LATEST NEWS

Surge Continues to Intercept Significant Lithium Results with Second 2023 Hole up to 5820 ppm Lithium

9 Reasons Why Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI) Could Shine Bright Ahead Of 2024!

OTC: NILIF | TSXV: NILI

IDENTIFYING THE OPPORTUNITY

THE TREND HAS SPOKEN

We have had a massive push to the upside, this is the second opportunity

TARGETS

Target #1: $0.834 (+32.47%)

Target #2: $1.06 (+68.36%)

Target #3: $1.15 (+82.66%)

Support: $0.5121

Surge Battery Metals Inc.

(OTC: NILIF | TSXV: NILI)

Spotlight On Lithium: New Bull Run Expected In Energy Storage Metal (58)

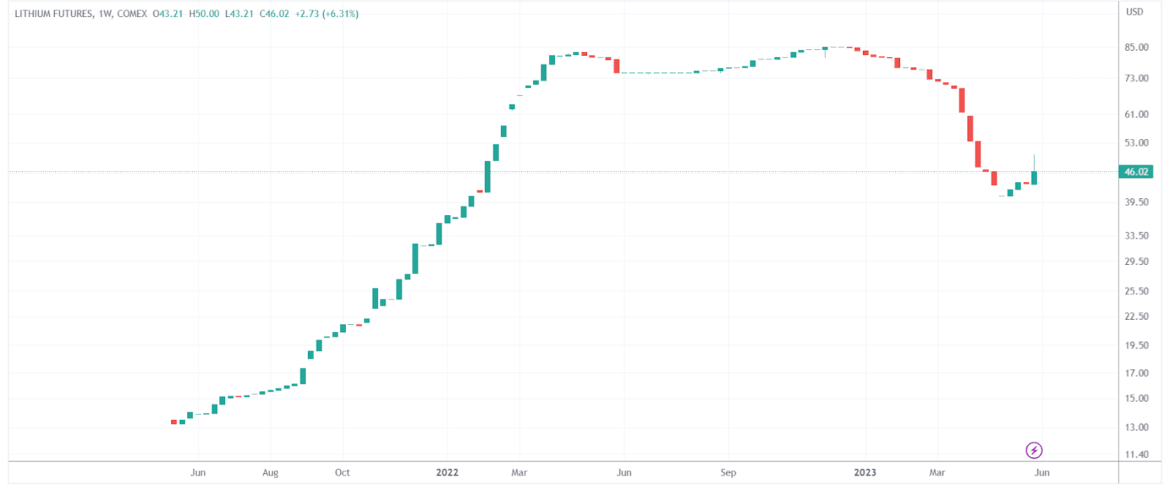

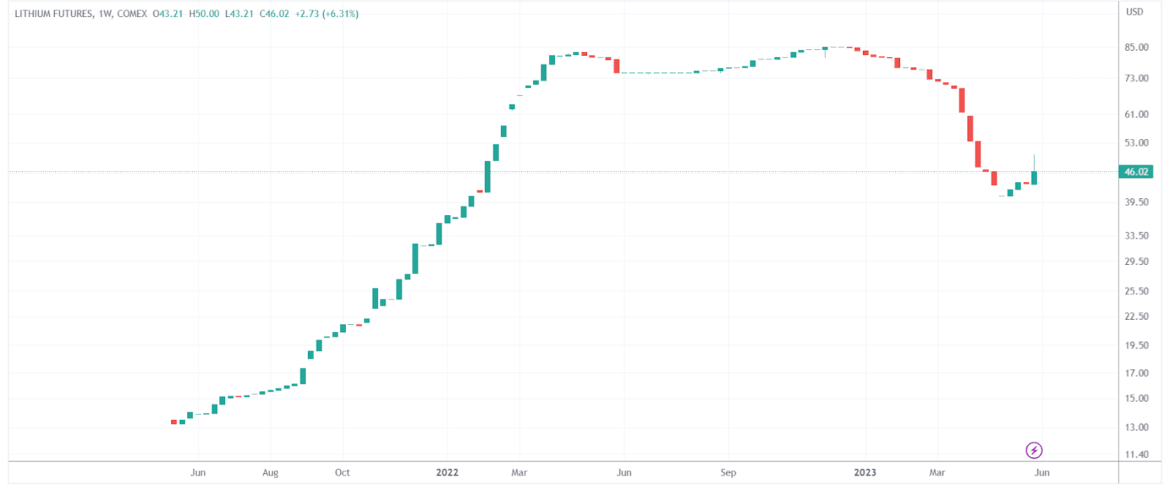

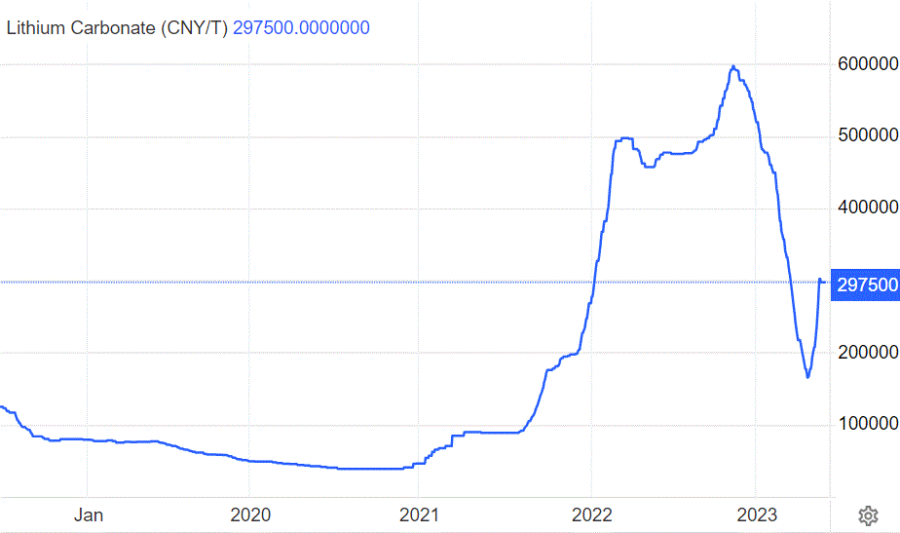

Exciting times lie ahead for those interested in the lithium market as the super cycle in lithium is set to resume. After experiencing a pullback in the past six months, the lithium market is showing signs of bottoming out and preparing for a new bull run. The next leg of lithium’s mega bull market is expected to begin slowly but gain momentum later this year, as projected in our lithium forecast for 2023. (58)

A glance at the weekly chart of spot lithium reveals the recent drop in 2023 followed by a bounce that commenced in May. Although this bounce is still in its early stages and requires further consolidation to establish a solid foundation, the key point is that spot lithium is unlikely to experience a significant decline from its current levels. This stability is crucial for sustaining the positive momentum in lithium mining operations. (58)

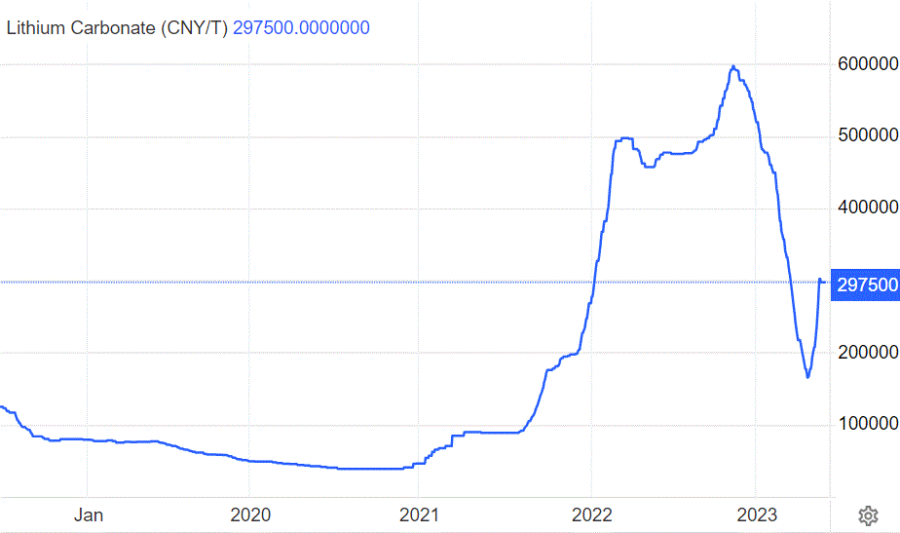

China’s spot lithium market has witnessed a meaningful bounce over the past four weeks, reinforcing the notion that the drop in lithium prices in China can be seen as a successful back-test. This indicates that the price retraced back to the point where the accelerated (exponential) upward move initiated in 2021. (58)

The current state of Lithium

The resurgence of lithium’s mega bull market instills renewed confidence among industry experts and those closely following the lithium market. Despite the recent pullback, the underlying fundamentals of lithium remain strong, driven by the increasing demand for electric vehicles (EVs) and renewable energy storage. Lithium-ion batteries continue to be the preferred choice for these applications due to their high energy density and long cycle life. (58)

The anticipated revival in the lithium market presents a significant growth opportunity for companies involved in lithium mining operations. As the demand for lithium continues to rise, mining companies are poised to benefit from the expected acceleration in lithium prices. This upswing will enable them to capitalize on their operations and investments in lithium extraction and production. (58)

While the lithium market’s recovery is still in its early stages, the signs are encouraging for a resumption of the mega bull market. As the spot lithium prices stabilize and China’s lithium market displays a bounce, industry experts remain optimistic about the future trajectory of lithium. With the ongoing transition towards clean energy and the increasing adoption of EVs, the demand for lithium is expected to experience sustained growth in the years to come. (58)

Those interested in the lithium market can look forward to an anticipated resurgence in the super cycle of lithium. The recent pullback has created an opportune moment for those observing the lithium market. With spot lithium showing signs of stabilization and China’s market bouncing back, the stage is set for a new bull run. As the demand for lithium continues to surge, mining companies, particularly those involved in lithium extraction and production, stand to benefit from the expected rise in lithium prices. Among these companies, Surge Battery Metals Inc. (OTC: NILIF | TSXV:NILI) deserves attention as one company to keep an eye on. (34)

With its strategic focus on exploration and development of battery metals, Surge Battery Metals Inc. (OTC: NILIF | TSXV:NILI) is well-positioned to for the resurgence of the lithium market and the potential to contribute to the future of sustainable energy storage. (34)

The future looks promising for the lithium market as it plays a crucial role in powering the sustainable energy revolution, and Surge Battery Metals Inc. (OTC: NILIF | TSXV:NILI) stands ready to be a key player in this exciting journey. (34)

EV Battery Metals Market Impact:

- Demand for nickel is forecast to increase rapidly this decade with the energy transition. (26)...

