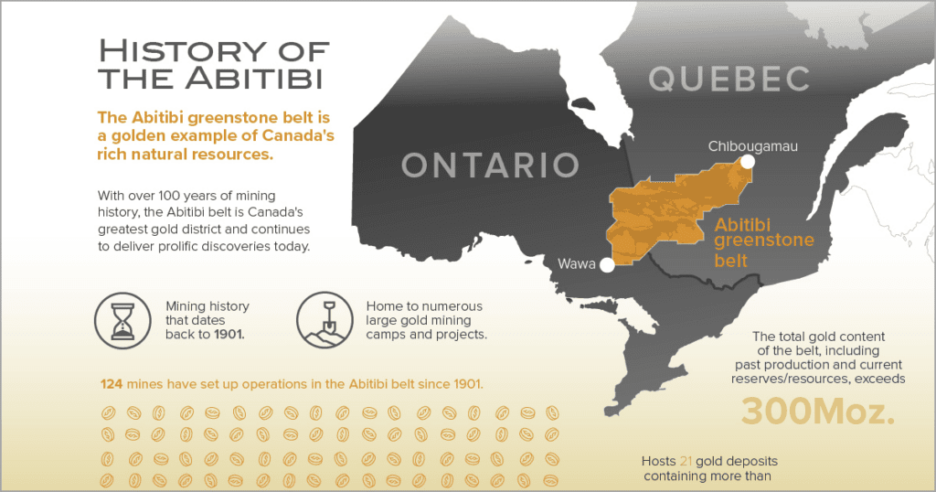

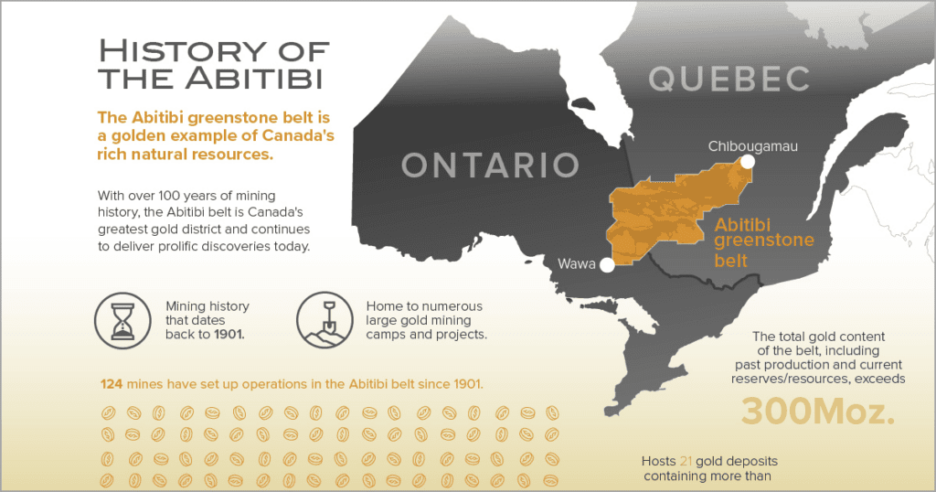

GOLD MINING IN CANADA: A LEGACY OF RICHES

Canada has a storied history of gold mining, boasting some of the world’s most productive and renowned gold districts. From the Klondike Gold Rush in the Yukon to the Abitibi Greenstone Belt in Ontario and Quebec, the country has long been a hub for exploration, mining, and production of this precious metal.

A Diverse Landscape for Gold Exploration

The vast and geologically diverse landscape of Canada provides a plethora of opportunities for gold exploration. The Canadian Shield, which covers a significant portion of the country, is known for its ancient rock formations and rich mineral deposits. Gold mining in Canada is widespread, with notable operations in provinces such as Ontario, Quebec, British Columbia, and the Yukon Territory.

Supportive Mining Policies and Infrastructure

Canada’s mining-friendly policies and well-developed infrastructure make it an attractive destination for mining companies and industry stakeholders alike. The country has a transparent and efficient permitting process, along with strong environmental and safety regulations. Additionally, access to skilled labor, advanced technology, and transportation networks facilitates efficient mining operations.

Economic Impact and Community Engagement

Gold mining plays a critical role in Canada’s economy, contributing to job creation, tax revenues, and community development. The industry places a strong emphasis on community engagement and sustainable practices to minimize environmental impact and foster positive relationships with local populations.

The Future of Gold Mining in Canada

Gold mining in Canada is expected to continue its upward trajectory, driven by global demand for precious metals and sustained exploration activities. Technological advancements are also enhancing the industry’s ability to access previously untapped deposits and improve recovery rates.

As the gold mining industry in Canada continues to thrive, one company that is capturing the attention of industry stakeholders is iMetal Resources Inc. (OTCQB: IMRFF) (TSXV: IMR).

With strategically positioned projects in the prolific Abitibi Greenstone Gold Belt, iMetal Resources Inc. (OTCQB: IMRFF) (TSXV: IMR) is poised to capitalize on the region’s abundant mineral wealth.

iMetal Resources Inc. (OTCQB: IMRFF) (TSXV: IMR)’s commitment to responsible mining practices and community engagement aligns with the values of the wider mining community in Canada. With a diverse portfolio of projects and a keen focus on exploration, iMetal Resources Inc. (OTCQB: IMRFF) (TSXV: IMR) stands out as a dynamic company with exciting prospects for growth and discovery.

iMetal Resources Inc.

(OTCQB: IMRFF) (TSXV: IMR)

iMetal Resources, Inc. (TSXV: IMR) (OTCQB: IMRFF) Achieves Upgrade to OTCQB Venture Market, Enhancing U.S. Market Presence

iMetal Resources, Inc. (TSXV: IMR) (OTCQB: IMRFF) has recently announced a significant development in its efforts to enhance shareholder value and increase its visibility in the U.S. market. The company has successfully upgraded its listing from the OTC Pink to the OTCQB Venture Market (“OTCQB”), where it will trade under the symbol “IMRFF.” The upgrade became effective at the start of trading on May 3, 2023.

In addition to its presence on the OTCQB, iMetal Resources continues to be listed on the TSX Venture Exchange under the symbol “IMR” and on the Frankfurt Stock Exchange under the symbol “A7V.”

The OTCQB is a leading U.S. trading platform operated by the OTC Markets Group. It serves as a premier marketplace for early-stage and developing U.S. and international companies seeking to provide greater transparency and access to information. To qualify for listing on the OTCQB, companies must meet specific eligibility criteria, including being current in their financial reporting, undergoing an annual company verification and management certification process, and meeting a minimum bid price test.

