A NOVEL SOLUTION

“JOIN TV, North America's premiere F.A.S.T. (Free Ad Supported Television) channel and AVOD network, is set to launch in Fall 2023. Providing free on-demand channels for global audiences, it promises a diverse array of content, ending the need for monthly cable or subscription-based streaming services.”

5 Reasons Why Join TV (OTCPK: RINO) Could Be Poised For Significant Upside Potential in 2023

IDENTIFYING THE OPPORTUNITY

COMPRESSION AND RELEASE

We are seeing multiple time frames with the same setup, and that confluence historically pays nicely!

TARGETS

Target #1: $0.0230(+86.99%)

Target #2: $0.0472 (+283.74%)

Target #3: $0.0694 (+464.23%)

Target #4: $0.0906 (+696.59%)

Support: $0.0007

Join Entertainment

(OTC: RINO)

Company: Who is Join Entertainment?

Overview

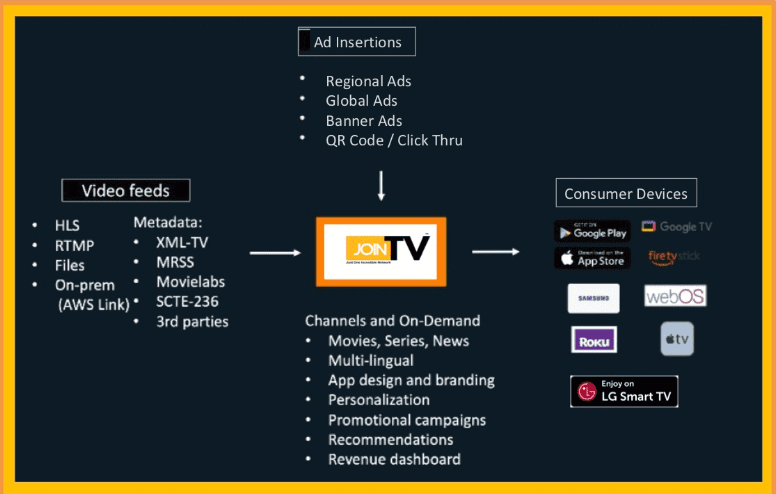

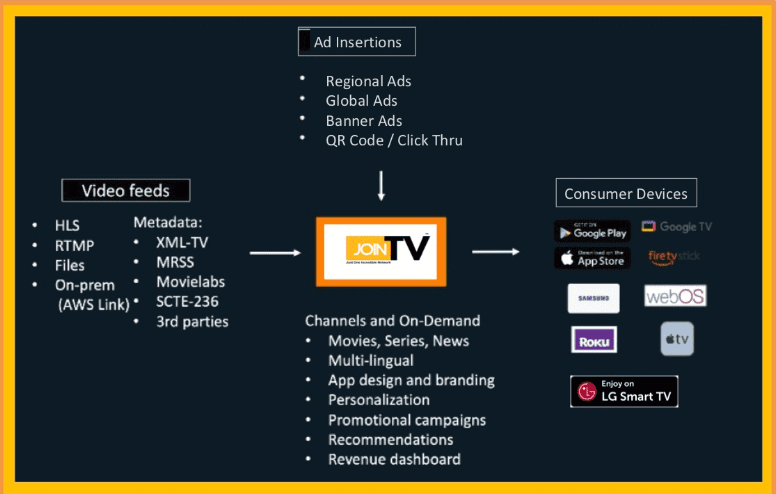

JOIN TV - Just One Incredible Network – is a North American Entertainment Network that provides distribution and revenue generating solutions to OTT (Over-the-Top) platforms worldwide. We are an aggregator of F.A.S.T. (Free Ad Streaming Television) channels: we create them, distribute them, and we are monetizing them through the JOIN TV global network.

FAST channels are available on over 1.4 billion Smart televisions around the world, distributed by services such as Amazon Prime, Roku, Google Chromecast, LG, Samsung, Apple + and 25 others.

Revenue Streams are generated through inserted advertisement (commercials), or paid service channels (such as government or corporate channels) and the distribution of acquired content to other broadcasters. Additional revenue streams are generated through onscreen QR Code links, banner ads and live event programs scheduled as pay-per-view content.

In addition to broadcasting channels JOIN TV will represent 1000’s of hours of content to broadcasters around the world making it one of the largest North American based television distribution company that supports and can launch standalone “Branded” FAST channels for companies, brands, regions, or government programs.

Team

As a team of highly experienced professionals in the field of film and television production and broadcasting, our team brings a wealth of knowledge and expertise to the emerging FAST industry.

Our team consists of individuals with diverse backgrounds and skills, each of whom are experts in all aspects of broadcast, production, post-production, advertising, marketing, and branded channel sales.

From concept development and design to implementation and ongoing support.

We have a deep understanding of the latest technologies and trends in the global FAST marketplace and industry.

