LATEST NEWS

Recharge Resources Lithium Brine Sample Testing Completed at Ekosolve Pilot Plant with Data Processing Now Underway

7 Critical Reasons Why Recharge Resources Ltd. (CSE: RR) (OTC: RECHF) Could Be Poised For Significant Upside Potential in 2023.

IDENTIFYING THE OPPORTUNITY

DISTRIBUTION GAP MEANS MOMENTUM

With a float of 65M and few restricted shares, a little bit of investor interest could send this soaring!

TARGETS

Target #1: $0.3496 (+33.95%)

Target #2: $0.3752 (+43.75%)

Target #3: $0.4313 (+65.25%)

Support: $0.2118

BONUS: $0.5150 (+97.32%)

RECHARGE RESOURCES LTD.

(CSE: RR) (OTC: RECHF)

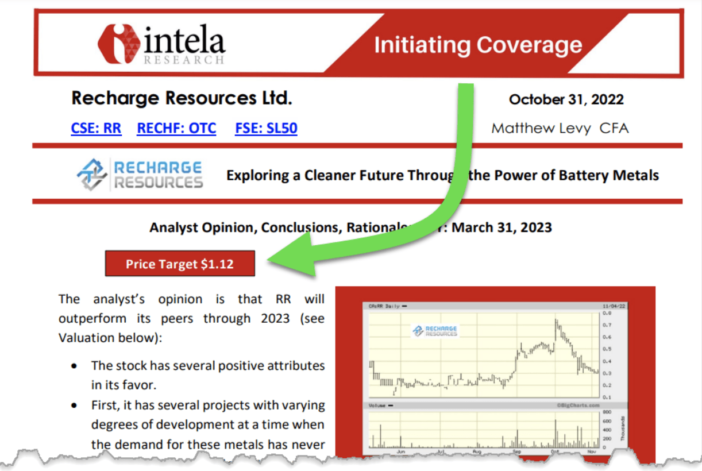

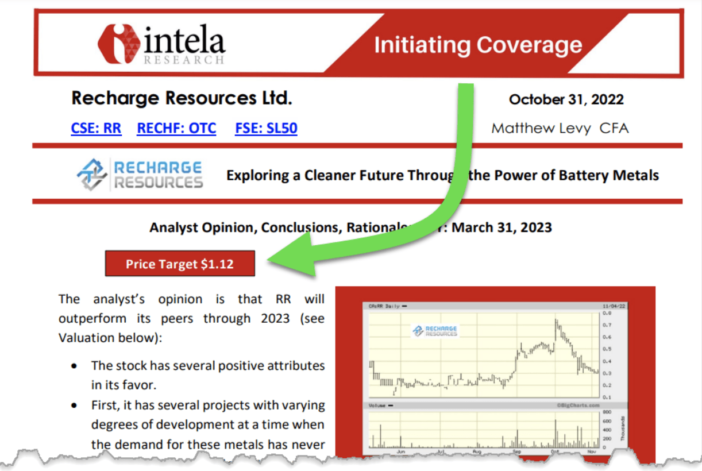

Analyst Coverage on Recharge Resources Ltd. (CSE: RR) (OTC: RECHF) Suggests Approx. 224% Potential Upside with $1.12 Target (35)

analysts, Lithium, nickel, cobalt, and copper

Recharge Resources Ltd. (CSE: RR) (OTC: RECHF) specializes in lithium, nickel, cobalt, and copper, has garnered positive attention from analysts who believe the company has the potential to outperform its peers in the coming years.

Matthew Levy CFA, an analyst at Intela Research, initiated coverage on Recharge Resources Ltd. (CSE: RR) (OTC: RECHF) with a target of $1.12 indicating a potential upside of over 224% from (CSE: RR)’s opening price of $.345 on 6/21/2023. (35) (18)

With several projects at different stages of development and an increasing demand for the metals they work with, Recharge Resources Ltd. (CSE: RR) (OTC: RECHF) could be well-positioned to capitalize on the thriving battery industry. (35)

One significant achievement for the company is the execution of a Letter of Intent with Richlink Capital Pty Ltd. Under this agreement, Recharge Resources Ltd. (CSE: RR) (OTC: RECHF) will supply a minimum of 10,000 up to 20,000 tonnes annually of lithium chloride or lithium carbonate from its Pocitos 1 Lithium Brine Project in Salta, Argentina to two clients in China. This partnership not only demonstrates the company’s commitment to meeting the growing demand for lithium but also solidifies its position in the market. (35)

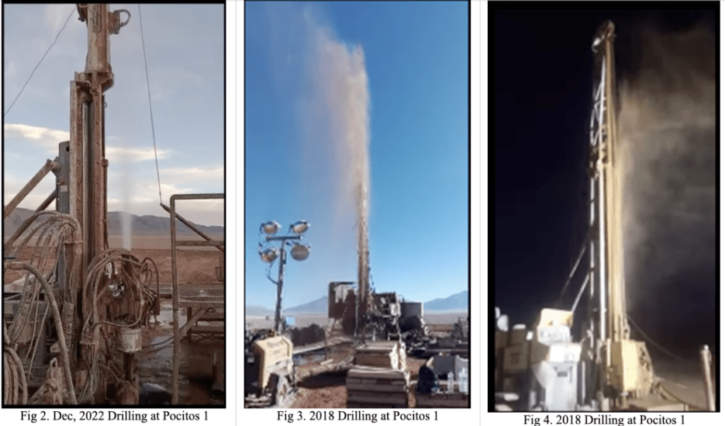

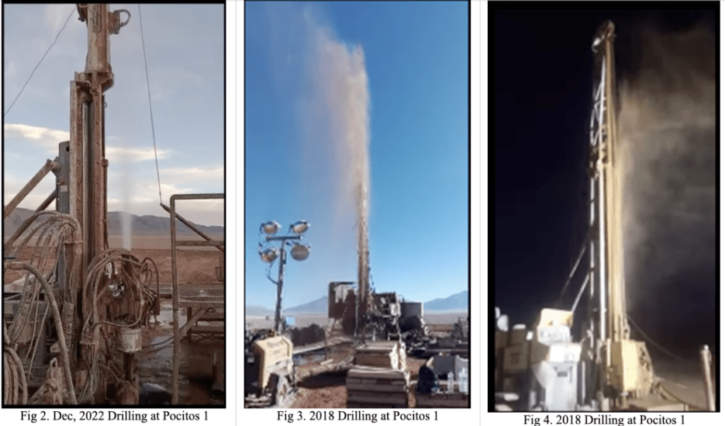

Furthermore, in 2022, Recharge Resources Ltd. (CSE: RR) (OTC: RECHF) began drilling at its advanced-stage Pocitos 1 Lithium Brine Project, indicating its dedication to advancing projects and expanding its resource base. Additionally, the company announced plans to transfer its 100% owned Pinchi Lake Nickel Project to a new subsidiary called “SpinCo” or “NextCharge.” By providing funding to SpinCo and spinning out the shares to Recharge’s shareholders, the company aims to unlock the value of this project and further enhance value for its stakeholders. (35)

The positive outlook on Recharge Resources Ltd. (CSE: RR) (OTC: RECHF) stems from the increasing demand for lithium, nickel, cobalt, and copper, which are essential metals used in batteries for electronic devices and electric vehicles (EVs). With the exponential growth of lithium-ion batteries projected to continue, driven by personal devices and EVs, the battery market is expected to reach an impressive $183 billion by 2030. (35)

Recharge Resources Ltd. (CSE: RR) (OTC: RECHF)’s focus on lithium-ion batteries aligns well with the industry’s trajectory. Established automakers like Tesla, Toyota, Ford, and Volkswagen are scaling up their EV production, while new players like Lucid Motors are entering the market. The growth of EVs was already remarkable, with a 43% increase between 2019 and 2020, despite representing only a 1% market share. As the adoption of EVs accelerates, the demand for metals used in battery production, including lithium, nickel, copper, and cobalt, will experience significant growth.

