Harnessing Opportunities in Solar Energy: A Closer Look at SolarBank Corp.

In today's shifting economic landscape, President Biden’s energy policies are driving a significant transition towards green energy, creating lucrative opportunities for investors. While these policies pose challenges for the fossil fuel industry, they are also unleashing a wave of investment in sustainable energy sources, particularly solar power.

SolarBank Corp. (NASDAQ: SUUN) stands out in this burgeoning market. With over a decade of experience and more than 100 solar power plants to its name, SolarBank has a solid track record and a strong leadership team. The company recently secured a $41 million deal, positioning itself to capitalize on the growing demand for solar energy. As solar power becomes a primary alternative to fossil fuels, SolarBank's strategic positioning and proven expertise make it a compelling consideration for investors looking to benefit from the green energy boom.

8 reasons why SolarBank (NASDAQ: SUUN could become a “shining star” of your portfolio, no matter which way the political winds blow.

IDENTIFYING THE OPPORTUNITY

THE WEDGE IS PRIMED

TARGETS

Target #1: $6.30 (+4.83%)

Target #2: $6.50 (+8.15%)

Target #3: $7.02 (+16.81%)

Target #4: $7.50 (+24.79%)

Target #5: $8.00 (+33.11%)

Reason #1: The U.S. and Other Governments Are All-In on the Net Zero Bandwagon — and Solar Power Is Critical to Making It Happen

The solar power boom is largely driven by governments around the world demanding that we stop using fossil fuels and replace them with renewable sources of energy.

For example, in December 2023, the 200 nations involved in the United Nations Climate Change Summit — including the United States — reached an agreement to stop using fossil fuels and to triple the use of renewable energy.

The agreement came on the heels of John Kerry, President Biden’s envoy to the Summit, telling attendees that the US is going to stop building coal plants and will shut down existing plants.

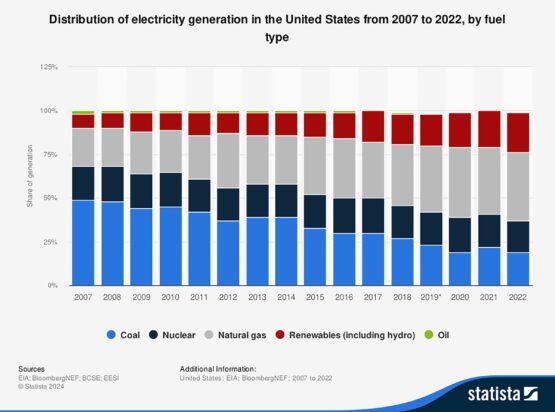

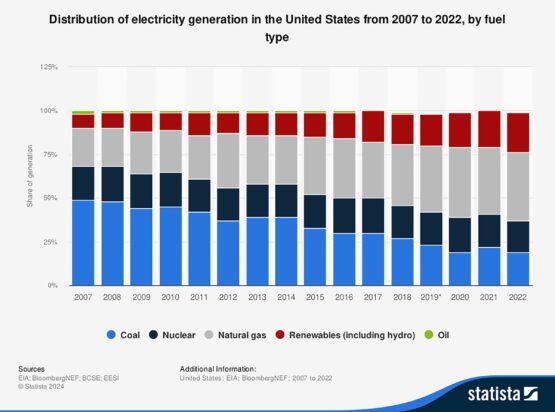

Over the last 15 years, renewable forms of energy — including solar power — have generated a rising percentage of U.S. electricity. Government spending and mandates ensure that this trend will only accelerate over the next few years.

President Biden: Solar and Wind Will Replace Coal

According to the Administration, the power previously generated by these coal plants will be generated by wind and solar power instead.

Natural gas is also under attack. At the Climate Summit, a letter was circulated demanding that Western nations, including the United States, ban all new natural gas infrastructure projects, starting immediately.

That’s a tall order considering that natural gas accounts for about 39% of all U.S. electricity generation, while coal generates 19%. In other words, dumping natural gas and coal will force the United States to replace energy sources that account for 58% of U.S. electricity generation.

