LATEST NEWS

Troy Minerals Announces Upcoming Drill Program at Its High Grade Ree Lac Jacques Project in Quebec

8 Reasons Why Troy Minerals Inc. (CSE:TROY)(OTCQB:TROYF) Could Be Poised For Significant Upside Potential in 2024

IDENTIFYING THE OPPORTUNITY

INSTITUTIONAL SUPPORT IS IN PLACE AND READY TO PUSH HIGHER

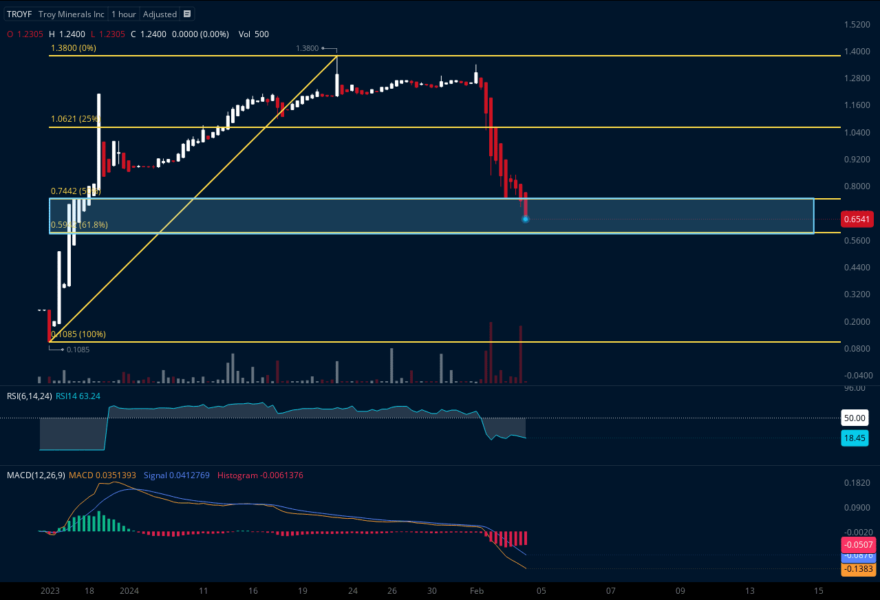

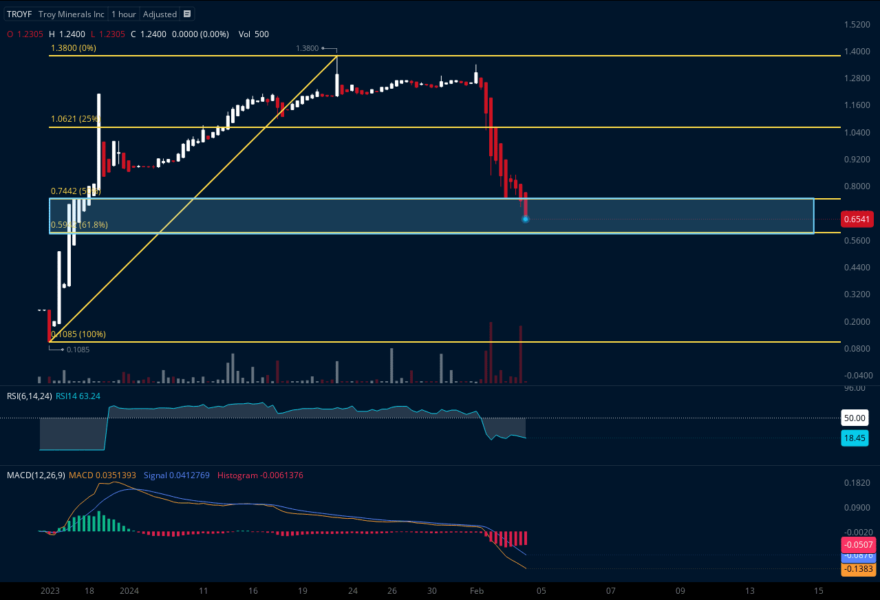

After the initial bullish rally, we are being presented with an excellent retracement opportunity for the next leg up

TARGETS

Target #1: $1.00 (+21.43%)

Target #2: $1.38 (+36.00%)

Target #3: $1.60 (+49.14%)

Target #4: $1.93 (+81.00%)

Support: Mid-$6 Range

Troy Minerals Inc.

(CSE:TROY)(OTCQB:TROYF)

The Analyst: James Hyerczyk

James Hyerczyk is a Florida-based technical analyst, market researcher, educator and trader. James began his career in Chicago in 1982 as a futures market analyst for floor traders at the Chicago Board of Trade, the Chicago Mercantile Exchange, and numerous brokerage firms. He has been providing quality analysis for professional traders for 40 years.

Billionaires tend to invest with one eye on the future.

And three of them – Jeff Bezos, Michael Bloomberg, and Bill Gates – now have their sights set on a sector that many analysts predict will go into deficit this decade.

These members of the billionaire club have funded – to the tune of nearly $200 million – what’s been called a “massive treasure hunt” for rare earth elements.

What is it about these relatively unheard-of commodities that have many savvy investors and billionaires alike watching and investing?

This group of metals is crucial for semiconductor chips, renewable energy, electric vehicles, and much more.

