IDENTIFYING THE OPPORTUNITY

THIS WEDGE HAS BEEN COMPRESSING AND IS PRIMED FOR RELEASE

TARGETS

Target #1: $0.94 (+8.55%)

Target #2: $1.08 (+24.71%)

Target #3: $1.26 (+45.50%)

Target #4: $1.42 (+63.97%)

Support: $0.8058

GoldMining controls a diversified portfolio of resource-stage gold and gold-copper projects in the Americas.

Alastair Still, CEO of GoldMining Inc., has been in the mining industry since the mid-90s… and he’s watching a major shift happening in the gold mining space.

For years, large gold companies have underinvested in their projects and exploring for new assets.

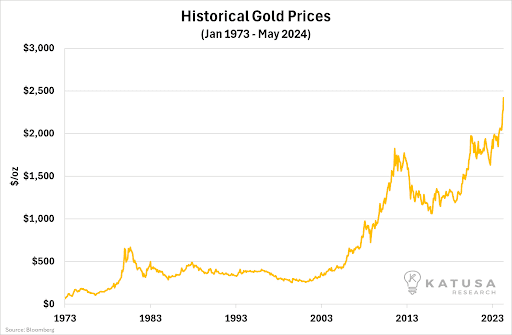

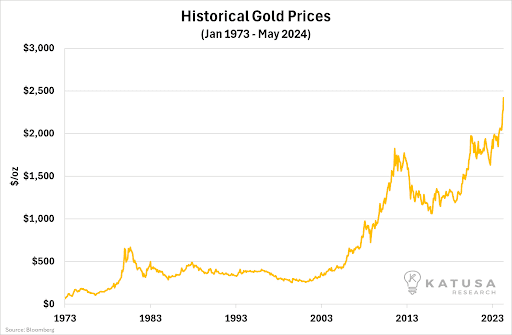

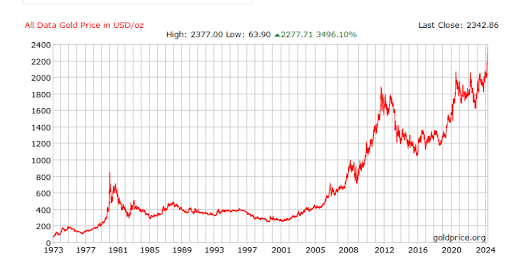

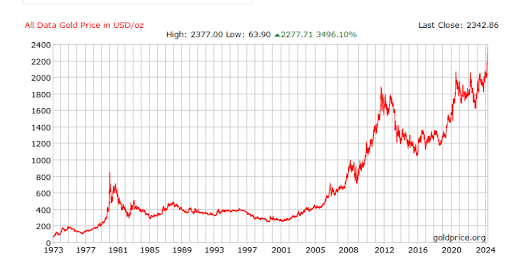

Gold and commodity prices peaked in 2011 and stayed depressed as money flowed to tech stocks, real estate, you name it.

Suddenly…in 2024…

Gold prices have hit record highs… and don’t forget about copper nearing all-time highs!

And mining companies are looking for projects they can acquire and advance to the production stage.

Enter Alastair and a potential opportunity for GoldMining Inc.

GoldMining (TSX: GOLD; NYSE-A: GLDG) is a public company that had its IPO in 2011.

GoldMining Inc. is listed and trades on the NYSE American under the symbol GLDG.

It has quietly been buying up gold and copper mining projects in North and South America since the company’s inception.

Born out of the panic of the Great Recession…

GoldMining is focused on the acquisition and development of gold assets in the Americas.

Through its disciplined acquisition strategy, the Company now controls a diversified portfolio of resource-stage gold, gold-copper projects and strategic investments in Canada, U.S.A., Brazil, Colombia, and Peru.

“Development” means pushing the ball forward progressing mineral resource estimates, preliminary mine scoping studies, environmental monitoring, and permitting… just some of the groundwork so a big company can jump in and take over from there.

Acquiring and developing is what GoldMining has done for 15 years… and now it's time to seek to take advantage of 15 years of acquisitions and work.

In 2020, the vision shifted from acquiring to seeking to unlock value for shareholders.

The CEO of GoldMining, Alastair Still, came up through the ranks at numerous operating gold mines in Canada as a Chief Geologist for the likes of major gold producers like Kinross Gold, and Placer Dome, before working with Goldcorp/Newmont, the largest gold mining company in the world.

