Autonomix Medical Inc. (NASDAQ: AMIX) is leading the charge to disrupt the $12 Trillion Dollar Healthcare Industry with the integration of A.I.

The field of electrophysiology has seen rapid growth as of late, and with continuous innovation, more opportunities are emerging. As the industry continues to surge, AMIX is looking to make a name for themselves.

LATEST NEWS

Autonomix Medical, Inc. Granted New European Patent for First-in-Class Catheter-Based Technology

About The Company

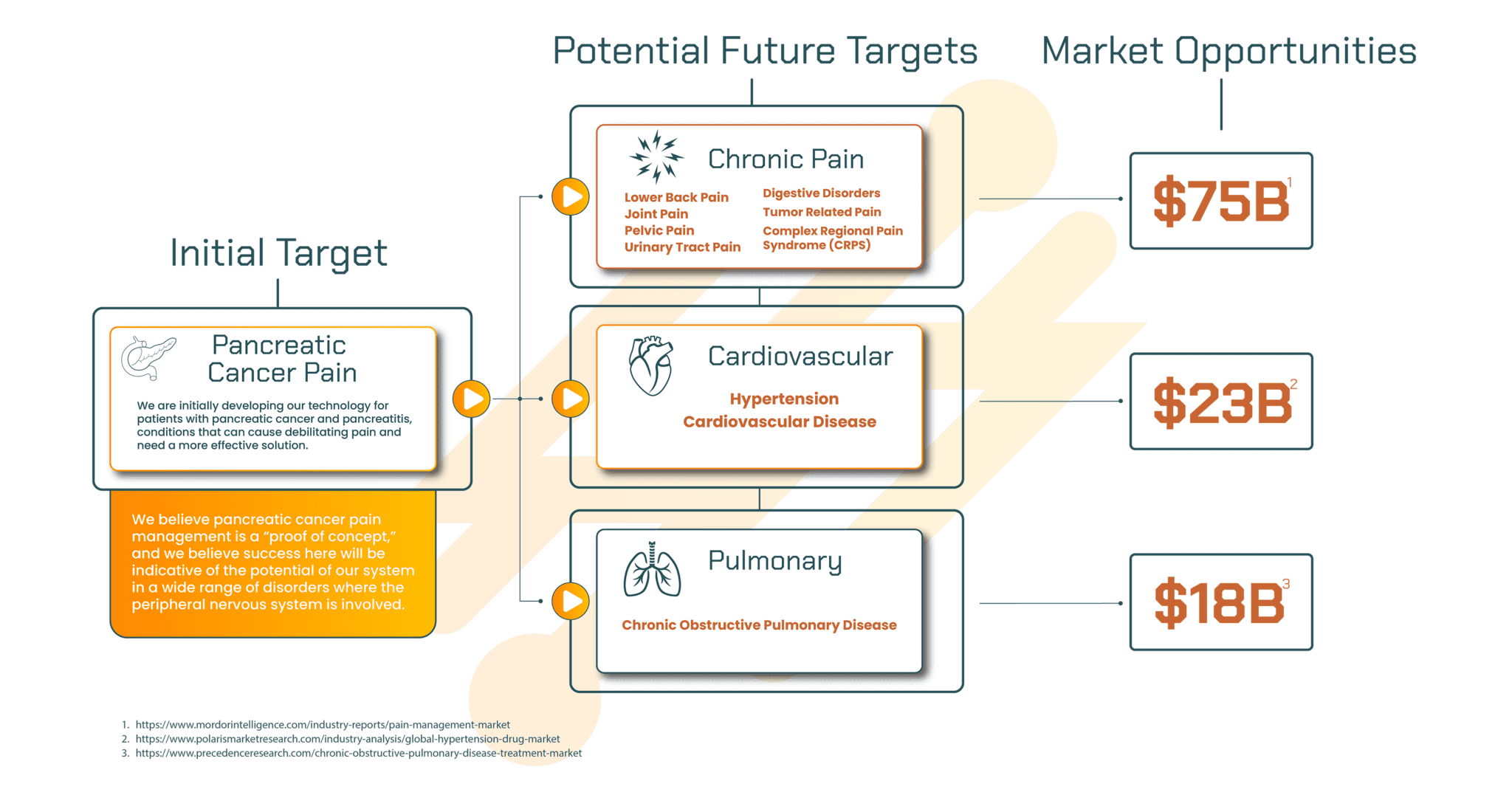

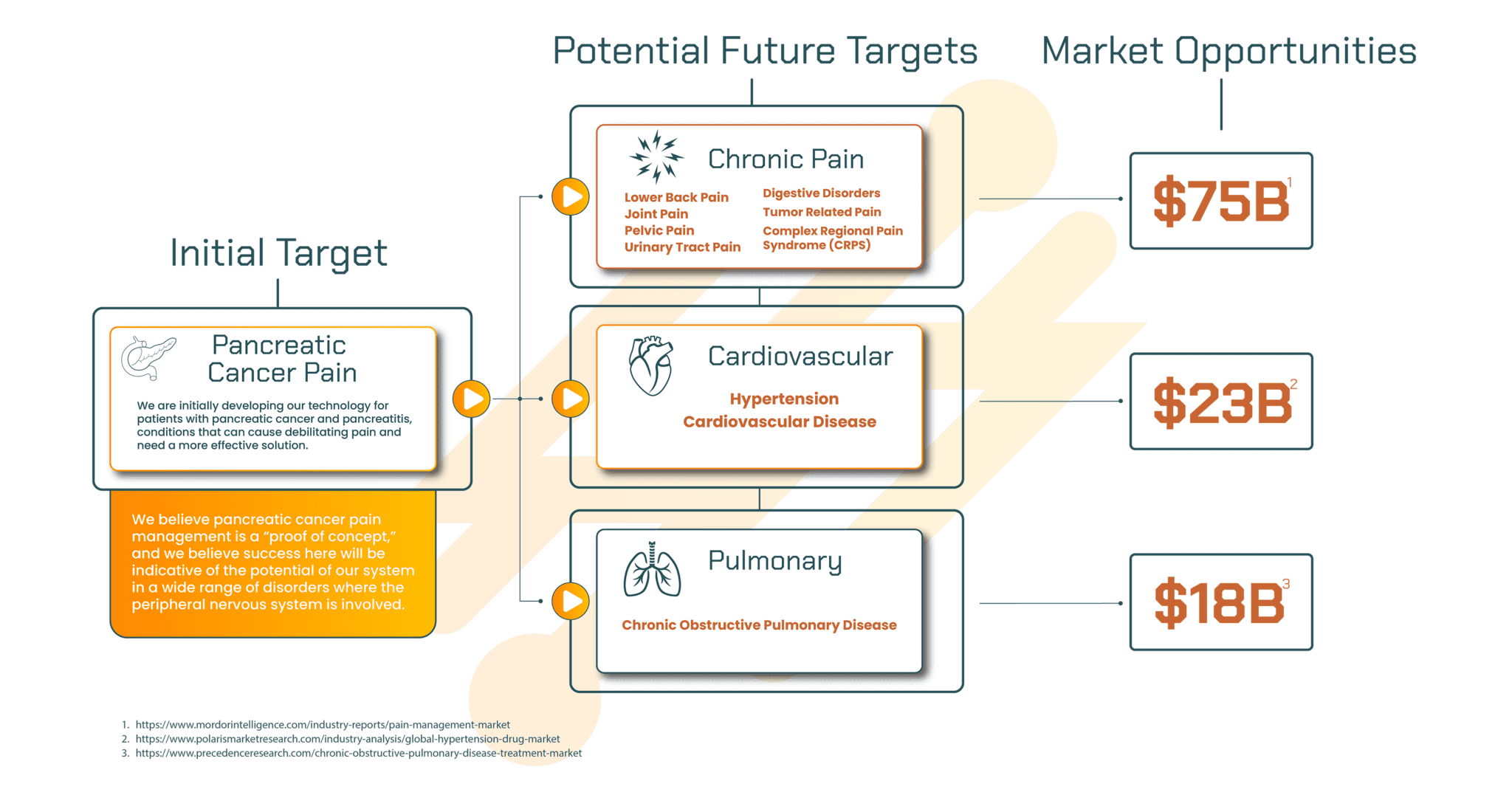

Autonomix Medical, Inc. (NASDAQ: AMIX) is a clinical-stage medical device company developing a first-in-class, catheter-based microchip sensing platform—dubbed the "GPS for the nervous system"—designed for real-time, intra-procedural nerve mapping and targeted transvascular denervation. The technology, currently under clinical investigation, holds promise for treating conditions like chronic pain from pancreatic cancer, hypertension, and cardiology disorders. Autonomix is backed by a rapidly expanding intellectual property portfolio (120+ patents issued or pending) and continues to advance toward pivotal human trials.

