Watch Out Elon Musk…

Little-Known Brain Stimulation Company Reports 1,868% Surge in Product Revenue Following FDA Submission...

And with one insider's recent purchase of over 50,000 shares of NeuroOne Medical Technologies Corporation (NASDAQ: NMTC), now may be the perfect time to pay close attention.

NeuroOne Medical Technologies Corporation (NASDAQ: NMTC)

7 Reasons Why Neuroone Medical Technologies Corp (NMTC) Could Be Poised For Significant Upside Potential in 2023.

Watch Out Elon Musk: NeuroOne Medical Technologies Corporation (NASDAQ: NMTC) Makes Bold Move with FDA Application Submission for First Known sEEG-Guided RF System

Neuralink, the neurotech startup co-founded by Elon Musk, has made a significant breakthrough in its mission to develop brain implants with the announcement of FDA approval for its first in-human clinical study. This approval marks an important milestone for the company as it aims to help patients suffering from severe paralysis regain their ability to communicate by controlling external technologies using neural signals.

The brain implant being developed by Neuralink, known as the Link, has the potential to revolutionize the lives of individuals with conditions like ALS. By harnessing neural signals, patients could regain the ability to communicate with their loved ones through the control of cursors and typing using their minds.

In a tweet, Neuralink expressed gratitude for the collaborative effort between their team and the FDA, highlighting the importance of this achievement as an initial step toward helping many people. However, the specific details of the approved trial have not been disclosed, and patient recruitment is yet to begin.

Neuralink operates within the emerging field of brain-computer interfaces (BCIs), which involve decoding brain signals and translating them into commands for external devices. With Elon Musk’s involvement and the prominence of his other ventures, such as Tesla, SpaceX, and Twitter, Neuralink has gained significant attention within the BCI industry.

While BCI technology has been under study for decades, receiving FDA approval for a commercial medical device is a rigorous process that involves extensive testing and data collection. So far, no BCI company has obtained the FDA’s final seal of approval. However, Neuralink’s FDA approval for an in-human study brings them closer to their goal of bringing their technology to the market.

Neuralink’s BCI system requires patients to undergo invasive brain surgery, with the Link implant serving as the core component. The implant, a small circular device, processes and translates neural signals, which are detected by thin, flexible threads inserted directly into the brain tissue.

Patients equipped with Neuralink devices will be able to control external devices such as mice and keyboards through a Bluetooth connection using the Neuralink app.

The FDA’s approval of Neuralink’s in-human study comes after the company faced several challenges. In February, the U.S. Department of Transportation initiated an investigation into Neuralink’s alleged unsafe packaging and transportation of contaminated hardware. Additionally, reports surfaced in March that the FDA had initially rejected Neuralink’s application for human trials, highlighting numerous concerns that needed to be addressed.

Neuralink has also faced criticism from activist groups regarding its treatment of animals during experiments. The Physicians Committee for Responsible Medicine (PCRM), an organization advocating against animal testing, has urged Musk to disclose details about the experiments involving monkeys, which allegedly resulted in severe health issues and death.

Beyond assisting patients with paralysis, experts believe that BCIs hold potential in treating other conditions such as blindness and mental illness. Musk himself has expressed a broader vision for Neuralink to explore these future applications, including potential uses for healthy individuals.

As Neuralink continues to make strides in the field of brain implants and BCIs, it is certainly a company worth keeping an eye on. With its innovative technology and the vision of Elon Musk, Neuralink has the potential to transform the way we interface with and understand the human brain.

NeuroOne Medical Technologies Corporation (NASDAQ: NMTC) is another company that warrants attention in the field of medical technology. While Neuralink focuses on brain implants and BCIs, NeuroOne is dedicated to improving surgical care options and outcomes for patients with neurological disorders.

NeuroOne Medical Technologies Corporation (NASDAQ: NMTC) has recently made significant progress with its OneRF™ Ablation System, a groundbreaking technology that has the potential to transform neurosurgery. The system is the first known stereoelectroencephalography (sEEG)-guided radio frequency (RF) system capable of recording and ablating nervous tissue, offering the added benefit of temperature control. By utilizing already implanted sEEG electrodes to record brain activity, the system can precisely ablate nervous tissue when connected to a proprietary RF generator.

