Huge New Gold Prediction for 2023

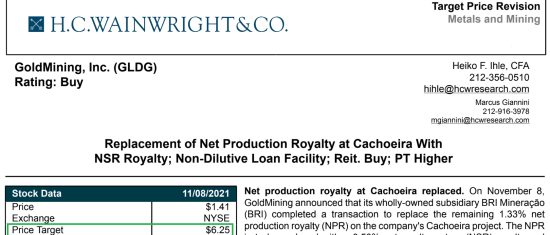

GOLDMining Inc. (NYSE: GLDG) Recently Received a Price Target Upgrade from H. C. Wainwright & Co. from $1.00/share to $6.25/share. Miners Are Starting to Outperform Gold but are Still Historically Cheap...

Build your watchlist with us

Get the latest stock ideas direct to your inbox. 100% free and your information stays with us.

SOMETHING BIG IS COMING...

An analyst that has tracked this company for years just gave it a price target of USD $6.25, which implies a 500% upside from today's price!

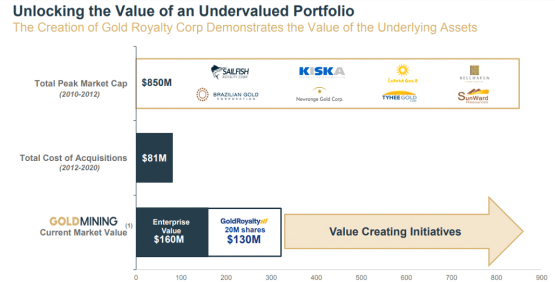

Unlocking the Value of an Undervalued Portfolio

In 2022, because of numerous standalone, non-repeatable, and unique catalysts, GOLDMining Inc. (NYSE: GLDG) could be entering its most significant year since its formation!

At this very second, it is the most crucial gold alert we're making, and you should dive deep into the bullish thesis.

When GOLDMining's (NYSE: GLDG) largest shareholder, founder Amir Adnani, formulated the idea to purchase gold resources in the ground at the depths of the bear market, he was able to make acquisitions at TEN CENTS on the dollar!

As you can see, the combined market cap of the companies whose projects were acquired was $850M, yet GOLDMining Inc.'s shareholders paid only $81M for them!

MASSIVE Historical Upside Rallies

Why is This Important?

The reason I'm telling you that GOLDMining Inc. (NYSE: GLDG) is trading for some of the cheapest valuations in its 10-year corporate history right now is that its Sao Jorge project in Brazil was worth $150M on its own in the 2011 bull market, nearly equal to GOLDMining's market cap today, yet the company owns 15 projects, not just one!