With semiconductor chips, for example…

They provide the computing power necessary for everything from smartphones and smart devices to vehicles, TVs, washing machines, and microwaves.

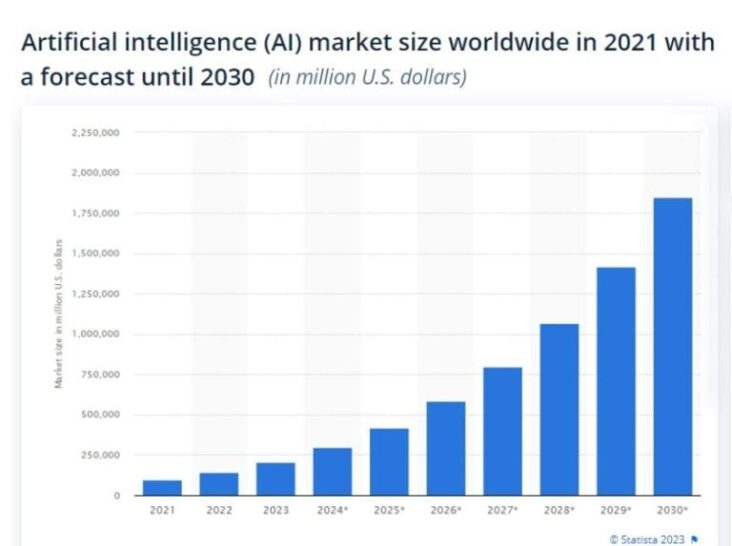

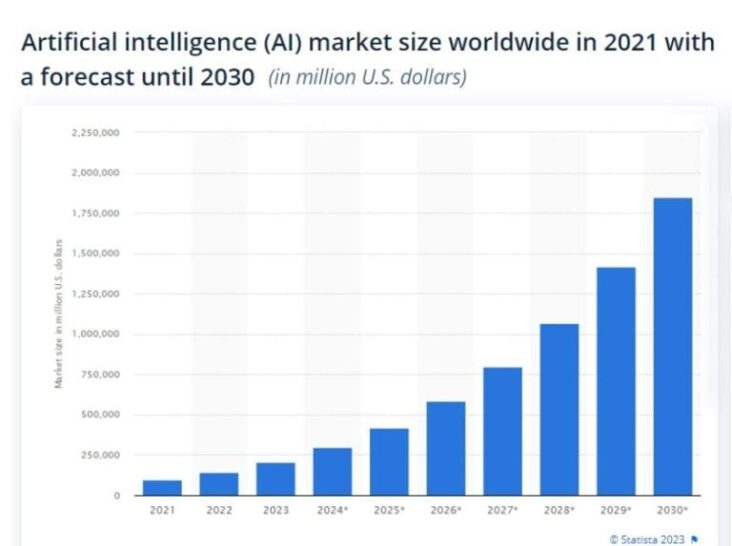

That’s why I’ve seen a trend unfolding with investments in semiconductor and artificial intelligence (AI) stocks.

Investors have gone all-in with stocks such as NVIDIA, a world leader in artificial intelligence computing chips and applications.

But here’s the thing…

These Semiconductor Chips Cannot Be Manufactured Without Rare Earth Elements (REEs).

It’s even bigger than private investor and billionaire interest, the development of a robust supply chain for rare earth elements has full American and Canadian government support…

These governments clearly understand the need to secure a supply of rare earth minerals sufficient to achieve semiconductor independence.

Both the U.S. and Canada view it as a matter of national security.

Because right now, China has an “iron grip” on the mining of rare earth elements.

In fact, China accounted for 70% of global mine production of rare earths in 2022.

What’s worse, China has already imposed export controls on certain rare earths needed to make semiconductor chips.

This could spell MAJOR disaster…

Especially when the U.S. Department of Defense calls China its top strategic threat.

Now more than ever, government officials — and particularly the Pentagon — worry that the U.S. is increasingly vulnerable to any disruption in the rare earth supply chain.

I’m no math whiz, but when you add it all up…

No Rare Earth Metals = No Semiconductor Chips = No AI And Other Advanced Technologies

Without many more new mines being developed within North America, the West will continue to be at the mercy of China for these critical rare earth elements.

Known as “the seeds of technology,” REEs have unique properties that make today’s emerging technologies possible.

From miniaturizing electronics… to the development of electric vehicles, wind turbines, and other “green” technologies… to supporting vital defense, telecommunication, and transportation systems…

Rare earth elements play a starring role.

That’s why it’s important for investors to understand this megatrend now.

Nobody wants to be late to the game. And nobody wants to miss out. I believe there’s an emerging opportunity for one particular company in this space.* And right now, it’s still flying under the radar.

The company I’m talking about is Troy Minerals Inc. (CSE:TROY)(OTCQB:TROYF).

I’m adding this stock to my watch list RIGHT NOW.

Why?

Well, for one thing, Troy Minerals Inc. (CSE:TROY)(OTCQB:TROYF) aims to become a top North American explorer of rare earth and critical elements vital to the trillion-dollar semiconductor industry, the AI revolution, and the renewable energy market.*

Read on…

What Nobody Bothered To Tell You About The “Chip War”

Metals such as rare earths have been called “the new oil.”