- Global Lithium Compounds Market Expected to Witness Booming Expansion of USD 61.22 billion by 2027 : Fior Markets... Globe News Wire (47)

- You Might Not Be Planning to Buy an EV, But Automakers Are Betting Billions You Will... Car and Driver.(48)

- EXCLUSIVE China in talks with automakers on EV subsidy extension -sources... Reuters (49)

Benzinga Interview Shines Light On Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI)’S Robust Exploration Program (57)

Key Takeaways From Surge Battery Metals' CEO Interview With Benzinga: Board Expansion, Financial Stability, And Promising Drilling Results (57)

Expansion of Board: Surge Battery Metals has added two seasoned industry professionals to its board, Graham Harris and Iain Scar. Harris brings 40 years of corporate finance experience and a background in lithium, having previously founded and sold Millennia Lithium to Lithium Americas for $490 million. Scar adds 29 years of experience at Rio Tinto and has been instrumental in three successful lithium projects. (57)

Impressive Drilling Results: The company's Nevada North lithium project has shown promising results, with the last drilled hole indicating an average lithium composition of 3,254 parts per million. This discovery suggests a significant lithium reserve at the site, positioning the project as extremely noteworthy in the lithium exploration space. (57)

Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI): Powering America's Lithium Revolution (63)

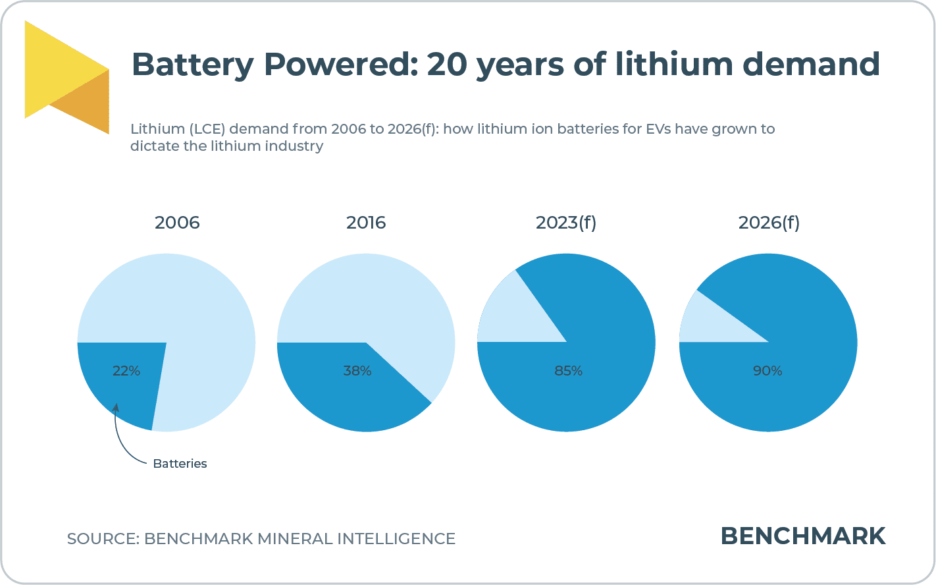

Lithium has emerged as a linchpin of the global transition towards renewable energy and electric mobility. As the world pivots away from fossil fuels and embraces green energy solutions, the demand for lithium-ion batteries has skyrocketed. Among the companies poised to capitalize on this booming market is Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI). (63)

In a recent episode of the nationally syndicated program “Price The Business,” Graham Harris, the visionary behind Surge Battery Metals, delved into the significance of lithium in the modern economy. Host Kevin Price and Harris discussed the importance of securing a reliable source of lithium to drive America’s push towards sustainable energy. (63)

The Rise of Lithium and Surge Battery Metals…(63)

Harris, the founder and former chairman of Millennial Lithium, a company that sold for half a billion dollars, has a proven track record in the lithium industry. Now, with Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI), he aims to repeat his success. The company’s flagship project, based in Nevada, positions it in a jurisdiction that is not only resource-rich but also shareholder-friendly.

The project stands out due to its impressive early-stage drilling results, suggesting the presence of a high-grade lithium resource. Harris emphasized that the project’s potential far outweighs its current market cap, projecting substantial growth as they continue to develop the resource.

Domestic Supply and Economic Security…(63)

One of the key concerns surrounding the global lithium market is the dominance of foreign players, particularly China, in securing lithium assets and supply chains. Harris emphasized the urgency of developing a domestic source of lithium to ensure America’s energy security and economic independence. Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI)’s project in Nevada contributes to this mission by providing a domestic source of lithium, minimizing reliance on geopolitically sensitive regions.

Harris highlighted that the project’s strategic location and favorable political environment in Nevada position it as a promising source for a critical component of lithium-ion batteries. As the United States strives to reduce its reliance on fossil fuels and transition towards electrification, a reliable and domestic supply of lithium becomes paramount.

A Bright Future for Surge Battery Metals…(63)

Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI)’s progress is moving swiftly, with geophysics completed and a second round of drilling underway. The company aims to publish its maiden resource by November, a significant milestone that will shed light on the project’s scale and potential.

Harris’s vision for Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI) is grounded in his experience and expertise in the lithium space. His optimism stems from the project’s early success and the robust lithium demand forecast. As the world embraces electric vehicles, renewable energy, and energy storage solutions, the role of lithium will only become more pronounced, driving the company’s growth and contributing to America’s energy revolution.

In the rapidly evolving landscape of clean energy and electrification, Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI) stands out as a beacon of innovation and progress, working to secure a sustainable and sovereign energy future for the United States. (63)

Surge Battery Metals Inc.

(OTC: NILIF | TSXV: NILI)

The Department Of Energy's Loan Is Part Of The White House's Push To Create A Domestic EV Supply Chain. (29)

The U.S. Department of Energy (DOE) has agreed to loan a Nevada startup $2 billion to support its production of critical battery materials, a staggering sum that illustrates the White House’s determination to domesticate the electric vehicle supply chain.(29)

Redwood Materials will use the money for the construction of the first factory in the nation to produce anode copper foil and cathode active materials, two essential components in EV batteries.

The company, founded by former Tesla executive JB Straubel, says it will manufacture enough of them to support the production of 1 million electric vehicles per year by 2025.

According to the Department of Energy, that would reduce the country’s gasoline consumption by more than 395 million gallons annually and cut carbon dioxide emissions by more than 3.5 million tons. (29)

It also would ease automakers’ reliance on battery components made overseas. (29) News like this could bode well for lithium exploration companies like Surge Battery Metals Inc. (OTC: NILIF) (TSXV:NILI) who recently announced its best lithium drill results to date at its Nevada North Lithium Project.(30)

Surge Battery Metals Inc. (OTC: NILIF | TSXV: NILI): Powering The Clean Energy Transition With Critical Minerals (54)

The global transition to cleaner energy hinges on the availability of critical minerals such as lithium and nickel. Essential for technologies like electric vehicle batteries and energy storage systems, these minerals are in high demand. As automakers and chemical companies seek to secure supplies, the sustainability and availability of these minerals have become a top priority for industry leaders and policymakers.

Surge Battery Metals Inc. (OTC: NILIF | TSXV: NILI) is a forward-thinking company exploring for clean energy metals that power the electric vehicles of tomorrow and the broader transition to cleaner energy. The company’s focus includes critical minerals such as lithium and nickel.

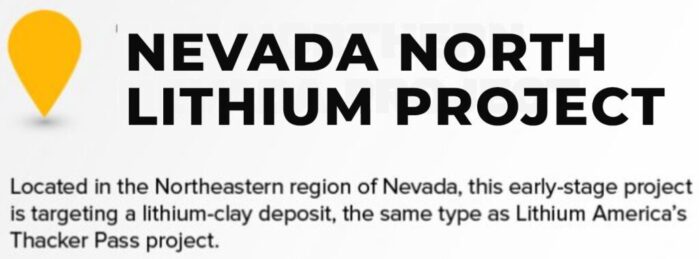

With its strategic targeting of lithium clay deposits in high-potential areas in Nevada, Surge Battery Metals Inc. (OTC: NILIF | TSXV: NILI) is exploring projects including the Nevada North lithium project, the San Emidio Desert lithium project, and the Teels Marsh West lithium project. The company’s flagship Nevada North lithium project is located in the mineral-rich Elko County.

As demand for electric vehicles and energy storage continues to rise, Surge Battery Metals Inc. (OTC: NILIF | TSXV: NILI) is one company to keep an eye on. (54)

Nevada North Lithium Project: Surge Battery Metals Inc. (OTC: NILIF | TSXV: NILI)'S Flagship Of Exploration Excellence (55)

In the video above, we’ll take a closer look at the Surge Battery Metals Inc. (OTC: NILIF | TSXV: NILI)’s flagship Nevada North lithium project, which has shown promising high-grade lithium clay results. Finalizing plans to acquire an initial 38 mineral claims in Northern Nevada in June 2021, Surge Battery Metals Inc. (OTC: NILIF | TSXV: NILI) has since expanded the project area following impressive exploration results. (55)

