NASDAQ: FLGC

This Cannabis Company Looks Set to Explode 5x Higher in 2022

With the lowest production cost in the world, and revenues screaming higher Flora Growth Corp. must get on your radar today!

Build your watchlist with us

Get the latest stock ideas direct to your inbox. 100% free and your information stays with us.

The Top 5 Reasons To Be High on Flora Growth Corp.

1) Analysts believe that Flora Growth Corp. (NASDAQ: FLGC) stock could be surprisingly undervalued with a 5x upside potential.

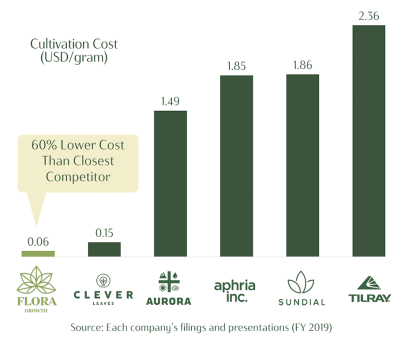

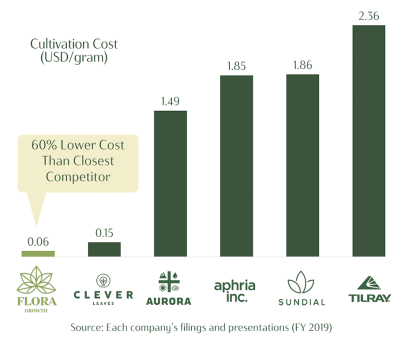

2) The company boasts the world’s lowest production costs for dried flower creating a much broader cushion for excellent profit margins.

3) The company’s revenues are sharply on the rise since going public in 2020.

4) Flora Growth Corp. (NASDAQ: FLGC) has a solid international presence and a quickly expanding portfolio of new clients.

5) With the launch of Munzhi, Flora Growth Corp. (NASDAQ: FLGC) is in prime position to capture a large chunk of the $3.31 billion Colombian wellness market.

The U.S. cannabis industry is growing at an unparalleled pace. Sales for 2021 are estimated to finish at $31 billion, an increase of 41% over 2020. And yet, despite this positive sales growth, cannabis stocks slumped in the second half of 2021.

Think about it. Sales up, revenues up, growth flourishing – stock prices down?

This screams opportunity! And Flora Growth Corp (NASDAQ: FLGC) is a perfect example. In fact, not one but two Wall Street analysts believe Flora could be unreasonably undervalued.

After reaching a high of $21.45 on Aug 16, 2021, Flora appears to have been caught up in the extreme undertow that bashed the Global Cannabis Stock Index down from $55.91 on Aug 13, 2021 to $32.11 on Dec 20, 2021.

But whoever said the market runs on logic and not emotions?

Flora Growth Corp (NASDAQ: FLGC): Boasts a Sizeable Advantage with Its Strong International Presence

What makes Flora such a compelling and unique company is the fact that they have tossed their net far and wide. While many cannabis companies rely heavily on the sometimes lumbering approval processes in Canada and the United States, Flora is playing it smart by planting their seeds in the global marketplace as well.

For example, Flora is keeping the wheels of revenue moving with orders for its Mind Naturals and Awe CBD skincare brands for the Spanish and Mexican markets.

The European cannabis market stands at $4.96 billion and is expected to reach $13.37 billion by 2026. While the Mexican market is reported to be between 1.8 and 2 billion U.S. dollars.

That’s why the company expects second half 2021 revenues to come in between $9 million and $11 million, trouncing 1H20, which saw just $100,000.

Flora Growth Corp (NASDAQ: FLGC): Developing AI-Powered Compounds to Address Chronic Pain

There’s absolutely no question at this point in time, the continued trend of medical and adult-use cann-a-bis legalization rapidly sweeping across the globe.

Meet Flora Lab. According to company CEO Luis Merchan, “Our objective is to create and leverage a proprietary dr-ug development platform in collaboration with an artificial intelligence and machine learning group to identify new bioactive compounds within the cann-a-bis plant that interact with certain gene targets responsible for specific disease states and conditions.”