The last century was ruled by oil and gas. Dominating politics and economics. Creating wealth beyond measure. Even setting off wars.

But there’s a different kind of war going on right now, with rare earths at the center of it.

It’s a chip war…

Today, the U.S.-China chip war centers on the island nation of Taiwan.

Taiwan represents the beating heart of semiconductor manufacturing.

In fact, Taiwanese companies hold a 68% market share in the manufacture of semiconductors used for AI and quantum computing applications.

And while China has downplayed threats to take over Taiwan, President Xi has also warned that China’s unification with Taiwan is unstoppable.

A Chinese blockade of Taiwan — even without becoming a military conflict…

Could disrupt over $2 trillion in economic activity by cutting off the primary source of semiconductors from global supply chains.

Of course, the U.S. would like to steer clear of any China-Taiwan conflict.

Especially since China is one of the world’s largest producers of rare earths and many other strategic metals.

But China is the worst kind of trade partner – that’s because it can’t be trusted.

The U.S. government recognizes that fact.

That’s why, in March 2023, President Biden delivered an URGENT plea during his visit to Canada…

A plea for Canada to help the U.S. with its need for rare earths and other critical minerals.

While speaking to Parliament, Biden cast it as an ideal partnership…

Li-FTroy Minerals Inc.

(CSE:TROY)(OTCQB:TROYF)T

(CSE: LIFT)(OTCQX: LIFFF)

“We don’t have the minerals to mine, you can mine them.” - Pres. Biden

President Biden went on to say:

“Canada in particular has large quantities of critical minerals that are essential for our clean energy future… and I believe we have an incredible opportunity to work together so Canada and the United States can source and supply here in North America everything we need for reliable and resilient supply chains.”

A Joint Statement put out by President Biden and Prime Minister Trudeau focused on the importance of these mineral sources to semiconductors, renewable energy, electric vehicles, aerospace, and defense, among other sectors.

And it wasn’t all talk…

The news reported that there was a “pot of gold” at the end of President Joe Biden’s Canadian jaunt – one that’s going into Canada’s mining sector.

This was actually a $250 million fund with a goal of accelerating the critical minerals supply chain for both countries.

This is great news, as Canada is estimated to have over 15 million metric tons of rare earth oxide.

Right now is a great time to research this trend.

Especially with bipartisan support in the U.S. to reduce dependence on China for our critical minerals.

Both the U.S. and Canada signaled their commitment to start decoupling from China.

And Troy Minerals Inc. (CSE:TROY)(OTCQB:TROYF), with its promising Canadian Rare Earths Project near Montreal, could be among the first companies to benefit from such a strategic partnership.*

What Makes Rare Earths So Critical?

Li-FT's exploration strategy is underpinned by several key principles:

Diversification: The company maintains a diverse portfolio of lithium projects at various stages of exploration and development. This strategy mitigates risk and ensures a steady stream of opportunities.

Active Drilling Initiatives: Li-FT (CSE: LIFT)(OTCQX: LIFFF) is actively engaged in drilling initiatives across its projects. These initiatives aim to confirm existing lithium resources, identify new ones, and establish resource assessments.

Rigorous Evaluation: Each project undergoes rigorous evaluation to assess its lithium potential. This evaluation includes surface sampling, drilling, and geological studies.

Environmental and Social Responsibility: Li-FT (CSE: LIFT)(OTCQX: LIFFF) places a strong emphasis on environmental, social, and governance (ESG) considerations. The company works collaboratively with local Indigenous communities, prioritizes local and Indigenous employment, and operates within a stable regulatory jurisdiction.

Li-FT's Commitment to Sustainability: As Li-FT (CSE: LIFT)(OTCQX: LIFFF) ventures into the heart of the lithium industry, we remain dedicated to sustainability and environmental responsibility. Our commitment extends beyond regulatory compliance, as we actively seek ways to minimize our environmental footprint.

Community Engagement: Li-FT (CSE: LIFT)(OTCQX: LIFFF) is committed to building positive relationships based on trust, respect, and mutual benefit with the communities who have lived on the land for many generations. We work closely with Indigenous leaders to ensure that our exploration activities align with their cultural values and economic interests.

Environmental Stewardship: Li-FT (CSE: LIFT)(OTCQX: LIFFF) places a high value on environmental stewardship. We adhere to rigorous environmental management practices throughout our exploration process. This includes responsible land reclamation, water management, and monitoring of our activities' environmental impact.

A Sustainable Future: Li-FT's vision extends beyond immediate exploration goals. We are dedicated to contributing to a sustainable future, where lithium plays a central role in clean energy and technology. By responsibly developing lithium resources, we aim to support the global transition to renewable energy and reduce our dependence on fossil fuels.

With exceptional lithium grades, strategic locations, and a commitment to environmental and social responsibility, Li-FT is well-positioned to capitalize on the growing global demand for lithium and contribute to the green energy transition. As the company continues its exploration journey, investors can look forward to significant developments that unlock the vast lithium potential within these projects.

And the semiconductor and AI sectors cannot survive without rare earth elements, one of the critical mineral groups that Troy Minerals Inc. (CSE:TROY)(OTCQB:TROYF) is laser-focused on.

REEs also play crucial roles in modern U.S. military and defense technology.