These 5 key points outline the potential of a Healthcare Tech innovator like Autonomix (NASDAQ: AMIX)

Autonomix Medical Inc.

(NASDAQ: AMIX)

Technology & Innovation

Autonomix is advancing technology that could reshape how physicians treat nervous system disorders. Its minimally invasive, catheter-based platform allows for real-time sensing and ablation from within blood vessels, eliminating the need for open procedures.

By providing immediate feedback on nerve location and treatment effectiveness, the system may improve both patient outcomes and procedural efficiency.

A robust patent portfolio underpins this innovation. With more than 120 patents issued or pending across global markets, Autonomix has established a strong foundation of intellectual property protection. This growing portfolio strengthens the company’s position as it advances clinical and regulatory pathways.

The company’s initial focus is pancreatic cancer pain, a condition with limited options for relief. Autonomix is conducting proof-of-concept human trials for its transvascular radiofrequency ablation technology. Early procedures have been completed successfully, and topline results from the first patient cohort are expected soon.

Preclinical studies have shown promise as well. In animal models, the company demonstrated reductions in tumor growth and metastases following targeted nerve ablation, further validating the platform’s potential.

With adaptability across multiple therapeutic areas including cardiology, pulmonology, and gastroenterology, Autonomix is positioning its technology as a versatile platform with broad clinical utility.

Autonomix Medical Inc.

(NASDAQ: AMIX)

Clinical Progress & Milestones

The past year has been marked by significant progress for Autonomix. In 2024, the company completed its IPO, raising approximately $11.2 million gross proceeds to fund operations, research, and clinical development.

This capital raise provided the runway to initiate human clinical studies while strengthening the balance sheet.

Autonomix’s proof-of-concept clinical trial for pancreatic cancer pain is underway, with patient enrollment in progress and early procedures completed. Topline results from the initial five patients are anticipated in the near term, offering important insights into safety and efficacy. These data will guide the company’s progression toward pivotal trials.

Corporate milestones have also included the issuance of new patents, successful completion of animal studies, and advancement of the platform’s microchip sensing technology through an ASIC development partnership. These achievements demonstrate momentum not only in clinical development but also in strengthening the underlying technology.

Looking ahead, the company has a clear development roadmap. Plans include completing device design within 2024, developing the full ablation system by 2025, launching combined clinical trials in 2025, and targeting a de novo submission to the FDA in 2026. If successful, Autonomix anticipates potential clearance as early as 2027.

Engagement with the investment community has also grown, including presentations, press releases, and the launch of the “CEO Corner” platform to share updates directly with stakeholders.

Autonomix Medical Inc. (NASDAQ: AMIX)

As a clinical-stage company, Autonomix remains pre-revenue. For the fiscal year ended March 31, 2024, the company reported a net loss of approximately $15.4 million, reflecting the costs of advancing research and development compared to a net loss of $2.0 million in the prior year. These figures highlight the company’s early-stage nature and focus on building long-term value through innovation.

At fiscal year-end, Autonomix reported cash reserves of $8.6 million and working capital of approximately $7.0 million. Additional financings following the IPO raised about $10 million across late 2024 and early 2025, bolstering liquidity for ongoing operations. While independent auditors noted substantial doubt about the company’s ability to continue as a going concern without future funding, Autonomix has consistently demonstrated its ability to access capital markets to support progress.

The company’s balance sheet shows assets of approximately $11.95 million against liabilities of around $2.25 million, leaving equity near $9.7 million as of December 2024. SEC filings, including 8-Ks and quarterly reports, reflect active corporate governance and disclosure of leadership transitions, financing activities, and executive compensation updates. Leadership appointments have strengthened the company’s direction, with Brad Hauser named CEO and Lori Bisson appointed Vice-Chairman of the Board.

Taken together, these financial and governance developments highlight a company navigating the typical challenges of early-stage biotech and medtech development while advancing toward important clinical and regulatory milestones.

