7 Reasons Why GT Biopharma, Inc. (Nasdaq: GTBP) Could Become the Next High-Upside Biotech Success Story

GT Biopharma, inc.

(NASDAQ: GTBP)

Little-Known GT Biopharma (Nasdaq: GTBP) Appears Poised to Change Cancer Treatment Forever…and Potentially Deliver High Upside to Early Investors

An exciting – and potentially fast-moving – opportunity is now unfolding in the biotech space.

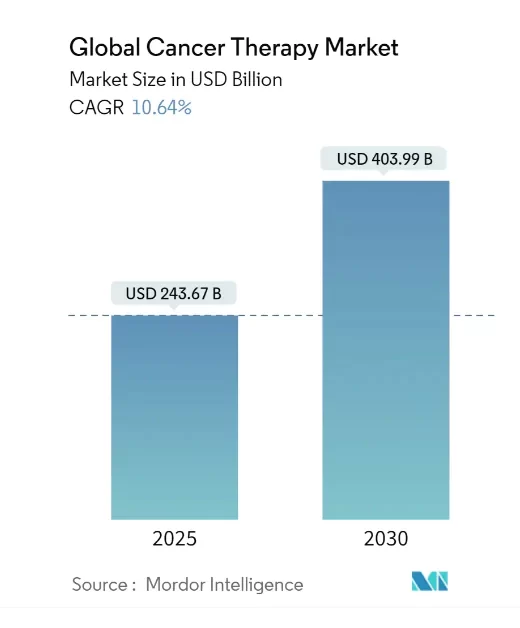

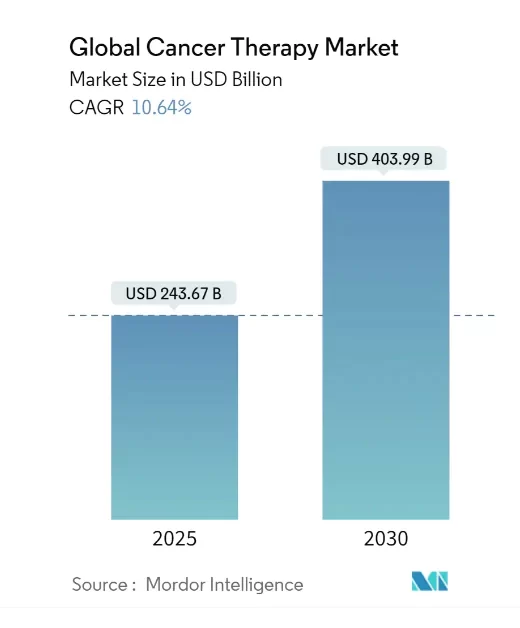

One under-the-radar company is pioneering a breakthrough cancer treatment that has the potential to disrupt the $243.67 billion cancer treatment market.

And that market is growing rapidly, with experts projecting it to be worth as much as $403.99 billion by 2030.

In the midst of this rapidly growing market, this company’s treatment has the potential to be truly disruptive when it comes to the way cancer is treated.

That’s because its proprietary treatment platform is designed to harness and enhance the cancer killing abilities of a patient’s immune system’s natural killer cells…allowing the body to potentially destroy cancer cells on its own – without surgery, chemotherapy or radiation.

The under-the-radar Nasdaq company developing this potential cancer breakthrough is GT Biopharma, Inc. (Nasdaq: GTBP).

GT Biopharma is a clinical stage immune-oncology company led by a team of leading cancer researchers – including the University of Minnesota’s Dr. Jeffrey Miller – that is in the process of proving the efficacy of a true cancer breakthrough.

The company is focused on developing innovative therapies based on the company’s proprietary NK cell engager (TriKE) technology. The company’s first generation of this therapy already delivered impressive results in Phase 1 clinical trials…

…and the company has since developed a second generation of this therapy which it estimates to be potentially 10 to 40 times more effective than its first generation therapy.

TriKE therapeutic agents are targeted immunotherapeutic agents that simultaneously react with natural killer (NK) cells and cancer cells to selectively facilitate the killing of cancer cells.

What this means is that TriKE agents effectively mobilize a patient’s own immune system to help target and kill cancer cells – and only cancer cells – again and again.

GT Biopharma’s TriKE therapy addresses the most important aspects of the humoral (antibody) response against cancer, namely:

(1) the ability of antibody to mediate antibody dependent cellular cytotoxicity (ADCC) through CD16…

(2) the ability via IL-15 to mediate in vivo expansion of the immune population to recruit more NK cells and generate an anti-cancer response, and…

(3) recognition of a cancer cell’s target tumor antigen.

