5 Key Reasons Why Avalon GloboCare Corp. (Nasdaq: ALBT) Could See Significant Upside Potential In Early 2023.

IDENTIFYING THE OPPORTUNITY

THIS DIAMOND IN THE ROUGH IS READY TO SHINE

With a low float and solid fundamentals, we have plenty of potential for a strong rally from this level

TARGETS

Target #1: $2.10 (+162.50%)

Target #2: $3.03 (+278.75%)

Target #3: $4.34 (+442.50%)

Target #4: $6.02 (+652.50%)

Target #5: $7.21 (+801.25%)

Support: $0.67

AVALON GLOBOCARE CORP.

(NASDAQ: ALBT)

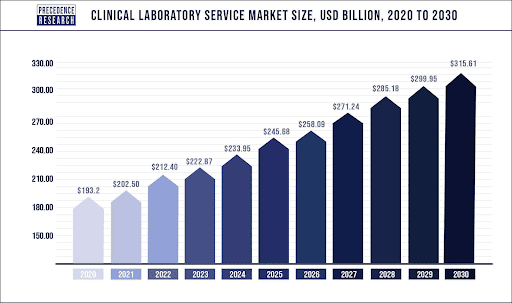

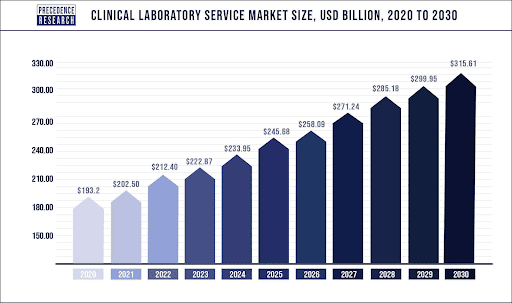

Promising Growth Prospects In The Global Clinical Laboratory Service Market (2)

The global clinical laboratory service market is poised for significant expansion, with an estimated value of $202 billion and projected growth surpassing $315 billion by 2030. This market is primarily driven by the increasing demand for early diagnostic tests and the rising prevalence of chronic diseases. The biotechnology and healthcare industries, particularly in developed regions like the U.S. and Canada, are experiencing rapid growth, further fueling the demand for clinical laboratory services. Government and private investments aimed at developing and expanding these industries are key drivers of market growth. (2)

The rising prevalence of chronic diseases and increased investments in research laboratories have a significant impact on the demand for clinical laboratory services. Additionally, the need for efficient data storage and management, driven by the proliferation of research centers worldwide, contributes to market growth. The adoption of automated technologies to enhance productivity and reduce costs also augments the market’s expansion. Key players in the industry continually introduce new services to meet patient needs, further propelling market growth.

The clinical chemistry segment, which accounted for a significant revenue share, is projected to maintain its dominance throughout the forecast period. This segment benefits from the introduction of new technologies, a wide range of clinical chemistry tests, and the emergence of point-of-care testing methods. Moreover, investments in research activities by healthcare industry players drive the growth of laboratories globally, making the clinical chemistry segment the fastest-growing segment. (2)

The human and tumor genetics tests segment is expected to register the highest growth rate, indicating the increasing importance of genetic testing in diagnosis and treatment.

Among service providers, hospital-based laboratories currently hold the largest revenue share. Factors such as the growing prevalence of cancer, research activities aimed at innovative services, and the rising demand for clinical chemistry services in hospitals contribute to the growth of this segment.

The toxicology testing services segment is anticipated to exhibit the fastest growth rate. Advancements in clinical diagnostic methods and increasing awareness about disease diagnosis and treatment contribute to the growth of this segment.

The global clinical laboratory service market offers promising growth prospects, driven by the increasing demand for early diagnostic tests and the rising prevalence of chronic diseases. Investments in research laboratories, automation technologies, and the introduction of new services by key players further contribute to market expansion. (2)

As the market evolves, opportunities for growth and innovation abound. One little-known company to keep an eye on in this sector is Avalon GloboCare Corp. (Nasdaq: ALBT). This company could be extremely well-positioned to capitalize on these opportunities and make significant contributions to the advancement of the industry. (8)

AVALON GLOBOCARE CORP.