JOIN Entertainment

(OTC: RINO)

FAST Forward: Embracing a Streaming Revolution, Fueled by the Future of Entertainment

FAST (Free Ad Supported Television) bypasses cable and satellite television providers that traditionally act as a controller or distributor and is accessed directly via the internet to over 1+ Billion Smart TVs globally. Viewers watch on-demand or streaming programs for free – no need to pay for cable or monthly subscription fees. Current examples of (FAST) channels operating in the U.S. marketspace include: Peacock, Pluto, Tubi, Roku, Sling, Xumo, Samsung TV+, and Stirr.

The JOIN TV Network – Branded as JOIN (Just One Incredible Network) is North American owned and operated and upon launch will be North America's Premiere FAST Channel Network with over 25 unique channels of content made available to viewers globally. Each channel has its own dedicated app so viewers control what they watch, when they want to watch it, anywhere and at any time. Examples of JOIN TV Channels include: JOIN Travel, JOIN Comedy, JOIN Music, JOIN Fashion, JOIN Sports, JOIN Crypto, JOIN Trending, JOIN Mystic, JOIN Indigenous, JOIN Veterans.

In addition to broadcasting channels, JOIN TV will represent 1000’s of hours of content to other broadcasters around the world making it the largest North American based television distribution company.

JOIN TV has an estimated 12 to 18-month lead-time advantage for the emerging Global (FAST) Marketplace. Once JOIN TV has successfully established itself in the North American market, the company will widen its focus and expand into South America, the UK, Ireland and other European territories so we can create new channels and lead the way in Europe and Latin America.

What Are FAST Channels?

Free Ad Streaming Television provides a similar viewing experience to linear television, complete with commercial breaks but is delivered at no cost through internet-connected TVs. FAST channels are yet another disruption to the broadcast television industry, a new, but familiar, development in an industry where television manufacturers, broadcast studios, and OTT players generate revenue streams through advertisements that typically run 12 minutes per one-hour of content.

Viewers see FAST channels as a complement or an alternative choice to the premium content they pay for, like Netflix, Amazon, HBO and Disney+. Additionally, FAST channels fill a gap found when consumers cut the cord, allowing them to quickly find and watch continuous content without searching and finding specific shows.

The most popular FAST channels are fairly broad. Currently, the top watched FAST channel broadcasters and networks are: Pluto TV (owned by Viacom CBS), Xumo (owned by NBCU), Tubi (owned by Fox), Peacock (owned by NBCU), The Roku Channel (RokuTM), IMDBTV (owned by Amazon), Samsung TV+ (Samsung) and LG Smart TV (LG).

Why FAST, Why Now?

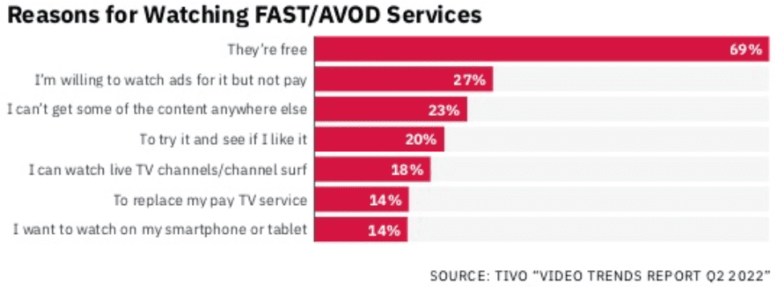

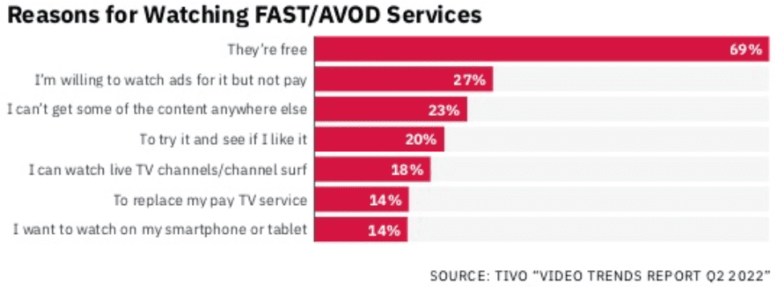

There are several factors contributing to the increasing popularity of FAST channels with viewers. Among them: the programming is free to watch, doesn’t require any dedicated set up like cable and pay TV, offers a wide array of linear and on-demand content, and its user-friendly program guides makes FAST a desirable option for viewers. With no cord connection required at the consumer’s end and minimal infrastructure on the delivery side, FAST channels are a simple solution to providing entertainment at no cost to the viewer and minimal expense to the distributor.

