Cracking the $716.6 billion beauty industry

Here’s why SENTIENT BRANDS could send shockwaves through the potential $716.6 billion global beauty and personal care market.

Build your watchlist with us

Get the latest stock ideas direct to your inbox. 100% free and your information stays with us.

Top reasons to consider Sentient Brands Holding Inc.

01

Sentient Brands Oeuvre Is A Clean, Non-Toxic Beauty Brand And Is A Disruptive Business Opportunity That Strongly Appeals To Shifting Consumers Demand More From Their Products. (3)

02

Skin Care Will See The Strongest Performance Of The Prestige Beauty Industry, Growing 22 Percent In 2021 And A Further 10 Percent In 2022. By 2024, Skin Care Will Account For 34 Percent Of The Global Beauty Market In North America Alone. (5)

03

Oeuvre Is Positioned At The Intersection Of CB-D, Beauty And Wellness In The Luxury Sector And The Global CB-D Oil Segment Alone Is Anticipated To Reach $1.1 Billion By 2026. (11)

04

Big Beauty Conglomerates Are Snapping Up Clean Beauty Companies Like Sentient Brands To Fill Gaps In Their Portfolio, Including Appealing To Younger And More Sustainability-Minded Consumers. (13)

05

Sentient Brands Consistently Delivers The Product, The Ingredients, And The Packaging, But The Strength Of Their Executive Bench Offers Shareholders Confidence In The Company.

Sentient Brands Holdings Inc. new PRESS RELEASE details the launch of it's "Oeuvre Skincare" luxury product line.

Oeuvre - “A Body of Art” - is a next-generation luxury skincare product line and lifestyle brand derived from the Company’s proprietary OE Complex: CBD + Gemstones + Bioactives. Oeuvre Skincare products contain proprietary formulations of synergistically balanced luxury ingredients, combined with the Company’s rigorous commitment to formulating ‘Clean Beauty’ products without toxins, irritants, and unnecessary additives. Oeuvre Skincare products are non-toxic, ungendered, and contain zero GMO, retinyl palmitate, petroleum, mineral oil, parabens, sulfates, or synthetic colors. Product offerings under the Oeuvre Skincare product line include:

- Purifying Exfoliator

- Replenishing Oil

- Ultra-Nourishing Face Cream

- Revitalizing Eye Cream

For more information about the Company’s Oeuvre Skincare line of products, please visit:

www.OeuvreSkincare.com

The beauty market has come out of the lockdowns absolutely booming

First, we’ll look at the prestige beauty industry then take a deeper dive into the “clean beauty” market.

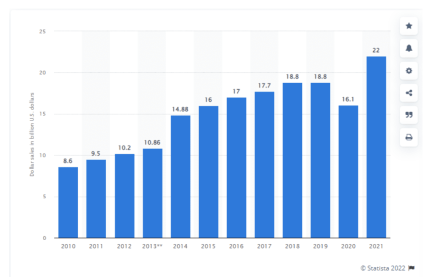

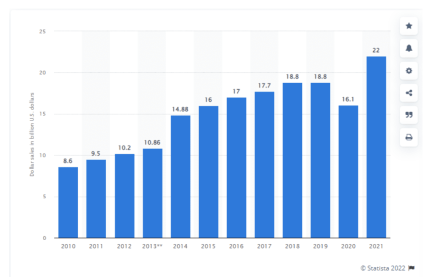

After being hit significantly by the global health crisis in 2020, the U.S. prestige beauty industry generated $22 billion in 2021, a 30% increase in dollar sales, versus 2020, according to The NPD Group.

“The beauty industry is unique in its ability to instill self-confidence and change the way people feel,” said Larissa Jensen, beauty industry advisor at NPD.

Dollar sales of the prestige beauty industry in the United States

The skin care market is shining with a healthy glow

According to an article in the Business of Fashion, “Skin care will see the strongest performance, growing 22 percent in 2021 and a further 10 percent in 2022. By 2024, we estimate skin care will account for 34 percent of the global beauty market.” (5)

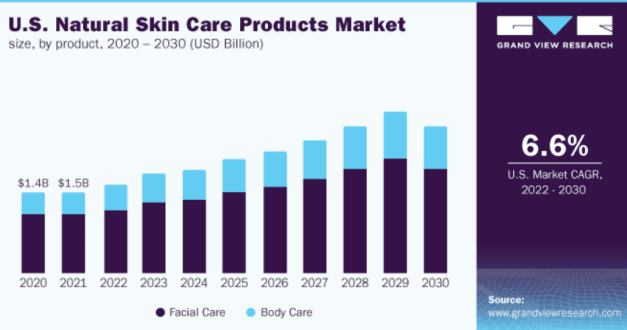

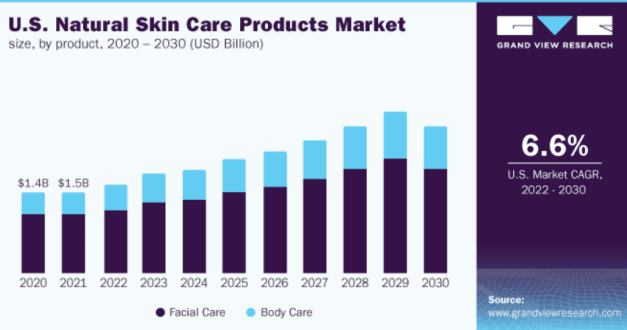

Consumers in North America are aggressively searching for natural and organic substitutes due to increasing concerns about toxic additives in skin care products and toiletries. The market for natural and organic skin care products is growing like crazy.