Recharge Resources Ltd. (CSE: RR) (OTC: RECHF)’s correlation with these metals, due to its primary role as a mining firm, presents an opportunity in the market. The recent correction in commodity prices provides a favorable entry point, considering the strong correlation between the stock and metal prices. This correlation offers potential upside once prices resume their ascent. (35)

Recharge Resources Ltd. (CSE: RR) (OTC: RECHF) presents an enticing opportunity within the mining sector, with its focus on lithium, nickel, cobalt, and copper. Analysts anticipate that the company’s projects, combined with the growing demand for metals used in batteries, position it favorably for future growth. The company’s strategic projects, such as the Pocitos 1 Lithium Brine Project and the Pinchi Lake Nickel Project, provide a solid foundation for capturing market opportunities. (35)

With the global push toward clean energy and sustainable transportation, the demand for battery metals is expected to soar. Recharge Resources Ltd. (CSE: RR) (OTC: RECHF) is poised to benefit from this trend as it continues to explore and develop its mineral resources. By focusing on lithium, nickel, cobalt, and copper, the company aligns itself with the core components of modern battery technologies. (35)

The strong outlook for Recharge Resources Ltd. (CSE: RR) (OTC: RECHF) is further supported by the entry of new players into the market and the expansion plans of established automakers. As the adoption of EVs and electronic devices accelerates, the demand for battery metals will continue to rise. This bodes well for Recharge Resources Ltd. (CSE: RR) (OTC: RECHF), as it positions itself as a reliable supplier of these critical resources. (35)

While every market research opportunity carries inherent risks, Recharge Resources Ltd. (CSE: RR) (OTC: RECHF)’s positive attributes, ongoing project developments, and favorable market conditions position the company for potential outperformance. As analysts indicate, the stock may hold the potential to exceed its peers based on the strong demand for battery metals, the execution of strategic agreements, and the company’s commitment to advancing its projects. (35)

RECHARGE RESOURCES LTD.

(CSE: RR) (OTC: RECHF)

There Will Be a Race to Sell U.S.-Built EVs (21)

2022 was the year that electric vehicles entered the mainstream. Not everyone has one, but buying an EV no longer makes you an outlier. Driven by policy initiatives from governments and billions of dollars in investment from automakers, we can safely say the EV industry has begun to take shape. (21)

Over the next year, that landscape will develop beyond the foundations of 2022. Here are some of our best guesses for what you can expect.(21)

There will be a race to sell U.S.-built EVs in the first quarter The Inflation Reduction Act, which the Biden administration passed in August, has already had a huge effect on the EV industry as automakers work to onshore their supply chains and factories. But with certain aspects of the IRA’s EV tax credit rules now to be delayed until March 2023, we’re expecting to see EV sales take off in the first quarter of the year.(21)

Under the bill, eligible EVs could qualify for a $7,500 tax credit if they meet the requirements of being built in North America and having sourced critical battery materials from the U.S. or free trade agreement countries. Those rules were meant to go into effect on January 1, 2023, but the Treasury Department has delayed guidance on the critical materials rule until March. And it’s a good thing, too. While automakers in 2022 scrambled to set up factories in the U.S., most critical materials still come from China, so they need time (likely years) to set up new supply chains. (21)

One company that could be extremely well-positioned for this need of critical materials is Recharge Resources Ltd. (CSE: RR) (OTC: RECHF).

With Demand for EVs Soaring, the US is Racing to Secure Supplies of Lithium (16)

With demand for EVs soaring, the US is racing to secure supplies of the critical mineral. The U.S. government offered a loan of up to $700 million to Australian producer, Ioneer, for its undeveloped lithium mine and processing plant in Nevada. (16)

The loan — the Department of Energy’s largest to date to the lithium sector — could fast-track development of the site. Ioneer plans to start production from the mine in 2026 and has contracts to supply Ford and Toyota with output. It could eventually turn out enough lithium for 370,000 EVs a year.(16)

It is part of the U.S. government’s effort to secure supplies of metals such as lithium, cobalt, nickel and graphite that are crucial to the clean energy industries that officials see as key terrain for future economic competition with China.(16)

Analysts say it must happen much more quickly.(16)

The Inflation Reduction Act’s full EV tax credits only go to cars that source components and raw materials from the US or free trade partner countries — a policy North American lithium executives have said is sorely needed to compete with Beijing.(16)

Also, last year, the U.S. invoked the Defense Production Act, a Korean war-era power, to boost domestic supply of battery metals, splurged $2.8bn for 20 companies working on EV battery supply chain projects in the US and entered into a pact to invest in critical mineral projects overseas with allies such as Canada, the EU, the UK and Australia.(16)

Even with all of this government backing, the challenges to boost supply remain formidable. Projects in the west have suffered from lengthy permitting processes at a time when China is increasingly turning to laxer regulatory regimes in Africa and Latin America to secure feedstock for its vast lithium refineries at home. (16)

The US has one operational lithium mine — and another proposed lithium mine in Nevada, Thacker Pass, has been opposed by conservation groups. A court ruling that could decide Thacker Pass’s fate is due early this year.(16)

Elon Musk’s Tesla recently had to renegotiate a lithium supply deal with the miner Piedmont Lithium because a proposed mine in North Carolina has gotten bogged down in the regulatory thicket. The supply may come from Canada instead.(16)

Canada has large lithium reserves and is home to brine (in the west) and spodumene (in Québec and Ontario).(24)

Some clean energy backers have argued that Congress needs to reform the way projects are evaluated and permitted to speed up new supplies.

Chris Berry, president of advisory House Mountain Partners, said the permitting decision for the Thacker Pass project will be a “real test case for how serious we are in the west about reconfiguring critical metals supply chains.” (16)

A further issue is that the US lags not only behind China — which has 80% of global lithium hydroxide processing capacity — but also Australia and Europe in its plans to build lithium refineries.

Tesla is among the companies eyeing new refining capacity, with plans for a possible investment of more than $350 million on lithium refinery along the US Gulf Coast, a major hub of the global oil refining business.