Meanwhile, renewable energy sources — solar, wind and hydro —only provide about 22.5% of America’s electricity.

When you consider that the U.S. government wants 80% of U.S. energy production to be clean and renewable by 2030, we clearly have a long way to go.

It’s an ambitious goal that could mean good tidings for SolarBank Corp. (NASDAQ: SUUN).

Now, obviously it will be many years — perhaps decades — before solar will be able to replace the power generated by natural gas.

And even in places where solar panels generate a significant percentage of local power, natural gas serves as an important backstop for when the sun isn’t cooperating and additional power is needed. However, solar power is on the rise and the more electricity it generates, the more diversified the power grid becomes and the less reliant we become on natural gas imports.

Also important, solar power helps decentralize energy production so if one form of power generation falls short or even fails, another is available to help make up the deficit.

Hundreds of Billions of Dollars Allocated to Fast-Track the Transition to Solar

To make this all happen, the U.S. government is spending hundreds of billions of dollars.

For example, the Inflation Reduction Act (IRA) spends $369 billion on clean energy projects designed to “tackle the climate crisis.” And that’s on top of the $242 billion allocated by the 2021 Infrastructure Investment and Jobs Act to fight climate change with clean energy.

The IRA also includes a 10-year extension of the 30% solar power investment tax credit — with up to 50% available on some projects.

To this point, Pol Lezcano, a solar industry analyst at the research firm BloombergNEF, said, “The incentives in the IRA are like pouring gasoline on a fire.”And Lezcano’s not alone.

An analysis by Jeffries, a leading global investment bank, predicts “exponential growth” ahead for renewable energy.

However, the billions of dollars in spending and tax credit are just a portion of what’s driving the growth of the solar power market.

States are Mandating Renewable Energy

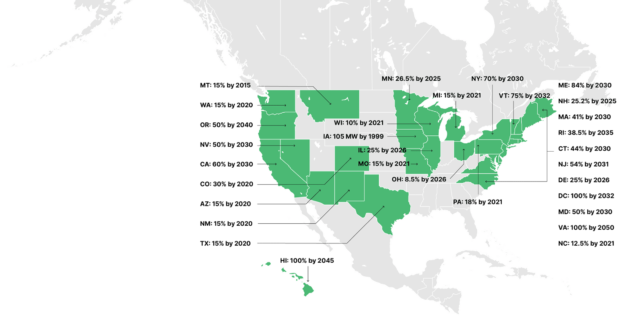

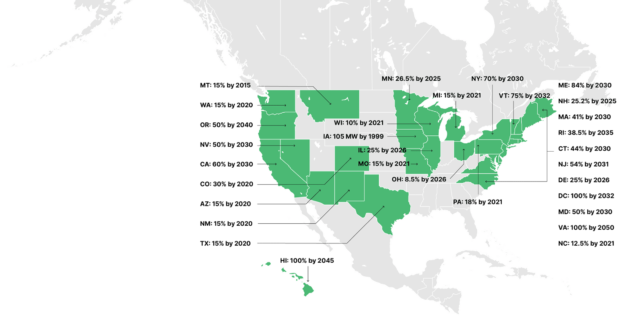

30 states and the District of Columbia are imposing renewable energy mandates to dramatically speed up the transition to solar and wind power.

Politicians also imposing mandates to make the transition move even faster.

At least 30 states have passed Renewable Portfolio Standards — a fancy name for mandates to use an increasing percentage of renewable energy.

It’s anybody’s guess if we can meet them, but you can be sure the politicians will be spending money and passing regulations to make it happen.

The policies mandate a specific percentage of electricity sold by utilities to come from renewable sources.

Somebody has to supply the solar power to meet all that energy demand … and that makes what SolarBank Corp. offers all that more powerful.

Of course, future governments may revise, reduce or eliminate incentives and policy support for solar and battery storage power, which could affect demand for SolarBank Corp’s services.

However, given the solar industry’s current momentum, it’s my opinion that that risk will be mitigated by rising demand and increasing private capital investment. Which brings me to my second reason.

