Actinium Pharmaceuticals Signs Agreement with National Cancer Institute

With a reaffirmed buy rating from HC Wainwright at a price target of $53.00 and more than $80 million in cash and cash equivalents at the end of Q2 2022, ATNM (Actinium Pharmaceuticals, NYSE:ATNM) has plenty of momentum and achievable milestones through mid-2025.

What You Should Know

Biotech Stocks

Biotech stocks can start as little known afterthoughts and turn into explosive disruptors on the cusp of revolutionizing medicine in months, weeks, or even days.

For example, did you even know who Moderna was 2 years ago?

On March 20, 2020, Moderna was nothing but a little-known biotech innovator developing an experimental vaccine trading at $30.05. Within the last 52-week period (as of 4/7/22)? It hit a high of $497.59 for a move of over 1,500% (2).

Amidst the continued carnage of the worldwide health situation, many biotech stocks have seen their shares skyrocket to incredible highs in 2022 year-to-date (as of 4/7/22):

- Pulmatrix, Inc. 1,530.06%

- Celsion Corporation 863.16%

- Baudax Bio, Inc. 723.27%

- Voyager Therapeutics, Inc. 230.07%

- CTI BioPharma Corp. 110.89%

Get this, though.

How many well-respected analysts gave them a price target showing significant upside potential (4)?

Are any of those stocks in the midst of a Phase 3 trial that could potentially cure one of the most debilitating forms of cancer we know- relapsed or recurrent, acute myelogenous leukemia (AML)?

Meet Actinium Pharmaceuticals (NYSE: ATNM). This clinical-stage biopharmaceutical company could completely revolutionize medicine. All by developing targeted radiotherapies that deliver cancer-killing radiation with cellular-level precision.

Based on recent history, when biotech companies find a solution, the results can be life-changing. Keep a very close eye on this company as its Iomab-B treatment progresses through Phase III SIERRA trials.

That’s why we put together this comprehensive research report on Actinium Pharmaceuticals (NYSE: ATNM), which we’re thrilled to send your way. We’re about to reveal the top 5 reasons to strongly consider this company ASAP.

We have a long track record of finding diamonds in the rough. Actinium Pharmaceuticals (NYSE: ATNM) could be our latest and greatest find.

News

Actinium Pharmaceuticals continues to be a major disruptor in biotech. Check out some of the latest news and developments.

THE OPPORTUNITY IS ALREADY HERE...

HC Wainwright reaffirmed their buy rating on shares of Actinium Pharmaceuticals with a current $53.00 price target

Approximately $80+ Million in cash and cash equivalents at the end of Q2 2022 expected to fund key value creating clinical, regulatory, and R&D milestones through mid-2025

Previous targeted radiotherapy trial achieves 100% bone marrow transplant engraftment

Actinium’s Iomab-B Nearing Treatment with SIERRA Trials

When you want to find a biotech play, you have to think this way- “don’t talk about it, be about it.”

Well, Actinium isn’t just talking the talk, they’re walking the walk.

