U.S. Inflation Reduction Act Unleashes Potential for Little-Known Company's Net-Zero Mining Plans to Power Clean Energy and Electric Vehicles with Domestic Resources…

See why now could be the best time to start your research on Lancaster Resources (CSE: LCR)(OTC:LANRF).

LANCASTER RESOURCES (CSE: LCR)(OTC: LANRF)

LATEST NEWS

Andrew Watson Joins Lancaster Resources as VP, Engineering and Operations to Propel Lithium Exploration and Solar Development

10 Reasons Why Lancaster Resources (CSE: LCR) (OTC: LANRF) Could Be Poised For Significant Upside Potential in 2023!

IDENTIFYING THE OPPORTUNITY

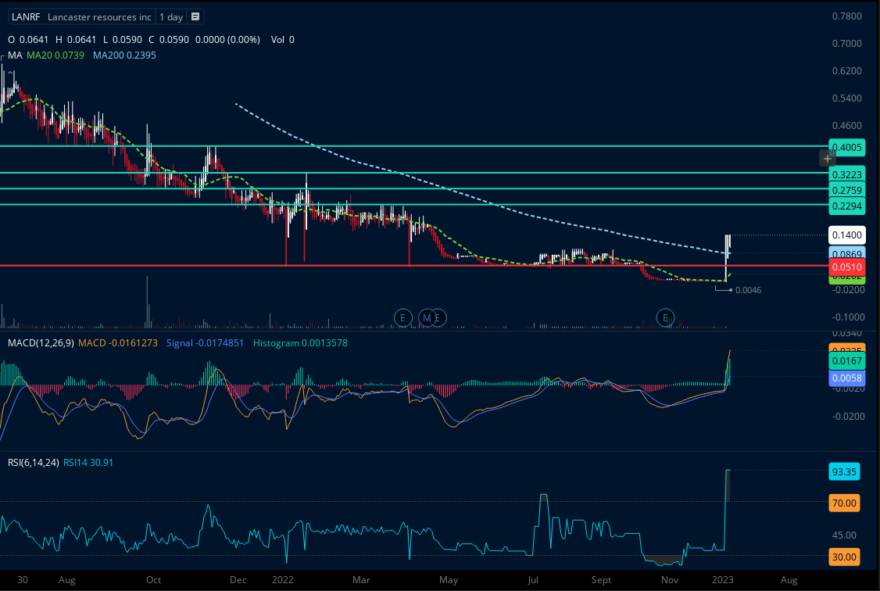

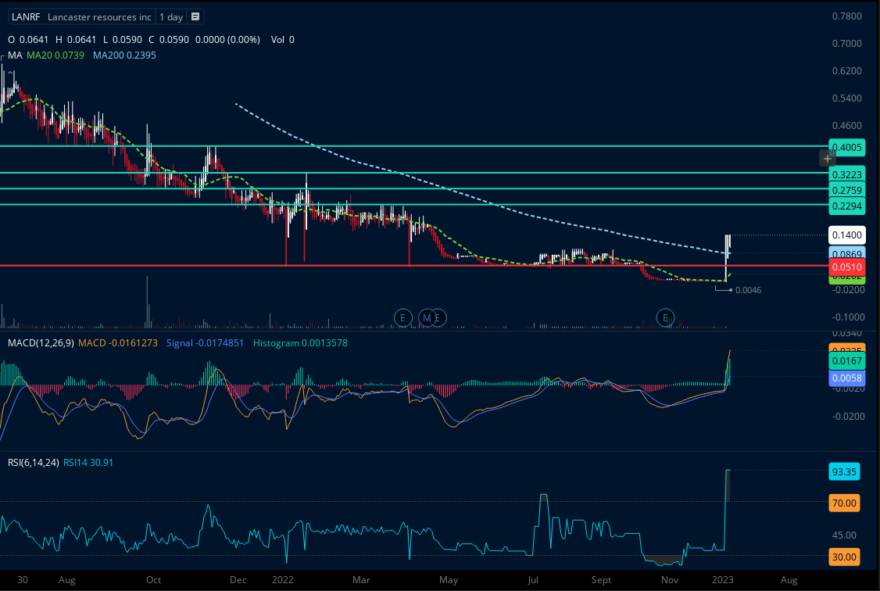

TREND BREAKS LEAD OFTEN TO MASSIVE RUNS

With a float of roughly 42M and very few restricted shares, a little bit of investor interest could send this soaring!