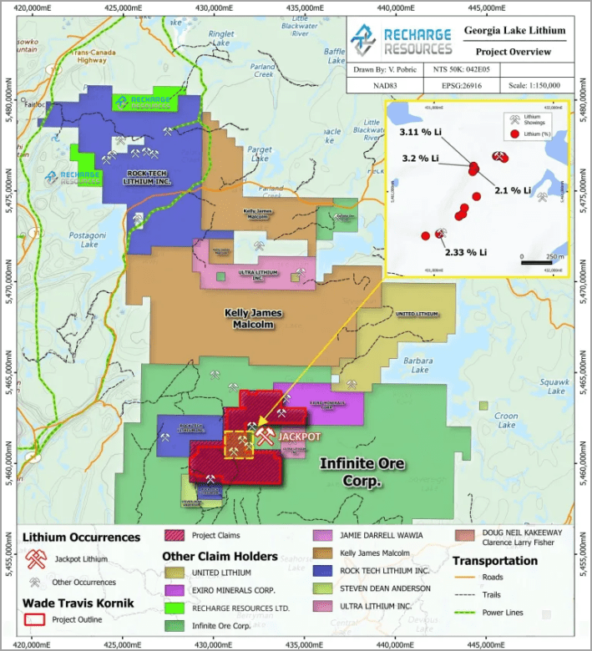

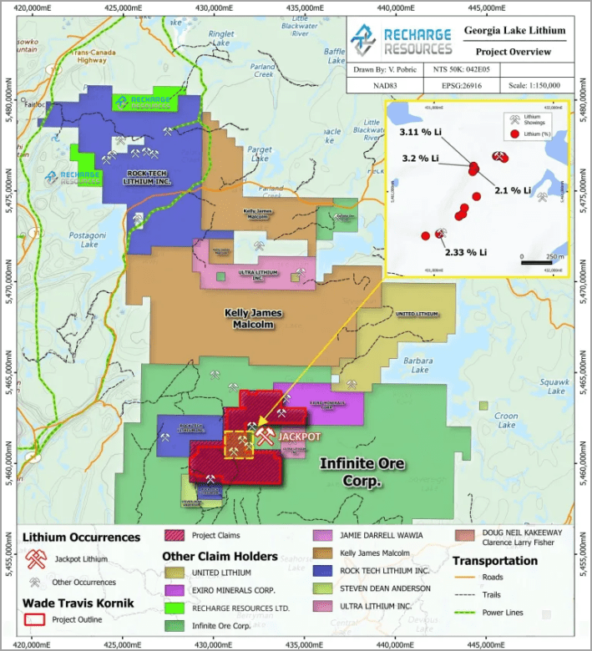

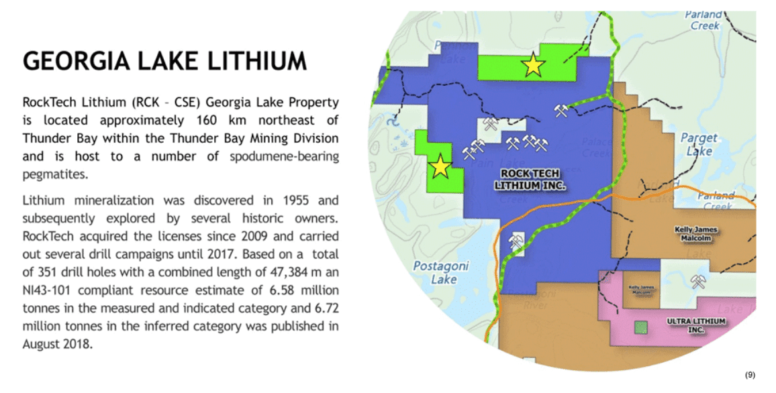

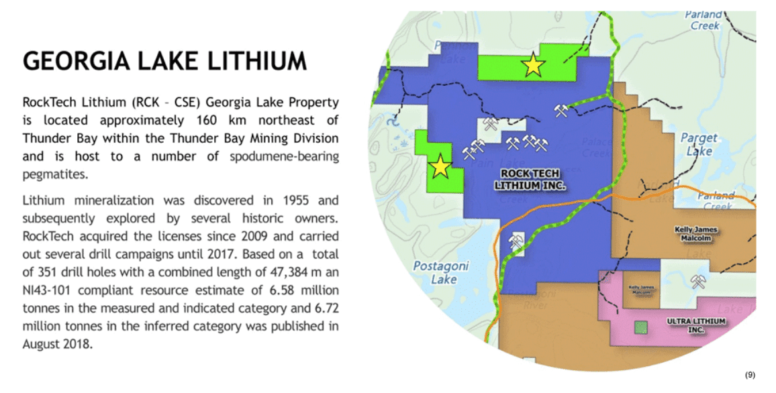

Recharge Resources Ltd. (CSE: RR) (OTC: RECHF) Receives Dataset & Reports from Airborne Survey at Georgia Lake Lithium Project To Demonstrate "Structural Continuity" From Neighboring Rock Tech Lithium Inc.’s Property. (26)

On December 29th, 2022, Recharge Resources Ltd. (CSE: RR) (OTC: RECHF) announced that Prospectair Geosurveys has finalized processing the high-resolution heliborne magnetic survey data collected from the company’s 100% owned Georgia Lake North and West Lithium Properties in Ontario, Canada.

The Property is immediately contiguous to Rock Tech Lithium Inc’s (RCK–V) (“Rock Tech”) Georgia Lake Lithium Property and located approximately 160 km northeast of Thunder Bay, Ontario, within the Thunder Bay Mining Division.

Recharge will be reviewing the data over the next month to implement a spring field program consisting of geological mapping and prospecting over target areas once conditions are favourable.

CEO, David Greenway, stated, “We are making progress on all fronts across our portfolio of projects. We are thrilled with the efficiency of Prospectair Geosurveys’ turn around time of the geophysical data and look forward to interpreting the results to direct an aggressive spring 2023 field program at our 100% owned Georgia Lake Lithium Project.”(26)

“The point of this airborne survey was to identify the potential for structural continuity from neighbouring Rock Tech’s active development at its Georgia Lake Project. Rock Tech signed a major lithium supply agreement with Mercedes-Benz AG and Recharge is committed to advancing and monetizing its portfolio of assets to the benefit of all stakeholders,” Greenway continued.(26)

On October 20th, 2022, Mercedes-Benz (MBGn.DE) signed a supply agreement with Canadian-German Rock Tech to receive on average 10,000 tonnes of battery-grade lithium hydroxide per year. The deal, which comes shortly after the two groups said they would explore a strategic partnership, has a value over five years of 1.5 billion euros (US$1.47 billion) and will provide enough lithium hydroxide for 150,000 cars a year, the companies said.(26)

The 548 line-km airborne survey included covering neighboring known lithium-bearing pegmatite structures, mobilization and demobilization, room and board, supply and delivery of fuel, data gathering and processing. All final results will be presented to section 4.4 with a final report signed by QP and NI 43-101 compliant.(26)

Joerg Kleinboeck, P.Geo (JMK Exploration Consulting) has reviewed the technical information that forms the basis for portions of this news release, and has approved the disclosure herein. Mr Kleinboeck is independent of the Company and is a qualified person as defined under National Instrument 43-101.(26)

The Company previously announced on December 8th, 2022 it had engaged LFG Equities Corp. for digital media services through social media channels and online media placements for a 6-month term. The Company has granted to LFG Equities 335,000 stock options at a price of $0.35 per share and is valid for a one-year term. The options are governed by the Company’s incentive stock option plan.(26)

Georgia Lake North & West – Lithium Properties – Ontario

The Georgia Lake North and West Properties are located approximately 160 km northeast of Thunder Bay, Ontario, within the Thunder Bay Mining Division. Recharge’s property is contiguous to the North and West boundaries of Rock Tech Lithium’s Georgia Lake Lithium Property and consists of two claim blocks totaling 320 hectares and 432 hectares.(26)

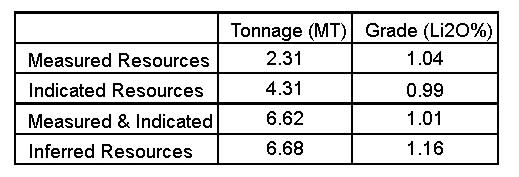

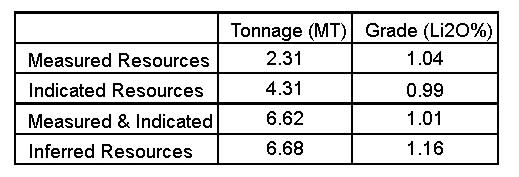

The Rock Tech Lithium Georgia Lake Project is host to several spodumene-bearing pegmatites. Lithium mineralization was discovered in 1955 and subsequently explored by several historic owners. Rock Tech’s property hosts an NI 43-101 Mineral Resource, as reported in Rock Tech’s Preliminary Economic Assessment filed on Rock Tech’s SEDAR profile, with an effective date of March 15, 2021. The Mineral Resource is summarized in the following table:(26)

Recharge’s management cautions that past results or discoveries on properties in proximity to Recharge may not necessarily be indicative of the presence of mineralization on the Company’s properties.

Recharge Resources Ltd. (CSE: RR) (OTC: RECHF) is a Canadian mineral exploration company focused on exploring and developing the production of high-value battery metals to create green, renewable energy to meet the demands of the advancing electric vehicle and fuel cell vehicle market.(26)

RECHARGE RESOURCES LTD.

