LATEST NEWS

Alset Capital Inc. Announces Investee Company Cedarcross Enters into Supply Agreement to Purchase Nvidia AI Computing Hardware from Earthmade Computer Inc., an Authorized Distributor of Super Micro Computer, Inc.

Alset Capital Inc. Announces Secured Loan to AI Investee Company Cedarcross International Technologies, Cedarcross to Purchase 10 Nvidia H100 HGX Servers

5 Reasons Why Alset Capital Inc (TSXV: KSUM) Could Be Poised For Significant Upside Potential in 2024

Investing in Alset Capital Inc. (TSXV: KSUM) presents an opportunity to capitalize on the exponential growth of the AI market. With strategic investments in AI ventures, a focus on dominating the AI computing infrastructure sector, and a clear aspiration to become a market leader, Alset is poised for significant upside potential. Backed by a strong portfolio of assets, a unique value proposition, and a commitment to financial prudence, Alset offers investors an attractive entry into the rapidly evolving AI landscape.

IDENTIFYING THE OPPORTUNITY

WE ARE AT A CRITICAL BREAKOUT THRESHOLD AND LOOKING STRONG

We have an influx of volume pushing into this consolidation zone, which provides Alset with high-potential

Alset Capital Inc

(TSXV: KSUM)

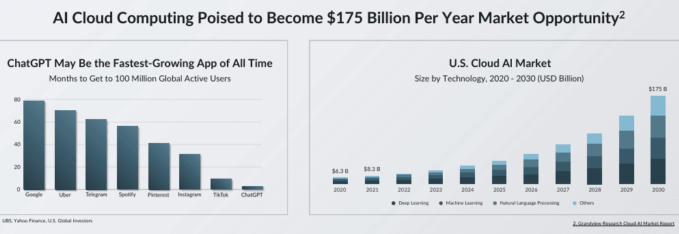

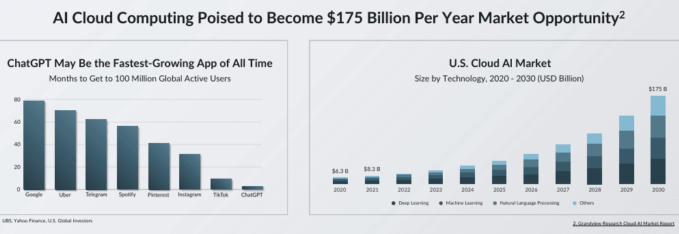

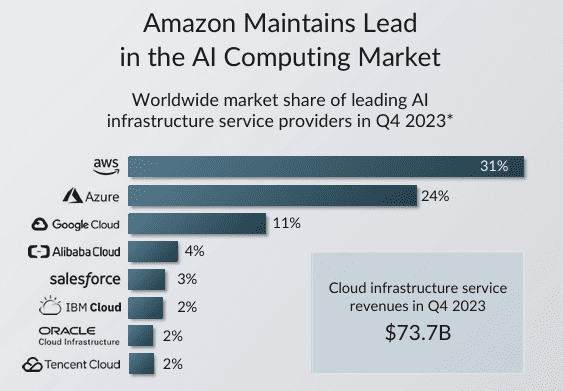

The Expanding AI Market: A $175 Billion Per Year Opportunity

In today's fast-paced technological landscape, the AI revolution is reshaping industries across the globe, presenting an unprecedented market opportunity. Alset Capital Inc. (TSXV: KSUM) stands at the forefront of this transformative wave, poised to capitalize on the immense market opportunity presented by AI innovation. With the global AI market projected to have a staggering economic impact of $15.7 trillion, and AI cloud computing poised to become a $175 billion per year market opportunity, investing in Alset represents an entry into a sector with unparalleled growth potential. From enhancing productivity and efficiency to driving innovation and unlocking new revenue streams, AI technologies are becoming indispensable for businesses seeking to maintain a competitive edge in the digital era.

Alset is strategically positioned to address the burgeoning demand for AI solutions. Through its investments in Cedarcross International Technologies Inc. and Vertex AI Ventures Inc., the company is empowering enterprises with access to high-performance AI computing and cutting-edge data management services. By democratizing access to AI technologies and providing essential infrastructure and support, Alset is not only driving significant shareholder value but could also fuel the advancement of AI-driven innovation on a global scale.

