Discover How Just Kitchen is Quickly Gobbling Up Business in This Flourishing Market Expected to Reach US$49.72 Billion

Build your watchlist with us

Get the latest stock ideas direct to your inbox. 100% free and your information stays with us.

5 Reasons Just Kitchen (TSXV: JK) (OTCPK: JKHCF) Has The Potential To Deliver Exceptional Shareholder Value

Just Kitchen took the wildly popular ghost kitchen concept and improved it dramatically with their ingenious spoke model.

Their spoke model is so appealing that 7-Eleven has signed an agreement to use Just Kitchen as their preparation and delivery partners.

Just Kitchen is based in Asia which is densely populated and the fastest growing on-demand food delivery market on the planet, estimated to reach $49.72 billion.

The Company’s stack technology is both a valuable end-to-end supply chain logistics solution for their clients and also an innovative TV home ordering mechanism which has the potential to reach as many as 236 million connected devices.

Just Kitchen’s leadership is driven by an incredible entrepreneurial spirit as well as many years of combined success in the food, beverage, delivery, and hospitality markets.

Once you take a look at Just Kitchen’s exceptional growth and genius business model, you’ll understand why this party’s just getting started.

And, how this small cap company could be one of the most explosive tech stories of 2022.

Step on into the ghost kitchen

It’s food delivery’s hottest trend. Ghost kitchens are food prep operations with no waiters, no dining room, and no parking lot – really, no public presence whatsoever. But they can be readily found on food delivery apps.

They are physical spaces for operators to create food for off-premises consumption. They can run on a royalty model. Ghost kitchens also prepare dishes for multiple restaurants and/or franchises.

Staff are given recipes and trained to create the meals that are delivered to the consumer, typically through a 3rd party like Uber Eats drivers.

This is great for restaurants who can now expand their deliveries to distant parts of a city, they save on delivery costs, and they save a boat load on renting and staffing new locales.

The customer can order on-demand. Everyone’s happy. Mega win/win!

Kick It Up One Mega Notch

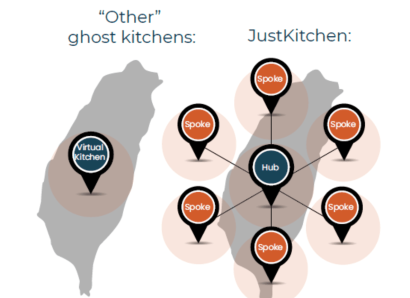

While other “ghosters” are busy doing their thing, the brains behind Just Kitchen took this business model and amped it up to unbelievable proportions.

They call it their “hub and spoke” model and its pure genius.

What they do is have a central hub where food is semi-prepared and blast frozen. This is delivered to the spokes early in the morning where they do the final prep and heating.

This allows Just Kitchen’s clients to cover much more territory than normal and scale to new areas without the need for another locale. And they absolutely love it.

Not only can they cover more territory but because the spokes are efficient finishing kitchens, there capital cost and operating costs are substantially lower than a traditional ghost kitchen and the finished food can be completed and delivered to the customer far quicker resulting in a significantly better dining experience and better ratings.

But they don’t stop there. Just Kitchen has developed a proprietary data stack that helps clients better plan menus and anticipate demand.

This company has it all

Just Kitchen’s tech stack optimized ghost kitchens by:

Improving supply chain management, aids marketing and development of new brands

Providing predictive analytics through data aggregation from multiple sources

Leveraging data for agile business strategy development

GPOPlus is even disrupting GPOs?

This Las Vegas-based company is not your run-of-the-mill GPO. The company is wisely carving out a piece of this gargantuan GPO market by identifying underserved industries, segments, and markets then developing specific GPOs around them where there is little to no competition.

The love for this model by small business is flowing. That’s because GPOPlus has low minimum order quantities (MOQ) which enable small and mid-sized companies to participate with larger corporations. Finally a level playing field for the little guy!

This is not a company leading guys on scooters. This is a powerful business with massive profit potential and a very savvy leadership team. You definitely do not want to underestimate how quickly this company can move.

Solidifying Their Presence In The Fastest Growing Market On The Planet

Right now the company is concentrating on the Asian market which is absolutely booming. Right now they are doing business in Hong Kong, Taiwan, and the Philippines. Soon they will be adding Japan, Singapore, and Malaysia.

In fact, food delivery in Asia grew an astounding 183% from 2019 to 2020…and has not slowed down!

The southeast Asia on-demand food delivery market is growing like wildfire.

There’s no question Asia is modernizing at a rapid pace. Frost & Sullivan estimated gross merchandise value (GMV) of $15.15 billion in 2021 for on-demand, doorstep food delivery services catapulting to $49.72 billion in 2030.

Now to-go orders can be placed right from TV…who’s hungry?

Television is filled with food commercials. Delicious food. Temping. Tantalizing. Now that food can be ordered with the click of a button.

This mega-convenience is due to the company’s JKOS technology integrated with the Android TV-compatible HAKOmini set top box device which is extremely popular in Asia.

This shrewd business move opens up Just Kitchen’s market potential big time.

How big? Over 20,000 HAKOmini units have been sold to date, with over 64% of owners being active daily users.

Holding 49% of the market, Android TV dominates viewing in Asia.

According to Strategy Analytics, over half of the world’s 1.1 billion televisions will be smart-enabled by 2026, while Rethink predicts that Android TV will have a 25% share of the smart TV and TV-connected devices market by 2026.