Alastair helped manage the growth of Goldcorp’s portfolio which helped solidify its merger in 2019 with Newmont to form the world’s largest gold mining company.

He knows what a good deal looks like AND what the big miners are looking to acquire…

And, as gold came back from the grave in the early Covid days, Alastair joined the Company in 2020 and grabbed the reins as CEO at GoldMining Inc. the following year to build the new roadmap for the company.

He got to work fast.

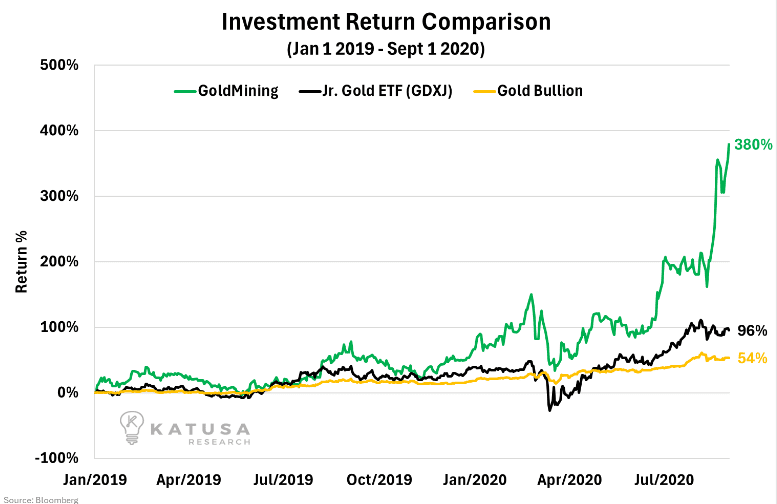

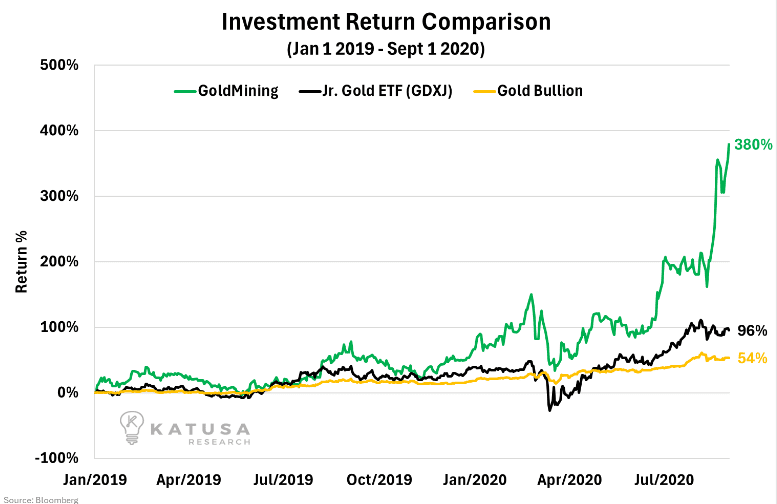

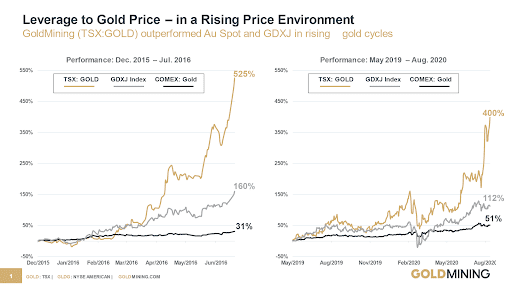

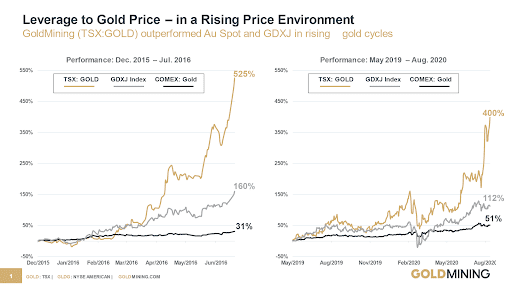

In fact, GoldMining was a top performing gold company in 2020, well outperforming the gold price and GDXJ Index as shown below.

Within the first year into the job at GoldMining, Alastair helped IPO a new gold royalty company, Gold Royalty Corp.

Now, in 2024, with near-record high gold prices, GoldMining is in an ideal position to continue to unlock value from its portfolio of assets.