With a scalable platform that offers the ability to target a variety of tumor cell markers, TriKE molecules can be used to treat both solid tumors and hematological cancers.

GT Biopharma’s 2nd Generation TriKE Could Be 10 to 40 Times More Effective and Is Now in Phase 1 Clinical Trial

Building on the success of the Phase 1 clinical trials for its first-generation TriKEs, the company is now developing unique precision therapeutic agents using camelid-derived nanobodies.

These drugs, called second-generation TriKEs, leverage the distinct properties of camelid antibodies, which are smaller and more stable when stored (i.e., cold storage not required) than traditional human monoclonal antibodies, allowing for ease of engineering and storage.

These camelid drug candidates are designed to address various cancers and autoimmune disorders, and the versatility of these nanobodies enables them to be engineered for optimal therapeutic effects, offering potential benefits such as reduced side effects and more convenient routes of delivery.

And, as mentioned earlier, the company estimates this second generation TriKE therapy could be 10 to 40 times more effective than its first generation predecessor.

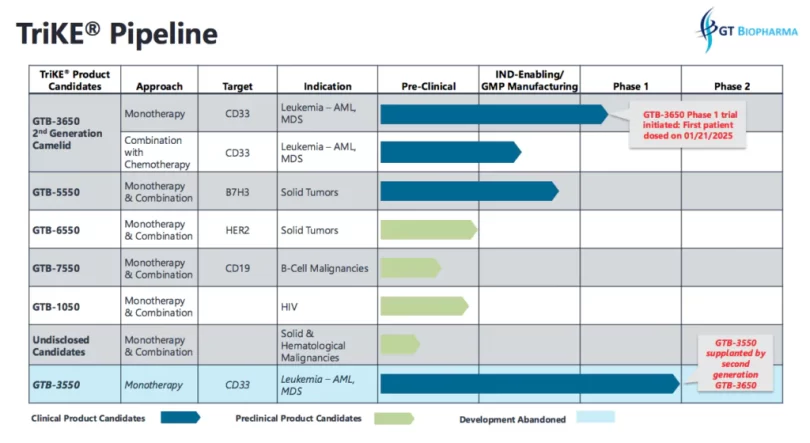

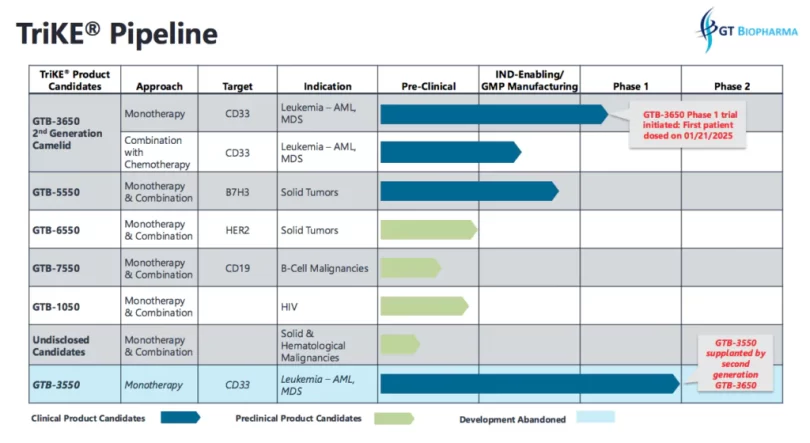

GT Biopharma (Nasdaq: GTBP) has a diversified TriKE therapeutic pipeline targeting several oncology indications and HIV. This includes:

* GTB-3550 TriKE – This is the company’s first-generation TriKE product candidate that was initially evaluated in a first-in-human Phase 1 clinical trial for the treatment of relapsed/refractory acute myeloid leukemia (AML) and high-risk myelodysplastic syndromes (MDS). In the completed Phase 1 clinical study, GTB-3550 was shown to be safe and well-tolerated at the dose levels evaluated. The study of GTB-3550 demonstrates clinical proof of concept and provides a framework for the design of future clinical trials of TriKE product candidates.

* GTB-3650 TriKE – This TriKE is being developed for the treatment of CD33 positive leukemias, including AML and MDS. GTB-3650 TriKE is the first TriKE product candidate under development that utilizes camelid nanobody technology. The IND application for GTB-3650 was cleared by the FDA in late June 2024, and the company began study enrollment targeting patients with relapsed/refractory AML and high grade MDS on January 21, 2025.

* GTB-5550 TriKE – The GTB-5550 TriKE product candidate is in development for the treatment of B7H3 positive solid tumor cancers.