(CSE: RR) (OTC: RECHF)

Why This News Could Be Game-Changing For Recharge Resources

Simple. The company who made the strategic partnership with Mercedes-Benz is right next door! Recharge Resources CEO, David Greenway, had this to say:

"While we continue to advance our two fully-funded drill programs at Brussels creek and Pocitos 1 lithium Salar in Salta, Argentina, it is hard to ignore the developments by our neighbours Rock Tech Lithium and their new strategic partnership with premium automaker Mercedes-Benz. Recharge Resources will plan a surface reconnaissance exploration program on our Georgia Lake projects with a goal of identifying the potential for continuity of mineralization from Rock Tech’s active development at Georgia Lake.”

Could this upcoming exploration program catapult this relatively unknown company into the mainstream? What if they hit it big and find an unconscionable supply?

Recharge Resources’ 2023 Drilling Campaign At Pocitos 1 Lithium Brine Project Plans Another Milestone Under Offtake Loi To Supply Up To 20,000 Tonnes Per Year Of Lithium Carbonate Equivalent

This Is Another Planned Milestone In The Company’s Endeavour To Build Up To A 20,000-Tonne Lithium Extraction Ekosolve™ Plant(35)

On February 06, 2023 Recharge Resources Ltd. (CSE: RR) (OTC: RECHF) announced the Company has applied to Argentina’s Department of Mines for Recharge to drill a fourth hole after the success of the now three previous holes hitting the targeted lithium bearing brine aquifers at its “Pocitos 1” Lithium Brine project in Salta, Argentina. (35)

The position of the next drill hole has been positioned to maximize the size of the potential resource using the previously completed TEM geophysics and drilling data. (35)

This is another planned milestone in the Company’s endeavour to build up to a 20,000-tonne lithium extraction Ekosolve™ plant at its Pocitos 1 Project in order to supply Richlink Capital Pty Ltd battery materials clients up to 20,000 tonnes of lithium chloride/carbonate per year as previously announced under letter of intent. Their clients were given an update in China on plans and progress Recharge has made. (35)

CEO and Director, David Greenway stated, ” The world needs more lithium battery materials and Pocitos 1 continues to present that it may be a significant contributor to the supply puzzle being solved by Gigafactories of lithium product. The future of the Pocitos 1 Project continues to improve and we couldn’t be more excited by these results. The recent results have achieved a consistent lithium concentration 40 ppm higher than what was previously recorded with substantial brine flow. Our next goal of establishing a NI 43-101 compliant mineral resource, a scoping study of the project and formalising our offtake agreement for lithium carbonate is getting closer.” (35)

Recharge Resources Ltd. (CSE: RR) (OTC: RECHF) Achieves Promising Results in Testing Lithium Brine Samples at Ekosolve Pilot Plant (36)

Recharge Resources Ltd. (CSE: RR) (OTC: RECHF) is making significant strides in its Pocitos Lithium Brine Project. The recent completion of rigorous brine sample testing at the Ekosolve™ pilot plant located at the University of Melbourne marks a crucial milestone in the company’s path towards a full-scale plant implementation. This achievement underscores Recharge Resources’ commitment to advancing its lithium extraction capabilities and solidifying its position in the growing lithium market.

The brine samples, extracted from the Pocitos lithium brine project in Salta, Argentina, underwent comprehensive testing at the Ekosolve™ pilot plant. This pre-engineering step aims to evaluate the performance and recovery rates of the Ekosolve™ Extraction process. By assessing the efficiency of the extraction process and recovery rates, Recharge Resources Ltd. (CSE: RR) (OTC: RECHF) gains valuable insights into the viability of scaling up the plant to handle up to 20,000 tonnes of lithium brine annually.

Currently, data processing and aggregation are underway, and the company anticipates announcing recovery rates in the coming weeks. Previous studies conducted by Ekosolve™ have indicated that the economic viability threshold lies in brine flow exceeding 35,000 megalitres per year, coupled with lithium content above 110 ppm. Recharge Resources has shown great promise in its 2022 drill campaign at Pocitos 1, with lithium assays averaging 169 ppm over a two-week period. Furthermore, exceptional brine flow rates were observed in all three drill holes, further bolstering the project’s potential. (36)

The Ekosolve™ Lithium Solvent Exchange Extraction process has proven its efficiency in handling brines and producing lithium carbonate with a grade surpassing 99.5% purity and an impressive recovery rate of 96%. These exceptional results outperform existing ion exchange or adsorption processes available in the market. The Ekosolve™ technology, licensed by the University of Melbourne to Ekosolve Limited, has the potential to revolutionize lithium extraction and position Recharge Resources as a key player in the industry. (36)

The expertise of Recharge Resources Ltd. (CSE: RR) (OTC: RECHF)’s Qualified Person (QP), Phil Thomas, adds substantial value to the project. With over two decades of experience in exploring lithium brines and a successful track record in building and operating a pilot plant at Rincon Salar (which was later sold to Rio Tinto for a remarkable US$825 million), Thomas brings extensive knowledge and insights to the team. His involvement, combined with the team’s accomplishments in exploring the Pozuelos salar (recently sold to Ganfeng for US$962 million), further enhances the prospects of the Pocitos Lithium Brine Project.

Recharge Resources Ltd. (CSE: RR) (OTC: RECHF)’s CEO, David Greenway, expressed excitement about the positive developments at the Pocitos Lithium Brine Project. The company’s progress, including the forthcoming NI 43-101 report, completed MT geophysics survey, upcoming drill program, and planned NI 43-101 resource estimate, highlights its commitment to advancing the project and creating value for its stakeholders. The recently completed MT survey has provided crucial information on the locations where conductive brines, containing lithium, are concentrated, further guiding the project’s next steps. (36)

Situated approximately 10 km from the township of Pocitos, the project benefits from convenient access to essential infrastructure such as gas, electricity, and internet services. With extensive exploration efforts, including surface sampling, trenching, TEM and MT geophysics, and the successful drilling of three DDH holes, Recharge Resources has invested over USD $2.0 million in developing the project. The outstanding brine flow results and the presence of lithium values of up to 169 ppm recorded during the drill campaigns confirm the project’s significant potential.

As Recharge Resources Ltd. (CSE: RR) (OTC: RECHF) continues to make strides in the Pocitos Lithium Brine Project, the company could be well-positioned to capitalize on the growing demand for lithium in the global market. The successful completion of brine sample testing at the Ekosolve™ pilot plant signifies a major step forward in the project’s development. (36)

Recharge Resources Ltd. (CSE: RR) (OTC: RECHF)’s commitment to utilizing innovative technologies such as the Ekosolve™ Extraction process demonstrates its dedication to maximizing efficiency and sustainability in lithium extraction. With its ability to produce lithium carbonate with exceptional purity and recovery rates, the company is poised to meet the stringent quality requirements of battery manufacturers and other lithium consumers.

The positive results from the Ekosolve™ pilot plant testing validate Recharge Resources Ltd. (CSE: RR) (OTC: RECHF)’s strategy and strengthen its position as a key player in the lithium industry. As demand for lithium continues to rise due to the growing popularity of electric vehicles and renewable energy storage solutions, the company’s focus on lithium extraction places it in a favorable position for long-term success. (36)

Recharge Resources Ltd. (CSE: RR) (OTC: RECHF)’s CEO, David Greenway, expressed his enthusiasm for the project’s advancements and the positive outlook for the Pocitos Lithium Brine Project. With ongoing activities such as the MT geophysics survey and upcoming drill program, the company remains committed to unlocking the project’s full potential. The wealth of data and insights gained from these initiatives will contribute to the forthcoming NI 43-101 resource estimate, providing investors and stakeholders with a comprehensive understanding of the project’s value. (36)

Furthermore, the expertise of the Qualified Person, Phil Thomas, brings a wealth of knowledge and experience to the table. Thomas’ track record of success in lithium exploration and production further instills confidence in Recharge Resources’ ability to deliver results and create value for its shareholders. (36)

The Pocitos Lithium Brine Project’s strategic location near the township of Pocitos and its access to essential infrastructure significantly enhance its economic viability. This proximity facilitates efficient operations and minimizes logistical challenges, ultimately benefiting the project’s cost-effectiveness and long-term sustainability.

