7 Reasons Why Cadiz Inc. (NASDAQ: CDZI) Could Be Poised For Significant Upside Potential in 2024

IDENTIFYING THE OPPORTUNITY

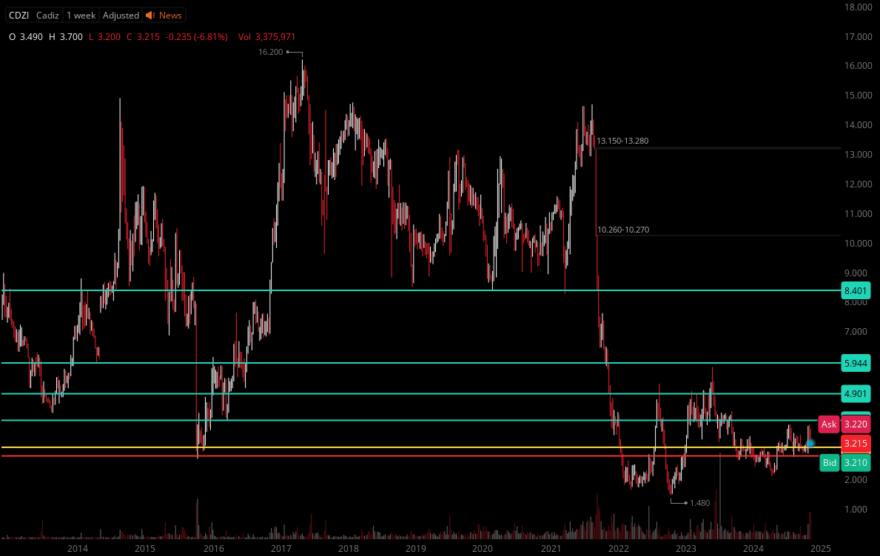

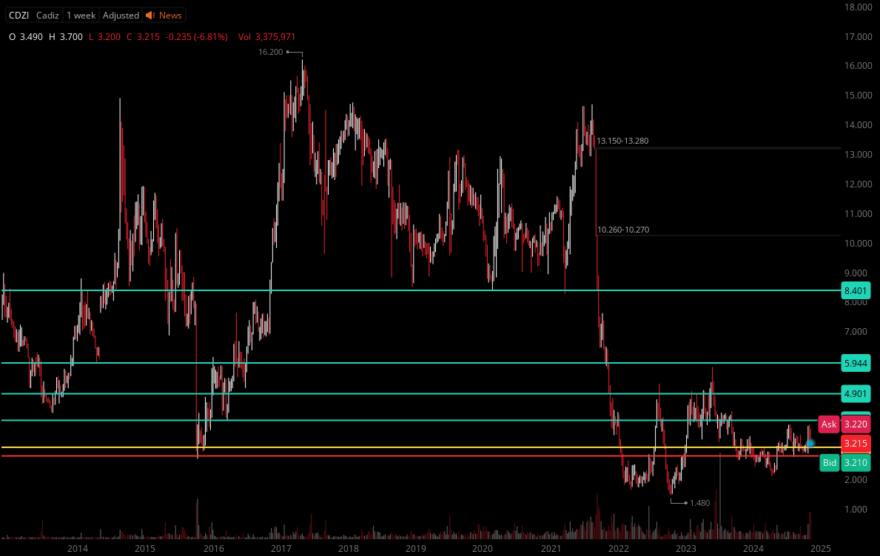

PRICE MOVED UP MORE THAN 800% FROM THIS ZONE

From $0.25 to $27.00 between 2003 and 2007, this chart has a history of multi-digit runners. From 2015 to 2017, it moved up another 500%.

TARGETS

Key Level #1: $4.00 (+23.84%)

Key Level #2: $4.90 (+51.70%)

Key Level #3: $5.94 (+83.90%)

Key Level #4: $8.40 (+160.06%)

Potential Support: $2.79

Cadiz, Inc.

(NASDAQ: CDZI)

A Water Giant in the Making: Why Cadiz Inc. Could Be the Next Big Thing in Utilities

What They Do

Cadiz is a water solutions innovator delivering access to safe, reliable, and affordable water for people. They are partners in water equity, promoting human access to clean water through partnerships that leverage a unique combination of supply, storage, pipeline and treatment solutions, cutting-edge innovation, and industry-leading standards of environmental stewardship.

Cadiz Inc. Stock Surge: A Closer Look at the Recent RallY

Over the past three months, Cadiz Inc. (NASDAQ: CDZI) has experienced a remarkable surge in its stock price, gaining significant attention from investors. From April to June, CDZI stock soared by an impressive 52%, reflecting growing investor confidence and heightened interest in the company’s strategic initiatives and robust water asset portfolio.