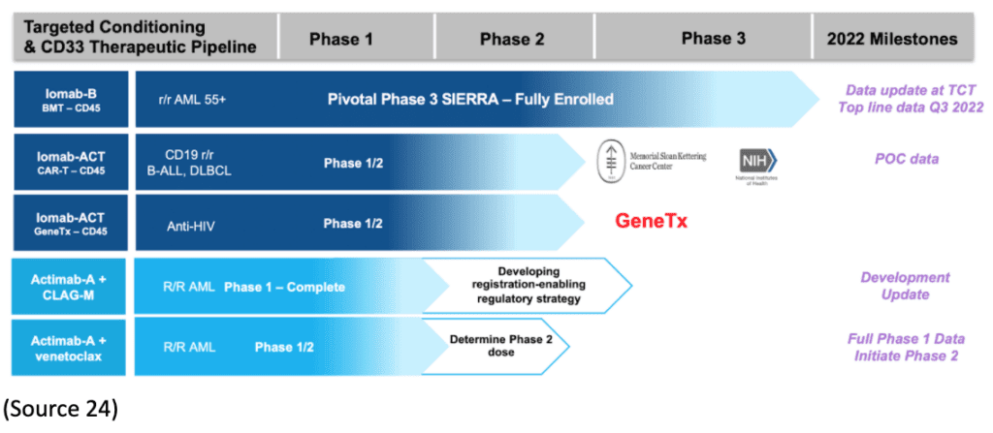

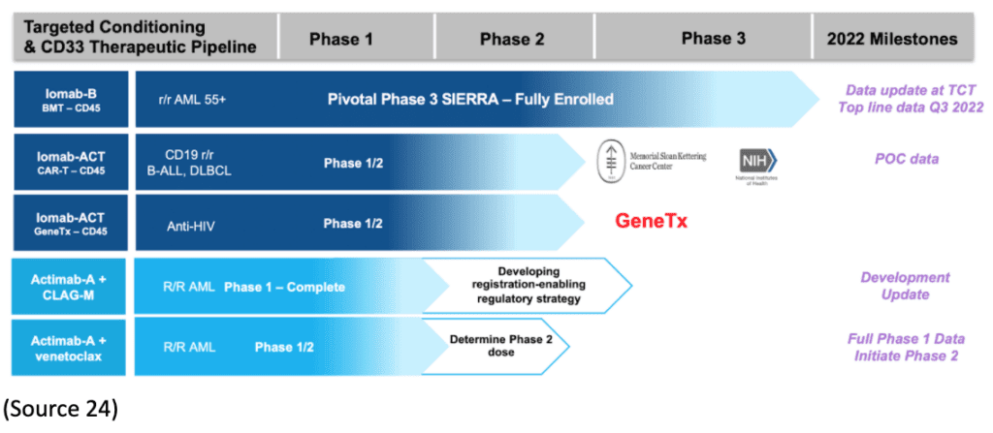

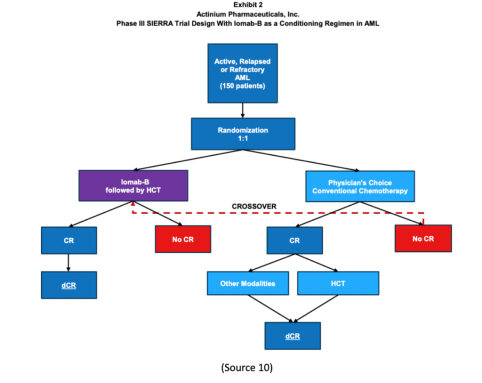

On September 15, Actinium announced enrollment for its pivotal Phase III SIERRA trial of Iomab-B was complete (1).

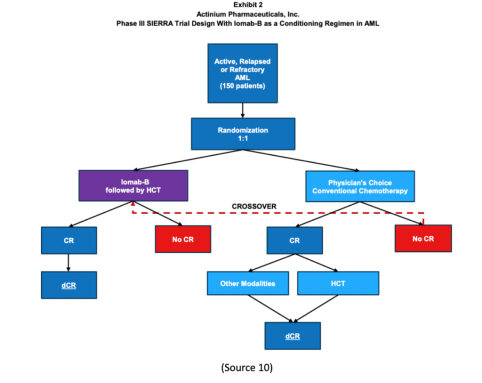

SIERRA is a 150-patient, multicenter, randomized trial studying Iomab-B, an antibody-radiation conjugate comprising an anti-CD45 antibody and radioactive iodine-131 (I-131), compared with salvage chemotherapy inactive, relapsed, or refractory acute myeloid leukemia (AML).“

Iomab-B was developed to address the significant unmet need of patients who could benefit and possibly be cured of their blood cancer with a bone marrow transplant but could not receive a transplant because non-targeted conditioning regimens could not produce a remission or are too toxic in this patient population.

We are confident that Iomab-B will squarely address this unmet need given its targeted nature and ability to deliver high amounts of radiation directly to the bone marrow resulting in myeloablation while sparing healthy organs,” said Dr. Avinash Desai, Actinium Pharmaceuticals’ Executive VP, Clinical Development (9).

The company’s Chief Medical Officer, Avinash Desai said (17):

“The remarkably consistent and high rates of BMT engraftment together with the low rates of non-relapse transplant-related mortality at day 100 with Iomab-B through 100% enrollment give us great confidence in SIERRA.”

And the company’s press release added more:

- Consistent 5-times greater difference between Iomab-B vs Control arm at each 100-day NR-TRM (non-relapse transplant-related mortality) interim analysis of the SIERRA trial.

- Control arm therapies failed to achieve remission in 83% of patients with just 14% of patients being potentially evaluable at 100-day NR-TRM for the primary endpoint compared to 100% BMT engraftment with Iomab-B and 70% of patients potentially evaluable for the primary endpoint.

- Unmet need in relapsed and refractory AML demonstrated by 66% of patients enrolled in SIERRA having received and failed targeted therapies prior to enrollment.

- Significantly lower rate of sepsis (p=0.002) and lower rates of febrile neutropenia in patients receiving Iomab-B compared to salvage therapy in the control arm.

With this info coming out at the 63rd American Society of Hematology Annual Meeting and Exposition (ASH), could it help spark additional interest in Actinium?

In short, if things continue progressing the way they are, Actinium Pharmaceuticals (NYSE:ATNM) could be a game-changer.

The SIERRA Trial is the ONLY Randomized Phase 3 Trial to Offer Bone Marrow Transplants

The company’s SIERRA trial for Iomab-B is a 150-patient, randomized 1:1 pivotal Phase 3 trial studying Iomab-B compared to physician’s choice of salvage chemotherapy in patients age 55 and above with active, relapsed, or refractory AML or acute myeloid leukemia (9).

