LATEST NEWS

Kaival Brands Amends Agreement with Phillip Morris International for Distribution of ENDS Products

7 Reasons Why Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) Could Be Poised For Significant Upside Potential in 2023

IDENTIFYING THE OPPORTUNITY

COMPRESS AND RELEASE

With a float of ~14M, a little bit of investor interest could send this soaring again!

TARGETS

Target #1: $0.88 (+91.72%)

Target #2: $1.24 (+170.15%)

Target #3: $1.56 (+239.87%)

Target #4: $2.32 (+405.45%)

Bonus #1: $3.04 (+562.31%)

Bonus #2: $4.47 (+873.86%)

KAIVAL BRANDS INNOVATIONS GROUP, INC.

(NASDAQ: KAVL)

Discover A Market That's Expected To Grow Over 660% To $168 Billion By 2030

The world is changing - That means potential

Around the world, people are becoming increasingly aware of the hazardous effects of smoking regular cigarettes. In response to this growing concern, alternative products have been developed to assist individuals in quitting smoking. One of the most significant global health issues related to smoking is cancer. Traditional cig-a-rettes contain over 4,000 chemicals, including to-bacco and numerous toxins and carcinogens that can cause cancer and lung diseases. E-cig-a-rettes, on the other hand, eliminate the risk of cancer and avoid the ingestion of harmful substances found in to-bacco smoke. Additionally, e-cig-a-rettes produce less harmful materials and pose less risk to smokers with asthma.

An electronic cig-a-rette typically consists of a battery, an atomizer, and an inhaler, simulating the act of smoking without releasing smoke into the air. These devices are filled with a liquid solution containing nicotine or being nicotine-free, which is heated and turned into vapor for inhalation. Compared to traditional cig-a-rettes, e-cig-a-rettes are considered less hazardous, making them an attractive option for individuals looking to quit smoking.

As research conducted by medical institutions and associations continues to highlight the safety advantages of e-cig-a-rettes over traditional cig-a-rettes, particularly among the younger generation, the market for e-cig-a-rettes is expected to experience further expansion. The ability of e-cig-a-rette providers to customize their products, offering features such as temperature control and varied nicotine dosages, is also projected to drive demand.