(NASDAQ: ALBT)

Recent Acquisition Reveals Little-Known Company’s Strategic Rollup Strategy For Future $315 Billion Diagnostics Sector…(1)(2)

Avalon GloboCare Corp. (NASDAQ: ALBT) recently announced its acquisition of a 40% interest in Laboratory Services MSO, LLC (LSM), a premier clinical diagnostics and reference laboratory. The transaction marks the launch of Avalon’s new rollup strategy targeting toxicology and pharmacogenetic laboratories. (6)

Headquartered in Costa Mesa, California, LSM provides a wide range of diagnostic tests, including drug testing, toxicology, pharmacogenetics, and various test services, from general blood work to anatomic pathology. The laboratory also has a sophisticated and state-of-the-art facility for clinical diagnostics and reference laboratory.

The total consideration for the transaction was $21 million, with $9 million paid in cash, $11 million in shares of the Company’s Series B preferred stock, and $1 million in cash payable on February 9, 2024. The seller is also eligible to receive certain earnout payments upon achieving specific operating results, which could amount to $10,000,000. (6)

The parties entered into an operating agreement in connection with the transaction, which includes a pro-rata percentage of LSM’s net income. Additionally, Avalon has an exclusive option to purchase an additional 20% of LSM for $6 million in cash and $4 million in additional shares of the Company’s Series B preferred stock.

David Jin, M.D., Ph.D President and Chief Executive Officer of Avalon, stated that this transaction is expected to be accretive to earnings and will add strong clinical and rollup synergies to the existing Avalon portfolio and future growth plan. Dr. Jin also expressed excitement about the potential to acquire a controlling interest in LSM within the next nine months.

Avalon aims to leverage LSM’s experience and infrastructure to achieve significant synergies with respect to revenue growth and market shares by targeting laboratories with exceptional performance, positive revenue track records, and niche-market advantage.

Gold Price Outlook: Catalysts and Market Dynamics

AVALON GLOBOCARE CORP.

(NASDAQ: ALBT)

Avalon GloboCare Corp. (Nasdaq: ALBT) Expands Its Reach With Strategic Acquisition Of DE Laboratory… (22)

In a significant move that underscores its commitment to expansion and innovation, Avalon GloboCare Corp. (Nasdaq: ALBT) has announced the acquisition of DE Laboratory LLC, a reputable laboratory located in Houston, Texas. This strategic acquisition, executed by Avalon’s Laboratory Services MSO, LLC, presents a multitude of growth opportunities and solidifies Avalon’s presence within the dynamic landscape of laboratory testing and services. (22)

DE Labs has made its mark as a CLIA-certified and COLA-accredited laboratory, providing a comprehensive array of high-quality testing services. With a specialization in various crucial fields, including drug testing, genetic testing, urinary testing, and CV-19 PCR testing, DE Labs has emerged as a reliable destination for accurate diagnostics and analyses. Handling an impressive volume of 1,500 lab tests each month, the laboratory’s reputation for precision and efficiency has garnered the trust of both healthcare professionals and patients alike.

Avalon’s acquisition of DE Labs is not just a strategic decision, it’s a calculated move aimed at harnessing the vast potential for growth within the laboratory testing sector. The laboratory is now being operated as a wholly-owned subsidiary of LSM, with Avalon owning a substantial 40% interest in LSM. This ownership structure positions Avalon to leverage DE Labs’ expertise while contributing its own resources and insights to foster a symbiotic relationship.

One of the most compelling aspects of this acquisition is the planned expansion of DE Labs’ reach into the surrounding counties. With Avalon’s support, LSM is directing growth capital towards geographical expansion, allowing the laboratory to broaden its footprint and reach more individuals in need of its crucial testing services. This move aligns with Avalon’s overarching strategy of tapping into unique roll-up opportunities within the laboratory testing and services market, which is characterized by its fragmented nature.