TARGETS

Target #1: $0.2294 (+63.86%)

Target #2: $0.2759 (+97.07%)

Target #3: $0.3223 (+130.21%)

Target #4: $0.4005 (+186.07%)

Support: $0.0510

LANCASTER RESOURCES

(CSE: LCR)(OTC: LANRF)

Unlocking the Potential of Critical Minerals for Clean Energy: Discover a Company Leading the Charge

The United States is making significant strides in its transition to clean energy, with the goal of reducing its carbon footprint and embracing sustainable technologies. A central component of this energy transition is the secure and sustainable supply of critical minerals, which are indispensable for the development of renewable energy sources, electric vehicles (EVs), and energy storage solutions. The Inflation Reduction Act, signed into law by the White House, is set to play a pivotal role in the U.S. energy transition by incentivizing the domestic production of these essential minerals. (1)

The Inflation Reduction Act is a landmark bill with far-reaching implications for the mining industry and the energy transition. The $750 billion bill, which primarily addresses healthcare and tax reforms, has been hailed as the U.S.’s first true climate bill. It includes a legal requirement for the country to reduce greenhouse gas emissions by 40% between 2005 and 2030. (1)

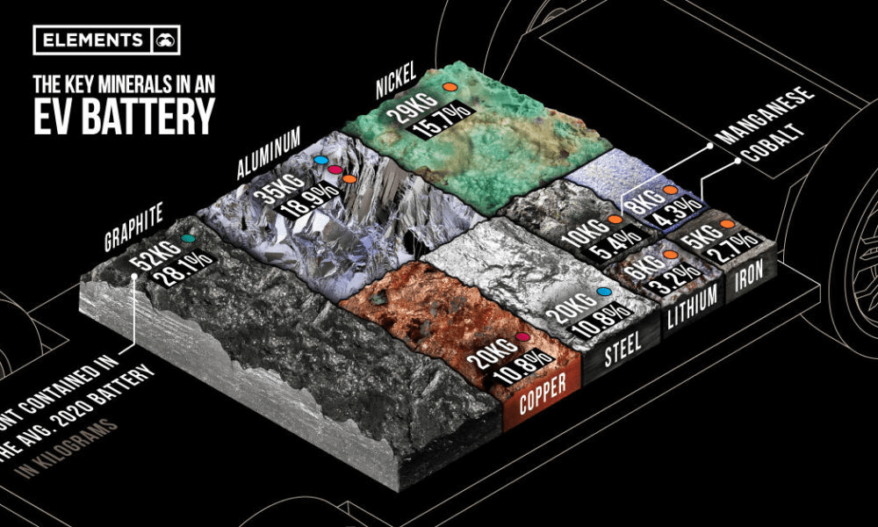

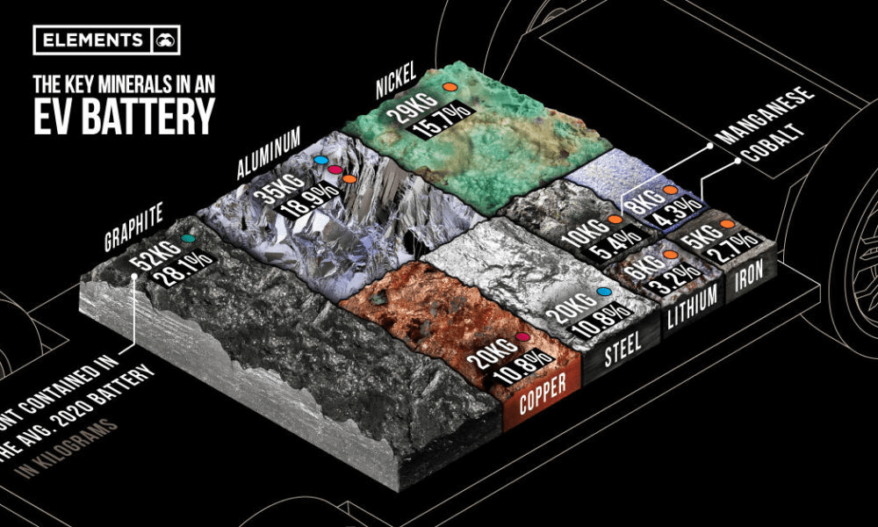

The act specifically highlights the importance of critical minerals in the energy transition. It names 50 “applicable critical minerals” that are vital for the energy transition, including battery metals such as cobalt and lithium, rare earth metals like neodymium, and other minerals such as aluminum, tin, nickel, graphite, and chromium. These minerals are crucial for the manufacturing of EVs, wind turbines, solar panels, and energy storage systems. (1)