Flora Lab is actively participating in a study on the use of cannabinoids in patients suffering from Fibromyalgia or chronic pain, with the primary research sites located in the United States and the United Kingdom.

Flora Growth Corp. (NASDAQ: FLGC) is Quickly Expanding

At the moment, Flora Growth is targeting transactions to complete the supply chain via key infrastructure to enhance its global distribution with the aim to compete on low-cost, high-quality inputs paired with premium brands that create business lines with robust margins.

Most recently, the company signed a Letter of Intent to acquire 100% of the outstanding equity interests of Switzerland based Koch & Gsell and its wholly-owned hemp brand, Heimat.

In fact, according to a recent company press release:

“The Heimat brand, if acquired, will represent a substantive addition to the Flora brand portfolio as a high growth brand, with trailing twelve-month revenues of US$7.6M. Pursuant to the terms of the LOI and subject to the definitive acquisition agreement and approvals, upon the closing of the transaction, Flora will also invest CHF 2 million (Swiss Francs), or approximately US$2.2M, to rapidly grow the Heimat brand into new markets and to strengthen Heimat’s position in the Swiss market. Further, by leveraging Koch & Gsell’s existing distribution network, Flora plans to introduce its brand portfolio, including Mind Naturals, Mambe, and Almost Virgin, to the Swiss and European market.”

The company also just announced it signed a Letter of Intent for the purpose of making an initial strategic equity investment of €2M (two-million Euros) into the European cannabis company, Hoshi International Inc.

“This initial investment into Hoshi is the first of many steps by Flora to advance its plans to launch Flora-branded products across the world,” said Luis Merchan, CEO of Flora. “We believe in backing strong teams with proven track records and creating synergistic relationships where core competencies have minimal overlap. The Hoshi team has built a fantastic base in Europe and by utilizing our low-cost, high-potency product and established brands, it allows both of our organizations to have a competitive edge as the European cannabis market continues to grow rapidly.”

Hoshi is positioned to become a leading vertically integrated medical cannabis company in Europe. Hoshi was founded by a group of cannabis entrepreneurs who have built and scaled several cannabis businesses in the highly regulated cannabis market in Canada. Flora’s proposed investment into Hoshi will establish Flora as a preferred strategic supplier to Hoshi’s two EU processing facilities, located in Malta and Portugal.

Argus Research Sees a Very Bright Future for the Company

In a July 21, 2021 report, Argus Research company reported the following:

Flora Growth is well capitalized, with $30 million in proceeds from a December 2020 private financing, $16.6 million in IPO proceeds, and the expected infusion of more than $20 million from the exercise of warrants.

We forecast revenue of 9 million in 2021 and $32 million in 2022, excluding the impact of recently announced transactions. We expect annual revenue growth to exceed 100% over the next two years as Flora expands its cultivation and extraction capabilities; broadens its consumer product portfolio; brings its manufacturing facility online; and expands into new markets, most notably in Europe.

We expect Flora to emerge as an important cultivator and global supplier of quality cannabis given its significant cost advantages.

Reduced Costs Gives the Company a Huge Competitive Advantage

What many people don’t realize is that cannabis is a specialty cut flower, and Colombia is the number one producer of flowers in the world and the number two largest exporter of flowers behind the Netherlands.

As a result, Flora is able to produce dry flower at a significantly lower cost than most growers. Its production cost of approximately $0.06 per gram compares with costs that can exceed $1.00 per gram in certain parts of North America.

Reduced Costs Gives the Company a Huge Competitive Advantage

Colombia boasts excellent favorable economic conditions, in the fact that the agricultural skilled labor is about 9x more cost effective than the United States. This includes much lower production costs that include utilities and water.

What’s even more amazing is that Flora’s costs are also lower than those of its Colombian peers. (the closest currently producing at $0.15 per gram).

That said, management estimates that Flora’s all-in costs, including packaging and transportation, are closer to peer average costs for cultivation alone, and significantly lower than the all-in costs of growers in other regions.

