CRYPTO’S “Y2K” MOMENT IS HERE

How United Royale’s Northern Shield Platform Could Be the Secret to Avoiding Disaster in a Potential $368 Billion Industry

Build your watchlist with us

Get the latest stock ideas direct to your inbox. 100% free and your information stays with us.

4 FACTORS THAT MAKE UNITED ROYALE A LEADER IN THE NEW DECENTRALIZED ECONOMY

Within the next 12 months, Gartner estimates that 90% of enterprise blockchain applications will require immediate replacement to maintain security, remain competitive, and avoid obsolescence.2

As of November 1st, 2021, the company finalized its acquisition of TrueNorth Quantum, Inc. and its proprietary Northern Shield platform for developing advanced, decentralized apps on the blockchain.3

United Royale’s blockchain platform is scalable and optimized to “leapfrog” new Decentralized Apps (or “DApps”) of any size to market 5x faster than the competition. All while disrupting a sector projected to soar to $368 Billion by 2027.5, 6

Blockchain has boomed and is projected to add over $176 Billion in business value by 2025. The Northern Shield platform is designed to meet the blockchain security standards of major financial institutions across various markets, from FinTech to MedTech.4

The Problem With New Tech

During the panic of “Y2K” and the tech market crash that followed soon after, American companies learned a valuable lesson—never underestimate the dangers (or the complexities) of new technology.

Now, it seems, history may be doomed to repeat itself as some of America’s largest companies wrestle with their own outdated blockchain infrastructure.

Many companies rushed to implement blockchain-based technology over the last few years, with one unfortunate consequence

“Product managers should prepare for rapid evolution, early obsolescence … and the potential failure of early-stage technologies/functionality in the blockchain platform market,” according to the experts at Gartner.

These companies (and thousands more) will require an enterprise-grade, scalable “turnkey” solution to maintain security and viability moving forward. Those same experts at Gartner are warning those companies that they have less than 12 months to make it happen.2

Fortunately, one company has been hard at work on a platform to power the new decentralized economy.

United Royale (OTC:URYL) and its Northern Shield platform.

What you may not realize, however, is the crucial role that Blockchain platforms play in maintaining the availability and the security of blockchain data. Thus, they support the liquidity of the currencies connected to them

“Blockchain platforms are emerging platforms and, at this point, nearly indistinguishable in some cases from core blockchain technology,” explains analyst Adrian Lee.2

This is a crucial distinction that many companies overlooked in a rush to join the Blockchain Boom. Hence, many of the world’s largest companies could be exposed to a wave of security risks or unexpected outages if they don’t keep up and fast.

The Northern Shield Blockchain Platform was developed to address this specific issue—and it was almost certainly a driving force behind United Royale’s recent acquisition of True North Quantum, Inc.8

With Northern Shield, United Royale (OTC:URYL) has a dedicated, enterprise-grade Platform-as-a-Service (PaaS) solution with an integrated “Partner Accelerator Program” to fast-track new clients. All while speeding up the process from idea-to-market by as much as 500%.5

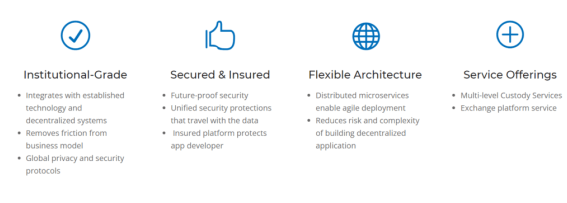

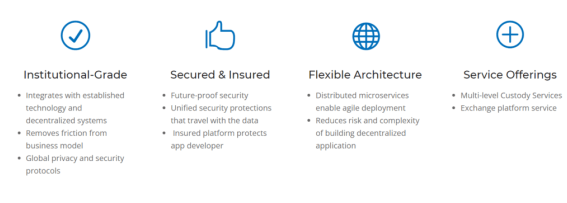

ADVANTAGES OF THE NORTHERN SHIELD BLOCKCHAIN PLATFORM

At the time this report was written, the ink on this acquisition deal was barely dry.

Yet, it’s fairly likely that United Royale (OTC:URYL) could rapidly start onboarding new clients as the Decentralized Economy begins soaring towards an estimated $368 Billion by 2027 at a 56.1% CAGR. 6

Northern Shield is a powerful platform with little real competition to speak of. Engineered to scale and meet the standards of even the strictest financial institutions, it has applications across some of the fastest-growing tech markets across the world:

FinTech:

Expected to reach a global market value of approximately $324 billion by 2026 at a 23.41% CAGR. 10

MedTech:

The global MedTech market, or medical device market more specifically, is expected to grow from $471 Billion in 2020 to reach $623 Billion by 2026, at a 5% CAGR. 9

AgTech:

The global AgTech market was valued at $17.4 billion in 2019. It’s projected to skyrocket to $41.1 billion by 2027 at a 12.1% CAGR.11

HealthTech:

In 2019, the global digital health market was worth an estimated $175 billion. Projections show this market could boom to roughly $660 billion by 2025 at an expected CAGR of almost 25%. 12

But even as these market segments present a MASSIVE opportunity for potential growth, it’s important to remember that the company is just getting started.

