4 Reasons Why Peerless ETFs (NYSE: WEEL) Provides Protection & Growth In Market-Neutral Conditions, Which Is An Often Overlooked Diversification Keystone

Peerless etfs

(NYSE: WEEL)

An Innovative Investment Strategy

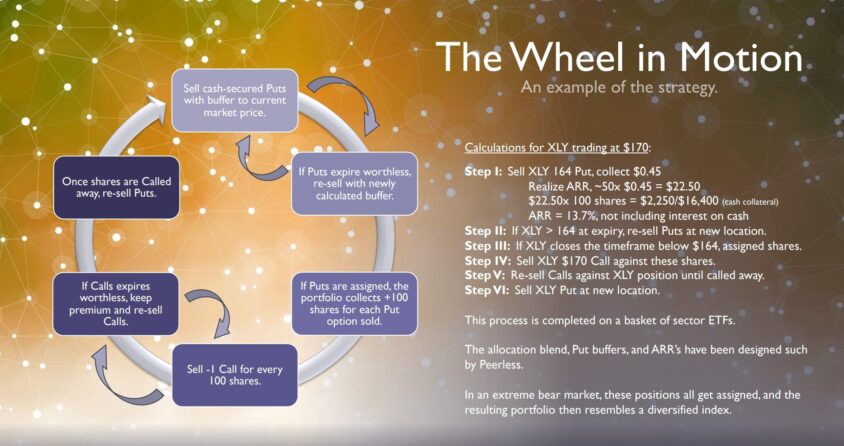

The Peerless Option Income Wheel ETF (NYSE: WEEL) stands out in the investment landscape as the first-ever ETF providing turnkey access to the popular Option Wheel investment strategy. This innovative approach utilizes a dynamic, patent-pending combination of secured put writing and covered call writing to generate income.

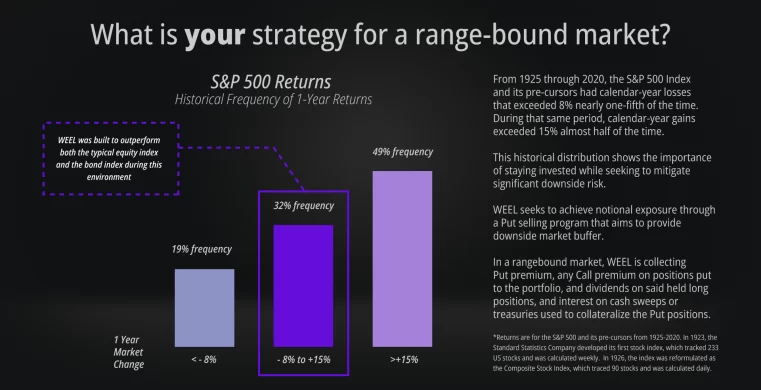

Unlike traditional equity investments, WEEL aims to deliver equity-like returns with reduced overall volatility, making it an appealing choice for investors seeking a balance between income generation and risk management. The disciplined, mechanical methodology underpinning WEEL assists in buying low and selling high while continuously collecting income, providing a sustainable and risk-managed solution to create excess returns in range-bound markets.

Moreover, the strategy’s independence from market index appreciation sets it apart, offering potential returns regardless of bullish or bearish sentiments. The fund’s allocation predominantly across sector ETFs, with flexibility to utilize individual securities if necessary, ensures broad market exposure while effectively managing risk.

This structured approach, free from emotional biases and market predictions, aims to simulate broad market exposure on a notional basis, leveraging cash (or treasury) secured puts. By maintaining tight time frames for short put positions, the strategy allows for frequent buffer resets, controlling downside risk and ensuring continuous income generation.

Income Generation and Volatility Reduction

One of the core objectives of the Peerless Option Income Wheel ETF is to generate current income while dampening volatility compared to traditional long-only portfolios. This is achieved through a strategic blend of put premiums, call premiums, and cash yield, creating a triple income potential. The fund’s methodology involves writing out-of-the-money secured puts to provide a buffer against potential losses while generating income.

If these puts are assigned, the positions are then managed with covered calls until they rebound, ensuring continuous income generation. In bearish market conditions, the majority of positions may be assigned, resulting in a diversified equity allocation across sectors and market capitalization.

The strategic approach of WEEL aims to outperform typical covered call strategies, especially in flat or down markets. Historical data indicates that the S&P 500 Index experienced calendar-year losses exceeding 8% nearly one-fifth of the time from 1925 to 2020. During such periods, WEEL’s approach of collecting put and call premiums, along with interest on cash sweeps or treasuries, provides a significant advantage.

This focus on income generation, combined with risk management features akin to buffer-style products, allows WEEL to achieve equity-like returns with lower overall volatility, offering investors a sophisticated and resilient income strategy.

peerless etfs

(nyse: weel)

How They Work: The Peerless Option Income Wheel

- Utilizes only Secured Puts / Covered Call writing strategies as a means of reducing portfolio risk.

- Derivative Income Category – Not a “structured outcome” product (Options Trading Category)

- Portfolio Construction includes sector ETFs, individual names, and other products for necessary exposure.

- Rules-based process that is repeatable and proprietary. Assists in buying low, selling high.

- Risk Profile is lower than the typical covered call strategy (via beta).

- Core long-term alternative. Not a fad product.

- Peerless has been running this strategy in both Separately Managed Account format and hedge fund format on a formalized basis since March 2021.

- Extensive back testing has confirmed confidence in the strategy.

Introducing the Management Team of Peerless ETFs (NYSE: WEEL)

Peerless Wealth, LLC is an SEC-registered investment advisory firm and investment manager specializing in wealth and investment management for affluent clients. Founder Erik Thompson posits that a considerable number of individual investors, alongside numerous financial advisors, may not allocate sufficient focus towards planning for (and capitalizing on) markets characterized by stagnation, or bounded within a specific range. Over the last few years, he began running the option wheel income generation technique on an account-by-account basis and also in a private hedge fund. Performance solidified the technique and gave Peerless Wealth the confidence to roll it out to the public via an ETF. Peerless ETFs, a division of Peerless Wealth, LLC, offers the first and only SEC-registered 40-Act fund that utilizes the Option Wheel.

Erik Thompson

Peerless Wealth Founder - Co-Portfolio Manager

Robert Pascarella, PE

Research & Trading, Co-Portfolio Manager

Rob serves as an IAR at Peerless Wealth. An engineer by trade, he collaborated closely with Erik in the conceptualization and enhancement of their proprietary strategy. Notably, their innovative approach has garnered patent pending status with the US Patent and Trademark Office (USPTO). Leveraging further mathematical and data science background, Rob’s work extended to comprehensive backtesting, where the duo rigorously assessed the efficacy and robustness of their trading strategy across various market conditions. Through meticulous analysis of historical data and simulations, they refined the strategy to ensure its resilience and effectiveness in navigating dynamic market environments. This iterative process underscores their commitment to delivering a sophisticated and adaptive investment solution.

Sources

- Source 1: https://peerlessetfs.com/

- Source 2: https://peerlessetfs.com/wp-content/uploads/2024/05/WEEL_May24_PostEffectiveWeb-1.pdf

- Source 3: https://finance.yahoo.com/quote/WEEL/news/

- Source 4: https://money.usnews.com/funds/etfs/derivative-income/peerless-option-income-wheel-etf/weel

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: The investing authority LLC was hired by company to create awareness for $96,900 total for a 12 month campaign