David Jin, M.D., Ph.D., President and Chief Executive Officer of Avalon, highlighted the strategic significance of this acquisition. He emphasized, “Our strategy is to take advantage of a unique roll-up opportunity within the highly fragmented market for laboratory testing and services.” (22)

The aim is to identify laboratories with outstanding performance, proven revenue track records, and specialized advantages within niche markets. Through the integration of LSM’s operational experience and infrastructure, Avalon anticipates substantial synergies that will drive revenue growth and expand market share, solidifying its position as a key player in the laboratory services sector.

As the healthcare landscape continues to evolve, the role of laboratory testing in enabling accurate diagnostics, personalized treatment plans, and preventive care cannot be understated. The acquisition of DE Labs not only reflects Avalon GloboCare Corp. (Nasdaq: ALBT)’s commitment to innovation and expansion but also its dedication to contributing to advancements in healthcare delivery and patient outcomes.

Avalon GloboCare Corp. (Nasdaq: ALBT)’s acquisition of DE Laboratory LLC represents a pivotal move within the laboratory testing and services sector. This strategic decision capitalizes on the laboratory’s impressive track record, offering a wide spectrum of testing services, and positions Avalon for substantial growth. With an eye towards geographical expansion and synergistic collaboration, Avalon is poised to make a lasting impact on the healthcare industry, driving innovation and excellence in diagnostics and testing services. (22)

DIGGING DEEP

AVALON GLOBOCARE CORP.

(NASDAQ: ALBT)

Avalon GloboCare Corp. (NASDAQ: ALBT)’S Strategic Investment Pays Off: LSM Records $14.7 Million Revenue And $6.3 Million Net Income (1)

Avalon GloboCare Corp. (NASDAQ: ALBT) recently announced its financial results for Laboratory Services MSO, LLC (LSM) for the twelve months ending December 31, 2022. The company, headquartered in Freehold, New Jersey, reported impressive figures, with LSM achieving a revenue of $14.7 million and a net income of $6.3 million during the period. (1)

The financial highlights for LSM in 2022 demonstrate its strong performance and profitability. Avalon GloboCare Corp. (NASDAQ: ALBT)’s strategic investment in LSM, acquiring a 40% interest in February 2023, has been validated by these results. The collaboration with LSM, a premier clinical diagnostics and reference laboratory based in Costa Mesa, California, has proven to be a successful endeavor.

LSM offers an extensive range of diagnostic tests, including drug testing, toxicology, pharmacogenetics (PGx), as well as general blood work, anatomic pathology, and other specialized services. With its quick turnaround times and state-of-the-art facility, LSM has built a stellar reputation for customer service satisfaction.

David Jin, M.D., Ph.D., President, and Chief Executive Officer of Avalon GloboCare, expressed satisfaction with LSM’s financial performance, emphasizing the company’s goal to further grow LSM’s top and bottom line. Leveraging LSM’s expertise and infrastructure, Avalon GloboCare plans to capitalize on the highly fragmented market for laboratory testing and services by targeting laboratories with exceptional performance and niche-market advantages. The aim is to achieve significant synergies through a strategic rollup approach.

The future looks promising for Avalon GloboCare Corp. (NASDAQ: ALBT) and LSM, as their 40% profit-sharing arrangement with LSM is expected to result in significant future cash flow to the company. With a strong focus on expanding LSM’s operations and leveraging its experience and infrastructure, Avalon GloboCare aims to create further success within the clinical diagnostics and reference laboratory sector. (1)

LSM’s commitment to excellence and its broad portfolio of diagnostic tests, combined with Avalon GloboCare’s strategic vision, position the partnership for continued growth and success. With over 600,000 tests completed since its inception and two operational locations in California, LSM is well-positioned to make a lasting impact in the industry.

