CARBON MARKETS ARE APPROACHING A TRILLION DOLLAR VALUATION

And DeepMarkit is facilitating their transition to the digital economy. Reuters, Jan 31 2022

Build your watchlist with us

Get the latest stock ideas direct to your inbox. 100% free and your information stays with us.

DeepMarkit Corp. is a publicly traded company WHOSE SHARES TRADE in Canada (TSX Venture Exchange: MKT) and the U.S. (OTC: MKTDF)

One of the most highly sought-after investment themes since the tech boom in the late 90s might just be a sector to which very few people are currently paying attention.

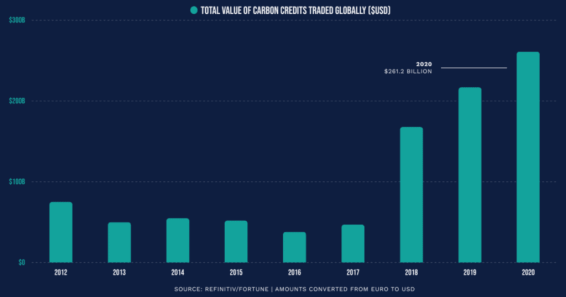

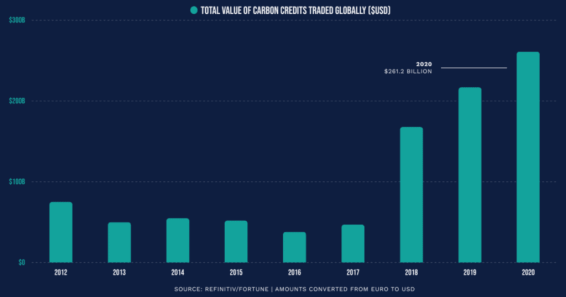

It’s an asset class that has grown to nearly a trillion-dollar valuation in the past 5 years (according to Refinitiv) and until now has mainly been limited to institutional involvement. (2)

DeepMarkit Corp. (OTC: MKTDF, TSX-V: MKT) has found a way to provide easy access to the retail community, as well as to large players that have, until now, had a difficult time accessing these markets.

We are referring to the carbon credit sector. Driven by the “Net Zero by 2050” (5) decarbonization movement, the sector is flourishing, and its markets are growing and expanding quickly.

DeepMarkit Corp. is working to do to carbon offset and renewable energy markets what the Internet did to stock trading 30 years ago: bring them online and make them accessible to anybody with a Wi-Fi connection.

In a move to add even more value to the company, on April 20, 2022, DeepMarkit announced a strategic initiative to explore the minting of Renewable Energy Credits – a market whose value surpassed $12 billion last year and is projected to reach $100 billion by 2030. (1)

In addition, there is a potentially lucrative royalty model built into the company’s soon-to-launch platform. Read on to learn how all of this works together to create what could be a significant early-stage opportunity for DeepMarkit and its shareholders.

DeepMarkit’s platform, MintCarbon.io, is being planned to launch imminently. (6) What a great opportunity to get a company with a market capitalization of approximately US$20 million (as of April 28, 2022) on your radar.(11)

Carbon Onboarding Arrangement with Billion Dollar Asian Fund - Radiance Assets Berhad

In a potentially “company making” move, on April 12th DeepMarkit signed a binding definitive agreement with Radiance Assets Berhad (Radiance) under which Radiance will introduce carbon credit projects for onboarding through DeepMarkit’s MintCarbon.io platform that is being developed to mint carbon offset credits into NFTs. Any minting and royalty-based revenues earned by DeepMarkit via Radiance’s referrals will result in a percentage-based sharing arrangement with Radiance.(8)

Based in Malaysia, Radiance is a diverse investment holding company with a focus on innovative and technologically-driven businesses in the areas of Cleantech, Medtech and Fintech. Radiance also has a focus on the environment and solutions that better peoples’ lives. Radiance has several classes of funds including a new Agritech fund being launched with an asset value of USD 250 million. As previously announced, Radiance is currently a shareholder of DeepMarkit via recent private placements. (8)

With this agreement in place and more potentially on the way, as well as the imminent launch of MintCarbon.io, the table has been set for potentially significant growth for this microcap stock.

