{{brizy_dc_post_title}}

GBT Technologies Inc.’s AI driven-technology could reshape the world and potentially earn billions of dollars.

Build your watchlist with us

Get the latest stock ideas direct to your inbox. 100% free and your information stays with us.

4 Top Reasons Shrewd Individuals Will Consider GBT Technologies, Inc.

1) Right now GTCH is a tiny $5.2 million cap company (1/19/22) with an impressive IP portfolio that, once commercialized, has the potential to be worth multiple billions of dollars.

2) Society is reliant on medical devices and data to help track and analyze epidemics and pandemics. With FDA approval qTerm can disrupt a potential $23.5 billion medical device market.

3) Telemedicine is expected to rise by 38% over the next five years. This creates a massive opportunity for GBT’s qTerm and AI technologies. As The global Artificial Intelligence (AI) market size is expected to gain momentum by reaching USD $360.36 billion by 2028.

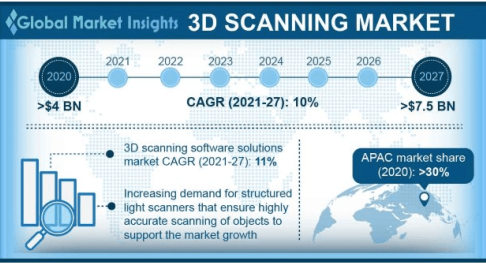

4) GBTs’ wireless motion detection patent application was approved for prioritized examination by the United States Patent and Trademark Office. This could help provide exclusive licensing in a potential $7.5 billion market.

Technology is evolving faster than our brains can keep up.

From wearable technology to smart homes to drones, everything we know, and love is being “disrupted” by the Internet of Things (IoT).

Today a small company called GBT Technologies Inc. (OTC PINK: GTCH) develops AI-driven technology primarily for the medical industry as well as military and commercial applications.

The GBT “difference” is their powerful Avant! AI program featuring the cognitive capabilities, and intelligence that empowers devices.

Right now they are working with the FDA(1) to get their technologies recognized as “medical devices” which has the potential to open many markets far and wide.

GBT Technologies, Inc.: The Little Company Where Big Dreams Become Reality

GBT Technologies is a development stage company focusing on the Internet of Things (IoT), Artificial Intelligence (AI) and Enabled Mobile Technology Platforms.

The company has assembled a team with vast technology expertise and is building an intellectual property portfolio that will get any tech lover’s heart racing.

Their mind-blowing Intellectual Property (IP) portfolio includes:

- 3D scanning and imaging

- AI personal health assistant

- Long range radio scanning

- Advanced nanometer designs

- Military remote tracking apps

- Smart microchip

GBT Technologies, Inc. Seeing Through Walls – How Much Is That Worth? How About a Possible $7.5 Billion!

Let’s start with perhaps the coolest of their projects. It combines 3-D technology with X-ray vision capabilities and it’s called Apollo.(7)

It’s a highly advanced motion detection system with realistic 3D graphics.

The Apollo system is based on radio frequency (“RF”) waves to track an entity’s motion and position in real time. RF signals bounce through entities and objects, then reflect back with changes.

An AI algorithm tracks and analyzes the reflected data, constructing a real time 3D video of the scanned area. Apollo can even distinguish between living entities and inanimate objects, working through barriers like walls, water, and soil.

Applying Augmented Reality (“AR”) technology within Apollo will also allow it to integrate or “speak with” a wide number of other applications.

Better still, Global Market Insights Inc., reports the market valuation of 3D scanning will cross an astonishing $7.5 billion by 2027.

1) Healthcare

2) Aerospace & Defense

3) Architecture & Engineering

4) Mining

5) Entertainment & Media

GBT Technologies, Inc.: Marquis Product qTerm: “Your Personal AI Medical Assistant” with a $23.5 Billion Potential.

Smart medical devices using IoT wireless technology are revolutionizing healthcare. These wearables can now link patients to doctors, transmitting critical medical data in real time.