The submission of a 510(k) application to the U.S. Food and Drug Administration (FDA) for the OneRF™ Ablation System represents a major milestone for NeuroOne Medical Technologies Corporation (NASDAQ: NMTC). If the application is cleared by the FDA, the company will be one step closer to bringing this innovative RF ablation system to the market. The OneRF™ Ablation System combines diagnostic and therapeutic capabilities, providing clinicians with greater control over temperature management during the ablation process. This not only offers a safer clinical option for patients but also has the potential to reduce the number of invasive procedures and hospital stays, resulting in lower costs.

NeuroOne Medical Technologies Corporation (NASDAQ: NMTC) estimates that the current brain ablation market is valued at least $100 million worldwide, with significant growth potential due to the large addressable patient populations with unmet clinical needs. With the groundbreaking nature of the OneRF™ Ablation System and its potential to revolutionize neurosurgical procedures, NeuroOne is a company to watch closely.

Dave Rosa, the CEO of NeuroOne Medical Technologies Corporation (NASDAQ: NMTC), expressed his excitement and pride in the achievement of submitting the 510(k) application. He emphasized the significance of this milestone as it represents the first known FDA submission of an sEEG electrode intended for both recording brain activity and ablating nervous tissue. Rosa also highlighted the potential applications of the system beyond brain tissue ablation, indicating a broader opportunity for NeuroOne than initially anticipated.

As NeuroOne Medical Technologies Corporation (NASDAQ: NMTC) awaits initial feedback from the FDA regarding the application, industry observers and stakeholders should keep a close eye on the company’s progress. With its commitment to improving surgical care options and its innovative OneRF™ Ablation System, NeuroOne Medical Technologies Corporation (NASDAQ: NMTC) has the potential to make a significant impact in the field of neurology and neurosurgery, benefiting patients and advancing medical technology.

NeuroOne Medical Technologies Corporation (NASDAQ: NMTC) Receives FDA Clearance

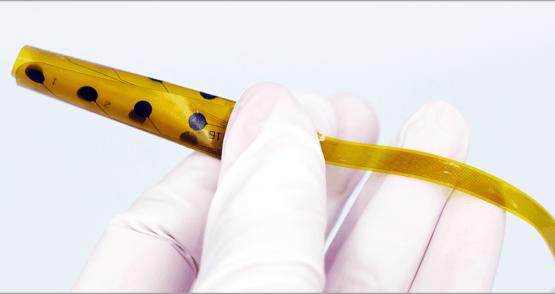

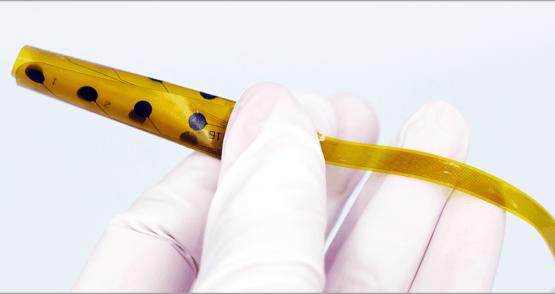

NeuroOne Medical Technologies Corporation (NASDAQ: NMTC) has recently received FDA clearance for its Evo® sEEG electrode, marking a major milestone for the company. The Evo® sEEG electrode is a thin-film, high-definition electrode that provides clear and accurate recordings of brain activity during neurosurgical procedures.

The Evo® sEEG electrode is a disruptive technology that has the potential to transform the field of neurology. The electrode is designed to be used in conjunction with the company’s OnePass™ technology, which allows for the placement of multiple electrodes in a single pass, reducing the time and complexity of the surgical procedure.

This technology has the potential to make neurosurgery more efficient and effective, improving patient outcomes and reducing healthcare costs. The clearance of the Evo® sEEG electrode is a significant achievement for NeuroOne, as it is the company’s first FDA-cleared product. The company is now in a position to begin commercializing the electrode.