The upgrade to the OTCQB brings a host of key benefits to iMetal Resources, Inc. (TSXV: IMR) (OTCQB: IMRFF) and its shareholders. The OTCQB’s streamlined market standards enable Canadian companies like iMetal Resources to provide a strong baseline of transparency, which is essential for informing and engaging the U.S. market. Additionally, the OTCQB platform offers enhanced visibility and access to a broader audience, which can contribute to increased liquidity and trading volume for the company’s shares.

iMetal Resources, Inc. (TSXV: IMR) (OTCQB: IMRFF) is recognized for its proactive exploration approach and commitment to unlocking the full potential of its mining projects, including the Carheil project in Quebec. The company’s upgrade to the OTCQB is a testament to its dedication to maintaining high standards of corporate governance and transparency.

As iMetal Resources, Inc. (TSXV: IMR) (OTCQB: IMRFF) continues to advance its exploration projects and achieve key milestones, the company’s presence on the OTCQB is expected to play a vital role in facilitating its growth and success. The upgrade represents an important step for iMetal Resources as it seeks to expand its reach and connect with a wider audience of shareholders and stakeholders in the U.S. market.

Gold Price Outlook: Catalysts and Market Dynamics

The precious metal gold has been shining brightly recently, with prices rallying close to historical highs. In the past six months alone, gold has risen about 20% to over $2,000 per ounce, approaching its all-time high of $2,075 according to Forbes.com. The age-old appeal of gold as a store of value persists today, with a highlight of growth potential under the right market conditions. While some experts are bullish on gold’s ongoing rally, others remain cautious about its future prospects.

Key Factors Driving Gold's Rally

The outlook for interest rates has been a major factor influencing gold prices in 2023. The Federal Reserve’s aggressive rate hikes to combat inflation have shown signs of success in curbing price increases. Moreover, a banking crisis in March led to tightened credit markets, further dampening inflationary pressures.

Gold Price Predictions

Multiple analysts and asset managers have made bullish predictions for gold prices in 2023. CMC Markets forecasts gold prices between $2,500 and $2,600, while Wheaton Precious Metals CEO Randy Smallwood anticipates $2,500 per ounce. Swiss Asia Capital predicts gold could even reach $4,000 an ounce by year-end.

Bank of America is also optimistic, forecasting an average annual price of $2,009 per ounce for gold in 2023, with a potential climb to $2,200 in the fourth quarter.

Supply and Demand Considerations

The World Gold Council reported an 18% increase in global gold demand in 2022, reaching 4,741 tons. Jewelry, central banks, industrial use, and investment demand (including gold ETFs) all contribute to the strong demand for gold.

As gold prices rise, gold ETF demand often increases, potentially propelling prices even higher. Nicholas Colas of DataTrek Research suggests that gold could be a valuable addition to a diversified portfolio, potentially comprising 3% to 5% of holdings.

Amid this bullish outlook for gold, one little-known company that market enthusiasts may wish to keep an eye on is iMetal Resources Inc. (OTCQB: IMRFF) (TSXV: IMR).

Positioned strategically in a prolific gold-producing region, iMetal Resources Inc. (OTCQB: IMRFF) (TSXV: IMR) stands out as a company with the potential to capitalize on the current dynamics in the gold market.

iMetal Resources Inc.

(OTCQB: IMRFF) (TSXV: IMR)

Ontario's Golden Opportunity: Exploring the Abitibi Greenstone Gold Belt

When it comes to mining potential, Ontario’s Abitibi Greenstone Gold Belt is truly a treasure trove. This massive geological formation, which extends across Ontario and Quebec, has long been recognized as one of the richest gold-bearing regions in the world. With mining-friendly jurisdictions, excellent infrastructure, and a storied history of successful mining operations, the Abitibi Greenstone Gold Belt is a gold miner’s dream.

In this report, we’ll take a closer look at the geological and historical significance of Ontario’s mining belts, and why they continue to attract attention from some of the world’s largest gold producers. We’ll also introduce one little-known company, iMetal Resources Inc. (OTCQB: IMRFF) (TSXV: IMR), which has the potential to make waves with its exciting projects in this prolific Greenstone gold belt.

A Geological Treasure: The Abitibi Greenstone Gold Belt

The Abitibi Greenstone Gold Belt is an Archean-age formation that spans roughly 700 kilometers from east to west. The belt is known for its abundant mineral deposits, particularly gold, but also silver, copper, and zinc. The immense endowment of precious and base metals in the region has been quantified to impressive figures: over 200 million ounces of gold (Moz Au), 400 million ounces of silver (Moz Ag), 15 billion tons of copper (Btons Cu), and 35 billion tons of zinc (Btons Zn).

The belt’s mineral wealth is the result of geological processes that took place billions of years ago. The formation of the belt involved the collision of tectonic plates, resulting in the creation of volcanic and sedimentary rocks that were later metamorphosed and intruded by granitic rocks. The abundance of gold is linked to the presence of quartz veins, which were formed during hydrothermal activity associated with ancient volcanic and tectonic events.

A Historical Legacy: Past Production and Major Deposits

Ontario’s mining belts have a long history of successful mining operations, with over 100 producing mines having been established in the region. Among these mines are 21 distinct gold deposits, each boasting over 3 million ounces of gold. This rich history of mining and exploration underscores the significant potential of the belt for future discoveries.

The belt’s status as a world-class mining destination is further reinforced by the presence of several major gold producers. Companies such as Newmont (formerly Goldcorp), Osisko, IAMGOLD, and Agnico Eagle (formerly Kirkland Lake Gold) all have active operations in the area, testifying to the region’s undeniable appeal to industry giants.

DIGGING DEEP

iMetal Resources Inc.

(OTCQB: IMRFF) (TSXV: IMR)

Unearthing Potential: iMetal Resources Inc. (OTCQB: IMRFF) (TSXV: IMR) and the Abitibi Greenstone Gold Belt

In the world of mining, the Abitibi Greenstone Gold Belt stands as a geological marvel—an untapped treasure trove that continues to capture the imagination of the industry. Amid the excitement, iMetal Resources Inc. (OTCQB: IMRFF) (TSXV: IMR) is emerging as a player to watch in this legendary region.