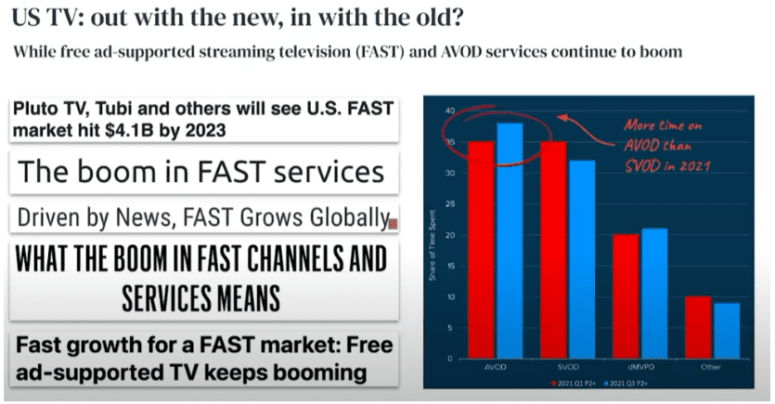

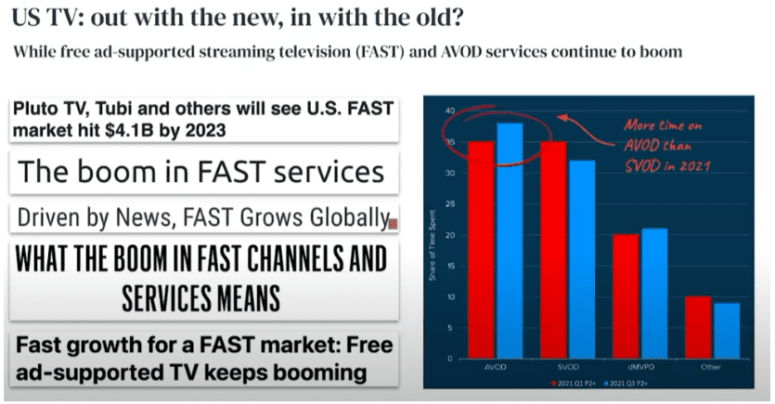

Many viewers have hit their limit on monthly content subscriptions, so FAST channels are a welcome way to fill their content gaps. The bottom line: FAST channels are experiencing faster user growth and overall consumption compared to paid subscription services and consumers who are “Cord-cutting” from traditional cable television subscriptions.

Cable and Pay-TV Cord-Cutting Trends

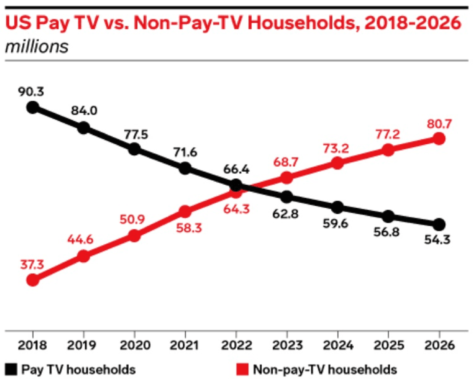

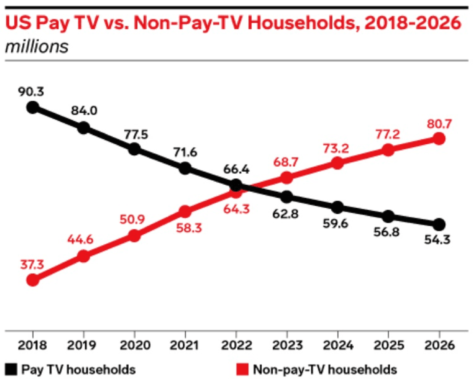

Cord-cutting is responsible for leading cable TV providers losing millions of customers they can’t seem to win back. In fact, traditional Pay-TV providers lost approximately 6 million Pay-TV subscribers each year from 2018 to 2022 and the trend is expected to continue as consumers switch to free services such as FAST.

In total, major US cable TV and satellite TV companies have lost 25 million subscribers since 2012, and are projected to lose another 25 million by 2025. The largest traditional cable TV providers experiencing subscriber losses include:

• Comcast: The company had 18.55 million TV customers in Q3 2021. However, in the first half of 2022, it lost more than a million and now sits at around 17.14 million customers.

• Verizon: Subscriber numbers for the company have decreased every quarter since Q4 2016. The company lost more than 150,000 TV subscribers in Q1 2022 and now sits at around 7.3 million overall.

• Charter: This organization is now losing tens of thousands of video customers each year. Its CEO blames higher carriage fees imposed by programmers as a key trigger for customers who are moving on to cord- cutting services. This network had an abysmal 2022, with over 225,000 customers cancelling their Pay TV subscription, up from a loss of 58,000 in Q4 of 2021.

• DirecTV (satellite): This AT&T-owned company lost 473,000 satellite TV subscribers in Q2 2021, improving from a much bigger decline of 887,000 subscribers in the previous year. However, it has failed to stem the tide, with a further 300,000 customers leaving in Q1 of 2022.

• Dish Network: The second-largest cable TV provider in the US has also seen its customer share dip. Dish Network lost 273,000 net pay-TV subscribers in Q4 2021, compared with a drop of 133,000 in the previous year, and lost another 228,000 customers in Q1 of 2022.

• Comcast: Which has experienced unquestionably the largest loss of cable TV subscribers is not optimistic about its Pay-TV prospects. The company predicts it will see even more of its customers dropping its traditional cable TV packages in 2023 as consumers switch to free services such as FAST.

Most cord-cutters are not ditching TV all together, but are instead moving to all- digital streaming services, such as FAST Channels, that can also be accessed by their smartphones and tablets.