As Recharge Resources Ltd. (CSE: RR) (OTC: RECHF) continues to make significant progress in its exploration and development efforts, investors and stakeholders eagerly await the upcoming results and milestones. The company’s commitment to sustainability, innovative extraction technologies, and the rising global demand for lithium position it for success in the evolving battery and renewable energy sectors.

Recharge Resources Ltd. (CSE: RR) (OTC: RECHF)’s successful completion of brine sample testing at the Ekosolve™ pilot plant represents a significant milestone for the Pocitos Lithium Brine Project. The positive results validate the company’s strategy and highlight its ability to meet the growing demand for high-quality lithium. With an experienced team, strategic location, and ongoing exploration activities, Recharge Resources could be well-positioned to capitalize on the increasing demand for lithium and drive long-term value for its stakeholders.

Here’s why this could be important beyond your wildest imagination…

The world is running into a severe supply-demand situation with lithium — again.

The last time this happened, some of the world’s top lithium companies exploded. (2)

- Albemarle ran from approximately $45 to roughly $137

- Lithium Americas Corp. ran from about 93 cents to roughly $10.40

- Galaxy Resources Ltd. ran from around 15 cents to nearly $2.75

Now, it’s happening all over again.

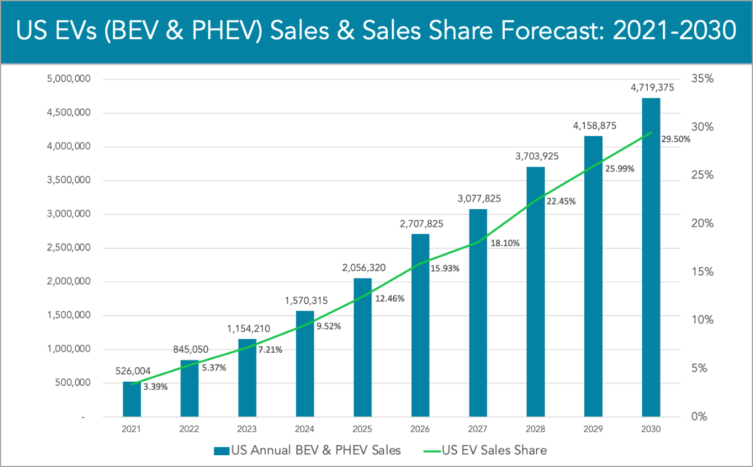

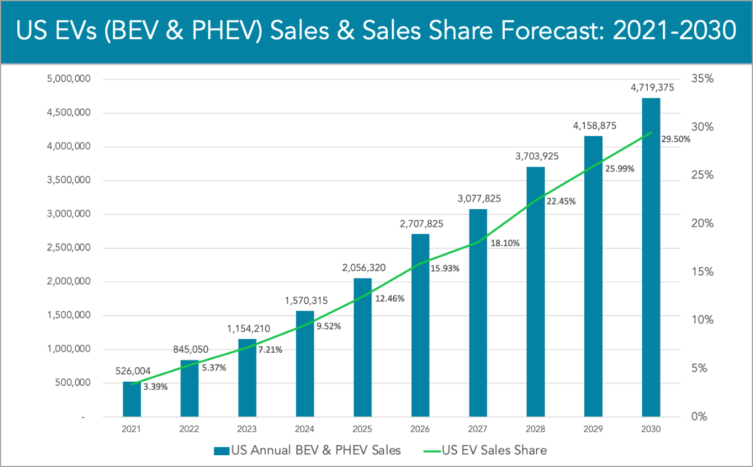

All as electric vehicle sales ramp higher faster than expected, and as governments all around the world rush to put millions of EVs on the roads. (3)

In fact, recently the U.S. signed an executive order that 50% of all vehicles must be electric by 2030.(6) By then, according to Resource World:

The world will see 125 million EVs on the road, which will only drive further demand for lithium supply.” In fact, “It is anticipated demand for vehicle battery metal will increase sharply over the next several years as automakers abandon internal combustion engines for EVs. (7)

There’s just one problem.

At the moment, there’s not enough lithium supply.

Even the International Energy Agency just warned:

The supply of critical minerals crucial for technologies such as wind turbines and electric vehicles will have to be ramped up over the next decades if the planet’s climate targets are to be met.”(7) At least 30 times as much lithium, nickel and other key minerals may be required by the electric car industry by 2040 to meet global climate targets. (7)

Plus, consider this.

The global battery metals market was valued at $11.3 billion in 2019 and is projected to reach $20.5 billion by 2027, at an 8.2% CAGR.(8)

Moreover, demand for battery metals is expected to jump 500% by 2050. (12)

On top of this, by 2038, the world is expected to buy more passenger electric vehicles than fossil fuel cars. In 2019, demand from EV batteries was 17 kt for lithium, 14.4 kt for cobalt, and 65 kt for nickel; by 2030, it is expected to jump to 185 kt for lithium, 90 kt for cobalt, and 925 kt for nickel.(9)

Yet, for that to happen, the global community will need a significant amount of lithium supply, which is where Recharge Resources Canada TSXV: (RR) U.S. OTC: (RECHF) may help. Significantly.

DIGGING DEEP

RECHARGE RESOURCES LTD.

(CSE: RR) (OTC: RECHF)

Just Who is Recharge Resources Canada

Recharge Resources is currently looking to identify, explore, and develop complementary battery metals technologies via open-source applications to improve the world and meet growing demand. Recharge Resources is uniquely positioned to acquire mining properties that produce essential battery materials to meet the increasing demand for electric vehicles. All while it has industry experts leading the way across the supply chain.

In addition, as a diversified battery metals company Recharge Resources focuses on all 3 elements of battery metals, not just one, including lithium, nickel, and cobalt.

THE RECHARGE RESOURCE ADVANTAGE

Recharge Resources is uniquely positioned to acquire mining properties to produce numerous battery metals. With high potential exploration projects in three categories of battery metals, including Lithium, Nickel and Cobalt, Recharge Resources is capitalizing on numerous opportunities to enhance the electric vehicle and battery power markets.

Lithium (Li) - Georgia Lake West & North

Lithium-ion batteries (LIBs) are an advanced battery technology that uses lithium ions as a key component of its electrochemistry. In batteries, lithium ions move from the negative electrode through an electrolyte to the positive electrode during discharge, and back when charging.

LIBs have one of the highest energy densities of any battery technology and are currently the dominant technology for electric vehicles.

Nickel (Ni) – Murray Ridge/Pinchi Lake

Nickel makes up one-third of Nickel Manganese Cobalt (NMC) cathodes and 80% of Nickel Cobalt Aluminum (NCA) cathodes. In battery power nickel helps deliver higher energy density and greater storage capacity at a lower cost. Specifically in EVs, nickel battery power provides a longer driving range for vehicles.

Gold (Au) – Brussels Creek

Gold is used in minute quantities in circuit boards for electric vehicles. Although more costly than its counterparts, in a recent discovery researchers determined that gold nanowires can be used to store electricity and create batteries that last 400 times longer than traditional lithium batteries. Gold nanowires are able to cycle through 200,000 recharges without significant corrosion or decline.