Supply and Demand

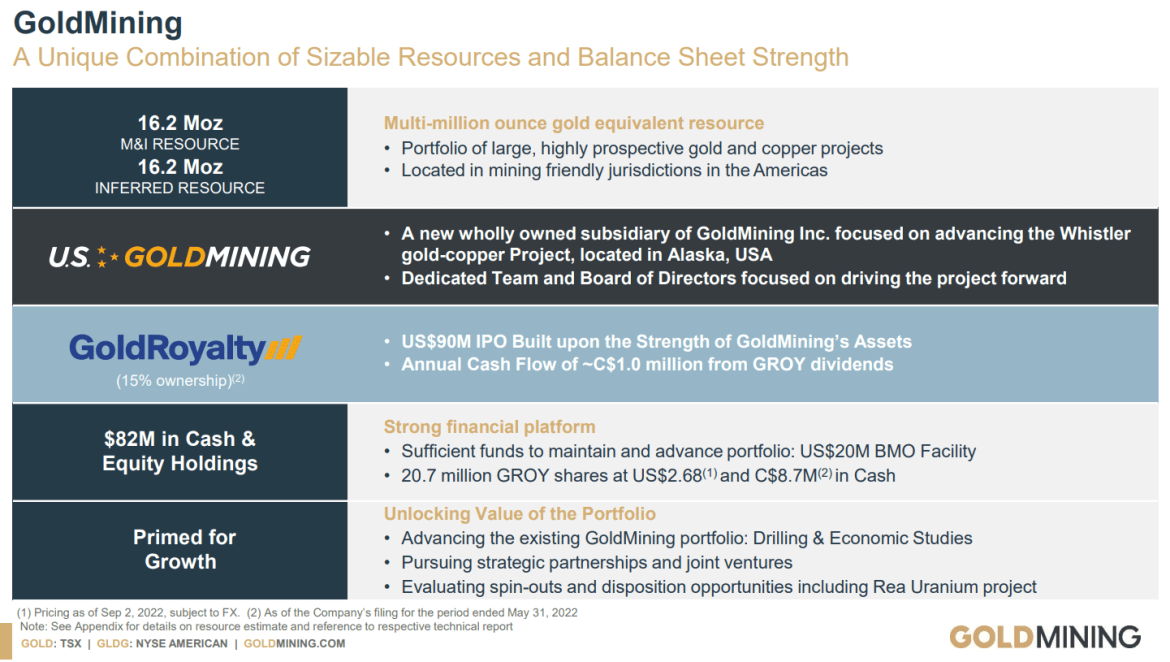

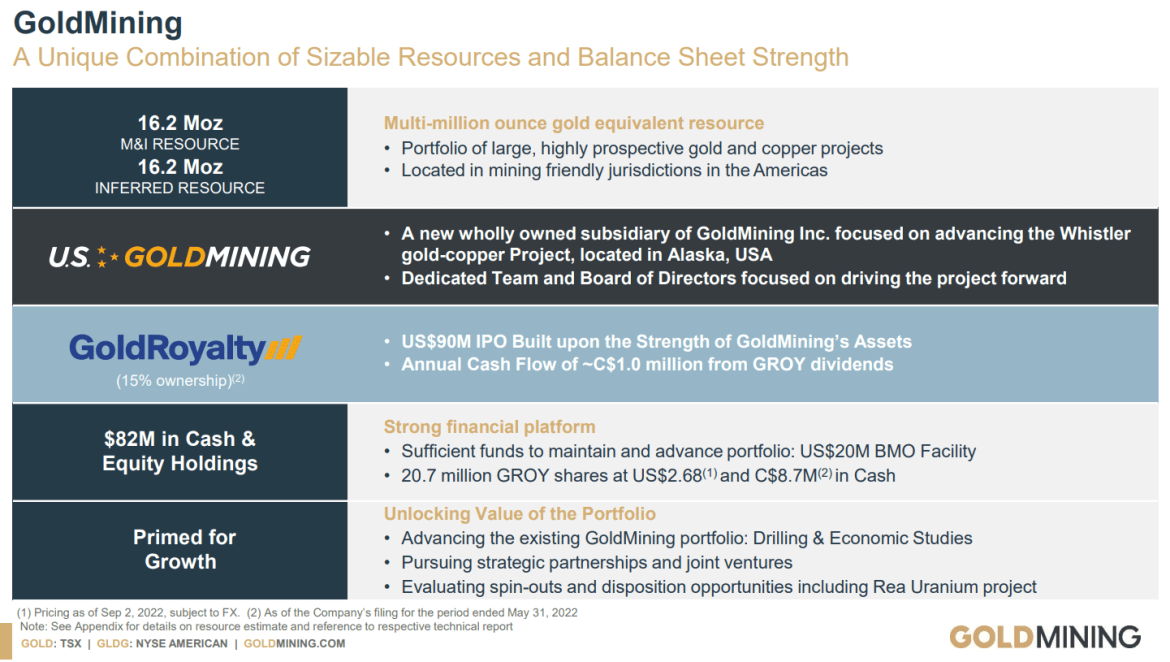

With 32M ounces of gold equivalent resources (16.2M in the M&I category and 16.2M inferred), the market is now trading these resources for $2.20/ounce of gold.

Incredible Discounts

If GOLDMining's management searches for a new project today, it would have to pay $40-$50 per ounce, which means that buying shares of GOLDMining Inc. (NYSE: GLDG) gives one access to gold ounces at a 95% discount to the average transaction in 2021.

Strong Financial Performance

Every historical break of trend resistance has resulted in massive bullish rallies, providing an excellent return on investment for both speculative traders and long-term investors.

