Saving Lives With Faster, Easier, and More Effective Cancer Screening

Learn how this company's cancer screening solutions could take over a $3.7 billion market.

Build your watchlist with us

Get the latest stock ideas direct to your inbox. 100% free and your information stays with us.

Mainz Biomed - 4 Key Reasons To Get This Potentially Undervalued Idea On Your Radar ASAP

- The Company’s Flagship Product (ColoAlert) Could Become An Inexpensive Alternative In A $3.7 Billion Market.

- The Company Recently Acquired Exclusive Rights To Novel mRNA Biomarkers .

- If And When The Company Receives FDA Premarket Approval For Its ColoAlert Flagship Product, It Could Become A Game-Changing Milestone.

- Another Key Pipeline Product Could Detect What May Become The World’s Second Most Deadly Cancer

Cancer is never fun to talk about...

The chances of it impacting either yourself, your family, or your friends appears to be growing on a yearly basis.

Though types like breast, lung, and prostate cancer are typically the most talked about, they’re not the only forms out there.

What do you know about colorectal cancer? Did you know it is the second most lethal form of cancer in the United States?

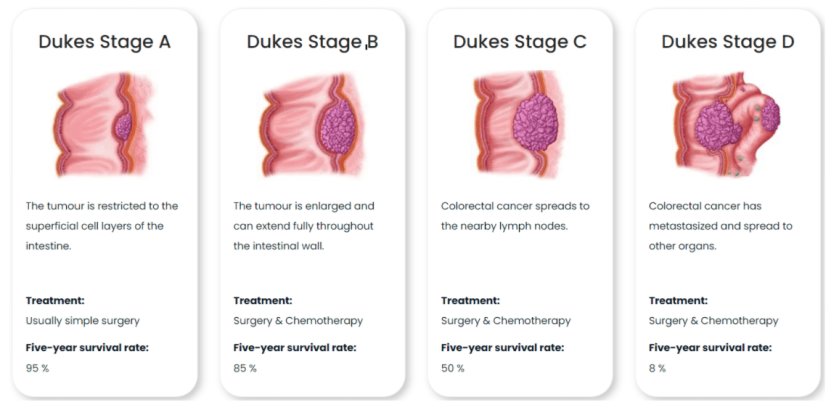

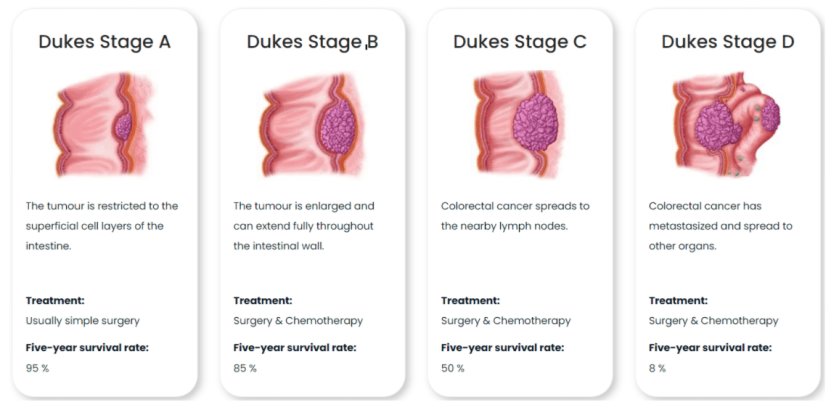

Good news is, it is highly preventable with early detection providing 5- year survival rates above 90%.

How Does Colorectal Cancer Develop?

Colorectal cancer often develops from polyps.

These are initially benign cell clusters that occur in many people. However, the cells of the polyps can undergo genetic changes, causing the cells to mutate and become precursors of colorectal cancer called adenomas.

The classification of colorectal cancer stages is often based on the so-called Dukes Stages:

Which Screening Options Are Available?

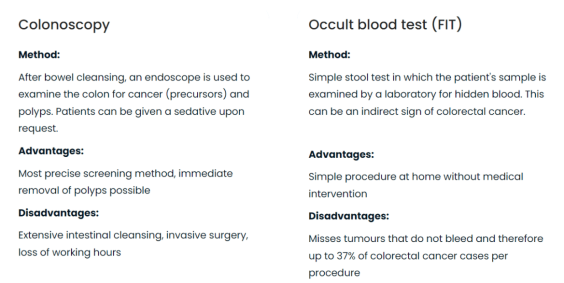

There are two options to screen for colorectal cancer, a colonoscopy and an occult blood test. Colonoscopies are invasive, expensive, and may occasionally cause injury or miss seeing smaller polyps.

ColoAlert, Mainz Biomed's flagship product, combines the advantages of both methods.