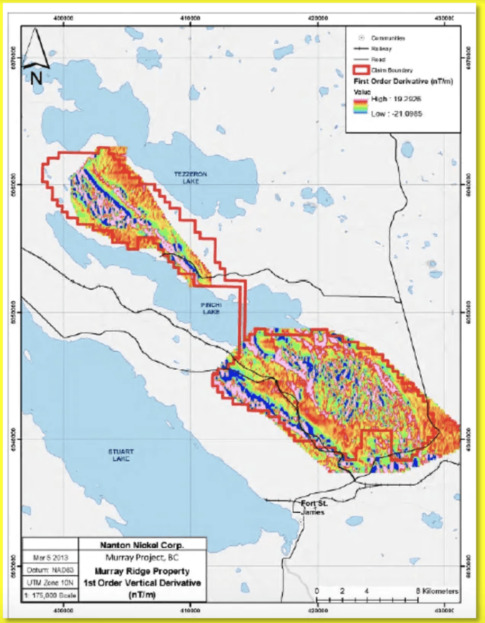

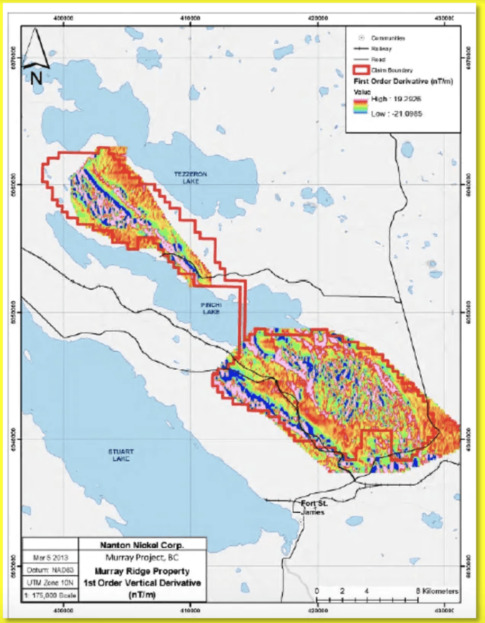

In A Potentially Game-Changing Move, Recharge Resources Expands Its Pinchi Lake Nickel Project (13)

Recently, the company announced the expansion of the Pinchi Lake Nickel Project, located approximately 15 to 30 km northwest of Fort St. James and 120 km northwest of Prince George in the Omineca Mining District of central British Columbia.

The project area has been increased to include historical work at the recommendation of the Company’s geological team, following a review of historic workings in the surrounding area.

The Pinchi Lake Nickel claims have been enlarged by 568 hectares (1,404 acres) to total size of 3,922.64 hectares (9,693.05 acres) to include areas of anomalous nickel sampling results in three separate areas, indicated from previous sampling as described in assessment reports on the BC Government Aris website.

President & CEO of Recharge, Yari Nieken, commented:

"We have multiple highly-prospective battery metals exploration projects underway, targeting lithium, nickel, copper, gold and palladium in active mining camps. Throughout 2021, Recharge has advanced multiple projects and significantly expanded its geological understanding and footprint at Pinchi Lake to cover multiple historical nickel occurrences that will be further explored throughout our Phase 2 work program at the recommendation of our geological team. The Company looks forward to an active 2022 exploration season as we continue to develop our portfolio of battery metals projects in highly prospective and mining friendly regions of North America focusing on nickel and lithium." (13)

The Potential for Drilling Success at the Following Properties Could Also Dramatically Advance Recharge Resources Canada TSXV:(RR) U.S. OTC:(RECHF): (10)

Murray Lake Nickel (11)

At its Murray Lake Nickel site, geological mapping, prospecting, and geochemical soil sampling have confirmed the occurrence of favorable geology and structure on the property. With an exploration program planned, localized serpentinization associated with ultramafic rocks has also been found.

Georgia Lake North & West Lithium(11)

Recharge Resources’ Georgia Lake North & West lithium properties, which are next to RockTech Lithium’s Georgia Lake Property, consist of two projects totaling 320 hectares and 432 hectares, respectively. The neighboring RockTech project is located 160 km northeast of Thunder Bay within the Thunder Bay Mining Division.

North East Property

Claims: 20

Hectares: 320

South West Property

Claims: 12

Hectares: 192

Lithium mineralization was discovered in 1955 and subsequently explored by several historic owners. RockTech acquired the licenses in 2009 and carried out several drill campaigns until 2017. Based on a total of 351 drill holes with a combined length of 47,384 m, a NI43-101 compliant resource estimate of 6.58 million tons in the measured and indicated category and 6.72 million tons in the inferred category were published in August 2018.(11)

A phase 1 exploration program is now being planned to test both claim blocks throughout the active 2022 season. (13)

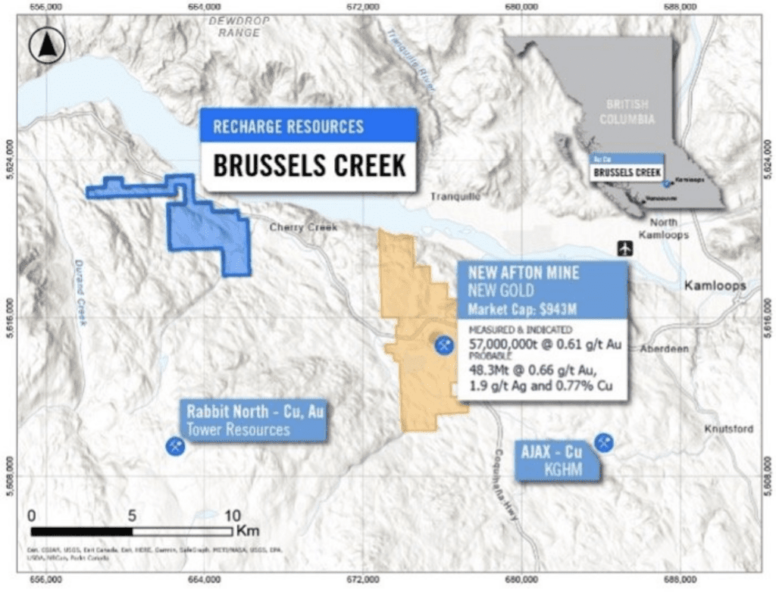

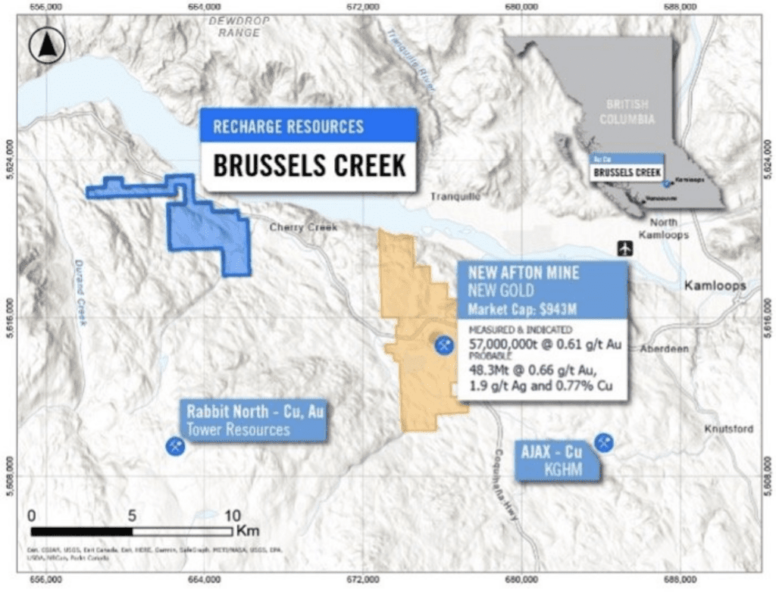

Recharge Resources Ltd. (CSE: RR) (OTC: RECHF) Unveils Major Gold Breakthrough at Brussels Creek Project (39)