IDENTIFYING THE OPPORTUNITY

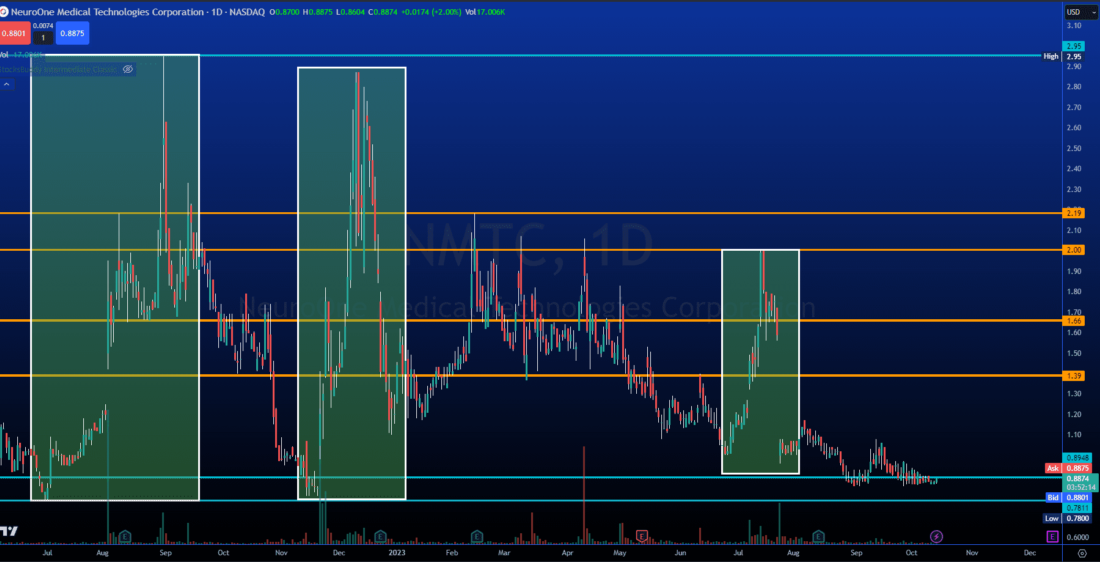

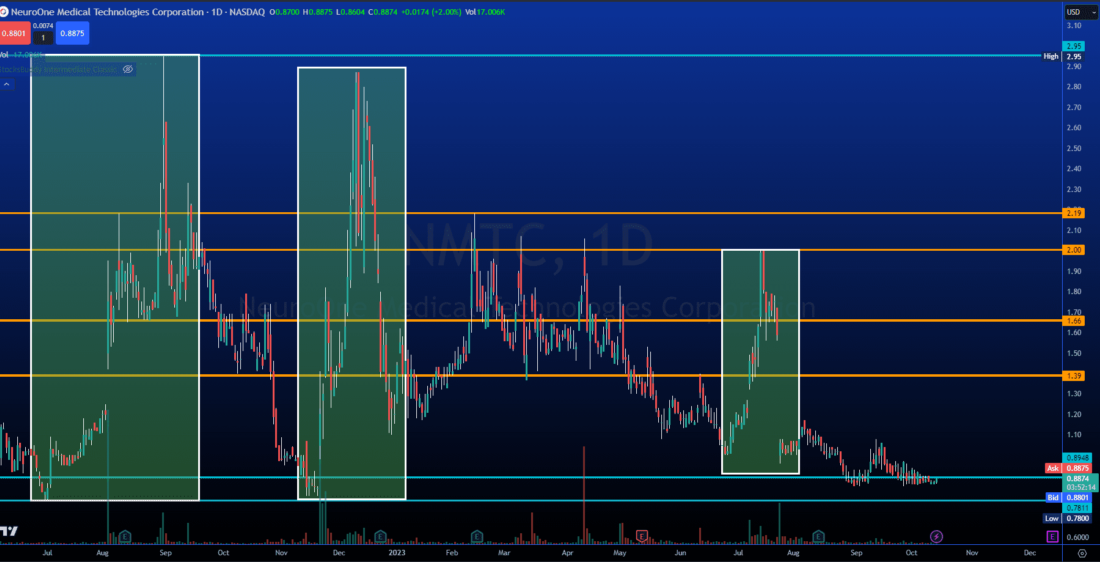

Strong Support And Plenty of Airspace! Ready For Round Four...

We have seen strong volume and ascending lows, indicating bullish momentum inbound, each time leading to a massive price surge.