Cool right?

Here’s the kicker, though. This trial is believed to be the ONLY randomized Phase 3 trial to offer BMT, the only potentially curative treatment option, to this patient population (9).

Plus, Iomab-B is a radiotherapy that targets cells expressing CD45. This protein is found only on blood cancer cells and immune cells, including bone marrow stem cells, with the radioisotope iodine-131. It is intended to be a targeted conditioning agent to enable potentially curative BMTs (9).

This could completely revolutionize the medical community…especially when you consider how impressive trial data already looks (12):

Get the latest stock ideas direct to your inbox.

100% free and your information stays with us.

- 100-percent engraftment consistent throughout interim analyses at 25 percent, 50 percent, and 75 percent of patient enrollment despite heavy leukemia burden before Iomab-B treatment.

- Personalized Iomab-B therapy enables targeted delivery of radiation to the bone marrow enabling myeloablation in a well-tolerated manner.

- Iomab-B delivers high amounts of targeted radiation to the bone marrow with minimal impact on other organs resulting in lower rates and severity of adverse events.

Wake up and smell the Iomab-B. If all goes according to plan Actinium Pharmaceuticals (NYSE:ATNM) could completely transform cancer treatment.

Their Patent Portfolio Is Being Strengthened With International IP

Why limit yourself to one domestic market if you have such a potentially strong treatment candidate that could change the entire world?

Actinium recently announced that its intellectual property portfolio around Iomab-B has been further strengthened internationally (13).

- In the EU, Actinium has been issued a patent covering the composition and methods of administration of Iomab-B, an Antibody Radiation Conjugate (ARC) comprised of apamistamab, a CD45 targeting antibody, and the radioisotope iodine-131. The issued patent in the EU is expected to have a useful life through 2036.

- In addition, Actinium has been granted a patent covering the same composition and methods of administration claims in Japan.

According to Dr. Dale Ludwig, Actinium's Chief Scientific Officer:

“We are excited to expand our already robust patent portfolio with these key patents in the EU and Japan. As the only CD45 ARC for targeting conditioning in clinical development, these international patents, together with our U.S. patents lay the foundation for aggressive development of Iomab-B for BMT conditioning and Iomab-ACT for conditioning prior to cell and gene therapies. Iomab-B is well characterized and supported by extensive clinical data across multiple clinical trials and indications.”

“Our ARC approach has significant advantages over other approaches such as monoclonal antibodies or antibody-drug conjugates that require payload internalization, making them impractical for targeting CD45. We look forward to continuing to build our leadership position in targeted conditioning led by Iomab-B and remaining at the forefront of innovation in targeted radiotherapy."

Analysts Are Going Crazy Over ATNM’s Potential Upside

While the ATNM stock did pull back in recent months, it may have caught strong double bottom support around $4.41.

With new, potentially exciting developments within the company, the stock may have the potential to retest prior highs around $20 a share.

Many analysts are also not just going long on this stock. They’re going all in. William Blair, for one, gives the stock an “Outperform” rating with a risk-adjusted fair value of $11.12 per share value (10).

Blair also stated that the “company finished the second quarter with a cash level of $81.9 million, which according to our estimates will likely sustain company operations into the first half of 2023, potentially beyond the Phase III SIERRA trial top-line readout" (10).

Most importantly, “Pending positive results from the Phase III SIERRA study and successful regulatory interactions with the FDA, [Iomab-B] is poised to disrupt the $600 million preconditioning market in the United States and Europe” (10).

Other analysts are even more bullish on the stock.

After ATNM announced full enrollment for its Phase III SIERRA Trial, Jones Trading immediately gave the company a $40 price target. (Source 16) Moreover, Jones Trading forecasted Actinium to see approximately $500 million in peak sales by 2032 (16).

But what if I told you that this isn’t even the most bullish analyst call?! H.C. Wainwright gave the stock a $45 price target (4)! That would give it potentially 773% upside (from close 4/7/22) of room to run!

773%!

Based on this rating, H.C. Wainwright says that “the common stock of the company is expected to outperform a passive index composed of all the common stock of companies within the same sector" (4).

But wait, there’s more…

Along with AVEO Technology, ATNM just entered into a research collaboration to develop and study a first-in-class antibody radio-conjugate (ARC) targeting ErbB3, also known as HER3, which is overexpressed in several solid tumor indications with high unmet needs, including colorectal, gastric, head and neck, breast, ovarian, melanoma, prostate and bladder cancers (25).

That could be substantial.

Even more impressive, Actinium just announced it entered into a research collaboration to study Actinium’s Actimab-A targeted radiotherapy in combination with RR-001, EpicentRx’s novel small molecule immunotherapy targeting AML (26).