Key Statistics for FAST Channel Growth

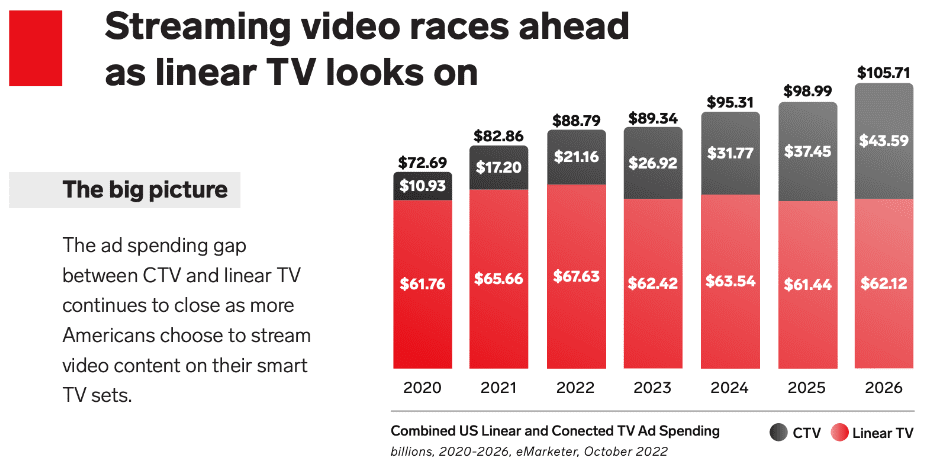

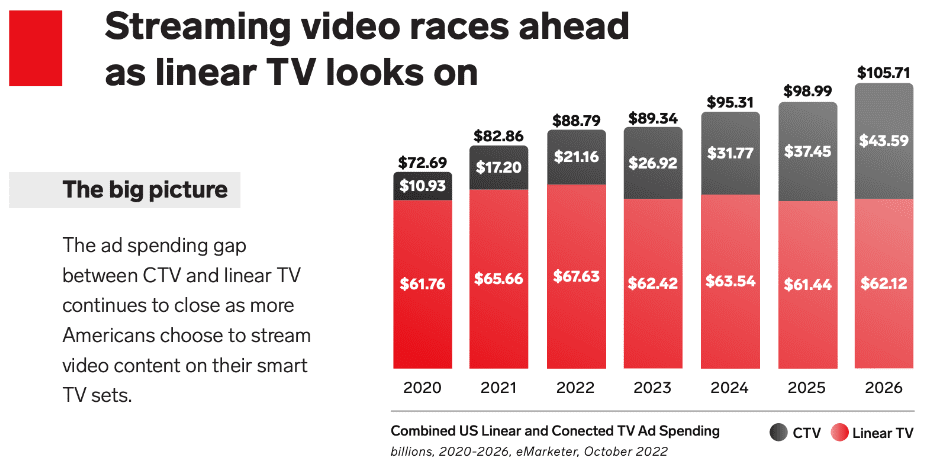

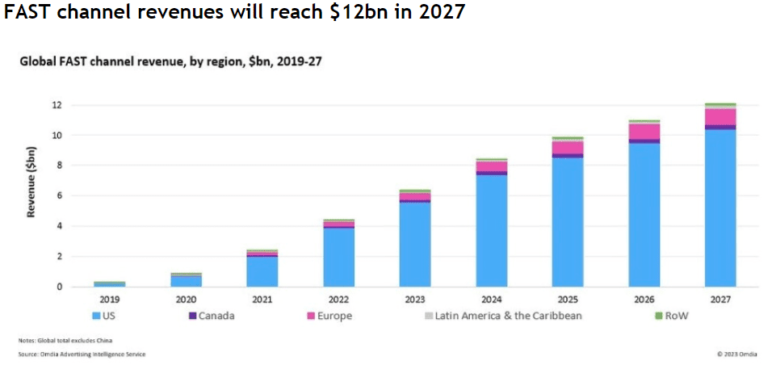

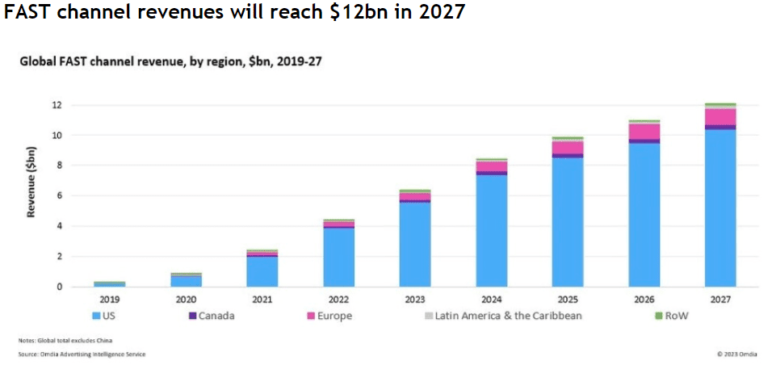

• 4.1 billion USD is the expected revenue of linear free ad-supported streaming TV (FAST) in the US in 2023. (Statista)

• 9 billion USD is the FAST channel ad revenue projection by 2026. (S&P Global Market Intelligence)

• 1,400 is the minimum number of FAST channels across 22 networks. (Variety)

• 18% is the increase in FAST channel ad impressions in 2022, and viewing time has gone up 10% year-over-year. (Conviva)

• The economic case for developing FAST channels is strong, with ad revenue in the United States growing at an accelerated clip. S&P Global Market Intelligence recently estimated U.S. FAST business in the range of $4 billion in revenue in 2023 and will more than double to almost $9 billion by 2026.