TRADE CONFIRMATION

Watch for a volume over 200k and/or a potential bullish candle close above local highs.

Volume will precede the move, key indication of our push coming and an impulsive break to the upside.

We are watching for an influx of volume and letting the price breathe into valuation territory, any upcoming catalyst has potential to spring that process into action.

TARGETS

$1.39 (+20.87%)

$1.66 (+44.35%)

$2.00 (+73.91%)

$2.19 (+90.43%)

BONUS: $2.95 (+156.52%)

SUPPORT AT $0.78

NeuroOne Medical Technologies Corporation (NASDAQ: NMTC)’s Patented Technologies have the Potential to Disrupt the Medical Device Industry, Particularly in the Field of Neurology.

NeuroOne’s patented technologies have the potential to disrupt the medical device industry, particularly in the field of neurology. The company’s OneRF® Ablation System and Evo® Depth Electrode have the potential to revolutionize the way brain tumors and seizures are treated.

The OneRF® Ablation System is a unique technology that combines radiofrequency energy and a proprietary fluid delivery system to create a localized thermal ablation of brain tissue.

This targeted approach is intended to reduce the risk of collateral damage to surrounding healthy tissue, which can occur with traditional surgical methods. The OneRF® Ablation System has the potential to offer patients a minimally invasive treatment option that could reduce complications and improve outcomes.

The Evo® Depth Electrode is a flexible electrode that is used for intracranial EEG (iEEG) recordings in epilepsy patients. The Evo® Depth Electrode was designed with an innovative design that includes multiple flexible arms, each with four contact points, allowing for a more precise and accurate mapping of brain activity. This technology could help to identify seizure foci with greater accuracy, improving the chances of successful surgical outcomes and reducing the risk of complications.

NeuroOne’s innovative technologies could potentially revolutionize the way neurological conditions are treated, offering patients safer, less invasive treatment options with better outcomes. The company’s technology also has the potential to reduce healthcare costs by shortening hospital stays and reducing the need for repeat procedures.

NeuroOne’s disruptive technologies have the potential to significantly improve patient outcomes while simultaneously transforming the medical device industry.

NeuroOne Medical Technologies Corporation (NASDAQ: NMTC)’s Platform Technology has the Potential for Multiple Applications, Making it a Versatile Player in the Medical Device Industry.

The company’s technologies can be used in spinal cord and deep brain stimulation, as well as targeted stimulation for movement, psychiatric, and cognitive disorders.

The potential applications for NeuroOne’s technology are vast. In spinal cord stimulation, the technology could be used to treat chronic pain, which affects millions of people worldwide. Deep brain stimulation has been shown to be effective in treating Parkinson’s disease, essential tremors, and dystonia, with the potential for additional applications such as depression and obsessive-compulsive disorder.

Targeted stimulation for movement disorders could be a game-changer in the treatment of neurological disorders. This technology has the potential to enable precise and targeted stimulation of specific regions of the brain, reducing the side effects associated with current treatments.

The platform technology’s versatility also has implications for psychiatric and cognitive disorders. Neurostimulation has been shown to be effective in treating depression, anxiety, and substance abuse disorders. By leveraging its platform technology, NeuroOne can potentially develop therapies for these conditions that are more effective and with fewer side effects than current treatments.

NeuroOne’s platform technology has the potential to address unmet medical needs in a variety of neurological and psychiatric conditions, making it a promising player in the medical device industry.

NeuroOne’s platform technology has the potential to address unmet medical needs in a variety of neurological and psychiatric conditions, making it a promising player in the medical device industry.