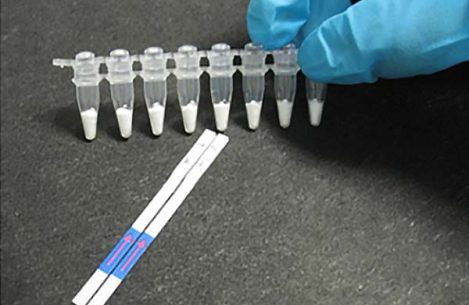

Through the analysis of tumor DNA, ColoAlert detects significantly more cases of colorectal cancer than other stool tests and allows for an earlier diagnosis in those affected – all in a simple at-home stool test!

Simple, Fast, Accurate and Non-Invasive

- A PCR-based CRC early detection stool test

- Up to 60% fewer missed cases compared to fecal immunochemical test (FIT)

- Non-invasive, no preparation or sedation, no time off work

- 98% patient satisfaction – Easy product to use

- Designed to offer affordable CRC screening solution

Patients receive a simple kit that includes instructions, a stool collector and shipping instructions to return the kit through regular mail to their local lab for testing and results. It's that easy.

ColoAlert Market Opportunity

Recent FDA decisions suggest that screening should be conducted once every three years starting at age 45.

Currently, there are 112 Million Americans aged 50+, a total that is expected to increase to 157 million within 10 years.

- 37 Million Tests per year in the US estimated potential: 112M pop. ÷ 3 (years) at 100% compliance

- 52 Million Tests per year within 10 years estimated potential: 157M pop. ÷ 3 (years) at 100% compliance

- 19 Million Colonoscopies each year in USA

~38.8% Age 50 to 75 have never been screened (in USA

- $3.7 Billion Market Opportunity

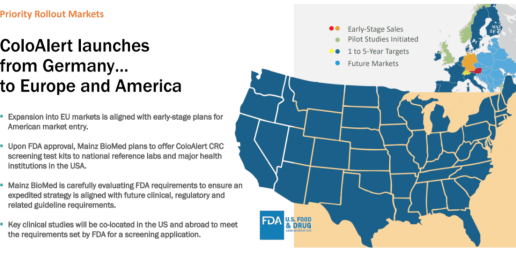

Mainz Biomed: Strategic Rollout

The company aims to become the leading global brand for CRC detection through extensive US and European market partnerships.

THE COMPETITION’S APPROACH…

The largest U.S. provider independently markets and distributes its product directly. All nationwide samples must come from, and be returned to, a single corporate laboratory – a time-consuming process.

MAINZ BIOMED’s APPROACH…

Mainz BioMed intends to develop and leverage scalable dissemination through a collaborative partner program.

PARTNERSHIPS: Large lab chains incentivized to support sales & marketing efforts to physician clients & consumers.

RELATIONSHIPS: Established regional and national labs offer existing client relationships (i.e.: physicians, clinics, hospitals, universities, government institutions, health organizations, etc).

PROFITABILITY: ColoAlert is designed for profitability, rapid commercial uptake, and broad consumer acceptance.

PROTECTION: Mainz BioMed protects its intellectual property through trade secrets to control all critical reagents, processes and formulations.

Why Mainz Biomed May Have Outrageous Potential

At this moment, Exact Sciences, the makers of ColoGuard, offers the only other competitive product using similar technology.

Other sector companies promote testing for CRC but are using standard tests like FIT or occult blood testing.

Currently, Exact Sciences (Nasdaq: EXAS) has a market cap of ~$14.4 billion (as of 2/10/22).

With such little competition in the market, can you see why Mainz Biomed (Nasdaq: MYNZ) could be extremely undervalued at this moment?

Get the latest stock ideas direct to your inbox.

100% free and your information stays with us.

Game-Changing 2022 Announcement: Mainz Biomed Acquires Exclusive Rights to Novel mRNA Biomarkers

Potential for ColoAlert to Emerge as the Most Robust and Accurate At-home Screening Test for Colorectal Cancer

Biomarkers Demonstrated Unique Ability to Identify Curable Precancerous Colonic Polyps as well as Curable Early-Stage Colorectal Cancer

BERKELEY, Calif. and MAINZ, Germany, Jan. 05, 2022 (GLOBE NEWSWIRE) — Mainz Biomed N.V. (NASDAQ:MYNZ) (“Mainz Biomed” or the “Company”), a molecular genetics diagnostic company specializing in the early detection of cancer, announced today it has entered into a Technology Rights Agreement with Socpra Sciences Santé Et Humaines S.E.C. (“TTS”) to access a portfolio of novel mRNA biomarkers for potential future integration into ColoAlert, the Company’s highly efficacious, and easy-to-use detection test for colorectal cancer (“CRC”).

Mainz is currently marketing ColoAlert in Europe through its unique business model of partnering with third-party laboratories for test kit processing versus the traditional methodology of operating a single facility. The Company is also preparing to initiate ColoAlert’s regulatory pathway for approval in the United States.

Under the terms of the Technology Rights Agreement, the Company has the unilateral option to license the exclusive global rights to five gene expression biomarkers which have demonstrated a high degree of effectiveness in detecting CRC lesions including advanced adenomas (“AA”), a type of pre-cancerous polyp often attributed to this deadly disease.

