8 Exciting Reasons Lottery.com May Have Winner Written All Over It

What You should know

Unveiling the 1,020% in Upside Potential of Lottery.com Inc. (Nasdaq: LTRY)

According to the weekly stock chart view on StockCharts.com, the moving averages for Lottery.com Inc. (Nasdaq: LTRY) are as follows: The weekly average price and the 50-day moving average both stand at around $0.48 and $0.49 respectively, aligning closely with the opening price of $0.48 on May 9, 2023. (21)

However, it’s the 100-day and 200-day moving averages that present a more intriguing picture. The 100-day moving average stands at $4.05, while the 200-day moving average is at an even more impressive $7.63. These figures represent a significant increase from the current opening price, suggesting a substantial upside potential. (21)

To put this into perspective, if Lottery.com Inc. (Nasdaq: LTRY) were to reach the 100-day moving average level from the opening price of $0.48 on May 9, 2023, this would represent an increase of approximately 743%. If the shares were to reach the 200-day moving average level, this would represent a staggering increase of approximately 1,489%. (21) These moves are not certain, but the potential should be noted.

According to Barchart.com. Lottery.com Inc. (Nasdaq: LTRY) reached a high of $5.38 on 1/12/2022, which would indicate an upside potential of over 1,020% from 5/9/2023’s opening price of $.48. (17)

While these figures/moving averages are not predictions, they do highlight the potential for Lottery.com Inc. (Nasdaq: LTRY).

For those keeping an eye on the tech sector and the evolving lottery industry, Lottery.com Inc. (Nasdaq: LTRY) is certainly worth watching closely at these current levels.

Who doesn’t want to win the lottery, kick back and live the good life?

Let’s face it. Everybody wants to be a winner.

Maybe that’s why online gaming is taking off the way it is. Did you know there was about $7 billion dollars wagered on the Super Bowl alone? It’s insane. (3)

States across the US are seeing the value of legalizing online gaming. Now they really see it by the tax revenues. New York saw a whopping 25% of those Super Bowl wagers. (3)

“Nationwide, sports betting handles are up more than 150% this year,” said Dave Forman, head of research at AGA.

“We’ve seen 11 states launch in 2021. So just the expansion alone, when you couple that with the growth of mature markets, there’s no question that the Super Bowl’s probably going to shatter last year’s record.” (1)

So State lotteries are raking it in too, right? Not exactly.

Revenue from the New York Lottery and its nine racetracks with video-lottery terminals fell 19% in 2020 from 2019, according to data obtained by the USA TODAY Network New York through a Freedom of Information request. (2)

The drop was in part because the “racinos” were closed from March through September due to the CV-19 pandemic, but also because traditional lottery games, such as Powerball, Mega Millions and Quick Draw, saw revenue plummet. (2)

While it’s true revenues bounced back some after the lockdowns. What did we learn from all this? Well, in order to bring in steadier play, help avoid major downturns, and to attract millennials and Gen Z, states need to up their game.

