THE EV BOOM AND $200B+ IN COPPER-RELATED INFRASTRUCTURE SPENDING SPEAK TO UNTAPPED POTENTIAL

Yet Soaring Inflation and a Supply-Demand Crisis are Potential Catalysts that have Alpha Copper Corp.’s (CSE: ALCU) (OTC: ALCUF) Stock Skyrocketing

Build your watchlist with us

Get the latest stock ideas direct to your inbox. 100% free and your information stays with us.

Top 4 Potential Catalysts for Alpha Copper Corp.

Bullish Indicators have Alpha Copper Corp. On Fire

Copper bull market due to unprecedented demand

Growing EV Boom, Greening Economy, and Infrastructure Bill are all dependent on Copper

Two Impressive Projects in a Mining-Friendly Region

Meet Alpha Copper Corp. (CSE: ALCU) (OTC: ALCUF)

The market in 2022 has kicked off with a muted sentiment. This isn’t the free ride we had a year ago when interest rate hikes were not on the Fed’s radar. Worst-case scenarios also said that potential inflation could be transitory at worst.

That seems like forever ago.

The broader market has sputtered to start 2022. But look deeper. A little-known mining stock has stormed out of the gate, rallying as much as 55+% just 18 days into the New Year. (Source 2)

Mounting economic headwinds, including inflation, supply chain issues, and a global energy crisis, are striking fear into the people’s hearts. We aren’t blind to it. Instead of feeling sorry for yourself, consider why this copper explorer has rocketed during these times.

Beyond Alpha’s potential resiliency to inflation as a copper explorer, we could have a severe supply-demand crunch amid EV demand. The move to electric vehicles simply will not be possible without new sources of copper from companies like Alpha because of the ungodly amount of copper that EVs need.

What’s more, the recently passed massive infrastructure spending bill in the U.S. could require $200B+ worth of projects reliant on copper. (Source 1)

As a Canadian mineral exploration company focused on advancing its Indata and Okeover (“OK”) Projects in mineral-rich British Columbia, Canada, Alpha Copper has the ingredients. Both projects contain numerous drill-ready targets and geophysical anomalies. Indata is also located just 3 km from 2 of the most promising copper discoveries in Canada, Kwanika and Stardust. (Source 1)

So read on and see why Alpha Copper Corp. (CSE: ALCU) (OTC: ALCUF)could be one of the hottest companies in 2022.

As of Jan 18, 2022, from highs around the start of the year, the Dow has dipped as much as -4.41%, (Source 3) the S&P -5.01%, (Source 4) and the Nasdaq -8.49%. (Source 5)

That has simply not been the case for Alpha Copper Corp. (CSE: ALCU) (OTC: ALCUF).

The stock has not only outperformed, it has shattered these moves and charged out of 2022’s gate like a possessed bull. It has practically seen a vertical surge ever since the ball dropped, running over 55% from a low of CAD $0.45 on Jan 4, 2022, to a high of CAD $0.70 on Jan 18, 2022. (Source 2)

Yet while skeptics may say the stock could be overdue for a cooling-off period, the data and indicators show that this may only be the start.

Coupled with copper’s potential catalysts, the stock is flashing many short-, medium-, and long-term bullish technical indicators as of Jan 18, 2022.

Some of its triggered indicators include its 20 Day Moving Average, 20 – 50 Day MACD Oscillator, 20 – 100 Day MACD Oscillator, 20 – 200 Day MACD Oscillator, 50 Day Moving Average, 50 – 100 Day MACD Oscillator, 50 – 150 Day MACD Oscillator, 50 – 200 Day MACD Oscillator, 100 Day Moving Average, 150 Day Moving Average, 200 Day Moving Average, and 100 – 200 Day MACD Oscillator. (Source 6)

Moreover, as of Jan 19, 2022, ALCU had a float of roughly 18.76M, with 38.82% of shares held by insiders. (Source 7) The stock has also seen its market cap multiply by more than 4x from 2.07M to 8.45M ever since Mar 31, 2021. (Source 7)

When you see this type of structure and makeup, and a market cap that’s seen exponential growth, any inkling of good news could cause the stock to rapidly move. Keep your eyes on ALCU as mounting signs point towards unprecedented copper demand which could provide a spark for continued vertical chart momentum.

