Break Through Element Increases Lithium Batteries Capacity By 400%

Lithium batteries have changed the world, powering laptops to cell phones, electric cars to solar energy, a total revolution.

Build your watchlist with us

Get the latest stock ideas direct to your inbox. 100% free and your information stays with us.

Every Metal Has Its Day

Tellurium is still a relatively unknown metal that seems to have found a new and lucrative home, Lithium–Tellurium batteries, one could expect both demand and price for this rare metal to skyrocket.

Current Lithium-ion Battery Technology Not Making The Grade

Since Sony Corporation released the first rechargeable lithium-ion battery in 1991 scientists have been trying to overcome their shortcomings, and improve their performance:

- Lithium-ion batteries are fragile and require circuitry to stop them from overcharging and exploding, causing many fires and deaths.

- Besides this major safety concern, current Lithium-ion batteries degrade quickly and last only two to three years after manufacturing.

- They are sensitive to high temperatures and if the battery is completely discharged, it can no longer be recharged.

- Also, if the “separator” gets damaged, it can burst into flames.

Big Names Are Feeling The Drain

No industry using Lithium-ion batteries is immune to their safety hazards.

- In August 2021, General Motors announced that it was recalling 142,000 Chevy Bolts — every Bolt ever made — because of fire risk.

- Hyundai Motor’s recall of their Kona EV cars due to safety concerns cost them $854 million.

- The Samsung recall of their Galaxy 7 cell phone cost the company $5.3 billion due to their tendency to explode and cause fires.

But Now There Appears to Be a Solution

Recent scientific breakthroughs have discovered that the addition of a rare metal called Tellurium overcomes the current limitations of today’s Lithium-based battery technology.

Tellurium (Te) is to Lithium what Lithium was to batteries, a game changer.

The point of using dummy text for your paragraph is that it has a more-or-less normal distribution of letters. making it look like readable English.

A Tellurium First for North America

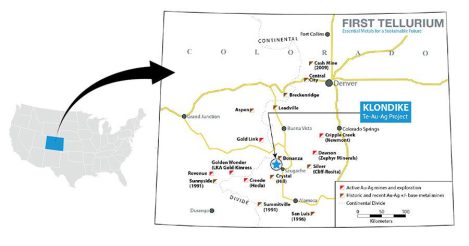

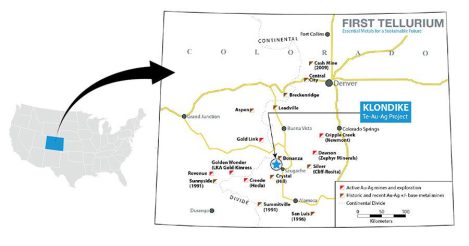

Tellurium is a rare metal often sourced as a by-product of copper with the largest global supplier being China. Now, however, there is a company in North America solely focused on its recovery, First Tellurium Corp. (CSE:FTEL, OTC:GODYF).

First Tellurium is uniquely positioned to benefit from this scientific breakthrough as it is one of the only companies in the world purely dedicated to Tellurium exploration with their two resource-rich Tellurium projects:

- The Klondike Tellurium-silver-gold property in Sagauche County, Colorado

- and the polymetallic Deer Horn Property in BC, Canada.

Its Klondike project would be the very first dedicated Tellurium mine in the U.S… and the second in production world-over.

What The Experts Are Saying

Industry professionals rave about First Tellurium’s projects.

Mr. John Keller, a veteran geologist with 23 years of experience in the minerals exploration and mining industry as an exploration geologist and exploration manager, originally assessed the Klondike project in late 2006. Keller stated:

“The Klondike property has by far the highest Tellurium grades in rock samples of the hundreds of prospects and mines I examined in the US and Canada from 2006 to 2011… Some samples at Klondike were an order of magnitude higher in “Te” grade than any others we collected in the U.S. or Canada.”

Then, there is Mr. Jim Guilinger whose exploration and development experience spans more than 20 years involving various investigations consulting projects for Tellurium throughout the USA and the World. He states:

“Having spent a great deal of my life exploring and reporting on Tellurium, including a worldwide Tellurium resource and market review, I am most impressed with the properties held by First Tellurium.”

First Tellurium Strategically Positioned to Benefit from President Biden’s Trillion-Dollar Infrastructure Bill

Biden Executive Order will put battery materials at heart of US climate technology ‘leadership’.

In a response to The Bill’s passage, Biden said:

“We will get America off the sidelines on manufacturing solar panels, wind farms, batteries, and electric vehicles to grow these supply chains, reward companies for paying good wages and for sourcing their materials from here in the United States.”

A substantial part of the Biden Infrastructure Bill is to further develop a local supply of raw materials and rely less on imports from countries like China.

Get the latest stock ideas direct to your inbox.

100% free and your information stays with us.