Sources

1: https://ir.actiniumpharma.com/press-releases/detail/401

2: https://finance.yahoo.com/quote/MRNA/history?p=MRNA

3: https://fknol.com/list/best-performing/biotech-stocks.php

4: Client Provided Analyst Material HC Wainwright

5: https://www.marketsandmarkets.com/Market-Reports/chronic-lymphocytic-leukemia-223.html

6: https://checkrare.com/targeted-therapy-for-acute-myeloid-leukemia/

7: https://www.cancer.net/cancer-types/leukemia-acute-myeloid-aml/statistics

8: https://cancer.ca/en/cancer-information/cancer-types/acute-myelogenous-leukemia-aml/treatment/relapsed-or-refractory

9: https://www.prnewswire.com/news-releases/actinium-completes-enrollment-in-the-pivotal-phase-3-sierra-trial-of-iomab-b-301377219.html

10: Client Provided Analyst Material William Blair

11: https://d1io3yog0oux5.cloudfront.net/_7a9aad056eac4863c502660ef790af6d/actiniumpharma/db/206/944/pdf/Actinium_InvestorPresentation_September+2021.pdf

12: https://ir.actiniumpharma.com/press-releases/detail/398/pivotal-phase-3-sierra-trial-data-showing-100-bone-marrow

13: https://www.prnewswire.com/news-releases/actinium-further-strengthens-patent-portfolio-with-international-ip-covering-the-composition-and-methods-of-administration-of-iomab-b-antibody-radiation-conjugate-in-the-eu-and-japan-301314557.html

14: https://stockcharts.com/h-sc/ui?s=atnm

15: https://stockcharts.com/h-sc/ui

16: Client Provided Analyst Material Jones Trading

17: https://ir.actiniumpharma.com/press-releases/detail/412/actinium-pharmaceuticals-inc-announces-greater-difference

18: https://www.tipranks.com/news/blurbs/maxim-group-sticks-to-its-buy-rating-for-actinium-pharmaceuticals-atnm/

19: https://www.prnewswire.com/news-releases/actinium-announces-multiple-abstracts-highlighting-iomab-b-and-actimab-a-accepted-for-presentation-at-the-63rd-annual-american-society-of-hematology-annual-meeting-301416516.html

20: https://www.actiniumpharma.com/product-pipeline/iomab-b

21: https://www.barchart.com/stocks/quotes/ATNM/opinion

22: https://invezz.com/news/2021/11/09/market-highlights-stocks-react-to-earnings-rele[…]nvests-250-billion-in-autolus-elon-musk-to-sell-10-tesla-stake/

23: https://finance.yahoo.com/news/actinium-pharmaceuticals-inc-announces-greater-123000631.html

24: https://d1io3yog0oux5.cloudfront.net/_6ce8013bee626e168ac4cd2f3de00f02/actiniumpharma/db/206/944/pdf/Actinium_Investor+Presentation_April+2022+%281%29.pdf

25: https://investor.aveooncology.com/news-releases/news-release-details/actinium-pharmaceuticals-inc-and-aveo-oncology-enter-research

26: https://www.prnewswire.com/news-releases/actinium-pharmaceuticals-inc-and-epicentrx-announce-strategic-research-collaboration-to-combine-targeted-radiotherapies-with-next-generation-cd47sirp-immunotherapy-301454275.html

Disclaimer

Stock Research Today is a project of Virtus Media LLC and intended solely for entertainment and informational purposes. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and promote small public companies. By reading our website / media webpage you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our website / media webpage .We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website / media webpage are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. Virtus Media business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media. often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Compensation – Pursuant to an agreement between Virtus Media LLC and TD Media LLC, Virtus Media LLC has been hired for a period beginning on 4/11/22 and ending after 2 business days to publicly disseminate information about (NYSE: ATNM) via digital communications. We have been paid eleven thousand five hundred USD via ACH Bank Transfer. Pursuant to an agreement between Virtus Media LLC and Lifewater Media LLC, Virtus Media LLC has been hired for a period beginning on 10/26/22 and ending after 10/28/22 days to publicly disseminate information about (NYSE: ATNM) via digital communications. We have been paid twenty thousand USD via ACH Bank Transfer. Pursuant to an agreement between Virtus Media LLC and Lifewater Media LLC, Virtus Media LLC has been hired for a period beginning on 12/08/22 and ending after 12/13/22 days to publicly disseminate information about (NYSE: ATNM) via digital communications. We have been paid fifteen thousand USD via ACH Bank Transfer. Pursuant to an agreement between Virtus Media LLC and Lifewater media LLC, Virtus Media has been hired for a period beginning on 2023-02-14 and ending after 2023-02-16 to publicly disseminate information about NASDAQ: ATNM. We have been paid fifteen thousand dollars USD via ACH Bank Transfer.