Reason #2: Billionaire Investors and Private Equity Firms Are Pouring Billions of Dollars Into Renewable Energy Companies

The rapid growth of the renewable energy sector — especially solar power — has drawn interest and multi-billion-dollar investments from private equity firms and numerous billionaires.

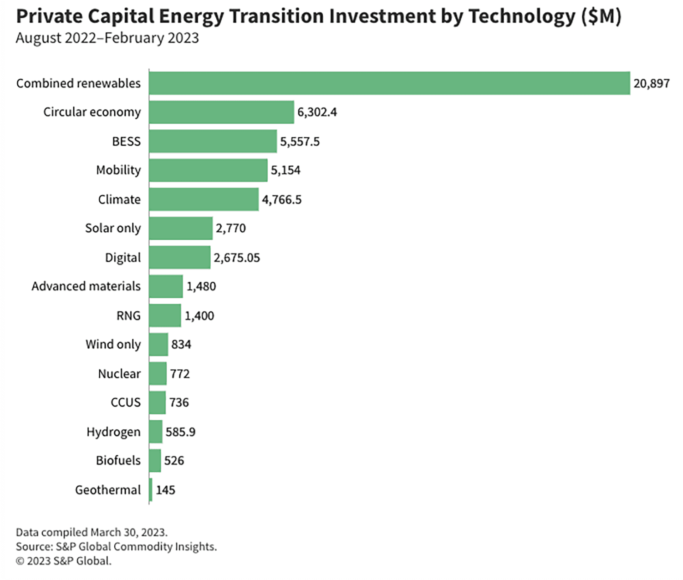

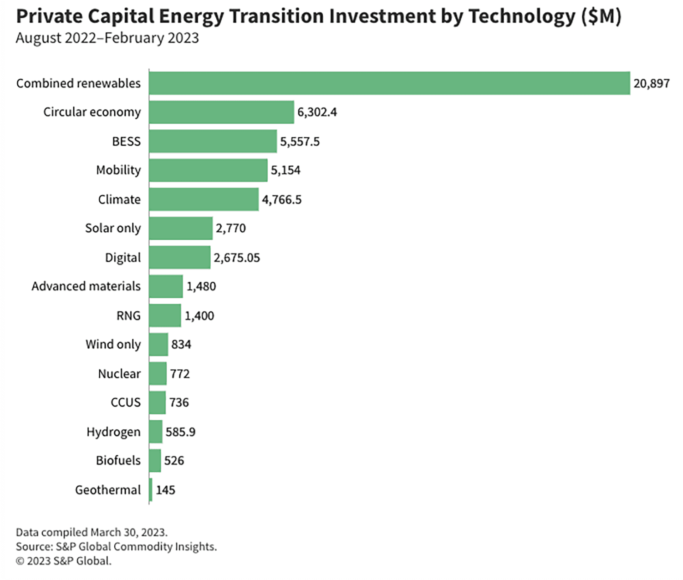

Private equity firms invested more than $50 billion into the clean energy transition between August 2022 and February 2023 alone.

For starters, S&P Global Commodity Insights reviewed private equity investments from August 2022 through February 2023 and found that firms invested more than $50 billion in those seven months alone.

However, private equity firms aren’t the only ones looking to get in on the action.

A multitude of billionaire investors are also pouring money into the clean energy sector via Breakthrough Energy Ventures, a multi-billion-dollar investment fund founded by Bill Gates.

Other billionaires who have invested in the fund include:

- Jeff Bezos, founder of Amazon.com

- Richard Branson, founder of the Virgin Group

- Michael Bloomberg, founder of Bloomberg LP

- John Doerr, Chairman of the venture capital firm Kleiner Perkins Caufield & Byers

- Ray Dalio, founder of Bridgewater Associates, a hedge fund and investment management firm

To date, Breakthrough Energy Ventures has raised $2 billion, though Gates’ goal is to raise and invest $15 billion in clean energy ventures. While these individuals are not SolarBank Corp. investors, they do provide context for the interest in and the growth of the industry.

