5 Reasons Why World Copper LTD (TSXV: WCU | OTC: WCUFF ) Could Be Poised For Significant Upside Potential in 2024

IDENTIFYING THE OPPORTUNITY

THIS BATTERING RAM IS READY TO BREAK THROUGH

With a float of 48M and few restricted shares, a little bit of investor interest could send this soaring!

TARGETS

Key Level #1: $0.16 (+23.08%)

Key Level #2: $0.20 (+53.85%)

Key Level #3: $0.28 (+115.38%)

Potential Support: $0.10

World Copper LTD

(TSXV: WCU | OTC: WCUFF)

Strategic copper asset development

World Copper Ltd. is strategically positioned as a compelling investment opportunity, driven by its robust portfolio of advanced copper oxide projects. The company's primary assets, Zonia in Arizona and Escalones in Chile, showcase significant potential with impressive resource estimates.

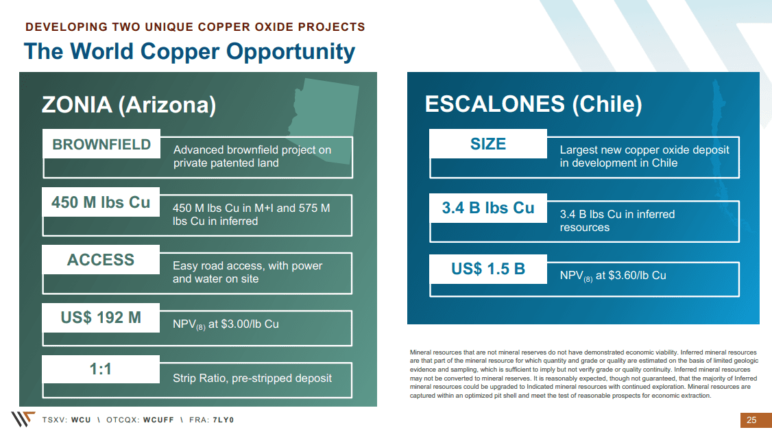

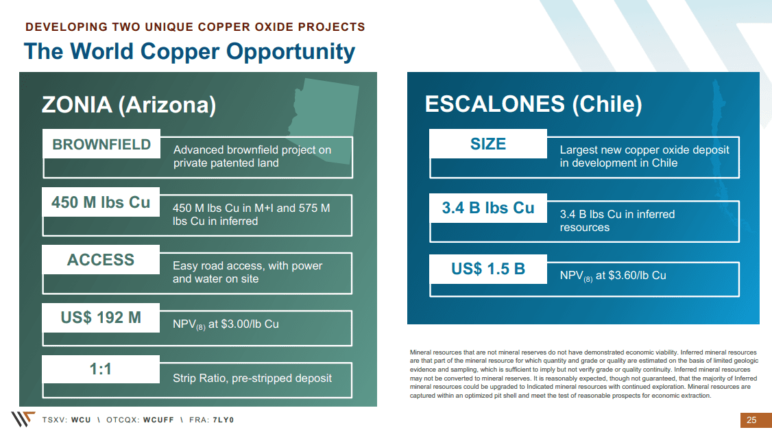

Zonia, an advanced brownfield project, boasts 450 million pounds of copper in Measured and Indicated resources and 575 million pounds in Inferred resources. Located on private patented land, it offers advantages in permitting and infrastructure, which expedite the path to production.

The project's proximity to Phoenix, access to power and water, and existing infrastructure enhance its attractiveness. With a favorable NPV of $192 million at $3.00/lb copper and substantial resource expansion potential, Zonia represents a low-risk, high-reward investment.

Escalones, the largest new copper oxide deposit in development in Chile, further bolsters World Copper's value proposition. With 3.4 billion pounds of copper in Inferred resources, Escalones presents significant upside potential. The project's PEA outlines a robust economic case with a post-tax NPV of $1.5 billion and a 46.2% IRR at $3.60/lb copper.

