Diversely Positioned in the Technology Sector with One Investment

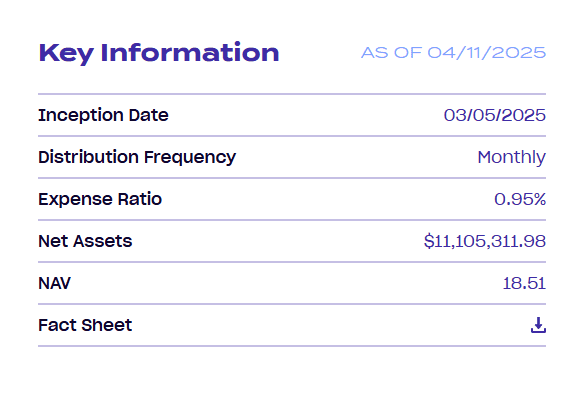

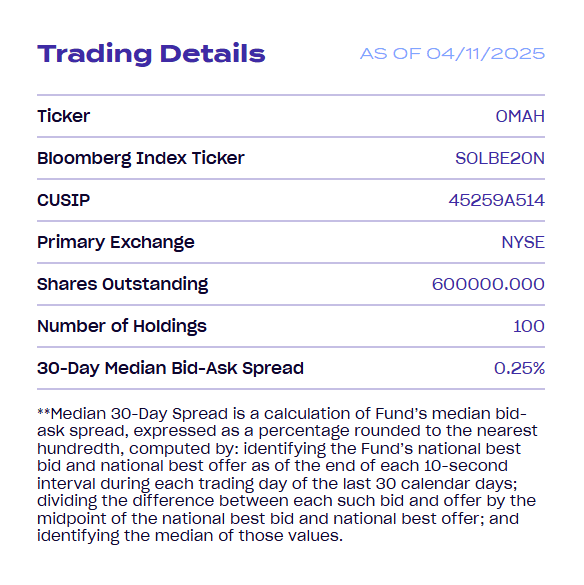

The VistaShares VistaShares Target 15 Berkshire Select Income ETF (NYSE: OMAH) represents a first-of-its-kind approach, designed to provide investors with core equity exposure, high monthly income, and a strategy built to adapt across market cycles.

A Differentiated Approach to Income and Equity Exposure

The VistaShares Target 15™ Berkshire Select Income ETF (Ticker: OMAH) introduces a distinctive strategy that combines traditional value investing with a modern income-generating overlay. Built on the foundation of Berkshire Hathaway's long-standing investment philosophy, the ETF is structured to offer consistent monthly income while maintaining exposure to a portfolio of resilient, large-cap equities.

OMAH’s portfolio consists of Berkshire Hathaway Inc. (BRK.B) and a curated selection of Berkshire’s top 20 publicly disclosed equity holdings. This core is overlaid with a data-driven options strategy designed to pursue an annual income target of 15%, distributed monthly at approximately 1.25%. The strategy is actively managed by the VistaShares investment committee, leveraging fundamental research and systematic risk management.

5 Key Reasons Why VistaShares Believes VistaShares Target 15 Berkshire Select Income ETF (NYSE: OMAH) is a Prime Investment For 2025

Designed to Address Modern Portfolio Challenges

OMAH was built with the evolving needs of income-seeking investors in mind. Traditional equity income strategies have faced headwinds in low-yield environments. OMAH aims to solve this by implementing a disciplined options overlay strategy while maintaining exposure to companies with long-term track records of performance and stability.

The ETF is actively managed by VistaShares in partnership with Tidal Financial Group and follows a transparent, research-driven process. With its first monthly distribution completed—aligned with the fund’s 1.25% monthly income target—OMAH has begun delivering on its stated objective. Importantly, while the strategy aims to enhance income, it is not structured for downside protection and should be viewed in the context of a broader asset allocation strategy.

ETF Summary

The VistaShares Target 15™ Berkshire Select Income ETF combines core equity investing with options-based income generation. The equity portion mirrors the 20 largest holdings in Berkshire Hathaway’s portfolio, including direct exposure to BRK.B. The fund is designed for investors seeking income, supported by professional management and disciplined portfolio construction.

ETF Objective

The ETF is actively managed and seeks to deliver income first and long-term capital appreciation secondarily. This is accomplished through:

- Equity investments based on the Solactive VistaShares Berkshire Select Index

- A rules-based options strategy aimed at generating 15% annual income, paid monthly

Meet the VistaShares Investment Committee

Adam Patti | CEO

Adam is a pioneer in the Exchange-Traded Funds industry. Prior to VistaShares, Adam founded IndexIQ with a vision to combine institutional quality alternative investment strategies with the power of ETFs to enhance portfolio construction for all investors. IndexIQ established itself as the leading alternative investment manager in the ETF industry and was acquired by New York Life Insurance Company in 2015.

As Chairman & CEO of IndexIQ, Adam was an architect behind IndexIQ's award winning product line of alternative investment strategies, and post-acquisition worked to successfully integrate the firm into the New York Life Investments infrastructure, including the roll-out of IndexIQ branded ETFs globally.

Robert Whitelaw | Chief Investment Strategist

Robert F. Whitelaw was most recently the Dean of the Undergraduate College, and continues to serve, as the Edward C. Johnson 3d Professor of Entrepreneurial Finance at the Leonard N. Stern School of Business, New York University.