While you can’t invest in the private start-ups these billionaires are taking a chance on, you can get access to an investment in green energy through SolarBank Corp.

Reason #3: Demand for Solar Energy Is Soaring, and SolarBank Corp. Is Positioned to Help Meet It

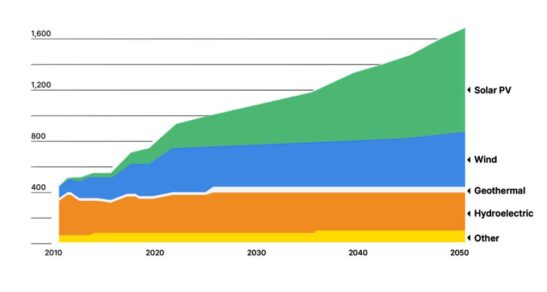

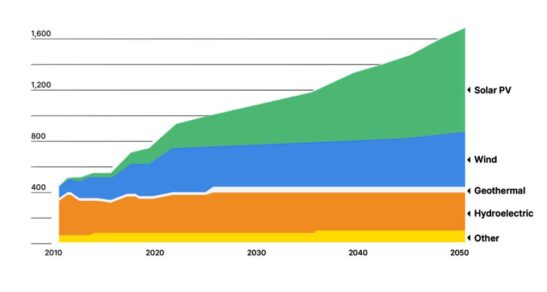

Over the last few years, demand for solar power has increased by leaps and bounds. In fact, since 2010, global solar power capacity has risen an astonishing 48 times. This rising demand has been fueled in part by the spending, tax credits and mandates I detailed a moment ago.

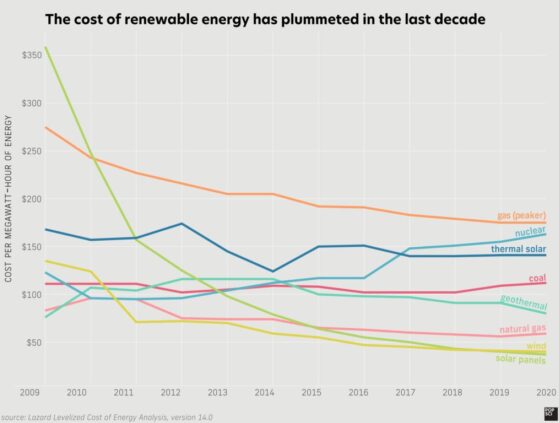

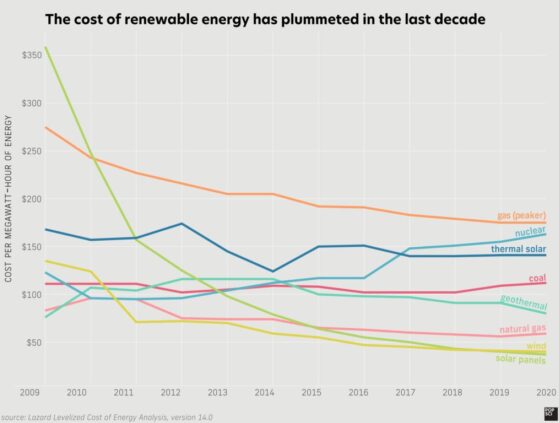

The cost of solar has plummeted by 90% just since 2011.

However, a third factor is that, as the chart below shows, the cost of both solar and battery storage have fallen dramatically over the last decade.

Since 2011, when solar was the most expensive form of electricity generation, its cost has fallen a whopping 90%.

In fact, the International Energy Agency reports that solar is now cheaper than natural gas and coal when it comes to generating electricity.

This is due in large part to technological innovation and economies of scale created by increased demand.

And the future looks even brighter.

The International Renewable Energy Agency estimates that electricity consumption derived from renewables will grow from 25% in 2018 to 90% by 2050.

And #1 will be solar, which the Department of Energy, says could account for as much as 40% of the U.S. electricity supply by 2035.

But get this: Currently, solar accounts for only about 5% of all the electricity generated in the U.S.

