What Could Potential FDA Approval Mean for This Little-Known Biotech Stock in Early 2024?

Dawson James Analyst Jason Kolberts’ $10.00 target could mean potential upside of 1,198% for Citius Pharmaceuticals, Inc. (Nasdaq: CTXR) right after bouncing off its 52-week low of $.77 cents on 12/30/22 according to Barchart.com’s price history.

7 Reasons why Citius Pharmaceuticals, Inc. (Nasdaq: CTXR) could witness unstoppable growth in 2024.

Citius Pharmaceuticals, Inc. (Nasdaq: CTXR)

Citius Pharmaceuticals, Inc. (Nasdaq: CTXR) Gets $10.00 Target From Dawson James Analyst Jason Kolberts.

Jason Kolberts is no stranger to the biotech and pharmaceutical industries.

He’s actually the Director of Research at Dawson James Securities, Inc.

And for those who don’t know, Dawson James is a full-service boutique investment banking firm focused on emerging growth companies since 2004 and committed to helping clients navigate the healthcare, biotechnology and technology markets.

Jason Kolberts’ career began as a chemist in the pharmaceutical industry and evolved into a product and marketing manager with Schering-Plough in Japan. Upon returning from Japan, Jason joined Salomon Smith Barney, as a research associate which has now evolved into a 20-year career on Wall Street as a leader in the Healthcare space.

Kolberts’ coverage expands across multiple therapeutic areas in biotechnology, specialty pharmaceuticals, and medical devices. As an analyst Jason has developed a high level of expertise in oncology, virology and cell-based medicine such as CAR (Chimeric Antigen Receptor)-T cells and regenerative medicine (stem cells).

Prior to joining Dawson James, Mr. Kolbert spent the prior year as a senior biotechnology analyst at HC Wainwright and spent the previous seven years at the Maxim group, where he was an Executive Managing Director and the Head of Healthcare Research at the firm. During this period Jason and his team covered 80 names across the healthcare vertical. Jason’s Wall Street career began with seven years at Citi Group followed by several years on the buy side as a portfolio manager with the Susquehanna International Group.

One company that seems to have caught the eye of Jason Kolbert is Citius Pharmaceuticals, Inc. (Nasdaq: CTXR).

Mr. Kolbert has a $10.00 target on Citius Pharmaceuticals, Inc. (Nasdaq: CTXR).

This could mean a potential upside of 1,198% for Citius Pharmaceuticals, Inc. (Nasdaq: CTXR) after a recent bounce off its 52-week low of $.77 cents on 12/30/22 according to Barchart.com’s price history.

Non-Hodgkin’s Lymphoma is one of the deadliest forms of cancer.

Targeting your body’s germ-fighting immune system, it invades your body’s lymph nodes. Left unchecked, it can kill more than 1-in-3 of those diagnosed, with over a half-million new cases each year.

But one company could be set to change all that …

Flying well under the radar, Citius Pharmaceuticals (NSDQ: CTXR) has quietly acquired the rights to the experimental compound “E-7777,” a direct improvement to a previously FDA-approved medication that directly attacks infected cancer cells inside the human body.

And this new cancer-fighting remedy could be mere months away from its own approval.

If and when it hits the market, this new treatment could provide a whole new proven alternative to the harsh side effects of chemotherapy or aggressive radiation treatment.

Directly targeting and attacking infected cells, E-7777 could transform the $3.5 Billion market for Non-Hodgkin’s Lymphoma treatment. The anticipated PDUFA action date is July 28, 2023.

The best part of this whole story? This is just one of several potentially game-changing new therapies in the company’s pipeline …

THE TRADE OPPORTUNITY

Here’s How Mino-Lok Could Help With Another $1.5 Billion Medical Crisis:

Mino-Lok is an antibiotic designed to treat patients with catheter-related bloodstream infections (CRBSIs). At present, these infections are treated by removing the catheter and prescribing antibiotics.