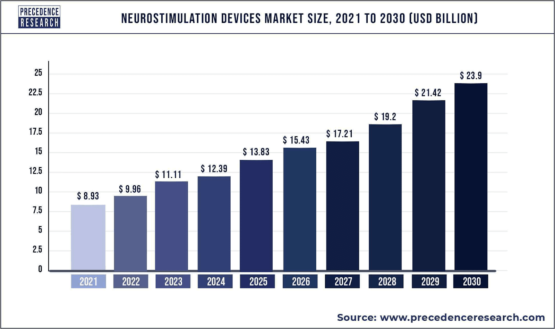

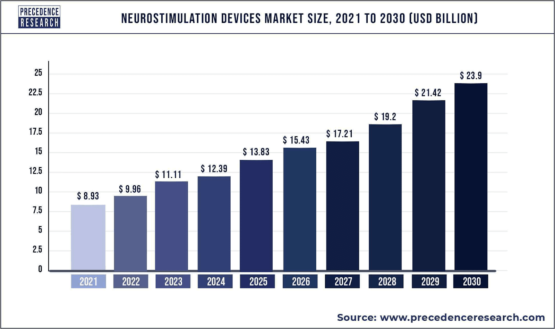

The market for neurostimulation devices is expected to reach $23.9 billion worldwide by 2030, with potential applications for Parkinson’s Disease, Epilepsy, Essential Tremors, and other neurological conditions. The growing demand for neurostimulation devices can be attributed to the rising incidence of neurological disorders, an aging population, and advancements in technology.

Parkinson’s Disease, which affects over 10 million people worldwide, is a progressive disorder that impairs movement and coordination. Neurostimulation devices, such as deep brain stimulation (DBS), have been shown to be effective in treating the symptoms of Parkinson’s Disease.

Epilepsy, which affects over 50 million people worldwide, is a neurological disorder characterized by recurrent seizures. Neurostimulation devices, such as vagus nerve stimulation (VNS), have been shown to reduce the frequency and severity of seizures in patients with epilepsy.

Essential Tremors, which affect over 7 million people in the US alone, are involuntary movements that can affect the hands, head, and voice. Neurostimulation devices, such as deep brain stimulation (DBS), have been shown to be effective in reducing the symptoms of Essential Tremors.

NeuroOne Medical Technologies Corporation (NASDAQ: NMTC) is also advancing a pipeline of therapeutic electrode technologies for brain tissue ablation and chronic stimulation use for DBS (deep brain stimulation) and spinal cord stimulation for chronic back pain. These therapeutic electrode technologies represent addressable markets valued between $500 million and $6 billion.

With the potential for NeuroOne’s platform technology to be applied in multiple neurological conditions, the company is well-positioned to capture a significant share of the growing neurostimulation device market. Additionally, the company’s disruptive technologies, such as the OneRF® Ablation System and Evo® Depth Electrode, have the potential to revolutionize the way neurological conditions are treated, further increasing the company’s potential for growth in the neurostimulation device market.

NeuroOne Medical Technologies Corporation (NASDAQ: NMTC)'s disruptive technologies and platform potential make the company an attractive partner for larger medical device companies looking to expand their product offerings in the neurology space.