April to June: A Period of Significant Growth

The stock’s impressive performance over the last quarter can be attributed to several key factors. Firstly, there has been an increased awareness of Cadiz Inc.’s vast water reserves and its critical role in addressing water scarcity in the Southwest. As climate change continues to impact traditional water sources, Cadiz’s aquifer system, which holds more than twice the capacity of Lake Mead, has emerged as a vital resource for the region.

Additionally, under the leadership of CEO Susan Kennedy, the company has successfully navigated regulatory hurdles and secured strategic infrastructure, further positioning itself for substantial growth. Kennedy’s background as Chief of Staff for former California Governors Gray Davis and Arnold Schwarzenegger has equipped her with the expertise to drive Cadiz’s mission forward, garnering investor trust.

Cadiz, Inc.

(NASDAQ: CDZI)

Financial Potential and Market Valuation

With a water asset valued at $5 billion and significant cash flow potential, Cadiz Inc. is dramatically undervalued in the current market. The company’s substantial reserves and infrastructure capabilities suggest that it should be trading much higher than its current valuation.

Investor Sentiment and Market Potential

Investor sentiment towards Cadiz Inc. has shifted positively as the market begins to recognize the company’s potential. The recent media coverage on CNBC and USA Today can play a crucial role in elevating the company’s profile. This increased visibility can likely contribute to the stock’s upward momentum, as more investors become aware of Cadiz’s strategic advantages and long-term growth prospects.

Future Outlook: Another Potential Surge?

Given the recent performance and the underlying value of Cadiz’s water assets, we believe the stock could see another increase in the coming weeks. The company’s ability to provide millions of acre-feet of water, coupled with its extensive infrastructure, positions it well to meet the growing demand for sustainable water solutions in the Southwest.

Regulatory Success and Public Partnerships

Cadiz Inc. has successfully navigated through extensive regulatory processes and litigation, securing a strong position for future growth. The company is now well-positioned for significant public partnerships and infrastructure projects, which are essential for bolstering water security in the face of climate variability.

Media Spotlight

The transformative journey of Cadiz Inc. has not gone unnoticed. The company has been featured on prominent platforms such as CNBC and USA Today, highlighting its innovative approach to water management and its pivotal role in addressing water scarcity.

Susan Kennedy's Leadership and Vision

At the helm of Cadiz Inc. is CEO Susan Kennedy, a formidable leader with a distinguished career in California’s public sector. Kennedy served as Chief of Staff for two California governors, Gray Davis and Arnold Schwarzenegger, where she played a crucial role in the state’s utilities sector. Her deep understanding of regulatory environments and strategic infrastructure management is now driving Cadiz's mission to address water scarcity in the Southwest.

Combatting Climate Change and Heat Waves

One of Cadiz Inc.'s primary objectives is to combat the effects of climate change and increasing heat waves by supplying water to the arid Southwest. The company's vast aquifer system in the eastern Mojave Desert holds between 30 to 50 million acre-feet of water—more than twice the size of Lake Mead. This massive water asset positions Cadiz as a critical player in regional water security.

Unmatched Water Infrastructure

Cadiz Inc. boasts the largest water pipeline in the Southwest, a strategic asset that enables efficient transportation of water to where it's needed most. This infrastructure, combined with strategic acquisitions of pipelines and rights-of-way, allows Cadiz to manage its water resources effectively, ensuring reliable delivery to drought-stricken areas.

Cadiz, Inc. Leadership

(NASDAQ: CDZI)

Susan Kennedy - Chairman and Chief Executive Officer

- CEO since Jan 2024

- Cadiz Board since 2021

- CEO of AMS

- Chief of Staff to CA Gov. Schwarzenegger

- CA Public Utilities Commission

- Cabinet Secretary Gov. Gray Davis

- Comms. Director Sen. Dianne Feinstein

Stan Speer - Chief Financial Officer

- CFO 2018 - present, 1997 - 2003

- Managing Director with Alvarez & Marsal

- Partner with Coopers & Lybrand

- Board of Directors Sunworks Inc.

Cathryn Rivera - chief operating officer

- COO since Sept 2024

- Appointments Secretary CA Gov. Gavin Newsom

- Commissioner CA Agricultural Labor Relations Board

- Chief Deputy Cabinet Secretary to CA Gov. Gray Davis

Sources

- Source 1: https://cadizinc.com/investors/#presentation

- Source 2: https://www.microcapsdaily.com/nasdaq-cdzi

- Source 3: https://cadizinc.com/solutions/

- Source 4: https://cadizinc.com/

- Source 5: https://finance.yahoo.com/quote/CDZI?p=CDZI&.tsrc=fin-srch

- Source 6: https://finance.yahoo.com/news/cadiz-announces-northern-pipeline-now-123000760.html

- Source 7: https://cadizinc.com/environment/

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media LLC and West Coast Media LLC, Virtus Media LLC has been hired by West Coast Media LLC for a period beginning on 2024-11-14 and ending 2024-11-19 to publicly disseminate information about OTC: CDZI via digital communications. We have been paid five thousand dollars USD.