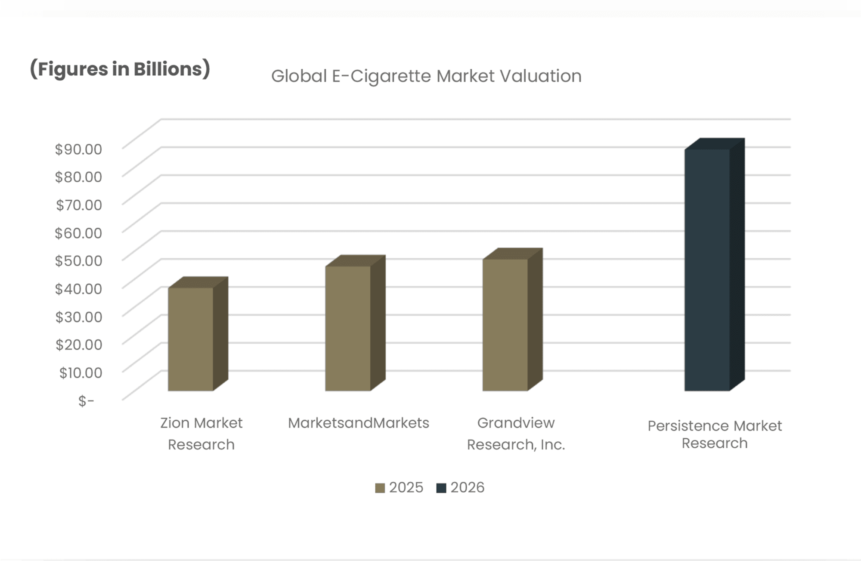

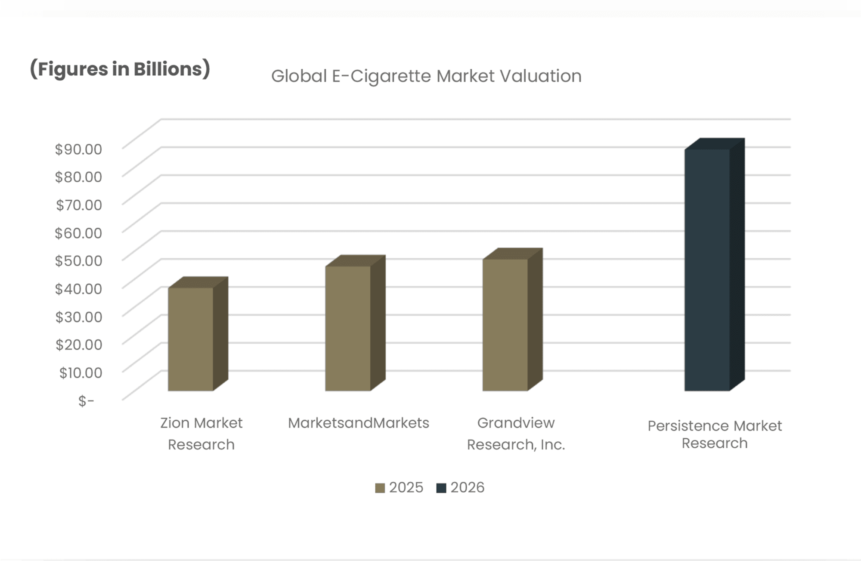

According to a report from Beyond Market Insights, the Global E-Cig-a-rette Market was worth $22.17 billion in 2022 and is estimated to grow over 660% to $168.96 billion by 2030.

One little-known company to keep an eye on in this space is Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL).

Keep reading to see why Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) deserves a top spot on your daily watchlist.

KAIVAL BRANDS INNOVATIONS GROUP, INC.

(NASDAQ: KAVL)

Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL): A Promising Growth Story Supported By Bullish Report And $2.67 Target From Harbinger Research

Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) is making waves in the electronic nicotine delivery systems (ENDS) market, and it comes as no surprise with the backing of Harbinger Research’s positive outlook.

Resilient Sales Growth and High-Profile Contracts

Despite facing challenges in previous years, Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) has shown remarkable resilience and has witnessed rapid sales growth. After achieving an impressive $100 million in sales in CY2020, the company went through a tough phase, but it emerged stronger and more focused.

In the second fiscal quarter of ’23, Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) experienced a substantial 25% increase in revenues, signaling a positive turnaround. Moreover, the recent acquisition of major contracts with industry giants such as Circle K and Kwik Trip/Mapco stores is a testament to the company’s growing market presence.

Driving Innovation with GoFire IP Portfolio

Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL)’s commitment to innovation has been further strengthened by the strategic acquisition of the GoFire Intellectual Property (IP) portfolio. With 12 existing patents and 46 patents pending, the company now enjoys a strong position in the ENDS market, poised for groundbreaking product development.

The acquired IP portfolio opens doors to multiple licensing opportunities and near-term royalty revenues, while also empowering Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) to create cutting-edge ENDS products, setting itself apart from competitors.

Positive Regulatory Environment

Harbinger Research’s report highlights the favorable regulatory environment for Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL). With the FDA’s crackdown on illicit ENDS sales, the company is well-positioned to benefit from a stable market, enhancing its growth potential.

A Vision for the Future

Harbinger Research recognizes Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) as a promising player in the ENDS market. Its ability to overcome challenges, secure high-profile contracts, and drive innovation has led to a positive outlook for the company.

With a bullish rating from Harbinger Research and a 12-month price target of $2.67 per share, Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) is positioned for a bright future, backed by a research firm that believes in its growth story.

Harbinger Research Report Suggests 513% Potential Upside For Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL)

Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) has demonstrated the potential for significant upside potential with a 52-week range of $.435 – $1.80. Not that any returns to previous highs are certain, but the potential for a 313% upside, after bouncing off their 52-week low on 8/10/2023, suggests a strong reason to begin your research on this company.

Since bouncing off of their May low of $.524 on 5/23/2023, shares of Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) moved over 84% in just over one month when they reached $.9652 on 6/26/2023.

However, the most significant potential upside lies in the target set by Brian Connell, CFA of Harbinger Research. The $2.67 target set by Harbinger suggests an upside potential of over 513% after shares of Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) bounced off their 52-week low of $.435 on 8/10/2023.

In fact, Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) has what some on Wall Street would consider a “low float.”

Market participants typically consider a float of 10-to-20 million shares as a low float. Some larger corporations have very high floats in the billions.

Companies with a low float frequently have a large portion of their equity held by controlling investors such as directors and employees, which leaves only a tiny percentage of the stock available for public trading.

Because low-float stocks have fewer shares available, market participants may have difficulty finding shares available.