For example, each F-35 Lightning II fighter jet uses 920 pounds of rare earth materials.

Rare earths are found in missile and weapon guidance systems, in disk drive motors installed in planes and tanks, electronic warfare jamming devices, satellite communications, and radar and sonar systems.

The list seems endless.

From magnetic storage of enormous quantities of data to the magnets used in MRI machines that diagnose and treat many medical conditions…

It’s hard to find an industry in which rare earth elements are not used.

But unfortunately, as the demand for critical minerals rises to levels beyond any seen before, supply shortfalls are looming.

In particular, an alarming shortage of rare earths is impending.

This could truly be considered a national emergency.

The good news is, Canadian rare earth miners could be perfectly positioned as allies to help the U.S. develop a reliable supply chain – before it’s too late.

And if a significant rare earth discovery was to occur for Troy Minerals Inc. (CSE:TROY)(OTCQB:TROYF), this could become a game changer for early investors.*

Troy Minerals Inc.

(CSE:TROY)(OTCQB:TROYF)

Canadian Rare Earth Project Offers A Promising Critical Mineral Opportunity

Troy Minerals Inc. (CSE:TROY)(OTCQB:TROYF) is a Canadian-based exploration company focused on the acquisition, exploration, and development of multiple mineral properties.

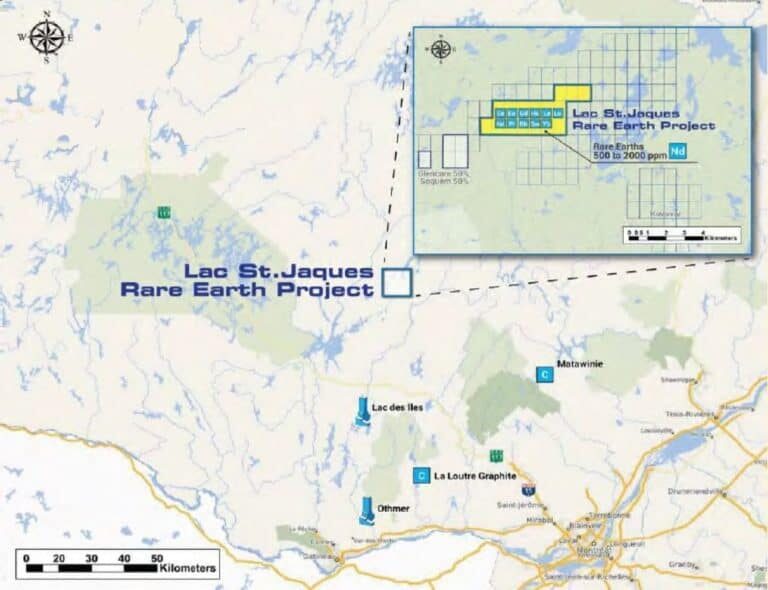

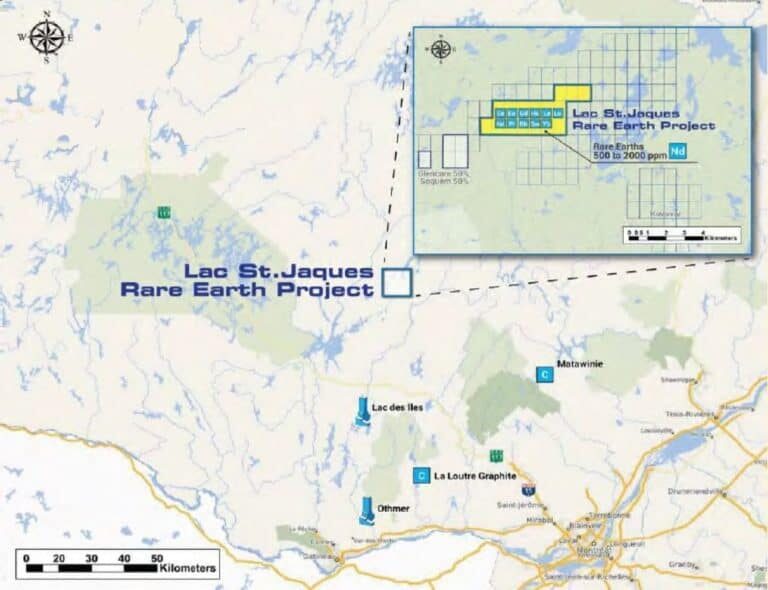

This includes the Lac Jacques High-Grade Rare Earth Project located 155 miles – just 3 hours driving distance – north of Montreal, Quebec.

The road-accessible project comprises 20 claims totaling 2,300 acres, with easy drivable access to all parts of the project area. Hydro power lines are located only 1.2 miles away from the project boundaries.

As its name implies, the property hosts high-grade real earth element (REE) mineralization at the surface.

On October 30, 2023, Troy Minerals Inc. (CSE:TROY)(OTCQB:TROYF) announced the completion of the Phase One exploration program including soil sampling and prospecting at Lac Jacques.

Troy Minerals Inc. (CSE:TROY)(OTCQB:TROYF) has now moved to the next phase with the commencement of drilling at Lac Jacques. Drill holes will test the high-grade REE exposure as well as the on-strike extension to the east.