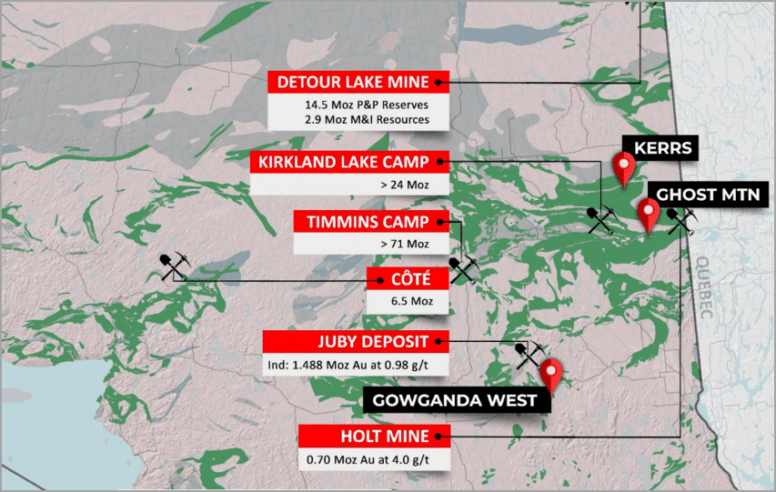

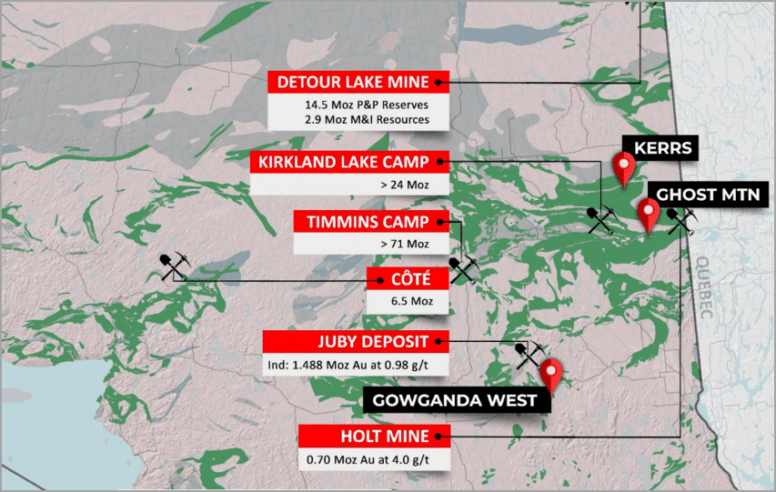

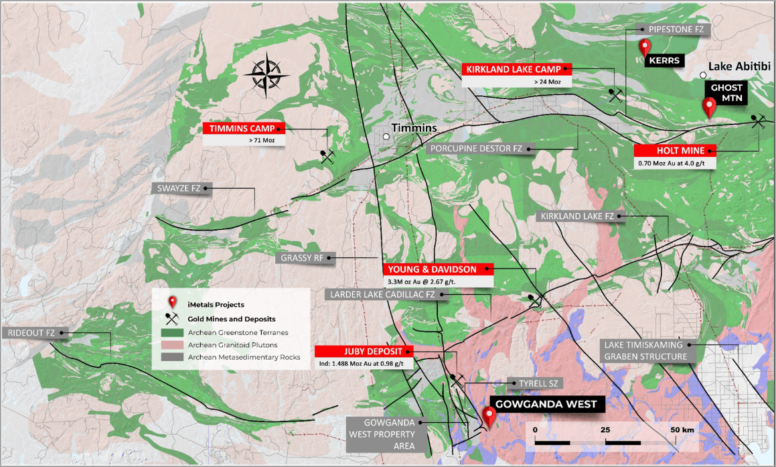

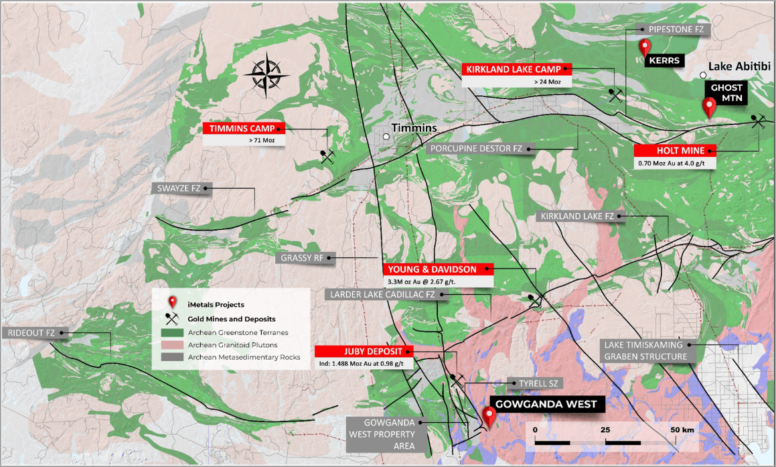

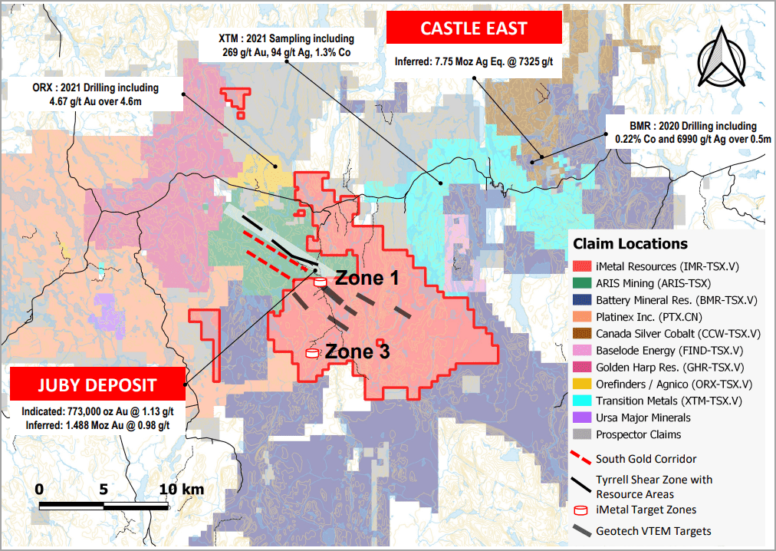

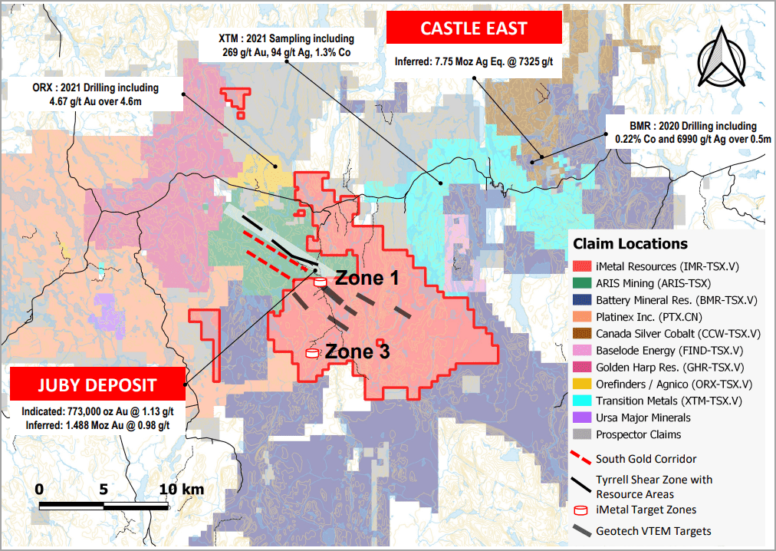

iMetal Resources Inc. (OTCQB: IMRFF) (TSXV: IMR) boasts three key projects (pictured above) at different levels of development within the Abitibi Belt, each offering a unique opportunity to capitalize on the region’s abundant mineral wealth. With a strategic foothold in the area, the company is poised to make a significant impact as it harnesses the potential of this mineral-rich landscape.

Discover the gold rush unfolding in Ontario's famed Abitibi Greenstone Gold Belt!

This geological hotspot is renowned for its rich mining history and bountiful resources, drawing attention from mining companies worldwide. Right at the heart of the action is iMetal Resources Inc. (OTCQB: IMRFF) (TSXV: IMR)—a dynamic company with a diverse project portfolio and a steadfast commitment to responsible mining.

As society’s hunger for precious metals surges, the Abitibi Gold Belt is ready to deliver. So get ready for an exciting journey as we delve into iMetal Resources Inc. (OTCQB: IMRFF) (TSXV: IMR)’s standout projects, including Gowganda West, Kerrs Gold Deposit, and Ghost Mountain.

Together, we’ll uncover the potential that lies beneath the surface and see how iMetal Resources Inc. (OTCQB: IMRFF) (TSXV: IMR) is shaping the future of gold mining.

The stage is set for exploration, discovery, and growth. With its clear vision and strategic positioning, iMetal Resources Inc. (OTCQB: IMRFF) (TSXV: IMR) could be next to make a golden splash in one of the world’s most renowned gold-producing regions.

As the company advances its projects and explores new opportunities, all eyes should be on iMetal Resources Inc. (OTCQB: IMRFF) (TSXV: IMR) as it charts a course toward success in the illustrious Abitibi Greenstone Gold Belt.