Low float stocks have the potential to present significant swings as active market participants take notice.

As of 8/2/2023, Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) has less than 14.2 million shares available in its public float according to MarketWatch.com, so this could be one interesting situation to watch closely.

Not to mention that according to FinViz.com, Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) insiders own over 75% of shares as of 8/2/2023.

While the company’s stock price has seen fluctuations, it’s important to note that Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) is a company focused on incubating innovative and profitable adult-focused products into mature and dominant brands.

Currently, the Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL)’s primary focus lies in the distribution of electronic nicotine delivery systems (“ENDS”), which is a rapidly growing industry with a global valuation of $50.9 billion.

Harbinger Research Report Suggests 330% Potential Upside For Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL)

The electronic cig-a-rette market and electronic nicotine delivery systems (ENDS) industry have witnessed exponential growth in recent years, making it one of the most promising sectors for potential investors.

Currently, the global valuation of this market stands at an impressive $50.9 billion, showcasing the scale and financial potential of the industry. What makes this even more compelling is the projected annual growth rate of over 20%, indicating that the market is not only substantial but also showing no signs of slowing down.

Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) is strategically positioned within this lucrative market, presenting an exciting opportunity for investors seeking high-growth prospects. As a company operating in the electronic cig-a-rette and ENDS industry, Kaival Brands taps into this rapid expansion, offering significant revenue potential.

The demand for electronic nicotine delivery systems has been on the rise, fueled by several factors. One of the most prominent drivers is the growing awareness of the harmful effects of traditional cig-a-rette smoking. As people become more health-conscious, they are actively seeking safer alternatives to smoking, which has led to an upsurge in the adoption of electronic cig-a-rettes and ENDS devices.

Additionally, advancements in technology and product innovation have played a crucial role in driving market growth. Electronic cig-a-rettes provide users with a smoking-like experience without the harmful chemicals found in traditional to-bacco cig-a-rettes. They operate by heating a nicotine-containing or nicotine-free liquid, turning it into vapor, and delivering it to the user without combustion or smoke. This has significantly reduced health risks associated with smoking and made ENDS products an appealing option for both current smokers looking to quit and individuals seeking a less harmful way to consume nicotine.

As the market continues to evolve, regulatory environments worldwide are also adapting to accommodate the growing popularity of electronic cig-a-rettes. This shift towards compliant products has opened doors for companies like Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL), which place a strong emphasis on compliance and position their products as premier electronic nicotine delivery systems in the market. This proactive approach positions Kaival for success, as it aligns with the changing preferences of consumers and regulators alike.

With a global market valued at $50.9 billion and a projected annual growth rate of over 20%, Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) stands to benefit from the rising demand for electronic nicotine delivery systems. The company’s focus on compliance, strategic partnerships, and its flagship product, the BIDI® Stick, position it as a key player in this rapidly growing industry.

KAIVAL BRANDS INNOVATIONS GROUP, INC.

(NASDAQ: KAVL)

Cutting-Edge Products: Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) Leads The ENDS Industry With Innovation…

Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) is a trailblazer in the electronic nicotine delivery systems (ENDS) industry, boasting a remarkable array of cutting-edge products that have positioned the company at the forefront of this rapidly expanding market. With a commitment to innovation and a deep understanding of consumer needs, Kaival Brands has curated a diverse product portfolio that caters to the demands of both seasoned smokers seeking a safer alternative and new users looking for a modern and enjoyable nicotine experience.

At the heart of Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL)’s success is their flagship product, the BIDI® Stick. This remarkable device has quickly gained traction in the market, thanks to its unique features and consumer-centric design. The BIDI® Stick offers users a seamless and satisfying vaping experience without the harmful chemicals associated with traditional to-bacco cig-a-rettes. Designed to be user-friendly, the BIDI® Stick requires no complicated setup or maintenance, making it an accessible choice for both beginners and experienced vapers.

The BIDI® Stick sets itself apart with its premium quality and commitment to environmental sustainability. The device is engineered with recyclable components, reducing its impact on the environment. Moreover, it incorporates advanced anti-counterfeit technology, ensuring that consumers receive authentic and safe products every time.

Beyond the BIDI® Stick, Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) has continued to invest in research and development, resulting in a diverse and innovative product range. Their dedication to creating high-quality products has garnered widespread acclaim and has established the company as a trusted name in the ENDS industry.