Multiple FAST platforms are now more prominent in the number of viewers compared to cable and satellite TV platforms in the U.S. Networks continue to fuel this growth with idle content in their libraries, putting that content to good use, earning revenue with the FAST model.

A growing number of large media companies are investing in FAST, including Viacom (Pluto TV), NBCU (Peacock) and Fox (Tubi). TV manufacturers also have their own FAST channels: The Roku Channel, Samsung TV Plus, Vizio’s WatchFree+, and more. It’s also been widely reported that Google is about to launch 50 free ad- supported channels.

JOIN Entertainment

(OTC: RINO)

The Global f.a.s.t. marketplace has reach in 83% of american homes

The United States is a far more mature market for FAST and many high-profile transactions have happened. In January 2019, Viacom purchased Pluto TV TM for $340 million. In February of 2020, Comcast acquired XumoTM for over $100 million, and in March 2020, Fox purchased Tubi for $440 million.

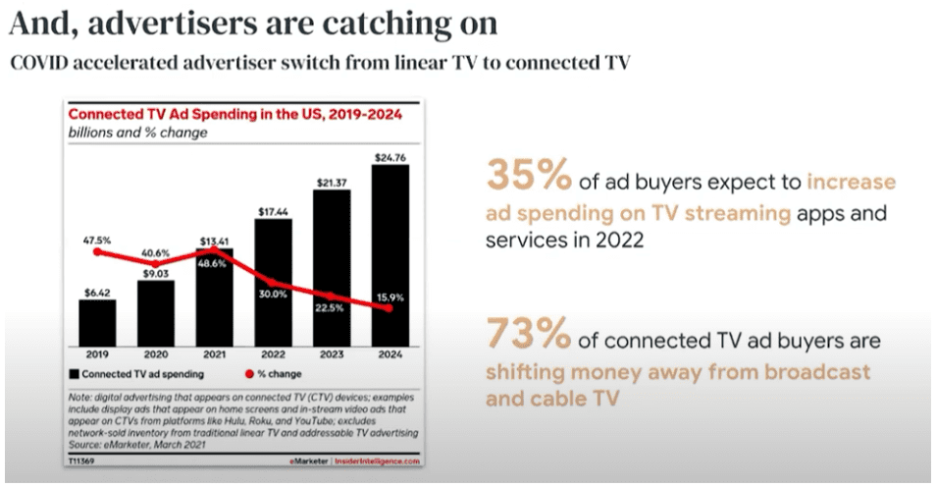

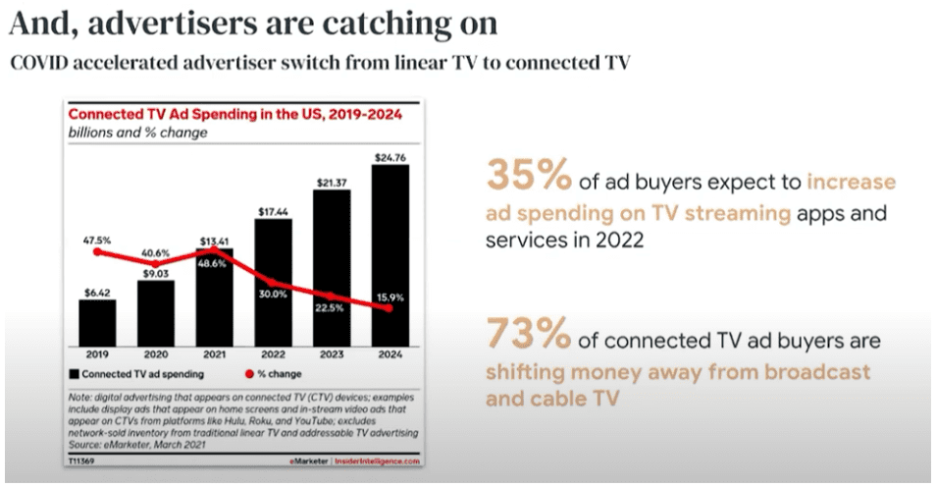

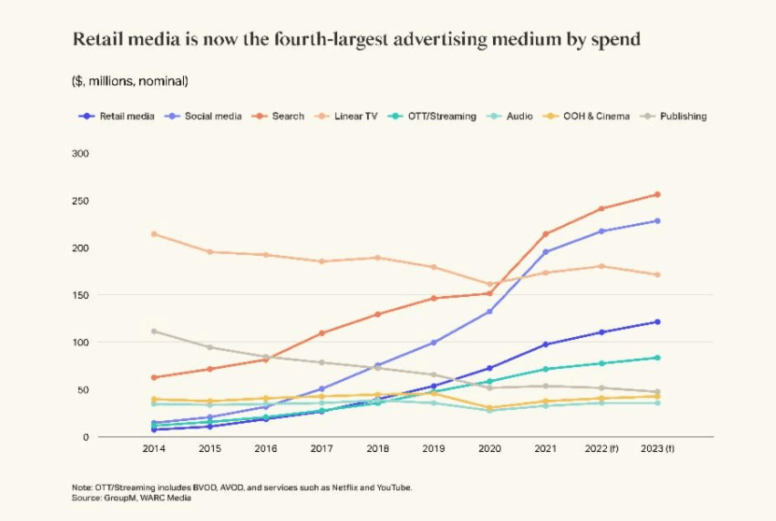

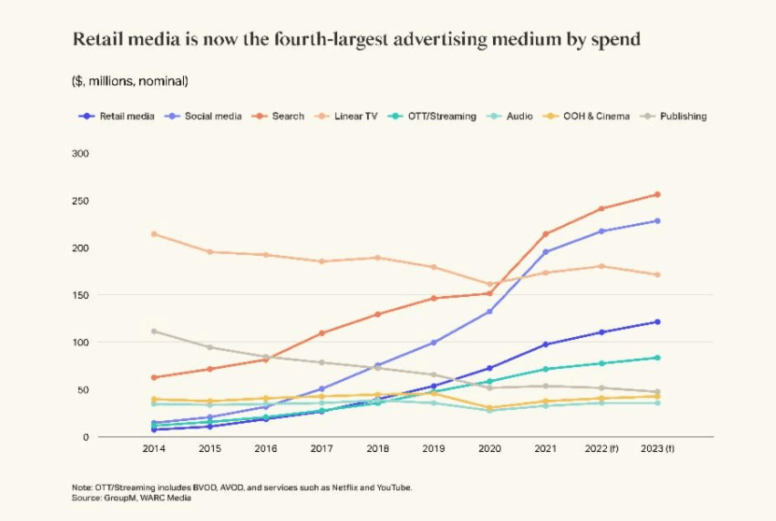

As of 2021, 83% of households in the United States have at least one (FAST) channel, used by at least one person every month. At the same time, advertisers are shifting their dollars from traditional TV to streaming TV, with marketers estimated to spend over $25 billion on advertising-supported video by 2025.

In 2022, Streaming Stocks plunged after Netflix loses 200K subscribers in the first three months of the year; worse, it anticipates losing another 2 million by year’s end. The news comes as a shock, as Wall Street reportedly expected the company to tack on 2.5 million subscribers and experience future growth... not lose them by the hundreds of thousands. In light of the report, Netflix stock plummeted 35 percent, losing $55 billion in market capitalization.

In Q1 2023, Fox turned down $2 Billion USD offer to sell Tubi, according to Bloomberg. With the undeniable shift to (FAST), free ad-supported models have emerged as front-runners in the race for consumer attention and ad revenue for both content owners and advertisers, this means now is the time to monetize premium content through an ad-only business model. The consumer demand is there – and they are telling us they want more (FAST) platforms, rather than subscription based streaming platforms.