Get the latest stock ideas direct to your inbox.

100% free and your information stays with us.

Reduced Costs Gives the Company a Huge Competitive Advantage

While Colombia was once infamous for its illicit drug trade, the country has now become a hotbed for agricultural businesses which include everything from coffee to bananas and cut flowers. Roughly 5 years ago, the Colombian government signed the 1787 bill into law. Law 1787 was created to regulate the use of medicinal cannabis and its trade in the country.(4)

This was spearheaded by Flora’s Strategic Advisor Juan Manuel Galán, who at the time served as a former senator of Colombia.

In a May 2020 interview, Galán said,

“I was a Senator for three periods for 12 years in total. In the last period of my tenure, I proposed the law that established all the norms for legalizing cann-a-bis for medical use. And during those years I also tried to put forward a debate to find new policies and not having this same policy that we’ve been applying for 50 years.”

By passing this new law, Colombia joined a slew of other countries looking to explore the potential advantages of using cannabis as an alternative to pharmaceuticals.

Colombia truly is Flora Growth’s (NASDAQ: FLGC) secret to pursuing the role of becoming one of the biggest players in the industry.

“Given its cost advantages, we believe Colombia is positioned to become a major global export hub for cannabis, particularly if producers pursue EU GMP-compliant operating practices.“

– Canaccord Genuity

The Cosechemos cultivation farm, Flora’s core division, is located in Bucaramanga, Colombia, and is licensed to cultivate 247 acres (100 hectares) of cannabis.

With Cosechemos’ demonstrated low production costs, Flora is ready to sell high-quality cannabis at competitive prices.

Cosechemos has launched three successful pilot crop plantings consisting of 4.94 acres with impressive results:

30 varieties of non-psychoactive cann-a-bis tested.

Demonstrated production cost of $0.06/gram.

Optimized cultivation strategy, yielding over 125 grams/plant.

Initiated third-party organic and global G.A.P. certification in Ql 2020.

Cosechemos’ extraction facility is currently under construction, with completion expected in Q3 2021. It will be built to EU-GM P standards, and immediately seek EU-GMP certification.

Cosechemos plans to cultivate 49 acres in 2021; 9 acres for C-B-D and 40 acres for T-H-C.

Additionally, Cosechemos holds rights to an additional 5,268 acres licensed in Puerto Boyaca, Santander, to increase the scale of its cultivation as required.

Low-Cost Colombian Cultivation: Flora’s Cost Advantage

Favorable Growing Conditions

- 8 hours of daily sunlight, 365 days/year

- Consistent 3 mph wind, decreases incidence of plant-harming pathogen

- Organic nutrient-rich soil allows for high density planting

Low-Cost Infrastructure

- Long-term monthly lease of only US$10/acre, with purchase option

- Six natural spring water deposits on site: water cost $0

- Low utility costs at less than US$150/month

Locally-Adapted Strategy

- 3+ years of evaluating strains to perfect growing economics

- Developing unique organic agronomic management system tailored to Cosechemos' climate and conditions

- Optimized cultivation strategy to obtain 3+ harvests per year (1.5-3X more than peers), high productivity per area and a high-quality product

North America vs. Colombia Cannabis Growth Comparisons

North American Cannabis

- Avg. cost $1.89/gram(15) & 20 °F / 6.4-hours of daylight

- Most grown indoor using artificial light with substantial energy costs and waste

- Significant costs only to try and reproduce ideal outdoor growing environment of Colombia

South American Cannabis

- Avg. cost $0.06/gram & 65 °F / 12.8-hours of daylight

- Free natural sunlight and water, nutrient-rich soil

- High-quality outdoor-grown product

With a +25X cost advantage over its North American counterparts, don’t you think it might be a good time to start paying close attention to Flora Growth Corp. (NASDAQ: FLGC)?

FLGC: More Than A Cannabis Cultivator

While cannabis legalization continues globally, Flora Growth is creating initial demand for its cannabis products through internal brands that capitalize on consumer and competitive industry trends.