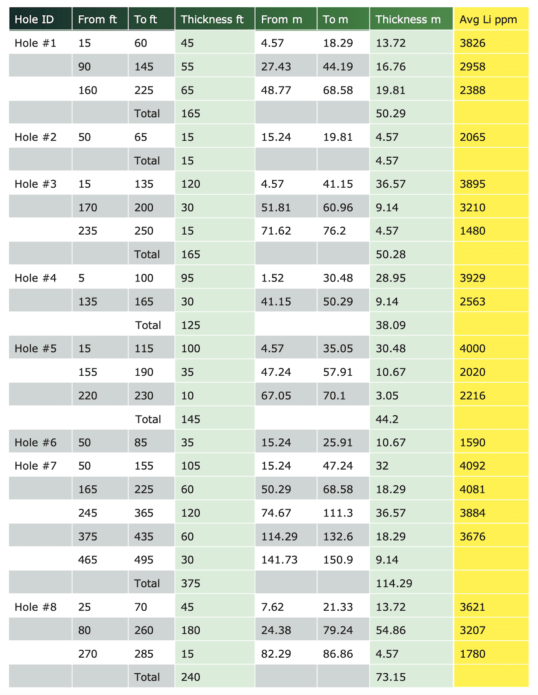

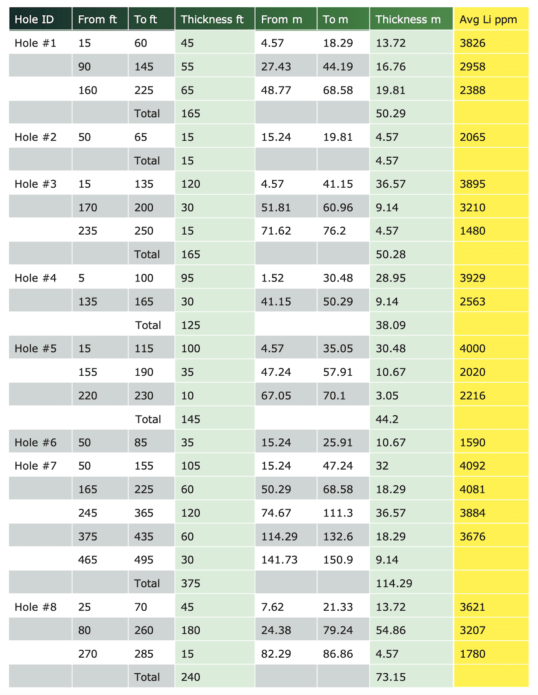

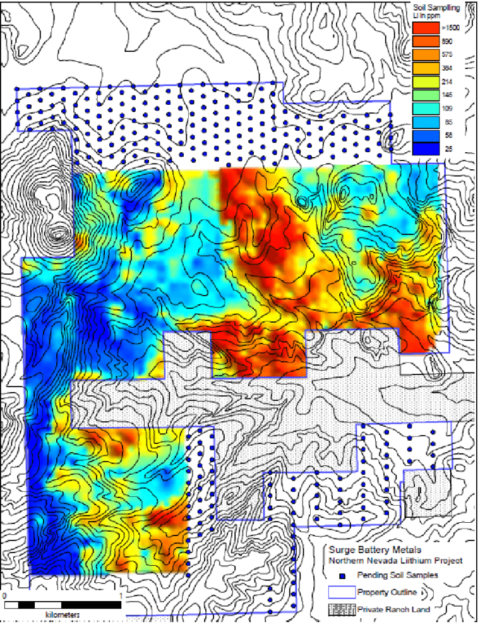

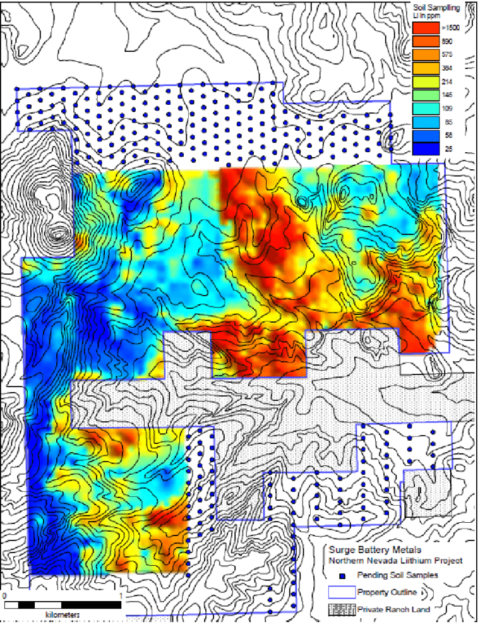

The project has seen some of the highest surface lithium values ever reported in Nevada. An eight-hole scout drilling program confirmed that significant lithium values continue in depth, with mineralization starting from the surface. The company’s geological interpretation has shown significant exploration potential, with an initial exploration target of 2.5 million tons of lithium carbonate equivalent. (55)

The Nevada North project has excellent potential for a large-scale, high-quality deposit. With lithium being a critical mineral for clean energy technologies, Surge Battery Metals Inc. (OTC: NILIF | TSXV:NILI) is one company to watch as it advances this promising project. (55)

Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI) Announces Best Lithium Results To Date At The Nevada North Lithium Project. (32)

On January 3, 2023, Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI) released the assay results from holes NN2207 and NN2208 at the 100% owned Nevada North Lithium Project in Elko County, Nevada. (32)

Hole NN2207 intersected the thickest intervals of lithium-rich claystone encountered to date, a total of 120.4 meters (395 feet) averaging 3943 ppm lithium in four zones.

NN2208 had the strongest individual sample interval (5950 ppm lithium between 45 to 50 feet, 13.72 to 15.24 meters) of the maiden 2022 program.

The intercepts shown in the table below used a 1,000 ppm lithium cut-off without internal dilution. (32)

Results from the above holes extend the strike length of the mineralization to 1,620 meters from NN2205 to NN2208. The width of the mineralization is not as well determined since the holes are mostly on a north-south alignment because of topography and access, but is at least 400 meters and soil anomalies indicate it is likely much more. (32)

Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI) is currently planning for the 2023 field season which will include a detailed drilling program that will commence when ground conditions allow. During the off-season, a mineralogical and spectral analysis will be applied to the 2022 drill cuttings along with in-depth reviews of surface and sub-surface geochemistry.

Mr. Greg Reimer, Company President & CEO states:

Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI)’s Nevada North Lithium Project contains a potentially significant lithium clay deposit, the result of a maiden drill campaign. (34)

It shares similarities to Lithium America’s Thacker Pass, one of America’s largest lithium clay deposits and Nevada’s Clayton Valley, home to America’s only current lithium production.(34)

SeekingAlpha's Analysis Of Surge Battery Metals Inc. (TSXV: NILI) (OTCQX: NILIF) Unveils A Hidden Lithium Gem In Nevada…(68)

In a recent report found on SeekingAlpha.com, the spotlight is turned towards Surge Battery Metals Inc. (TSXV: NILI) (OTCQX: NILIF) and its remarkable journey in the lithium mining industry. While Lithium Americas has been making headlines with its extensive lithium property in Nevada, Surge Battery Metals Inc. (TSXV: NILI) (OTCQX: NILIF)’s Nevada North Lithium Project (NNLP), located just east of Lithium Americas’ property, has quietly emerged as a formidable contender. (68)

The Lithium Awakening (68)

Highlighting the recent surge in interest in lithium mining, credit is given to Lithium Americas’ Thacker Pass development for gaining widespread recognition. Acknowledging the significance of Lithium Americas’ achievement, the report emphasizes its role in raising awareness about lithium as a crucial element in EV batteries and energy storage solutions.

However, the author asserts that their interest extends beyond Lithium Americas and points to Surge Battery Metals Inc. (TSXV: NILI) (OTCQX: NILIF) as an early-stage lithium company that deserves attention. Surge Battery Metals Inc. (TSXV: NILI) (OTCQX: NILIF) is presented as a potential game-changer in the lithium market, possessing characteristics that rival and may even surpass those of Thacker Pass, yet trading at a significantly lower valuation.

Surge Battery Metals Inc. (TSXV: NILI) (OTCQX: NILIF): An Overview (68)

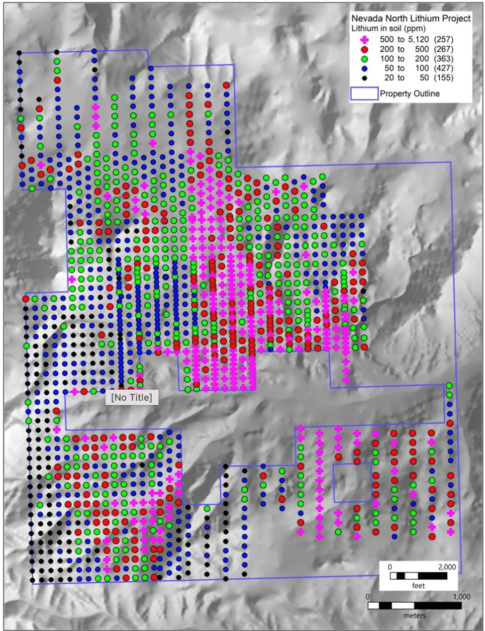

Offering a comprehensive glimpse into Surge Battery Metals Inc.’s (TSXV: NILI) (OTCQX: NILIF) Nevada North Lithium Project (NNLP), the spotlight is cast on its Northeast Nevada location in Elko County. With the NNLP’s remarkable growth, including 725 mineral claims spanning 22.45 square miles, the project’s expansion potential becomes evident, driven by recent drilling outcomes, soil sample analyses, and geophysical data.

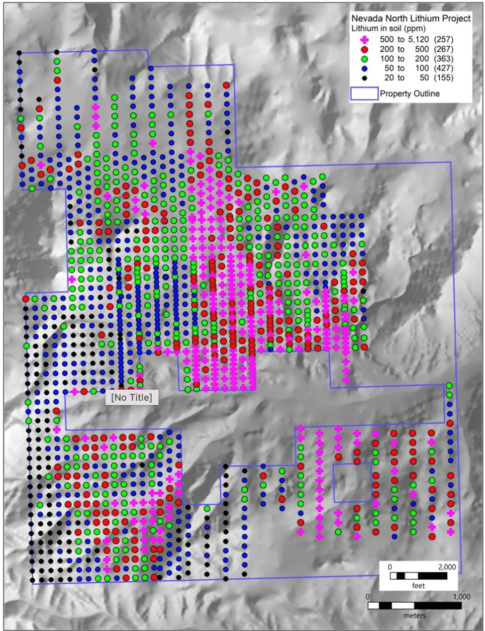

Drawing attention to geologist Alan Morris’ soil sample results, the uniqueness of the NNLP’s geological features is emphasized. These results reveal surface lithium values ranging from 500 to 5,120 parts per million (ppm), a rarity within the industry, according to the author.

Drilling Success (68)

The economic significance of surface lithium readings is underscored, and the report details the exceptional results of Surge Battery Metals Inc. (TSXV: NILI) (OTCQX: NILIF)’s 2022 drilling campaign. Notable outcomes from the drilling campaign include:

- Hole 5's penetration of over 100 feet of lithium mineralization with an average of 4,001 ppm from the surface.

- Hole 7's lithium mineralization extending over 330 feet, ranging from 3,324 to 4,105 ppm lithium.

Furthermore, it emphasizes the results from the ongoing 2023 drilling campaign, with assay results from two holes revealing impressive lithium content. NN23-01, for instance, boasts approximately 75 feet of near-surface mineralization with 4,939 ppm lithium, including zones reaching up to 8,070 ppm Li, setting a record for Nevada.

Nevada North Lithium Project (NNLP) to Thacker Pass

In this analysis, the comparison between Surge Battery Metals Inc. (TSXV: NILI) (OTCQX: NILIF)’s NNLP and Lithium Americas’ Thacker Pass is explored. While Thacker Pass is at a more advanced stage with permit approvals, defined metallurgy, and strong financial backing, the analysis sheds light on NNLP’s unique advantages. These advantages include higher average grades and the presence of Hectorite, which simplifies lithium extraction.

Financial Overview (68)

A financial overview of Surge Battery Metals Inc. (TSXV: NILI) (OTCQX: NILIF) is provided, with details of the company’s recent funding of approximately $7 million in June 2023, primarily from American Lithium. The report notes a healthy balance sheet with approximately $9.6 million in funds at the end of June.

Upcoming Milestones (68)

Several key milestones lie on the horizon for Surge Battery Metals Inc. (TSXV: NILI) (OTCQX: NILIF). Among these, the eagerly anticipated Maiden Resource Estimate (MRE) is expected to make its debut, possibly as early as November 2023, though more likely in Q1 2024 to incorporate the latest findings from the recent drilling campaign. Additionally, the company might unveil announcements regarding further land acquisitions, strategic investments, and site visits by global automakers. (68)

Poised for significant recognition and potential acquisition in the lithium mining industry, Surge Battery Metals Inc. (TSXV: NILI) (OTCQX: NILIF) appears to be on a trajectory toward becoming an attractive target for major players in the lithium sector, including mining giants and industry stakeholders. (68)

Highlighting the importance of acknowledging Surge Battery Metals Inc. (TSXV: NILI) (OTCQX: NILIF) as a prominent player in the lithium market’s evolution, this assessment underscores the invaluable insights offered by SeekingAlpha’s comprehensive report in disseminating this remarkable narrative to a broader audience. (68)Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI) Strikes Lithium Gold: Announces Highest-Grade Drill Results Ever (64)(65)

Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI) Strikes Lithium Gold: Announces Highest-Grade Drill Results Ever (64)(65)

Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI) is making headlines in the world of lithium exploration with back-to-back groundbreaking discoveries at the Nevada North Lithium Project. In a span of just two weeks, the company announced remarkable results from two drill holes, marking significant milestones in its pursuit of high-grade lithium deposits. (64)(65)

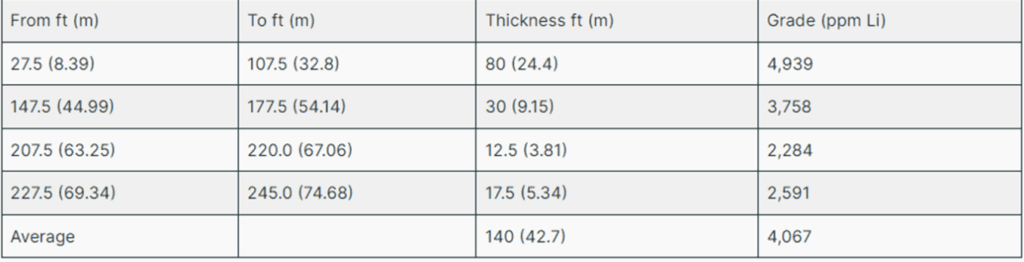

The First 2023 Hole: September 12, 2023 (64)

On September 12, 2023, Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI) sent shockwaves through the industry with the announcement of its first certified analytical results for the 2023 summer drilling program at the Nevada North Lithium Project (NNLP). These results revealed an astonishing array of high lithium values, setting new records for the exploration efforts at NNLP.