Introducing the Management Team of Autonomix Medical Inc

(NASDAQ: AMIX)

Brad Hauser - President & CEO

Mr. Hauser is a globally renowned medical technology innovation leader and seasoned executive with more than 20 years of experience building teams that bring unique energy-based technologies from concept, through design validation, clinical studies, regulatory approvals, manufacturing, and commercialization. Over the course of his career, he has been a visionary for top laser, radiofrequency, sound and cold technologies treating a broad range of indications from vascular to adipose tissue to skin.

Jennifer Cook - Chief Business Officer

Ms. Cook is an innovative, cross-functional leader with significant expertise working with early developmental stage companies and building them into fully integrated companies. Over the course of her career, she has a proven track record with translating vision to expand value proposition and creating successful go-to-market solutions.

Dr. Robert Schwartz - Chief Medical Officer

Dr. Schwartz is a serial medical device inventor and developer of the Watchman™, a left atrial appendage closure device and proven one-time procedure that reduces the risk of stroke in non-valvular atrial fibrillation (NVAF) patients and the risk of bleeding that comes with a long-term oral anticoagulant use. The Watchman™ sold to Boston Scientific and has generated over $1 Billion in revenue.

Sources

- https://www.globenewswire.com/news-release/2024/05/31/2891496/0/en/Autonomix-Medical-Inc-Reports-Full-Year-2024-Financial-Results-and-Provides-Corporate-Update.html

- https://www.autonomix.com/

- https://ir.autonomix.com/autonomix-medical-inc-granted-new-european-patent-for-first-in-class-catheter-based-technology/

- https://ir.autonomix.com/autonomix-medical-inc-granted-new-u-s-patent-to-advance-minimally-invasive-nerve-focused-treatments-across-high-need-indications/

- https://ir.autonomix.com/autonomix-medical-inc-announces-u-s-patent-granted-covering-the-treatment-of-cancerous-tumors-and-cancer-related-pain-with-companys-proprietary-catheter-based-technology/

- https://www.globenewswire.com/news-release/2024/11/11/2978245/0/en/Autonomix-Medical-Inc-Reports-Second-Quarter-Fiscal-Year-2025-Financial-Results-and-Provides-a-Corporate-Update.html

- https://www.globenewswire.com/news-release/2025/07/21/3118741/0/en/Autonomix-Medical-Inc-Granted-New-U-S-Patent-to-Advance-Minimally-Invasive-Nerve-Focused-Treatments-Across-High-Need-Indications.html

- https://ir.autonomix.com/press-releases/

- https://www.biospace.com/press-releases/autonomix-medical-inc-granted-u-s-patent-covering-sensing-data-collection-and-processing-with-companys-proprietary-catheter-based-technology/

- https://www.marketwatch.com/story/autonomix-medical-files-8k-unregistered-equity-sales-amix-9fcd06e4

- https://last10k.com/sec-filings/amix

- https://www.sec.gov/Archives/edgar/data/1617867/000143774925003669/amix20241231_10q.htm

- https://stocktitan.net/sec-filings/AMIX/

- https://www.nasdaq.com/market-activity/stocks/amix/sec-filings

- https://www.nasdaq.com/articles/autonomix-medical-inc-strengthens-patent-portfolio-issuance-us-patent-no-12295646-smart

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media Group LLC and third party, Virtus Media LLC has been hired by third party for a period beginning on 2024-06-18 and ending 2024-06-25 to publicly disseminate information about NASDAQ: AMIX via digital communications. We have been paid thirteen thousand USD. Pursuant to an agreement between Virtus Media LLC and JRZ, Virtus Media LLC has been hired by JRZ for a period beginning on 8/25/2025 and ending 9/5/2025 to publicly disseminate information about NASDAQ: AMIX via digital communications. We have been paid $75,000 USD. Social Media Compensation: Virtus Media Group LLC has paid Influencer #1 $1,200 to publicly disseminate information about NASDAQ: AMIX via digital communications. Virtus Media Group LLC has paid Influencer #2 $750 to publicly disseminate information about NASDAQ: AMIX via digital communications. Virtus Media Group LLC has paid Influencer #3 $15,000 to publicly disseminate information about NASDAQ: AMIX via digital communications. Virtus Media Group LLC has paid The Investing Authority $9,500 to publicly disseminate information about NASDAQ: AMIX via digital communications.