Alastair claims, “it’s harvesting time,” from the gold and gold-copper rich portfolio of assets in the Americas. That means trying to monetize in some form the assets to benefit shareholders.

He is now trying to position the Company to capitalize on its buildup of projects over the last 15 years.

GoldMining Inc. had some 14 mining projects at the end of 2021.

By 2024, two of those assets have been part of transactions to unlock value. So, what happened?

1) It IPO'd Whistler Project, Alaska, into a separate public company that trades on its own on Nasdaq.

2) It completed the option sale of the Nutmeg Mountain Project for paid equity consideration and contingent payments totaling 14X what it initially paid based on share prices at the time of closing resulting in 28% indirect ownership of the project.

Meaning, there are 12 mining projects in their portfolio, where he can look to monetize and pull value from... extracting value like the previous two transactions is the intent.

And,

If you look at GoldMining’s stock price…

And consider the current market value of their existing cash and publicly traded equities…

- Then these 12 other mining projects present tremendous opportunity and

- Contain a cumulative total of 12.5 million gold-equivalent ounces measured and indicated and 9.7 million gold-equivalent ounces inferred.

(NOTE: Please refer to GoldMining's website for further important information regarding its resource estimates and links to all technical reports on its projects.)

We believe this diversified portfolio of gold focused resources provides a strong opportunity for shareholders.

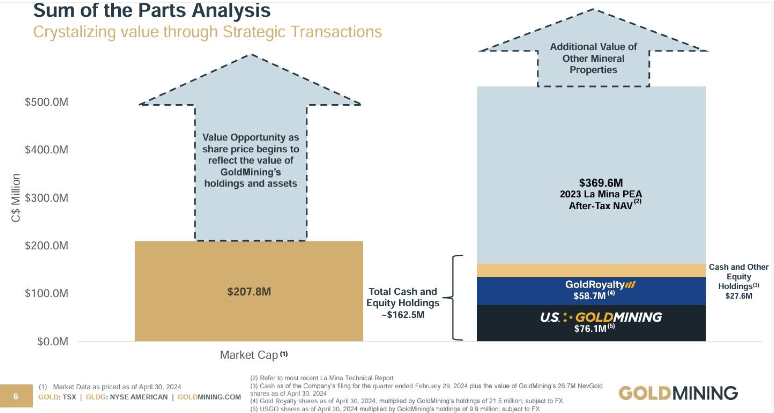

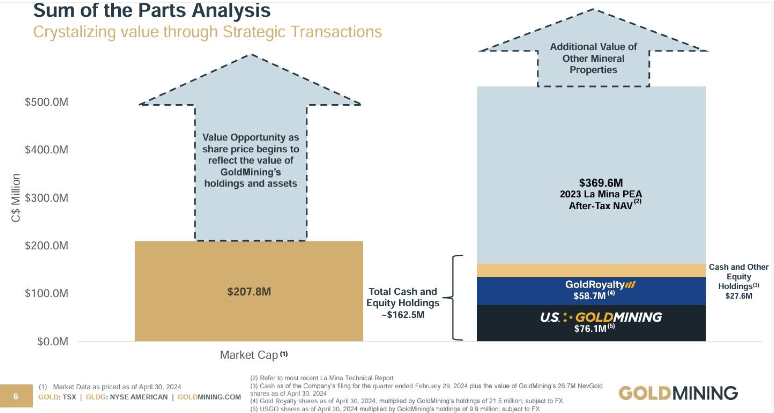

Take a look:

The company holds around CAD$162.5M in cash and equity holdings (based on cash as of GoldMining’s filing for the quarter ended February 29, 2024 plus the market value of public company shares based on closing prices on applicable stock exchanges on April 30, 2024) and has NO debt.

The market cap of the stock is around CAD$203M as of May 15, 2024.

As GoldMining seeks to unlock more value from its projects…it could daylight additional value from an extensive portfolio of gold focused projects.

The company holds 12 other mining projects outside of the CAD$162.5M in cash and other publicly traded equity holdings (based on April 30, 2024 trading prices).

- Just ONE of these projects – La Mina in Colombia – has a Preliminary Economic Assessment (PEA), that included an estimate of pre-tax net present value (NPV) of $447.3 Million using a 5% discount rate using a $1,750 gold price. (based on a 2023 technical report).

- The gold price today is above $2,300 per ounce.