Avalon GloboCare Corp. (NASDAQ: ALBT) continues to make strides as a commercial stage company dedicated to developing and delivering innovative, transformative, precision diagnostics and clinical laboratory services. The company remains dedicated to driving growth and achieving synergies within the laboratory testing and services market. With its focus on strategic investments and the strong performance of LSM, Avalon GloboCare Corp. (NASDAQ: ALBT) is a company to watch closely as it navigates the rapidly evolving landscape of the healthcare industry. (1)

Avalon GloboCare Corp. (NASDAQ: ALBT) Inks Deal For

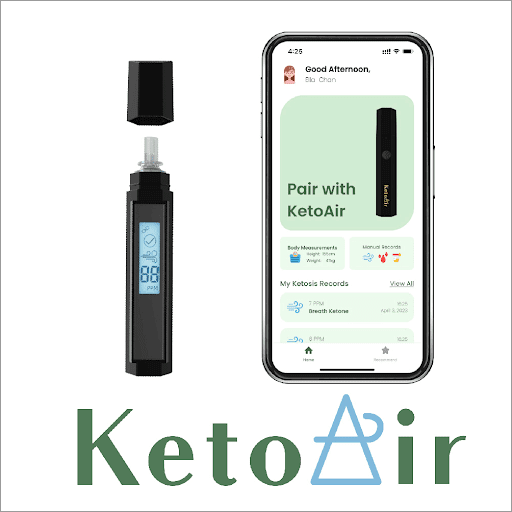

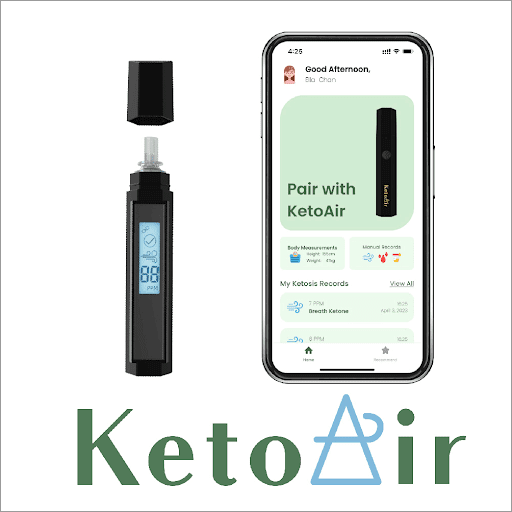

Breakthrough AI-Driven Breathalyzer (13)

Avalon GloboCare Corp. (NASDAQ: ALBT) recently announced a significant agreement with Qi Diagnostics Limited (Qi Diagnostics). This agreement grants Avalon exclusive distribution rights to market Qi Diagnostics’ groundbreaking KetoAir breathalyzer device and associated accessories, including future models. The distribution will cover North America, South America, the U.K., and the European Union. KetoAir functions as a companion diagnostic and monitoring device for ketogenic dietary management and will initially focus on the diabetes reversal and weight management markets. (13)

Qi Diagnostics is a renowned medical device company specializing in the development and manufacturing of proprietary Volatile Organic Compound (VOC) nanosensor-based in vitro diagnostic and screening devices. Their latest innovation, KetoAir, combines a breathalyzer with artificial intelligence (AI)-powered nutritionist consultation, providing invaluable support for ketogenic health management. Notably, KetoAir holds registration with the United States Food and Drug Administration, showcasing its compliance with regulatory standards.

In addition to the distribution agreement, Avalon GloboCare Corp. (NASDAQ: ALBT) and Qi Diagnostics have plans for a collaborative effort to co-develop a breathalyzer device aimed at screening and early detection of lung cancer. The companies will share joint ownership of any intellectual property resulting from this co-development.