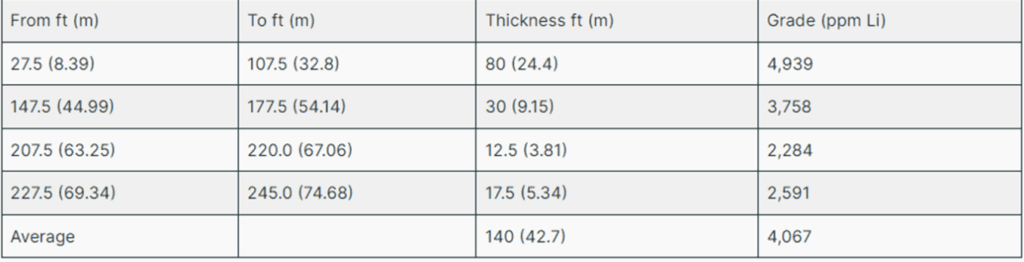

Composite lithium values for all four mineralized horizons, using a 1,000 ppm cutoff with no internal dilution, are shown in the following table.

Samples extracted from the sonic drill hole NN2301 (located at Drill site location R) returned positive results ranging from 1,000 ppm to a staggering 8,070 ppm lithium. The most impressive zone was found just 27.5 feet (8.39 meters) below the surface, extending 80 feet (24.4 meters), with lithium values ranging from 3,090 ppm to 8,070 ppm. This zone boasted an overall composite grade of 4,939 ppm lithium, surpassing previous records and marking a 28% improvement over the 2022 drill program. (64)

The composite thickness of intersected clay horizons was 140 feet (42.7 meters), resulting in an average grade of 4,067 ppm lithium. These findings were instrumental in confirming the presence of high-grade lithium clay formations, positioning Surge Battery Metals Inc. as a significant player in the lithium market.

The Second 2023 Hole: September 26, 2023(65)

Only two weeks later, on September 26, 2023, Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI) returned with another astonishing announcement, solidifying its status as a pioneer in lithium exploration. The second certified assay results from the 2023 summer drilling program unveiled lithium values ranging from 1,000 ppm to a remarkable 5,820 ppm.

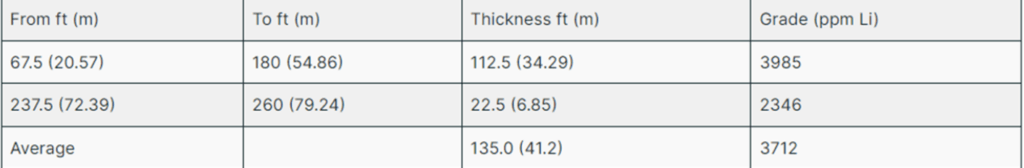

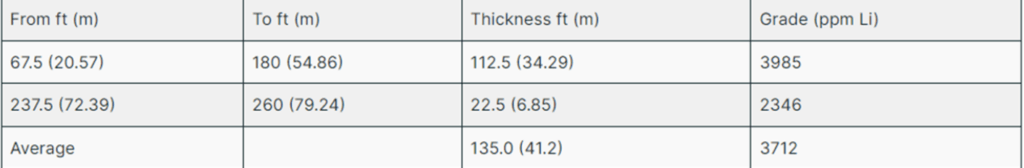

Composite lithium values for both mineralized horizons, using a 1,000 ppm cutoff with no internal dilution, are shown in the following table:

Sonic drill hole NN2302, situated at Drill site location M, was the source of these impressive findings. The highest-grade zone, starting at 67.5 feet (20.57 meters) below the surface and extending a remarkable 180 feet (54.86 meters), displayed an overall composite grade of 3,985 ppm lithium. NN2302 showcased a composite thickness of intersected clay horizons measuring 135 feet (41.2 meters), resulting in an average grade of 3,712 ppm lithium. (65)

Significantly, the composite grade of clay horizons in NN2302 exceeded the average composite grade of clay horizons from the previous year’s (2022) reverse circulation drillholes by an impressive 15%.

Implications for the Future(64)(65)

These back-to-back discoveries at the Nevada North Lithium Project have far-reaching implications for Surge Battery Metals Inc. and the lithium industry as a whole. The consistently high-grade lithium values found in these drill holes underscore the company’s commitment to innovation and its mission to contribute to a sustainable energy future.

Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI)’s strategic approach to drilling, coupled with rigorous sampling and analysis protocols, has yielded results that not only confirm the presence of valuable lithium deposits but also extend the strike length of the deposit from 1,620 meters to an impressive 3,000 meters. Additionally, regulatory approval for Drill Site “W” further extends the strike length to 3,500 meters, showcasing the company’s dedication to maximizing the potential of the Nevada North Lithium Project. (64)(65)

Greg Reimer, Chief Executive Officer, and Director of Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI), expressed his excitement for these findings, highlighting the significance of NN2302 as a step out to the northwest from the 2022 program. He also teased upcoming results from holes P and V, where similar clay units were encountered during 2023 drilling and logging. (64)(65)

As Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI) continues to unveil the results of its 2023 summer drilling program, the industry and investors alike eagerly anticipate further groundbreaking discoveries in the realm of lithium mining. These discoveries hold the promise of reshaping the energy landscape, accelerating the transition to cleaner and more sustainable power sources, and establishing Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI) as a key player in the lithium exploration arena.

Follow-up drilling will commence this spring to further expand the known lithium-bearing clay horizons.

So with that in mind let’s take a deeper look and find out exactly what Surge Battery Metals has to offer …

Surge Battery Metals Inc.

(OTC: NILIF | TSXV: NILI)

Meeting Insatiable Demand For EVs And Clean Power

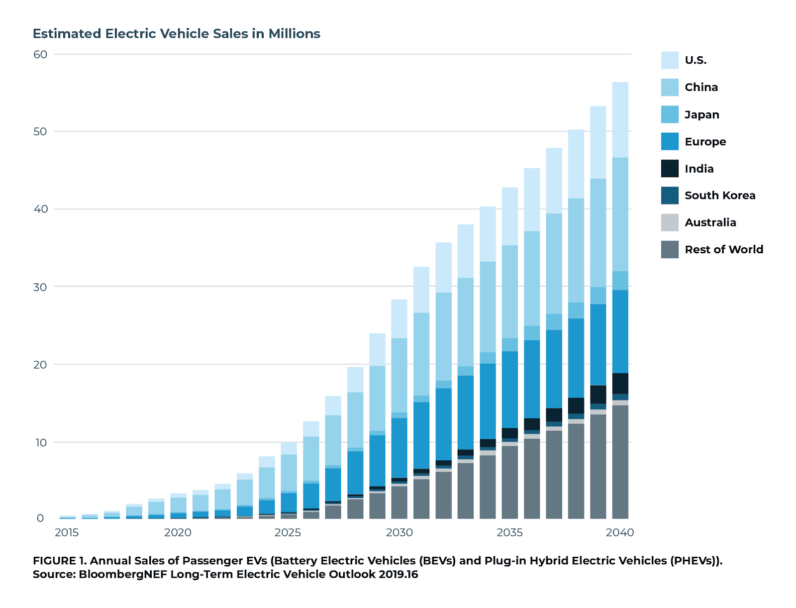

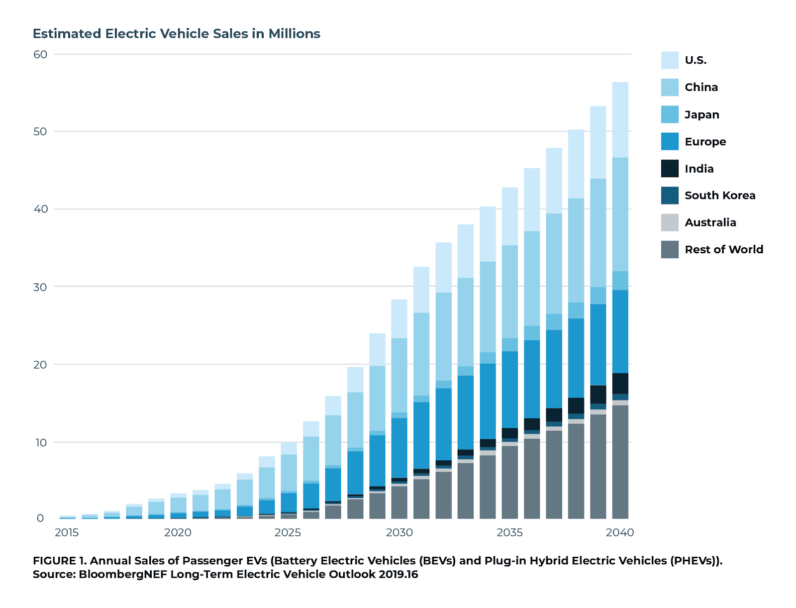

As the world gradually transitions to Electric Vehicles (EVs), demand for so-called “Green Metals” used in the production of batteries is soaring even faster.

Minerals like Nickel, and Lithium are integral to the process of battery construction, so demand is skyrocketing as more major automakers begin to produce their own EVs.

Even Bloomberg is noticing the lithium trend as battery metal extends 400% gain. “(Lithium) producers can reap huge profits amid warnings of deep deficits.” (13)

U.S. EV Registrations surge 60% in Q1, driven by Tesla, Ford, and new Korean models.

And remember; this isn’t just a fad. Electric Vehicles are here to stay …

Tesla, for example, is expecting to produce a staggering 20 million EVs by 2030 (5) Other automakers plan to launch a record 100 different pure Battery Electric Vehicles by 2024. (6)

The US government has even mandated 100% zero-emission vehicles by 2035. (7)

That means the transition to electric vehicles is now a matter of “when,” not “if.” And as this transition begins to accelerate, access to Green Metals is prime to become a potential bottleneck that could drive prices even higher than anticipated.