Located near major infrastructure and the world's largest underground copper mine, El Teniente, Escalones benefits from logistical advantages and established exploration camp facilities. The extensive land package, combined with multiple new porphyry targets, enhances the project's exploration potential, making it a cornerstone asset for future growth.

WORLD COPPER LTD

(TSXV: WCU | OTC: WCUFF)

Sustainable and Efficient Operations

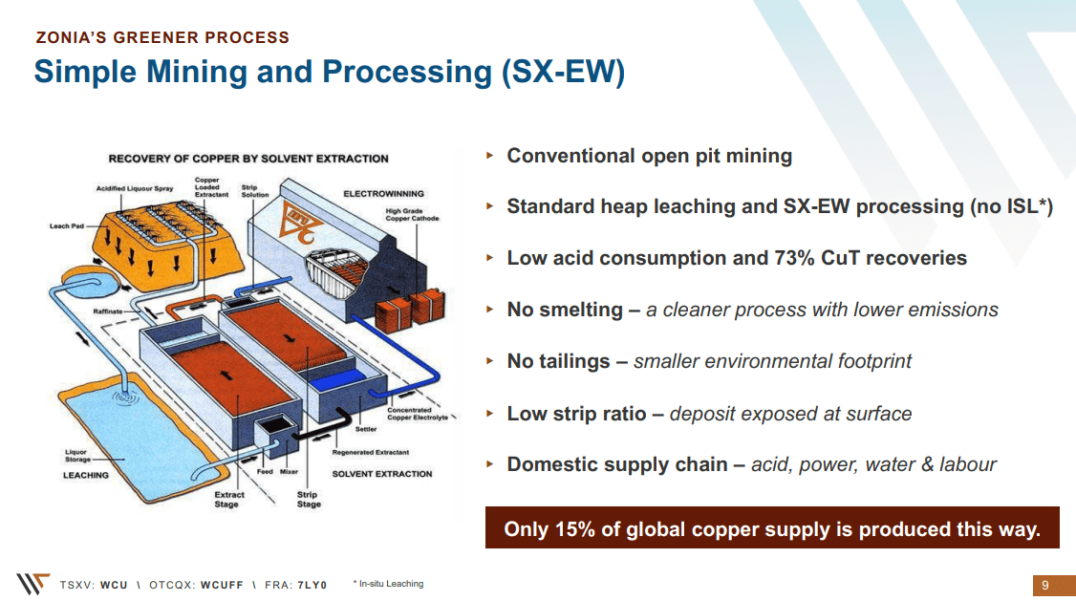

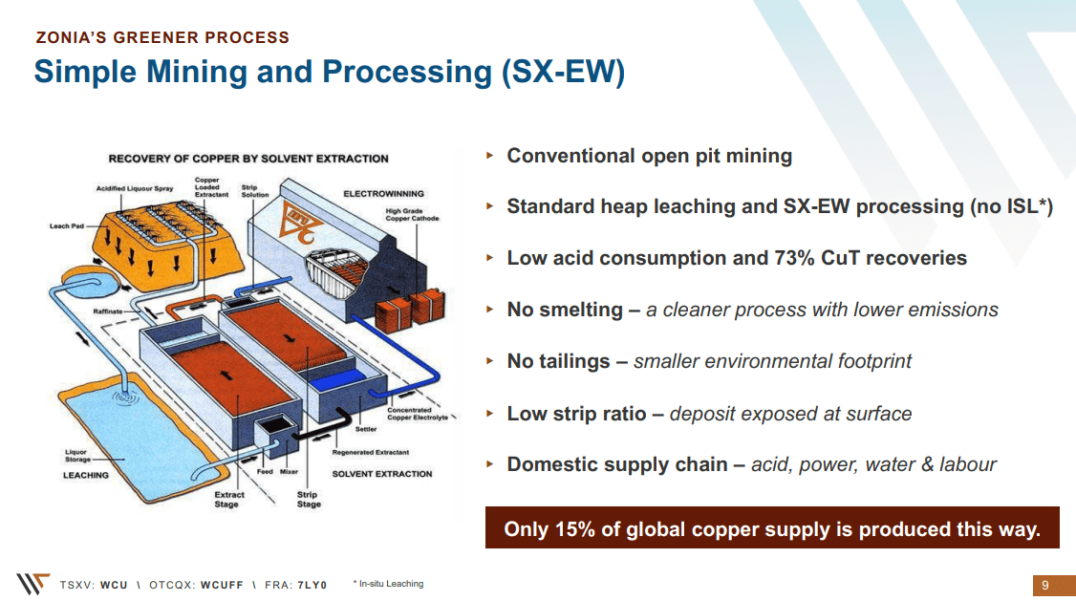

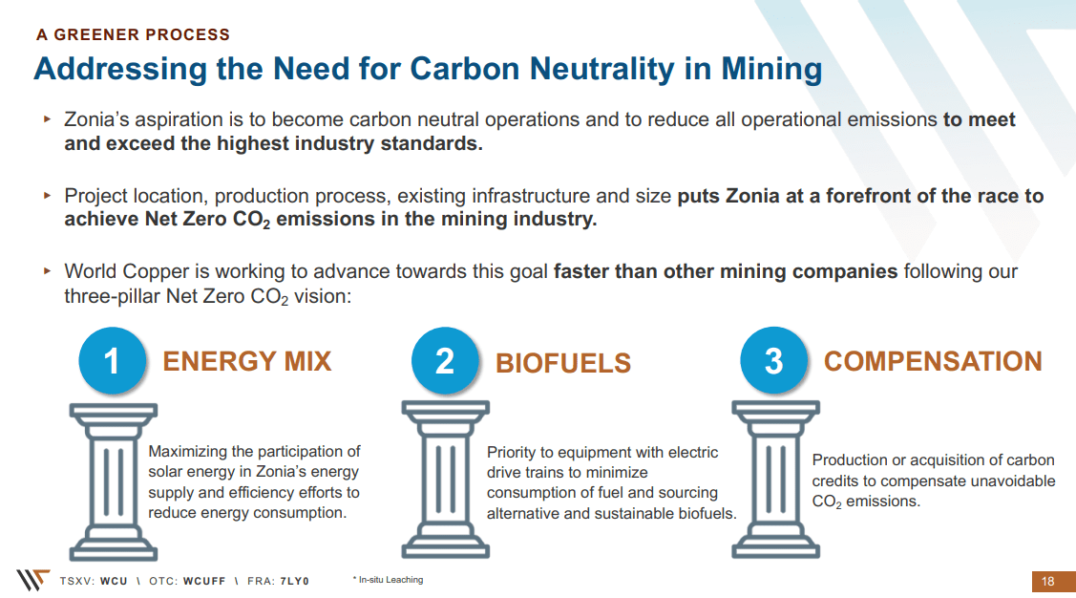

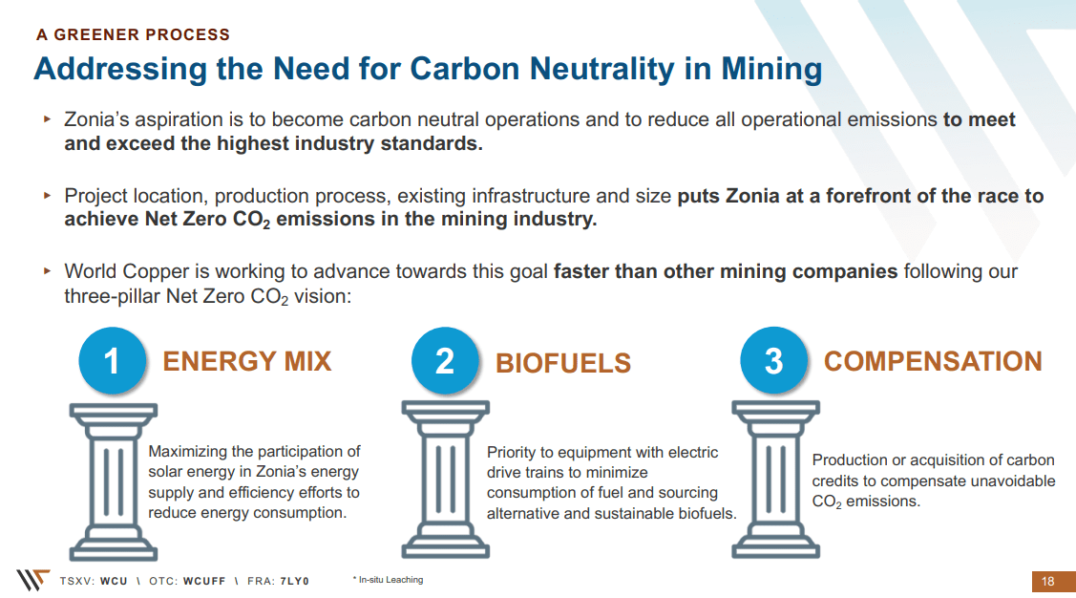

World Copper LTD (TSXV: WCU | OTC: WCUFF) is committed to developing environmentally sustainable and efficient mining operations. The Zonia project exemplifies this commitment through its adoption of the SX-EW (solvent extraction-electrowinning) copper processing method, which is 38% less carbon-intensive than traditional concentrate smelting and refining.

This process eliminates the need for smelting, significantly reducing greenhouse gas emissions and producing 99.99% pure copper cathode on-site. The project's low strip ratio and minimal acid consumption further enhance its environmental and economic efficiency. Additionally, Zonia's location offers high solar power potential, contributing to a low-emission energy mix and aligning with global decarbonization trends.

Escalones also adheres to sustainable practices, leveraging its favorable location and infrastructure to minimize environmental impact. The project's potential to produce 50,000 tonnes of copper cathodes annually over 20 years underscores its long-term viability.

By focusing on copper oxide resources, which have a lower environmental footprint compared to sulfide deposits, World Copper is positioned as a responsible player in the mining industry. These sustainable practices not only mitigate environmental risks but also align with increasing regulatory and market demands for greener mining solutions.

WORLD COPPER LTD

( TSXV: WCU | OTC: WCUFF)