Professor Whitelaw is best known for his comprehensive research on empirical asset pricing, including the resolution of the market-level risk-return puzzle, the role of information processing in explaining excess volatility, and the impact of frictions in generating apparent market inefficiency. His research also addresses the pricing and hedging of fixed income securities, and risk measurement and management.

His papers have been published in academic journals such as the Journal of Finance, the Journal of Financial Economics, and the Review of Financial Studies, as well as practitioner journals such as the Journal of Derivatives, the Journal of Fixed Income, Risk, and the Financial Analysts Journal. His research has received awards from organizations including Goldman Sachs Asset Management and the Chicago Quantitative Alliance. In addition, he is a Research Associate at the National Bureau of Economic Research (NBER), Program on Asset Pricing, and a past Associate Editor of the Review of Financial Studies and the Journal of Finance.

Jon McNeill | Co-Founder

Jon currently serves as the CEO and Co-Founder of the venture studio, DVx Ventures. With a track record of founding and scaling six companies, Jon has led teams that generated tens of thousands of jobs and delivered multi-billion dollar returns for investors. At DVx, Jon and his team have launched 12 companies that are attacking broad opportunities in large markets.

Previously, Jon served as President at Tesla, where revenue grew from $2B to $20B in just 30 months. Subsequently, Jon joined Lyft as COO, where he played a pivotal role in doubling revenues and helping to take the company public. With a history as a six-time serial entrepreneur, Jon has a wealth of experience in operating and scaling companies during periods of hyper-growth in revenue and operations and has delivered returns of 9x to investors.

Sundeep “Sunny” Madra | Advisor to Investment Committee

Sundeep "Sunny" Madra is a recognized thought leader in the Artificial Intelligence space known for his deep expertise in AI, machine learning, and large-scale computing systems. A seasoned entrepreneur, Sunny has an impressive track record of founding and successfully exiting multiple startups. His latest venture, Definitive Intelligence, was acquired by Groq — a cutting-edge computing company known for creating the fastest chip for LLM (Large Language Model) inference, enabling real-time chatbot responses with proprietary Language Processing Units (LPUs) — in early 2024. Following the acquisition, Sunny played a key role in launching GroqCloud and currently serves as the President of Supply Chain, Operations, and Go-to-Market at Groq.

Sunny's other business ventures include co-founding and serving as CEO of Autonomic, a technology company focused on building infrastructure for smart mobility applications, which was later acquired by Ford. Prior to that, he co-founded and served as CTO of Xtreme Labs, a mobile app development company for leading brands, which was acquired by Pivotal.

In addition to his entrepreneurial ventures, Sunny held leadership roles at Ford, where he served as Vice President of Ford X, overseeing the automaker’s technology-focused initiatives.

Important Information

Investors should consider the investment objectives, risks, charges, and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about the Fund, please call (844)875-2288 or visit www.vistashares.com. Read the prospectus or summary prospectus carefully before investing.

Investing involves risk, including possible loss of principal. The BITA VistaShares Artificial Intelligence Supercycle Index is a rules-based composite index that tracks the market performance of companies, listed on global stock exchanges, that derive their revenues from producing high performance semiconductors, and building and operating AI-enabled applications and datacenters.

Artificial Intelligence Risk. Common stocks are generally exposed to greater risk than other types of securities, such as preferred stock and debt obligations, because common stockholders generally have inferior rights to receive payment from specific issuers. Technology Sector Risks. The Fund will invest substantially in companies in the technology sector, and therefore the performance of the Fund could be negatively impacted by events affecting this sector.

Concentration Risk. To the extent that the Fund concentrates in an industry, it will be subject to the risk that economic, political, or other conditions that have a negative effect on that industry will negatively impact the Fund to a greater extent than if its assets were invested in a wider variety of industries.

New Fund Risk. The Fund is a recently organized management investment company with no operating history. As a result, prospective investors do not have an extensive track record or history on which to base their investment decisions.

Foreside Fund Services, LLC, distributor. Foreside Fund Services is not affiliated with VistaShares or Stock Research Today.

Sources

- https://www.vistashares.com/

- https://www.vistashares.com/insights/

- https://www.vistashares.com/about-us/

- https://www.vistashares.com/omah-combining-the-power-of-berkshire-with-high-monthly-income/

- https://www.vistashares.com/etf/omah/

- https://finance.yahoo.com/quote/OMAH/

- https://finance.yahoo.com/news/vistashares-announces-march-2025-distribution-150000567.html

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to agreement with Vista Shares, TIA expects to be paid a total of $60k for a period beginning on 1.29.25 thru 7.29.25. Pursuant to an agreement between TIA and Wolf financial LLC, Wolf expects to be paid 48k total for a period beginning on 1.29.25 thru 7.29.25. Pursuant to an agreement between Vista Shares and The Investing Authority, The Investing Authority has been hired to publicly disseminate information about NYSE: OMAH via digital communications for a period beginning August 2025 and ending after Febrauary 2026. The Investing Authority has been paid $90,000 USD. Pursuant to an agreement between VistaShares and The Investing Authority, The Investing Authority has been hired to publicly disseminate information about NYSE: OMAH via digital communications beginning on 7/29/25 and ending 2/1/26 for $90,000 USD. The Investing Authority has contracted WOLF Financial LLC to publicly disseminate information about NYSE: OMAH via digital communications for a period beginning on 7/29/25 and ending 2/1/26 for $72,000 USD.