“While our recent drill program targeted the historic high-grade REE exposed in a trench, our prospecting shows that the high-grade dyke material may have a strike length of more than 2 miles. This is very promising and we are excited to drill it beginning in late January 2024” – Rana Vig, President Troy Minerals Inc. (CSE:TROY)(OTCQB:TROYF)

DIGGING DEEP

Troy Minerals Inc.

(CSE:TROY)(OTCQB:TROYF)

Strong Company Leadership With A Successful Record Of Exits

When it comes to evaluating potential investments, it’s always important to know who’s in charge.

Troy Minerals Inc. (CSE:TROY)(OTCQB:TROYF) has a strong and experienced leadership team led by CEO Rana Vig with a successful track record of previous exits.

Mr. Vg has over 30 years of successful business experience. He has played key roles in publicly traded companies, including President of Musgrove Minerals (copper, gold) and Chairman & CEO of Continental Precious Minerals (uranium).

In 2018, he became CEO of Lead Ventures and oversaw and executed the acquisition and $5 billion+ reverse takeover of Curaleaf Holdings which raised $520 million – one of the largest Canadian cannabis financings in history.

His track record also includes taking over the helm of Rockbridge Resources, which he successfully restructured by acquiring, through a reverse takeover, the $2 billion+ Harvest Health & Rec, which closed a $300 million financing deal – the 3rd largest cannabis financing of 2018. In 2017, he received the Canadian Senate 150th Anniversary Medal, awarded to Canadians actively working to make Canada a better place to live.

His entrepreneurial expertise in these transformative acquisitions and strategic restructuring has driven growth and success for these companies.

Director Norman Brewster has an equally impressive mineral industry career.

Mr. Brewster’s background includes developing the Aguas Tenidas Mine in Spain, negotiating the purchase of the Condestable Mine in Peru, and aiding the successful acquisition of Iberian Minerals Corp. by Trafigura Group Pte. Ltd. in an all-cash takeover valued at around $497 million, and was a director and committee member of Spider Resources that approved the approximately $250 million takeover by Cliffs Natural Resources Inc.

Led by this all-star team of experts, Troy Minerals Inc. (CSE:TROY)(OTCQB:TROYF) is poised to be a critical player in the North American rare earth supply chain.*

But Troy Minerals Inc. (CSE:TROY)(OTCQB:TROYF) doesn’t have all its “eggs” in one North American basket.

Troy Minerals Inc.

(CSE:TROY)(OTCQB:TROYF)

Multiple Properties With Multiple Critical Minerals

Troy Minerals Inc. (CSE:TROY)(OTCQB:TROYF) also owns the Lac Jacques High-Grade Rare Earth Project located 155 miles – three hours driving distance – north of Montreal, Quebec.

The road-accessible project comprises 20 claims[99] totaling 2,300 acres, with easy, drivable access to all parts of the project area. Hydropower lines are located only 1.2 miles away from the project boundaries.

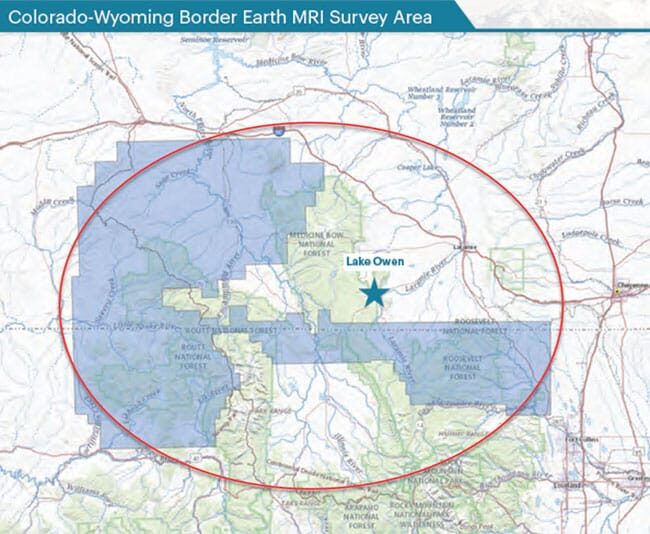

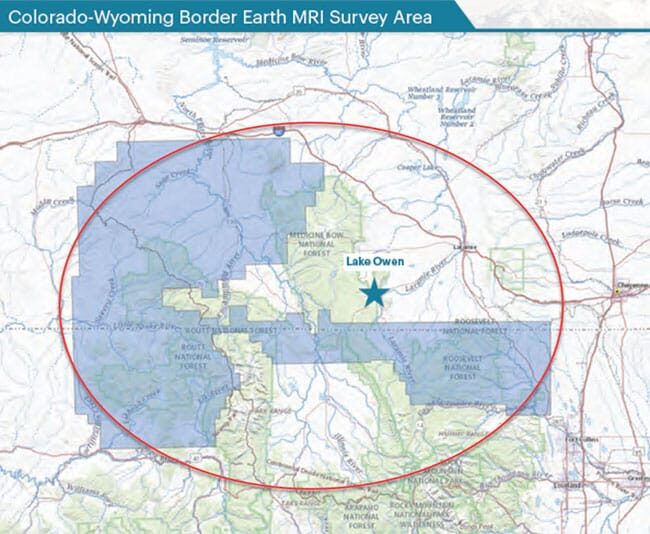

Troy Minerals Inc. (CSE:TROY)(OTCQB:TROYF) is also focused on delineating a high-grade, large-scale vanadium-titanium-platinum group elements resource in Wyoming.