Only First Tellurium Corp. (CSE:FTEL, OTC:GODYF) Is Solely Focused On This New Bonanza

6 Reasons to take a closer look:

- Demand for Tellurium has never been higher with the potential to revolutionize energy storage

- Tellurium is also at the heart of a breakthrough that could fuel one of mankind’s most sensational advances in solar technologies.

- They are the only dedicated exploration company focused on Tellurium in North America

- First Tellurium has some of the richest Tellurium assets ever surveyed

- Recently onboarded multiple industry experts and crucially backed with by an accomplished CEO

- First Tellurium has successfully completed multiple financing rounds

Can Tellurium Lithium-ion Batteries Save the World

Governments globally are looking to lower their carbon footprint and become less reliant on fossil fuels. The shift is to green renewable energy.

Solar, wind and wave technologies are a focus. Once these technologies generate the power it still needs to be stored and current battery technology is not keeping pace.

Electric Vehicles EV are leading the charge for a greener environment but are still hampered by charging times and driving distances. Global EV sales increased 80% in 2021 as automakers including Ford, GM commit to zero emissions.

Many of these global initiatives would be well served by a safer battery that stores more power, and lasts up to 4 times longer. Many think the solution is a Tellurium Lithium-ion battery.

With an increased life, quicker charging and more power, it’s possible that new battery technology augmented with the addition of Tellurium could be what leads the way to a safer cleaner planet.

FIRST TELLURIUM CORP. (CSE:FTEL, OTC:GODYF) could be at the right place, at the right time, and is definitely worth a closer look.

Sources

1. https://www.machinedesign.com/materials/article/21130846/a-layer-of-tellurium-boosts-lithiumions-operational-life

2. https://www.prnewswire.com/news-releases/global-lithium-ion-battery-market-size-could-exceed-115-billion-by-2030-as-demand-is-booming-301341685.html

3. https://tradingeconomics.com/commodity/lithium?user=analyst22779

4. https://www.bbc.com/news/business-51171391

5. https://www.ionenergy.co/resources/blogs/battery-safety/

6. https://www.washingtonpost.com/technology/2021/12/30/chevy-bolt-gm/

7. https://europe.autonews.com/automakers/hyundai-will-replace-battery-systems-900m-ev-recall

8. https://eu.usatoday.com/story/tech/2016/10/14/samsung-note-7-recall-cost-least-53-billion/92040942/

9. https://www.globenewswire.com/news-release/2021/11/23/2339716/0/en/First-Tellurium-Recruits-First-Solar-s-Previous-Exploration-Manager-and-Veteran-Geologist-John-Keller-to-Advisory-Board.html

10.https://www.asiaresearchnews.com/html/article.php/aid/9145/cid/2/research/technology/the_agency_for_science%2C_technology_and_research_%28a%2Astar%29/tellurium_electrodes_boost_lithium_batteries%0A.html

11. https://earth.stanford.edu/news/critical-minerals-scarcity-could-threaten-renewable-energy-future#gs.euifcm

12. https://www.globenewswire.com/news-release/2021/12/07/2347284/0/en/Former-First-Solar-Tellurium-Explorer-James-Guilinger-Joins-First-Tellurium-s-Team.html

13. https://www.energy-storage.news/biden-executive-order-will-put-battery-materials-at-heart-of-us-climate-technology-leadership/

14. https://www.whitehouse.gov/briefing-room/statements-releases/2021/11/06/statement-by-president-joe-biden-on-the-house-passage-of-the-bipartisan-infrastructure-investment-and-jobs-act/

15. https://www.utilitydive.com/news/global-ev-sales-rise-80-in-2021-as-automakers-including-ford-gm-commit-t/609949/

Disclaimer

Stock Research Today is a project of Dadmin Capital LLC and intended solely for entertainment and informational purposes. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/. This website / media webpage is owned, operated and edited by Dadmin Capital LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Dadmin Capital” refers to Dadmin Capital LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and promote small public companies. By reading our website / media webpage you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our website / media webpage .We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website / media webpage are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. Dadmin Capital business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Dadmin Capital. often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Compensation – Pursuant to an agreement between Dadmin Capital LLC and Lifewater Media LLC, Dadmin Capital LLC has been hired for a period beginning on 2/14/22 and ending after 5 business days to publicly disseminate information about (OTC: GODYF) via digital communications. We have been paid seven thousand five hundred USD via ACH Bank Transfer. Social Media Compensation – Pursuant to an agreement between Dadmin Capital LLC and Social Media Outlet, Dadmin Capital LLC has hired Social Media Outlet for a period beginning on 2/14/22 and ending after five business days to publicly disseminate information about (OTC: GODYF, CSE: FTEL) via digital communications. We have paid this Social Media Outlet one thousand USD via ACH Bank Transfer. Pursuant to an agreement between Dadmin Capital LLC and Social Media Outlet, Dadmin Capital LLC has hired Social Media Outlet for a period beginning on 2/14/22 and ending after five business days to publicly disseminate information about (OTC: GODYF, CSE:FTEL) via digital communications. We have paid this Social Media Outlet one thousand USD via ACH Bank Transfer.