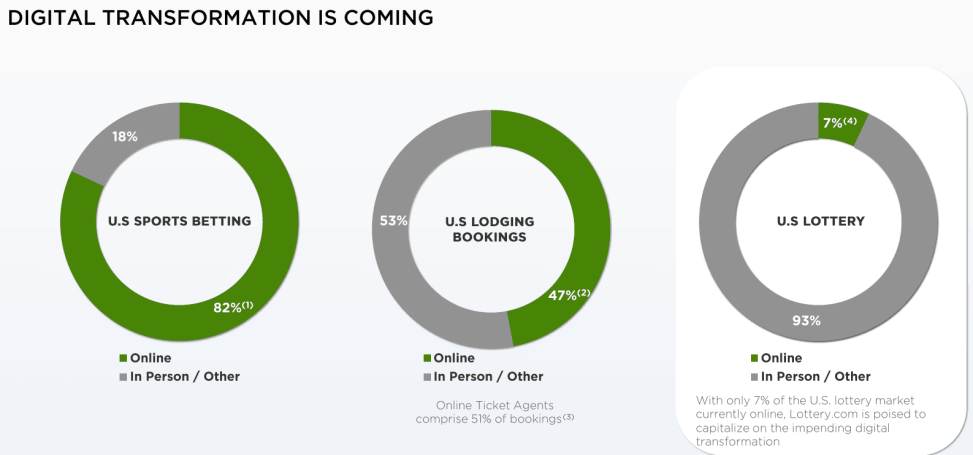

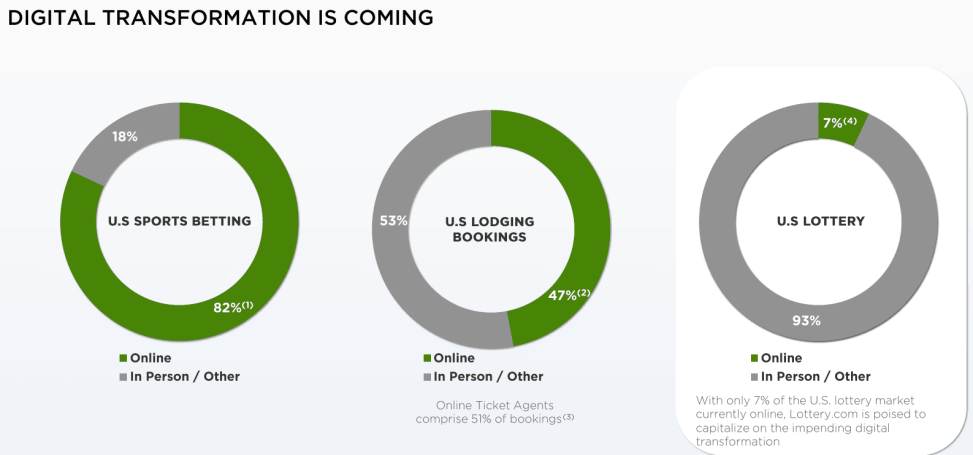

With only 7% of transactions happening online…the U.S. lottery needs a shot in the arm, and Lottery.com is working hard to get them up-to-speed.

Oh and Lottery.com also has a subsidiary in Sports.com primed to potentially capture a piece of that massive sports action as well. (See how later in the report!)

THE TRADE OPPORTUNITY

With its moving averages hinting at substantial upside potential, LTRY is making waves in the industry. But don't just take my word for it, let's look at the bigger picture.

With the RSI & MACD both in favorable situations, alongside the aforementioned bullish moving averages, we are looking at price targets of:

Bringing the Lottery into the 21st Century

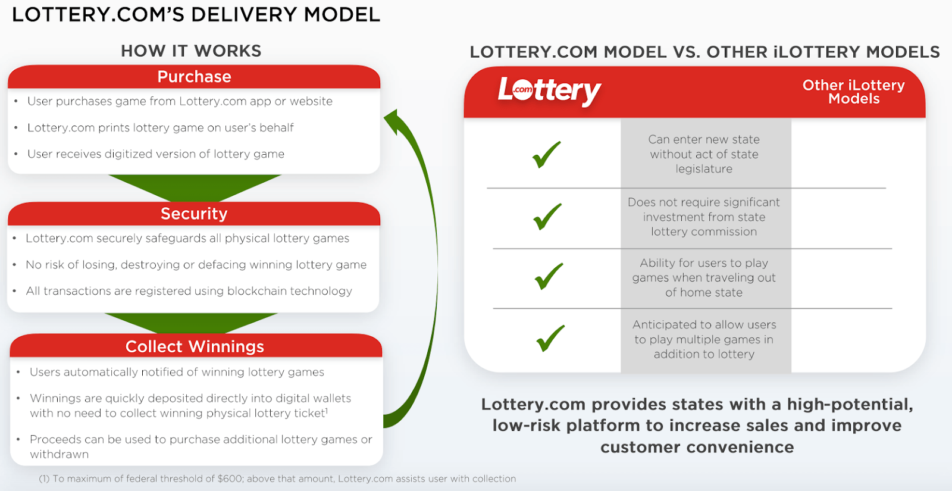

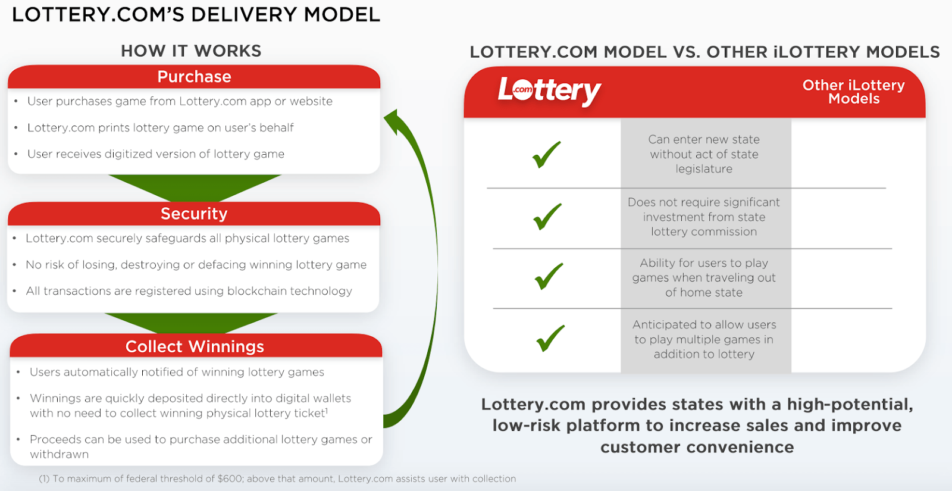

Lottery.com does not intend to be a lottery provider, they aim to help states take their offerings to a wider audience. An audience tethered to their phones. Ones that don’t use cash. Moreso millennials who want to play, but aren’t big on playing the lotto at convenience stores.

