IDENTIFYING THE OPPORTUNITY

INSTITUTIONAL SUPPORT IS IN PLACE AND READY TO RUN

We have a strong history of confident bullish rallies from this zone and excellent incentive from the market interest perspective!

TARGETS

$1.74 (+17.57%)

$1.83 (+23.65%)

$2.00 (+35.14%)

$2.25 (+52.03%)

$2.70 (+82.43%)

Potential support in the $1.36 range

EQUUS TOTAL RETURN INC

(NYSE: eqs)

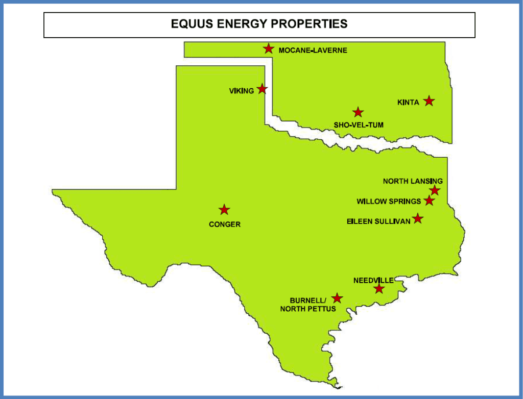

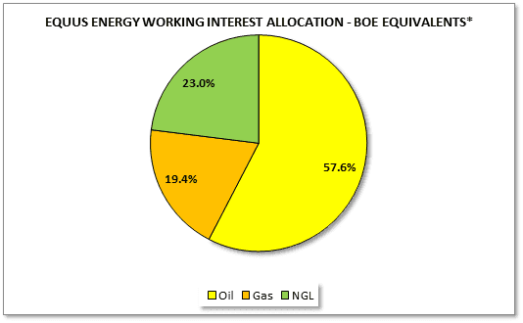

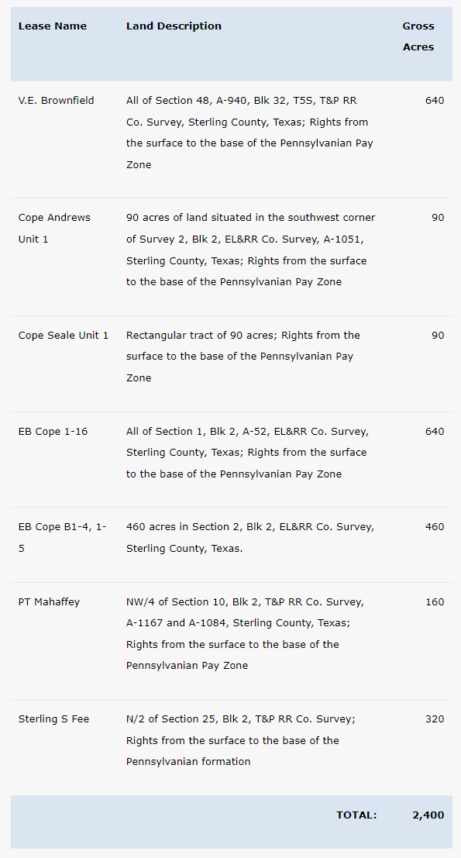

Equus Energy, LLC (“Equus Energy”) has non-operated ownership of 10 fields in Texas and Oklahoma (collectively, the “Properties”). This portfolio represents interests in 141 wells across 13 counties in these two states. Proved reserves are 44% producing and approximately 58% oil; additional liquids are associated with the gas reserves which have a high BTU content. A significant portion of the overall value stems from the Company’s 2,400 acres in the Conger Field. Located in Sterling County, Texas, the Conger Field is operated by Chevron and has historically managed an active recompletion program.

FIELD LOCATIONS

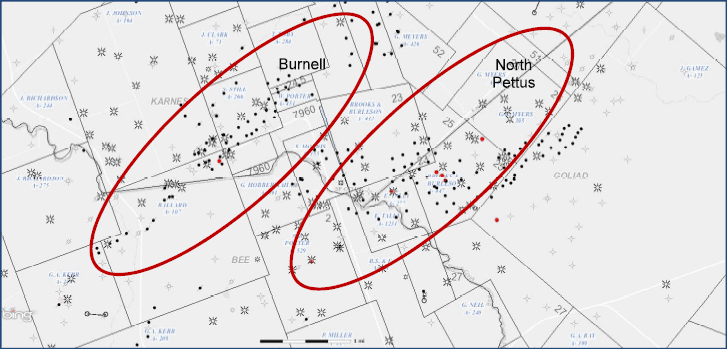

The Company’s 10 field locations range from the Texas and Oklahoma panhandles to the Gulf Coast. Two of these fields, the Conger and the Burnell/North Pettus fields, have rights to the Permian Wolfcamp formation and the Eagle Ford formation, respectively, two of the most productive and low cost hydrocarbon production zones on earth.