According to Expert Market Research, the face care market alone in North America is expected to reach a staggering $1.8 billion by 2026. (6)

The U.S. has an absolutely robust market which hit $1.5 billion in 2021 and is growing at an incredible 6.6% CAGR. (7)

The increasing awareness among consumers about the side effects of harmful substances used in cosmetics products will facilitate the natural cosmetics market

growth in Asian countries led by Japan, China, India, and South Korea. (8)

In fact, the potential growth difference for the natural cosmetics market between 2021 and 2026 is USD $56.06 billion. (8)

The increasing awareness among consumers about the side effects of harmful substances used in cosmetics products will facilitate the natural cosmetics market growth in Asian countries led by Japan, China, India, and South Korea. (8)

In fact, the potential growth difference for the natural cosmetics market between 2021 and 2026 is USD $56.06 billion. (8)

Big Beauty Is Snapping Up Clean Beauty Companies

A perfect example is the buyout of the popular boutique brand Drunk Elephant by Shiseido for $845 million. (13) The interesting part is the brand is not against using synthetic ingredients as stated in their brand philosophy, “We never take into account whether something is synthetic or natural, instead choosing ingredients based on biocompatibility.” (14)

According to Euromonitor market data, Shiseido generated 52% of its beauty and personal care sales outside of Japan in 2013, compared to 56% in 2018. With that number increasing, bringing U.S.-based Drunk Elephant into the fold is sound business. (13)

Now let’s look at another big acquisition by Unilever.

Unilever reportedly spent nearly $2.3 billion to build out its prestige beauty portfolio with six acquisitions, including Dermalogica, Kate Somerville, Living Proof and Hourglass, according to Coresight Research. (13)

However in order to really reach the “prestige” audience, they purchased Tatcha for $500 million. Tatcha’s products center around rituals of the geisha, and use ingredients like rice, algae, and green tea. (15)

Prior to acquiring Tatcha in June 2019 for a reported $500 million, Unilever reportedly spent nearly $2.3 billion to build out its prestige beauty portfolio with six acquisitions, including Dermalogica, Kate Somerville, Living Proof and Hourglass, according to Coresight Research. (13)

While it’s certainly an expensive strategy, conglomerates believe it’s easier to buy and then scale an existing brand than to overhaul decades-old operations to meet clean standards and market demand.

Expert Leadership Guides The Sentient Brand Mission

George Furlan - CEO

George brings more than 20 years of extensive expertise in building and expanding early stage, mid-tier and global brands.

G.F. Partners his full service consulting firm provides creative, strategic and operational support to a diverse range of fashion and lifestyle companies including, Fleur du Mal, Raleigh Denim and Post Imperial.

As President NAHM, he built the organization and infrastructure and guided a successful global launch for Tommy Hilfiger. He relaunched Hugo Boss luxury division and directed it's sales for the Americas. As director of sales and merchandising for Versace, George led sales, merchandising and marketing efforts for the USA and Canadian markets.

James Mansour - Chief Brand & Innovation Officer

James is an award-winning branding authority who works closely with Global Brands to insure success. He was instrumental in the development of many brands that have become icons in the marketplace and multi-billion-dollar business including:

Victoria's Secret the #1 Lingerie Brand in the world & Bath and Body Works the #1 Beauty Products Specialty Retailer in the world.

He has also created award-winning work for 3M, Dupont Corian and many other Global Giants.

Mansour leads the strategy, product development and marketing of our brands across all media, providing clarity, consistency and engaging interactivity at every touch point with the customer.

Best In Class Strategy

![]()

![]()

Our team’s hands-on, real world experience building consumer-focused global brands for iconic companies like Bath and Body Works, Hugo Boss, Victoria’s Secret, Versace - and upstarts like Fleur Du Mal is exceptional.

Sentient brings the next-level expertise needed to find the market whitespace, build and grow a portfolio of exceptional brands. Market forecasting, Product innovation resources, Operational team-building and Digital fluency - combined with the ability to arrange distribution opportunities that help drive explosive growth.

China Loves Western Clean Beauty Companies

Chinese consumers love Western niche skincare products. In fact, China’s $62.8 billion beauty market is now a promised land for Western niche beauty brands, from vegan products and “clean” beauty brands to facelift alternatives. (16)

And here’s an interesting fun fact. According to a 2019 Reuter Communications survey of more than 300 consumers across Shanghai, Beijing and Guangzhou, niche beauty brands are preferred by 92 percent of male and 31 percent of female customers. (16)

The search volume of the term “Green Life” has grown 26.33% in the past 90 days in WeChat, and on lifestyle APP Xiaohongshu, there are over 460,000 articles related to “Green Life”. On Weibo, China’s equivalent of Twitter, the hashtag “Green Life” has over 719,000 interactions. (17)

This is yet another reason Oeuvre could be a serious acquisition target as Western Big Beauty looks to capture their share of the burgeoning Chinese and Asian market.