In addition, U.S. President Joseph Biden has recently introduced the Inflation Reduction Act, which actively encourages electric vehicle manufacturers to expand production and sourcing in North America, one of the requirements being “The components used in EV batteries must not have been ‘extracted processed, or recycled by a foreign entity of concern’ which includes China and Russia.” Furthermore, by 2029, 100% of battery manufacturing must take place in North America. (24)

Two driving forces behind the goal of this legislation are to accelerate building our domestic and/or friendly support of critical minerals such as Lithium and Nickel, and to break China’s stranglehold on the supply chain of those critical minerals. The bill will funnel hundreds of billions of dollars into clean energy while accelerating America’s transition away from fossil fuels, including making EVs more affordable. (25)

Promoting The Future Of Clean Energy And Digital Transition With Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI)

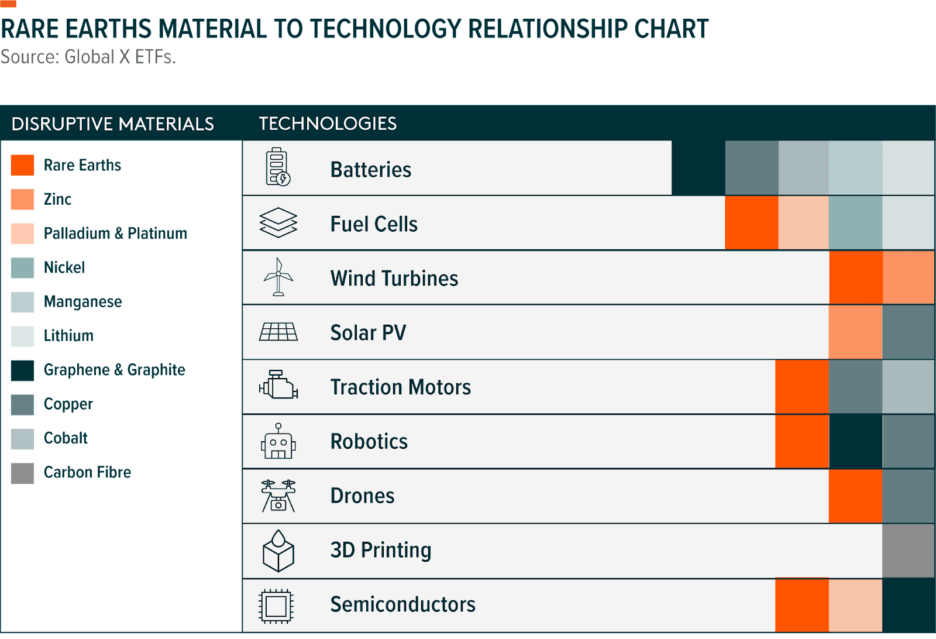

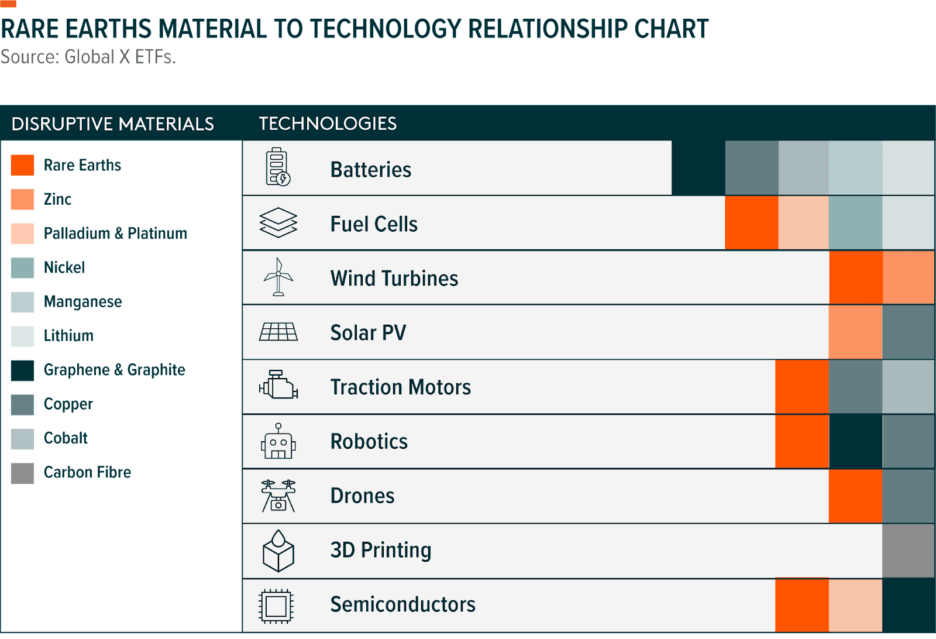

In the ever-evolving landscape of the 21st century, the demand for materials that drive clean energy and digital innovation has never been greater. As the world transitions toward sustainable and connected technologies, the fundamental building blocks of these advancements, such as lithium and nickel, are gaining center stage. (39)

This is where Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI) comes into play as a key player in the extraction and production of these crucial materials. (34)

Disruptive materials are the lifeblood of the technologies transforming our world. Among these materials, lithium and nickel are indispensable elements in the creation of advanced batteries that power electric vehicles (EVs), energy storage solutions, and portable electronics.(39)

Setting The Stage For A Supercycle: Lithium And Nickel In High Demand

Historically, rapidly growing demand combined with persistent and insufficient supply have created the conditions necessary to spark a supercycle. The simultaneous emergence of several game-changing technologies that have been, and continue to be, heavily adopted could create similar conditions for supercycles in specific materials.

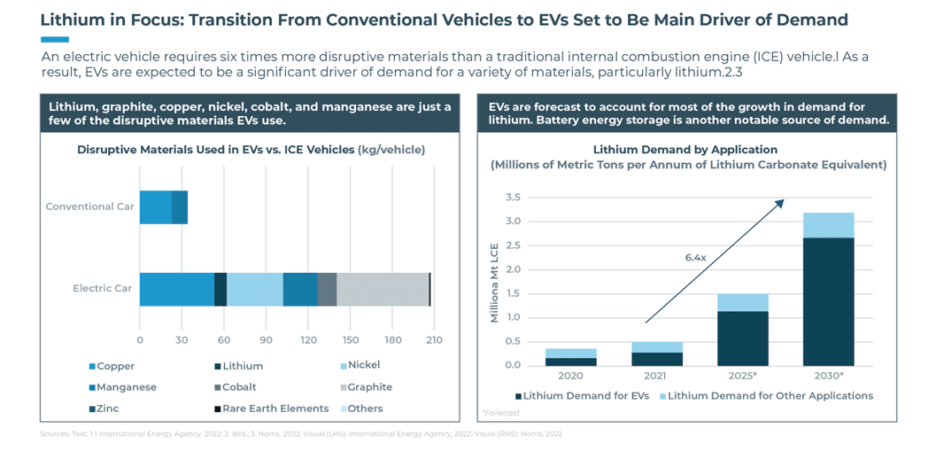

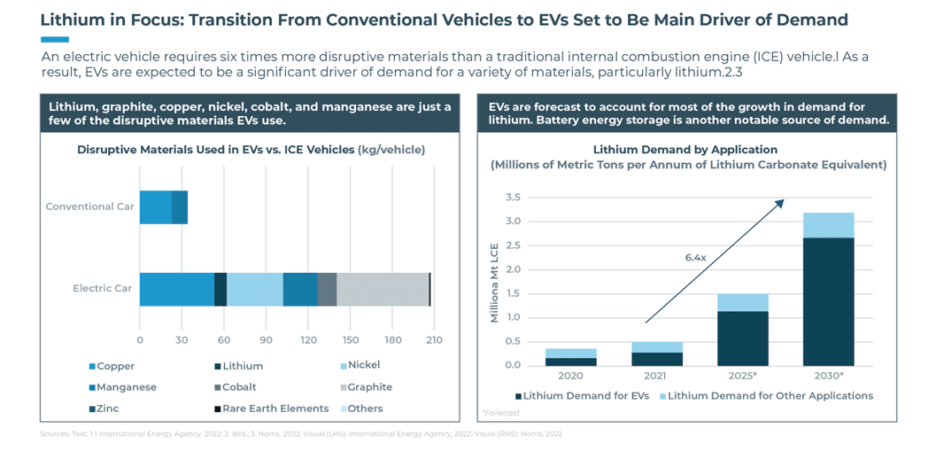

We’ve started to see this in the ongoing transition from internal combustion engine (ICE) vehicles to electric vehicles (EVs), which is poised to be a significant driver of demand for materials like lithium and nickel. An EV requires six times more of these materials than a traditional ICE.

The extraordinary growth in the adoption of EVs and the expansion of clean energy initiatives have ignited a supercycle for disruptive materials. During a supercycle, prices for these materials rise above the trend for extended periods, driven by a combination of robust demand and challenges in supply. Lithium and nickel are key beneficiaries of this supercycle, as they are essential components in the manufacturing of high-capacity batteries.(39)

Surge Battery Metals Inc.: Pioneering The Lithium And Nickel Revolution

Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI) has a strong commitment to sustainable practices and is at the forefront of this transformation. The company has positioned itself to be a leader in the exploration, extraction and production of lithium and nickel, meeting the growing demand for these materials head-on. (34)

Climate action and clean technology initiatives are driving a surge in demand for lithium and nickel, leading to the potential for substantial revenue growth for Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI). (34)

By 2040, revenue from disruptive materials is projected to increase five-fold, reaching over $250 billion. (39)

Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI) is strategically positioned to capitalize on this trend. The company’s focus on lithium and nickel places it squarely within the ecosystem of companies set to benefit from the rise of clean technology, electric vehicles, and digital transformation. (34)

The Road Ahead: A Bright Future for Disruptive Materials

The journey toward a sustainable and connected future is well underway. As we continue to embrace electrification and digitalization, the importance of lithium and nickel as key enablers of innovation cannot be overstated.(39) Surge Battery Metals Inc. (OTC: NILIF) (TSXV:NILI) is a company with the vision and expertise to harness the potential of these disruptive materials, ensuring their availability for the technologies that will shape our world for decades to come.(34)

Surge Battery Metals Inc. (OTC: NILIF) (TSXV:NILI) Only Targets Battery Metals That Have Rapid Demand Growth Forecasts And Are Positioned To Outperform In The Market

Nickel and Lithium are the backbone of leading-edge battery technologies while representing the best opportunities to create secure, domestic supply solutions for North American automakers and battery manufacturers. (34)

GM To Invest $650 Million In A Lithium Company To Support Its Electric Vehicle Business (35)

On January 31, 2023, General Motors said it plans to invest $650 million in Lithium Americas to secure access to lithium, a vital component of batteries for electric vehicles. (35)

It’s the biggest investment an automaker has ever made to secure sources of the raw materials that go into batteries, the companies said.

When the lithium is extracted from the Thacker Pass mine, which is the largest source of lithium identified in the U.S., and processed it will provide enough for GM to make as many as 1 million electric vehicles per year, the companies said.

Lithium is a critical component for batteries because it has a very high energy density and withstands charging and discharging well, according to GM and Lithium Americas. (35)

Securing sources of materials is especially critical as GM looks to ramp up production of EVs. In a letter to shareholders also published Tuesday, Barra said 2023 would be “a breakout year” for Ultium Platform, its battery platform for EVs. (35)

Barra said GM is on track to produce 400,000 EVs from 2022 through the first half of 2023 in North America. (35)

In exchange for its investment, GM will get exclusive access to the first phase of lithium production and the right of first offer on the second phase of lithium production that will come out of the Thacker Pass project, according to GM and Lithium Americas. (35)

Lithium production at Thacker Pass, in northern Nevada, is due to begin in the second half of 2026, the companies said. This will create 1,000 jobs as the mine is being constructed and 500 during operations.(35)

In The Realm Of Mining & Exploration Stocks, Surge Battery Metals Inc. Shows Remarkable Potential

Combining an absolutely huge portfolio of claims across the richest regions of Canada and Nevada, they’ve effectively de-risked through diversification at a level that most competitors can’t match.

