NASDAQ: SPRC

This Innovative Biotech May Have a 3.5x Upside

Meet SciSparc Ltd. the biotech disruptor with potential pipeline revenues of about

$490,926,545. (NASDAQ:SPRC)

Build your watchlist with us

Get the latest stock ideas direct to your inbox. 100% free and your information stays with us.

A Fresh Take On Medical Cannabis

Cannabis buds are covered in sticky, shining dots of resin, and in this resin are hundreds of therapeutic compounds that contribute to the effects and benefits of cannabis.

In those compounds lies the secret to incredible potential.

Those hidden compounds the plant produces work together to create unique effects and benefits known as “the entourage effect.”

They can produce a synergy in the body to reduce inflammation and allow other drugs to do their jobs.

THAT is a MASSIVE differentiator which makes SciSparc Ltd. (NASDAQ: SPRC) so unique and so compelling

Top 5 Reasons to Get SciSparc Ltd. (NASDAQ: SPRC) to Your Radar Right Now

1. Leveraging the “entourage effect” the company has three powerhouse cannabis-based drugs in late development to help treat Tourette Syndrome (TS), Obstructive Sleep Apnea (OSA), and Autism Spectrum Disorder (ASD).

2. SciSparc Ltd. (NASDAQ: SPRC) already has a fully approved commercial product CannAmide, approved by Health Canada.

3. Early Phase 2a studies on SciSparc’s SCI 110 is showing real progress on treating obstructive sleep apnea and appears it could rapidly make it to Phase 3. SCI 110 is also proving to be effective for Tourette Syndrome, Alzheimer’s Disease, and Agitation.

4. Aegis Capital Corp. Issued a Buy Rating Looking for a 3.5x Upside Potential

5. The company also has two more therapies in the pipeline SCI-160 for Pain and SCI-210 for Autism.

SciSparc Ltd. (NASDAQ: SPRC): CannAmide™ a Fully Approved Commercial

Product Approved by Health Canada

CannAmide™ is recommended for use as an anti-inflammatory to help relieve chronic pain while the tablets will be marketed to pharmacies and other retail outlets across Canada.

This is incredible news as until now, opioids are pretty much the only option for many people.

But we all know the devastating effects opioid abuse is wreaking on the world.

Overdose deaths amongst celebrities have been going on for years. With the recent opioid epidemic this country is facing, we are seeing more and more celebrities, and people in general, die as a result of op-i-ate addiction. Some celebrities that have recently died as a result of opioid abuse/addiction include:

● Prince

● Philip Seymour Hoffman

● Tom Petty

● Heath Ledger

CannAmide Provides a Safer, Non-Addictive Treatment Option

Adi Zuloff-Shani, PhD. the Company's Chief Technology Officer, commented, "The onset of commercial production is a big step on the path to commercializing our first pharmaceutical drug product.

CannAmide represents a significant opportunity in the chronic pain sector, where opioids remain the mainstay treatment.

Despite the increase in related addiction, overdose and death, opioids continue to generate nearly $20 billion in revenue annually.

Our formulation relies on naturally occurring PEA, and therefore has no known serious side effects or drug interactions, making it what we believe to be a safe treatment option."

SciSparc Ltd. (NASADQ: SPRC): SCI-110 is Very Close to Tapping into the $7.1

Billion Sleep Apnea Market

It is estimated that 22 million Americans suffer from sleep apnea, with 80 percent of the cases of moderate and severe obstructive sleep apnea undiagnosed.

Several studies have shown an association between sleep apnea and problems like type 2 diabetes, strokes, heart attacks and even a shortened lifespan.

Currently in Phase 2a SciSparc’s SCI 110 is looking to completely disrupt the sleep apnea devices market, currently valued at USD $7.1 billion, and projected to reach USD 9.9 billion by 2026.

Early Results are VERY Encouraging

Program Highlights19

● Of the 10 patients recruited into the study, nine patients have completed the study and one has dropped out of the study due to a treatment associated adverse event (dizziness).