Recently, Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) made a strategic move to further bolster its position in the market by acquiring valuable intellectual property from GoFire, Inc. This significant acquisition promises exciting future developments and breakthroughs in ENDS technology. With a portfolio of 12 existing patents and 46 pending applications, the company is now well-equipped to create groundbreaking and unique ENDS product technologies that are poised to revolutionize the industry.

Kaival Brands’ commitment to staying at the cutting edge of the ENDS market, coupled with their focus on compliance and consumer satisfaction, has garnered attention from industry giants and investors alike. As the demand for safer nicotine delivery systems continues to rise, Kaival Brands is primed to capitalize on this exponential growth, solidifying their position as a dominant player in the industry.

In conclusion, Kaival Brands’ diverse and innovative product portfolio, led by the highly successful BIDI® Stick, showcases the company’s dedication to driving positive change in the ENDS industry. With their recent intellectual property acquisition, Kaival Brands is poised to bring forth exciting advancements that will shape the future of electronic nicotine delivery systems and further fuel their growth trajectory in this dynamic and promising market.

Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) Expands Distribution Network, Targeting Accelerated Growth In US And International Markets…

Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) is making significant strides in the electronic nicotine delivery systems (ENDS) market as it rapidly expands its distribution network in the US and beyond. With a keen focus on innovation and customer satisfaction, the company has positioned itself at the forefront of the industry, boasting a diverse and cutting-edge product portfolio.

One of the driving forces behind Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL)’s success is its flagship product, the BIDI® Stick, which has gained remarkable traction in the market. This user-friendly and premium device offers a safer and more satisfying alternative to traditional to-bacco cig-a-rettes. Equipped with advanced anti-counterfeit technology and recyclable components, the BIDI® Stick embodies the company’s commitment to environmental sustainability and product integrity.

Through strategic collaborations with prominent national brokers, Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) has gained access to thousands of new retail locations across the US. This expansion into key retail outlets ensures that its innovative products, including the BIDI® Stick, reach a wider customer base, tapping into the growing demand for ENDS products.

Furthermore, Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) recently announced the initial shipment of BIDI® Sticks to over 900 Kwik Trip and Mapco locations, with plans for further expansion to over 1,200 locations by the end of the year. This follows the company’s successful shipment to over 1,000 Circle K locations, with a planned ramp-up to 5,000 locations in the South Atlantic and Midwest regions of the United States.

Beyond the US market, Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) has secured an International Licensing Agreement with the esteemed Philip Morris International (PMI), granting PMI exclusive rights to distribute Kaival’s ENDS products in select international markets. Partnering with a global industry leader like PMI presents immense growth potential for Kaival Brands as it opens up new revenue opportunities and strengthens its presence on the international stage.

The strategic collaboration with PMI reflects the high quality and appeal of Kaival Brands’ products, earning recognition and trust from a major player in the to-bacco and nicotine industry. With access to PMI’s vast distribution network and global expertise, Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) is well-positioned to capitalize on the rising international demand for ENDS products.

Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) continues to build momentum in the ENDS industry through its rapidly expanding distribution network and strategic partnerships. With an innovative product portfolio and strong market presence, the company is poised for accelerated growth and market leadership. As the global demand for safer nicotine delivery systems continues to surge, Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) is well-equipped to capitalize on these opportunities, securing its position as a trailblazer in the dynamic and promising ENDS market.

DIGGING DEEP

KAIVAL BRANDS INNOVATIONS GROUP, INC.

(NASDAQ: KAVL)

Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) Bolsters Leadership With Seasoned CEO And CFO Appointments…

Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) is making significant waves in the electronic nicotine delivery systems (ENDS) industry with recent key appointments to its executive team. The company, which is focused on incubating and commercializing innovative products into mature and dominant brands, has brought on board Thomas J. Metzler as its new Chief Financial Officer (CFO), Treasurer, and Secretary, effective from August 1, 2023. Additionally, the company has promoted Eric Mosser, the current President & Chief Operating Officer, to the position of Chief Executive Officer.

Mr. Metzler’s appointment marks a pivotal moment for Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL), as he brings over two decades of finance and operational expertise in the vaping and consumer products sector. His prior role as Managing Director of a Division of Turning Point Brands, a prominent manufacturer, marketer, and distributor of branded alternative smoking accessories and consumables, has equipped him with the skills to transform financial management efficiencies, enhance cost controls, develop strategic product promotions, and build strategic alliances with suppliers. Moreover, Mr. Metzler has been instrumental in driving record growth with retail and wholesale distributors through the implementation of key performance indicators (KPIs) and other revenue optimization strategies.