Reason #2 - An Economic Environment Tailor Made For Copper

The most recent consumer price index report revealed that inflation has reached a 40-year high. (Source 8)

Bond yields are also jumping, and as of Jan 19, 2022, the 10-year note spiked to nearly 2%, with the inflation-sensitive 2-year yield hitting 1%. This is a near 2-year high for both. (Source 9)

When markets sold off on Jan 18, 2022, UBS Global Wealth Management’s head of equities for the Americas, David Lefkowitz, said it was “all about interest rates” and that the 10-year’s surge “has big implications for the internals of the market.” (Source 9)

This reflects a Fed policy that has “overstayed its welcome” (Source 9) , contributing to the historical type of inflation we’re seeing.

Say hello to a potential copper bull market.

Traditionally, copper is seen as a strong hedge against inflation because its properties are essential for day-to-day life. It conducts heat and electricity and is malleable. It’s commonly used in electrical equipment such as wiring and motors. It is also valuable for construction (for example, roofing and plumbing) and industrial machinery (such as heat exchangers). (Source 10)

Computers and other electrical devices also use a great deal of copper, (Source 10) and copper wiring is likely powering wherever you are and behind your pipes and plumbing. (Source 11)

Yet outside of significantly outperforming the commodity it mines, Alpha Copper Corp. (CSE: ALCU) (OTC: ALCUF) may be an even better inflation hedge than the copper itself. An October 2020 Forbes article stated that “precious metals mining stocks probably provide a better inflation hedge than base metals and other commodities” and “rise with inflation but usually produce earnings even in non-inflationary times.” (Source 13)

Reason #3- An EV Boom, Greening Economy, and Infrastructure Bill Dependent on Copper Explorers Like Alpha Copper Corp.

Copper’s unique properties make it crucial for our day-to-day lives. Yet the metal could be even more vital for a sustainable future, and many consider it “the king of the ‘green metals.’” (Source 14)

Copper is an integral part of sustainable energy initiatives because of its reliability, efficiency, and performance. Its superior electrical and thermal conductivities increase the energy efficiency of countless energy-driven systems that rely on electric motors and transformers.

The same physical properties are vital in collecting, storing, and distributing energy from solar, wind, and other renewable sources.

First, let’s look at EVs. The move to electric vehicles simply will not be possible without new sources of copper. Electric vehicles use copper in charging infrastructure, cabling, drive motors, and batteries, more than double the copper of an internal combustion engine automobile. (Source 1)

Consider how much copper various types of vehicles need too: (Source 1)

Get the latest stock ideas direct to your inbox.

100% free and your information stays with us.

- Conventional cars-18-49 lbs

- Hybrid electric vehicles (HEV)-approximately 85 lbs

- Plug-in hybrid electric vehicles (PHEV)- 132 lbs

- Battery electric vehicles (BEVs)-183 lbs

- Hybrid electric bus-196 lbs

- Battery electric bus- 814 lbs

Yet, copper’s importance in the greening of the economy extends well beyond electric vehicles. (Source 1)

Transmission Lines

According to the Edison Electric Institute, the U.S. electric transmission network consists of more than 600,000 circuit miles of lines, 240,000 of which are considered high-voltage lines (230 Kilovolts and more). Copper is also a key component of transmission, which consists of structural frames, conductor lines, cables, transformers, circuit breakers, switches, and substations.

Wind Turbines

A 3 megawatt (MW) wind turbine contains up to 4.7 TONS OF COPPER. Often remote locations require extensive cabling to connect to the grid, especially offshore wind farms.

Motors and Generators

In its latest annual Electric Vehicle Outlook, BloombergNEF (BNEF) projected global sales of zero-emission cars to rise from 4% of the market in 2020 to 70% by 2040. (Source 16) BNEF also estimated EVs to be a $7 trillion global market by 2030 and a $46 trillion market by 2050. (Source 17)

Solar Power

Solar power generation requires 5.5 tons of copper per MW 2

Even before the $1 trillion+ infrastructure bill was passed, copper was rallying and needed for various sustainable projects. A quote from Global X ETFs stated, “cleantech and renewables projects, as well as infrastructure development, represent significant growth opportunities for copper, with substantial amounts of copper required to rebuild modern infrastructure and energy systems.” (Source 15)

Now that the bill is a law, it’s almost as if we have a shopping list of copper-based projects with billions of dollars to back it up. We could genuinely see $201 Billion spent on infrastructure projects that need considerable amounts of copper.