Because United Royale and TrueNorth are dedicated to building a decentralized economy beyond only financial applications…

A DIGITAL CLEARINGHOUSE FOR THE DECENTRALIZED ECONOMY

The global market for cryptocurrencies is currently valued at over $1.49 Billion. Yet, in reality, cry-pto-currencies could be just the first “proof of concept” when it comes to blockchain’s revolutionary potential. 21

The next wave of blockchain-based evolution has already arrived—in the form of Decentralized Apps, or DApps. These DApps can be indistinguishable from the apps you use every day on your smartphone or laptop. But by pivoting to blockchain infrastructure, these companies can tap into some of the same practical benefits that make cryptocurrencies so appealing, including:

- Removing transaction fees

- Allowing users to retain their data

- Employing an open-source infrastructure

- Since there is no central place to hack, data breaches aren’t even possible

- Accepting cryptocurrency as a payment

- Generating income for users

- Censorship-proof

- No central authority or monopoly

If you’ve heard of Non-Fungible Tokens (or NFTs), then you’re familiar with one of the most successful types of DApps on the market today.

By attaching classic collectibles like art and trading cards to the blockchain, NFTs provide collectors with the kind of peace of mind and authenticity they’ve only dreamed of in the past. And unlike traditional comic books, stamps, and coins, NFTs don’t ever age or patina. That’s enough of an appealing proposition to drive individual sales of $11.8 million14 and as much as $69 million for an individual “Beeple” NFT. 15

But the new market is not without its problems …

Take, for example, the recent sale of CryptoPunk #9998 in October of 2021 for the jaw-dropping and seemingly impossible price of $532 million. 16

Protecting Investors

Once you look a little deeper, you’ll realize that the sale was effectively fraudulent.

What likely occurred was a phenomenon known as a “wash sale,” which in the world of finance happens when both the buyer and the seller are the same person, and the price is a complete fabrication.

It’s a massively deceptive practice- even if the party involved was just having a laugh.

Within a traditional financial system, measures are typically put in place to prevent this kind of occurrence. However, the new infrastructure of these emerging blockchain platforms is simply not sophisticated enough to screen these activities out.

By implementing the Northern Shield platform, DApps of all sizes can tap into similar enterprise-grade solutions as larger financial institutions, with a critical focus on transaction security and flexibility.

What’s more, Northern Shield’s Partner Accelerator Program offers practical support to help empower developers through every step of the process and bring new DApps to market 5x faster.

For larger financial applications, Northern Shield can guide clients through the process of App Development and Rapid Prototyping. It can also ensure that the app function meets each institution’s specific standards for compliance and safe transactions.

It could mean offering crucial capital injection or working on a transaction-based pricing model for smaller developers and apps. It could also allow fees to scale with revenue as new DApps grow organically.

United Royale’s (OTC:URYL) Partner Accelerator Program is an appealing proposition for potential clients. Meanwhile, it’s also an excellent way for investors to get exposure through what is effectively an “incubator” for up-and-coming DApps.

United Royale coul

Incorporated in Kowloon, Hong Kong, in 2015, United Royale (OTC:URYL) is a small-cap stock with 3+ years of trading history on the OTC. As of Nov 3, 2021, it also had a market cap of just over $110 million.17

Shares were trading as high as $6.50 as recently as Dec 04, 2020, before tumbling to $0.80 when the market closed on Nov 02, 2021.22 This downside price action was likely due to the company’s aggressive pivot into the blockchain space, which remained a mystery following the dismissal of prior management in March of 2020.18

Fortunes for the stock have dramatically changed since the summer, though. As the company’s vision has become clearer, the stock has seen an uptrend, starting with announcing a Letter of Intent (LOI) to acquire TrueNorth Quantum Inc. on Jul 30 of 2021.19

If United Royale (OTC:URYL) retraces its recent highs, that could mean 1,525% of upside potential from its Jan 12, 2021 closing price of $0.40.17 Now, I’m not saying this stock is going to run 1,500%+ in the next day or two, but you need to be aware of the potential upside and potential catalysts that could fuel this stock towards its 2020 highs.