● Among the remaining nine patients, 55% demonstrated significant improvement in Apnea Hypopnea Index (AHI) values marking a reduction of around 54%.

● Two patients reported mild side effects which were resolved when the dosages of T-H-C were reduced to 5 mg/day.

● In general, SCI 110 therapy was well tolerated and has exhibited no serious adverse events.

The company is closer than ever to treating what could be considered an actual plague, and if anything, the most silent of killers.

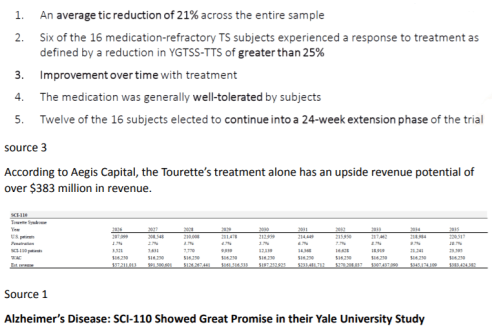

SciSparc Ltd. (NASDAQ: SPRC): SCI-110 is Also Showing Tremendous Promise in Treating Tourette Syndrome, Alzheimer’s Disease and Agitation

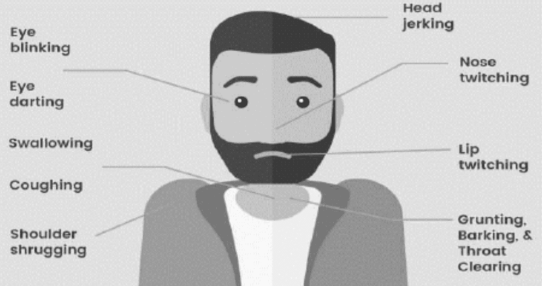

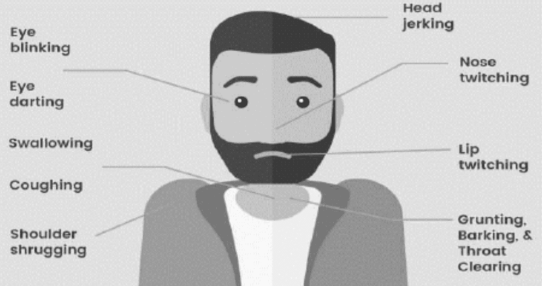

The global Tourette syndrome market is expanding at a rapid pace due to the consistent efforts of several organizations to increase awareness regarding the disease among patients.

The major factor driving the growth of the market is the increasing cases of Tourette syndrome all across the world. As per the data of the CDC study, 1 of every 360 (0.3%) children 6-17 years of age in the US have received a diagnosis of TS, which is about 138,000 children.

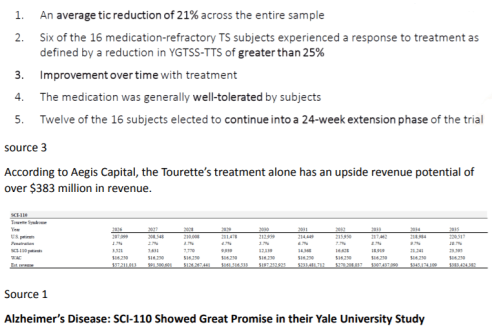

Tourette Syndrome: SCI-110 Showed Great Promise in their Yale University Study

Get the latest stock ideas direct to your inbox.

100% free and your information stays with us.

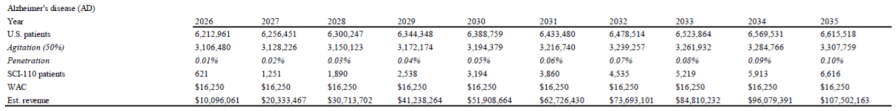

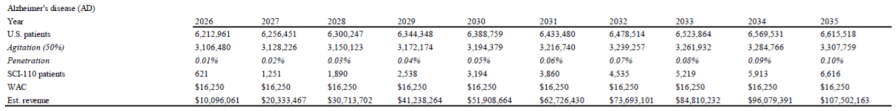

Alzheimer’s disease is a brain disorder that slowly destroys memory and thinking skills, and, eventually, the ability to carry out the simplest tasks. In most people with Alzheimer’s, symptoms first appear later in life. Estimates vary, but experts suggest that more than 6 million Americans, most of them age 65 or older.