La Mina is just 1 of 12 projects, at varying stages of exploration, owned by GoldMining.

The Company has recently announced plans to advance exploration at the São Jorge project in Pará State, Brazil (See press release dated November 29, 2023). The project has a near-surface gold mineral resource and an extensive land package of over 113,650 acres (that’s more than 5 times the size of Manhattan Island).

The GoldMining team has pinpointed several promising new exploration targets within the pProject, located in a rapidly developing gold region.

This area has attracted substantial investments from major gold financiers in adjacent projects, including the Tocantinzinho mine targeted to start production in 2024 to become Brazil’s third largest gold mine.

Along with its exploration targets, São Jorge sits near paved roads and powerlines, with easy access to water which also makes it extremely attractive for potential future development.

Similar projects are extremely remote, far from roads and access, which is not the case for São Jorge.

The project has undergone 37,154 meters of drilling across 145 holes, identifying 711,800 ounces of gold in the measured and indicated category, plus additional ounces in the inferred category.

(For further important information see the technical report titled “São Jorge Gold Project, Pará State, Brazil, Independent Technical Report on Mineral Resources” with an effective date of May 31, 2021, which is available at w ww.sedarplus.com under GoldMining’s SEDAR+ profile.)

This is why the strategy that GoldMining deployed over the last 15 years was so smart…

As today they have a sizeable gold resource…

On a very large regional project…

In an attractive district that already has other projects that have attracted major investments of hundreds of millions of dollars from some of the industry’s largest players on other projects in the area.

(Note: You can access all of Goldmining’s resource and technical reports here)

That’s just a snapshot of 2 of the company’s 12 assets.

The Company's recent strategic move aims to unlock the inherent value of each project, potentially leading to increases in shareholder value as these assets are better recognized in the market.

That’s why looking at GoldMining Inc. (NYSE-A: GLDG) is a way to diversify your portfolio for exposure to a number of different gold projects with estimated gold resources.

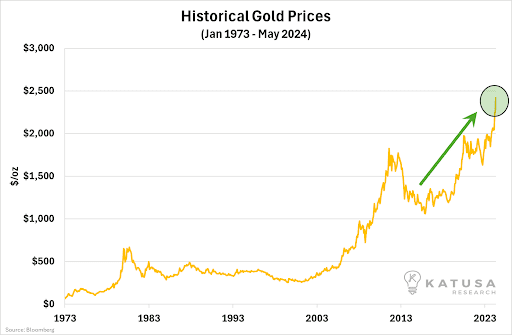

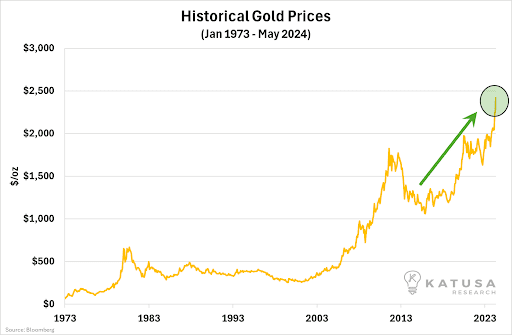

GoldMining Inc. has historically seen its stock respond during select intervals when gold has increased in the last decade

This doesn't mean it will always be the case. Gold has recently hit record highs:

GoldMining Inc. only went public in May 2011.

Since then, during select intervals when gold has seen a price increase (see the graphic above)… GoldMining Inc. has seen its stock rise.

The first case --- from December 2015 to July 2016, GoldMining (TSX: GOLD) went up 525%. That was in just 8 months

From May 2019 - August 2020…

GoldMining caught the attention of investors and went up 400%. Meanwhile, GDXJ (tracks a basket of junior mining stocks) only went up 112%.

As gold reserves decline globally…

And inflation persists with endless money printing…

Gold is seeing a rejuvenation not seen in decades

Since the last gold price boom 15 years ago, the major gold mining companies have struggled to maintain production levels and watched their reserves shrink.

That’s simply because as gold prices remained sluggish… it was not profitable to get the yellow metal out of the ground.

According to S&P Global, some major gold companies, like Kinross (an $8B gold miner) have seen their reserves go from lasting 25 years in 2010… to now 8 years (and dropping). There are only two ways the gold majors can replace their reserves:

- Spend the money to explore and find more resources and reserves, or

- Acquire companies with resources and reserves

McKinsey estimates gold reserves held by large gold companies are below 2007 levels

We’re looking at the perfect storm for gold prices to continue to climb higher. And you’re seeing record breakouts in real time:

- We have the highest inflation since 1981 - inflation is over double-digits in many goods such as grocery items… even real estate is up double digits since 2020.