Investment In cedarcross international technologies inc

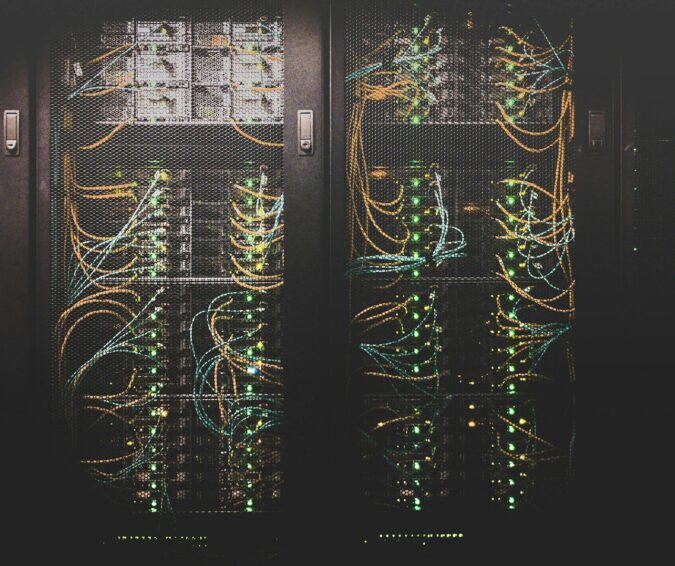

Alset Capital Inc. (TSXV: KSUM) has secured a substantial ownership stake in Cedarcross International Technologies Inc., a pioneering force in democratizing access to high-performance AI computing. Cedarcross revolutionizes the AI landscape by providing unparalleled access to the world's fastest AI servers, powered by NVIDIA H100 HGX GPU servers. With an emphasis on technological innovation, Cedarcross empowers enterprises with computing capabilities exceeding 700,000 hours, heralding a new era of unprecedented performance and efficiency. Under Alset's strategic guidance, Cedarcross is poised to accelerate the adoption of AI technologies and drive significant value for stakeholders.

Investment in Vertex AI ventures Inc.

Vertex AI Ventures Inc., supported by Alset Capital Inc. (TSXV: KSUM), is pioneering intellectual property (IP) management and data solutions with a multifaceted approach. With a core focus on intellectual property acquisition and licensing, Vertex AI Ventures excels in identifying, acquiring, and strategically licensing crucial IP assets. Clients partnering with Vertex AI Ventures gain access to a comprehensive suite of services dedicated to protecting and expanding their IP portfolios.

From meticulous identification to strategic licensing, Vertex AI Ventures provides tailored solutions to elevate intellectual assets to their fullest potential. Moreover, Vertex AI Ventures goes beyond mere acquisition, investing significantly in fortifying the integrity and resilience of its own IP portfolio. By prioritizing the safeguarding of inventive creations, Vertex AI Ventures ensures a robust foundation for ongoing innovation and sustained growth for its partners and shareholders.

In addition to its IP management services, Vertex AI Ventures offers cutting-edge data management solutions to address the evolving needs of businesses in today's data-driven landscape. Through advanced analytics and machine learning integration, clients can harness the power of AI technologies to derive actionable insights in real time. Vertex AI Ventures also prioritizes cybersecurity and compliance assurance, implementing state-of-the-art measures to safeguard valuable data and ensure compliance with regulatory requirements.

With scalable infrastructure and cloud integration services, Vertex AI Ventures future-proofs data operations, enabling businesses to scale based on demand. Through its continuous improvement program, Vertex AI Ventures plans to collaborate closely with clients to refine and optimize data management strategies, ensuring consistent value delivery and positioning clients for success in the dynamic realm of data and intellectual property management.

ALSET CAPITAL INC

(TSXV: KSUM)

Alset's Unique Value Proposition

Alset stands out in the competitive landscape through its innovative approach to AI investment and infrastructure development, combining strategic foresight, technological expertise, and a commitment to sustainable growth.

Strategic Vision and Investments: Alset proactively identifies and nurtures breakthrough AI technologies by investing strategically in both early-stage startups and established ventures. This approach cultivates innovation and fosters the development of robust business models within the dynamic AI ecosystem.

Pioneering AI Infrastructure: At the forefront of AI computing infrastructure, Alset provides unparalleled access to high-performance computing AI servers and data management solutions. Through ownership stakes in leading companies like Cedarcross International Technologies Inc. and Vertex AI Ventures Inc., Alset empowers businesses with high-performance computing capabilities, enabling them to thrive in an increasingly data-driven world.

Financial Prudence and Innovation: Alset demonstrates judicious financial management, ensuring efficient capital allocation and sustainable growth. Through strategies such as leasing computing capabilities to enterprise clients, and Platform-as-a-Service (PaaS) offerings, Alset aims to leverage compounding growth from cash flow to maximize shareholder value while minimizing risk.

Tailored Solutions for Scalable Growth: Alset offers customized solutions to address the evolving needs of clients and partners. From advanced analytics and machine learning integration to cybersecurity and compliance assurance, Alset provides a comprehensive suite of services to future-proof data operations and drive business success.

Recognizing the value of surplus cloud computing power, Alset aims to maximize its utilization through innovative intellectual property (IP) strategies. By expanding its investment portfolio through strategic investments in AI companies and research departments, Alset plans to offer early-stage computing power in exchange for equity in AI models under development. This not only provides valuable resources to emerging AI ventures but also positions Alset for long-term growth and value creation.