Not only is FAST a viable consumer alternative to on-demand streaming platforms, but consumers are clearly shifting their time and attention toward this model. And, good news, so are advertisers. 200 million global viewers and 47% of US consumers are watching ad-supported platforms like Samsung TV Plus, The Roku Channel, Pluto, and Amazon IMDb TV— and as new FAST services launch, this trend will only accelerate. Meanwhile, marketers are betting big on FAST, estimated to spend over $25 Billion on advertising-supported video by 2025.

A Drastic change in trend

Approximately 200 million global viewers and 47% of US consumers are watching ad-supported platforms like Samsung TV Plus, The Roku Channel, Pluto, and Amazon IMDb TV— and as new FAST services launch, this trend will only accelerate. Meanwhile, marketers are betting big on FAST, estimated to spend over $25 Billion on advertising-supported video by 2025.

Current North American fast industry

The North American industry is new and JOIN TV will have very early mover status into this technology. The landscape for North American programming is changing, with networks such as Bell, Rogers, CBC and Corus cutting back on their programming, the cable channels have suffered. Netflix and other SVOD (Subscription Video on Demand) channels are losing subscribers mainly due to an unwillingness to pay the rising monthly fees. FAST channels are free and are paid for with advertising.

JOIN tv network - global launch

The future of television is in FAST Channels, and JOIN TV is in a position to become the leader and premiere FAST Channel Network supporting and broadcasting North American content for television viewership domestically and globally.

Programming is made accessible to world viewers through the company’s versatile platform that streams video on a wide range of popular consumer devices, including: Samsung, ROKU, Apple (iOS/tvOS), Google (AndroidTV) and Web (PC/Mobile).

The JOIN Network app will also be embedded in future “Out-of-the-Box” consumer devices and Smart TVs (Samsung TV+ / LG Smart TV / Roku) along with Hospitality Grade Monitors.

JOIN TV Competitors

In Q4 2022, PLUTO TV (owned by Paramount Streaming, a division of Paramount Global) announced plans to enter the FAST Channel market with select channels including a 365 day a year Christmas Content Channel. The Founders of JOIN TV see this as good news as proof that there is strong interest from U.S. based and owned companies looking to expand into the global FAST Channel Market.