With extensive knowledge of vaping technologies and a proven track record of establishing strong partnerships with industry stakeholders, Mr. Metzler is well-equipped to maximize inventory turn and drive revenue growth for Kaival Brands. He also brings his experience in mergers and acquisitions and post-acquisition integration to the table, which will be instrumental in harnessing the potential of the vaporizer and inhalation patent portfolio acquired by the company in May 2023.

In his new role as Chief Executive Officer, Eric Mosser continues to display his leadership prowess, having already served as President & Chief Operating Officer at Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) since 2020. He also brings over a decade of senior leadership experience, including founding Lasermycig LLC and serving as CEO of Chillcorp Ltd., a full-service corporation managing four companies involved in the electronic cig-a-rettes and vaporizers industry. Mr. Mosser’s expertise in information technology and business management has contributed significantly to the growth and success of Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL).

Commenting on the new appointments, Eric Mosser expressed enthusiasm for the future of Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) and welcomed Mr. Metzler to the team. He highlighted the wealth of experience and knowledge that Mr. Metzler brings to the CFO position, emphasizing his contributions to the company’s growth plans. Mr. Metzler, in turn, expressed his excitement to join Kaival Brands and contribute his expertise in helping the company scale its revenue and achieve success in the dynamic ENDS market.

With an impressive product portfolio, a strong international collaboration with Philip Morris, robust intellectual property, and a supportive board of directors, Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) is well-positioned for a promising future. The strategic appointments of Thomas Metzler and Eric Mosser are significant building blocks that reinforce the company’s commitment to growth, innovation, and market leadership in the rapidly expanding ENDS industry. As Kaival Brands Innovations Group, Inc. (Nasdaq: KAVL) continues to drive positive change and strive towards scaling its revenue, industry stakeholders and consumers can expect a bright future ahead for the company and its cutting-edge products.

Sources

- Source 1: https://d1io3yog0oux5.cloudfront.net/harbingerresearch/media/0cfbcab24c319d00381b7f5b1c1b7779.pdf

- Source 2: https://www.barchart.com/stocks/quotes/KAVL/price-history/historical

- Source 3: https://s27.q4cdn.com/593731714/files/doc_presentation/2023/07/KAVL-Investor-Presentation-July.pdf

- Source 4: https://www.sofi.com/learn/content/understanding-low-float-stocks/

- Source 5: https://www.marketwatch.com/investing/stock/kavl?mod=search_symbol

- Source 6: https://finance.yahoo.com/news/kaival-brands-reports-fiscal-2023-204800357.html

- Source 7: https://finance.yahoo.com/news/kaival-brands-acquires-extensive-vaporizer-120000424.html

- Source 8: https://tinyurl.com/2p8xkcdt

- Source 9: https://global.cornell.edu/sites/default/files/styles/homepage_banner/public/2021-08/AdobeStock_283024784_f.jpg?h=df51affa&itok=1GAXdnae

- Source 10: https://schrts.co/vQgZavTs

- Source 11: https://cdn.shortpixel.ai/spai/w_630+q_lossy+ret_img+to_webp/https://kaivalbrands.com/wp-content/uploads/2022/09/BIDI-Stick.jpg

- Source 12: https://vimeo.com/441040141/cdfed6a733

- Source 13: https://www.vapingpost.com/wp-content/uploads/2021/10/pmi-1021×400.jpg

- Source 14: https://finance.yahoo.com/news/kaival-brands-launches-distribution-bidi-121500613.html

- Source 15: https://finance.yahoo.com/news/kaival-brands-appoints-chief-executive-121500117.html

- Source 16: https://kaivalbrands.com/

- Source 17: https://finviz.com/quote.ashx?t=KAVL&p=d

- Source 18: https://finance.yahoo.com/news/kaival-brands-amends-agreement-phillip-200500247.html

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media LLC and Lifewater Media, Virtus Media LLC has been hired by Lifewater Media LLC for a period beginning on 08/23/2023 and ending 08/24/2023 to publicly disseminate information about NASDAQ: KAVL via digital communications. We have been paid fifteen thousand dollars USD.

Pursuant to an agreement between Third party and 4K Media LLC, 4K Media LLC has been hired for a period beginning on 09/11/2023 and ending 09/15/2023 to publicly disseminate information about NASDAQ: KAVL via digital communications. We have been paid two thousand five hundred dollars USD.