Strong Market Position and Growth Potential

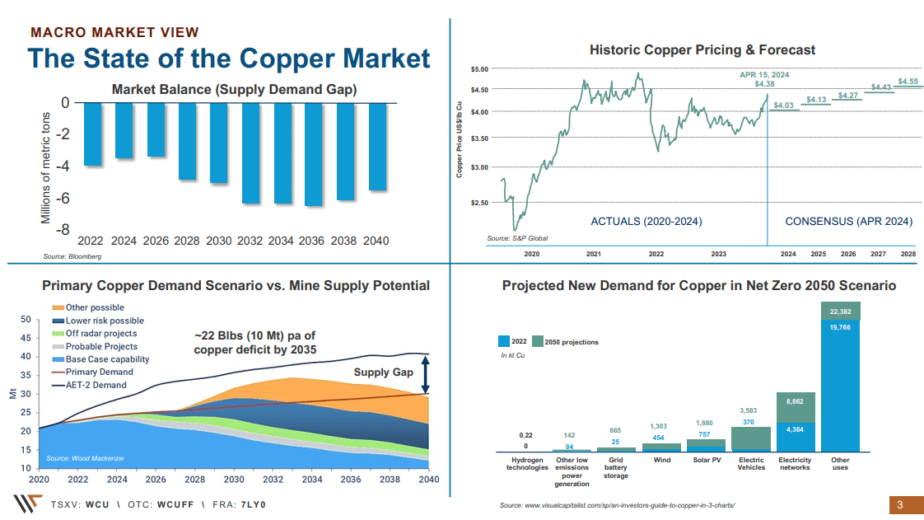

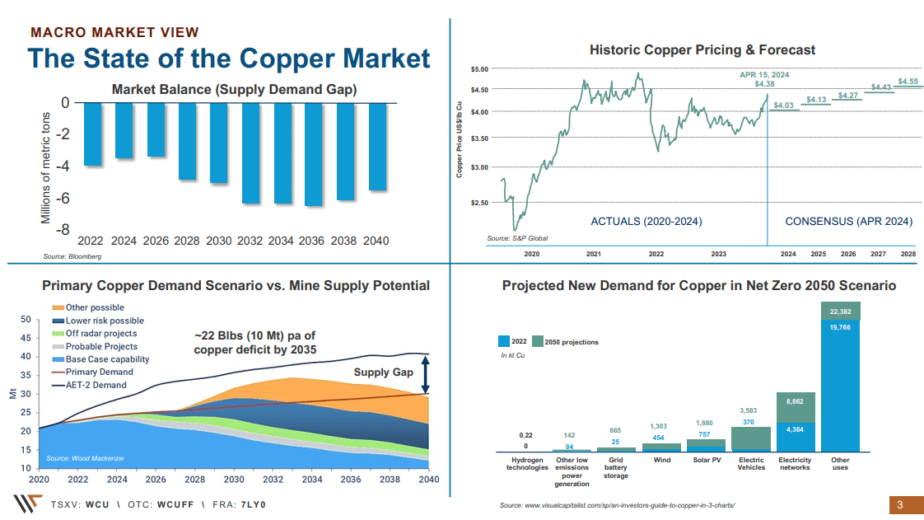

World Copper's strategic focus on copper, a critical metal for the global energy transition, positions it favorably in a market with robust long-term demand.

Copper's essential role in electrification, renewable energy infrastructure, and electric vehicles underscores its strategic importance. With copper prices projected to remain strong due to supply constraints and increasing demand, World Copper's assets are well-positioned to capitalize on these favorable market dynamics.

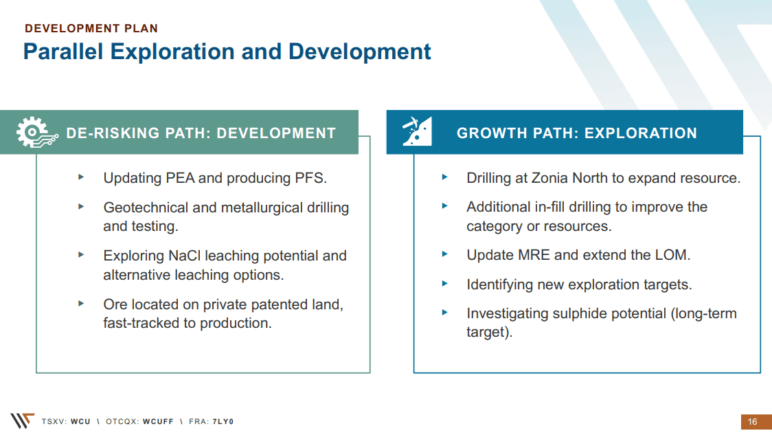

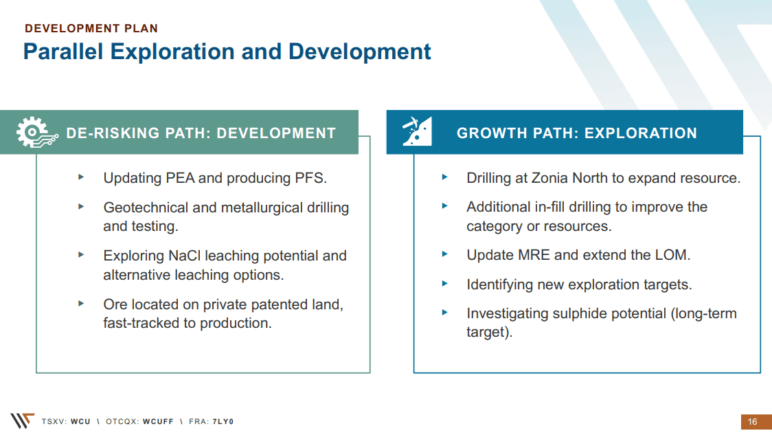

The company's dual-track approach, balancing project development and exploration, ensures steady progress and value creation.