With a long-term vision to allocate 80% of computing power to stable, long-term enterprise clients, Alset aims to establish mutually beneficial partnerships with established industry players. By offering reliable computing infrastructure and fostering strategic collaborations, Alset seeks to become the preferred provider for enterprise-grade AI solutions. Additionally, Alset reserves 20% of computing power for startups and early-stage institutional modeling, fostering innovation and supporting the growth of emerging players in the AI ecosystem.

To further enhance its value proposition, Alset intends to negotiate early-stage equity agreements for institutional modeling, allowing it to retain rights over select AI models and participate in their future success. These strategic initiatives strengthen Alset's position in the market, fostering collaboration and driving mutual growth.

ALSET CAPITAL INC

(TSXV: KSUM)

Seizing the Moment: Alset's Niche-Focused AI Cloud Computing

In the rapidly evolving landscape of artificial intelligence (AI), computing capacity stands as the pivotal factor driving innovation. Alset recognizes the critical role of AI computing infrastructure, particularly in training large language models (LLMs) like ChatGPT and Bard. However, the scarcity of cloud computing capacity poses a significant challenge, marked by limited supply of chips, servers, and data centers.

Addressing Scarcity with Niche Focus: Alset seizes this opportunity by adopting a niche-focused approach to AI cloud computing. Unlike blockbuster providers, Alset specializes in catering to the customized needs of fledgling AI companies. By understanding the unique requirements of emerging players in the AI ecosystem, Alset fills a crucial gap in the market, providing tailored solutions that larger providers cannot match.

Bridging the Gap in AI Infrastructure: Alset's niche-focused strategy is aimed at bridging the gap between the demand for AI computing capacity and the limited availability of resources. Through strategic partnerships and innovative solutions, Alset aims to alleviate the challenges posed by scarcity, empowering AI startups and established ventures alike to access the computing power they need to drive innovation and growth.

Customized Solutions for Emerging Players: By prioritizing the needs of emerging AI companies, Alset offers customized solutions that address the specific challenges they face. Whether it's providing access to high-performance AI servers or offering data management services tailored to their requirements, Alset stands as a reliable partner for fledgling AI ventures seeking to scale and succeed in a competitive landscape.

Driving Forward in AI Innovation: As the demand for AI continues to soar, Alset remains committed to driving forward in AI innovation. By focusing on niche AI cloud computing, Alset not only meets the current needs of the market but also anticipates and prepares for future challenges and opportunities in the dynamic AI ecosystem.

ALSET CAPITAL INC

(TSXV: KSUM)

Alset Capital's Leadership: Experienced and Committed

Morgan Good, CEO & Director

Morgan Good is a seasoned Venture Capitalist and capital markets expert with almost two decades of experience. His expertise spans finance, M&A, corporate restructuring, development, and marketing. He has played a pivotal role in raising over $100 million CAD for numerous private and public issuers throughout his career and has served on various sector-specific boards.

Roger He, Head of Business Development & Director

Roger He is a member of The Chartered Professional Accountants in British Columbia and Saskatchewan, as well as a member of the CFA Society in Vancouver. He holds a graduate degree from Simon Fraser University and an undergraduate degree from the University of Saskatchewan. He also sits on the board of ARCpoint Inc. (TSXV:ARC)

Niko Kontogiannis, Director of Vertex AI

Mr. Kontogiannis, a serial entrepreneur and fintech pioneer, co-founded and financed VersaPay, a leading North American growth company. He then played a key role in founding and financing PayFirma, the first fintech company to implement mobile payments on smartphones. In 2018, he facilitated the M&A with Merrco, establishing a global leadership position in high-risk payment processing for the Cannabis industry and regulated businesses. He launched his family office, PENCK, in 2018.

Sources

- Source 1: https://cedarcrosstech.com/about/

- Source 2: https://vertexaiventures.com/

- Source 3: https://seekingalpha.com/pr/19673027-alset-capital-inc-announces-secured-loan-to-ai-investee-company-cedarcross-international

- Source 4: https://seekingalpha.com/symbol/KSUM:CA/press-releases

- Source 5: https://seekingalpha.com/pr/19676669-alset-capital-announces-investee-company-cedarcross-enters-supply-agreement-to-purchase

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media LLC and Omni8 Communications Inc., Virtus Media LLC has been hired by Omni8 Communications Inc. for a period beginning on 04/10/2024 and ending 05/03/2024 to publicly disseminate information about TSXV: KSUM via digital communications. We have been paid twenty five thousand dollars USD. Virtus media agrees to pay social media influencer #1 one thousand five hundred dollars USD and social media influencer #2 one thousand dollars USD and social media influencer #3 one thousand five hundred dollars USD and social media influencer #4 eight thousand dollars USD and social media influencer #5 six hundred dollars USD and social media influencer #6 one hundred fifty dollars USD and social media influencer #7 three hundred fifty dollars USD and social media influencer #8 four hundred fifty dollars USD and social media influencer #9 two hundred fifty dollars USD.