JOIN TV will have a very high % of PNI (Programs of National Interest). Programming and shows that tell North American stories and promote our culture to audiences at home & abroad. Rogers Cable allocates 5% of their programming, Bell Cable TV 7.5% Corus TV 8.5%. JOIN TV will have several dedicated content channels with 100% PNI programming.

DIGGING DEEP

JOIN Entertainment

(OTC: RINO)

Revenue Generation - What This All Means For Investors

Advertising Revenues

The rise of FAST channels presents a new opportunity for advertisers to reach their target audience. As many FAST channels are a collection of content related to a specific niche interest, as long as marketers have a basic understanding of the interests of their target audience, JOIN TV has the potential to make strong connections between brand and consumer.

Revenues are generated through ad insertions (commercials) that are inserted during programming. Ad Revenues generated by FAST channels are calculated by “impressions”. Known as CPMs (Cost Per Milles) that show the amount of ad views the content provider gets paid for per 1,000 ad views.

FAST Channel Revenues Will Reach $12B In 2027

Taking into account the leading platforms in free ad-supported TV, it is easy to see the benefits they obtain from launching their FAST channels. For example, Hulu makes approximately $15 USD per month on advertising – per subscriber which is more than they charge for their premium ad-free package, which is currently $12.99.

This parameter can vary depending on the ad content and time of the day, but it usually fluctuates between $10 and $25. FAST allows distributors like JOIN TV to provide ad content more dynamically and makes it consumer-centered whether to a household in general or just one individual.

The CPM model in FAST TV channels is measured in $40-$50 per 1,000 impressions. Thus, TV content providers can earn $0.60-$1 for every hour a single consumer watches their FAST channel. With an audience of millions of viewers, the cumulative number ends up being more profitable than monthly paid subscription models. (source article: https://amplify.nabshow.com/articles/why-streamers-are-pressing- fast-forward/ )

JOIN TV will align relevant brands with themed channels and content that fit advertisers’ target audience’s interests. JOIN TV works with advertisers to create programmatic solutions to run dynamic overlays, split screen spots, and even brand and product insertions creating three key brand awareness opportunities for advertisers:

1. Growth potential: JOIN TV channels are free, available 24/7, and have no access limitations such as cable or satellite fees or sign-up.

2. Higher intent and attention: JOIN TV will offer quality programming and thematic content that appeals to niche target groups. When viewers join the JOIN Network – they join channels and programing of interest (=intent). Example: JOIN Music, JOIN Sports, JOIN Fashion, generating greater audience attention and niche advertising opportunities.

3. Personalization will increase: Beyond adding contextual advertising capabilities, JOIN TV plans to embed AI inside their FAST channels to personalize viewing guides, increasing target audience viewership.

Data suggests FAST channels are here to stay and are an excellent opportunity for advertisers to connect with target buyers across a specific piece of content or an entire channel. If advertisers haven’t begun exploring FAST channels, 2023 is the time to start. Moreover, if a brand previously had success reaching customers on traditional broadcast television but, thanks to cord-cutting, have seen a decrease in reach, FAST channels are a great way to regain the demographic.

Branded Channel Revenues

In addition to being a broadcasting Network, JOIN TV can support and launch stand- alone, niche FAST channels for specific regions, industries, companies, or government programs with the same global reach to over +1 Billion Smart TVs.

These “branded” television channels will be made available independent of the JOIN Network and are an added revenue stream for the company by charging monthly hosting, operational and programming fees at an average cost of $10,000 CDN per month. Some of the groups include “pop-up channels” for marketing companies, international trade organizations, and foreign companies looking to expand product awareness into North America.

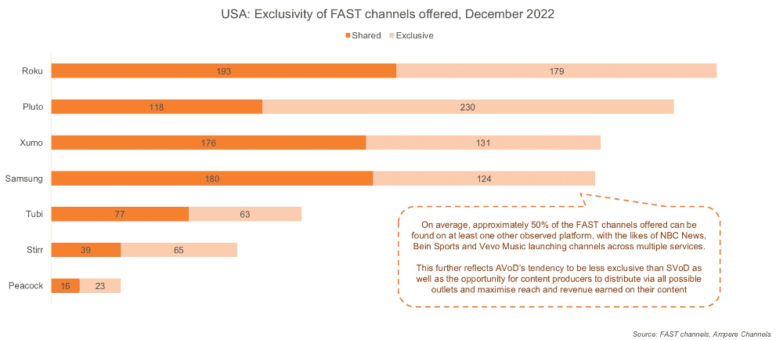

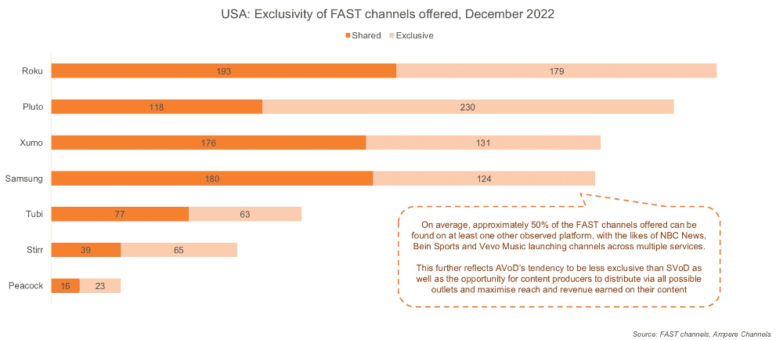

Distribution Revenues

In addition to accessing programming through the JOIN TV Network, the company will also act as a distributor of content to other broadcasters as a third-party distribution agent making it one of the largest North American based television distribution company. An interesting trend that once again gives FAST channels a revenue generating advantage over monthly subscription SVOD or pay channels is the opportunity to host the same channels, or distribute the same content across multiple FAST networks. The era of exclusivity of content to just one network is switching to a shared model which generates multiple revenue streams across multiple services for content owners represented by JOIN TV.