- Central banks are buying more gold than they did in the last 50+ years — central banks continue to break records in how much gold they’re stashing.

- And the interest rates are the highest since pre-2008… gold spiked following the Great Recession crash. Gold spiked after the 2020 crash. Who knows what’s in store as the stock market reaches eye-watering record-breaking heights?

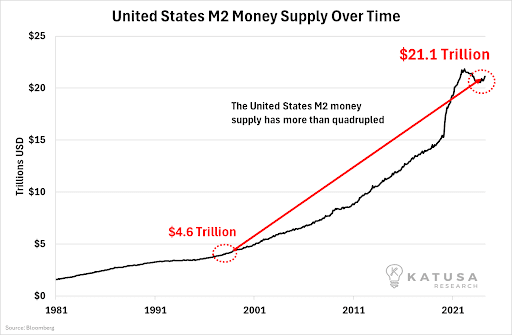

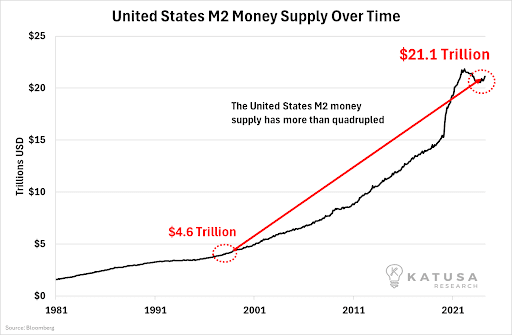

The US money supply --- the world’s reserve currency --- has become less and less valuable with each passing day.

You know why…

Because the Federal Reserve and Treasury continue to print more currency daily.

And the pace has only increased.

- Since 2000… the US has printed nearly 5X more currency.

- In 2000… gold spot prices sat around $400/ounce.

Today? It’s over 5X more at $2,300 per ounce and going. Meaning, gold has kept up with inflation as it is supposed to do.

Even if the US stopped printing tomorrow (which is unlikely), we’d still have an oversupply of dollars.

That alone should keep gold in demand and prices strong.

Add central banks snapping up gold bars at a record pace globally…

And gold miners have dwindling reserves.

Dwindling reserves means they need more projects to advance to boost their supply to be able to mine so they can sell more gold.

Plummeting reserves is a death sentence for miners unless they find new projects.

In this new gold boom, GoldMining Inc. has laid a foundation to succeed in unlocking value from a resource-rich portfolio of gold assets.

If you wish to speculate on small cap miners, you might typically buy a single mining stock.

That small cap may only have one solo asset or project they’re focused on… or perhaps they own a small handful in different stages of exploration or development.

In other words, for many mining plays, you’re often putting your entire trust in one, single project.

After all, MOST mining projects fail.

They run out of money, the government shuts down their project, the quality of the deposit is at a lower grade than expected.

There are million reasons a project can fail.

This is where it gets interesting for GoldMining Inc…

Their vision is NOT to risk the farm on one project. Taking on the capital expense, risk and stress of putting a mine into production is difficult.

“With a diversified portfolio, we’re less exposed to single project, high risks faced by many in the gold production business,”

… is something Alastair will be quick to tell you.

Instead, GoldMining Inc. takes a more ‘value investor’ approach.

That means, buy up mining projects at times when gold markets are relatively low and hold onto them until the right moment…

Buy them when no one else wants them.

This happened 15 years ago, when projects were sold at depressed prices by single asset companies who couldn’t raise the capital required to advance the assets.

An example is the Yellowknife Gold project in Canada.

The project sits in one of the highest grade past producing gold belts in Canada.

GoldMining scooped up the project in 2017 as gold prices floundered around $1,200/ounce --- gold today is over $2,320 per ounce

- The prior owners had already invested over $60 million into the project,

- GoldMining acquired the project for approximately $5 million in GoldMining shares - A good deal for GoldMining's shareholders.

(See GoldMining news release dated May 10, 2017 announcing transaction. 4,000,000 GoldMining shares as consideration - GoldMining share closed at C$1.68 on May 10 implying then-valuation of CAD$6.72M)

On that same belt was the Con Mine gold project, now partially owned by Newmont.