Exploring the Strategic Projects of iMetal Resources Inc. (OTCQB: IMRFF) (TSXV: IMR) in the Abitibi Greenstone Gold Belt

iMetal Resources Inc. (OTCQB: IMRFF) (TSXV: IMR) is strategically positioned in the Abitibi Greenstone Gold Belt with a portfolio of projects that are not only promising but also located in close proximity to major mining operations and deposits. This advantageous positioning offers iMetal Resources unique opportunities for exploration and collaboration. Let’s take a closer look at iMetal Resources’ key projects in the belt: Gowganda West, Kerrs Gold Deposit, and Ghost Mountain.

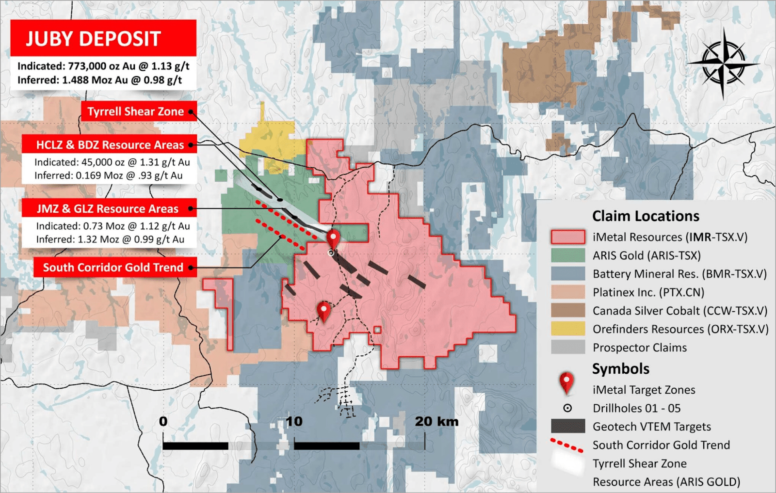

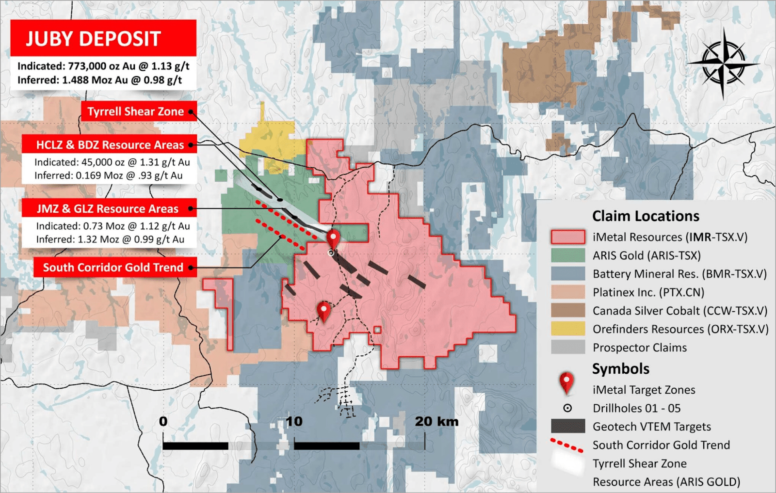

The Potential of the Gowganda West Project

The Gowganda West project is contiguous to the west and north of Aris Gold’s Juby deposit, a known gold deposit that has attracted significant interest in the region. Additionally, Gowganda West is contiguous to the west and northwest of Agnico Eagle and Orefinders Resources’ mining properties, placing it in a highly prospective geological setting.

The project is characterized by shear-hosted gold mineralization, a type of gold deposit that forms along shear zones or structural discontinuities in the Earth’s crust. The presence of shear-hosted gold provides strong indications of the project’s potential to host significant gold mineralization.

iMetal Resources Inc. (OTCQB: IMRFF) (TSXV: IMR) has been making significant strides in the exploration of its Gowganda West project, located in the prolific gold and base metals district of Ontario, Canada. As the project continues to show promising results and exciting potential, industry observers should be keeping a close eye on iMetal Resources’ endeavors. Let’s explore some of the key aspects of the Gowganda West project that make it a standout among mining exploration ventures.