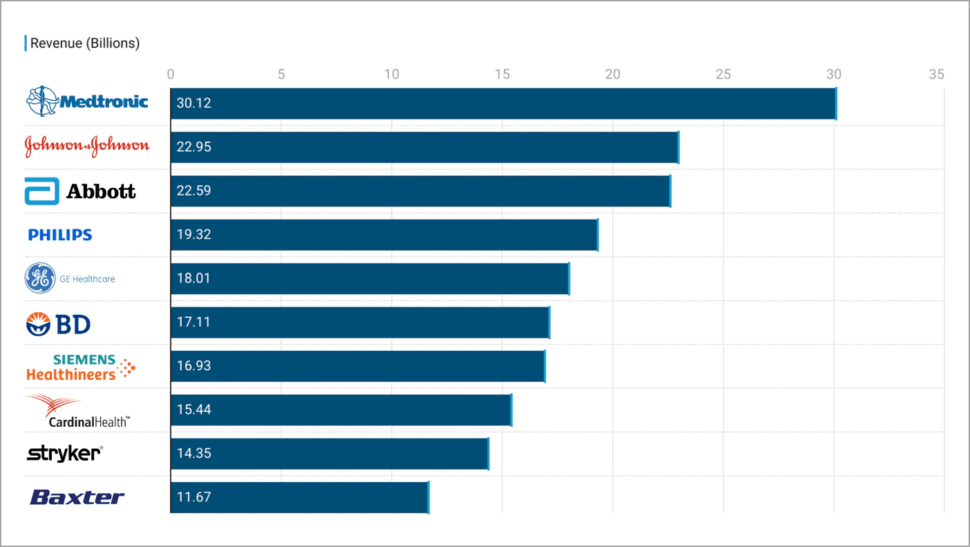

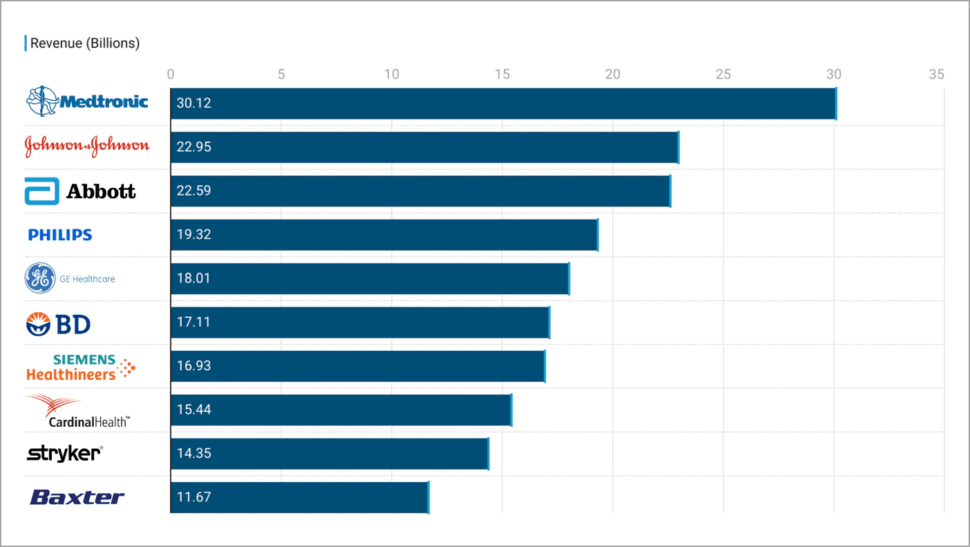

In 2022, the top 10 medical device companies in the world totaled over $188 billion in revenue.

NeuroOne Medical Technologies Corporation (NASDAQ: NMTC)’s disruptive technologies and platform potential make the company an attractive partner for larger medical device companies looking to expand their product offerings in the neurology space. The company’s strategy to access the ablation market through additional partnerships leveraging the resources of commercial med tech companies is a testament to its potential for successful collaborations.

Zimmer Biomet, one of the largest medical device companies in the world, has rights of first negotiation with NeuroOne. This partnership provides NeuroOne with the resources and expertise of a well-established company to help bring its products to market and expand its reach.

NeuroOne’s electrode technology has potential applications in a variety of neurological conditions, including epilepsy, Parkinson’s disease, and chronic pain, presenting an opportunity for partnerships with companies developing treatments in these areas. The company’s innovative thin-film electrode technology offers a competitive advantage over current electrode technology and may be of interest to companies looking to differentiate themselves in the market.

NeuroOne’s potential partnerships with larger medical device companies could provide the company with access to greater resources, expertise, and distribution channels, enabling it to accelerate its growth and expand its reach.

NeuroOne’s potential for successful partnerships in the neurology space represents a significant growth opportunity for the company.

NeuroOne Medical Technologies Corporation (NASDAQ: NMTC)'s advisory board is made up of leading neurosurgeons and anesthesiologists from prestigious institutions.

NeuroOne Medical Technologies Corporation (NASDAQ: NMTC)’s strong advisory board is made up of leading neurosurgeons and anesthesiologists from prestigious institutions such as Mayo Clinic, Duke University Medical Center, and Emory University. The expertise and experience of the advisory board members are critical to NeuroOne’s success in developing and commercializing innovative electrode technologies for neurological conditions.

The advisory board’s members provide NeuroOne with valuable insights and guidance in the areas of product development, clinical research, and regulatory affairs. Their knowledge and experience in the field of neurology help the company to identify unmet needs in the market and develop solutions that address those needs.

The advisory board members serve as key opinion leaders in the neurology space, helping to raise awareness of NeuroOne’s products and technologies and promoting the adoption of these products by their peers in the medical community.