In its lifetime, the mine produced over 6.1 million ounces of high-grade gold.

GoldMining’s Yellowknife project is a different project and has its own geological characteristics, risks etc., so Con Mine is not indicative of the potential it has, but it certainly has a great address.

And Yellowknife is just 1 of 12 investments still in the portfolio.

(Click here for more information on the Yellowknife project)

GoldMining Inc.

(GLDG:NYSE)

GoldMining Inc. Is Modernizing The Mining Sector Blueprint

Rather than put all the risk into 1 or 2 mining projects, praying for the lottery ticket to pay off… CEO Alastair and team are seeking to add shareholder value in two innovative ways:

One way to provide shareholder value: Spin-offs that go public

A spin-off is simply taking an asset they already own and going public via IPO.

This allows GoldMining to raise capital, divest to de-risk the main portfolio, raise the awareness of the GoldMining brand, and attract more capital to different projects.

The first spin-off was in 2021 for a new royalty company called Gold Royalty Corp.

Unlike regular miners who own the land, invest in mining for extraction, etc…

Gold Royalty Corp. buys the rights to the production of a mine. So they inject capital into a miner and rather than receive shares, they get a royalty for production when the mine is up and running.

- The benefit is a one-time injection for long-term, low risk cash flow on producing assets.

Franco-Nevada is the largest gold royalty company in the world. It owns 418 royalties and its market cap is $24 billion.

Gold Royalty Corp. which launched its IPO just over 3 years ago, now owns 240 (and counting) royalties…

You can get your own exposure to Gold Royalty Corp. through GoldMining Inc. because GoldMining Inc. currently owns approximately 15% of GROY.

As GROY grows its business, GoldMining continues to have exposure through its ongoing ownership.

As GROY looks to add more and more producing royalties or some of its advanced stage existing royalties ramp up towards production, its value proposition improves. That’s not a guarantee, just common sense at this point.

For more information, see Gold Royalty's disclosure at www.sedarplus.ca and its website, including its Form 20-F for the year ended December 31, 2023.

GoldMining owns over 21 million shares of Gold Royalty, which includes adding to their position since Gold Royalty’s IPO.

And Gold Royalty wasn’t a one-off spin-off.

- In April 2023, GoldMining spun off US GoldMining Inc. (NASDAQ: USGO) for a second successful IPO.

GoldMining Inc. spinning off assets at a brisk pace!

The Whistler Project is a fully permitted gold-copper exploration project in Alaska.

GoldMining Inc. owns approximately 80% of the outstanding shares, which are listed on NASDAQ.

Rather than speculating on one mining asset directly…

GoldMining Inc. gives you exposure to a single-project stock, like USGO, without putting all your eggs in one basket.

Alastair has helped commandeer two successful IPOs in three years for GoldMining Inc. subsidiaries and there may be more to come.

The other strategy to unlock value for shareholders is:

#2 way to provide shareholder value:

Strategic sales and partnerships of current assets

When Alastair talks about “harvesting,” this is another big way to do so…

Take projects from within the GoldMining Inc. portfolio of assets:

And then sell or option them to other gold mining and exploration companies - with specialty skills to advance them further.

Remember, many of the largest gold miners have seen their reserves shrink to pre-2007 levels. That’s alarming.

In 2024, GoldMining completed its divestiture of the Nutmeg Mountain project in Idaho which it acquired for just CAD$1.15M.

It sold it to, NevGold Corp., a public company for share consideration then valued at CAD$9M that GoldMining has already received and stands to receive a further CAD$7.5M in future potential payments.

GoldMining is now the largest shareholder, owning about 28% of this public company listed in Canada with four gold projects including Nutmeg Mountain

- Assuming the buyer of this one asset meets certain specified milestones for the project and contingent payments are made, GoldMining could receive up to 14X return on its investment under this deal!

GoldMining still retains exposure to exploration successes on the property through its approximate 28% equity ownership.

This is how you harvest wins for shareholders.

- Plus, GoldMining Inc. (and its shareholders) get to ride any future success at the projectwith no additional investment required.

How did GoldMining Inc. find these buyers?

- Alastair and team know many players in the gold space. They make a point to know who their mining neighbors are as well.

That’s what GoldMining wants to do. Stay focused on targeted advancement of projects and find partners who can complete active drilling and development. In other words, harvest the gains from the projects they bought at the lows of the market.