Flora expects to be well-positioned with robust infrastructure, reliable supply-chains, and global distribution as the cannabis market is expected to expand rapidly over the next decade.

Cosechemos: Contracted cultivation facility with 247 acres in Bucaramanga, Colombia; has achieved production costs of US$0.06 per gram.

Flora Lab: modern manufacturing facility with GMP certifications to supply Flora’s medical and consumer brands.

Flora Beauty: Internally developed portfolio of beauty & skincare products. Founded by former Miss Universe and global beauty influencer Paulina Vega.

Kasa Wholefood: Portfolio of natural food & beverage products, responsibly sourced from exotic Amazonian fruits.

Hemp Textiles & Co: Sells textiles made from he-mp to businesses and consumers, starting with inaugural brand Stardog Loungewear.

Flora Growth Corp. Expands Into U.K. And Central American Markets

The company recently made a MAJOR announcement in regards to expansion into new markets.

Check it out:

Flora Growth Expands into U.K. and Central American Markets with Sales to New International Distribution PartnersFlora Growth’s Mambe, Mind Naturals, and Almost Virgin Brands Fulfill Initial Orders in New Markets; Company Reaches Significant Milestones as It Continues to Execute On Its International Growth Strategy

TORONTO, May 14, 2021 (GLOBE NEWSWIRE) — Flora Growth Corp. (NASDAQ: FLGC) (“Flora” or the “Company”), an all-outdoor cultivator and manufacturer of cann-a-bis-derived products and brands, today announced it has expanded into the United Kingdom (the “UK”) and Costa Rica, fulfilling initial orders from two new distributors. Specifically, Flora’s Kasa Wholefoods division (“Kasa”) has fulfilled an initial shipment of Mambe juices to a distributor for the Central American food and beverage market, while an initial shipment of Almost Virgin, Mind Naturals and Mambe products was fulfilled to the UK.

UK Expansion Flora is pleased to announce that it has completed an initial shipment of products from its Mind Naturals, Almost Virgin, and Mambe brands to the UK. This order is a significant milestone for Flora, as it represents the Company’s first shipment of CB-containing products into Europe. Going forward, Flora intends to expand on its relationship in the UK to bring its entire product portfolio into the UK market and into adjacent markets throughout the European Union.

Central American Expansion In April 2021, Kasa signed a distribution agreement with GMD Latinoamérica, a Costa Rica-based distributor for the Central American food and beverage market. Exports will begin in Puerto Limon, Costa Rica. Kasa is also in the process of registering additional product lines of its portfolio for the Central American and Caribbean markets.

“Flora Growth’s expansion into the UK and Central America aligns perfectly with our strategy of aggressive expansion into new markets, as we continue to establish our premium brands’ international presence,” said Flora CEO Luis Merchan. “We look forward to working with our new distribution partners in both Europe and Central America and hope to expand even further into both continents in the coming months.”

Could this be the immediate term catalyst to provide Flora Growth Corp. (NASDAQ: FLGC) with a spark towards a vertical surge up the charts?

The Top 5 Reasons To Be High on Flora Growth Corp.

1) Analysts believe that Flora Growth Corp. (NASDAQ: FLGC) stock could be surprisingly undervalued with a 5x upside potential.

2) The company boasts the world’s lowest production costs for dried flower creating a much broader cushion for excellent profit margins.

3) The company’s revenues are sharply on the rise since going public in 2020.

4) Flora Growth Corp. (NASDAQ: FLGC) has a solid international presence and a quickly expanding portfolio of new clients.

5) With the launch of Munzhi, Flora Growth Corp. (NASDAQ: FLGC) is in prime position to capture a large chunk of the $3.31 billion Colombian wellness market.