To encourage domestic mining of these critical minerals, the act provides mining companies with a production credit equal to 10% of production costs, provided the extracted minerals meet defined purity thresholds. This incentive is designed to strengthen the U.S. mining industry and reduce dependence on foreign mineral sources. (1)

Building Domestic EV Supply Chains and Supporting the Energy Transition

The Inflation Reduction Act also aims to establish electric vehicle (EV) supply chains within the U.S., in response to the growth of China’s EV industry. It includes provisions for tax credits for manufacturers of EVs that meet minimum thresholds for U.S.-manufactured components. Specifically, at least 40% of critical minerals in U.S.-made EV batteries must come from U.S. miners or recycling plants, or mines in countries with free trade deals with the U.S. This requirement will gradually increase to a maximum of 80% by 2027. (1)

The act also sets minimum percentages for the value of battery components sourced from North America required for a project to receive tax credits. By 2029, 100% of the value of a U.S.-made battery’s components must come from North America.

These provisions are designed to promote the domestic production of EVs and critical minerals, thereby supporting the U.S. energy transition and reducing reliance on foreign supply chains.

Amid these developments, one company to keep an eye on in this space is Lancaster Resources (CSE: LCR)(OTC: LANRF).

Lancaster Resources is newly listed in both Canada and the U.S. And Lancaster Resources (CSE: LCR)(OTC: LANRF) is currently flying under the radar screen on Bay Street in Canada and Wall Street in the U.S. The company’s projects are strategically located in the United States, positioning it to take advantage of the Inflation Reduction Act. This legislation presents a significant opportunity for Lancaster Resources to play a key role in supplying the essential minerals required for the growing EV industry and the broader transition to clean energy. (1)

As the U.S. moves forward with its climate commitments and energy transition goals, the secure and sustainable supply of critical minerals will be of paramount importance. The Inflation Reduction Act provides a framework for achieving this objective and ensuring that the U.S. remains at the forefront of the global energy transition.

The Inflation Reduction Act is a testament to the U.S. government’s commitment to achieving its climate goals and advancing the energy transition. By recognizing the strategic importance of critical minerals and providing targeted incentives for their production, the act sets the stage for a new era of clean energy innovation and sustainable development. As the U.S. continues to pursue its net-zero ambitions, companies like Lancaster Resources (CSE: LCR)(OTC: LANRF) are well-positioned to play a vital role in shaping the energy landscape of the future. As a newly listed company in the U.S., Lancaster Resources may not yet be on the radar of many on Wall Street, but its strategic positioning in the critical minerals sector makes it a company to watch as the U.S. accelerates its transition to clean energy and electric vehicles. (1)

Electric Vehicle Revolution: Global Market to Reach $1.7 Trillion by 2032

The electric vehicle (EV) market is experiencing a period of remarkable growth, driven by technological advancements, environmental awareness, and supportive government policies. As the global EV market size is projected to expand from USD 205.58 billion in 2022 to around USD 1.7 trillion by 2032, the demand for critical minerals used in EV batteries is also expected to surge. Lancaster Resources (CSE: LCR)(OTC: LANRF) is strategically positioned to contribute to the EV supply chain and benefit from the market’s growth potential. (19)(2)

Lancaster Resources (CSE: LCR)(OTC: LANRF) is poised to play a significant role in the rapidly expanding EV market. Here’s how the company is positioned for success: (19)

The EV market is on a trajectory of rapid expansion, and Lancaster Resources (CSE: LCR)(OTC: LANRF) is strategically positioned to benefit from this growth. With its focus on critical minerals, commitment to sustainability, and strong leadership, Lancaster Resources is poised to play a key role in meeting the growing demand for critical minerals in the EV industry. As the EV market continues to evolve, companies like Lancaster Resources (CSE: LCR)(OTC: LANRF) are essential in ensuring a secure and sustainable supply chain for the future of transportation.

Lancaster Resources

(CSE: LCR)(OTC: LANRF)

Lancaster Resources (CSE: LCR)(OTC: LANRF): A Pioneering Force in the Global Energy Transition

Sustainable, Effective Impact

The global energy landscape is undergoing a profound transformation as the world seeks to reduce its reliance on fossil fuels and embrace cleaner, more sustainable energy sources.

This energy transition, driven by concerns over climate change and the need for energy security, presents a unique opportunity for forward-thinking companies that are actively participating in the shift toward a low-carbon future.

One such company is Lancaster Resources (CSE: LCR)(OTC: LANRF), a mineral exploration company with a strategic focus on discovering and developing minerals that are essential for electrification and decarbonization, such as lithium and copper.