It doesn’t matter where the patient is located. GBT Technologies’ qTerm is a smart thermometer and vital signs monitoring device that uses a thermal sensing system and unique Al technology.

Connected devices like qTerm offer a number of direct benefits to patients and providers perhaps three of the most important are:

Real-Time Patient Monitoring

More Personalized Care

Increased Safety

Their Pending FDA Approval Could Become a Huge Catalyst

“We plan to offer the technology for personal, hospitals and clinics usage and seeking to comply with the industry’s standards and regulations. FDA approval means that the FDA has formally approved the qTerm product to be safe and effective for market and sale in the U.S.” – Danny Rittman, CTO of GBT Technologies(1)

How big of a potential catalyst you ask? Game-changing is not even close to the right word.

According to a research report by Market Research Future (MRFR), the smart medical devices market is estimated to reach $23.50 billion by 2027 at a compound annual growth rate (CAGR) of 23.5%.(3)

Are you beginning to see the massive potential here? At a tiny $5.2 million market cap (1/19/22) just a measly 1% of that market could possibly catapult GTCH to some very impressive potential gains.

GBT Technologies, Inc.: With So Many Incredible Concepts in the Pipeline…Any One Can Set GTCH on Fire!

GBT has an impressive portfolio of forthcoming Intellectual Property that includes smart microchips, mobile application software, and supporting cloud software.(9)

What’s really exciting is that the company owns a patented self-learning and adaptive Integrated Circuit (IC), called GopherInsight™ that is targeted to be installed within IoT/Mobile Devices. These smart microchips communicate with each other via private, secured communications allowing for greater computing power, database management, and sharing functionalities between all devices.

The commercialization and potential uses are enormous.

Bringing the Power of Avant! AI to Healthcare & Optical Networks

Avant! AI is a Powerful Artificial Intelligence program designed to govern all GBT technology. It is capable of processing vast amounts of data efficiently and quickly. It is based on modern AI technologies including Deep Neural Network (DNN), vectorization and other advanced methodologies enabling usage for a multitude of applications that include tele-medicine and health industries, and the semiconductor and cyber security.

In fact, the company is currently enhancing its Avant! AI Technology to support the Healthcare advisory system. The system will address the needs of a new era of intelligent telemedicine, one that will assist patients and healthcare specialists through connected devices.

Avant! enhancement phase targets completion during the next few months, after which they will release a new version of both mobile and web applications.

Get the latest stock ideas direct to your inbox.

100% free and your information stays with us.

Enhanced Quality and Strong Security for Optical Networks

GTCH has begun researching implementation of AI methods for Optical Networks which aims to greatly improve performance, quality, reliability, and security. This includes AI based applications for optical network control, switching and management, including cloud scenarios evaluations, WDM (Wavelength Division Multiplexing) a fiber-optic transmission technique that enables the use of multiple light wavelengths/colors for sending data and 5G communications.

As the internet/cellular traffic has been exponentially growing, and more diversified services emerged, the capacity and reliability of optical networks have to expand accordingly. Better efficiency and flexibility are needed as many users access the network at the same time. Another crucial aspect is security to protect user’s data and privacy. GBT believes that implementing an AI management system for optical networks will provide our era’s desired properties of high performance, reliable and secured optical networking.

GBT Currently Holds 3 IP Patents in Asset Tracking, Logistics, Semiconductor and IOT Database Management

In conjunction with their patents, GBT has also secured a wide range of IP subsets in the areas of IC, artificial intelligence, AI, IOT database management, cyber security, radio technology, ID facial recognition systems by and other means, futuristic 3-D Multiplanar IC designs, wearable health device, robotic health devices, semiconductor application, EDA software, cutting-edge Technology (with alliances to new NFT market’s needs in form of technology) among other applications.