Drop what you’re doing this second and check out Flora Growth Corp. (NASDAQ: FLGC) before it’s too late…

Sources

Source 1: https://www.tipranks.com/stocks/flgc/forecast

Source 2: https://tinyurl.com/yckm2wft

Source 3: https://tinyurl.com/yubtw246

Source 4: https://tinyurl.com/muj4c9uv

Source 5: https://finance.yahoo.com/quote/FLGC/history?p=FLGC

Source 6: https://tinyurl.com/ycka9sm8

Source 7: https://finance.yahoo.com/news/flora-growth-continues-international-expansion-122500099.html

Source 8: https://tinyurl.com/mtcs7vkb

Source 9: https://tinyurl.com/36bkx6rb

Source 10: https://www.businesswire.com/news/home/20210903005217/en/Flora-Lab-Receives-GMP-Certification-For-Manufacturing-Cosmetic-Products-Demonstrating-Operational-Excellence-And-Enabling-Global-Export-Of-Product-Portfolio

Source 11: https://www.imarcgroup.com/health-wellness-market

Source 12: https://bit.ly/3iG34j9

Source 13: https://blog.bizvibe.com/blog/top-flower-producing-countries

Source 14: Flora Growth Company Presentation

Source 15: 2019 Average of Aphria, Tilray, Sundial, Aurora

Source 16: https://finance.yahoo.com/news/flora-growth-corp-announces-closing-211400310.html

Source 17: https://finance.yahoo.com/news/flora-growth-expands-u-k-110000557.html

Source 18: https://bit.ly/3eWeaA9

Source 19: https://mgretailer.com/business/growing-horticulture/cultivating-cannabis-cost-by-state/

Source 20: https://www.nationmaster.com/country-info/compare/Colombia/United-States/Economy

Source 21: https://finance.yahoo.com/news/flora-growth-expands-food-beverage-113000974.html

Source A: https://floragrowth.ca/flora-growth-to-acquire-koch-gsell-and-enter-europe-with-leading-manufacturer-of-natural-swiss-hemp-products/

Source B: https://floragrowth.ca/flora-expands-presence-into-eu-signs-loi-to-become-long-term-strategic-partner-to-hoshi-international/

Disclaimer

Stock Research Today is a project of Dadmin Capital LLC and intended solely for entertainment and informational purposes. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/. This website / media webpage is owned, operated and edited by Dadmin Capital LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Dadmin Capital” refers to Dadmin Capital LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and promote small public companies. By reading our website / media webpage you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our website / media webpage .We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website / media webpage are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. Dadmin Capital business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Dadmin Capital. often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Compensation - Pursuant to an agreement between Dadmin Capital LLC and TD Media LLC, Dadmin Capital LLC has been hired for a period beginning on 1/4/22 and ending after 3 business days to publicly disseminate information about (NASDAQ: FLGC) via digital communications. We have been paid eleven thousand five hundred USD via ACH Bank Transfer.

Pursuant to an agreement between Dadmin Capital LLC and TD Media LLC, Dadmin Capital LLC has been hired for a period beginning on 1/31/22 and ending after 3 business days to publicly disseminate information about (NASDAQ: FLGC) via digital communications. We have been paid eleven thousand five hundred USD via ACH Bank Transfer. Pursuant to an agreement between Dadmin Capital LLC and LifeWater Media, Dadmin Capital LLC has been hired for a period beginning on 2/10/22 and ending after 2 business days to publicly disseminate information about (NASDAQ: FLGC) via digital communications. We have been paid five thousand USD via ACH Bank Transfer. Social Media Compensation - Pursuant to an agreement between Dadmin Capital LLC and Social Media Outlet, Dadmin Capital LLC has hired Social Media Outlet for a period beginning on 2/1/22 and ending after one business day to publicly disseminate information about (NASDAQ: FLGC) via digital communications. We have paid this Social Media Outlet one thousand dollars USD via ACH Bank Transfer. Pursuant to an agreement between Dadmin Capital LLC and Social Media Outlet, Dadmin Capital LLC has hired Social Media Outlet for a period beginning on 2/1/22 and ending after one business day to publicly disseminate information about (NASDAQ: FLGC) via digital communications. We have paid this Social Media Outlet three thousand five hundred USD via ACH Bank Transfer.