Here’s why industry stakeholders should keep a close eye on Lancaster Resources (CSE: LCR)(OTC: LANRF) as the energy transition unfolds. (2)

Exploring Critical Minerals for a Sustainable Future

The transition to a low-carbon future is accelerating, and electric vehicles (EVs) are at the forefront of this transformation. As consumers and governments around the world embrace EVs as a more sustainable alternative to traditional internal combustion engine vehicles, the demand for lithium-ion batteries is surging. Lithium, a key component of these batteries, is indispensable for the electrification of transportation and the expansion of renewable energy infrastructure. (14)

Copper, another critical mineral, plays a vital role in the manufacturing of electrical wiring and components used in renewable energy technologies such as wind turbines and solar panels. As the world continues to embrace renewable energy sources, the need for copper is also on the rise. (14)

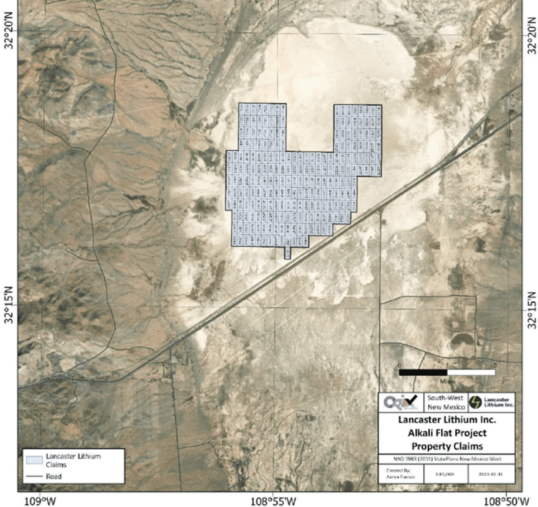

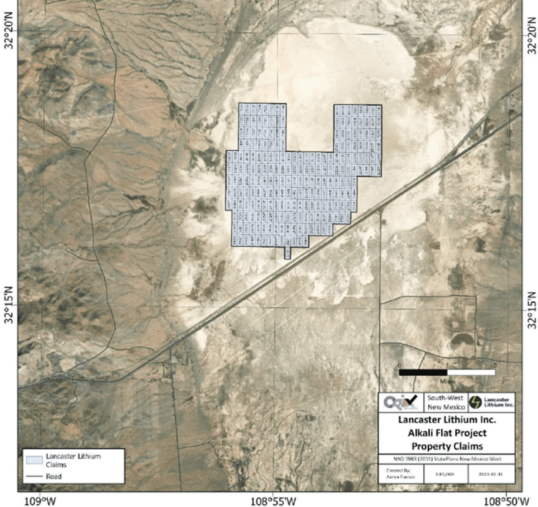

Lancaster Resources is at the forefront of the global energy transition, with a strategic focus on lithium and copper exploration. Lancaster Resources (CSE: LCR)(OTC: LANRF)’s endeavors include the exploration of the Alkali Flat Lithium Project in New Mexico, which holds significant promise for the discovery and development of lithium resources. (2)

Lancaster Resources' Vision for Alkali: Harnessing Solar Power for a Sustainable Energy Future

Lancaster Resources (CSE: LCR)(OTC: LANRF) is dedicated to sustainable project development with minimal environmental impact. With a strong focus on sustainability, innovation, and positive community impact, the company is actively engaged in projects that align with the global energy transition. (21)

Currently, Lancaster Resources is exploring the Alkali Flat Lithium Project in New Mexico, while concurrently developing a nearby solar project. By harnessing solar power, the company aims to minimize its reliance on non-renewable energy sources and drive its operations with clean, sustainable energy. These efforts reflect the company’s commitment to environmental responsibility and positively influencing the communities in which it operates.

In addition to these projects, Lancaster Resources is continuously building its portfolio to seize opportunities in the energy transition. By embracing renewable energy and sustainable practices, the company positions itself at the forefront of shaping a greener and more sustainable future.