In a study evaluating these biomarkers published in the online peer review journal platform MDPI (March 11, 2021), study results achieved overall sensitivities of 75% for AA and 95% for CRC, respectively, for a 96% specificity outcome.

If these statistical results are duplicated when the biomarkers are integrated into ColoAlert, we believe that it will ultimately position the Company’s CRC test to be the most robust and accurate at-home diagnostic screening test on the market. It will not only detect cancerous polyps with a high degree of accuracy but has the potential to prevent CRC through early detection of precancerous adenomas.

The Company will now commence a clinical study in Europe to evaluate the effectiveness of these biomarkers to enhance ColoAlert’s utility in terms of extending its capability to include the identification of advanced adenomas, while increasing rates of diagnostic sensitivity and specificity.

Given ColoAlert in its present form has already been CE-IVD marked (complying with EU safety, health and environmental requirements), the timeline and process to initiate this “add-on” study is expedited, and the company is targeting the first half of 2022 to launch the clinical study. Furthermore, data generated by the study may potentially be incorporated into the Company’s design of ColoAlert’s U.S. clinical trial for consideration by the FDA.

And Here’s Why That Last Sentence Is So Important…

If the FDA grants premarket approval for ColoAlert, it could become a significantly cheaper alternative to ColoGuard, the product from Exact Science (~$14 Billion market cap).

Another Market Opportunity For Mainz Biomed ? You Better Believe It

As GenX individuals age into their 40’s and 50’s they become part of the age group recommended to begin testing for CRC and more.

Mainz BioMed is currently developing proprietary genetic testing methods for pancreatic cancer.

Sources

Source 1: https://mainzbiomed.com/wp-content/uploads/2021/07/Mainz-BioMed-Corporate-Update-January-2022-v1.13.21-1.pdf

Source 2: https://www.cancer.org/cancer/colon-rectal-cancer/about/key-statistics.html

Source 3: https://www.coloalert.com/pages/about-crc

Source 4: https://www.prb.org/resources/u-s-population-is-growing-older/

Source 5: https://idataresearch.com/an-astounding-19-million-colonoscopies-are-performed-annually-in-the-united-states/

Source 6: https://idataresearch.com/an-astounding-19-million-colonoscopies-are-performed-annually-in-the-united-states/

Source 7: https://finance.yahoo.com/quote/EXAS?p=EXAS&.tsrc=fin-srch

Source 8: https://finance.yahoo.com/news/mainz-biomed-acquires-exclusive-rights-080100033.html

Source 9: https://www.pancan.org/press-releases/pancreatic-cancer-still-on-path-to-become-second-leading-cause-of-cancer-related-death-in-u-s-by-2020/

Source 10: https://www.mayoclinic.org/diseases-conditions/colon-cancer/in-depth/colon-cancer-screening/art-20046825

Disclaimer

Stock Research Today is a project of Dadmin Capital LLC and intended solely for entertainment and informational purposes. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/. This website / media webpage is owned, operated and edited by Dadmin Capital LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Dadmin Capital” refers to Dadmin Capital LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and promote small public companies. By reading our website / media webpage you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our website / media webpage .We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website / media webpage are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. Dadmin Capital business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Dadmin Capital. often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Compensation – Pursuant to an agreement between Dadmin Capital LLC and TD Media LLC, Dadmin Capital LLC has been hired for a period beginning on 2/14/2022 and ending after 5 business days to publicly disseminate information about (NASDAQ: MYNZ) via digital communications. We have been paid eleven thousand five hundred USD via ACH Bank Transfer. Pursuant to an agreement between Dadmin Capital LLC and TD Media LLC, Dadmin Capital LLC has been hired for a period beginning on 3/14/2022 and ending after 2 business days to publicly disseminate information about (NASDAQ: MYNZ) via digital communications. We have been paid eleven thousand five hundred USD via ACH Bank Transfer. Pursuant to an agreement between Dadmin Capital LLC and TD Media LLC, Dadmin Capital LLC has been hired for a period beginning on 5/9/2022 and ending after 2 business days to publicly disseminate information about (NASDAQ: MYNZ) via digital communications. We have been paid eleven thousand five hundred USD via ACH Bank Transfer. Social Media Compensation – Pursuant to an agreement between Dadmin Capital LLC and Social Media Outlet, Dadmin Capital LLC has hired Social Media Outlet for a period beginning on 2/1/22 and ending after one business day to publicly disseminate information about (NASDAQ: MYNZ) via digital communications. We have paid this Social Media Outlet one thousand USD via ACH Bank Transfer. Pursuant to an agreement between Dadmin Capital LLC and Social Media Outlet, Dadmin Capital LLC has hired Social Media Outlet for a period beginning on 3/14/22 and ending after one business day to publicly disseminate information about (NASDAQ: MYNZ) via digital communications. We have paid this Social Media Outlet one thousand USD via ACH Bank Transfer.