To manage that portfolio, they’ve assembled a team that begs belief—including Greg Reimer, former VP of Canada’s massive BC Hydro, and Strategic Advisor Chip Richardson, a lifelong banker with experience working with everyone from UBS to Morgan Stanley.

And to back all that up, the company has a debt-free balance sheet with ample liquid capital; fully funding their planned exploration for the next year, and locking in enough runway for roughly another year after that.

Put simply; this company is offering potentially blue-chip value at penny stock prices.

Surge Battery Metals Inc. (OTCMKTS: NILIF, TSX: NILI) is one of the only metal exploration companies on the TSX with resources in Lithium and Nickel. (1)

The company’s holdings include four primary areas across two jurisdictions, British Columbia in Canada, and Nevada in the United States. Both jurisdictions are among the most favorable in the world for exploration and mining thanks to sophisticated infrastructure, friendly regulations, and a wealth of local talent that makes it easy to find geologists and needed personnel.

According to an assessment from major Wall Street firm Network1Financial:

The Canadian properties are at an early stage of exploration. Canada is one of the largest regions in the race to develop efficient and productive EV battery metals. There are considerable investment opportunities in British Columbia mineral targets. Many skilled metal exploration specialists and technical batteries specialists are based in the country creating an industry foundation that is developing an exhaustive and sustainable supply chain. (1)

Meanwhile, in Nevada, the company’s holdings include three projects: Nevada North Lithium Project, the San Emidio Desert Galt Project, and the Teel’s Marsh West Project.

DIGGING DEEP

Surge Battery Metals Inc.

(OTC: NILIF | TSXV: NILI)

NEVADA NORTH LITHIUM PROJECT

Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI) Expands The Nevada North Lithium Project Land Package (37)

On January 10, 2023, Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI) reported that the Company has acquired a 100% interest in 71 additional mineral claims resulting from a recently completed staking program. (37)

The Nevada North Lithium Project now comprises 243 mineral claims with a total area footprint of approximately 1,946 hectares or 4,810 acres. The land package is 100% owned and completely free of royalties. (37)

Recently announced drill results (see News Release dated Jan. 3, 2023) have demonstrated the potential for a significant lithium discovery at the Nevada North Lithium Project located in Elko County about 73 Km north-northeast of Elko Nevada. (37)

The maiden drilling program, consisting of eight widely spaced drill holes, has identified strong lithium values (up to 5950 ppm) associated with a series of stacked blue-green clay layers up to 120.4 meters or 395 feet thick. (37)

To date mineralization, as evidenced by drilling, has a strike length of approximately 1,620 meters or 5,315 feet. The width of the mineralization is not as well determined since the holes are mostly on a north-south alignment because of topography and access but is at least 400 meters and soil anomalies indicate it is likely much more.

The mineralization appears to be open to further development given the dimensions of a widespread lithium soil anomaly shown on the accompanying map.

Mr. Greg Reimer, Company President & CEO states:

Preliminary sampling returned lithium values that run as high as 5,120 ppm (0.51%) lithium and included eighty-nine samples with 1,000 (0.1%) or more ppm lithium. The zone of highly anomalous samples extends about 1,700 meters east-west in two bands about 300 to 400 meters wide. Drilling is currently underway.

Mr. Greg Reimer, Company President & CEO states:

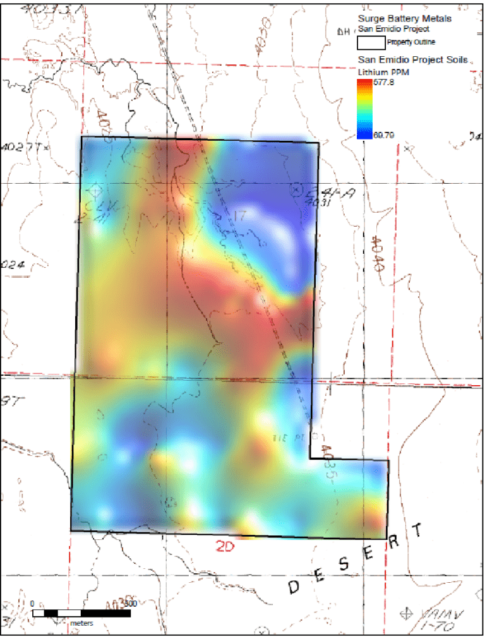

Nevada North Lithium Project- Lithium anomaly map from surface sampling

SAN EMIDIO DESERT PROJECT

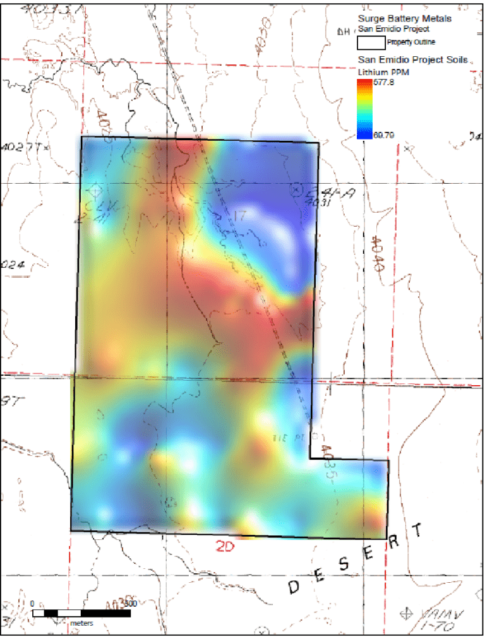

Further west, just a few miles from Tesla’s new Gigafactory is the company’s San Emidio Desert Project(11)

The Company has a Property Option Agreement to earn an undivided 80% interest in sixteen mineral claims, comprising 640 acres located within Nevada’s San Emidio Desert, known as the Galt Property.

Recent mineral exploration on the Galt claim group includes fifty-one playa sediment samples collected for chemical analysis at ALS Geochemistry in Vancouver, B.C. Results show 68 to 852 parts per million lithium (mean 365 ppm) and results from two seven-foot-deep auger holes show lithium concentrations in the range of 143.5 to 773 ppm.

Drilling is planned once permitting is in place.

Nevada North Lithium Project- Lithium anomaly map from surface sampling

TEELS MARSH LITHIUMI PROJECT(50)

Finally, the most recent addition to Surge’s portfolio is the Teel’s Marsh Lithium Project. This highly prospective property has had USGS geochemical survey sample reports as high as 850 ppm. Teel’s Marsh’s potential also extends to the fact that it hosts significant zones of permeability because of volcanic ash beds, which have proven to be the most productive brine sources in Clayton Valley. A sonic drilling program is envisaged as the next stage of exploration.(50)

BRITISH COLUMBIA NICKEL PROJECTS

British Columbia Nickel Project (45)

Surge Battery Metals’ nickel project in British Columbia include six mineral claims in the Mount Sidney Williams area of north central BC. Claim HN4 covers 1863 hectares immediately south of and adjacent to the Decar Project of FPX Minerals Inc and the nearby N100 claim group which covers 8659 hectares, located not far to the northeast.

The Company has entered into an Option Agreement with Nickel Rock Resources to acquire an 80% interest in these mineral claims. The Surge British Columbia Nickel Project consists of two non-contiguous mineral claims groups, located in central British Columbia. HN4 covers 1863 hectares immediately south of and adjacent to the Decar Nickel Project of FPX Minerals Inc and the Nickel 100 Group covers 8659 hectares, located some distance to the northeast. Three of the claims are subject to 2% NSR, including the Hard Nickel 4 claim and the two southernmost claims of the Nickel 100 claims. (45)

These projects are hosted by an ultramafic/ophiolite complex, a similar mineralized suite of rocks to that hosting the Baptiste and Van deposits of FPX Nickel. (45)

In 2022, Surge spent $900,000 further developing this exploration target. (45)

These exploration stage projects are in the Trembleur Lake area of central British Columbia, partially adjacent to FPX Nickel Corp.’s Decar Nickel Project, which is an advanced project targeting awaruite, a nickel-iron alloy mineral, hosted by serpentinized ultramafic intrusive rocks of the Trembleur Ultramafic Unit.

The Surge properties are partially underlain by rocks like those hosting the Decar project of FPX Nickel Inc where mineralization includes nickel, cobalt, and chromium. Previous exploration suggests that at least some of the nickel mineralization occurs as awaruite which is a naturally occurring nickel-iron alloy important in the manufacture of environmentally efficient batteries for the electric vehicle markets globally. The mineral awaruite is both highly magnetic and very dense and is therefore amenable to concentration by mechanical processes including magnetic and gravity separation. This style of deposit is unique and presents considerable metallurgical and processing cost saving advantages.

A September 7, 2022 FPX News Release Stated: FPX Nickel Scoping Study Outlines Development of World’s Largest Integrated Nickel Sulphate Operation for EV Battery Supply Chain at Baptiste Project in British Columbia.(46)

Mining and exploration can be an extremely difficult, cost-intensive, and unpredictable business.

New mines can cost a fortune to discover and develop. They can take years and require support & help from host governments. And even after all that investment, fluctuations in metal prices can still wreak havoc on operations.

With these four projects, and the hundreds of claims contained within, Surge Battery Metals has a nearly unrivaled level of flexibility and freedom when it comes to both exploration and subsequent mining.

Depending on prevailing market conditions and early exploration results, the company could prioritize individual sites, then use the windfall to fund further development in other metals.

This level of freedom would also allow the company to potentially spin off successful mining projects for acquisition, in turn funding future development and mining.

All of this is in stark contrast to the state of many micro-cap mining & exploration companies, which are often just connected to a single property or jurisdiction that may (or may not) ever pay out.

Canada’s Top Mining Insiders Behind The Wheel

Just as impressive as the company’s aggressively de-risked portfolio and their stake in some of the world’s friendliest mining jurisdictions are the people behind the scenes making it all happen.

We already mentioned President and CEO Greg Reimer, former Executive Vice-President (EVP) of BC Hydro’s Transmission & Distribution (T&D) business group, who held the EVP position from June 2010 until 2017 leaving BC Hydro to pursue work in the green energy field. For those on the American side of the border, BC Hydro is Canada’s third-largest electric utility, with over $5.7 Billion in annual revenues from 32 hydroelectric facilities.8

In his senior executive capacity, Greg brings a wealth of operational experience and strong leadership from over 26 years in the public sector. At BC Hydro, Greg was responsible for approximately 2,300 employees who plan, design, build, operate and maintain the systems and assets needed to deliver electricity safely and reliably to BC Hydro’s four million customers.

In total, Greg was accountable for $580M in annual capital investments in transmission and distribution infrastructure, and $325M in annual operating and maintenance expenditures. Greg also led a major strategic, multi-year transformation of BC Hydro’s T&D organization that is increasing operational efficiency, improving safety performance, and building a more reliable, modern electricity grid to meet growing customer expectations.

Director Graham Harris was the Founder, Chair and Director of Millennial Lithium Corp., which was recently acquired by Lithium Americas for $490M. With more than four decades of experience in the finance industry, Mr. Harris has held senior VP positions at Canaccord Genuity Corp. and Yorkton Securities. He has successfully raised over $400 million in development and venture capital for public and private companies. Additionally, he co-founded Cap-Ex Iron Ore Ltd. and served as a founding director of M2 Cobalt Corp., which was acquired by Jervois Global Ltd. Currently, Mr. Harris holds the position of Senior VP, Capital Markets, and director at Millennial Potash Corp.