Lottery.com has developed a full technology stack to help solve this. There really is an app for that! Through their validated, certified, secure, and geo-fenced technology, users can safely buy their tickets right from their handheld devices. States love it because now they can reach a much wider audience, especially an out of state audience without an Act of State Legislature.

Did you know the State of Nevada has no lottery?

That’s right, even in Las Vegas, the mecca of gaming, there is no lottery. Las Vegas residents have to drive about an hour to the Lottery Store in Primm Nevada where they can legally play.

How is that you ask? It’s because the store is located on Lotto Store Rd and has a Nipton, California address, even though the small community of Nipton is more than 15 miles away, and Lotto Store Rd is entirely on the Nevada side of the border. Thankfully Lottery.com is working hard to help people everywhere avoid these type hassles.

It’s true, states can create their own digital lottery systems (and some have), but this requires a lot of time and money. Systems have to pass stringent laws and obtain funding for development. Let’s not forget the cost of site maintenance.

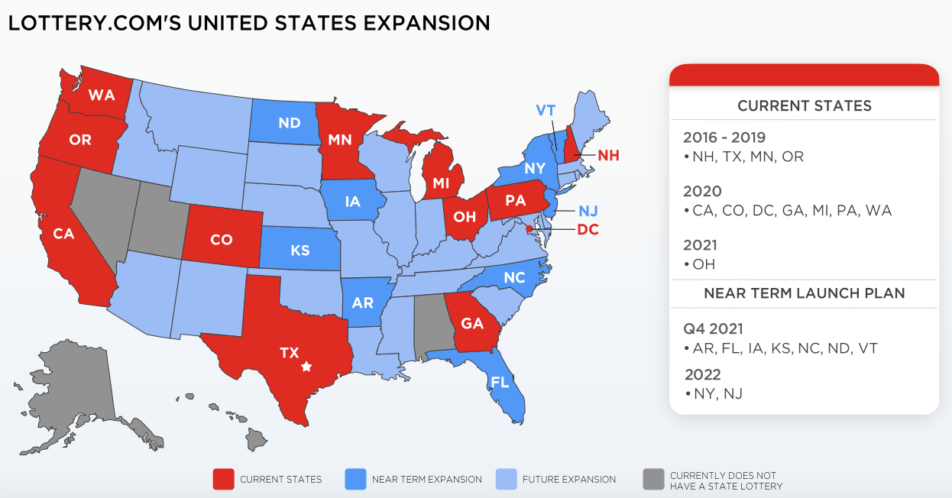

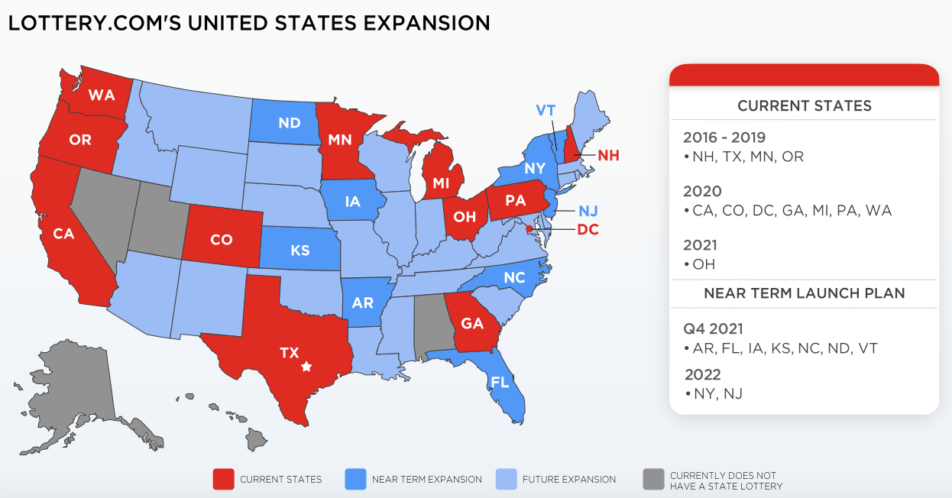

And let’s be honest, when was the last time anyone raved about the user experience on a state-run site? Right now Lottery.com is active in 12 states including Texas and California with nine more in the pipeline.