It’s no secret the smart money is already positioned for the Big Boom that’s coming…

We’re talking about a range of systems ready for marketplace applications or working prototypes including qTerm, AI Avant, IOT Database management, GPS less tracking, Honeycomb Encryption and EDA Software.

GTCH envisions this system as a creation of a global mesh network using advanced nodes and super performing new generation IC technology. The core of the system will be its advanced microchip technology; technology that can be installed in any mobile or fixed device worldwide. GBT’s vision is to produce this system as a low cost, secure, private-mesh-network between all enabled devices. Thus, providing shared processing, advanced mobile database management and sharing while using these enhanced mobile features as an alternative to traditional carrier services.

This just may be the company that can open a backdoor to a new trillion-dollar tech revolution for you…

GBT Technologies, Inc.: Could Be the Penny Stock to Fix Your Eyes on this Second

Look, no one could ever predict when or if any company is going to hit it big…but every once in a while, a humble penny stock like GTCH turns into a billion-dollar company.

In fact, here are three former penny stocks that had interested parties saying, “meh,” and now are dominant household names.

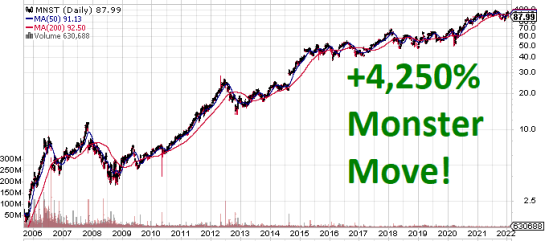

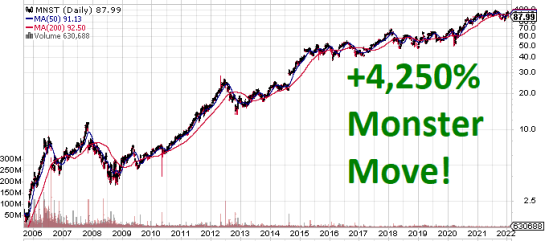

Monster Beverage Corpporation (NASDAQ: MNST)

In September 2005, shares were trading as low as $2 per share. Fast-forward 17 years later and Monster is currently trading at about $87.

That's a 4,250% move!

Amazon (NASDAQ: AMZN)

When this tech giant debuted on the market on June 18,1997, it traded for $1.52 per share. Right now, it’s over $3,150 per share.

Just no words for this one!

Listen, I’m not saying that GTCH is going to soar to over $1,000 a share, but we all know these companies above made a lot of people “overnight” millionaires. As technology becomes more ingrained into every aspect of life – work, play and everything in between – GBT Technologies, Inc. is developing even better technologies than the ones that previously delivered explosive growth.

So it may be AI-wise idea to get GTCH on your radar today.

Sources

Source 1: https://www.globenewswire.com/en/news-release/2021/01/12/2156859/0/en/GBT-Seeks-FDA-Approval-for-its-qTerm-Device.html

Source 2: https://www.globenewswire.com/news-release/2021/12/28/2358432/0/en/GBT-GRANTED-Patents-IP-Intellectual-Property-Update.html

Source 3: https://www.mpo-mag.com/contents/view_breaking-news/2021-10-19/smart-medical-devices-market-worth-2350b-by-2027/

Source 4: https://www.fiercehealthcare.com/sponsored/rapid-advances-digital-and-remote-health-are-changing-care-delivery-landscape

Source 5: https://www.globenewswire.com/news-release/2021/09/16/2298078/0/en/Artificial-Intelligence-AI-Market-to-Hit-USD-360-36-Billion-by-2028-Surging-Innovation-in-Artificial-Internet-of-Things-AIoT-to-Augment-Growth-Fortune-Business-Insights.html

Source 6: https://www.globenewswire.com/news-release/2021/04/05/2204145/0/en/3D-Scanning-Market-revenue-to-cross-USD-7-5-Bn-by-2027-Global-Market-Insights-Inc.html