* GTB-4550 TriKE – The GTB-4550 TriKE product candidate is in development for the treatment of PD-L1 positive solid tumor cancers.

* GTB-6550 TriKE – The GTB-6550 TriKE product candidate is in development for the treatment of HER2 positive solid tumor cancers.

* GTB-7550 TriKE – The GTB-7550 TriKE product candidate is in development for the treatment of lupus and other autoimmune disorders.

Should this TriKE prove effective in trials for the treatment of autoimmune disorders, GT Biopharma could also then become a player in the global autoimmune disease therapeutics market, which is projected to grow to $116.8 billion by 2032.

Upside Alert: GT Biopharma (Nasdaq: GTBP) Appears to Be Significantly Undervalued

This groundbreaking new, cancer-fighting technology obviously has enormous potential. It offers the promise of potentially making cancer treatment more effective, more affordable and more efficient…

…and it also has the potential to help investors collect potential windfall profits in the event of consistent, positive clinical trial results for its multiple drug candidates.

What type of potential exists for investors with GT Biopharma (Nasdaq: GTBP)?

For starters, take a look at what the professionals have to say:

In December 2024, securities analysts at Roth MKM initiated coverage of GT Biopharma with a “Buy” recommendation.

Roth MKM established a 12-month price target of $11 for the company’s shares, which represents a forecasted potential upside of roughly 350% from the share price of $2.38 on 4/2/25.

Roth MKM analyst Jonathan Aschoff wrote, “We are initiating coverage of GT Biopharma, Inc. (GTBP) with a Buy rating and a 12-month price target of $11 based on a DCF analysis using a 25% discount rate that is applied to all cash flows and the terminal value, which is based on a 5x multiple of our projected 2033 operating income of $113 million. We arrive at this valuation by projecting future revenue from GTB-3650, while we await initial clinical validation with GTB-5550 and GTB-7550.”

And for further indication of the potential that exists for GT Biopharma (Nasdaq: GTBP) to see an increase in valuation, take a quick look at how its valuation compares to some of its competitors.

- Fate Therapeutics (Nasdaq: FATE) currently has a market cap of $79.84 million…

- Nkarta, Inc. (Nasdaq: NKTX) has a market cap of $123.82 million…

- And Innate Pharma S.A. (Nasdaq: IPHA) now has a market cap of $185.87 million.

Compare those market caps to GT Biopharma (Nasdaq: GTBP) and its roughly $6 million market cap – with $4 million in cash on its balance sheet and zero debt – and you can see there is potential for significant increase in valuation for the company.

GT Biopharma, inc.

(NASDAQ: GTBP)

GT Biopharma Could be the Next

Potentially Lucrative “Big Pharma” Takeover Target

Within the industry, some of GT Biopharma’s closest peers with early-stage NK cell activating technology have already generated a great deal of attention from larger biotech companies.

And when this happens, it can be potentially very lucrative. For example:

- In 2018, $135 billion market cap Sanofi (Nasdaq: SNY) invested $96 million upfront – with $5 billion in additional potential milestones – to license drugs from Affimed N.V. (Nasdaq: AFMD).

- In 2020, Affimed N.V. cashed in again, with $7 billion market cap Roivant Sciences Ltd. (Nasdaq: ROIV) investing $60 million upfront – with $2 billion in additional potential milestones – in a preclinical license deal for rights to single molecule drugs from the company.

- In 2021, Sanofi made another large investment of $1 billion upfront – with $225 million in additional potential milestones – to acquire the entire platform of Ammunix Pharmaceuticals.

- In May 2022, $139 billion market cap Gilead Sciences, Inc. (Nasdaq: GILD) invested $300 million upfront in a preclinical license deal with privately-held Dragonfly Therapeutics.

- And in December 2022, Sanofi invested €25 million upfront – with €1.3 billion in additional potential milestones – to license drugs from Innate Pharma S.A. (Nasdaq: IPHA).

These lucrative M&A deals are a great illustration of the value of NK cell engagers in the market. Larger pharmaceutical companies have a long and proven history of “scouting” smaller companies with impressive potential and then moving in for a takeover.

Should that happen with a company like GT Biopharma, Inc. (Nasdaq: GTBP), early investors would be best-positioned to reap the potential rewards.

GT Biopharma is Led by a Proven Team with Deep Immuno-Oncology Experience

One of the more impressive aspects of GT Biopharma is the company’s highly experienced management leading the way.

It’s a team that has a wealth of deep expertise in all stages of oncology drug development that helps position the company for success.