A Strategic Location with Enormous Potential

The Gowganda West project spans a sizable 147 square kilometers and is strategically positioned just 90 minutes by road from the renowned mining hub of Kirkland Lake. The project boasts road access, which is crucial for effective exploration and development activities.

One of the most compelling aspects of the Gowganda West project is its contiguous location with Aris Mining (TSX: ARIS), the company that hosts the notable Juby deposit. The Juby deposit has been identified as hosting 770,000 ounces of gold (Indicated) at 1.1 grams per tonne (g/t) and an impressive 1.5 million ounces at 0.98 g/t (Inferred). This alone speaks volumes about the project’s potential for high-grade gold mineralization.

The geological structures that host the Juby deposits have been observed to trend onto iMetal Resources’ ground, further solidifying the company’s positioning and potential for gold discoveries. The project is also contiguous to Orefinders and the Kirkland Lake-Agnico Eagle territory, adding to the significance of its strategic location.

High-Grade Discoveries: Silver, Gold, and Base Metals

The Gowganda West project is characterized by numerous high-grade results across silver, gold, and base metals, making it a diversified exploration venture. Within the project area, a 6-kilometer north-south trending corridor of gold mineralization and alteration has been identified, which is associated with the contact between finer and coarser metasediments.

Two specific zones within this corridor—Zone 1 and Zone 3—have demonstrated particularly encouraging results:

ZONE 1

Zone 1 features quartz veins within a sericite alteration zone, which is a favorable environment for gold mineralization. Notably, the 2021 grab samples from this zone have yielded remarkable results, with gold grades of 27.2 and 16.35 g/t. The drilling campaigns conducted in 2019 and 2022 have further revealed significant alteration with anomalous gold and the presence of multiple trends.

ZONE 3

Zone 3 shares similar geological features with Zone 1, including quartz veins in a sericite alteration zone. The 2021 grab samples from this zone have been particularly noteworthy, with astounding gold grades of 67.9, 29.6, and 11.3 g/t—results that highlight the tremendous potential for gold exploration in the area.

A Promising Future for iMetal Resources

The Gowganda West project’s strategic location, high-grade discoveries, and geological potential make it an exceptional exploration venture for iMetal Resources Inc. As the company continues to advance its exploration efforts, the project stands to offer significant value to both the company and its investors. For those interested in the mining and exploration sector, the Gowganda West project represents an opportunity that is truly worth keeping an eye on.

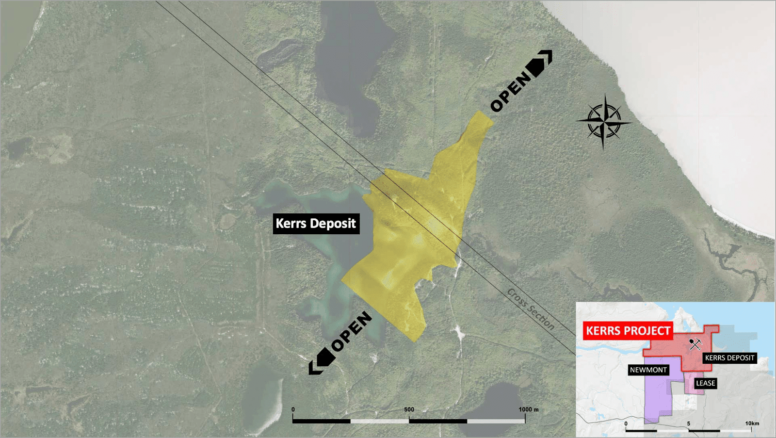

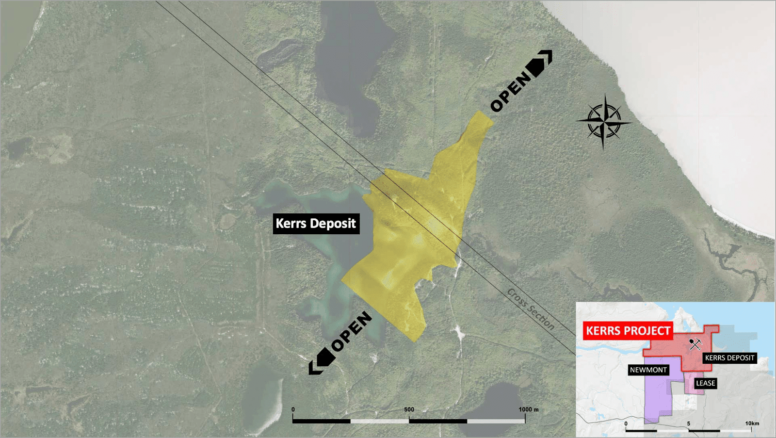

Kerrs Gold Deposit: Quartz Vein Replacement Breccia Gold with Expansion Potential

16The Kerrs Gold Deposit is characterized by quartz vein replacement breccia gold mineralization, a style of deposit in which gold-bearing quartz veins are emplaced within brecciated host rocks. This type of gold deposit is known for its potential to host high-grade gold mineralization.

The Kerrs Gold Deposit benefits from a 43-101 Historic resource, indicating that a significant amount of exploration work has already been carried out on the property. There is also significant potential for expansion of the resource, which is a key focus for iMetal Resources Inc. (OTCQB: IMRFF) (TSXV: IMR).

iMetal Resources Inc. (OTCQB: IMRFF) (TSXV: IMR)’s Kerrs Gold Deposit is contiguous to the south and west of Newmont Corporation, one of the world’s largest gold producers. This proximity to a major mining company underscores the potential of the Kerrs Gold Deposit as a valuable asset in the iMetal Resources Inc. (OTCQB: IMRFF) (TSXV: IMR) portfolio.