Creating shareholder value through a well-executed, research-driven business model, Sentient Brands Holdings (OTC: SNBH) has a singular objective. To develop and operate next-generation lifestyle brands with a passion for uniqueness, defined by its vision of what will become a stand-out in both today and tomorrow’s marketplace.

Get the latest stock ideas direct to your inbox.

100% free and your information stays with us.

Sources

Source 1: https://www.grandviewresearch.com/press-release/global-beauty-personal-care-products-market

Source 2: https://www.theguardian.com/fashion/2019/feb/04/is-clean-beauty-a-skincare-revolution-or-a-pointless-indulgence

Source 3: https://www.premiumbeautynews.com/en/u-s-prestige-beauty-sales-grew-by,19823

Source 4: https://www.statista.com/statistics/419668/dollar-sales-of-the-us-prestige-beauty-industry/

Source 5: https://www.businessoffashion.com/articles/beauty/the-state-of-fashion-2022-bof-mckinsey-beauty-global-sector-forecast/

Source 6: https://www.expertmarketresearch.com/reports/north-america-natural-and-organic-face-care-market

Source 7: https://www.grandviewresearch.com/industry-analysis/natural-skin-care-products-market

Source 8: https://tinyurl.com/mt97c26h

Source 9: https://www.prnewswire.com/news-releases/sentient-brands-holdings-inc-launches-its-oeuvre-skincare-luxury-product-line-301439823.html

Source 10: https://www.prnewswire.com/news-releases/global-cb-d-skin-care-market-size-anticipated-to-reach-3-4-billion-by-2026–with-a-cagr-of-24-80-301448736.html

Source 11: https://www.globenewswire.com/news-release/2021/08/24/2285829/0/en/CB-D-Skincare-Products-Market-Size-to-Grow-Substantially-at-29-1-CAGR-from-2021-to-2028-Report-by-Market-Research-Future-MRFR.html

Source 12: https://www.businessoffashion.com/articles/beauty/what-estee-lauders-latest-investment-says-about-its-acquisition-strategy/

Source 13: https://www.glossy.co/beauty/why-shiseido-was-the-right-choice-for-drunk-elephant/

Source 14: https://www.drunkelephant.com/pages/philosophy

Source 15: https://wwd.com/beauty-industry-news/skin-care/unilever-acquires-tatcha-in-deal-said-approaching-500m-1203163718/

Source 16: https://www.voguebusiness.com/beauty/china-niche-skincare

Source 17: https://www.linkedin.com/pulse/why-opportunity-clean-beauty-china-now-chlo%C3%A9-reuter/

Disclaimer

Stock Research Today is a project of Dadmin Capital LLC and intended solely for entertainment and informational purposes. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/. This website / media webpage is owned, operated and edited by Dadmin Capital LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Dadmin Capital” refers to Dadmin Capital LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and promote small public companies. By reading our website / media webpage you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our website / media webpage .We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website / media webpage are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. Dadmin Capital business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Dadmin Capital. often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Compensation - Pursuant to an agreement between Dadmin Capital LLC and West Coast Media LLC, Dadmin Capital LLC has been hired for a period beginning on 12/21/21 and ending after 1 business day to publicly disseminate information about (OTCMKTS:SNBH) via digital communications. We have been paid One Thousand Two Hundred Fifty USD via ACH Bank Transfer. Pursuant to an agreement between Dadmin Capital LLC and West Coast Media LLC, Dadmin Capital LLC has been hired for a period beginning on 3/16/22 and ending after 1 business day to publicly disseminate information about (OTCMKTS:SNBH) via digital communications. We have been paid Eleven Thousand Five Hundred USD via ACH Bank Transfer. Social Media Compensation - Pursuant to an agreement between Dadmin Capital LLC and Social Media Outlet, Dadmin Capital LLC has hired Social Media Outlet for a period beginning on 3/16/22 and ending after one business day to publicly disseminate information about (OTC: SNBH) via digital communications. We have paid this Social Media Outlet one thousand USD via ACH Bank Transfer. Pursuant to an agreement between Dadmin Capital LLC and Social Media Outlet, Dadmin Capital LLC has hired Social Media Outlet for a period beginning on 3/16/22 and ending after one business day to publicly disseminate information about (OTC: SNBH) via digital communications. We have paid this Social Media Outlet one thousand USD via ACH Bank Transfer. Pursuant to an agreement between Dadmin Capital LLC and Social Media Outlet, Dadmin Capital LLC has hired Social Media Outlet for a period beginning on 3/16/22 and ending after one business day to publicly disseminate information about (OTC: SNBH) via digital communications. We have paid this Social Media Outlet Five Hundred USD via ACH Bank Transfer.