About Themes ETFs

Themes ETFs is a U.S.-based investment firm specializing in innovative, rules-based exchange-traded funds that focus on targeted sectors, geographies, and thematic opportunities. Their product suite includes leveraged, inverse, and thematic strategies designed to provide investors with transparent, cost-efficient access to specialized market segments across global equity markets. Themes ETFs aims to combine regulatory rigor with flexible investment solutions to meet evolving investor needs.

5 Reasons Why Leverage Shares 2X Long UNH Daily ETF (UNHG) Could Be Poised For Significant Upside Potential

Leverage Shares 2x Long UNH Daily ETF (NASDAQ: UNHG)

A Tactical Instrument for Focused Exposure

The Leverage Shares 2X Long UNH Daily ETF was created to meet the demand for targeted, amplified exposure to blue-chip equities. In this case, the ETF focuses exclusively on UnitedHealth Group, a company consistently ranked as one of the largest by market cap in the U.S. healthcare sector.

UNH has long been viewed as a bellwether for healthcare trends, with a significant footprint in insurance, technology-enabled health services, and pharmacy benefit management. By providing 2x daily performance on this stock, UNHG allows investors to participate in short-term market movements while aligning with a healthcare sector leader.

It’s important to note that the 2x exposure resets daily, meaning long-term returns may diverge significantly from twice the performance of UNH over time due to compounding.

How the 2X Exposure Works

UNHG employs a derivatives-based strategy, primarily using total return swaps, to obtain its exposure. These instruments mirror the daily performance of UnitedHealth Group without the fund holding the stock directly.

The ETF is rebalanced daily, meaning it resets its leverage at the close of each trading day. This structure is particularly suited for short-term trading and not for buy-and-hold investing, as compounding effects can produce outcomes that differ from expectations over time. The fund is UCITS-compliant and trades on the Cboe BZX Exchange under the ticker symbol UNHG.

Its holdings primarily consist of cash or near-cash instruments used to collateralize its derivative positions. This design enables operational efficiency while minimizing exposure to unintended positions.

Leverage Shares 2x Long UNH Daily ETF (NASDAQ: UNHG)

Designed for High Responsiveness

As of July 2025, UNHG has maintained strong daily tracking performance, closely matching 2x the daily return of UNH. Performance metrics should always be viewed in the context of short-term movements — this fund is engineered for precision over hours or days, not months.

The ETF is fully transparent, with holdings and swap exposures updated regularly on the issuer's website. It also benefits from solid daily trading volume and tight bid-ask spreads, enabling active investors to execute with relative ease.

Leverage Shares publishes a daily NAV and provides tools to track correlation, volatility, and price decay, which are critical metrics for leveraged instruments.

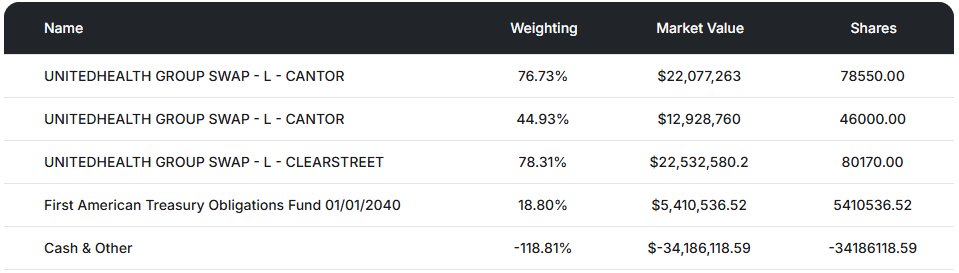

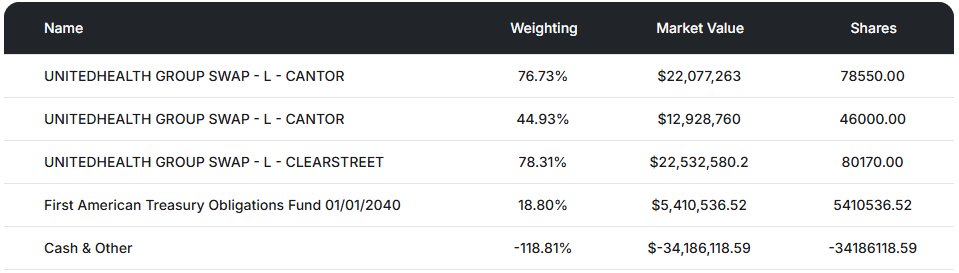

Holdings

The Leverage Shares 2X Long UNH Daily ETF (UNHG) primarily holds derivative instruments, specifically total return swaps, to achieve its investment objective of providing 2x daily leveraged exposure to the performance of UnitedHealth Group Inc. (UNH).As of the latest data, the fund's holdings include:

These instruments are used to replicate the daily performance of UNH stock, adjusted for the fund's 2x leverage factor.The use of swaps allows the ETF to gain exposure to UNH without holding the underlying stock directly.

Introducing the Management Team of Themes ETFs

(NASDAQ: UNHG)

José Gonzalez - CEO

Paul Bartkowiak joined Themes Management Company LLC in April 2024 serving as AVP of Portfolio Management. In this role, Paul is responsible for the daily management of the firm’s ETFs.

With 9 years of experience in the financial services sector, Paul has held prior roles at NISA Investment Advisors, LLC and Reinsurance Group of America. Paul’s most recent tenure was at ProShares Advisors LLC, where served as Senior Portfolio Analyst, most recently managing their Commodity and Cryptocurrency ETFs.

Paul earned a Bachelor’s degree in Finance from the University of Dayton and MBA from St. Louis University, Richard A. Chaifetz School of Business.

Tracy Gilvarry Grant - General Counsel

Tracy Grant is the General Counsel and co-founder of ThemesETFs.

Tracy is a seasoned, goal-focused legal professional with demonstrated track record of advising and representing high-profile international corporations, international investment banking institutions, mutual funds and insurance companies.

Her experience is in providing incomparable advice on mutual funds, secured transactions, financing transactions, securities and regulatory compliance and corporate and commercial law.

Calvin Tsang - Head of US Product Management & Development

Calvin Tsang has been with Themes Management Company LLC since its inception in January 2023, serving as the Head of Product Management & Development and as a Portfolio Manager. He is responsible for building out the ETF platform and infrastructure in the US.

Calvin possesses a rich depth of knowledge in managing ETF strategies, spanning across commodities, options, equity, and fixed income. Prior to joining Themes Management Company LLC, Calvin was a Portfolio Manager at Cboe Vest from January 2021 to December 2022, Multi-Asset Portfolio Manager at QS Investors from May 2019 to December 2020, and Senior Portfolio Analyst at ProShares from August 2014 to May 2019.

Calvin is a CFA charterholder and a certified FRM. He earned dual Bachelor’s degrees in Accounting and Economics from Binghamton University.

Sources

- Source 1: https://leverageshares.com/us/etfs/leverage-shares-2x-long-unh-daily‑etf/

- Source 2: https://leverageshares.com/us/documents/fact_sheets/Leverage‑Shares‑ETFs‑Factsheet‑2x%20UNH‑%2807.22.2025%29.pdf

- Source 3: https://www.nasdaq.com/market-activity/etf/unhg

- Source 4: https://finance.yahoo.com/quote/UNHG/

- Source 5: https://www.etf.com/UNHG

- Source 6: https://www.bloomberg.com/quote/UNHG%3AUS

- Source 7: https://trackinsight.com/en/fund/UNHG

- Source 8: https://seekingalpha.com/symbol/UNHG/holdings

- Source 9: https://fsmone.com.my/etfs/tools/etfs-factsheet/Leverage-Shares-2X-Long-Unh-Daily-ETF?exchange=NASDAQ&stock=UNHG

- Source 10: https://www.moomoo.com/etfs/UNHG-US

- Source 11: https://www.wsj.com/finance/investing/how-booming-leveraged-funds-can-incinerate-your-money-68241a9c

- Source 12: https://finviz.com/quote.ashx?t=UNHG&ty=oc

- Source 13: https://www.investopedia.com/4-aggressive-etf-strategies-8754978

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media LLC and WOLF Financial LLC, Virtus Media LLC has been hired for a period beginning on 2025-7-27 and ending 2025-10-27 to publicly disseminate information about NASDAQ: UNHC via digital communications. We have been paid one thousand dollars USD.