According to TechNavio, the lottery market in the US will be driven by factors such as high penetration of smartphones. The penetration of smartphones is increasing because of the declining average selling price of smartphones and developments in communication network infrastructure.

This is fantastic news for Lottery.com as the market is expected to expand by USD $27.90 billion at a CAGR of 5.96% offering the company a healthy amount of market opportunity.

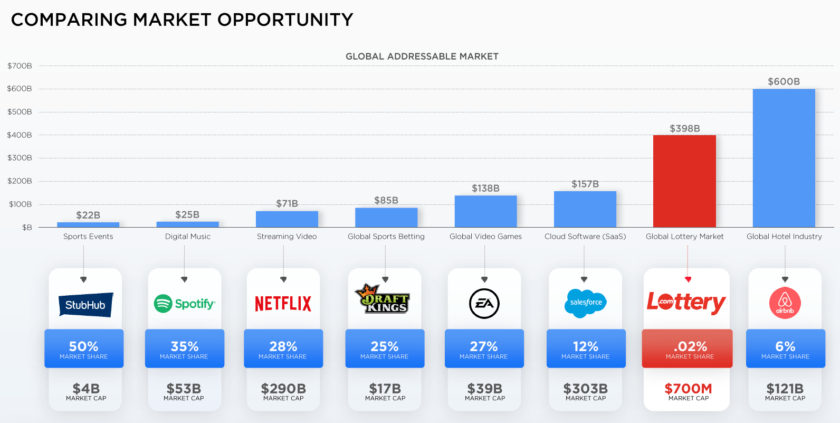

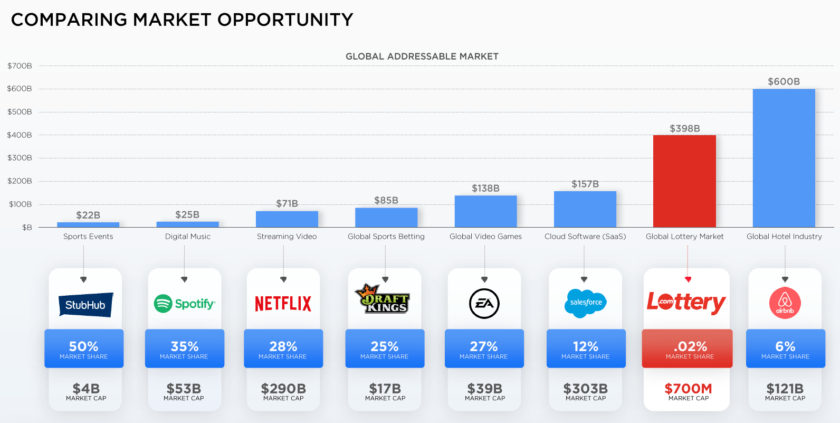

What’s even more impressive is the fact that it is playing in the 2nd largest global addressable market, the global lottery market, that’s worth $398 billion. Which dwarfs even global sports betting at $85 billion.

Right now Lottery.com is valued at a tiny $700 million market cap. And that’s with just 0.02% of the market share. Do the math and imagine how much upside potential this company has at a measly 1% of the market?

Let’s just say, big. Very big.

The Plan to Scale is in Full Motion. All Backed by a Suite of High Margin Products.

You see this is not about what ifs. Lottery.com has the means to potentially take more than 1% of the market. And here’s why. Not only does the company have a current US strategy, but they have a very impressive international strategy as well. In the US consumers can buy draw games and scratchers right online or from their smart devices for a reasonable service, or convenience fee.

Plus Lottery.com runs a charitable sweepstakes where players can donate to qualified causes and enter to win luxury sweepstakes. On the business 2 business side, Lottery.com features a robust API platform that can integrate to sell lottery tickets and games from their online properties. Partner sites can use their payment processors to complete the transactions and Lottery.com receives a service fee for each transaction. Gross margins on these transactions run from a very healthy 17%-33%. Partners with the best of the best…

That all sounds good, but who are the partners? Take a look at the list below and ask yourself how much upside is there for Lottery.com as buying lottery tickets online becomes more common. We all know how fast that can happen!

The World is Their Oyster…

As we’ve seen, the national market is amazing, but the international market? Frankly it’s even better.

Most every country has some sort of lottery game or games. However, many would prefer to play the US games like Powerball where the grand prize has reached as high as USD $1.56 billion in 2016.

In fact it’s so popular that the company’s surcharge can be between $2 to $5 per transaction. Gross margins for international play balloons as high as 34%-54%!

