The 120-Year-Old Business Model That Profits In About ANY Economic Environment

Discover how GPOPlus is harnessing this concept to advance small businesses, level the playing field, and tap into a combined $5 Trillion market potential.

Build your watchlist with us

Get the latest stock ideas direct to your inbox. 100% free and your information stays with us.

4 Reasons to Consider GPOPlus (OTC: GPOX) Now

Group Purchasing Organizations are excellent, high-profit potential business models that have been around for over 120 years.

GPOPlus can tap into a significant part of a combined $5 trillion potential market by lowering or even eliminating purchase size minimums.

Their division HealthGPO could bring in significant revenues by capturing as little as 1 percent of the healthcare GPO market.

cb-dGPO is an ingenious cost-cutting concept that is hitting the market at the absolute perfect time, as growth is still robust, but the industry is in a consolidation period.

Meeting Insatiable Demand For EVs And Clean Power

Inflation is back. It’s back in a major way.

The consumer price index for all items rose 0.6% in January, driving up annual inflation by 7.5%. That marked the biggest gain since February 1982 and was even higher than the Wall Street estimate.

It’s taking its toll on everyone…from manufacturers to businesses to the consumer.

The cost of healthcare is a major hot-button topic…

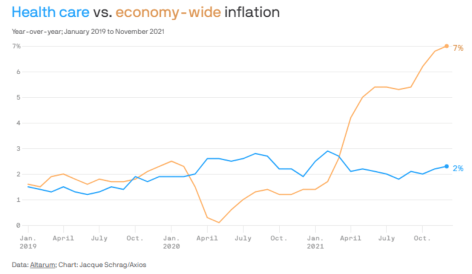

With all this inflation one would think healthcare costs are spiraling out of control due to the current inflation but…they are not. Healthcare costs are up only 2% while economy-wide inflation is at 7%.

You can thank the 120-year-old business model for helping hold those costs down.

At the same time, we’ve got a nasty case of shrinkflation

We’ve all felt the sting of inflation at the grocery store, but for 2022, we’re seeing ‘shrinkflation.’ That’s higher prices combined with smaller products.

Think about it…you buy a nice big bag of potato chips. When you get home and rip it open it’s 95% air with a handful of chips scattered at the bottom.

Same bag size. A lot less snacking.

According to the publisher Dworsky:

Crest 3D White went from 4.1 ounces to 3.8 ounces

Fun size Milky Way bags that have shrunk from 11.24 ounces to 10.65 ounces

Aleve has also gone from 100 tables to 90

Gain detergent has gone from 165 ounces down to 154

The Small Business world is really feeling the pinch…

It’s crazy. Small businesses are getting hit so hard by inflation that they are struggling to even afford to advertise on Amazon to stay competitive in the marketplace.

Imagine if there was a way to access the same goods and material pricing as the big-box stores? That would be one quantum leap ahead in leveling the playing field and GPOPlus is working hard to make that happen.

GPOPlus: The right company, in the right place, at the right time.

As the business cycle matures and ages, it goes through phases, just as people do. Right now there is consolidation going on in many industries and the economy in general.

Particularly healthcare and surprisingly the fledgling CB-D market.

Market conditions like these offer companies like GPOPlus (OTCPK: GPOX) a unique opportunity to thrive. Not only that, but they can also provide businesses much-needed price relief and expertise by implementing a powerful 120-year-old business model.

The Group Purchasing Organization (GPO)

A Group Purchasing Organization is a system or platform that allows any business to join a group of buyers who are interested in the same goods and services. Businesses can take advantage of the collective buying power of a large group to get discounts from vendors.

Group purchasing is used in many industries to purchase raw materials and supplies, but it is common practice in the grocery, health care, consumer durable, non-durable, industrial manufacturing, and agricultural industries.

Save me the money…

Sourcing motivates vendors to give GPO members discounted pricing. Businesses save on average 20-25% on products and services through group purchasing. They also save time (which is money) in gathering data, interviewing vendors, and choosing suppliers. (9)

Show me the money!

GPOs can collect administrative fees that are paid by the suppliers that GPOs oversee. Some GPOs collect participation fees from the buying members, and some may do both.

These fees can be a percentage of the purchase or set as an annual flat rate or can be a one-time payment that’s paid upon joining the GPO.

Members take part based on their purchasing needs and their degree of confidence in what should be competitor pricing consulted by their GPOs.

GPOPlus is even disrupting GPOs?

This Las Vegas-based company is not your run-of-the-mill GPO. The company is wisely carving out a piece of this gargantuan GPO market by identifying underserved industries, segments, and markets then developing specific GPOs around them where there is little to no competition.

The love for this model by small business is flowing. That’s because GPOPlus has low minimum order quantities (MOQ) which enable small and mid-sized companies to participate with larger corporations. Finally a level playing field for the little guy!

HealthGPO a Timely Alternative to an Overburdened Healthcare Industry

HealthGPO is a division of GPOPlus. They offer quality proven products at discounts (usually substantial discounts) without having to place substantial orders.

You see savvy companies like GPOPlus consistently push to maximize growth, profitability, value, and find opportunities.

So where better to target than the lowest hanging fruit, or where the entire concept of GPOs began? That’s the healthcare industry through HealthGPO.

Oh and here’s a statistic that will absolutely astound you. 97% of hospitals purchase through GPOs!

We’re looking at a whopping $59.7 BILLION pool of business potential

Healthcare Finance reports, Group purchasing organizations save the U.S. healthcare system up to $34 billion annually and will reduce healthcare spending by nearly half a trillion dollars over the next 10 years.