The management team, led by President and CEO Gordon Neal, brings extensive experience in the metals and mining sector, capital markets, and corporate governance. Their expertise in navigating complex regulatory environments and executing strategic initiatives provides a solid foundation for the company's growth. The combination of advanced project development, sustainable practices, and a strong market position makes World Copper an attractive investment.

The company's ability to de-risk its projects, expand resources, and deliver economic returns positions it as a leading contender in the copper mining industry, offering investors significant growth potential and long-term value.

Introducing the Management Team of World Copper LTD

(TSXV: WCU | OTC: WCUFF)

Gordon neal - president, ceo & director

Mr. Neal has extensive experience in the metals and mining sector, as well as in capital market, corporate governance, corporate finance and investor relations. Most recently he served as CEO & Director of Tincorp Metals, President of New Pacific Metals Corp, VP Corporate Development at Silvercorp Metals Inc., and VP Corporate Development at Mag Silver Corp. Since 2004, Mr. Neal has raised over $500M for various resource companies.

marcelo awad - executive director, chile

Mr. Awad has a long and distinguished career in the mining industry 18 years with Codelco, most recently as Executive Vice President 16 years with Antofagasta Minerals S.A., the Mining Division of Antofagasta Plc, including 8 years as CEO from 2004 to 2012, a period of significant growth for Antofagasta. In the 2011 Harvard Business Review, Mr. Awad was ranked as the number one CEO in Chile, 18th in Latin America and 87th in the world.

krzysztof napierala - vp business development

Mr. Napierala is a professional with 12 years of experience in mining and manufacturing industries. He is a driven executive with a strong background in business development, exploration, project management, and the management and restructuring of mining operations. His career is highlighted by over ten years with the KGHM Group, where he started as an associate supporting the company’s business development activities and new acquisitions.

john drobe - chief geologist

Mr. Drobe is a geologist with over 30 years experience specializing in porphyry copper-gold, epithermal and skarn deposits throughout the Americas. Mr. Drobe has a deep experience with organizing and managing exploration campaigns, particularly in South America, which he has participated in the exploration and development of projects in Peru, Argentina, Ecuador, Venezuela and Chile.

daniel macneil - technical advisor

Mr. MacNeil is an Economic Geologist specializing in the Precious and Base Metals sectors, with over 20 years of experience from continental-scale project generation to in-mine resource expansion in a wide variety of geological settings in the Americas, Europe, Eastern Europe and the Near East. His expertise includes project evaluation, target and opportunity identification, exploration strategy, district entry strategy, business development, strategic evaluation of geologic terranes and execution of target testing. Mr. MacNeil is the Founder of Vector Geological Solutions.

marla ritchie - corporate secretary

Ms. Ritchie brings over 25 years experience in public markets working as an Administrator and Corporate Secretary specializing in resource based exploration companies. Currently, she is also the corporate secretary for several companies, including International Tower Hill Mines Ltd. and Trevali Mining Corporation.

Sources

- Source 1: https://worldcopperltd.com/company/management/

- Source 2: https://worldcopperltd.com/

- Source 3: https://worldcopperltd.com/wp-content/uploads/2024/05/WCU-One-Pager-Spring-2024.pdf

- Source 4: https://worldcopperltd.com/wcu-corporate-presentation.pdf

- Source 5: https://worldcopperltd.com/news/

- Source 6: https://worldcopperltd.com/2024/07/02/world-copper-identifies-new-opportunity-at-zonia-copper-project-in-arizona/

- Source 7: https://worldcopperltd.com/investors/analyst-coverage/

- Source 8: https://worldcopperltd.com/company/properties/zonia/

- Source 9: https://worldcopperltd.com/company/properties/escalones/

- Source 10: https://ca.finance.yahoo.com/quote/WCU.V/

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media LLC and JRZ Capital LLC, Virtus Media LLC has been hired by JRZ Capital LLC for a period beginning on 2024-07-17 and ending 2024-08-14 to publicly disseminate information about TSXV: WCU | OTC: WCUFF via digital communications. We have been paid one hundred twenty thousand dollars USD.