In other words, the next five to 10 years are going to see massive growth in the solar industry.

As you’ll see in a moment, SolarBank Corp. (NASDAQ: SUUN) is already taking advantage of this growth with its 1 gigawatt pipeline of projects. Better yet, our analysis shows that its revenue guidance continues to indicate steady growth over the next year.

Reason #4: SolarBank Corp. Has an Impressive Résume

Over the last 10 years, SolarBank Corp. (NASDAQ: SUUN) has built more than 100 solar power plants — primarily in the United States and Canada.

The company’s longevity and experience set it apart from other players in SolarBank Corp’s market sectors.

The solar power market is defined by intense competition and constant innovation, and many companies aren’t able to keep up with the pace of change. It’s an industry-wide risk. And one SolarBank Corp. isn’t immune to.

However, the fact that SolarBank Corp. has successfully navigated those risks for more than a decade — while turning a profit, I might add — leads me to believe that it is well suited to continue developing and operating its solar projects well into the future.

In fact, the company was voted one of the “Top Ten Renewable Energy Solutions Providers in Canada” for 2023.

It’s an annual listing of companies at the forefront of providing renewable energy solutions.

In recent years, the company’s primary focus has been…

• Behind the Meter solar projects: These are energy systems that are built on a company’s property to generate and possibly store power. They are separate from the electric grid and thus aren’t metered by the electric company.

• Community Solar Projects: These are large solar panel farms that are usually owned by private developers or subscribers.

They provide electricity that is fed into the electric grid — but the residents, businesses and organizations that participate in the project get credit on their electric bill for their share of the power produced by the farm.

• Utility-Scale Solar Farms: These cover many acres of land with thousands of solar panels generating electricity for the grid.

A Rich History and a Bright Future

SolarBank Corp. got its start taking advantage of Ontario, Canada’s Feed-in Tariff program — a government policy mechanism. The program provided financial incentives for generating power from renewable sources of energy to make them more competitive with fossil fuels.

By the time the program ended, the company had completed more than 150 such projects generating enough electricity to power 10,000 homes.

Better yet, the program established SolarBank Corp. (NASDAQ: SUUN) as a reliable and reputable solar power provider and operator.

Here in the United States, it has also had a series of impressive successes. Here are a few highlights from its dozens of completed projects…

• In 2017, SolarBank Corp. entered a 30-year agreement with the Maryland Department of Transportation to solarize the state’s transportation systems.

• In 2020, a 7-megawatts at peak — meaning the maximum power it can produce under ideal conditions — Community Solar Farm began operation, supplying energy to residences in upper state of New York.

• In 2022, six solar projects were placed in commercial service.

Partnering With a Fortune 500 Behemoth

However, perhaps the company’s most impressive achievements came in late 2023, when it reached an agreement with Honeywell International, the $130.84 billion Fortune 500 behemoth.

Honeywell (NASDAQ: HON) engaged SolarBank Corp. (NASDAQ: SUUN) to engineer and build three 7-megawatt solar power projects in upstate New York.

The energy produced at the sites will feed into the local power grid, providing cheaper energy for renters and homeowners who want to take advantage of solar energy without having to install solar panels on their roofs.

The agreement is valued at $41 million — a significant number because it’s more than four times the company’s entire fiscal 2022 revenue.

SolarBank Corp’s agreement with Honeywell shows just how good a reputation the company has in the solar industry. And many more solar power agreements are in the pipeline.

However, the Honeywell deal was just the tip of the iceberg in 2023.

In addition to the $41 million Honeywell contract, the company was also awarded $47 million worth of contracts for three Battery Energy Storage System projects and a 5.9 megawatt Community Solar Project.

All this gives the company a great deal of credibility for the aggressive plans it has for the future, which brings us to…

Reason #5: SolarBank Corp. Has Embarked on an Expansion Plan That Could Mean Significant Growth Ahead

One of the things we really like about SolarBank Corp. (NASDAQ: SUUN) is that it refuses to rest on its laurels.