Fringe No More – Mainstream Here It Comes

Very few investors are familiar with carbon credit markets, or how big, they have become. Global carbon markets reached a valuation of $851 billion last year (2) while hedge funds and asset managers with trillions of dollars under management are expecting this number to grow by up to 15 times by 2030.(3)

In fact, carbon markets are poised to surpass the entire oil and gas sector in value.(4)

To the average investor, carbon credits are a fairly new concept because the sector has been opaque and largely inaccessible. Yet, it’s one of the biggest asset classes in the world and growing at a rapid pace thanks to the global push for countries and/or companies to become “Net Zero by 2050”. (9)

The SEC recently published a proposal that would force every publicly listed company to disclose their climate policy. (10)

Once implemented, the table will be set for carbon credits markets to become more mainstream and better understood.

Enter DeepMarkit

DeepMarkit is doing to carbon markets what the Internet did to stock trading 30 years ago – bringing them online via the Internet or, in this case, via the block-chain.

By facilitating the transition of global carbon markets to the digital economy via the block-chain, the company is working to enable access and transparency to carbon credits that never existed before. And DeepMarkit will be collecting minting fees and royalties while doing so, which positions the company for a high rate of growth in the near future.

The Company’s proprietary MintCarbon.io platform allows carbon credit holders to profile their projects and mint their carbon credits into NFTs, which are then deposited into the carbon credit holder’s block-chain wallet (ie. MetaMask) to be easily listed on any decentralized exchange in the world (such as OpenSea).

DeepMarkit Aligns with Verra and Gold Standard Carbon Credit Registries

In a move to prove the legitimacy of its product, DeepMarkit recently aligned with two of the world’s largest carbon credit registries – Verra and Gold Standard – ensuring that only legitimate, high-quality credits are minted via the MintCarbon.io platform. (12)

This collaboration also avails DeepMarkit to a vast database of projects for potential onboarding.

DeepMarkit’s business model is designed to earn revenue by charging the carbon credit holder a minting fee of up to 10% of the value of their credit-to-NFT transaction. The fee can be collected in carbon credits, Ethereum tokens, carbon credit NFT’s or a combination of the three.

And every time a carbon credit NFT is traded, on any decentralized exchange in the world, DeepMarkit is also set to collect a recurring royalty, which is shared with the original NFT minter.

As more carbon credits become listed via MintCarbon.io, DeepMarkit’s inventory of carbon credits and/or Eth-er-eum tokens will grow accordingly, and this exposes DeepMarkit investors to two rapidly growing asset classes, aside from carbon credit NFTs themselves.

5 Reasons To Consider DeepMarkit Corp Right Now

DeepMarkit is doing to the near-trillion-dollar carbon market what the Internet did to stock trading 30 years ago.

DeepMarkit collects a minting fee of up to 10% on nearly every transaction from carbon projects listed via their proprietary minting platform MintCarbon.io

MintCarbon.io is nearing its official launch and the company has already entered into a carbon credit onboarding arrangement with a large Asian fund (that owns 9.4% of DeepMarkit), which has access to carbon projects around the world.

DeepMarkit could be an early stage opportunity whose market capitalization is small (~US$20M, as of April 28) relative to the potential net proceeds from minting fees and recurring royalty revenues that the company could earn in the future.

A shared revenue model underpinned by a royalty stream gives DeepMarkit exposure to one of the fastest growing asset classes in the world.