Additionally, consider how tightly the stock is held too. Another encouraging factor is that the company’s single largest shareholder is its director, with 84,456,500 shares worth 59.48% of its ownership (as of 11/3/21). That’s a favorable $66.7 million vote of confidence in United Royale’s (OTC:URYL) future.17

Get the latest stock ideas direct to your inbox.

100% free and your information stays with us.

Sources

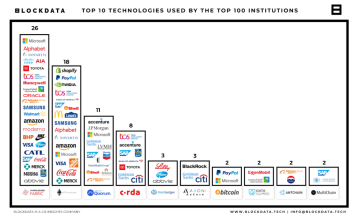

Source 1: Blockdata | 81 of the Top 100 Public Companies are using blockchain technology

Source 2: https://www.gartner.com/en/newsroom/press-releases/2019-07-03-gartner-predicts-90–of-current-enterprise-blockchain (90% of 81 is 72.9)

Source 3: https://www.yahoo.com/now/united-royale-group-holdings-corp-121031049.html

Source 4: https://www.gartner.com/en/doc/3855708-digital-disruption-profile-blockchains-radical-promise-spans-business-and-society

Source 5:https://truenorthquantum.com/wp-content/uploads/2021/07/TNQ_Fact-Sheet_draft_02.pdf

Source 6: https://www.emergenresearch.com/industry-report/dapps-market

Source 7: https://www.marketwatch.com/investing/stock/uryl

Source 8: https://truenorthquantum.com/solutions/

Source 9: https://www.globenewswire.com/en/news-release/2021/07/01/2256420/0/en/Global-Medical-Device-Market-Size-Share-Increases-at-5-CAGR-Will-Reach-USD-623-Billion-By-2026-Facts-Factors.html#:~:text=%5B225%2B%20Pages%20Research%20Report%5D,forecast%20period%20of%202021%2D2026.

Source 10: https://www.marketdataforecast.com/market-reports/fintech-market

Source 11: https://www.globenewswire.com/en/news-release/2021/04/16/2211431/28124/en/Global-Agritech-Market-Report-2021-Market-was-Valued-at-17-442-7-Million-in-2019-and-is-Projected-to-Reach-41-172-5-Million-by-2027.html

Source 12: https://www.statista.com/statistics/1092869/global-digital-health-market-size-forecast/#:~:text=In%202019%2C%20the%20global%20digital,660%20billion%20dollars%20by%202025.

Source 13: https://www.devteam.space/blog/the-future-of-dapps/

Source 14: https://news.artnet.com/market/sothebys-natively-digital-sale-1979174

Source 15: https://news.artnet.com/market/christies-nft-beeple-69-million-1951036

Source 16: https://bit.ly/3GRlyJ0

Source 17: https://bit.ly/3waNLoU

Source 18: https://docoh.com/filing/1652842/0001669772-16-000001/URYL-3

Source 19: https://finance.yahoo.com/news/united-royale-group-holdings-corp-123000885.html

Source 20: https://www.yahoo.com/now/united-royale-group-holdings-corp-121031049.html

Source 21: https://yhoo.it/3ENs7dL

Source 22: https://finance.yahoo.com/quote/URYL/history?p=URYL

- Source 23: https://www.barchart.com/stocks/quotes/URYL/interactive-chart

Disclaimer

Stock Research Today is a project of Dadmin Capital LLC and intended solely for entertainment and informational purposes. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/. This website / media webpage is owned, operated and edited by Dadmin Capital LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Dadmin Capital” refers to Dadmin Capital LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and promote small public companies. By reading our website / media webpage you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our website / media webpage .We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website / media webpage are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. Dadmin Capital business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Dadmin Capital. often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Compensation – Pursuant to an agreement between Dadmin Capital LLC and TD Media LLC, Dadmin Capital LLC has been hired for a period beginning on 4/4/22 and ending after 4 business days to publicly disseminate information about (OTC: URYL) via digital communications. We have been paid fifteen thousand USD via ACH Bank Transfer. Social Media Compensation – Pursuant to an agreement between Dadmin Capital LLC and Social Media Outlet, Dadmin Capital LLC has hired Social Media Outlet for a period beginning on 4/04/22 and ending after one business day to publicly disseminate information about (OTC: URYL) via digital communications. We have paid this Social Media Outlet six thousand USD via ACH Bank Transfer. Pursuant to an agreement between Dadmin Capital LLC and Social Media Outlet, Dadmin Capital LLC has hired Social Media Outlet for a period beginning on 4/4/22 and ending after one business day to publicly disseminate information about (NASDAQ: URYL) via digital communications. We have paid this Social Media Outlet one thousand USD via ACH Bank Transfer.