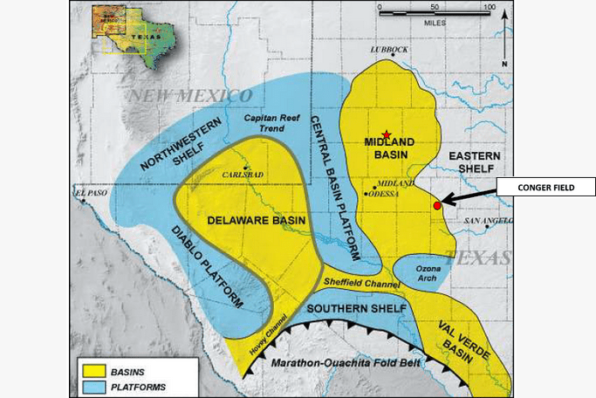

CONGER HISTORY

Equus Energy holds a 50% working interest in 40 Canyon Sand gas wells and rights to 2,400 gross acres in the Conger Field, located in Sterling County, Texas. The Conger Field is situated on the eastern (termed the “Midland”) side of the Permian Basin, the largest petroleum producing reservoir in the United States measured both by reserves and production, which presently accounts for almost ¼ of aggregate U.S. hydrocarbon production.

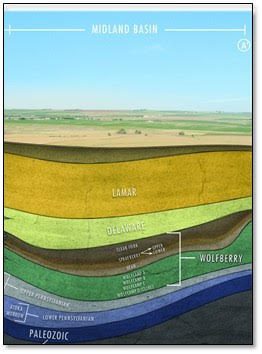

Equus Energy’s Conger wells are operated by Chevron USA, which has drilled over 350 Canyon Sand wells in the Conger Field since 1975. The wells were initially reported as oil wells (on a lease basis) then gradually reclassified as gas wells. In 2003, Chevron began a recompletion program in an oil and gas field near Conger from the Canyon Sand reservoir (upper Pennsylvanian formation) to the Wolfcamp formation, a prolific producer of oil and natural gas throughout the Permian Basin. In November 2016, the U.S. Geological Survey estimated that 20 million barrels of oil, 1.6 billion barrels of natural gas liquids, and 16 trillion cubic feet of natural gas was recoverable from the Wolfcamp formation.

Below is an illustration of the various geologic strata in the Midland section of the Permian Basin, with the Wolfcamp formation (divided into 4 sub-zones) beginning at a depth of approximately 6,000 feet.

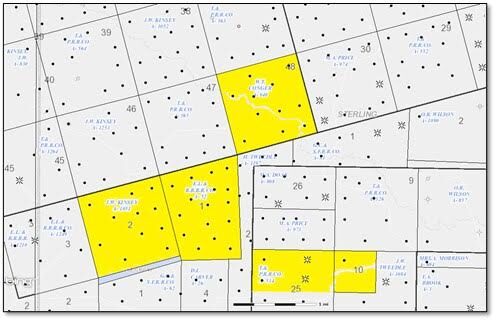

CONGER WELL MAP

The Conger Field is located in the southwestern corner of Sterling County, Texas, with the various Conger leases situated on contiguous or adjacent township sections concentrated in a few square miles. The leases in which Equus Energy holds a working interest are highlighted in yellow below:

BURNELL/N. PETTUS HISTORY

Generally. Equus Energy holds a 7.2% working interest in the Burnell Field and a 2.5% working interest in the North Pettus Field located in Karnes, Bee, and Goliad Counties in Southeast Texas. These interests have been unitized through various limited partnership and joint venture structures, with Trinity River as the principal operator, having acquired its operating interest from Legend Natural Gas LP in 2017. Legend acquired operatorship from Devon in 2005 and has since drilled over 20 wells in the two fields. The main targets have been the Middle Wilcox Z and G Sands at depths of 9,000’ and 10,000’. On the Burnell and North Pettus Units, there are 69 total wells that collectively produce approximately 2,000 MMCFD and ~200 barrels of liquids per day.