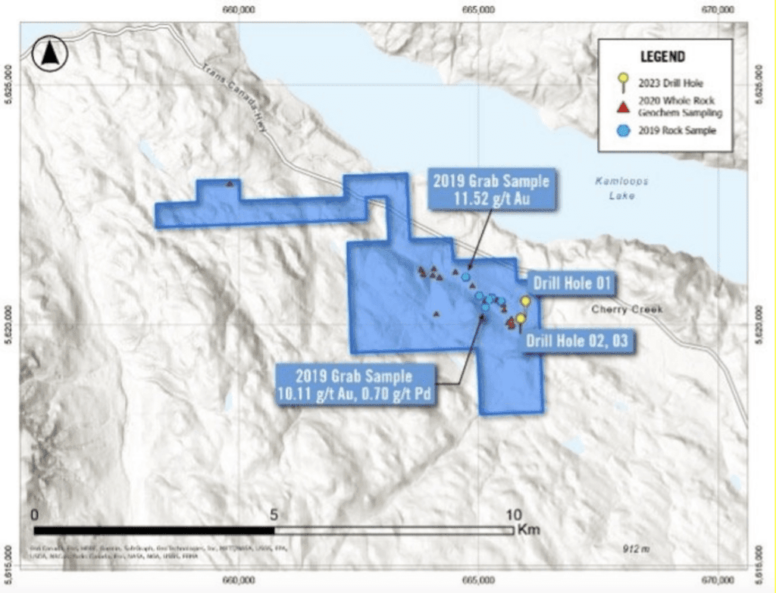

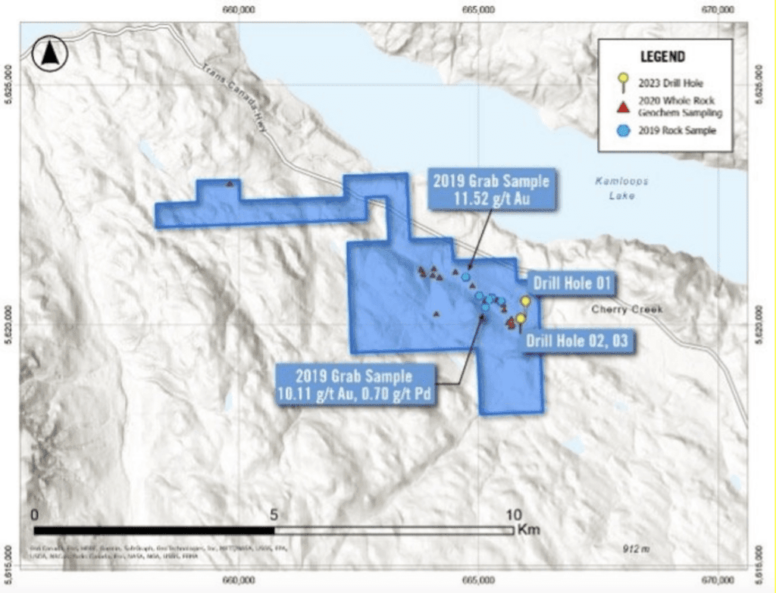

Recharge Resources Ltd. (CSE: RR) (OTC: RECHF) recently announced a significant development in its fully-funded spring drill program at the Brussels Creek Gold-Copper-Palladium Project in Kamloops, BC, Canada. The completion of assay results has revealed an exciting discovery of a new gold zone near the surface, underscoring the project’s potential for valuable mineral deposits.

Through a comprehensive 900-meter NQ drill program, Recharge Resources Ltd. (CSE: RR) (OTC: RECHF) aimed to explore the potential for copper-gold mineralization similar to that observed at the neighboring New Afton mine owned by New Gold Inc. The New Afton Mine, which commenced production in 2012, is located on the site of the historic Afton Open Pit mine. The success of the New Afton mine, characterized by substantial gold and copper production, served as inspiration for Recharge Resources’ exploration efforts. (39)

The assay results have now confirmed the presence of a new gold zone within the project area, spanning from 25.75m to 29.25m over a 3.5-meter interval. Impressively, the average grade of gold within this zone is measured at 5.08 grams per tonne. This discovery of near-surface gold mineralization highlights the significant bedrock potential within the Brussels Creek Project.

The gold zone at Brussels Creek is hosted by a quartz-feldspar porphyry intrusive associated with the Iron Mask plutonic suite. The presence of pervasive quartz sericite alteration, clay-carbonate stockworks, and minerals such as pyrite, sphalerite, chalcopyrite, and galena further confirm the mineral-rich nature of the zone. (39)

Situated approximately 24 kilometers west of Kamloops, the Brussels Creek Project covers 1,350.43 hectares and is adjacent to the prosperous New Afton mine. The geological characteristics of the project closely resemble those of successful mining operations in the region, such as Highland Valley, Mount Polly, Kemess, and Galore Creek. Historic sampling and mapping efforts have previously indicated the presence of a broad anomalous gold zone, with values of up to 3.5 grams per tonne recorded. Additional grab samples collected in 2019 further confirmed the project’s potential, returning values of 10.1 g/t Au and 11.5 g/t Au.

Recharge Resources Ltd. (CSE: RR) (OTC: RECHF) intends to focus future exploration activities on the large geophysical and geochemical anomalies surrounding the newly discovered gold zone. Simultaneously, preparations are underway for drilling at the Pocitos lithium brine project, demonstrating the company’s commitment to advancing multiple projects concurrently.

David Greenway, the CEO of Recharge Resources Ltd. (CSE: RR) (OTC: RECHF), expressed his appreciation for the progress achieved at the Brussels Creek Project. The company is eager to capitalize on this exciting discovery and is now planning further exploration in areas with high potential. The successful identification of a new gold zone marks a significant milestone for the project’s development. (39)

The strategic location of the Brussels Creek Project, combined with its geological similarities to neighboring mines, provides a solid foundation for continued exploration and potential resource expansion. Recharge Resources remains steadfast in its commitment to sustainable exploration practices, ensuring responsible and environmentally conscious operations across all its projects.

As Recharge Resources Ltd. (CSE: RR) (OTC: RECHF) progresses with its exploration efforts, stakeholders eagerly anticipate updates on the Brussels Creek Project and other ventures. The newly discovered gold zone represents a significant advancement, and the company is well-positioned to unlock further value from its diverse mineral portfolio. (39)

Recharge Resources Ltd. (CSE: RR) (OTC: RECHF) has achieved a notable milestone with the discovery of a new gold zone at the Brussels Creek Project. The identification of significant bedrock gold mineralization near the surface reinforces the project’s potential for valuable mineral deposits. With ongoing exploration and preparations for drilling at the Pocitos lithium brine project, the company is making steady progress in advancing its diverse portfolio. (39)

The Brussels Creek Project’s strategic location and geological similarities to successful mining operations in the region provide a solid foundation for continued exploration and potential resource expansion. Recharge Resources’ commitment to sustainable practices underscores its responsible approach to mineral exploration and mining.

As Recharge Resources Ltd. (CSE: RR) (OTC: RECHF) continues to advance its projects, stakeholders eagerly await further updates on the Brussels Creek Project and other initiatives. The discovery of the new gold zone opens exciting possibilities for future development and underscores the company’s potential for long-term value creation. (39)

It is crucial to note that the comparison of results from neighboring properties may not be indicative of mineralization on Recharge Resources Ltd. (CSE: RR) (OTC: RECHF)’s properties. Each project has distinct characteristics, and further exploration and evaluation are essential to fully understand their potential. (39)

Recharge Resources Canada TSXV:(RR) U.S. OTC: (RECHF) is Led by a Powerhouse Team (14)

TSXV: (RR) | OTC: (RECHF)

David Greenway - Director & CEO

With a career spanning approximately 20 years in the development of companies primarily listed on the TSX Venture Exchange, Mr. Dhillon has held a variety of positions, including investor relations, business development, senior management, and board directorships. He played a key role in the growth of U.S. Geothermal Inc., an Idaho-based company, where he served as part of the management team that transformed the company from a USD$2 million startup to a successful Independent Renewable Energy Power Producer with three new power plants in the Pacific Northwest. The company also transitioned from the TSX to the NYSE MKT during his 12-year tenure. In addition, Mr. Dhillon is a Founding Director of Torrent Gold Inc. (CSE: TGLD) and a Board Member of Lake Winn Resources Corp. (TSXV: LWR). As President & CEO of iMetal Resources, he brings an extensive worldwide list of contacts and expertise to the company.