Recent Price Upgrades

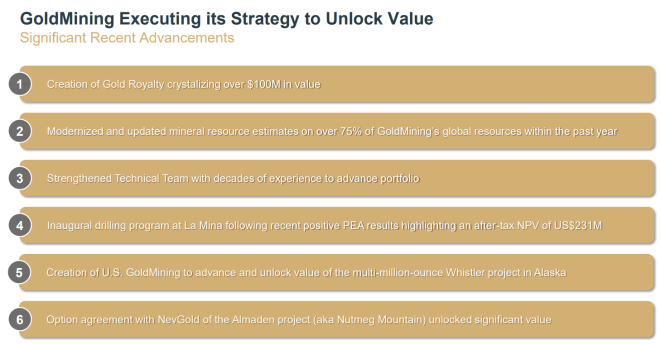

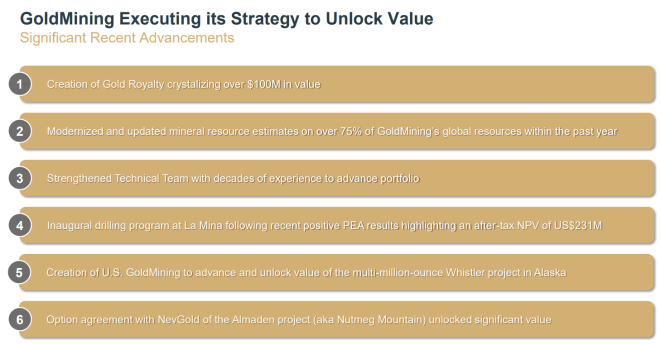

H.C. Wainwright & Co. recently delivered a price target of $6.25 per share, up from $1.00 per share. This is the result of current holdings, growth, and anticipation of upcoming catalysts

Who Else is Watching?

With shareholders such as BlackRock, Sprott Global, the KCR Fund (Katusa, Casey, and Rick Rule), the GDXJ ETF, as well as Oppenheimer Holdings, this isn't like any other junior miner, and I say that because more than HALF of its current market cap is its equity position in GROY, one of the fastest-growing royalty stcks in the world, worth more than $100M on its own.

We believe that the upcoming PEA reports management is advancing for La Mina, Yellowknife, and Sao Jorge will be the catalysts that make GOLDMining Inc.'s (NYSE: GLDG) current value a dream entry point.

Here's how this stock performed when gold's spot price rose in the past decade

Dec '13 - Mar '14: (US: GLDG) +164%, gold spot: 11.49% (10x LEVERAGE)

Jan 16' - Sept 16': (US: GLDG) +665%, gold spot: 22.65% (30x LEVERAGE)

Dec 18' - Feb 20': (US: GLDG) +150%, gold spot: 26.01% (5x LEVERAGE)

Mar 20' - Aug 20': (US: GLDG) +218%, gold spot: 36.12% (7x LEVERAGE)

At this very moment, (US: GLDG) gold resource (ounce equivalent in the ground) trades for $2.59/ounce. That's TWO dollars and eighty seven cents per ounce!

For comparison, the industry standard is currently between $40 and $50 per ounce. Given its portfolio size, had the market given it a price of only $20/ounce, HALF of the more conservative average, the stock could appreciate by 310%

This is what a friend of mine would classify as a "STEAL DEAL!"

Financials

VALUATION & CATALYSTS

The market is currently giving our No. 1 gold stock, which owns 32M ounces of gold equivalent resources a value of $82M, or only $2.59/ounce, nearly 94% below the industry standard of at least $40/ounce.

This is a stock that ought to trade at a premium since it has delivered leveraged returns compared with gold's price in all of its rallies this past decade (30x, 10x, 7x, and 5x), yet its price is exactly the same as it was in 2011.

At today's valuation, this stock is without a shadow of a doubt, our No. 1 idea for the gold rally - its catalysts are too attractive to ignore! Today's environment reminds me of 2016, when these mining stocks surged ON THE BACKS of rate hikes.

Stock Research Today is a project of Virtus Media LLC and intended solely for entertainment and informational purposes. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and promote small public companies. By reading our website / media webpage you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our website / media webpage .We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website / media webpage are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. Virtus Media business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media. often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Compensation – Pursuant to an agreement between Virtus Media LLC and West Coast media , Virtus Media has been hired for a period beginning on 2023-01-25 and ending after 2023-01-26 to publicly disseminate information about NYSE: GLDG. We have been paid $4000 USD via ACH Bank Transfer.

Ⓒ Copyright 2023 Virtus Media LLC. All Rights Reserved.