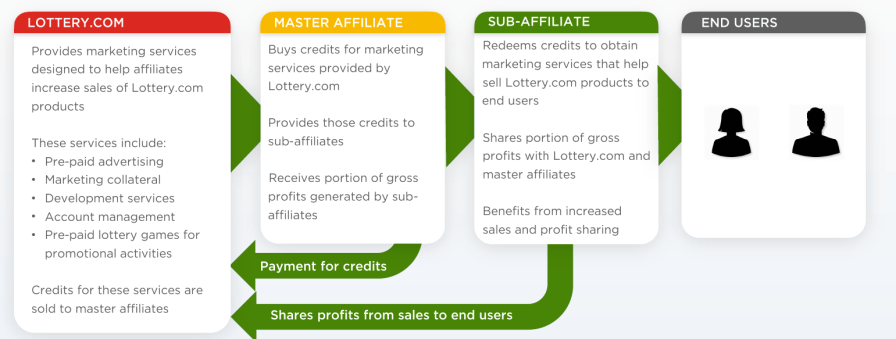

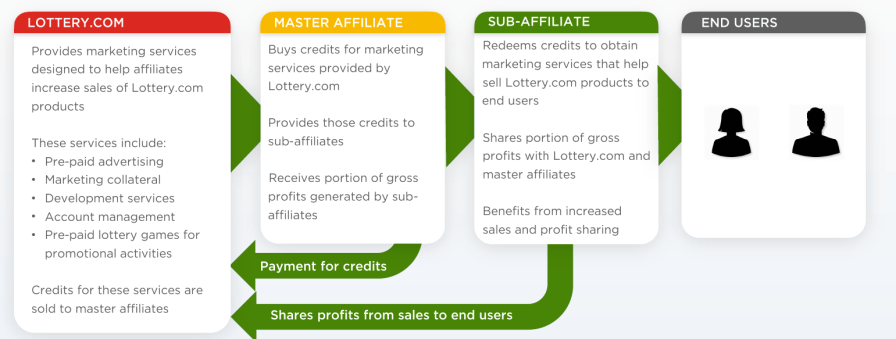

Lottery.com does this through their B2B global affiliate marketing program.

The company provides marketing services that are sold through a credit program. This includes pre-paid advertising, marketing collateral and more. This marketing plan is highly scalable and very profitable as the company generates revenues in two ways: marketing services and profit share from sales.

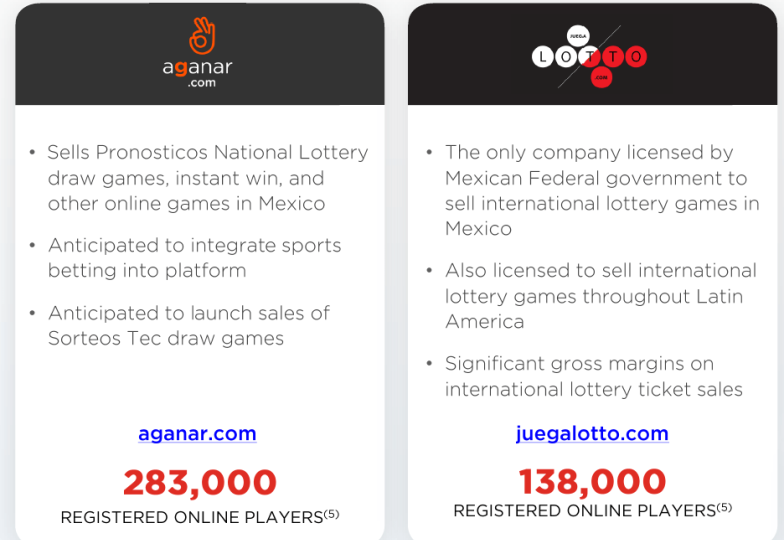

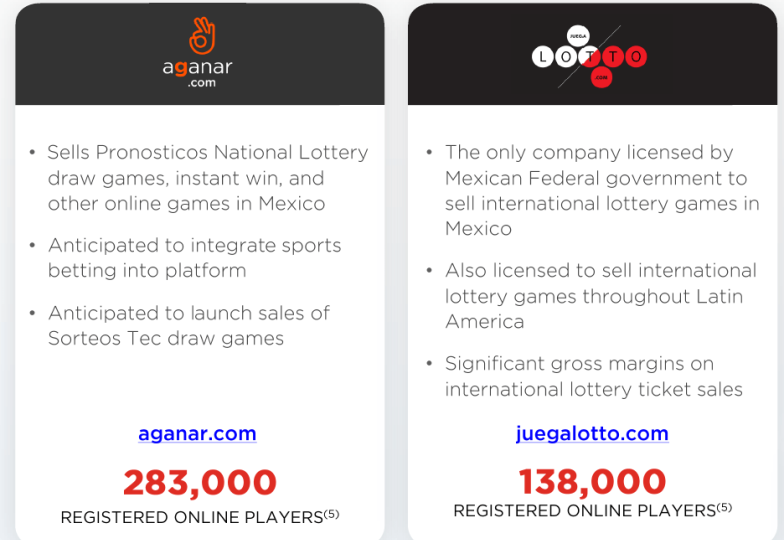

Key acquisitions provide a strong footprint in Central and South America.