(Source 19)

- $39 Billion to modernize public transit, with an emphasis on zero-emissions vehicles

- $65 Billion investment in improving the nation's broadband infrastructure

- $17 Billion in port infrastructure and $25 billion in airports to promote electrification and other low-carbon technologies, among other things

- $7.5 Billion for zero- and low-emission buses and ferries, aiming to deliver thousands of electric school buses to districts across the country

- $7.5 Billion would go to building a nationwide network of plug-in electric vehicle chargers

- $65 Billion to rebuild the electric grid, including building thousands of miles of new power lines and expanding renewable energy

Yet while this all sounds good in theory there it can’t happen without sufficient copper supply

Reason #4- Alpha Copper Corp.’s Crucial Positioning In A Severe Supply-Demand Crunch

Certainly, supply chain backlogs we’ve seen have contributed to inflation. It could be contributing to a massive supply-demand crunch for copper too. We are currently in a historic supply-demand crisis that only explorers like Alpha Copper Corp. (CSE:ALCU) (OTC:ALCUF) can help solve.

Yet, there have simply not been enough new copper deposits discovered beyond supply chain issues. According to Hellenic Shipping News:

“Like gold, fewer and fewer large copper deposits are being discovered, and the time between discovery and production has lengthened over the years as costs rise. S&P Global Kevin Murphy called last decade ‘dismal’ in terms of new discoveries. Of the 224 copper deposits that were discovered between 1990 and 2019, only 16 were found in the past 10 years. Although the earth’s surface still has an abundance of the red metal, most new deposits are of low grade.” (Source 18)

This positions Alpha Copper Corp. (CSE: ALCU) (OTC:ALCUF) extremely advantageously.

Estimates from the CRU Group claim that the copper industry needs to spend upwards of $100 billion to counter an estimated annual shortfall of 4.7 million metric tons by 2030. According to commodities trader Trafigura Group, the potential shortfall could also reach 10 million tons if no new mines get built. (Source 1)

The world simply needs all the copper it can get its hands on. We have infrastructure plans, clean energy demands, and pent-up demand for electric vehicles.

$200+ billion of infrastructure projects will need unprecedented amounts of copper. Ambitious forecasts have EVs eventually taking over the roads and powering a cleaner future.

Yet to think this can all happen without a sufficient amount of copper is a joke.

If copper supply cannot keep up with this demand, watch what happens. It could pose an even more mouth-watering opportunity for explorers like Alpha Copper Corp. (CSE: ALCU) (OTC:ALCUF) rather than solely the physical metal.

Reason #5- Two Impressive Projects in a Mining-Friendly Region

Alpha Copper Corp. (CSE: ALCU) (OTC:ALCUF) could be at such an advantageous position in what’s shaping up to be a strong future for copper explorers. All you have to do is look at what its two projects in mineral-rich British Columbia, Canada, have to offer as further proof.

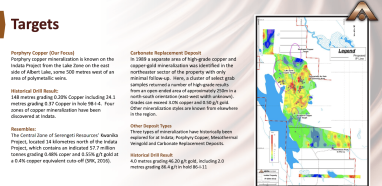

Indata The Indata Property comprises 16 mineral claims totaling 3,189 hectares. Situated in north-central British Columbia on the east side of Albert Lake, a 2-hour drive from the community of Fort St. James.

What’s more, is Alpha Copper has an option to earn a 60% interest on this property from Eastfield Resources Ltd. (Source 1)

Historically, the property has seen consistent results, and 40+ years of exploration and documentation indicate the possibility of a sizable copper deposit.

Okeover (“OK”)

The Okeover (“OK”) Property comprises 11 mineral claims totaling 3,950 hectares and is situated on the south coast of British Columbia, 25 km north of Powell River’s deepwater port facilities and 145 km northwest of Vancouver. Well-established forestry roads provide access to the property giving ready low-cost access to drill crews and equipment.

Geophysical anomalies have identified numerous drill-ready targets for copper and other minerals. Located ~25Km from the pacific tidal port, North Lake Zone’s historic resource specifically boasts 86.8 million tons and grading 0.31% copper.

Historic results also show strong exploration potential. Several high-grade drill targets are already identified and fully permitted. Additionally, porphyry targets exist

Several developed and fully operational mines also work nearby, including Mt. Milligan, Granisle, and Bell, which have established local expertise, manpower, and equipment resources within the region.

The Key Takeaways For Alpha Copper Corp.