The U.S. government already identified the company’s Lake Owen project as part of an American region with the potential for hosting critical mineral resources.

To this end, the U.S. Geological Survey has already performed a large-scale “Earth MRI” aerial survey program using 3D technology to map out and define mineral resources.

Project data and reports from this airborne and additional ground survey are expected to be shared with Troy Minerals Inc. (CSE:TROY)(OTCQB:TROYF) in the coming weeks.

What really excites me is that the property demonstrates significant potential for a world-class vanadium and titanium discovery, with approximately 1+ BILLION METRIC TONS.

So I can’t wait to see the report…

If you haven’t heard much about vanadium, it’s time to change that.

The metal vanadium has countless applications in the automotive, military, and aerospace industries.

Automakers use vanadium in car bodies to make them lighter and substantially stronger.

By 2025, it’s estimated that 85% of all vehicles will incorporate vanadium alloy to enhance fuel efficiency and the ability to meet EPA fuel economy standards.

Today, vanadium is also the key ingredient in cutting-edge vanadium redox flow batteries (VRFBs) used for grid-level energy storage.

The U.S. government considers vanadium critical for our national and economic security – yet less than 5% of the metal is mined and processed in America.

The push for more domestic sources is strong, since China and Russia are the world’s top vanadium producers.

Remember, vanadium is not the only critical metal Troy Minerals Inc. (CSE:TROY)(OTCQB:TROYF) is exploring for at the Lake Owen project…

It’s considered to have the potential for a large vanadium, titanium, and platinum group element (PGE) project in Wyoming.

The silver metal titanium is lightweight and resistant to corrosion. It’s as strong as steel but weighs about half as much.

It’s used in the pigmentation of paints and coatings – and has applications in the energy, chemical, aerospace, jewelry, cosmetics, and medical sectors.

Titanium combines with vanadium and other metals to produce high-performance alloys.

Jet engines, spacecraft, military equipment, body armor, and other high-tech products require parts made with these alloys.

Due to its extensive use and wide range of applications, titanium is in high demand.

Platinum group elements are among the rarest metals on earth.

Although platinum is known for its use as jewelry and as an investment commodity, the leading use of PGEs is in automotive catalytic converters.

I know we’ve covered a lot of ground today, but there’s more…

Troy Minerals Inc. (CSE:TROY)(OTCQB:TROYF) company portfolio also includes the 2,630-acre Ticktock Property located within the prolific Golden Triangle region of British Columbia, and the right to acquire 100% interest in the Green Gold Project west of Prince George, B.C.

I think you’ve seen that this company has the right assets, the right people, and a supportive Canada-U.S. alliance.

Sources

- [1] https://investornews.com/critical-minerals-rare-earths/the-top-billionaires-are-now-chasing-the-critical-magnet-rare-earths-part-1-of-2/

- [2] https://investornews.wpengine.com/critical-minerals-rare-earths/bezos-bloomberg-and-gates-look-to-greenlands-critical-minerals-for-a-greener-future/

- [3] https://www.cfr.org/blog/will-chinas-reliance-taiwanese-chips-prevent-war

- [4] https://www.nvidia.com/en-us/

- [5] https://www.reuters.com/technology/nvidia-make-arm-based-pc-chips-major-new-challenge-intel-2023-10-23/#:~:text=Oct%2023%20(Reuters)%20%2D%20Nvidia,that%20would%20run%20Microsoft’s%20(MSFT.

- [6] https://masterinvestor.co.uk/economics/the-microprocessor-and-rare-earth-metals-crunch-hits-home/

- [7] https://www.wsj.com/articles/the-u-s-wants-a-rare-earths-supply-chain-heres-why-it-wont-come-easily-dfc3b632

- [8] https://www.cnbc.com/2023/03/14/canada-is-aiming-to-beat-china-in-the-critical-race-for-rare-earth-metals-.html

- [9] https://www.politico.com/news/magazine/2022/12/14/rare-earth-mines-00071102

- [10] https://www.reuters.com/markets/commodities/chinas-rare-earths-dominance-focus-after-mineral-export-curbs-2023-07-05/#:~:text=Mining%3A%20China%20accounted%20for%2070,Survey%20(USGS)%20data%20shows.

- [11] https://www.politico.com/news/magazine/2022/12/14/rare-earth-mines-00071102

- [12] https://www.politico.com/news/magazine/2022/12/14/rare-earth-mines-00071102

- [13] https://www.politico.com/news/magazine/2022/12/14/rare-earth-mines-00071102

- [14] https://www.wsj.com/articles/the-u-s-wants-a-rare-earths-supply-chain-heres-why-it-wont-come-easily-dfc3b632

- [15] https://www.cnbc.com/2023/03/14/canada-is-aiming-to-beat-china-in-the-critical-race-for-rare-earth-metals-.html

- [16] https://www.rareelementresources.com/rare-earth-elements

- [17] https://www.rareelementresources.com/rare-earth-elements

- [18] https://www.mckinsey.com/industries/semiconductors/our-insights/the-semiconductor-decade-a-trillion-dollar-industry

- [19] https://thehill.com/opinion/international/3854245-metals-are-the-new-oil-with-all-the-geopolitical-and-environmental-complications/#:~:text=For%20good%20or%20for%20ill,of%20metals%20are%20heating%20up.