Latest News

May 12, 2022

DeepMarkit Successfully Tests and Mints Carbon Credit NFTs via its MintCarbon.io Platform

• Carbon Credits were Sourced from Two Wind Projects and a Landfill Project, all Authenticated on the Gold Standard and Verra Registries

• Three Scenarios of Retiring, Claiming and Holding a Carbon Credit NFT Were Successfully Tested via the Company’s Platform

• The Retirement Contract was Deployed on Polygon’s Lower-Emission Blockchain

Read More

May 11, 2022

DeepMarkit Enters Into Liquidity Support Agreement With Radiance

Malaysia-based Radiance, an Investment Holding Company, has Earmarked up to C$20,000,000 of Buy-side Liquidity

Read More

DeepMarkit is making it simple to list and track carbon credits on the block-chain through ITS proprietary platform MintCarbon.io, accessible to everyone, everywhere, at any time.

DeepMarkit is unlocking access, transparency and reliability to global carbon credit markets which were valued at $851 billion (Refinitive) last year.

By enabling the minting of carbon credits into universally tradable NFTs, the Company’s proprietary MintCarbon.io platform unlocks liquidity and transparency in historically opaque carbon markets, and features a shared revenue model underpinned by a recurring royalty stream in a market primed for rapid growth.

Market Capitalization (April 28, 2022): ~$26m CAD, ~$20m USD.

The Net Zero Asset Owner Alliance, a consortium of asset managers representing over US$6 Trillion, called for an immediate increase in the quality of carbon credits, which would lead to higher prices. “In essence, this means formalizing the use of carbon credits as a market proxy for a global carbon tax,” the Alliance said. (13)

Over the past six years, decarbonization has moved from a fringe idea to what may become the most highly sought-after investment theme since the late 90s tech boom.

Carbon Credits Are An Emerging Asset Class Backed By Government, Hedge Funds & Banks Managing Trillions of Dollars.

Increased pressure on corporations to implement Environmental, Social & Governance (ESG) policies has resulted in rapidly growing demand for carbon offset markets. Due to these changes, the total value of global carbon market trading grew five times since 2017, hitting a record $261 billion in 2020 (compliance & voluntary markets combined.)(14)

Global carbon markets value surged to record $851 billion(4) (U.S.) last year

THE CHALLENGE

While carbon credits are broadly available, trading is highly inaccessible, fragmented, opaque and inefficient. These issues hamper both supply and demand in the market.

THE OPPORTUNITY

Voluntary carbon credits are quickly becoming an inevitable part of everyday life; estimates show that demand could increase 15x by 2030 to $50 billion.* (15)

Unlocking access and liquidity to this growing asset class will drive innovation and funding toward the green economy.

* Task Force on Scaling Voluntary Carbon Markets

DEMOCRATIZING ACCESS TO GLOBAL CARBON CREDIT MARKETS

DeepMarkit (TSX Venture Exchange: MKT) (OTC: MKTDF) is transforming the way investors and project developers access the billion dollar voluntary carbon credit market. Its proprietary platform, MintCarbon.io, is powered by the Polygon network and enables offset holders to mint their credits into NFTs, which can be listed for trading on decentralized exchanges (such as OpenSeas.io) globally. A unique revenue-sharing model gives DeepMarkit investors exposure to a growing asset class.

DEEPMARKIT IS making it easy for anyone to access carbon credits via the Polygon powered blockchain.

DeepMarkit (TSX Venture Exchange: MKT) (OTC: MKTDF) proprietary, easy-to-use MintCarbon platform provides an on ramp into blockchain marketplaces for existing carbon credits issuers, unlocking access to a broader pool of investors and purchasers to better monetize the full value of their carbon credits.

THE SOLUTION

MintCarbon.io is a proprietary platform enabling turnkey tokenization of carbon credits into NFTs.

Powered by the Polygon network, MintCarbon provides carbon credit holders an 'on ramp' to the Blockchain, while enabling users to track, trade and consume / burn credits in a simple and secure way that is accessible to everyone, everywhere.

MintCarbon NFTs (smart contracts) are highly customizable and can be listed for trading on decentralized exchanges such as OpenSea.io.