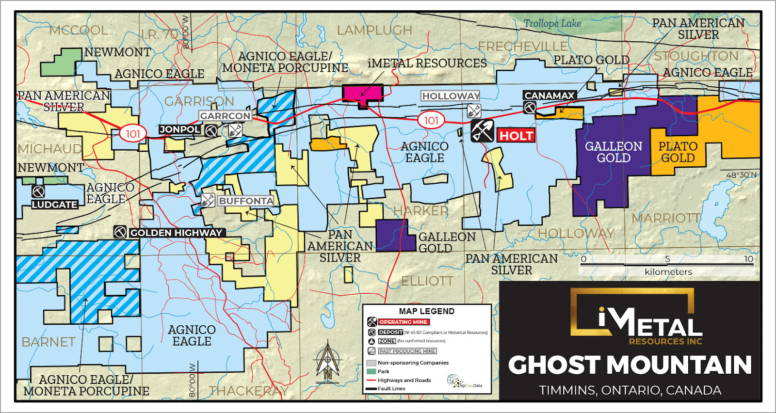

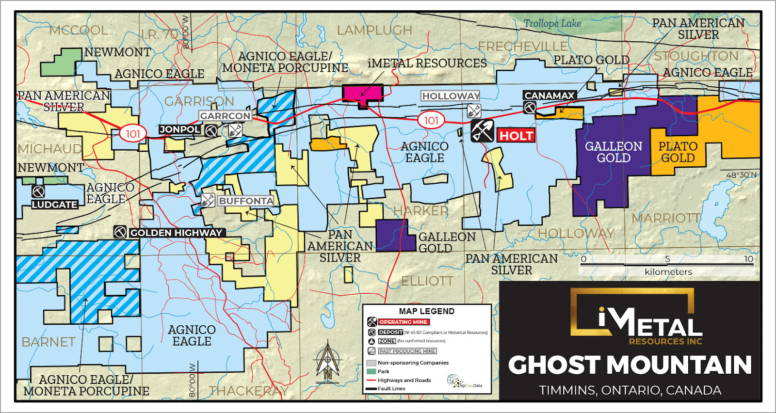

Ghost Mountain: In Close Proximity to Agnico Eagle's Operations

iMetal Resources Inc. (OTCQB: IMRFF) (TSXV: IMR) is making significant strides in its exploration efforts at the Ghost Mountain project, located within the prolific Abitibi Greenstone Gold Belt. Ghost Mountain is situated approximately 5 kilometers west of Agnico Eagle’s Holt and Holloway Mine, a major mining operation in the region. The project’s close proximity to an established mine provides iMetal Resources with valuable insights into the geological characteristics of the area and access to existing infrastructure.

The Ghost Mountain project holds significant exploration potential, and iMetal Resources is keen to capitalize on its strategic location. The company’s exploration efforts at Ghost Mountain aim to uncover new gold deposits and add value to the project. iMetal Resources’ projects in the Abitibi Greenstone Gold Belt are characterized by their strategic locations, proximity to established mining operations, and significant exploration potential. The company’s presence in this prolific region, along with its diverse project portfolio, potentially positions iMetal Resources for success in the years to come.

With a sharp focus on exploration and resource expansion, iMetal Resources is poised to make important contributions to the understanding and development of the Abitibi Greenstone Gold Belt. Market enthusiasts, industry stakeholders, and the broader mining community can look forward to exciting developments from iMetal Resources as the company continues to advance its projects and pursue its vision for growth and discovery in this world-renowned gold-producing region.

In a recent update, iMetal Resources announced the completion of a Digitally Enhanced Prospecting (DEP) survey at its 220-hectare Ghost Mountain property, located 42 km northeast of Kirkland Lake. The DEP survey, conducted by Waring Minerals Inc., utilized UAV LiDAR technology to locate outcrops on the property for sampling and mapping purposes. The DEP results will be combined with the 2022 AeroVision® survey results to guide the next stage of exploration, which will include defining drill targets. Several priority target areas were identified and sampled during the survey.

Saf Dhillon, Chief Executive Officer of iMetal, stated, "Ghost Mountain lies near several active gold exploration and mining operations including Agnico Eagle's Holt and Holloway Mines Property and McEwen Mining's Black Fox Mine. The DEP survey is the next step in our staged exploration program to bring Ghost Mountain to the drilling stage."

The geology of Ghost Mountain is divided into northern and southern sections, with the northern section underlain by mafic to ultramafic intrusive rocks of the Kidd-Munro Group, and the southern section underlain by a mixed group of felsic to mafic metavolcanic rocks and clastic metasedimentary rocks of the Destor Porcupine Complex. Both assemblages are important regional hosts for world-class gold and VMS deposits.

The company’s completion of an AeroVision® magnetic survey in 2022 resulted in a detailed geo-structural map, high-resolution magnetic maps, 3D magnetic susceptibility models, and a predictive targeting map, providing three solid targets for potential gold mineralization.