- [20] https://www.investors.com/news/taiwan-presidential-race-set-us-china-chip-war-nears-moment-of-truth-for-nvidia-apple-and-the-world/

- [21] https://www.cfr.org/blog/will-chinas-reliance-taiwanese-chips-prevent-war

- [22] https://www.investors.com/news/taiwan-presidential-race-set-us-china-chip-war-nears-moment-of-truth-for-nvidia-apple-and-the-world/

- [23] https://www.investors.com/news/taiwan-presidential-race-set-us-china-chip-war-nears-moment-of-truth-for-nvidia-apple-and-the-world/

- [24] https://www.nbcnews.com/news/china/xi-warned-biden-summit-beijing-will-reunify-taiwan-china-rcna130087

- [25] https://www.reuters.com/markets/commodities/chinas-rare-earths-dominance-focus-after-mineral-export-curbs-2023-07-05/#:~:text=Mining%3A%20China%20accounted%20for%2070,Survey%20(USGS)%20data%20shows.

- [26] https://www.cbc.ca/news/politics/critical-minerals-biden-trudeau-1.6790933

- [27] https://www.cbc.ca/news/politics/critical-minerals-biden-trudeau-1.6790933

- [28] https://www.cbc.ca/news/politics/critical-minerals-biden-trudeau-1.6790933

- [29] https://www.whitehouse.gov/briefing-room/statements-releases/2023/03/24/joint-statement-by-president-biden-and-prime-minister-trudeau/

- [30] https://www.cbc.ca/news/politics/critical-minerals-biden-trudeau-1.6790933

- [31] https://www.cbc.ca/news/politics/critical-minerals-biden-trudeau-1.6790933

- [32] https://www.cnbc.com/2023/03/14/canada-is-aiming-to-beat-china-in-the-critical-race-for-rare-earth-metals-.html

- [33] https://www.hsgac.senate.gov/media/dems/peters-romney-and-lankford-bipartisan-bill-to-reduce-dependence-on-china-and-other-adversarial-nations-for-critical-minerals-advances-in-the-senate/

- [34] https://www.reuters.com/markets/commodities/chinas-rare-earths-dominance-focus-after-mineral-export-curbs-2023-07-05/#:~:text=Mining%3A%20China%20accounted%20for%2070,Survey%20(USGS)%20data%20shows.

- [35] https://www.investopedia.com/terms/s/semiconductor.asp

- [36] https://www.hitachi-hightech.com/global/en/knowledge/semiconductor/room/about/life.html#:~:text=CPUs%20that%20operate%20personal%20computers,LED%20bulbs%20also%20use%20semiconductors.

- [37] https://www.hitachi-hightech.com/global/en/knowledge/semiconductor/room/about/life.html#:~:text=CPUs%20that%20operate%20personal%20computers,LED%20bulbs%20also%20use%20semiconductors.

- [38] https://www.hitachi-hightech.com/global/en/knowledge/semiconductor/room/about/life.html#:~:text=CPUs%20that%20operate%20personal%20computers,LED%20bulbs%20also%20use%20semiconductors.

- [39] https://www.precedenceresearch.com/press-release/semiconductor-market

- [40] https://www.investopedia.com/semiconductor-impact-on-the-stock-market-7367723#:~:text=As%20technology%20continues%20to%20advance,new%20and%20cutting%2Dedge%20products.

- [41] https://www.investopedia.com/terms/i/internet-things.asp

- [42] https://www.statista.com/statistics/1365145/artificial-intelligence-market-size/

- [43] https://www.statista.com/statistics/1365145/artificial-intelligence-market-size/

- [44] https://www.army.mil/article/227715/an_elemental_issue

- [45] https://www.airforcemag.com/article/rare-earth-uncertainty/

- [46] https://www.nrel.gov/news/program/2021/in-a-circular-economy-hard-drives-could-have-multiple-lives-in-the-future.html

- [47] https://www.metaltechnews.com/story/2020/04/29/tech-metals/rare-earth-metals-see-new-medical-uses/217.html

- [48] https://www.bcg.com/publications/2023/five-steps-for-solving-the-rare-earth-metals-shortage#:~:text=These%20minerals%20will%20therefore%20be,of%20rare%20earths%20is%20impending.

- [49] https://www.bcg.com/publications/2023/five-steps-for-solving-the-rare-earth-metals-shortage#:~:text=These%20minerals%20will%20therefore%20be,of%20rare%20earths%20is%20impending.