This is a costly medical process with potential complications. In fact, studies show that removal and reinsertion of CVCs have a 15% to 20% complication rate, including pneumothorax, misplacement, and arterial puncture.

Mino-Lok allows doctors to treat the infection without needing to remove the catheter, avoiding both costs and complications. It’s a simple, prescription solution to another $3.5 Billion problem.

Currently, in Phase 3 pivotal trials, it could be approved in a matter of months …

According to CEO Myron Holubiak:

“Data from the Mino-Lok® (M-L) Phase 3 program was reviewed by our independent Data Monitoring Committee (DMC) for safety and efficacy and found to be progressing as planned with no recommended changes to trial design.”

Mino-Lok has reportedly performed well to date

- Mino-Lok is the first and only therapy under investigation to salvage infected CVCs.

- In a Phase 2b trial, the Mino-Lok product demonstrated a 100% efficacy rate in salvaging colonized CVCs.

- Mino-Lok had no significant adverse events compared to an 18% serious adverse event rate when infected CVCs were removed and replaced.

- FDA Fast Track with QIDP designation and patent protection until June 2024. Formulation patent protection until November 2036.

- Currently in a Phase 3 pivotal superiority trial.

Meanwhile, Citius’ “Mino-Wrap” Could Revolutionize $400 Million Post-Mastectomy Infection Prevention Market

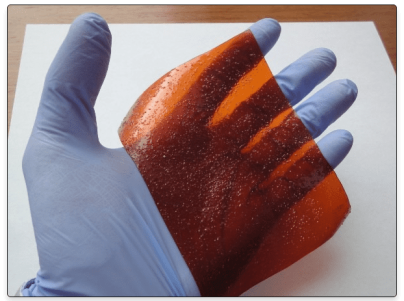

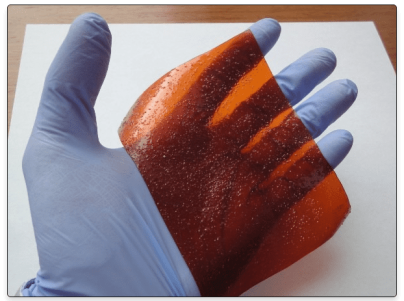

Citius’ Mino-Wrap could help reduce post-operative infections associated with surgical implants. Its gel-containing film is used primarily to wrap the tissue expander used in breast reconstructive surgeries.

As also noted by CEO Holubiak:

“We believe that this serious condition impacts about 100,000 women in the U.S. and many more in the rest of the world. Mino-Wrap is a bio-absorbable, antimicrobial semi-solid film that is wrapped around a tissue expander and placed in the surgical pocket following a mastectomy to prevent post-surgical infections. Once implanted, Mino-Wrap slowly dissolves in situ for a specified period of time, providing extended protection against infection.”

Program Highlights

- Potential to be first and only FDA-approved product to prevent infections associated with post-mastectomy breast implants

- Currently in pre-clinical development

- Development in partnership with The University of Texas MD Anderson Cancer Center and support from medical thought leaders

Offering Relief in an $80 Million Hemorrhoids Market

Shockingly, there are no FDA-approved prescription products for hemorrhoids at the moment.

However, that could soon change with Citius’ halobetasol and lidocaine formulations.

Hemorrhoids are an uncomfortable and often recurring condition. However, despite the numerous prescription and over-the-counter (OTC) products commonly used to treat hemorrhoids, none possess the necessary safety and efficacy data generated from rigorously conducted clinical trials.

Citius believes its halobetasol-lidocaine product could one day become that go-to treatment for physicians wanting to provide patients with a therapy demonstrating safety and efficacy.

Program Highlights

- There are no FDA-approved prescription products on the market for hemorrhoids

- Citius’ halobetasol and lidocaine formulation could become the first FDA-approved prescription product to treat hemorrhoids in the United States

- According to IMS, over 25 million units of topical combination prescription products for are sold in the US

Citius Pharmaceuticals (NSDQ: CTXR) Could Even Help Treat ARDS, Too

• There are about three million cases of Acute Respiratory Distress Syndrome (ARDS) globally, with approximately 200,000 instances just in the U.S.