Director Iain Scarr is the founder of IMEX Consultants, an industrial minerals consultancy that operates across the entire value chain. With over 30 years at Rio Tinto, he served as Commercial Director and VP of Exploration, spearheading several mineral discoveries in North and South America and Africa. Following his tenure at Rio Tinto, Mr. Scarr successfully guided three lithium projects in Argentina to the feasibility study stage before they were acquired.

Director Bob Culvert is another key player on the team, with over 35 years’ experience as a professional engineer working on every new frontier from Canada to West Africa, the Indian Subcontinent, and beyond. Over the past decade, he’s been serving as officer and director of several junior resource exploration and development companies. Bob is also a director of Carlin Gold Corporation.

Other key players on the financial side include the aforementioned Strategic Advisor Chip Richardson.

Breaking Down Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI)’S Monumental Price Movement

Surge Battery Metals Inc. (OTC: NILIF) experienced notable growth in its listed value between October 14, 2022 , and September 25, 2023. Starting at $.0458 on 10/14/2022, it has reached a new 52-week high of $1.15 recently, showcasing an impressive increase of approximately 2,410% according to Barchart.com. (40) This period of growth marked a significant milestone for Surge Battery Metals Inc. (OTC: NILIF).

In Canada, Surge Battery Metals Inc. (TSXV: NILI) witnessed a significant move of approximately 2,284% during the same period. The company’s share price value started at $.065 on October 14, 2022, and recently reached a new 52-week high of $1.55 per share on September 25, 2023. (41)

This remarkable surge may have been underpinned by key developments and discoveries made by Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI).

Lithium Clay Discovery And Further Drilling Plans:

One of the key drivers behind Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI)’s price appreciation could have been the company’s lithium clay discovery in northern Nevada.

The company’s President & CEO, Greg Reimer, highlighted in a shareholder update that the company’s Phase 1 drilling program had uncovered significant potential for a lithium deposit in an area not previously recognized for its lithium potential.

Furthermore, the company outlined plans for Phase 2 of its drilling program, which involved a budget of approximately $500,000 and plans to complete an additional seven holes. The drilling program was set to commence as soon as regulatory approvals were granted and weather conditions permitted. (44)

Metallurgical and Baseline Environmental Studies:

In addition to its exploration activities, Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI) conducted metallurgical and baseline environmental studies. The company aimed to ascertain the physical beneficiation techniques required to upgrade the lithium content of its discovery, thereby enhancing the project’s viability.(44)

Significant Commercial Discovery:

The company’s exploration activities culminated in the announcement of exciting results from test sites in Nevada. On January 27, 2023, Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI) revealed that the results may indicate a “significant commercial discovery,” a key factor that could potentially contribute to an accelerated interest in the company. (44)

In a remarkable feat of back-to-back discoveries, Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI) has unveiled record-breaking lithium results in its 2023 summer drilling program at the Nevada North Lithium Project, underscoring its pivotal role in the pursuit of high-grade lithium deposits and the transition to sustainable energy sources. (64)(65)

Surge Battery Metals Inc. (OTC: NILIF)’s impressive 2,410% stock price increase from October 14, 2022, to September 25, 2023, and Surge Battery Metals Inc. (TSXV: NILI)’s move 2,284% between October 14, 2022 and September 25, 2023, could potentially be attributed to the company’s lithium clay discovery, further drilling plans, metallurgical studies, and the announcement of a significant commercial discovery. (40)(41)

Surge Battery Metals Inc. (OTC: NILIF) (TSXV:NILI)’s focus on locating and developing high-value deposits of clean energy battery metals, which are vital to the rapidly growing electric vehicle (EV) market, is placing it in a favorable position to become a top company to watch in the market.

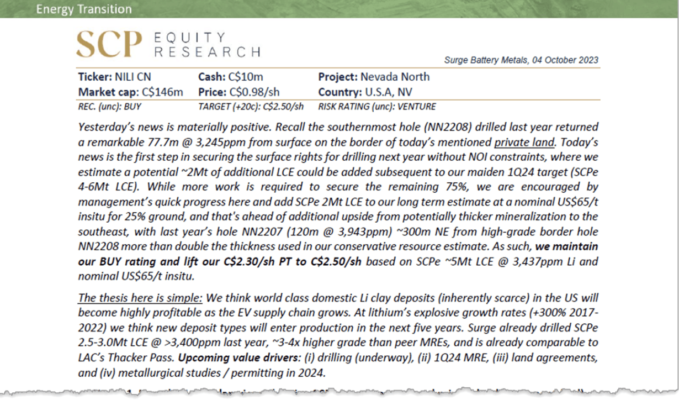

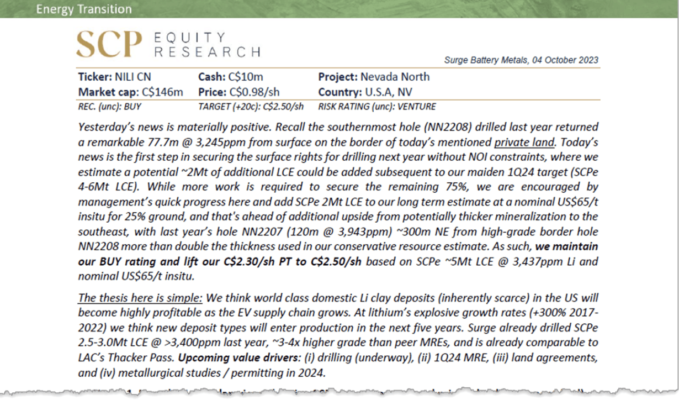

SCP Resource Finance Raises Their Target On Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI)(70)

Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI) has caught the attention of SCP Resource Finance, formerly known as Sprott Capital Partners. SCP Resource Finance, a leading and independent broker-dealer specializing in the global mining sector, recently raised their target for Surge Battery Metals Inc. (OTC: NILIF) (TSXV: NILI). This move reflects growing confidence in the company’s prospects and highlights the exciting developments in the lithium sector. (70)

The Mining Industry Experts

SCP Resource Finance boasts one of the most experienced research teams in the mining industry, making it a trusted partner for corporate and institutional clients involved in financing and M&A transactions. With its extensive relationships, specialized knowledge in the small to mid-sized mining space, and access to capital, SCP Resource Finance stands out as a reliable source of insight and analysis. (70)

Recent Positive Developments

Recently, Surge Battery Metals Inc. (TSXV: NILI) (OTCQX: NILIF) announced it has taken a significant step towards solidifying its position within its North Nevada Lithium Project (NNLP) by entering into two mineral property purchase agreements. These agreements grant Surge a 25% interest in the mineral rights to private lands, totaling 880 acres, situated within the borders of its NNLP. (71)

It’s also essential to recall the significant milestone achieved with the southernmost hole (NN2208) drilled last year. This hole returned a remarkable result of 77.7 meters at 3,245 ppm from the surface on the border of private land. Today’s news marks the first step in securing surface rights for drilling next year without NOI (Notice of Intent) constraints. It’s estimated that this could add approximately 2 million tonnes of additional Lithium Carbonate Equivalent (LCE) to the project, in addition to the maiden 1Q24 target of 4-6 million tonnes of LCE. (70)

While there is more work to be done to secure the remaining 75% of the surface rights, SCP Resource Finance is encouraged by the management’s swift progress. They have added a projected 2 million tonnes of LCE to their long-term estimate, valuing it at a nominal US$65 per tonne in situ for the 25% of ground already secured. Additionally, there is the potential for further upside from thicker mineralization to the southeast, as indicated by last year’s hole NN2207 (120 meters at 3,943 ppm), which is approximately 300 meters northeast from the high-grade border hole NN2208. (70)

SCP Resource Finance’s Bullish Sentiment (70)

SCP Resource Finance maintains a Bullish rating on Surge Battery Metals Inc. (TSXV: NILI) (OTCQX: NILIF) and has raised price target from C$2.30/share to C$2.50/share. This updated target is based on their projection of approximately 5 million tonnes of LCE at 3,437 ppm Lithium and a nominal US$65 per tonne in situ.

The Research Thesis(70)

The research thesis for Surge Battery Metals Inc. (TSXV: NILI) (OTCQX: NILIF) is straightforward but compelling. SCP Resource Finance believes that world-class domestic lithium clay deposits, which are inherently scarce, will become highly profitable as the electric vehicle (EV) supply chain continues to grow. With lithium’s explosive growth rates of over 300% from 2017 to 2022, it is expected that new deposit types will come into production in the next five years.

Surge Battery Metals Inc. (TSXV: NILI) (OTCQX: NILIF) has already demonstrated its potential by drilling approximately 2.5-3.0 million tonnes of LCE at over 3,400 ppm, a grade that is 3-4 times higher than peer Mineral Resource Estimates (MREs). This already places Surge in a comparable position to LAC’s Thacker Pass project. (70)

Upcoming Value Drivers (70)

There are several key catalysts that individuals should watch for in Surge Battery Metals Inc. (TSXV: NILI) (OTCQX: NILIF)’s journey:

- 3Q23/4Q23: Drill results from 8 holes, including a 400-meter northern step-out.

- 1Q24: Maiden resource estimate, projected at 4-6 million tonnes of LCE at 3,000-3,450 ppm Lithium.

- 2024: Metallurgical studies and geophysics.

- 4Q23-4Q24: Plan of Operations and NEPA permitting milestones.

Surge Battery Metals Inc. (TSXV: NILI) (OTCQX: NILIF) is poised to make a significant impact in the lithium sector, with SCP Resource Finance’s bullish outlook reinforcing the company’s potential. With impressive drilling results, strong management, and a promising project in Nevada North, Surge Battery Metals Inc. (TSXV: NILI) (OTCQX: NILIF) appears to be on a trajectory towards success. (70)

As the electric vehicle industry continues to grow, the demand for high-quality lithium deposits is expected to surge, making Surge Battery Metals Inc. (TSXV: NILI) (OTCQX: NILIF) an attractive research opportunity for those looking into the EV revolution. (70)

Surge Upgrades And Begins Trading On The OTCQX Best Market® In The United States… (66)

Surge Battery Metals Inc. has marked a significant milestone in its growth trajectory by securing approval for an upgrade to the OTCQX Best Market®. This strategic move is set to open new avenues for Surge Battery Metals, granting easier access to U.S. shareholders and enhancing liquidity while further solidifying the company’s position in the market. (66)

Effective as of September 28, 2023, Surge Battery Metals began trading on the OTCQX under the ticker symbol “NILIF,” alongside its continued trading on the TSX Venture Exchange in Canada under the symbol “NILI.” This dual listing strategy aims to widen the company’s reach, providing both domestic and international shareholders with increased opportunities to participate in Surge Battery Metals’ growth.

The OTCQX market is designed for established, investor-focused U.S. and international companies. To qualify for OTCQX, companies must meet high financial standards, follow best practice corporate governance, and demonstrate compliance with applicable securities laws. Graduating to the OTCQX market from the OTCQB market marks an important milestone for companies, enabling them to demonstrate their qualifications and build visibility among U.S. investors. (66)

Mr. Greg Reimer, Chief Executive Officer, and Director commented: “We are very pleased to advance to the OTCQX in order to provide our US investors with enhanced value in trading our securities.” (66)

One of the key advantages of Surge Battery Metals Inc. (TSXV: NILI) (OTCQX: NILIF)’s listing on the OTCQX is its recognition by the United States Securities and Exchange Commission (SEC) as an established public market. This recognition not only endorses the value of Surge Battery Metals’ securities but also underscores the transparency and credibility offered by the OTCQX platform. The SEC’s recognition enhances shareholder confidence by providing them with access to comprehensive public information for analysis and valuation purposes.