GPOs reduce supply-related purchasing costs to hospitals and nursing homes by 13.1 percent compared to providers who do not use GPO services, the authors said. In addition, GPOs generate billions in Medicare and Medicaid savings.

The analysis is based on national expenditure data along with survey responses from healthcare providers that use GPO services and represent a total business volume of $59.7 billion.

While GPOPlus is just getting started, HealthGPO is pioneering a niche opportunity in a massive market that’s ripe for this type of innovation.

And even if this adapted GPO model could capture a measly one percent of that $59.7 billion business volume – it could mean somewhere in the area of $597 million in potential business. And with an average contract administration fee between 1.22% and 2.25%, that could mean potential base revenues of up to $13.4 million.

So it’s not a stretch to believe this tiny Las Vegas upstart could soon stun the investment community.

cb-dGPO a Shot of Adrenaline For This Fledgling Industry

AdWeek reported that, after CB-D’s explosive 562% growth in 2019, brands now face an “extinction event.” They say a new report estimates up to two-thirds of brands could fail despite the category’s positive long-term outlook.

But doom and gloom it’s not. CB-D is still a very hot space, with sales expected to grow from $5 billion in 2020 to $17 billion by 2025.

Once again, we see the leadership at GPOPlus doing something very smart in creating the one and only cb-dGPO.

This will help stave off the predicted “extinction event” for many small companies by saving tens of thousands annually on hundreds of products with cb-dGPO’s negotiated vendor contracts.

But here’s the kicker, there will be ZERO volume requirements.

Get the latest stock ideas direct to your inbox.

100% free and your information stays with us.

With the industry going through severe consolidation, (17) this has all the potential to be a phenomenally successful business model.

CB-D quality ranges drastically from supplier to supplier with no standards currently in place. Ultimately, a company never really knows what they are going to get.

In addition, companies just don’t have the time and resources to do everything, from sourcing, formulating, manufacturing, testing, registering, branding, marketing, etc. is a whole lot of work.

As the industry matures, which is still a way off, companies like cb-dGPO can be a lifesaver. Not only will they be able to lower costs but ensure the quality of the product.

In a skyrocketing $17 billion market, there is a whole lot of money on the table. This is the absolute genius of the 120-year-old GPO business model.

Sources

- https://www.healthaffairs.org/doi/10.1377/hlthaff.2021.01763

- https://tinyurl.com/2p8mec7e

- https://www.cnbc.com/2022/02/10/january-2022-cpi-inflation-rises-7point5percent-over-the-past-year-even-more-than-expected.html

- https://tinyurl.com/2p942ry2

- https://www.khou.com/article/money/prices-continue-to-rise-as-size-of-grocery-store-products-shrink/285-d2f53ffb-250e-41fc-8603-00f645b437fc

- https://www.economist.com/finance-and-economics/2021/06/24/a-new-phase-in-the-financial-cycle

- https://healthpayerintelligence.com/news/health-insurance-industry-consolidation-grew-from-2014-to-202

- https://bit.ly/3BVcVuD

- https://educationleaves.com/what-is-group-purchasing-organization-gpo/

- https://www.nbcnews.com/tech/small-businesses-say-are-hurt-rising-costs-advertise-amazon-rcna16685

- https://www.definitivehc.com/blog/top-10-gpos-by-member-hospital-beds

- https://healthgpo.com/

- https://www.supplychainassociation.org/

- https://www.healthcarefinancenews.com/news/group-purchasing-organizations-reduce-supply-costs-131-percent

- https://www.supplychainassociation.org/about-us/faq/

- https://tinyurl.com/2p8p8u34

- https://tinyurl.com/36uwxk4p

- https://youtu.be/TdGAI-wnHM0

- https://bit.ly/3skKinD

Disclaimer

Stock Research Today is a project of Dadmin Capital LLC and intended solely for entertainment and informational purposes. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/. This website / media webpage is owned, operated and edited by Dadmin Capital LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Dadmin Capital” refers to Dadmin Capital LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and promote small public companies. By reading our website / media webpage you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our website / media webpage .We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website / media webpage are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. Dadmin Capital business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Dadmin Capital. often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Compensation – Pursuant to an agreement between Dadmin Capital LLC and TD Media LLC, Dadmin Capital LLC has been hired for a period beginning on 2/28/22 and ending after 5 business days to publicly disseminate information about (OTC: GPOX) via digital communications. We have been paid eleven thousand five hundred USD via ACH Bank Transfer. Social Media Compensation – Pursuant to an agreement between Dadmin Capital LLC and Social Media Outlet, Dadmin Capital LLC has hired Social Media Outlet for a period beginning on 2/28/22 and ending after one business day to publicly disseminate information about (OTC: GPOX) via digital communications. We have paid this Social Media Outlet one thousand USD via ACH Bank Transfer. Pursuant to an agreement between Dadmin Capital LLC and Social Media Outlet, Dadmin Capital LLC has hired Social Media Outlet for a period beginning on 2/28/22 and ending after one business day to publicly disseminate information about (OTC: GPOX) via digital communications. We have paid this Social Media Outlet one thousand USD via ACH Bank Transfer. Pursuant to an agreement between Dadmin Capital LLC and Social Media Outlet, Dadmin Capital LLC has hired Social Media Outlet for a period beginning on 2/28/22 and ending after one business day to publicly disseminate information about (OTC: GPOX) via digital communications. We have paid this Social Media Outlet five hundred USD via ACH Bank Transfer.