Lancaster Resources (CSE: LCR) (OTC: LANRF) is steadfast in its pursuit of building projects that prioritize environmental sustainability and contribute to the energy transition. Through its commitment to renewable energy, innovation, and responsible project development, the company is driving positive change and working towards a more sustainable future. (21)

Lancaster Resources (CSE: LCR) (US: LANRF) - Pioneering Net-Zero Mining in New Mexico for a Sustainable Energy Future

Lancaster Resources (CSE: LCR) (US: LANRF) is spearheading a groundbreaking approach to mining that prioritizes sustainability and environmental responsibility. As a newly listed company in the U.S., Lancaster Resources may not yet be widely recognized, but its strategic positioning and commitment to Net-Zero Mining make it a company with immense potential in shaping the energy landscape of the future. (21)

With a focus on New Mexico, Lancaster Resources recognizes the incredible solar potential and abundant natural resources of the region. New Mexico’s commitment to combating climate change and its favorable regulatory framework for mining operations create a conducive environment for the company’s vision of Net-Zero Mining.(21)

Net-Zero Mining is vital in addressing the challenges posed by climate change and reducing emissions associated with traditional mining practices. By embracing renewable energy sources, such as solar power, Lancaster Resources aims to significantly minimize its environmental footprint while simultaneously achieving financial savings and fostering profitability. (21)

New Mexico’s abundant sunlight presents an unparalleled opportunity for Lancaster Resources to harness solar energy for its mining operations. By leveraging solar power, the company can reduce its reliance on fossil fuels, decrease emissions, and contribute to the state’s renewable energy goals. (21)

Lancaster Resources stands out as a leader in the industry due to its experienced team, financial capacity, and commitment to Net-Zero Mining principles. The company recognizes the urgency of transitioning existing mining practices to support the global energy transition and meet the increasing demand for base metals and lithium driven by the electrification of transportation. (21)

The importance of Net-Zero Mining cannot be overstated. It not only aligns with the imperative of addressing climate change, but also positions companies for a competitive advantage and the ability to command premiums in the market. Lancaster Resources’ dedication to minimizing environmental impact while maximizing operational efficiency puts it at the forefront of sustainable mining practices. (21)

By targeting the lowest emissions profile in the mining industry, Lancaster Resources aims to shape the future of responsible resource development. Through the reduction of water and acid usage, the adoption of electrified equipment, and the displacement of diesel with cleaner alternatives, the company is driving positive change in the industry. (21)

While the company may be relatively unknown, its focus on Net-Zero Mining, strategic location in New Mexico, and emphasis on renewable energy make it a compelling player in the transition to a more sustainable world.

LANCASTER RESOURCES

(CSE: LCR)(OTC: LANRF)

Critical Copper: Lancaster Resources (CSE: LCR) (OTC: LANRF) Positioned for Success Amid U.S. Supply Risk Concerns

The Copper Development Association (CDA) has released a new report indicating that copper now meets the U.S. Geological Survey’s (USGS’) benchmark Supply Risk score of 0.4, making it eligible for inclusion on the U.S. Critical Minerals List. The list, first established in 2018, identifies minerals that are essential to U.S. economic and national security and have supply chains susceptible to disruption.

The USGS uses a qualitative methodology to calculate supply risk scores based on economic vulnerability, disruption potential, and trade exposure. However, the 2022 list relied on data from 2018, resulting in copper narrowly missing the 0.40 threshold for automatic inclusion.

CDA President and CEO Andrew G. Kireta Jr. explains that the association commissioned an analyst to update copper’s supply risk score using the latest data available through 2022. The updated data reveals that the share of copper consumption met by net imports has risen from 33% in 2018 to 44% in 2021 and 41% in 2022. In the first half of 2022, net import reliance stood at 48%.

The CDA’s report calculates copper’s Supply Risk score in 2022 as 0.423, with a four-year weighted average score of 0.407, both exceeding the USGS threshold. Kireta emphasizes the importance of copper in the clean energy transition and the need for immediate action to secure the copper industry’s contributions to national defense and economic security.

The report has garnered support from political, policy, and industry leaders who have sent letters to U.S. Department of the Interior Secretary Deb Haaland, urging the inclusion of copper on the list without waiting for the next update in three years. Copper Caucus Co-Chairs Bob Latta and Brian Higgins highlight the importance of copper for manufacturing facilities and economic transition.

Adding copper to the Critical Minerals List would allow for streamlined regulations and expedited development of new supply sources. John E. Gross, president of John E. Gross Consulting Inc., echoes the sentiment, stating that the U.S. must address its dependence on imported refined copper.

Lancaster Resources (CSE: LCR)(OTC: LANRF)’s focus on copper exploration aligns with the rising demand for this essential mineral. The company’s strategic focus on copper exploration positions it to benefit from the potential inclusion of copper on the U.S. Critical Minerals List.