NeuroOne’s strong advisory board represents a significant asset for the company, providing it with the expertise and guidance needed to successfully develop and commercialize innovative electrode technologies for the treatment of neurological conditions.

NeuroOne Medical Technologies Corporation (NASDAQ: NMTC)’s management team has decades of experience in the medical device industry, with a track record of success in product development, marketing, and business development.

Dave Rosa - President and Chief Executive Officer

Meet Dave Rosa, a medical device industry expert with over three decades of experience, spanning a wide range of technologies and products. In addition to his CEO roles with early-stage medical device companies, Dave has held senior positions with leading companies, including C.R. Bard, Boston Scientific, and St. Jude Medical. Dave has been named as an inventor on multiple medical device patents, served on seven corporate boards, and raised $200M in capital markets. He holds an MBA from Duquesne University and a BS in Commerce and Engineering from Drexel University.

Ron McClurg - Chief Financial Officer

Meet Ron McClurg, a financial leader with over 30 years of experience with private and public companies. Prior to joining NeuroOne, Ron was CFO of Incisive Surgical, a medical device manufacturer, and CFO and Treasurer of Wavecrest Corporation, a manufacturer of electronic test instruments. Ron has also held CFO positions with several publicly held companies, including Video Sentry Corporation, Insignia Systems, and Orthomet. He began his career in public accounting with Ernst & Young, where he earned his CPA certificate. Ron holds a Bachelor of Business Administration degree in Accounting from the University of Wisconsin Eau Claire.

Steve Mertens - Chief Technology Officer

Meet Steve Mertens, a product development expert with a passion for innovation. Prior to joining NeuroOne, Steve was Senior Vice President of R&D and Operations at Nuvaira, a lung denervation company developing minimally invasive products for obstructive lung diseases. Before that, he was a Senior Vice President of Research and Development for Boston Scientific, where he guided a wide range of technologies through product development for the cardiology, electrophysiology, and peripheral vascular markets. Steve holds a Bachelor of Science degree in Chemical Engineering from the University of Minnesota and a master's degree in Business Administration from the University of St. Thomas.

Mark Christianson - Co-Founder, Business Development Director, Medical Sales Liaison

Meet Mark Christianson, a seasoned executive with over 15 years of experience in sales, sales management, marketing, and project management with development-stage companies. Prior to NeuroOne, Mark held the positions of North American Sales Manager for Cortec Corporation, a manufacturer of specialty chemical products, and Regional Sales Manager for PMT Corporation, a leading manufacturer of products for neurosurgery, orthopedics, and plastic surgery. Mark holds an accounting degree from Augsburg College.

The management team’s expertise and experience in the medical device industry provide NeuroOne with the leadership and guidance needed to successfully develop and commercialize innovative electrode technologies for neurological conditions.

Overall, NeuroOne’s experienced management team is a key strength of the company and an important factor in its potential for long-term success.

Sources

- Source 1: https://finance.yahoo.com/news/neuroone-reports-first-quarter-fiscal-210000438.html

- Source 2: https://www.barchart.com/stocks/quotes/NMTC/price-history/historical

- Source 3: https://finviz.com/quote.ashx?t=NMTC&p=d

- Source 4: https://www.prnewswire.com/news-releases/neuroone-receives-fda-510k-clearance-to-market-its-evo-seeg-system-for-less-than-30-day-use-301658314.html

- Source 5: https://storage.googleapis.com/neuroone-1156-4b1gd/NeuroOne-InvestorPresentation-Feb-2023.pdf

- Source 6: https://stockcharts.com/h-sc/ui

- Source 7: https://www.raps.org/RAPS/media/news-images/news-images/FDA-Logo.jpg

- Source 8: https://www.sofi.com/learn/content/understanding-low-float-stocks/

- Source 9: https://www.marketwatch.com/investing/stock/nmtc?mod=search_symbol

- Source 10: https://parkinsonsnewstoday.com/news/neuroone-will-ask-fda-clear-rf-ablation-system-parkinsons-2023/

- Source 11: https://biotuesdays.com/wp-content/uploads/2020/07/NeuroOne-Rolled-Electrode.jpg

- Source 12: https://biotuesdays.com/2020/07/14/neuroone-developing-electrode-technology-to-treat-neurological-conditions/