Citibank put it best: “prepare for a decade of Dr. Copper on steroids.” (Source 20)

As Alpha Copper Corp. (CSE: ALCU) (OTC:ALCUF)) continues to see momentum, mounting potential catalysts have it firmly set up for the short and long term.

Its projects have game-changing potential in this environment of macro-level economic, environmental, and infrastructure-related catalysts. It is right at the core of a supply-demand squeeze that could truly position it perfectly for a bonanza of a rally.

We’re kickstarting 2022 at an exciting time for stocks like ALCU. The broader market appears sluggish, and investor sentiment is primarily “meh.” Yet it’s fascinating to see how and why ALCU has come charging out of the gates in 2022.

There is plenty of optimism around copper explorers as not only an inflation hedge but a vital component towards a sustainable future. Yet we don’t have enough copper supply to meet demand, clearly. We clearly need all the copper we can get our hands on and fast and cannot do it without companies like ALCU ALCUF.

Definitely keep your eyes peeled on Alpha Copper (CSE: ALCU) (OTC:ALCUF) ASAP. Its potential is too mouth-watering to ignore.

Sources

Source 1: https://alphacopper.com/wp-content/uploads/2022/01/PPT_AlphaCopper_V7.pdf

Source 2: https://www.barchart.com/stocks/quotes/ALCU.CN/interactive-chart

Source 3: https://schrts.co/FWHcMRvt

Source 4: https://schrts.co/ZaBTZven

Source 5: https://schrts.co/KaQNgWaI

Source 6: https://www.barchart.com/stocks/quotes/ALCU.CN/opinion

Source 7: https://finance.yahoo.com/quote/ALCU.CN/key-statistics?p=ALCU.CN

Source 8: https://www.wsj.com/articles/inflation-is-near-a-40-year-high-heres-what-it-looks-like-11639737004

Source 9: https://finance.yahoo.com/news/the-era-of-cheap-money-overstays-its-welcome-morning-brief-100752701.html?fr=yhssrp_catchall

Source 10: https://www.rsc.org/periodic-table/element/29/copper

Source 11: https://www.copper.org/education/c-facts/electronics/print-category.html

Source 12: https://www.copper.org/publications/pub_list/pdf/A6191-ElectricVehicles-Factsheet.pdf

Source 13: https://www.forbes.com/sites/billconerly/2020/10/17/its-time-for-inflation-hedges-consider-gold-mining-stocks-and-farmland/

Source 14: https://www.mining-journal.com/copper-news/news/1364930/%E2%80%9Ccopper-is-the-king-of-the-%E2%80%98green-metals%E2%80%99%E2%80%9D

Source 15: https://www.globalxetfs.com/whats-driving-coppers-rally/

Source 16: https://about.bnef.com/electric-vehicle-outlook/

Source 17: https://www.mining.com/ev-sales-expected-to-rise-by-2040-push-battery-metals-demand-report/

Source 18: https://www.mining.com/web/the-race-for-copper-the-metal-of-the-future/

Source 19: https://www.cnn.com/2021/07/28/politics/infrastructure-bill-explained/index.html

Source 20: https://www.mining-journal.com/copper-news/news/1342749/%E2%80%9Cprepare-for-decade-of-dr-copper-on-steroids%E2%80%9D

Disclaimer

Stock Research Today is a project of Dadmin Capital LLC and intended solely for entertainment and informational purposes. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/. This website / media webpage is owned, operated and edited by Dadmin Capital LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Dadmin Capital” refers to Dadmin Capital LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and promote small public companies. By reading our website / media webpage you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our website / media webpage .We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website / media webpage are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. Dadmin Capital business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Dadmin Capital. often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Compensation – Pursuant to an agreement between Dadmin Capital LLC and TD Media LLC, Dadmin Capital LLC has been hired for a period beginning on 4/18/22 and ending after 4 business days to publicly disseminate information about (CSE: ALCU | OTC: ALCUF) via digital communications. We have been paid fifteen thousand USD via ACH Bank Transfer. Social Media Compensation - Pursuant to an agreement between Dadmin Capital LLC and Social Media Outlet, Dadmin Capital LLC has hired Social Media Outlet for a period beginning on 4/18/22 and ending after one business day to publicly disseminate information about (CSE: ALCU | OTC: ALCUF) via digital communications. We have paid this Social Media Outlet six thousand USD via ACH Bank Transfer.