Lancaster Resources (CSE: LCR) (OTC: LANRF) recognizes the significance of copper in the global shift toward clean energy and electrification and is poised to contribute to the secure and sustainable supply of this critical mineral. (15)(2)

Lancaster Resources (CSE: LCR)(OTC: LANRF) Responds to New U.S. Critical Mineral Requirement for EV Batteries

The transition to electric vehicles (EVs) is accelerating, and with it comes a growing demand for critical minerals used in EV batteries. To ensure a secure and sustainable supply chain for these minerals, the U.S. government has introduced a new requirement that will impact the sourcing of critical minerals for EV batteries. Lancaster Resources (CSE: LCR)(OTC: LANRF) is well-positioned to respond to this new requirement with its domestic projects. (17)(2)

The New U.S. Requirement for Critical Minerals in EV Batteries:

Starting in 2023, the U.S. government will require that at least 40% of the value of the critical minerals in an EV’s battery be sourced from the U.S., countries with which the U.S. has a free trade agreement, or be recycled in North America. This requirement applies to vehicles placed in service after the Treasury and the IRS issue proposed guidance.

The required percentage will see a gradual increase each year, reaching 50% in 2024, 60% in 2025, 70% in 2026, and 80% after 2026. This initiative aims to reduce dependence on foreign sources of critical minerals, promote domestic production, and enhance sustainability through recycling. (17)

Lancaster Resources (CSE: LCR)(OTC: LANRF)'s Domestic Projects:

Lancaster Resources is a company that recognizes the importance of a secure and sustainable supply chain for critical minerals. With a strategic focus on domestic projects, Lancaster Resources is well-positioned to contribute to meeting the new U.S. requirement. (2)

The new U.S. requirement for critical minerals in EV batteries presents both challenges and opportunities for the industry. Lancaster Resources, with its emphasis on domestic exploration and sustainable practices, is poised to play a key role in meeting this requirement. As the demand for critical minerals continues to rise, companies like Lancaster Resources (CSE: LCR) (OTC: LANRF) are essential in ensuring a secure and sustainable supply chain for the EV industry. (17)(2)

DIGGING DEEP

LANCASTER RESOURCES

(CSE: LCR)(OTC: LANRF)

Commitment to Sustainability and Innovation

Lancaster Resources (CSE: LCR)(OTC: LANRF)’s dedication to sustainability sets it apart from many other companies in the mineral exploration sector. The company is committed to minimizing its environmental impact and harnessing renewable energy sources, such as solar power, for its projects. This approach aligns with the values of environmentally conscious stakeholders who seek to support companies that prioritize sustainability and responsible resource development. (2)

In addition to its sustainability efforts, Lancaster Resources is driving innovation in the mineral exploration sector. By leveraging advanced technologies and best practices, the company aims to enhance the efficiency and sustainability of its operations, thereby creating long-term value for its stakeholders. (2)

Strategic Domestic Project Locations

Lancaster Resources (CSE: LCR)(OTC: LANRF)’s projects are strategically located in the United States, allowing the company to benefit from the U.S. Inflation Reduction Act, which emphasizes the need for domestic sources of raw materials for electric vehicles. By focusing on domestic projects, LCR is well-positioned to contribute to the country’s efforts to establish a secure and stable supply of critical minerals for the EV industry.(2)

Lancaster Resources (CSE: LCR)(OTC: LANRF) is dedicated to positively impacting the environment and communities where it operates. The company fosters strong relationships with local stakeholders and works collaboratively with local residents, governments, and organizations to ensure that its projects align with the needs and values of the communities in which it operates.(2)

A Vision for Climate-Positive Lithium

Lancaster Resources (CSE: LCR)(OTC: LANRF)’s vision to produce Climate Positive Lithium reflects the company’s commitment to sustainability and environmental stewardship. Climate Positive Lithium refers to the production of lithium in a manner that reduces carbon emissions and minimizes the environmental impact of lithium extraction and processing. This approach involves harnessing renewable energy sources, such as solar power, to power lithium production facilities and implementing innovative technologies and practices to reduce the carbon footprint of lithium production. (2)

A Key Player in the Energy Transition

As the world continues its journey toward a low-carbon future, companies like Lancaster Resources will play a pivotal role in providing the resources needed to support this transition. With its strategic focus on lithium and copper exploration, commitment to sustainability, innovative approach to mineral development, and dedication to community engagement, Lancaster Resources is poised to make a meaningful contribution to the global shift toward a more sustainable and equitable future. (2)

Lancaster Resources (CSE: LCR)(OTC: LANRF)’s diversified portfolio, which includes the Alkali Flat Lithium Project and a solar project for renewable energy, provides exposure to multiple facets of the energy transition. The company’s domestic project locations in the United States align with national efforts to secure domestic sources of raw materials for electric vehicles, as emphasized by the U.S. Inflation Reduction Act. (2)

Lancaster Resources (CSE: LCR)(OTC: LANRF)’s team of experienced professionals and advisors brings a wealth of knowledge in mineral exploration, renewable energy, and sustainable practices, driving innovation in the sector. The company’s vision for Climate Positive Lithium exemplifies its commitment to environmental responsibility and sustainable practices, aligning with global efforts to combat climate change and promote responsible resource development. (2)

Introducing the Management and Technical Team of Lancaster Resources

(CSE: LCR)(OTC: LANRF).