The company’s president and CEO — Dr. Richard Lu — has set his sights on turning SolarBank Corp. into a major player by taking full advantage of the hyperspeed transition to solar energy.

That transition is still in its early stages — but as it accelerates in the years ahead, SolarBank Corp. looks to be well positioned to capitalize thanks to an impressive expansion plan.

Let’s take a look at some of the opportunities the company is looking at right now.

The Biden Administration Pushes Community Solar

As we previously mentioned, the company has completed a number of community solar projects that let individuals and businesses take advantage of solar power without having to put solar panels on their roofs.

These projects — also known as solar gardens — are the fastest growing segment of the solar industry.

They’re also vital because, according to the Environmental Protection Agency, more than 50% of Americans who would like to use solar energy are unable to install a rooftop solar array.

At the end of 2021, only about a million households in the U.S. were able to take advantage of community solar.

However, the Biden Administration is determined to expand that to five million by 2025 — a 400% increase.

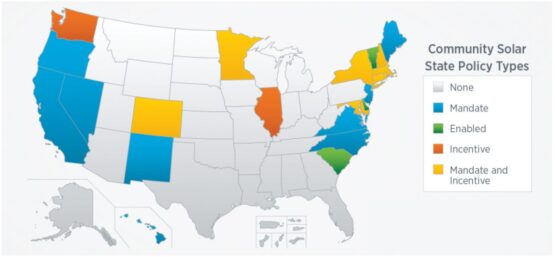

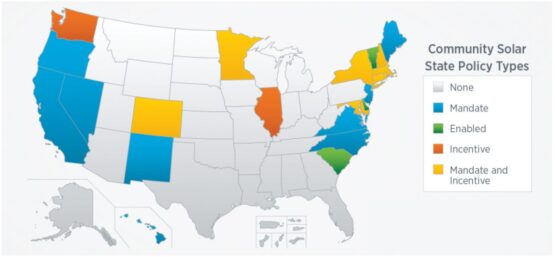

Community Solar State Policy Types

As you can see from this map, 22 states already mandate and incentivize the building of community solar projects.

This is great for SolarBank Corp. (NASDAQ: SUUN) because of its vast experience in building community solar facilities. That experience makes it an obvious go-to company for future projects.

Helping Big Companies Go Green “Behind the Meter”

Another opportunity for SolarBank Corp. is the growth of commercial and industrial behind the meter (BTM) power generation.

Currently, only around 1% of commercial electricity demand is met by on-site BTM solar. However, according to Grandview Research, the U.S. market will better than triple between 2023 and 2030 as more and more companies position themselves as “environmentally friendly.”

And SolarBank Corp’s track record positions the company nicely to continue picking up contracts to build BTM solar farms.

When you add up the projects in SolarBank Corp’s (NASDAQ: SUUN) potential development pipeline, you’re looking at projects with the potential to generate 1,000 megawatts at peak of power — enough to power 200,000 homes.

And enough to keep SolarBank Corp. busy for the next 10 years.

A Bigger Opportunity Beckons

However, all this could be small potatoes when compared to SolarBank Corp’s next big thing.

While community solar and BTM projects will remain the company’s bread and butter in the immediate future, a much bigger opportunity is around the corner.

And it’s the opportunity I’m most excited about because it sets the company up for stellar long-term growth.

You see, the company has recently emerged as an “independent power producer.” This means SolarBank Corp’s (NASDAQ: SUUN) builds its own solar farms to generate power that it will sell to utilities commercial entities or community solar subscribers.

Ultimately, it is targeting the development of utility scale solar farms that may have the capacity to generate more than 100 megawatts of electricity — enough to power 10,000 homes each.

This “build and own” model provides more stable long-term revenue than building plants for others. It also offers the largest market for solar energy long term and the opportunity for growth.

That’s because demand from utilities for green power — especially solar — is growing exponentially.

Utilities are increasingly required by law to meet “Renewable Portfolio Standards” — which means they must generate a certain percentage of electricity from renewable sources by a certain date.