The GoldMining portfolio contains numerous other projects that could be spun off or sold to other gold companies.

It’s already happened three times in the last three years…

One other project that could attract attention is buried in GoldMining’s portfolio.

A District-Scale Uranium Project in Alberta, Canada

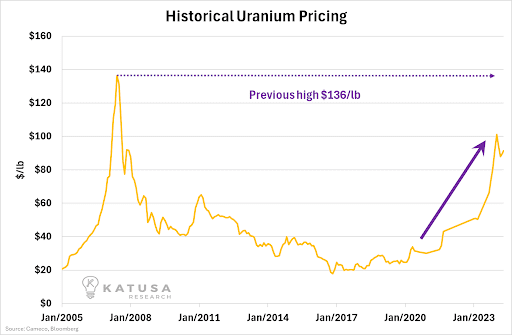

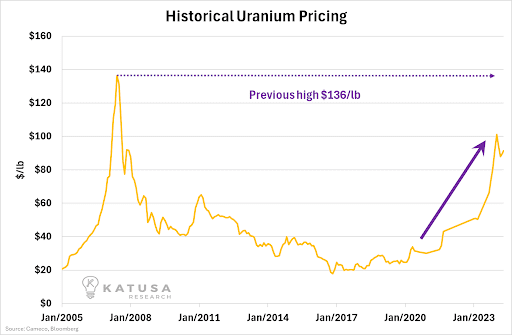

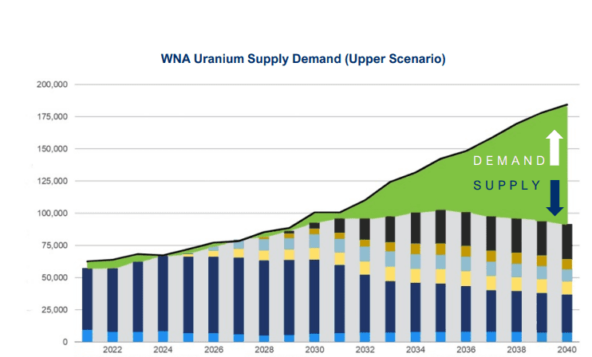

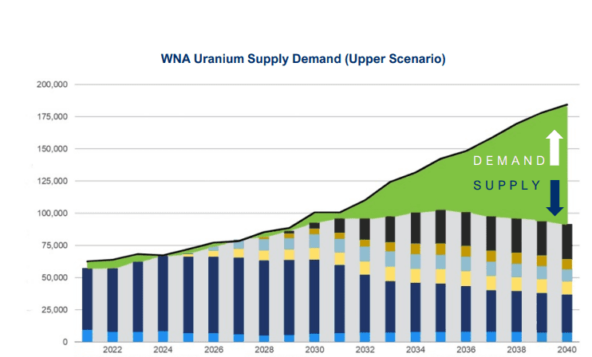

The uranium sector is one of the hottest asset classes in 2023 and 2024 year to date…

And GoldMining has another project where it could unlock further value in a continuing uranium bull market.

- Back in 2013, GoldMining acquired a uranium project in one of the best areas of uranium deposits in the entire world!

Uranium hit 17-year highs recently…

Bank of America is also optimistic, forecasting an average annual price of $2,009 per ounce for gold in 2023, with a potential climb to $2,200 in the fourth quarter.

What many don’t appreciate is that GoldMining has exposure to uranium as well.

See…

Back in 2013, near the very BOTTOM of the uranium market (see the chart above)…

GoldMining took 75% ownership of the REA Project. That’s not the most interesting part.

The exciting piece for investors is the Athabasca Basin is home to some of the highest grade uranium deposits in the world.

Cameco - one of the largest uranium providers on earth has its Millennium Uranium project there.

Mainstream news barely says a peep about it… but this supply crunch is happening.

Currently, the world consumes around 195M pounds of uranium… but only 144M pounds are being mined…

Much of it from risky jurisdictions like Niger, Russian-influenced countries like Kazakhstan and unreliable partners like China.

Given current uranium markets, REA presents another potential opportunity for GoldMining to seek to daylight value.

What would GoldMining Inc. know about uranium?

Well, their co-chairman, Amir Adnani founded a publicly-traded uranium company, Uranium Energy Corp. (NYSE-A: UEC).

UEC also has a project in the Athabasca Basin. Amir has the connections.