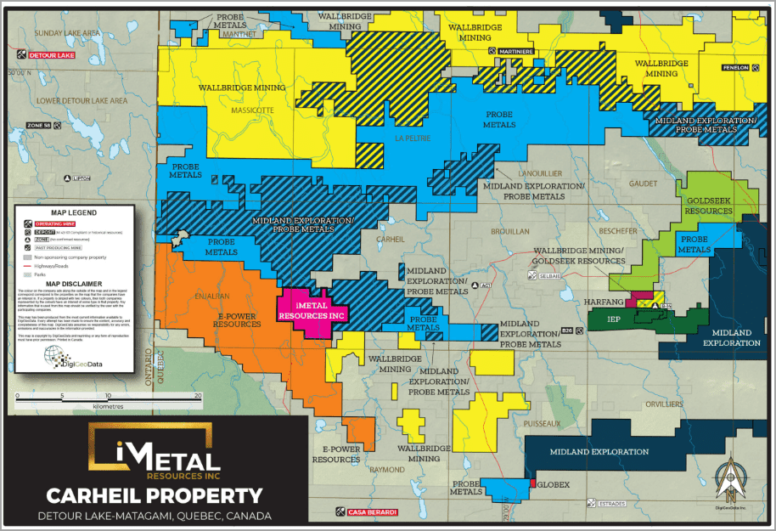

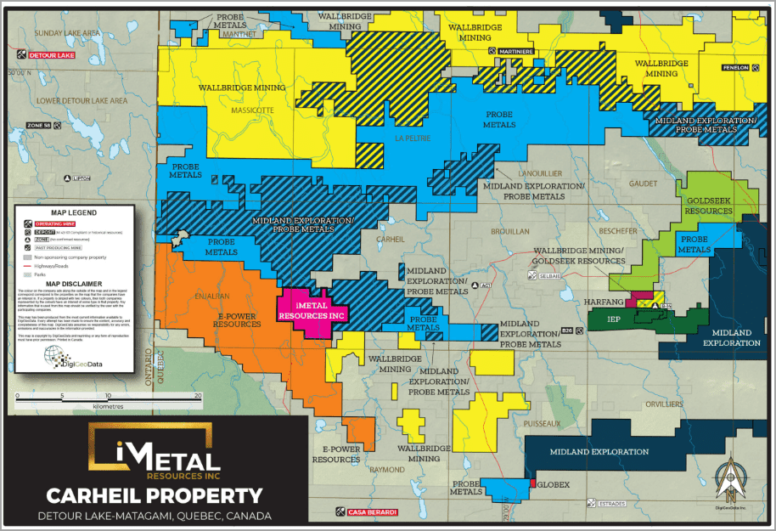

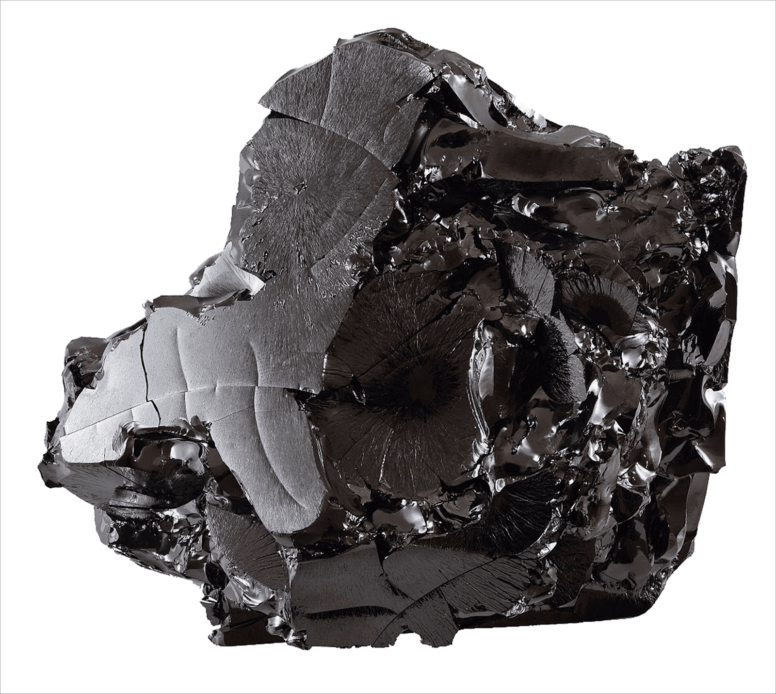

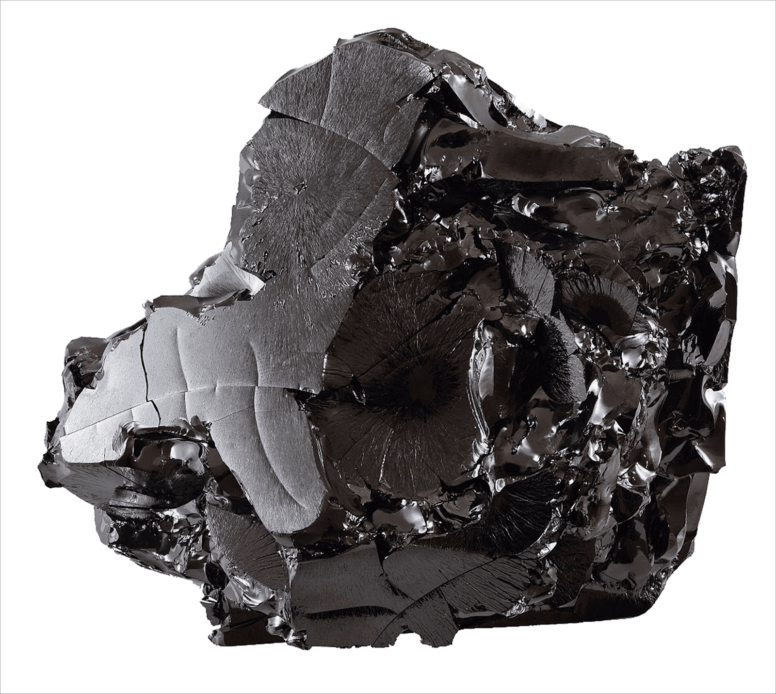

iMetal Resources Inc. (OTCQB: IMRFF) (TSXV: IMR): Uncovering High-Quality Graphite at the Carheil Project in Quebec.

iMetal Resources Inc. (OTCQB: IMRFF) (TSXV: IMR) is making significant progress at its Carheil project in the Northern Abitibi Greenstone Belt of Quebec. The company recently announced the completion of its 2023 Phase I drilling program, which included three holes totaling 1,053 meters. This phase of drilling followed up on the 2016 graphite drilling program, which yielded a highlight intersection of 7.48% Cg over 1.1 meters.

Saf Dhillon, President & CEO of iMetal, expressed satisfaction with the results of the 2023 Phase I program, stating, "We are pleased with the 2023 Phase I program as we intersected the target horizon in all three holes. Our team is already planning the next phase of drilling and exploration work for the property to both test the target graphite horizon along strike and to evaluate the prospectivity of the remainder of the claim block, in light of the recent Midland/Probe discovery in the neighborhood. Quebec is one of the most mining-friendly jurisdictions in the world, and we are excited to continue working there."

The drilling program was conducted by DIAFOR Inc. of Malartic, Quebec. While access to the site was limited due to winter conditions and a faster than normal melt shortened the program slightly, all three holes drilled successfully intersected the target horizon. Samples have been submitted to ALS Geochemistry in Rouyn-Noranda for assaying.

The Carheil project is an exploration-stage project with multi-metal potential and previous graphite results. It is located about 170 km north of Rouyn-Noranda and is strategically positioned near several significant mining operations, including the past-producing Selbaie Copper-Zinc-Silver-Gold mine, Hecla’s Casa Berardi Mine, and Agnico Eagle’s Detour Lake mine. Additionally, the property is directly adjacent to Midland Exploration/Probe Metals’ La Peltrie project, which recently intersected a 345.5 m of Cu-Mo-Au-Ag mineralization grading 0.21 CuEq.

One of the most intriguing aspects of the Carheil project is the presence of high-quality graphite, including Jumbo-sized graphite flakes. The presence of Jumbo-sized graphite flakes is highly desirable for mining companies, as they command premium prices in the market due to their superior properties. These properties make them ideal for a wide range of applications, including lithium-ion batteries, electric vehicles, and other high-tech industries.

As global demand for graphite continues to grow—fueled by technological advancements and the shift toward renewable energy—iMetal Resources is well-positioned to capitalize on the rising need for this vital resource. The Carheil project offers a compelling opportunity for the company to unlock value and establish itself as a leading player in the graphite exploration and mining sector.