California for example, requires utilities to get 60% of their electricity from renewable sources by 2030 and 100% by 2045.

Dozens of other states have similar mandates.

SolarBank Corp. has already begun building its independent power producer portfolio. In November 2023 it acquired control of two corporations that hold solar projects in Ontario with a combined capacity of 2.5 megawatts.

The company also recently began construction of its Geddes project in Geddes, New York. This will be the largest solar project to date to be owned by SolarBank Corp. (subject to financing) and once operational is expected to provide green energy for over 500 homes.

Now, the growth of SolarBank Corp’s independent power producer portfolio is dependent on access to additional debt and equity financing to support the development of these projects. It also needs to secure suitable land via lease or purchase and receipt of permits and regulatory approvals.

There’s no two ways about it — big aspirations require access to capital.

However, one of the things that really impresses me about SolarBank Corp. is that while it makes these aggressive plans for the future — plans that could help the company grow significantly — the management team’s fiscally conservative, smart asset allocation tells me that they’re not “betting the farm” on one big play that may or may not come to fruition.

Reason #6: SolarBank Corp’s Vertical Integration Provides a Competitive Advantage

SolarBank Corp. is a vertically integrated company, which gives the company nice competitive advantage and the ability to complete projects more quickly.

Another thing SolarBank Corp. (NASDAQ: SUUN) has going for it — and the major feature distinguishing it from a field of solar pretenders — is its full vertically integrated business model.

This vertical integration provides SolarBank Corp. with an agility that many companies could have a hard time replicating.

And, while most solar companies focus on one specific area of the renewable energy value chain, vertical integration means SolarBank Corp. brings its expertise to all of it.

This also gives the company a competitive advantage when it comes to cost.

It’s a step-by-step process — something akin to a “production line” in the words of SolarBank Corp. CEO Dr. Richard Lu.

It all starts with the origination of a project. SolarBank Corp. analyzes government policies, digs deep into the project’s finances to make sure it will create value for shareholders and finds and secures the right site for the project.

It then brings its development expertise to bear to get the necessary permits and environmental approvals. It also looks into available incentives and tax benefits. And it helps put a Power Purchase Agreement in place outlining the terms under which electricity will be sold.

The company’s financial team also gets involved to secure financial via equity, debt, tax credits or traditional construction financing. To date, the company has managed more than $100 million in project financing.

It then delivers the goods by engineering the project, procuring the necessary equipment and materials — including solar panels and inverters that convert DC electricity to AC — and building the project.

Lastly, the company can take care of operations and management. This includes managing subscribers to the power, as well as care for the assets themselves.

All this creates a seamless and efficient process that allows SolarBank Corp. (NASDAQ: SUUN) to bring a project to fruition in as little as 12 to 18 months … an impressive rate many companies would be hard-pressed to match.

Basically, the faster a company can bring additional projects online, the faster it can potentially see revenues flowing back into its coffers.

Reason #7: SolarBank Corp. Had Been Profitable for Years

We also like what we see when we look at SolarBank Corp’s numbers.

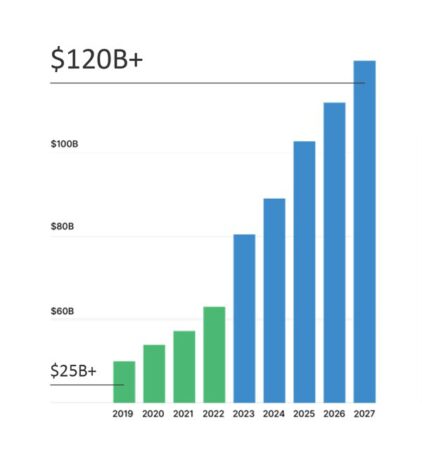

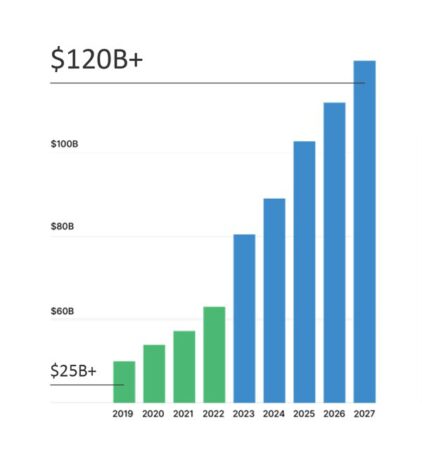

The company doubled its revenue to $13.7 million in the fiscal year that ended in June 2023.