Expressing his enthusiasm about the partnership, Dr. David Jin, President and CEO of Avalon GloboCare, stated, “We are very excited to partner with Qi Diagnostics to exclusively distribute KetoAir in key markets. Our initial focus will be on diabetes reversal and obesity management. Scientific evidence has increasingly demonstrated that nutritional ketosis is an effective and sustainable approach for reversing diabetes and managing weight. A properly implemented ketogenic diet has been clinically proven to lower blood sugar, enhance insulin sensitivity, and reduce inflammation.” (13)

Dr. Jin further emphasized the significance of KetoAir, stating, “KetoAir is the first breathalyzer on the market that combines an AI-powered nutritionist with a nanosensor-based breathalyzer for ketogenic health management. It detects and quantifies acetone levels in the breath, allowing users to monitor their ketosis state while receiving 24/7 nutritional advice. We are eager to bring KetoAir to the market and assist individuals with diabetes and weight management needs.” (13)

Although the parties intend to finalize a definitive agreement regarding the terms and pricing, there is no guarantee that such an agreement will be reached or deemed acceptable to Avalon GloboCare Corp. (NASDAQ: ALBT). Nonetheless, the collaboration between Avalon GloboCare and Qi Diagnostics holds great promise for advancing the field of ketogenic health management and potentially revolutionizing the way diabetes and weight management are approached. (13)

Avalon GloboCare Corp. (NASDAQ: ALBT) Secures 16 Patents For Revolutionary Medical Technologies (17)

Avalon GloboCare Corp. (NASDAQ: ALBT) has recently announced the issuance of a key U.S. patent by the United States Patent and Trademark Office (USPTO). The patent, numbered 11,555,060 and titled “QTY Fc Fusion Water Soluble Receptor Proteins,” was jointly filed with Dr. Shuguang Zhang of the Massachusetts Institute of Technology (MIT). This significant achievement expands Avalon’s intellectual property portfolio, showcasing its commitment to advancing medical technologies. (17)

The granted patent encompasses the composition of matter and methodology for multiple novel QTY-code modified cytokine and chemokine protein receptor molecules. At the core of this breakthrough is the “QTY Code,” a revolutionary technology developed in collaboration with MIT. This innovative platform has the remarkable ability to transform water-insoluble transmembrane receptor proteins into water-soluble proteins, significantly enhancing the solubility of designer peptides and proteins. As a result, the repertoire of selected therapeutic targets against cancers and other diseases is expanded, opening new avenues for medical advancements.

Dr. David Jin, President and Chief Executive Officer of Avalon GloboCare Corp. (NASDAQ: ALBT), expressed his satisfaction with the patent issuance, highlighting the company’s ongoing commitment to intellectual property development. With a total of 16 jointly filed patent applications, Avalon has established fruitful collaborations with esteemed partners, including top-tier universities, renowned research centers, and leading developers in the field. This strong portfolio reinforces Avalon’s position as an innovative contributor to medical advancements.

The QTY code protein design platform, developed in conjunction with Professor Shuguang Zhang’s laboratory at MIT, offers a transformative solution for working with water-insoluble proteins found within cellular membranes. By rendering these proteins water-soluble, the QTY technology enables their utilization in numerous clinical applications. Notably, soluble, antibody-like cytokine/chemokine decoy receptors derived through the QTY protein design hold great potential in various areas, including mitigating the “cytokine storm” associated with certain conditions and broadening the range of therapeutic targets addressable by advanced therapies. (17)

Dr. Jin concluded by emphasizing Avalon GloboCare Corp. (NASDAQ: ALBT)’s commitment to innovation and collaboration. In addition to the recently granted patent, the company has also made notable strides in other areas. For instance, Avalon GloboCare Corp. (NASDAQ: ALBT) has plans for a collaborative effort with Qi Diagnostics to co-develop a breathalyzer device aimed at screening and early detection of lung cancer. This collaboration will result in joint ownership of any intellectual property arising from the co-development, further highlighting Avalon’s dedication to advancing medical technologies and improving patient outcomes. (8)

“We are also pleased to submit a new patent application to the USPTO related to QTY glucose transporters, which are important cancer therapy targets. We believe using the QTY technology will accelerate our understanding of these proteins and the development of antibodies against them to treat cancer,”

Dr. Jin.(35)

AVALON GLOBOCARE CORP. (NASDAQ: ALBT) IN SUMMARY

Avalon GloboCare Corp. (Nasdaq: ALBT) has emerged as a company worth exploring for those interested in delving into the world of innovative healthcare and life sciences.