Burnell. The Burnell Field, also known as the Burnell Unit, is located just north of the North Pettus Unit of the Tulsita-Wilcox field. They are very similar accumulations with the trap being a downthrown structural closure that produces from the same Upper and Middle Wilcox Sands. Like the North Pettus Unit, Burnell Field was a Pennzoil legacy field. Prior to the sale of its interest in 2017, Legend drilled five wells in the Burnell Unit since 2005 and has made three Middle Wilcox Z or G Sand completions, one Upper Wilcox Massive Sand completion and one Upper Wilcox Slick Sand completion

North Pettus. The Tulsita-Wilcox Field was discovered in 1942 by Union Producing Company, and the majority of the field was unitized in 1947 as the North Pettus Unit. Prior to the sale of its interest to Trinity River in 2017, Legend drilled 17 wells in the unit since beginning their initial drilling program in early 2006. This activity resulted in an increase in gas production from 2,600 MCFD to over 18,000 MCFD in 2008. The Upper and Middle Wilcox Sand reservoirs are encountered at drilling depths of 6.000’ to 10,000’. The primary trap at all levels is a simple, downthrown rollover structural closure. The Middle Wilcox Sands, which are encountered at depths from 9,000’ to 10,000’, have been the primary focus of legend’s drilling program. Thirteen out of the 17 wells drilled at North Pettus Unit are Middle Wilcox Z or G Sand completions.

EQUUS TOTAL RETURN INC

(NYSE: EQS)

Morgan E&P (“MEP”) is an exploration and production company formed in 2023 to responsibly develop upstream opportunities targeting the prolific Bakken formation of the Williston Basin. MEP is a wholly-owned subsidiary of Equus Total Return, Inc. (NYSE:EQS).

Exploration And Production

Morgan E&P (“MEP”) is an exploration and production company formed in 2023 to responsibly develop upstream opportunities targeting the prolific Bakken formation of the Williston Basin. MEP is a wholly-owned subsidiary of Equus Total Return, Inc. (NYSE:EQS).

The MEP team has extensive experience in the Williston Basin, from the identification of successful producing areas, to the design, drilling and completion of over a thousand wells, to successful operational and financial contributions, all while committed to operating safely and responsibly.

BAKKEN FORMATION IN THE WILLISTON BASIN

Morgan E&P is committed to operations in the Williston Basin in North Dakota. Morgan E&P was formed in 2023 and its key management and operations team have drilling, completions and operations experience covering over 3,000 wells across the Williston basin as well as accumulated key expertise in the successful development of other unconventional reservoirs such as Permian, Powder River, Big Horn, Green River, and San Joaquin.

The operations team is dedicated to a data analytics driven approach that factors in key corporate values of sustainability, safety and local community partners as our strategic competitive advantage.

OVERVIEW OF THE BAKKEN FORMATION IN THE WILLISTON BASIN

The Bakken formation in the Williston Basin is a vast sedimentary rock unit covering approximately 200,000 square miles, with the majority situated in North Dakota. The United States Geological Survey (USGS) estimates that the Bakken formation holds recoverable reserves of up to 7.4 billion barrels of oil and 6.7 trillion cubic feet of natural gas, making it one of the most promising regions for energy production.

In recent years, the Bakken has experienced remarkable production growth, significantly contributing to the United States becoming a leading oil and gas producer, with over 1.5 million barrels of oil produced per day during 2022. Additionally, the Williston Basin benefits from a well-developed infrastructure, including over 10,000 miles of pipelines, numerous rail terminals, and processing facilities. This enables efficient transportation and distribution of oil and gas resources and provides a competitive advantage in accessing major refining and consuming markets.

Sources

Source 1: https://equuscap.com/Source 2: https://equuscap.com/about/Source 3: https://equuscap.com/about/operating-company-strategy/Source 4: https://equuscap.com/about/investment-criteria/Source 5: https://equuscap.com/about/portfolio/Source 6: https://equuscap.com/about/team/Source 7: https://equuscap.com/investor-relations/sec-filings/Source 8: https://equuscap.com/investor-relations/Source 9: https://equuscap.com/investor-relations/press-releases/Source 10: https://equuscap.com/investor-relations/stock-information/Source 11: https://equuscap.com/investor-relations/corporate-governance/Source 12: https://equuscap.com/investor-relations/stockholder-faqs/Source 13: https://morganep.com/Source 14: https://morganep.com/about-us/Source 15: https://morganep.com/team/Source 16: https://morganep.com/operations/Source 17: https://morganep.com/corporate-responsibility/Source 18: https://morganep.com/press-releases/Source 19: https://morganep.com/updates/Source 20: https://morganep.com/operations/Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media Group LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media Group LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media Group LLC and Lifewater Media, Virtus Media Group LLC has been hired by Lifewater Media LLC for a period beginning on 02/12/2024 and ending 02/14/2024 to publicly disseminate information about NYSE:EQS via digital communications. We have been paid seven thousand five hundred dollars USD. Virtus Media Group agrees to pay social media influencer #1 two hundred fifty dollars. Virtus Media Group agrees to pay social media influencer #2 two hundred fifty dollars. Virtus Media Group agrees to pay social media influencer #3 two hundred fifty dollars. Virtus Media Group agrees to pay social media influencer #4 two hundred fifty dollars.