QR Code Revenues

Second-screen usage is the new normal with 84% of US adults using a second screen (smartphone or tablet) while watching TV. This trend makes QR codes for FAST Channels an effective strategy, as viewers can scan the QR codes appearing on their favorite channel while watching their favorite program.

JOIN TV will be implementing QR Codes on relevant channels and programming and receive a % of revenues generated through each QR Code purchase. JOIN TV will also use its QR Code technology as a service that can be used on other FAST platforms or channels.

QR Code Case Study - ROKU

Roku is teaming up with Walmart on a shop-ability ad pilot program aiming to make TV streaming “the next e-commerce shopping destination.” Walmart will be the exclusive retailer to enable streamers to purchase featured products fulfilled by Walmart directly on Roku. The experience offers product discovery through on- screen QR Codes with seamless checkout, enabling purchase directly at the time of inspiration. “We’re working to connect with customers where they are already spending time, shortening the distance from discovery and inspiration to purchase,” said William White, CMO, Walmart. “No one has cracked the code around video shop-ability. By working with Roku, we’re the first to market retailers to bring customers a new shop-able experience and seamless checkout on the largest screen in their homes – their TV.”

JOIN Branding & Marketing

JOIN Branding

Every JOIN TV Channel will be branded as “JOIN” as part of our NETWORK brand building strategy. Example: JOIN Fashion TV / JOIN Travel TV / JOIN Music TV – to create an instantly recognized brand and awareness campaign for all of JOIN TV’s Content Channels.

JOIN Marketing

JOIN TV and each channel on the JOIN TV Network will be promoted through a three-tier marketing campaign:

1. The JOIN TV Network will have its own promotional “Network Launch” campaign.

2. Each JOIN Channel upon launching will also have its own promotional campaign.

3. FAST Channel Providers that carry the JOIN TV Network (example Roku) will assist in the promotion with higher profile placement on their select content menus.

Additional marketing campaigns will include social media along with traditional media news releases focused on educating the public on the increasing demand for FAST Channels and will use JOIN TV as a way to educate new users searching for Free Ad Streaming Television.

JOIN / TV Coins

TV Coins – is a unique feature that JOIN TV will be offering its viewers as an “awards” program as part of a marketing campaign that will offer rewards with real value. Viewers earn TV Coins when commercials play that can then be used towards online purchases through Amazon stores anywhere in the world. JOIN TV will be one of the first FAST Channel Networks to offer TV Coins to viewers making it unique from all other FAST networks.

Once JOIN TV has successfully established itself in the North American market, the company will widen its focus and expand into South America, the UK, Ireland and other European rights holders so we can create new channels and lead the way in Europe and Latin America.

JOIN Entertainment has received interest from varying levels of companies, brands and governments for JOIN TV to create their own “branded” television channels. These branded channels are a secondary revenue stream for the company that goes beyond the JOIN TV Network. Some of the groups include governments, marketing companies, international trade organization, and foreign companies looking to expand

Sources

- Source 1: https://www.jointvnetwork.com/

- Source 2: https://finance.yahoo.com/quote/RINO/

- Source 3: https://www.marketbeat.com/stocks/OTCMKTS/RINO/

- Source 4: https://www.marketwatch.com/investing/stock/rino

- Source 5: https://www.wsj.com/market-data/quotes/RINO

- Source 6: https://www.jointvnetwork.com/the-emerging-trend-of-lightning-fast-tv-streaming-a-new-era-in-entertainment/

- Source 7: https://capedge.com/company/1394220/RINO/filings

- Source 8: https://fintel.io/doc/sec-join-entertainment-holdings-inc-1394220-253g1-2023-june-20-19528-2427

- Source 9: https://www.jointvnetwork.com/about-us/

- Source 10: https://www.jointvnetwork.com/faq/

- Source 11: https://www.jointvnetwork.com/news/

- Source 12: https://www.jointvnetwork.com/good-news-for-canadian-television-viewers-as-the-f-a-s-t-channel-and-a-v-o-d-marketplace-continues-to-grow-through-the-launch-of-the-join-tv-network/

- Source 13: https://www.jointvnetwork.com/articles/

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media LLC and West Coast Media, Virtus Media LLC has been hired by West Coast Media LLC for a period beginning on 08/08/2023 and ending 08/08/2023 to publicly disseminate information about OTC: RINO via digital communications. We have been paid three thousand dollars USD.