This impressive team includes:

Michael Breen – Executive Chairman, Board of Directors

Michael Breen, an English qualified solicitor/attorney who was formerly the Managing Director of the Sports and Entertainment Division of Bank Insinger de Beaufort N. V., which is a wealth management organization and was part of BNP Paribas Group, one of the world’s largest banks. The holding company Insinger de Beaufort Holdings S.A. was listed on the Luxembourg Stock Exchange. Mr. Breen was also a director and major shareholder of an affiliate of Insinger de Beaufort Holdings S.A.

Jeffrey S. Miller, M.D. – Consulting Senior Medical Director

Dr. Miller is currently a Professor of Medicine at the University of Minnesota. He is the Interim Director of the University of Minnesota Masonic Cancer Center. He has more than 20 years of experience studying the biology of NK cells and other immune effector cells and their use in clinical immunotherapy with over 170 peer-reviewed publications. He is a member of numerous societies such as the American Society of Hematology, the American Association of Immunologists, a member of the American Society of Clinical Investigation since 1999.

Alan L. Urban – Chief Financial Officer

Alan Urban has over 30 years of corporate finance and accounting experience for a variety of public and private companies. Most notably Mr. Urban served as a member of the board of directors of GT Biopharma, Inc. (Nasdaq: GTBP), from mid-2022 to mid-2023; and as Chief Financial Officer for Research Solutions, Inc. (NASDAQ: RSSS), a SaaS and content provider in the scientific, technical and medical information space, for over a decade from 2011 to 2021.

Sources

[i] https://www.mordorintelligence.com/industry-reports/cancer-therapy-market

[ii] https://www.globenewswire.com/news-release/2024/12/13/2996844/0/en/Global-Autoimmune-Disease-Therapeutics-Market-to-Reach-USD-116-81-Billion-by-2032-Growing-at-a-5-52-CAGR-SNS-Insider.html

[iii] https://www.globenewswire.com/news-release/2024/12/13/2996844/0/en/Global-Autoimmune-Disease-Therapeutics-Market-to-Reach-USD-116-81-Billion-by-2032-Growing-at-a-5-52-CAGR-SNS-Insider.html

[iv] https://www.mordorintelligence.com/industry-reports/cancer-therapy-market

[v] https://www.globenewswire.com/news-release/2024/12/13/2996844/0/en/Global-Autoimmune-Disease-Therapeutics-Market-to-Reach-USD-116-81-Billion-by-2032-Growing-at-a-5-52-CAGR-SNS-Insider.html

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media LLC and JRZ Capital LLC, Virtus Media LLC has been hired by JRZ Capital LLC for a period beginning on 04/10/2024 and ending 05/03/2024 to publicly disseminate information about NASDAQ: VTGN via digital communications. We have been paid eighty three thousand nine hundred dollars USD. We have been paid an additional ten thousand dollars USD. Pursuant to an agreement between Virtus Media LLC and JRZ Capital LLC, Virtus Media LLC has been hired by JRZ Capital LLC for a period beginning on 9/23/2024 and lasting two weeks. We have been paid 10,000 USD. To date we have been paid one hundred three thousand nine hundred dollars USD to disseminate information about (NASDAQ:VTGN) via digital communications. We own zero shares of (NASDAQ:VTGN). Virtus media agrees to pay social media influencer #1 one thousand five hundred dollars USD and social media influencer #2 two thousand dollars USD and social media influencer #3 one thousand five hundred dollars USD and social media influencer #4 six hundred dollars USD and social media influencer #5 four hundred fifty dollars USD and social media influencer #6 three hundred fifty dollars USD and social media influencer #7 two hundred fifty dollars USD and social media influencer #8 one hundred fifty dollars USD and social media influencer #9 five hundred dollars USD and social media influencer #10 three hundred fifty dollars USD and social media influencer #11 two hundred dollars USD and social media influencer #12 six hundred dollars USD and social media influencer #13 four hundred fifty dollars USD and social media influencer #14 one thousand dollars USD and social media influencer #15 two thousand dollars USD and social media influencer #16 three thousand dollars USD and social media influencer #17 one thousand eight hundred dollars USD and social media influencer #18 one thousand seven hundred dollars USD and social media influencer #19 one thousand five hundred dollars USD and social media influencer #20 three hundred fifty dollars USD and social media influencer #21 three hundred fifty dollars USD and social media influencer #22 three hundred fifty dollars USD and social media influencer #23 three hundred fifty dollars USD and social media influencer #24 three hundred fifty dollars USD and social media influencer #25 four thousand dollars USD and social media influencer #26 two hundred dollars USD and social media influencer #27 two hundred fifty dollars USD and social media influencer #28 two thousand two hundred fifty dollars USD.