• The health crisis significantly added to the amount of ARDS cases, with death rates among patients on ventilators as high as 50%.

• Worse, at the moment, there are no approved treatments for ARDS.

According to Citius CEO Holubiak:

“Currently, there is no FDA-approved drug therapy for ARDS. We plan to submit an IND to the FDA and initiate our Phase 1 study by the end of the second quarter of 2022. Our first-in-human clinical trial is entitled “i-MSCs in Subjects with Acute Respiratory Distress Syndrome (ARDS) Due to [the health predicament]: i-MARCO.” Following the completion of a multi-center Phase 1 pilot study, we would expect to proceed on to a double-blinded, randomized Phase 2/3 trial to demonstrate the safety, efficacy, and multimodal healing capabilities of our i-MSCs in patients with moderate to severe ARDS due to [the health predicament].”

Program Highlights

• Novel stem cell therapy for the treatment of acute inflammatory respiratory disorders including acute respiratory distress syndrome (ARDS)

• i-MSCs derived from induced pluripotent stem cell reprogrammed using proprietary mRNA process

• No FDA-approved treatment for ARDS exists today

• Preclinical activities are underway

$5.5 Billion in Potential Market Disruption (From a $220 Million Company)

As you’ve seen today, some of the treatments in Citius Pharmaceuticals’ portfolio go far beyond the definition of “Cutting Edge” …

Mino-Lock could potentially erase the need to operate on those suffering from Catheter-Related Bloodstream Infections (CRBIs), revolutionizing treatment of a $1.5 Billion medical problem overnight. E-7777 could offer a powerful new alternative to those suffering from Non-Hodgkin’s Lymphoma.

Combined with a full pipeline of other treatments, Citius Pharmaceuticals could be sitting on top of $5.5 Billion in cumulative pharmaceutical market disruption…

With over 5 years of “cash runway” left to complete critical Research & Development, along with the outrageous profit potential if even one of these treatments makes it to market, Citius Pharmaceuticals (NSDQ:CTXR) is a company that should definitely be on your radar.

Latest News

Citius Pharmaceuticals - May 21, 2024

Citius Pharmaceuticals - May 14, 2023

Sources

https://www.prnewswire.com/news-releases/citius-receives-positive-fda-feedback-on-its-submitted-plan-to-study-catheter-compatibility-for-mino-lok-therapy-301069349.html

Source 2: https://www.prnewswire.com/news-releases/citius-pharmaceuticals-to-highlight-its-phase-3-clinical-trial-product-mino-lok-at-benzinga-biotech-small-cap-conference-on-march-25-301253709.html

Source 3: https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4093967/

Source 4: https://www.citiuspharma.com/opportunity/crbsis/

Source 5: https://www.everydayhealth.com/things-your-doctor-wont-tell-about-hospital-infections/

Source 6: https://www.gurufocus.com/news/697235/citius-announces-united-states-patent-trademark-office-registered-the-companys-minolok-trademark

Source 7: https://www.citiuspharma.com/mino-lok/

Source 8: https://www.citiuspharma.com/wp-content/uploads/2021/02/CTXR_Shareholder_Letter_Feb2021.pdfEditSign

Source 9: https://www.citiuspharma.com/mino-wrap/

Source 10: https://stockcharts.com/h-sc/ui?s=ctxr

Source 11: https://www.barchart.com/stocks/quotes/CTXR/opinion

Source 12: https://www.citiuspharma.com

Source 13: https://d1io3yog0oux5.cloudfront.net/_335875ea4142d81b5406df99d97e4cdf/citiuspharma/db/249/1064/pdf/3.19.2021.WEB.Presentation_Final.pdfEditSign

Source 14: https://www.citiuspharma.com/wp-content/uploads/2021/02/CTXR_Shareholder_Letter_Feb2021.pdfEditSign