With its diverse range of cutting-edge technologies and strategic partnerships, Avalon GloboCare Corp. (Nasdaq: ALBT) is positioning itself as a key player in the rapidly evolving healthcare landscape.

Sources

- Source 1: https://finance.yahoo.com/news/avalon-globocare-reports-laboratory-services-130000718.html

- Source 2: https://www.precedenceresearch.com/clinical-laboratory-service-market

- Source 3: https://www.barchart.com/stocks/quotes/ALBT/price-history/historical

- Source 4: https://stockstotrade.com/low-float-stocks/

- Source 5: https://www.marketwatch.com/investing/stock/albt?mod=search_symbol

- Source 6: https://finance.yahoo.com/news/avalon-globocare-announces-closing-strategic-140000910.html

- Source 7: https://www.avalon-globocare.com/investors/sec-filings/all-sec-filings/content/0001213900-23-049645/0001213900-23-049645.pdf

- Source 8: https://www.avalon-globocare.com/investors/news-events/press-releases/detail/105/avalon-globocare-signs-agreement-with-qi-diagnostics-to

- Source 9: https://www.globenewswire.com/en/news-release/2023/01/17/2590028/0/en/Avalon-GloboCare-Announces-Issuance-of-Key-U-S-Patent-for-Multiple-Novel-QTY-Code-Modified-Cytokine-and-Chemokine-Protein-Receptor-Molecules.html

- Source 10: https://schrts.co/BYBJQHGr

- Source 11: https://d1io3yog0oux5.cloudfront.net/_cd572f6352352522e1b55add97a68f17/avalonglobocare/db/600/5017/pdf/ALBT+June+2023-Final.pdf

- Source 12: https://assets.technologynetworks.com/production/dynamic/images/content/328512/top-10-diagnostics-news-stories-of-2019-328512-960×540.jpg?cb=10499578

- Source 13: https://finance.yahoo.com/news/avalon-globocare-signs-agreement-qi-130000275.html

- Source 14: https://etimg.etb2bimg.com/photo/96983450.cms

- Source 15: https://qidiagnostics.com/wp-content/uploads/2023/04/KetoAir_%E5%B7%A5%E4%BD%9C%E5%8D%80%E5%9F%9F-1.jpg

- Source 16: https://medtechintelligence.com/wp-content/uploads/2022/12/FDA-Logo.jpg

- Source 17: https://www.avalon-globocare.com/investors/news-events/press-releases/detail/102/avalon-globocare-announces-issuance-of-key-u-s-patent-for

- Source 18: https://www.mit.edu/files/images/201807/15656704711_00457bd2c9_b_1.jpg

- Source 19: https://qidiagnostics.com/wp-content/uploads/2022/10/INOSE2-e1666587303668.png

- Source 20: https://www.investopedia.com/articles/stocks/05/042605.asp

- Source 21: https://www.investopedia.com/ask/answers/121214/what-are-best-indicators-identify-overbought-and-oversold-stocks.asp

- Source 22: https://finance.yahoo.com/news/avalon-laboratory-services-mso-acquires-130000942.html

- Source 23: https://www.alfascientific.com/wp-content/uploads/2017/03/IVD-testing.jpg

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors. Compensation: Pursuant to an agreement between Virtus Media LLC and Lifewater Media, Virtus Media LLC has been hired by Lifewater Media LLC for a period beginning on 02/10/2023 and ending 02/15/2023 to publicly disseminate information about NASDAQ: ALBT via digital communications. We have been paid fifteen thousand dollars USD. Pursuant to a further agreement between Virtus Media LLC and Lifewater Media LLC, Virtus Media has been hired for a period beginning on 10/18/23 and ending 10/20/23. We have been paid fifteen thousand USD.