- [50] https://troyminerals.com/

- [51] chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://troyminerals.com/wp-content/uploads/2023/12/TROY_MINERALS_INVESTOR_DECK_DECEMBER.pdf

- [52] https://troyminerals.com/wp-content/uploads/2023/10/News-Release-Lac-Jacques-_October-30-2023_tv_oct-19_WJC-Oct-20.pdf

- [53] https://troyminerals.com/#!/projects

- [54] chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://troyminerals.com/wp-content/uploads/2023/12/TROY_MINERALS_INVESTOR_DECK_DECEMBER.pdf

- [55] https://troyminerals.com/#!/about

- [56] https://troyminerals.com/wp-content/uploads/2023/10/News-Release-Lac-Jacques-_October-30-2023_tv_oct-19_WJC-Oct-20.pdf

- [57] https://troyminerals.com/wp-content/uploads/2023/10/News-Release-Lac-Jacques-_October-30-2023_tv_oct-19_WJC-Oct-20.pdf

- [58] chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://troyminerals.com/wp-content/uploads/2023/12/TROY_MINERALS_INVESTOR_DECK_DECEMBER.pdf

- [59] chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://troyminerals.com/wp-content/uploads/2023/12/TROY_MINERALS_INVESTOR_DECK_DECEMBER.pdf

- [60] https://www.usgs.gov/special-topics/earth-mri/science/why-earth-mri-needed?qt-science_center_objects=0#qt-science_center_objects

- [61] chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://troyminerals.com/wp-content/uploads/2023/12/TROY_MINERALS_INVESTOR_DECK_DECEMBER.pdf

- [62] chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://troyminerals.com/wp-content/uploads/2023/12/TROY_MINERALS_INVESTOR_DECK_DECEMBER.pdf

- [63] https://troyminerals.com/wp-content/uploads/2023/11/Nov-14-Lake-Owen-update_USGS.pdf

- [64] chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://troyminerals.com/wp-content/uploads/2023/12/TROY_MINERALS_INVESTOR_DECK_DECEMBER.pdf

- [65] https://www.upsbatterycenter.com/blog/vanadium-is-the-worlds-most-important-metal/

- [66] chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://troyminerals.com/wp-content/uploads/2023/12/TROY_MINERALS_INVESTOR_DECK_DECEMBER.pdf

- [67] chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://troyminerals.com/wp-content/uploads/2023/12/TROY_MINERALS_INVESTOR_DECK_DECEMBER.pdf

- [68] chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://troyminerals.com/wp-content/uploads/2023/12/TROY_MINERALS_INVESTOR_DECK_DECEMBER.pdf

- [69] chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://troyminerals.com/wp-content/uploads/2023/12/TROY_MINERALS_INVESTOR_DECK_DECEMBER.pdf

- [70] chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://troyminerals.com/wp-content/uploads/2023/12/TROY_MINERALS_INVESTOR_DECK_DECEMBER.pdf

- [71] https://www.factmr.com/report/titanium-market

- [72] https://www.factmr.com/report/titanium-market

- [73] https://geology.com/articles/titanium/

- [74] https://geology.com/articles/titanium/

- [75] https://www.factmr.com/report/titanium-market

- [76] https://pubs.usgs.gov/fs/2014/3064/pdf/fs2014-3064.pdf

- [77] https://pubs.usgs.gov/fs/2014/3064/pdf/fs2014-3064.pdf

- [78] https://troyminerals.com/#!/projects

- [79] https://investornews.com/critical-minerals-rare-earths/the-top-billionaires-are-now-chasing-the-critical-magnet-rare-earths-part-1-of-2/

- [80] https://www.whitehouse.gov/briefing-room/statements-releases/2023/03/24/joint-statement-by-president-biden-and-prime-minister-trudeau/

- [81] https://www.politico.com/news/magazine/2022/12/14/rare-earth-mines-00071102

- [82] https://www.politico.com/news/magazine/2022/12/14/rare-earth-mines-00071102

- [83] https://www.reuters.com/technology/nvidia-make-arm-based-pc-chips-major-new-challenge-intel-2023-10-23/#:~:text=Oct%2023%20(Reuters)%20%2D%20Nvidia,that%20would%20run%20Microsoft’s%20(MSFT.

- [84] https://www.cbc.ca/news/politics/critical-minerals-biden-trudeau-1.6790933

- [85] chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://troyminerals.com/wp-content/uploads/2023/12/TROY_MINERALS_INVESTOR_DECK_DECEMBER.pdf

- [86] https://troyminerals.com/wp-content/uploads/2023/08/Troy-NR_August-30-2023_Final.pdf

- [87] chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://troyminerals.com/wp-content/uploads/2023/12/TROY_MINERALS_INVESTOR_DECK_DECEMBER.pdf

- [88] http://metalpedia.asianmetal.com/metal/titanium/application.shtml#:~:text=The%20aerospace%20industry%20is%20the,ratio%20and%20high%20temperature%20properties.

- [89] https://pubs.usgs.gov/fs/2014/3064/pdf/fs2014-3064.pdf

- [90] https://ipa-news.de/index/platinum-group-metals/

- [91] chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://troyminerals.com/wp-content/uploads/2023/12/TROY_MINERALS_INVESTOR_DECK_DECEMBER.pdf

- [92] https://finance.yahoo.com/news/troy-minerals-announces-upcoming-drill-081500662.html

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media Group LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media Group LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media Group LLC and Social media company, Virtus Media Group LLC has been hired by Social media company for a period beginning on 02/05/2024 and ending 02/09/2024 to publicly disseminate information about CSE: TROY via digital communications. We have been paid seventy-five thousand dollars USD. Virtus media agrees to pay social media influencer #1 two hundred dollars and social media influencer #2 two hundred dollars and social media influencer #3 five hundred dollars.