Source 7: https://www.apollo.io/companies/GBT-Technologies-Inc-/5e573f316d127c0001d1f61d?chart=count

Source 8: http://qterm.me/

Source 9: https://gbtti.com/technology/

Source 10: https://www.globenewswire.com/news-release/2021/12/28/2358432/0/en/GBT-GRANTED-Patents-IP-Intellectual-Property-Update.html

Source 11: https://stockcharts.com/h-sc/ui?s=MNST

Source 12: https://finance.yahoo.com/quote/MNST/history?p=MNST

Source 13: https://stockcharts.com/h-sc/ui?s=AAPL

Source 14: https://finance.yahoo.com/quote/AAPL/history?p=AAPL

Source 15: https://stockcharts.com/h-sc/ui?s=AMZN

Source 16: https://finance.yahoo.com/quote/AMZN/history?p=AMZN

Disclaimer

Stock Research Today is a project of Dadmin Capital LLC and intended solely for entertainment and informational purposes. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/. This website / media webpage is owned, operated and edited by Dadmin Capital LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Dadmin Capital” refers to Dadmin Capital LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and promote small public companies. By reading our website / media webpage you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our website / media webpage .We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website / media webpage are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. Dadmin Capital business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors. We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Dadmin Capital. often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Compensation – Pursuant to an agreement between Dadmin Capital LLC and TD Media LLC, Dadmin Capital LLC has been hired for a period beginning on 2/2/22 and ending after two business days to publicly disseminate information about (OTC PINK: GTCH) via digital communications. We have been paid eleven thousand five hundred USD via ACH Bank Transfer. Pursuant to an agreement between Dadmin Capital LLC and TD Media LLC, Dadmin Capital LLC has been hired for a period beginning on 2/22/22 and ending after 3 business days to publicly disseminate information about (NASDAQ: GTCH) via digital communications. We have been paid seven thousand five hundred USD via ACH Bank Transfer. Social Media Compensation – Pursuant to an agreement between Dadmin Capital LLC and Social Media Outlet, Dadmin Capital LLC has hired Social Media Outlet for a period beginning on 2/3/22 and ending after one business day to publicly disseminate information about (OTC: GTCH) via digital communications. We have paid this Social Media Outlet two hundred fifty USD via ACH Bank Transfer. Pursuant to an agreement between Dadmin Capital LLC and Social Media Outlet, Dadmin Capital LLC has hired Social Media Outlet for a period beginning on 2/2/22 and ending after one business day to publicly disseminate information about (OTC: GTCH) via digital communications. We have paid this Social Media Outlet five hundred USD via ACH Bank Transfer. Pursuant to an agreement between Dadmin Capital LLC and Social Media Outlet, Dadmin Capital LLC has hired Social Media Outlet for a period beginning on 2/1/22 and ending after one business day to publicly disseminate information about (OTC: GTCH) via digital communications. We have paid this Social Media Outlet one thousand USD via ACH Bank Transfer. Pursuant to an agreement between Dadmin Capital LLC and Social Media Outlet, Dadmin Capital LLC has hired Social Media Outlet for a period beginning on 2/25/22 and ending after one business day to publicly disseminate information about (NASDAQ: GTCH) via digital communications. We have paid this Social Media Outlet five hundred USD via ACH Bank Transfer. Pursuant to an agreement between Dadmin Capital LLC and Social Media Outlet, Dadmin Capital LLC has hired Social Media Outlet for a period beginning on 2/22/22 and ending after five business days to publicly disseminate information about (NASDAQ: GTCH) via digital communications. We have paid this Social Media Outlet one thousand USD via ACH Bank Transfer. Pursuant to an agreement between Dadmin Capital LLC and Social Media Outlet, Dadmin Capital LLC has hired Social Media Outlet for a period beginning on 2/22/22 and ending after five business days to publicly disseminate information about (NASDAQ: GTCH) via digital communications. We have paid this Social Media Outlet two hundred fifty USD via ACH Bank Transfer.