As of August 2021 the company completed the purchases of aganar.com and juegalotto.com boasting 421,000 registered players and a home in a combined $9.8 billion market.

Europe is in play as well…

In an effort to penetrate the entirety of this available market, Lottery.com has also finalized several international partnerships, including one to expand into Europe and another to expand into Turkey.

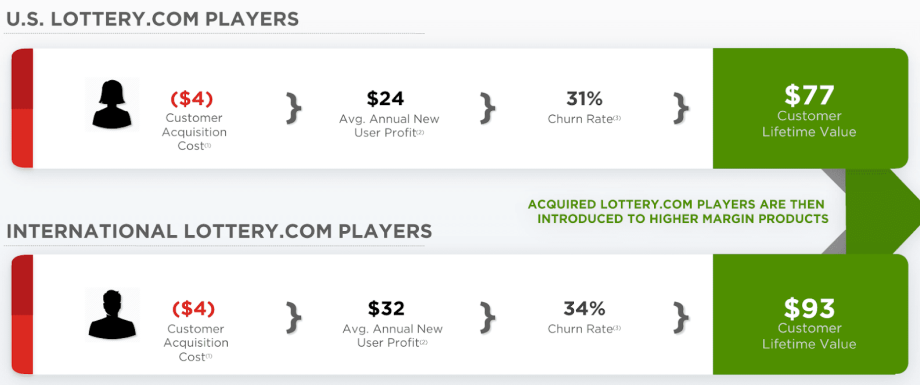

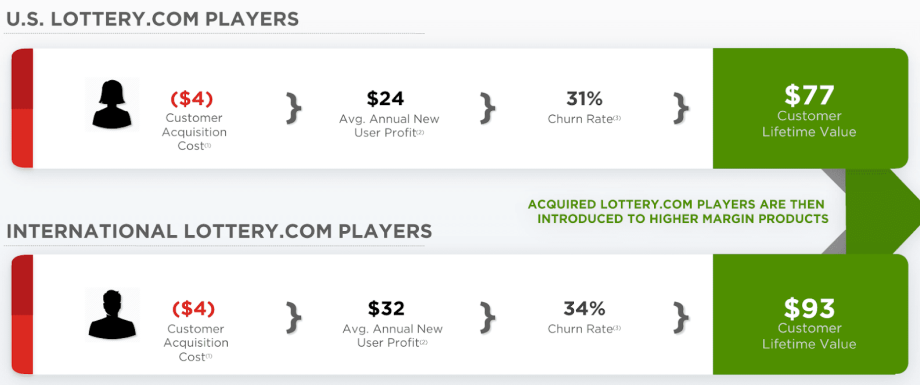

All with some of the lowest customer acquisition costs in the industry.

The company currently spends about $4 to acquire a user, and then extract on average $24 from them within just the first year, all while retaining almost 70% of them on an annual basis. And that is just the lower margin, US lottery player.

Let’s put that $4 into some perspective.

In online sports wagering, the customer acquisition costs for FanDuel and 32Red are $68 and $245.7.

And this will blow your mind. In the United States, the customer acquisition cost for an online casino player is more than $500.

How is that $4 looking now? The company is doing an absolutely amazing job at keeping costs low.

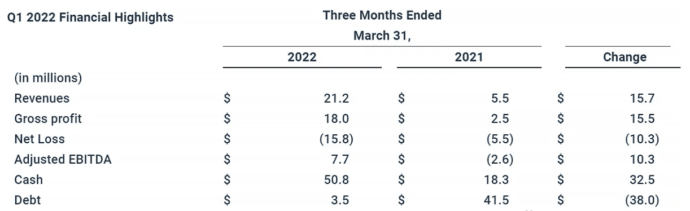

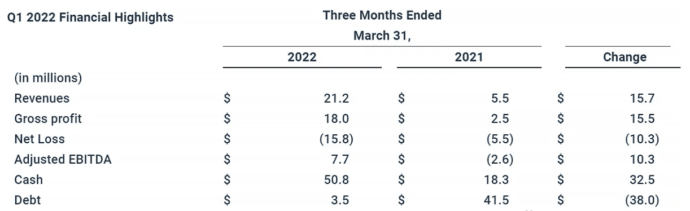

Lottery.com Inc. (Nasdaq: LTRY) Reports Robust First Quarter Results for 2022 with a 287% Revenue Increase. (18)