This represents inroads to a prospective market of 236 million of 905 million devices.

That’s how big…in fact the chart below shows how fast Just Kitchen is growing their business…it really is phenomenal.

Moving into the Convenience Store Market Could Be Another Significant Opportunity in the Making

This could be a bigger than big opportunity. Just Kitchen is in talks with convenience store giant 7-Eleven in Taiwan.

When you think of Taiwan, the first thought that comes to mind is not 7-Eleven. However, 7-Eleven has become such a national craze that it has become a stable part of many people’s lives.

In fact, Taiwan has more than 10,000 convenience stores, or one per approximately every 2,000 residents, the highest density in the world, according to industry statistics.

And 7-Eleven makes up more than half of those stores with at least 5,647 according to Statistica.

The business opportunity for Just Kitchen is very clear by the fact that Taiwanese customers choose convenience stores by a whopping 84%.

Get the latest stock ideas direct to your inbox.

100% free and your information stays with us.

Leading offline shopping channels used by Taiwanese consumers

Not only does this provide Just Kitchen a larger presence in Taiwan, but this deal has the real potential to generate significant revenues.

While there are no guarantees a deal will be signed if it were, it has the potential to be very significant to its business and could unlock similar deals in other Asian countries.

Keep your eyes on their PR for that one. It could be an absolute game-changer.

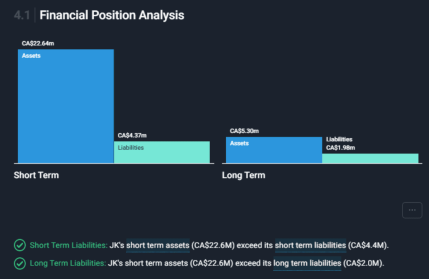

This Fast-Growing Company is Financially Sound

According to numbers from Simply Wall Street, Just Kitchen had about $20 million in cash assets exceeding its long and short-term obligations.

Now think to yourself, this company started doing business in Q3 of 2020. That’s quite a fast cash build. Simply Wall Street also reports the company has over 2 years of free cash flow.

Even better, Simply Wall Street shows Just Kitchen’s revenue is estimated to grow by 68.4% per year which better than the industry average of 18.7%.

Of course as a young business, nothing is ever guaranteed. But one has to be impressed at what Just Kitchen has accomplished to date and enthusiastic about their future.

Add to the mix an amazing management team and Just Kitchen is a company you definitely want to get on your radar right now.

Sources

- https://www.frost.com/frost-perspectives/hungry-for-growth-competitors-show-appetite-for-lucrative-southeast-asian-on-demand-food-delivery-market/

- https://investors.justkitchen.com/wp-content/uploads/2021/12/justkitchen_2pager_Dec_23-2021.pdf

- https://www.yahoo.com/now/justkitchen-launches-proprietary-software-jkos-070500863.html

- https://investors.justkitchen.com/#team

- https://tinyurl.com/8p6h9bd4

- https://thelowdown.momentum.asia/food-delivery-in-south-east-asia-almost-tripled-in-2020-accelerated-by-covid-19/

- https://digital.hbs.edu/platform-digit/submission/ghost-kitchen-attacks-7-elevens-food-business/

- https://simplywall.st/stocks/ca/consumer-services/tsxv-jk/just-kitchen-holdings-shares

- https://www.rapidtvnews.com/2021051860483/android-tv-dominates-asian-big-screen-viewing-as-on-demand-exceeds-live-streaming.html#axzz7KbdmOGAZ

Disclaimer

Stock Research Today is a project of Dadmin Capital LLC and intended solely for entertainment and informational purposes. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/. This website / media webpage is owned, operated and edited by Dadmin Capital LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Dadmin Capital” refers to Dadmin Capital LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and promote small public companies. By reading our website / media webpage you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our website / media webpage .We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website / media webpage are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. Dadmin Capital business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Dadmin Capital. often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Compensation – Pursuant to an agreement between Dadmin Capital LLC and TD Media LLC, Dadmin Capital LLC has been hired for a period beginning on 2/28/22 and ending on 3/3/2022 to publicly disseminate information about (OTCQB: JKHCF TSXV: JK) via digital communications. We have been paid thirteen thousand USD via ACH Bank Transfer. Social Media Compensation – Pursuant to an agreement between Dadmin Capital LLC and Social Media Outlet, Dadmin Capital LLC has hired Social Media Outlet for a period beginning on 2/28/22 and ending after one business day to publicly disseminate information about (OTCQB: JKHCF TSXV: JK) via digital communications. We have paid this Social Media Outlet one thousand USD via ACH Bank Transfer. Pursuant to an agreement between Dadmin Capital LLC and Social Media Outlet, Dadmin Capital LLC has hired Social Media Outlet for a period beginning on 2/28/22 and ending after one business day to publicly disseminate information about (OTCQB: JKHCF TSXV: JK) via digital communications. We have paid this Social Media Outlet one thousand USD via ACH Bank Transfer. Pursuant to an agreement between Dadmin Capital LLC and Social Media Outlet, Dadmin Capital LLC has hired Social Media Outlet for a period beginning on 2/28/22 and ending after one business day to publicly disseminate information about (OTCQB: JKHCF TSXV: JK) via digital communications. We have paid this Social Media Outlet five hundred USD via ACH Bank Transfer.