Lancaster Resources (CSE: LCR)(OTC: LANRF) is a company that has positioned itself at the forefront of the exploration and development of critical minerals essential for the global energy transition. As the world shifts toward a low-carbon future, Lancaster Resources’ strategic focus on lithium and copper exploration aligns with the increasing demand for these minerals in electric vehicles and renewable energy technologies. The success of Lancaster Resources can be attributed to its dynamic and experienced management and technical team, which brings a wealth of knowledge and expertise to the company’s operations. (2)

Management team

Penny White, BA, LLB - President & CEO

Penny White is an accomplished business leader with over 20 years of experience in the capital markets. As the President and CEO of Lancaster Lithium Inc., she brings a wealth of expertise and leadership to the company. Penny has a diverse background, with experience in sectors such as mining, pharmaceuticals, and clean energy. She co-founded a pharmaceutical company that was later acquired for $342 million and was the Chairman of Highbury Energy for 10 years. Penny has been recognized in PROFIT Magazine's W100 list of top entrepreneurs and has raised over $50 million for companies she has founded. In addition to her Law Degree, Penny has completed the Oxford Leading Sustainable Corporations Programme and the Oxford Climate Emergency Programme from Saïd Business School, University of Oxford. She is deeply committed to fighting climate change and working towards a more sustainable future.

Patrick Cruickshank, MBA, CFA - Advisor

Patrick Cruickshank brings over 20 years of experience from the Wealth Management Sector working for Merrill Lynch, Legg Mason, and Citigroup Capital Markets. Mr. Cruickshank was an NFLPA Advisor and transitioned into the Private Equity Sector, where he concentrated on acquiring, funding, and growing companies in the Energy and Resource Sector. He is the current CEO and Director of Nine Mile Metals Limited (CSE: NINE) and serves on a number of private resource companies. Mr. Cruickshank is also a former Canadian Olympic/U23 soccer player, US NCAA Division 1 Collegiate player and coach, and received his MBA from the Schulich School of Business at York University.

Technical team

Daniel Card, P. GEO, RPGEO - Technical Committee, EarthEx Founder

Daniel Card is a professional Geophysicist with a BSc. Hons degree from the University of Manitoba and is registered in Canada and Australia. His career started with Xstrata (now Glencore) and he played a key role in the discovery of the 9 MT Odysseus Nickel Sulphide Deposit. He served as Senior Geophysicist for Southern Geoscience Consultants and founded EarthEx, specializing in geophysical prospecting, data interpretation, 3D modeling, and target definition.

Mark Fedikow, B.Sc (Honors), M.Sc., Ph.D. - Advisory Board

Mark Fedikow is a mineral deposits geologist and applied geochemist with Honors B.Sc. and M.Sc. degrees in geology from the University of Windsor and a Ph.D. in exploration geochemistry from the University of New South Wales, Sydney, Australia. With over 40 years of experience working globally with junior and major exploration companies, Mark has been involved in the discovery of numerous commercial-grade deposits. He is registered as a Professional Geologist (P.Geo.) in Manitoba and as a Certified Professional Geologist (C.P.G.) with the Association of Professional Geologists in Westminster, Colorado, U.S.A.

Rodney Blakestad, J.D., C.P.G. - Exploration Consultant

Rodney Blakestad is a highly experienced consulting geologist with a successful career spanning over 40 years. Throughout his career, Rodney has been involved in the discovery of numerous commercial-grade deposits, including the bulk tonnage potential of the largest operating gold mine in Alaska (Fort Knox, now at 9M ounces), the Cerro Caliche bulk tonnage gold discovery near Cucurpe, Sonora, Mexico, and several volcanogenic massive sulfide deposits (VMS) in the Alaska Range, USA. Rodney's expertise in minerals exploration was developed through his university education at the University of Alaska and his Juris Doctor from the University of Denver Law School. Rodney is a Certified Professional Geologist with the American Institute of Professional Geologists and a registered Professional Geologist in the State of Alaska.