Lottery.com Inc. (Nasdaq: LTRY) reported strong financial results for the first quarter ending March 31, 2022. The company’s revenue for the first quarter of 2022 was $21.2 million, a significant increase of $15.7 million, or 287%, from the first quarter of 2021. This growth was primarily driven by the sale of LotteryLink credits to a LotteryLink affiliate. (18)

The gross profit for the first quarter of 2022 was $18.0 million, an increase of $15.5 million from the first quarter of 2021. This increase was primarily driven by the sale of LotteryLink credits to the above-mentioned LotteryLink affiliate. The net loss for the first quarter of 2022 was $15.8 million, while the Adjusted EBITDA was $7.7 million, an increase of $10.3 million from the first quarter of 2021.

Tony DiMatteo, Lottery.com Co-Founder and CEO at the time, expressed satisfaction with the first quarter results and the team’s continued focus on the core business and generating strong Adjusted EBITDA. He highlighted the contribution of LotteryLink to the company’s top and bottom-line growth and the expansion of the user base with limited advertising spend. (18)

DiMatteo also noted that the B2C campaigns in the second quarter have been positive with solid increases in app downloads versus the prior year period while achieving relatively low customer acquisition costs. He added that the promotional programs of LotteryLink have generated new users and created interest from additional national consumer brands looking to utilize LotteryLink for their marketing campaigns. (18)

The company also launched Phase 1 of Project Nexus in the second quarter of 2022. DiMatteo believes that these positive developments, combined with a strong balance sheet, position Lottery.com well for future growth. (18)

Expansion

Lottery.com Inc. (Nasdaq: LTRY) Resumes Ticket Operations and Expands into the Dominican Republic (16)

Lottery.com Inc. (Nasdaq: LTRY) is back in action and expanding its reach. After a nine-month hiatus, the company has resumed its ticket operations, supplying over seven million tickets for Texas lottery games in its first week back. This impressive feat demonstrates the company’s operational resilience and ability to bounce back swiftly. (16)

The company’s reactivation is not limited to Texas. Lottery.com has also inked an exclusive affiliate agreement with the International Gaming Alliance (IGA) to supply official Texas lottery tickets in the Dominican Republic. IGA boasts a robust retail and online distribution network in the Dominican Republic, with access to more than 1,000 retail distribution points. This partnership is expected to commence in May 2023, following the successful completion of testing.

Mark Gustavson, CEO of Lottery.com, expressed his optimism about the company’s progress and future prospects. He emphasized the company’s commitment to improving disclosure and reporting controls, as well as overhauling internal control systems.

The company’s turnaround strategy appears to be working according to plan, and the future looks promising.

Erick Caceres, Managing Partner for Dominican Republic Operations, echoed Gustavson’s enthusiasm. He expressed excitement about the partnership with Lottery.com, which will allow lottery enthusiasts in the Dominican Republic to participate in one of the most popular lottery games in the United States. (16)

Lottery.com Inc. (Nasdaq: LTRY) Welcomes New CEO Mark Gustavson: A New Era of Growth and Innovation (22)

Lottery.com Inc. (Nasdaq: LTRY) has recently announced a significant change in its executive leadership. The company has appointed Mark Gustavson as its new Chief Executive Officer, effective from February 1, 2023. Gustavson brings with him a wealth of experience and a proven track record of success in business development, finance, and operations. (22)

Gustavson’s appointment comes at a time when Lottery.com is poised for growth and expansion. His 17 years of experience in various technology companies, including senior management positions, make him an ideal fit for leading Lottery.com into its next phase of growth. His expertise in transactions, ranging from acquisitions and strategic collaborations to ordinary course transactions, will be invaluable to the company.

In addition to his extensive experience, Gustavson is a co-founder and currently serves as Chief Executive Officer of ZENIOS Technologies Corporation. He has also held significant roles in several other companies, including Regnum Corp (OTC:RGMP), Tri Capital Energy Corporation, Wookey Search Technologies Corporation, and Sharkreach Corporation.

Notably, Gustavson was instrumental in acquiring control of Sansar from Linden Labs Corporation in March 2020, where he implemented an expansion plan and deployed virtual reality applications for live events and festivals. His leadership in this venture underscores his ability to drive innovation and growth.(22)

You’ll want to be in it, to win it!

The more you do your due diligence on Lottery.com the more there is to like. Another vertical Lottery.com has signaled is that they intend to cross-promote with sports bettors. They have already acquired the domain name Sports.com to host a robust information platform that they can use to generate affiliate income from the wildly sports wagering sector.