Better yet, based on the projects it has already secured, SolarBank Corp. has provided revenue guidance of $33 to $37 million for the next fiscal year, which would be another double by June 2024.

The company’s build out of its independent power producer business provides a further opportunity for revenue growth.

However, it’s not just about revenue. The company was also profitable for its most recently completed financial year.

Reason #8: A Strong Management Team With More Than 100 Years of Combined Experience

One of the most critical factors in the success of any company is its management team.

Many financial advisors take management for granted. However, I’ve seen multiple companies with strong potential underachieve or fail altogether simply because their management teams were mediocre or stocked with family members instead of people with real experience.

That’s why I always take a close look to make sure management has the expertise and the experience to move the company forward. That includes interviewing members of the team and looking carefully at their past experience.

Fortunately, when we did our deep dive on the management behind SolarBank Corp. (NASDAQ: SUUN) we found a solid team with the skills and the experience to take the company to the next level.

Even better, we discovered that the management team, company directors, the founders, and advisors own 70% of the 27 million common shares outstanding, which indicates a strong belief in the company and the team running it.

They include:

Dr. Richard Lu

MD, MBA, President & CEO, Director

Dr. Richard Lu, MD, MBA, President & CEO, Director — Dr. Lu is an energy industry veteran with more than 25 years of global energy experience developing and implementing growth strategies for organizations in North America, Europe and Asia.

Dr. Lu’s accomplishments include acting as an Independent Director at dynaCERT Inc., a growing high-tech company that specializes in hydrogen application in the transportation industry.

Andrew van Doorn

MD, MBA, President & CEO, Director

Andrew has more than 28 years of executive leadership experience in engineering and construction in the renewable energy and utility sectors. In that time, he has completed solar projects generating more than 200 megawatts.

Andrew’s solar experience includes 32 megawatts of community solar in Minnesota, 28 megawatts built or under construction in New York State, and 20 megawatts of ground mount systems in Ontario.

Tracy Zheng

Chief Administrative Officer

Tracy is an accomplished business strategist with more than 25 years of experience in brand marketing, investments, business development and solar project operations.

She is responsible for managing solar sales teams, project feasibility studies and partnership negotiations. Tracy held senior marketing positions specializing in branding and strategy in Colgate-Palmolive, Clairol and other marketing research and internet companies. She has an MBA from York University in Toronto.

Sources

- Source 1: https://solarbankcorp.com/

- Source 2: https://solarbankcorp.com/investors/

- Source 3: https://solarbankcorp.com/wp-content/uploads/Solarbank_InvestorDeck-Web.pdf

- Source 4: https://solarbankcorp.com/wp-content/uploads/SolarBank_OneSheet.pdf

- Source 5: https://solarbankcorp.com/solarbank-announces-50-4-million-of-revenue-for-third-quarter/

- Source 6: https://solarbankcorp.com/about-us/

- Source 7: https://solarstockboom.com/

- Source 8: https://solarbankcorp.com/news/

- Source 9: https://www.nasdaq.com/market-activity/stocks/suun

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media Group LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media Group LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media Group LLC and InvestingChannel, Virtus Media Group LLC has been hired by InvestingChannel for a period beginning on 05/20/2024 and ending 05/24/2024 to publicly disseminate information about NASDAQ: SUUN via digital communications. We have been paid eight thousand dollars USD. Virtus Media Group LLC agrees to pay social media influencer #1 one thousand dollars and social media influencer #2 one thousand dollars and social media influencer #3 one thousand dollars and social media influencer #4 three hundred fifty dollars and social media influencer #5 one hundred fifty dollars.