Larry Segerstrom - Director

Mr. Greenway brings more than two decades of experience in managing, financing and developing growth strategies for various TSX Venture Exchange- and Canadian Securities Exchange-listed companies, including involvement in acquisitions, business valuations and investor relations. His key expertise lies in the management and development of junior public resource companies, especially in the mining, and oil and gas sector. He has held directorships, senior management and business development positions, including his role as the chief executive officer of Stamper Oil & Gas Corp., Veritas Pharma Inc., Chief Consolidated Gold Mines, SNS Silver Corp., Moneta Resources Inc. and Sterling Mining Company and his board position in Mountain View Conservation Centre. Mr. Greenway attended University in Bournemouth England, where he studied accounting and finance.

Natasha Sever - CFO

Mr. Segerstorm boasts more than 38 years of technical, operational, and business experience. After receiving his MSc in economic geology at the University of Arizona, Mr. Segerstrom spent a large portion of his life on porphyry copper-gold and copper-molybdenum deposits. As a bilingual engineer and geologist, his expertise lies in exploration, mine geology, and operations. With 20 years as a senior executive, Larry has led teams to several copper-gold discoveries. Larry also possesses an MBA in global management and is a qualified person under National Instrument 43-101.

Ms. Sever is a CPA designated in both Canada and Australia with a BCom from Edith Cowan University. She joins the company with more than 10 years of experience in senior finance roles over a wide range of industries, including mining, retail and technology. Ms. Sever has held officer positions at a number of publicly listed companies in both Canada and Australia and has a proven record of working in alignment with and to the benefit of the board and associated stakeholders. Her extensive experience with company financings as well as Toronto Stock Exchange and Australian Securities Exchange regulatory compliance will serve to ensure the company manages its affairs in a transparent and proper fashion.

Andrew Mugridge - Director

Mr. Mugridge has extensive experience consulting public traded resources exploration companies since entering the industry in 2006. Beyond serving in several officer, director, and senior management positions with TSX and TSX-Venture listed companies, Andrew ran a successful investor relations firm (2006-2014) and is currently a principle of a financial advisory firm in Vancouver, British Columbia.

Sources

- Source 1: https://www.reuters.com/business/energy/shortages-flagged-ev-materials-lithium-cobalt-2021-07-01/

- Source 2: https://stockcharts.com/h-sc/ui?s=alb

- Source 3: https://www.bloomberg.com/news/articles/2021-06-22/shift-to-electric-cars-coming-faster-than-expected-study-shows

- Source 4: https://www.cnbc.com/2021/05/05/electric-vehicles-renewables-will-need-rise-in-mineral-supply-iea.html

- Source 5: https://recharge-resources.com/projects/georgia-lake-west-north/

- Source 6: https://www.theverge.com/2021/8/5/22610501/biden-2030-ev-goal-trump-emissions-rollback

- Source 7: https://www.marketwatch.com/press-release/electric-vehicle-demand-already-creating-substantial-lithium-supply-issue-2021-06-02-91972749

- Source 8: https://www.alliedmarketresearch.com/press-release/battery-metals-market.html

- Source 9: https://recharge-resources.com

- Source 10: https://www.barchart.com/stocks/quotes/RR.VN/overview

- Source 11: https://recharge-resources.com/projects/

- Source 12: https://www.worldbank.org/en/news/press-release/2020/05/11/mineral-production-to-soar-as-demand-for-clean-energy-increases

- Source 13: https://finance.yahoo.com/news/recharge-resources-expands-pinchi-lake-130000117.html

- Source 14: https://recharge-resources.com/corporate/

- Source 15: https://www.benchmarkminerals.com/lithium-prices

- Source 16: https://www.ft.com/content/4a156181-00fb-4e6b-82d1-90ea5a044bcf

- Source 17: https://www.barchart.com/stocks/quotes/RECHF/price-history/historical?orderBy=tradeTime&orderDir=desc

- Source 18: https://www.barchart.com/stocks/quotes/RR.CN/price-history/historical

- Source 19: https://schrts.co/PGcUkaGD

- Source 20: https://schrts.co/BJJNSxRp

- Source 21: https://techcrunch.com/2022/12/27/an-ev-plosion-awaits-in-2023-and-itll-be-packed-with-tech/

- Source 22:https://www.ford.com/cmslibs/content/dam/vdm_ford/live/en_us/ford/nameplate/mache/2023/collections/3_2/EAxBaker22053_fade_16_7.jpg/_jcr_content/renditions/cq5dam.web.1440.1440.jpeg

- Source 23: https://evadoption.com/wp-content/uploads/2021/05/US-EVs-BEV-PHEV-Sales-Sales-Share-Forecast-2021-2030.png

- Source 24: https://www.innovationnewsnetwork.com/battery-metals-mines-and-opportunities-for-canada/27599/

- Source 25: https://www.zdnet.com/a/img/2017/08/17/c456ed8f-9165-4dd0-a149-2340d7608f92/elon-musk-tesla.jpg

- Source 26: https://finance.yahoo.com/news/recharge-receives-dataset-reports-airborne-080100480.html

- Source 27: https://miningir.com/wp-content/uploads/2022/12/Recharge-Prospectair.png

- Source 28: https://www.electrive.com/wp-content/uploads/2022/10/mercedes-rock-tech-min.png

- Source 29: https://finance.yahoo.com/news/paradigm-drillers-mobilizing-brussels-creek-080100272.html

- Source 30: https://recharge-resources.com/docs/RechargeResources-PRESENTATION-October2022.pdf

- Source 31: https://finance.yahoo.com/news/recharge-resources-intercepts-first-lithium-080100873.html

- Source 32: https://ml.globenewswire.com/Resource/Download/25bc69fb-c766-4f67-a0a9-7b75011a3b6c

- Source 33: https://ml.globenewswire.com/Resource/Download/606273c8-c26f-4a67-b53b-545e3fcc25ed

- Source 34: https://schrts.co/bNqakixJ (RECHF) chart

- Source 35: https://intelaresearch.com/wp-content/uploads/2022/11/RR-Intela-Report-Final-2022-10-30.pdf

- Source 36: https://finance.yahoo.com/news/recharge-resources-lithium-brine-sample-070513616.html

- Source 37: https://thenewswire.com/data/tnw/clients/img/e9861de2c0f6d524ba5f5536868b856b.png

- Source 38: https://thenewswire.com/data/tnw/clients/img/f00a18767276b57136bb8d9441c16f3f.png

- Source 39: https://finance.yahoo.com/news/recharge-makes-gold-discovery-brussels-070632643.html

- Source 40: https://investingnews.com/media-library/gold-nuggets-on-dark-ground.jpg?id=32309282&width=1200&height=800&quality=85&coordinates=0%2C0%2C0%2C0

- Source 41: https://finance.yahoo.com/news/recharge-resources-lithium-brine-sample-070513616.html

- Source 42: https://finance.yahoo.com/quote/RECHF/

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media LLC and Lifewater Media, Virtus Media LLC has been hired by Lifewater Media LLC for a period beginning on 06/26/2023 and ending 06/27/2023 to publicly disseminate information about OTC: RECHF via digital communications. We have been paid seven thousand five hundred dollars USD.