“The acquisition of the Sports.com domain is an important first step in entering the sports betting vertical,” said Lottery.com CEO Tony DiMatteo. “The brand name is a perfect fit for us, and this product pairing is special in the marketplace, as the lottery is one of the most popular games in the world. Our goal is to leverage our favorable customer acquisition costs and platform to efficiently drive growth for Lottery.com and parlay it into other related products.”

You didn’t think they were going to leave out the blockchain, did you?

Perhaps an even bigger area for expansion is the recently announced Project Nexus. Details on this are still coming out, but CEO Tony DiMatteo has said the intention of Project Nexus is to build a blockchain-based platform that any company can leverage for creating compliant, trusted games of chance, complete with support for payments and payouts in any form of currency (fiat or cry-pto). (14)

He has also said development is well underway, and that a global, progressive jackpot game (similar to PowerBall), run by Lottery.com on this platform could come as soon as Q2 2022. (15)

There is so much more to this fascinating company. It’s young, it’s profitable and it has delivered on explosive growth projections and it packs some serious upside potential. Get LTRY on your watchlist today.

SOMETHING BIG IS COMING...

Could a New Distribution Agreement Trigger a Potential 1,020% Move Back to 2022 Levels For This Leading Technology Company? (16)(17)

See why now could be the best time to start your research on Lottery.com Inc. (Nasdaq: LTRY)

Sources

Source 1: https://triblive.com/local/regional/super-wagers-7-6b-expected-to-be-bet-on-super-bowl-lvi-would-shatter-record/

Source 2: https://www.democratandchronicle.com/story/news/politics/albany/2021/03/11/ny-lottery-games-cas-inos/6945302002/

Source 3: https://sportshandle.com/ny-super-bowl-2022-geocomply/

Source 4: https://ir.lottery.com/static-files/774846f6-8047-42ec-8f55-44d8a9ee417a

Source 5: https://www.lasvegasadvisor.com/question/nevada-lottery/

Source 6: https://www.primmnevada.net/lotto-store/

Source 7: https://www.oleantimesherald.com/news/state/lottery-market-in-us-to-grow-by-usd-27-90-billion-from-2020-to-2025/article_db9011c2-8d4e-56cd-bfae-2a4ad4c61fe0.html

Source 8: https://www.usnews.com/news/us/articles/2021-10-05/what-are-the-10-largest-us-lottery-jackpots-ever-won

Source 9: https://askwonder.com/research/sports-betting-market-analysis-k5y28wdrn

Source 10: https://simplywall.st/stocks/us/consumer-services/nasdaq-ltry/lotterycom

Source 11: https://ir.lottery.com/news-releases/news-release-details/lotterycom-enters-agreement-ritzio-international-it-seeks-enter

Source 12: https://ir.lottery.com/news-releases/news-release-details/lotterycom-enters-large-and-fast-growing-market-turkey-offer-us

Source 13: https://ir.lottery.com/news-releases/news-release-details/lotterycom-acquires-sportscom-domain-signaling-expansion-sports

Source 14: https://ir.lottery.com/news-releases/news-release-details/lotterycom-commences-development-blockchain-gaming-platform

Source 15: https://twitter.com/tonydimatteo/status/1457776381090164739

Source 16: https://finance.yahoo.com/news/lottery-com-inc-recommences-ticket-173400350.html

Source 17: https://www.barchart.com/stocks/quotes/LTRY/price-history/historical?orderBy=tradeTime&orderDir=desc

Source 18: https://ir.lottery.com/node/8096/html

Source 19: https://imagenesyogonet.b-cdn.net/data/imagenes/2022/05/17/45723/1652799241-tabla-lottery-com-q1-2022-financial-results.jpg

Source 20: https://ml.globenewswire.com/Resource/Download/ec4f67ea-ec9d-479e-825b-2c706acca805

Source 21: https://schrts.co/bPnNrmBe

Source 22: https://finance.yahoo.com/news/lottery-com-inc-appoints-ceo-231500150.html

Source 23: https://cdn.ceoworld.biz/wp-content/uploads/2021/06/chief-executive-officer-1.jpg

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media LLC and Lifewater Media, Virtus Media LLC has been hired by Lifewater Media LLC for a period beginning on 02/22/2022 and ending 02/22/2023 to publicly disseminate information about NASDAQ: LTRY via digital communications. We have been paid eleven thousand five hundred dollars USD. Pursuant to a further agreement between Virtus Media LLC and Lifewater Media LLC, Virtus Media has been hired for a period beginning on 5/15/23 and ending 5/15/23. We have been paid thirty five thousand USD.