This disease is complex, and it is therefore unlikely that any one drug or other intervention will ever successfully treat it in all people living with the disease. Still, in recent years, scientists have made tremendous progress in better understanding Alzheimer’s and in developing and testing new treatments, including several medications that are in late-stage clinical trials.

As of the writing of this report, SCI-110 is in Phase 2a trials for Alzheimer’s Disease. If successful, the outlook from a revenue standpoint is incredible. We’re talking about a potential of $107

million in annual revenue.

SciSparc Ltd. (NASDAQ: SPRC): The Pipeline also Includes Potential Therapies for

Pain and Autism

Autism spectrum disorder (ASD) is a developmental disability that can cause significant social, communication and behavioral challenges. There is currently no cure for ASD. However, research shows that early intervention treatment services can improve a child’s development.

In 2021, the CDC reported that approximately 1 in 44 children in the U.S. is diagnosed with an autism spectrum disorder (ASD), according to 2018 data.

● in 27 boys identified with autism

● 1 in 116 girls identified with autism

In 2021, SciSparc entered an agreement with The Sheba Fund for Health Services and Research to perform a preclinical study for SCI-210. They also announced positive topline results in a controlled preclinical trial on neuropathic and post-operative pain for SCI-160.

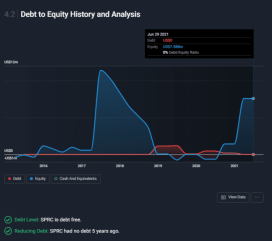

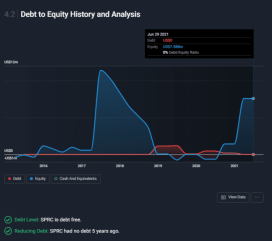

SciSparc Ltd. (NASDAQ: SPRC) Has Solid Financials with No Debt

The company's current liabilities make up less than 10% of their total assets of $8.3 million.

Fiscally they appear stellar with no debt on the books.

According to Simply Wall Street, the company offers a good value based on price to book of 1.9x vs the US Biotech Industry of 2.5x as a whole.

Top 5 Reasons To Get SciSparc Ltd. (NASDAQ: SPRC) To Your Radar Right Now

1. Leveraging the “entourage effect” the company has three powerhouse cannabis based drugs in late development to help treat Tourette Syndrome (TS), Obstructive Sleep Apnea (OSA), and Autism Spectrum Disorder (ASD).

2. SciSparc Ltd. (NASDAQ: SPRC) already has a fully approved commercial product CannAmide, approved by Health Canada.

3. Early Phase 2a studies on SciSparc’s SCI 110 is showing real progress on treating obstructive sleep apnea and appears it could rapidly make it to Stage 3. SCI 110 is also

proving to be effective for Tourette Syndrome, Alzheimer’s Disease, and Agitation.

4. Aegis Capital Corp. Issued a Buy Rating Looking for a 3.5x Upside Potential.

5. The company also has two more therapies in the pipeline SCI-160 for Pain and SCI-210

for Autism.

Disclaimer

Stock Research Today is a project of Dadmin Capital LLC and intended solely for entertainment and informational purposes. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/. This website / media webpage is owned, operated and edited by Dadmin Capital LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Dadmin Capital” refers to Dadmin Capital LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and promote small public companies. By reading our website / media webpage you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our website / media webpage .We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website / media webpage are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. Dadmin Capital business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Dadmin Capital. often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Compensation – Pursuant to an agreement between Dadmin Capital LLC and TD Media LLC, Dadmin Capital LLC has been hired for a period beginning on 1/4/22 and ending after 3 business days to publicly disseminate information about (NASDAQ: SPRC) via digital communications. We have been paid eleven thousand five hundred USD via ACH Bank Transfer.