The management and technical team of Lancaster Resources (CSE: LCR)(OTC: LANRF) brings together a diverse set of skills and experiences, positioning the company to excel in the exploration and development of critical minerals. Their collective expertise, dedication to sustainability, and commitment to innovation are key drivers of the company’s success as it navigates the dynamic landscape of the global energy transition.

As Lancaster Resources (CSE: LCR)(OTC: LANRF) continues to advance its projects and contribute to the global shift toward a low-carbon future, the company’s leadership and technical team will undoubtedly play a pivotal role in shaping its trajectory. With a strong foundation in place, Lancaster Resources is well-positioned for the growing demand for critical minerals and makes a positive impact on the world’s energy landscape.(2)

Sources

- Source 1: https://www.mining-technology.com/features/whats-in-the-inflation-reduction-act-for-miners/#:~:text=After%20passage%20of%20the%20act,maximum%20of%2080%25%20in%202027.

- Source 2: https://marketnewstrends.com/wp-content/uploads/sites/4/2023/05/Lancaster-Resources-Presentation-LWM.pdf

- Source 3: https://cdn.vox-cdn.com/thumbor/FEqj8H_agiW39Wk1aZadA24hHqc=/0x0:7500×3726/1200×800/filters:focal(2881×1381:4081×2581)/cdn.vox-cdn.com/uploads/chorus_image/image/64983110/shutterstock_1075034981.0.jpg

- Source 4: https://www.kimley-horn.com/wp-content/uploads/2021/11/Primary-min-1.jpeg

- Source 5: https://static.seekingalpha.com/uploads/2017/9/27/41325066-1506537476657737_origin.png

- Source 6: https://spectrum.ieee.org/media-library/illustration-of-an-electric-vehicle-plugged-into-a-house-plugged-into-a-battery.jpg?id=32878641&width=1200&height=600&coordinates=0%2C312%2C0%2C313

- Source 7: https://wp.technologyreview.com/wp-content/uploads/2022/10/AP21322010887951-crop.jpeg

- Source 8: https://blog.evbox.com/hs-fs/hubfs/Batteries_2.jpg?width=1000&height=667&name=Batteries_2.jpg

- Source 9: https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1256374145/image_1256374145.jpg?io=getty-c-crop-16-9

- Source 10: https://media.arcadis.com/-/media/project/arcadiscom/com/expertise/solutions/resilience/energy-transition/energy-transition—header.png?rev=c612212658e542d286845e971eae56e9

- Source 11: https://lancasterlithium.com/wp-content/uploads/2022/11/NewMexico_WebRes5-1024×683.jpg

- Source 12: https://www.treehugger.com/thmb/zUpmUk500L7Wvew1ZfV_bKWkMEo=/1500×0/filters:no_upscale():max_bytes(150000):strip_icc()/blue-solar-panels-1226088001-cee91a7ba920447280aed1d081b44859.jpg

- Source 13: https://img.i-scmp.com/cdn-cgi/image/fit=contain,width=1098,format=auto/sites/default/files/styles/1200×800/public/d8/images/canvas/2023/01/27/4476cc46-e1b1-4065-bfc0-48668fbbd698_08066062.jpg?itok=Msq4xiW9&v=1674811598

- Source 14: https://www.iea.org/news/clean-energy-demand-for-critical-minerals-set-to-soar-as-the-world-pursues-net-zero-goals

- Source 15: https://recyclingtoday.com/news/cda-report-shows-copper-critical-mineral-to-us-national-defense-economy/

- Source 16: https://aheadoftheherd.com/app/uploads/2020/12/copper-chemical-element-1027×675.jpg

- Source 17: https://home.treasury.gov/system/files/136/30DWhite-Paper.pdf

- Source 18: https://elements.visualcapitalist.com/wp-content/uploads/2022/04/ev-battery-minerals-1000×600.jpg

- Source 19 :https://www.precedenceresearch.com/electric-vehicle-market

- Source 20: https://image.cnbcfm.com/api/v1/image/106880046-1620412288708-gettyimages-1231905756-739423_FI_0323_LA_Renewable_Energy_023IKJPG.jpeg?v=1677736801

- Source 21: https://lancaster-resources.com/wp-content/uploads/2023/05/Lancaster-Resources-May-18.pptx.pdf

- Source 22: https://finance.yahoo.com/news/andrew-watson-joins-lancaster-resources-110000125.html

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media LLC and Lifewater Media, Virtus Media LLC has been hired by Lifewater Media LLC for a period beginning on 06/28/2023 and ending 06/29/2023 to publicly disseminate information about OTC:LANRF via digital communications. We have been paid seven thousand five hundred dollars USD.