PERPETUAL REVENUE STREAMS

DeepMarkit (TSX Venture Exchange: MKT) (OTC: MKTDF) collects up to 10% upon the first minting (creation) of a carbon credit NFT (smart contract)

The smart contract ensures a recurring royalty is automatically collected when a carbon credit NFT is re-sold or traded on a secondary market (eg. OpenSea.io)

Fees and royalties can be received in Eth-er-eum, carbon credits, carbon credit NFTs, or a combination, providing DeepMarkit with flexibility and increasing DeepMarkit's addressable market and exposing DeepMarkit to growing asset classes.

Bottom Line

Even as voluntary carbon credits become an increasingly obvious tool in the global push to achieving net-zero carbon footprint, despite the broad availability of credits, trading remains highly inaccessible, opaque, and inefficient.

Get the latest stock ideas direct to your inbox.

100% free and your information stays with us.

These are not only hurting the market’s ability to scale up, but it’s having a direct adverse effect on the carbon credit market’s efficacy as a tool to lower emissions.

DeepMarkit is working to provide a new level of transparency, standardization, and accountability to instill confidence in market participants and unlock desperately needed growth.

DeepMarkit is an early mover, with a proprietary platform and a competitive advantage, via a business model that is driven by a perpetual revenue stream in a market that is primed for ongoing growth

Sources

Source 1: https://www.globenewswire.com/news-release/2021/12/15/2352850/0/en/Renewable-Energy-Certificate-Market-Size-Worth-Around-US-100-96-Bn-by-2030.html

Source 2: https://www.reuters.com/business/energy/global-carbon-markets-value-surged-record-851-bln-last-year-refinitiv-2022-01-31/

Source 3: https://resilientllp.com/2021/06/25/report-indicates-forest-carbon-finance-has-more-the-doubled-in-last-4-years/

Source 4: https://www.reuters.com/business/energy/global-carbon-markets-value-surged-record-851-bln-last-year-refinitiv-2022-01-31/

Source 5: https://www.iea.org/reports/net-zero-by-2050

Source: 6: https://www.deepmarkit.com/ – under MintCarbon section *Anticipated to launch Q2-2022)

Source7: https://www.deepmarkit.com/news/deepmarkit-gains-access-to-global-carbon-credits-via-referral-arrangement

Source 8: https://www.deepmarkit.com/news/deepmarkit-announces-strategic-investment-and-loi-with-malaysia-based-radiance-assets-berhad

Source 9: https://www.iea.org/reports/net-zero-by-2050

Source10: https://www.sec.gov/news/press-release/2022-46

Source 11: https://finance.yahoo.com/

Source12: https://www.deepmarkit.com/news/deepmarkit-achieves-successful-registration-on-gold-standard-and-verra-carbon-registries

Source 13: https://www.bloomberg.com/news/articles/2021-09-22/investors-managing-6-6-trillion-call-for-funding-carbon-removal

Source 14: https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/coal/012721-global-carbon-market-grows-20-to-272-billion-in-2020-refinitiv

Source15: https://www.mckinsey.com/business-functions/sustainability/our-insights/a-blueprint-for-scaling-voluntary-carbon-markets-to-meet-the-climate-challenge

Disclaimer

Stock Research Today is a project of Virtus Media Group, LLC and intended solely for entertainment and informational purposes. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/. This website / media webpage is owned, operated and edited by Dadmin Capital LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Dadmin Capital” refers to Dadmin Capital LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and promote small public companies. By reading our website / media webpage you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our website / media webpage .We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website / media webpage are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. Dadmin Capital business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Dadmin Capital. often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Pursuant to an agreement between Dadmin Capital LLC and TD Media LLC, Dadmin Capital LLC has been hired for a period beginning on 5/16/22 and ending after 4 business days to publicly disseminate information about (OTC: MKDTF) via digital communications. We have been paid fifteen thousand USD via ACH Bank Transfer.

Pursuant to an agreement between Dadmin Capital LLC and Social Media Outlet, Dadmin Capital LLC has hired Social Media Outlet for a period beginning on 5/16/22 and ending after one business day to publicly disseminate information about (OTC: MKDTF) via digital communications. We have paid this Social Media Outlet five hundred USD via ACH Bank Transfer.