He’s driven lots of value for shareholders at UEC already.

GoldMining Inc. founder already has experience delivering impressive returns to shareholders

And Amir’s bringing that same vigor to GoldMining Inc. and he’s been with GoldMining Inc. since the beginning…

After reading about the company today, it’s not hard to see why. He believes in the long-term vision and Alastair is executing on it.

GoldMining Inc.

(GLDG:NYSE)

Inside leadership is significantly invested in GoldMining Inc.

Like Amir, insiders and directors own significant shares and have considerable skin in the game going for the long term.

Here’s a quick snapshot of GoldMining’s team and it’s got experts who have been in the mining industry for decades.

The Executive Team includes:

Alastair Still

Chief Executive Officer of GoldMining Inc (TSX: GOLD)

- +25 years of diverse experience working for major gold miners such as Newmont Corporation, Goldcorp Inc., Placer Dome Inc., Kinross Gold

- Served from 1999 until 2007 in Timmins, Ontario as Chief Geologist for Kinross, Placer Dome and then Goldcorp.

Amir Adnani

Chairman of GoldMining

- Directs the growth of a gold resources acquisition and development company

- President, CEO and Founder of Uranium Energy Corp.

- Chairman of Uranium Royalty Corp --- a uranium royalty and streaming company.

Tim Smith

CEO of US GoldMining Inc. (NASDAQ: USGO)

- Professional geoscientist with over 25 years of experience in mining and exploration.

- Stellar track record of prospecting gold mines in Australia and Canada with major companies like Newmont, Goldcorp and Kaminak Gold.

Paulo Pereira

President of GoldMining Inc.

- 25 years of experience of mining development and exploration in Brazil and Canada.

- Manages all the projects in Brazil

David Garofalo

- Served as President, CEO of Goldcorp Inc., until its sale to Newmont Corporation in April 2019.

- Served as President, CEO of Hudbay Minerals Inc.

- Chief Financial Officer of Agnico-Eagle Limited from 1998 to 2010

- He was named Mining Person of the Year by The Northern Miner in 2012

GOLDMINING INC.

(GLDG:NYSE)

You’ve seen the catalysts already:

GoldMining Inc. has a proven track record of buying mining projects at depressed prices over the last 15 years… and now harvesting value with two spin-offs and one sale in the last 3 years.

Gold prices seem poised to continue to break higher as inflation remains stubborn, plus the global debt rising in America and Europe.

The GoldMining Inc. management team has decades of experience in mining, growing portfolios, boosting shareholder value and gaining value by divesting from projects.

Even with selling one asset for up to 14X more than it initially paid for it and two others spun-off successfully.

Trading for under US $1 per share…

Provides direct exposure to 12.5 Million ounces of gold equivalent in the measured and indicated category

And 9.7 Million ounces in the inferred category

Across a portfolio of gold and gold-copper projects in the Americas

CAD$162.5 Million in cash and publicly traded equities (based on cash as of GoldMining’s filing for the quarter ended February 29, 2024 plus the market value of public company shares based on closing prices as of April 30, 2024)

With no debt and a bonus uranium play…

All while being exposed to leverage in both gold and uranium while prices have been increasing…

GoldMining Inc. (NYSE-A: GLDG) is worth a look for investors interested in not just a gold stock play… but also a company that’s diversified across multiple exploration stage projects they bought at lower prices…

Of course, please do your own due diligence.

GoldMining, Inc. has its entire investor presentation on their website.

(You should also carefully review its Annual Information Form for the year ended November 30, 2023, financial statements and other disclosures on its website and at www.sedarplus.ca.)

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media Group LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media Group LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media Group LLC and New Era Publishing Inc., Virtus Media Group LLC has been hired by New Era Publishing Inc. for a period beginning on 06/01/2024 and ending 06/07/2024 to publicly disseminate information about NYSE:GLDG via digital communications. We have been paid twenty five thousand dollars USD. Virtus Media Group LLC agrees to pay social media influencer #1 one thousand dollars and social media influencer #2 four thousand two hundred fifty dollars and social media influencer #3 three thousand one hundred ninety dollars and social media influencer #4 one hundred dollars and social media influencer #5 three hundred fifty dollars and social media influencer #6 one thousand dollars and social media influencer #7 six hundred dollars and social media influencer #8 four hundred ten dollars and The Investing Authority LLC twelve thousand dollars.