With the company’s proactive exploration approach and ongoing commitment to uncovering the full potential of the Carheil project, industry stakeholders should keep a close eye on iMetal Resources Inc. (OTC: IMRFF) (TSXV: IMR) as it continues to make strides in the mining industry.

iMetal Resources Inc. (OTCQB: IMRFF) (TSXV: IMR)’s Carheil project in Quebec is a standout exploration property with a unique geological profile and the potential for high-quality graphite production.

With the company’s proactive exploration approach and ongoing commitment to uncovering the full potential of the Carheil project, industry stakeholders should keep a close eye on iMetal Resources Inc. (OTCQB: IMRFF) (TSXV: IMR) as it continues to make strides in the mining industry.

Introducing the Management Team of iMetal Resources Inc.

(OTCQB: IMRFF) (TSXV: IMR)

iMetal Resources Inc. (OTCQB: IMRFF) (TSXV: IMR) is driven by a strong management team with extensive experience in a range of industries. The team, composed of professionals with expertise in geoscience, business development, and investor relations, is dedicated to advancing the company’s goals and maximizing shareholder value. Here are the key members of iMetal Resources’ management team and board of directors.

Satvir 'Saf' Dhillon - President & Chief Executive Officer

With a career spanning approximately 20 years in the development of companies primarily listed on the TSX Venture Exchange, Mr. Dhillon has held a variety of positions, including investor relations, business development, senior management, and board directorships. He played a key role in the growth of U.S. Geothermal Inc., an Idaho-based company, where he served as part of the management team that transformed the company from a USD$2 million startup to a successful Independent Renewable Energy Power Producer with three new power plants in the Pacific Northwest. The company also transitioned from the TSX to the NYSE MKT during his 12-year tenure. In addition, Mr. Dhillon is a Founding Director of Torrent Gold Inc. (CSE: TGLD) and a Board Member of Lake Winn Resources Corp. (TSXV: LWR). As President & CEO of iMetal Resources, he brings an extensive worldwide list of contacts and expertise to the company.

R. Tim Henneberry P.Geo – Director

R. Tim Henneberry is a Professional Geoscientist (P. Geo., BC) with an impressive 40 years of experience in both domestic and international exploration and production for the base and precious metals as well as industrial minerals. As President of Mammoth Geological Ltd., he has provided consulting services to numerous publicly traded companies since 1991. Additionally, Mr. Henneberry has held roles as Founder, Director, and Senior Officer for several companies listed on the TSX Venture and CSE.

Christopher W. Hill – Investor Relations Manager

An investor and entrepreneur, Christopher W. Hill has over a decade of experience in the capital markets. He began his career as an Investment Advisor and subsequently advised private companies on becoming publicly traded entities. Christopher specializes in corporate development and strategic financing and leverages his vast network in the capital markets to further the company's objectives.

Scott Davis – Director

Scott Davis, a partner of Cross Davis & Company LLP Chartered Professional Accountants, has a wealth of experience in accounting and management services for publicly-listed companies. He has held CFO positions for several TSX Venture Exchange-listed companies and has served in senior management roles, including at Appleby and Davidson & Company LLP Chartered Professional Accountants. His expertise in accounting and financial management is invaluable to iMetal Resources.

Robert Coltura - Director

Robert Coltura is a seasoned businessman with significant entrepreneurial experience. He is President and principal shareholder of Matalia Investments Ltd., a company that provides management consulting, corporate finance, and investor relation services to both public and private companies. With over 20 years of experience in various public companies, Mr. Coltura has held positions as both an officer and director, bringing a wealth of business development expertise to his roles. He has worked with a diverse array of companies to enhance their industry positioning. In addition to his role at iMetal Resources, Mr. Coltura serves as President of Coltura Financial Corp and Coltura Properties, which owns and manages commercial properties in British Columbia and the United States. His entrepreneurial acumen and industry insights make him a valuable asset to the iMetal Resources board of directors.

Sources

- Source 1: https://www.namibian.com.na/6221098/archive-read/Osino-strikes-gold

- Source 2: https://www.miningweekly.com/article/junior-explorer-scores-big-in-namibian-gold-belt-where-mining-majors-failed-2022-06-02

- Source 3 https://osinoresources.com/wp-content/uploads/2022/07/2022_06_08-Osino-Site-Comprehensive-Presentation-long-version-.pdf

- Source 4: https://www.mining-technology.com/analysis/feature-top-ten-biggest-gold-mines-south-africa/

- Source 5:https://seekingalpha.com/article/4520661-goldman-sachs-raises-gold-target-yet-again-to-2500oz-by-year-end-signaling-boost-to-gold-industry

- Source 6:https://sprott.com/media/5574/220809-osi-scp-mre.pdf

- Source 7:https://kingworldnews.com/billionaire-ross-beaty-on-skyrocketing-gold-silver/

- Source 8: https://www.globenewswire.com/news-release/2022/08/09/2494748/0/en/Osino-Reports-Increased-Mineral-Resource-at-Higher-Grade-at-Twin-Hills-Gold-Project-Namibia.html

- Source 9: https://www.goodreturns.in/news/how-the-us-fed-rates-impact-consumers-and-investors-1256992.html

- Source 10: https://www.foxbusiness.com/economy/jpmorgan-forecasts-another-super-sized-rate-hike-fed-september

- Source 11: https://docs.google.com/document/d/1DxL9imRSIoTQ3g2Is_bZ2oO2l5uBmyHu8pJMODkFXrc/edit

- Source 12:https://www.youtube.com/watch?v=mf4ABJv4bx4

- Source 13:https://osinoresources.com/projects/twin-hills-discovery/

- Source 14:https://www.canadianminingjournal.com/news/deconstructing-ross-beaty-exclusive-interview-at-the-mining-legends-speaker-series/

- Source 15 :https://www.marketscreener.com/quote/stock/OSINO-RESOURCES-CORP-46336048/company/

- Source 16: https://osinoresources.com/wp-content/uploads/2022/09/2022_09_12-Osino-Investor-Presentation.pdf

- Source 24: https://finance.yahoo.com/news/imetal-resources-announces-completion-winter-100000348.html

- Source 25: https://finance.yahoo.com/news/imetal-announces-upgrade-u-listing-100000852.html

- Source 26: https://finance.yahoo.com/news/imetal-resources-completes-digitally-enhanced-100000327.html

- Source 27: https://finance.yahoo.com/quote/IMRFF?p=IMRFF&.tsrc=fin-srch

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media LLC and Lifewater Media, Virtus Media LLC has been hired by Lifewater Media for a period beginning on 2023-05-16 and ending 2023-05-18 to publicly disseminate information about OTC: IMRFF via digital communications. We have been paid five thousand dollars USD.