Surge Battery Metals Inc. (TSXV: NILI) (OTCQX: NILIF)’s foray into the OTCQX Best Market® comes at a time of growing interest in battery metals due to the global shift towards renewable energy sources and electric mobility. As the demand for electric vehicles and energy storage systems continues to surge, the role of battery metals becomes increasingly pivotal in powering these innovations. Surge Battery Metals, with its commitment to responsible and sustainable resource development, is strategically positioned to capitalize on this burgeoning market trend.

Surge Battery Metals Inc. (TSXV: NILI) (OTCQX: NILIF)’s successful upgrade to the OTCQX Best Market® signifies a vital step in its evolution as a key player in the battery metals sector. This move not only widens its shareholder base but also enhances its overall market visibility. As the world moves towards a more sustainable energy landscape, Surge Battery Metals is poised to play a vital role in supplying the essential battery metals that power the future. (66)

Sources

- Source 1: https://cfcdn-fc.stockmarkettrendstoday.com/wp-content/uploads/sites/96/2022/01/SURGE_DD-1-2.pdf

- Source 2: https://surgebatterymetals.com/wp-content/uploads/2021/11/Surge-Battery-Metals_Fact-Sheet_v1.10_2021-11-29.pdf

- Source 3: https://www.albemarle.com/locations/north-america/nevada

- Source 4: https://rivercountry.newschannelnebraska.com/story/44788975/surge-battery-metals-inc-stock-surges-53-as-ev-battery-metals-sector-comes-into-investor-focus-otcqb-nilif-tsxv-nili

- Source 5: https://cleantechnica.com/2021/10/08/teslas-goal-20-million-annual-car-sales-by-2030/

- Source 6: https://www.consumerreports.org/hybrids-evs/why-electric-cars-may-soon-flood-the-us-market-a9006292675/

- Source 7: https://bit.ly/3eRvzsT

- Source 8: https://surgebatterymetals.com/management/

- Source 9: https://simplywall.st/stocks/ca/materials/tsxv-nili/surge-battery-metals-shares

- Source 10: https://www.albemarle.com/news/albemarle-announces-expansion-of-nevada-site-to-increase-domestic-production-of-lithium

- Source 11: https://en.wikipedia.org/wiki/Giga_Nevada

- Source 12: https://finance.yahoo.com/news/surge-battery-metals-announces-preliminary-130000615.html

- Source 13: https://www.bloomberg.com/news/articles/2022-01-24/lithium-hits-ludicrous-mode-as-battery-metal-extends-400-gain

- Source 14: https://www.wsj.com/articles/lithium-prices-soar-turbocharged-by-electric-vehicle-demand-and-scant-supply-11639334956?mod=Searchresults_pos9&page=1

- Source 15: https://www.bloomberg.com/opinion/articles/2022-01-18/ev-battery-makers-are-pushing-up-demand-for-all-inputs-even-graphite

- Source 16: https://www.supplychaindive.com/news/biden-signs-inflation-reduction-act-in-boost-to-us-electric-vehicle-product/629854/

- Source 17: https://surgebatterymetals.com/surge-battery-metals-increases-nevada-north-project-claim-area-to-cover-large-lithium-anomaly-2/)

- Source 18: https://surgebatterymetals.com/surge-battery-metals-announces-successful-completion-of-its-phase-1-exploration-program-on-the-hn4-nickel-project-located-in-northern-british-columbia/)

- Source 19: https://www.otcmarkets.com/otcapi/company/financial-report/344699/content

- Source 20: https://www.mining.com/demand-for-battery-metals-to-jump-500-by-2050/

- Source 21: https://surgebatterymetals.com/wp-content/uploads/2022/09/Surge-Battery-Metals_Corporate-Presentation_v1.24_2022-08-30.pdf

- Source 22: https://www.otcmarkets.com/stock/NILIF/overview

- Source 23: https://www.autonews.com/sales/us-ev-registrations-surge-60-q1-driven-tesla-ford-new-korean-models

- Source 24: https://www.supplychaindive.com/news/inflation-reduction-act-ev-battery-bofa/630965/

- Source 25: https://original.newsbreak.com/@jessica-n-abraham-561221/2737415062843-u-s-inflation-reduction-act-could-supercharge-canada-s-cobalt-related-sectors?s=ws_em

- Source 26: https://www.reuters.com/markets/commodities/vale-sees-44-increase-global-nickel-demand-by-2030-2022-09-07/

- Source 27: https://surgebatterymetals.com/surge-battery-metals-returns-up-to-5120-ppm-lithium-from-geochem-surveys-on-its-100-owned-nevada-north-project/

- Source 28: https://themarketherald.ca/surge-battery-metals-provides-corporate-update-2022-10-07/

- Source 29: https://grist.org/energy/tesla-co-founders-startup-gets-2-billion-to-boost-ev-battery-production/

- Source 30: https://finance.yahoo.com/news/surge-battery-metals-announces-best-184500545.html

- Source 31: https://www.visualcapitalist.com/company_spotlight/surge-battery-metals/

- Source 32: https://surgebatterymetals.com/surge-battery-metals-announces-best-lithium-results-to-date-from-drill-holes-7-and-8-at-the-nevada-north-lithium-project/

- Source 33: https://seekingalpha.com/article/4576053-lithium-americas-thacker-pass-approved-now-look-south-for-production

- Source 34: https://surgebatterymetals.com/wp-content/uploads/2023/03/SurgeBatteryMetals_new-design2023_v4.2.pdf

- Source 35: https://www.cnbc.com/2023/01/31/gm-to-invest-650-million-in-lithium-company-to-support-ev-growth.html

- Source 36: https://pv-magazine-usa.com/2023/01/31/gm-announces-650-million-production-plan-with-lithium-americas/

- Source 37: https://surgebatterymetals.com/surge-battery-metals-expands-the-nevada-north-lithium-project-land-package/

- Source 38: https://www.yahoo.com/now/surge-battery-metals-returns-5-132000165.html

- Source 39: https://rankiapro.com/en/case-disruptive-materials/

- Source 40: https://www.barchart.com/stocks/quotes/NILIF/price-history/historical?orderBy=highPrice&orderDir=desc

- Source 41: https://www.barchart.com/stocks/quotes/NILI.VN/price-history/historical?orderBy=highPrice&orderDir=desc

- Source 42: https://www.barchart.com/stocks/quotes/NILI.VN/technical-chart?plot=AREA&volume=total&data=DO&density=X&pricesOn=1&asPctChange=0&logscale=0&sym=NILI.VN&grid=1&height=500&studyheight=100

- Source 43: https://www.barchart.com/stocks/quotes/NILIF/technical-chart?plot=AREA&volume=total&data=DO&density=X&pricesOn=1&asPctChange=0&logscale=1&sym=NILIF&grid=1&height=500&studyheight=100

- Source 44: https://surgebatterymetals.com/surge-battery-metals-provides-shareholder-update-3/

- Source 45: https://www.juniorminingnetwork.com/junior-miner-news/press-releases/2575-tsx-venture/nili/138970-surge-battery-metals-announces-the-acquisition-of-the-remaining-20-interest-in-the-surge-nickel-project-bc.html

- Source 46: https://fpxnickel.com/2022/09/fpx-nickel-scoping-study-outlines-development-of-worlds-largest-integrated-nickel-sulphate-operation-for-ev-battery-supply-chain-at-baptiste-project-in-british-columbia/

- Source 47: https://www.globenewswire.com/en/news-release/2022/05/18/2445586/0/en/Global-Lithium-Compounds-Market-Expected-to-Witness-Booming-Expansion-of-USD-61-22-billion-by-2027-Fior-Markets.html

- Source 48: https://www.caranddriver.com/news/a40069176/automakers-ev-plant-plans/

- Source 49: https://www.moneycontrol.com/news/world/china-in-talks-with-automakers-on-ev-subsidy-extension-8529361.html

- Source 50: https://www.bloomberg.com/press-releases/2022-09-14/surge-battery-metals-increases-nevada-north-project-claim-area-to-cover-large-lithium-anomaly

- Source 51: https://www.yahoo.com/now/surge-battery-metals-expands-nevada-123000439.html

- Source 52: https://www.marketscreener.com/quote/stock/SURGE-BATTERY-METALS-INC-49478439/news/Surge-Battery-Metals-NILIF-in-Focus-as-the-U-S-Passes-Inflation-Reduction-Act-Placing-a-Big-Bet-41922107/

- Source 53: https://www.marketwatch.com/press-release/surge-battery-metals-provides-shareholder-update-2023-02-09

- Source 54: https://www.youtube.com/watch?v=6OnBmvPNSiA

- Source 55: https://www.youtube.com/watch?v=J_tIUUDTsZY

- Source 56: https://www.youtube.com/watch?v=YpBjdzs3eug

- Source 57: https://www.youtube.com/watch?v=oqEz5A7QtJE

- Source 58: https://investinghaven.com/lithium-investing/lithium-the-mega-bull-market-is-resuming/

- Source 59: https://finance.yahoo.com/quote/ALBT?p=ALBT

- Source 60: https://recyclico.com/wp-content/uploads/2021/01/AMY_OTCQB_PR.jpg

- Source 61: https://schrts.co/CIaUitsR

- Source 62: https://schrts.co/gWxwgHQR

- Source 63: https://thedailyblaze.com/china-is-becoming-the-opec-of-lithium/

- Source 64: https://surgebatterymetals.com/surge-announces-highest-grade-lithium-assays-to-date-with-up-to-8070-ppm-lithium-in-the-first-2023-hole-at-nevada-north-lithium-project/

- Source 65: https://surgebatterymetals.com/surge-continues-to-intercept-significant-lithium-results-with-second-2023-hole-up-to-5820-ppm-lithium/

- Source 66: https://surgebatterymetals.com/surge-upgrades-and-begins-trading-on-the-otcqx-in-the-united-states/

- Source 67: https://www.blackbird.video/wp-content/uploads/2021/07/logo.jpeg

- Source 68: https://seekingalpha.com/article/4638726-surge-battery-metals-lithium-giant-in-nevada-you-havent-heard-of

- Source 69: https://seekingalpha.com/samw/static/images/OrganizationLogo.b472cbb2.png

- Source 70: https://bpd-space.nyc3.cdn.digitaloceanspaces.com/scp/231004-scp-nili-privateland.pdf

- Source 71: https://finance.yahoo.com/news/surge-enters-agreements-become-strategic-183100464.html

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors. Compensation: Pursuant to an agreement between Virtus Media LLC and Lifewater Media, Virtus Media LLC has been hired by Lifewater Media LLC for a period beginning on 09/11/2023 and ending 09/20/2023 to publicly disseminate information about EXCH: TCKR via digital communications. We have been paid seven thousand five hundred dollars USD. Pursuant to a further agreement between Virtus Media LLC and Lifewater Media LLC, Virtus Media has been hired for a period beginning on 10/16/22 and ending 10/18/22. We have been paid seven thousand USD.