- Source 13: https://biotuesdays.com/wp-content/uploads/2020/07/Banner-NeuroOne-1024×512.jpg

- Source 14: https://www.globenewswire.com/en/news-release/2022/07/11/2477549/0/en/Neurostimulation-Devices-Market-Size-is-projected-to-reach-USD-14-billion-by-2030-growing-at-a-CAGR-of-13-Straits-Research.html

- Source 15: https://www.abbott.com/corpnewsroom/products-and-innovation/how-dbs-is-advancing-parkinsons-treatment.html

- Source 16: https://www.who.int/news-room/fact-sheets/detail/epilepsy

- Source 17: https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4137360/

- Source 18: https://www.precedenceresearch.com/neurostimulation-devices-market

- Source 19: https://www.prnewswire.com/news-releases/neuroone-receives-fda-510k-clearance-to-market-its-evo-seeg-system-for-less-than-30-day-use-301658314.html

- Source 20: https://www.breakingintodevice.com/blogs/medical-sales/top-medical-device-2022

- Source 21: https://minitex.umn.edu/sites/default/files/styles/manual_crop_16_9/public/images/2021-11/Mayo-Clinic-Logo-2001.jpg?h=cd178615&itok=wiZRzcm2

- Source 22: https://finance.yahoo.com/news/neuroone-submits-510-k-application-123500923.html

- Source 23: https://www.cnbc.com/2023/05/25/elon-musks-neuralink-gets-fda-approval-for-in-human-study.html

- Source 24: https://cdn.punchng.com/wp-content/uploads/2023/05/26220648/Is-Elon-Musks-Neuralink.jpg

- Source 25: https://www.medicaldevice-network.com/wp-content/uploads/sites/23/2023/06/brain-activity.jpg

- Source 26: https://schrts.co/wKFpmdgN

- Source 27: https://www.marketwatch.com/investing/stock/nmtc?mod=search_symbol

- Source 28: https://app.quotemedia.com/data/downloadFiling?type=HTML&webmasterId=500&ref=317688046

- Source 29: https://finance.yahoo.com/news/neuroone-reports-third-quarter-fiscal-200000988.html

- Source 30: https://mma.prnewswire.com/media/1357756/NeuroOne_Logo.jpg?p=facebook

- Source 31: https://schrts.co/fxHVgghy

- Source 32: https://finance.yahoo.com/news/insider-buying-cfo-ronald-mcclurg-050122479.html

- Source 33: https://image.cnbcfm.com/api/v1/image/107060697-16524392856ED4-WEX-051322-InsiderBuying.jpg?v=1652439284

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media LLC and Lifewater Media, Virtus Media LLC has been hired by Lifewater Media LLC for a period beginning on 11/22/2022 and ending 12/22/2022 to publicly disseminate information about NASDAQ: NMTC via digital communications. We have been paid five thousand dollars USD. Pursuant to a further agreement between Virtus Media LLC and TD Media LLC, Virtus Media has been hired for a period beginning on 2/8/22 and ending 2/9/22. We have been paid seven thousand USD. Pursuant to a further agreement between Virtus Media LLC and Lifewater Media LLC, Virtus Media has been hired for a period beginning on 4/10/23 and ending 4/12/23. We have been paid fifteen thousand USD. Pursuant to a further agreement between Virtus Media LLC and Lifewater Media LLC, Virtus Media has been hired for a period beginning on 7/5/23 and ending 7/10/23. We have been paid fifteen thousand USD. Pursuant to an agreement between Virtus Media LLC and Lifewater media , Virtus Media has been hired for a period beginning on 2023-07-20 and ending after 2023-07-21 to publicly disseminate information about NASDAQ: NMTC. We have been paid Ten Thousand dollars USD. Pursuant to an agreement between Virtus Media LLC and Lifewater media , Virtus Media has been hired for a period beginning on 2023-10-16 and ending after 2023-10-17 to publicly disseminate information about NASDAQ: NMTC. We have been paid ten thousand five hundred dollars USD. Virtus media agrees to pay Social media influencer 1. $200,Social media influencer 2. $200, Social media influencer 3. $350, Social media influencer 4. $500, Social media influencer 5. $250.