Source 15: https://www.citiuspharma.com/mino-wrap/

Source 16: https://www.citiuspharma.com/halo-lido/

Source 17: https://ir.citiuspharma.com/press-releases/detail/122/citius-pharmaceuticals-signs-an-exclusive-worldwide

Source 18: https://citiuspharma.com/pipeline/mino-lok/default.aspx

Source 19: https://citiuspharma.com/pipeline/mino-wrap/default.aspx

Source 20: https://www.citiuspharma.com/halo-lido/#:~:text=There%20are%20no%20FDA%2Dapproved,hemorrhoids%20in%20the%20United%20States

Source 21: https://citiuspharma.com/pipeline/stem-cell-platform/default.aspx

Source 22: https://www.cancer.net/cancer-types/lymphoma-non-hodgkin/statistics#:~:text=The%20overall%205%2Dyear%20survival,survival%20rate%20is%20around%2063%25.

Source 23: https://pubmed.ncbi.nlm.nih.gov/30895415/

Source 24: https://www.nuventra.com/resources/blog/why-do-clinical-trials-fail/#:~:text=This%20means%20that%20around%202,3%20fail%20to%20reach%20approval.

Source 25: https://www.google.com/search?rlz=1C1CHBF_enUS977US977&q=NASDAQ:+CTXR&stick=H4sIAAAAAAAAAONgecRowS3w8sc9YSn9SWtOXmPU5OIKzsgvd80rySypFJLmYoOyBKX4uXj10_UNDZOSzSxLDLIzeBax8vg5Brs4BlopOIdEBAEAzts1gUwAAAA&sa=X&ved=2ahUKEwi9i77gz8r0AhV1SzABHY-TBrkQsRV6BAg0EAM&biw=1536&bih=792&dpr=1.25

Source 26: https://simplywall.st/stocks/us/pharmaceuticals-biotech/nasdaq-ctxr/citius-pharmaceuticals/news/we-think-citius-pharmaceuticals-nasdaqctxr-can-afford-to-dri-1

Source 27: https://simplywall.st/stocks/us/pharmaceuticals-biotech/nasdaq-ctxr/citius-pharmaceuticals#intrinsic-value

Source 28: https://github.com/SimplyWallSt/Company-Analysis-Model/blob/master/MODEL.markdown#value

Source 29: https://finance.yahoo.com/quote/CTXR/history?p=CTXR

Source 30: https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6609997/

Source 31: https://www.biospace.com/article/catheter-related-bloodstream-infections-market-rise-in-prevalence-of-bloodstream-infection-is-projected-to-drive-the-global-market

Source 32 : https://dawsonjames.com/wp-content/uploads/2022/12/CTXR.12.23.22_-final1.pdf

Source 33 : https://www.barchart.com/stocks/quotes/CTXR/price-history/historical

Source 34 : https://finance.yahoo.com/news/citius-pharmaceuticals-inc-announces-u-123000919.html

Source 35 : https://finance.yahoo.com/news/citius-pharmaceuticals-inc-reports-fiscal-213000115.html

Source 36 : https://www.prnewswire.com/news-releases/citius-pharmaceuticals-to-accelerate-phase-3-mino-lok-trial-by-expanding-trial-sites-internationally-301541596.html

Source 37 : https://www.prnewswire.com/news-releases/citius-pharmaceuticals-announces-a-clinical-collaboration-with-the-university-of-pittsburgh-to-evaluate-t-reg-cell-depletion-with-iontak-e7777-in-combination-with-pembrolizumab-in-recurrent-or-metastatic-solid-cancer-tumors-in–301631592.html

Source 38 : https://dawsonjames.com/wp-content/uploads/2019/06/KolbertDORPRFinal.pdf

Source 39 : https://schrts.co/fUAydCuY

Source 40 : https://njbmagazine.com/monthly-articles/njs-burgeoning-biotech-industry/

Source 41 : https://www.thebalancemoney.com/triangle-chart-patterns-and-day-trading-strategies-4111224

Source 42 : https://mma.prnewswire.com/media/1593817/Citius_Logo.jpg?p=facebook

Source 43 : https://s28.q4cdn.com/169506891/files/doc_presentation/2022/12/Corporate-Overview-December-2022-FINAL.pdf

Source 44 : https://www.marketwatch.com/investing/stock/ctxr?mod=search_symbol

Source 45 : https://www.prnewswire.com/news-releases/citius-pharmaceuticals-inc-secures-3-6-million-through-new-jersey-economic-development-program-301683193.html

Source 46 : https://www.prnewswire.com/news-releases/citius-pharmaceuticals-announces-a-clinical-collaboration-with-the-university-of-pittsburgh-to-evaluate-t-reg-cell-depletion-with-iontak-e7777-in-combination-with-pembrolizumab-in-recurrent-or-metastatic-solid-cancer-tumors-in–301631592.html

Source 47 : https://www.pitt.edu/sites/default/files/styles/tier_one_hero/public/2021-07/mission-t1-cl-top-aerial.jpg?h=2c66ef4f&itok=YlGwAwOr

Source 48 : https://pbs.twimg.com/media/FmDiCOXXEAEcTfc?format=jpg&name=large

Source 49: https://www.adva.com/-/media/adva-main-site/about-us/investors/financial-results/financial-statements/financial-statements.jpg?rev=c7ba9b4d5faa4f73aecf63165df2b1a2

Source 50: https://citiuspharma.com/about/management-team/default.aspx

Source 51: https://finance.yahoo.com/news/citius-pharmaceuticals-achieves-primary-secondary-110000306.html

Source 52: https://finance.yahoo.com/news/citius-pharmaceuticals-inc-reports-fiscal-200500315.html

Disclaimer

Stock Research Today is a project of Dadmin Capital LLC and intended solely for entertainment and informational purposes. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/. This website / media webpage is owned, operated and edited by Dadmin Capital LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Dadmin Capital” refers to Dadmin Capital LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and promote small public companies. By reading our website / media webpage you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our website / media webpage .We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website / media webpage are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. Dadmin Capital business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors. We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Dadmin Capital. often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Compensation - Pursuant to an agreement between Dadmin Capital LLC and TD Media LLC, Dadmin Capital LLC has been hired for a period beginning on 12/08/21 and ending after 3 business days to publicly disseminate information about (NASDAQ: CTXR) via digital communications. We have been paid seven thousand five hundred USD via ACH Bank Transfer. Pursuant to an agreement between Dadmin Capital LLC and TD Media LLC, Dadmin Capital LLC has been hired for a period beginning on 5/4/22 and ending after 2 business days to publicly disseminate information about (NASDAQ: CTXR) via digital communications. We have been paid eleven thousand five hundred USD via ACH Bank Transfer. Pursuant to an agreement between Virtus Media LLC and Lifewater media LLC, Virtus Media has been hired for a period beginning on 2023-03-07 and ending after 2023-03-10 to publicly disseminate information about NASDAQ: CTXR. We have been paid fifteen thousand dollars USD via ACH Bank Transfer. Pursuant to an agreement between Virtus Media LLC and Bullseye Media Virtus Media LLC has been hired to publicly disseminate information about (NASDAQ: CTXR) via digital communications for a period of one day beginning and ending on 5/21/24. We have been paid nine hundred USD. Pursuant to an agreement between Virtus Media LLC and social media contractor, social media contractor has been paid four hundred USD to publicly disseminate information about NASDAQ: CTXR via digital communications. Pursuant to an agreement between Virtus Media LLC and social media contractor, social media contractor has been paid one hundred USD to publicly disseminate information about NASDAQ: CTXR via digital communications. Pursuant to an agreement between Virtus Media LLC and social media contractor, social media contractor has been paid one hundred USD to publicly disseminate information about NASDAQ: CTXR via digital communications.