Insiders Are Amassing Shares Of This Underappreciated Medical Technology Stock And This Is Why

Among the reasons: Taglich Brothers' analyst John Nobile says there could be an upside of approximately 265% for BioSig Technologies, Inc. (NASDAQ: BSGM)

BioSig Technologies' Innovation Is Changing The Landscape For Electrophysiology

And INSIDERS Portfolios

Major tech companies are aggressively moving into the medical device market. Amazon, Meta Platforms, Apple, Alphabet…. All want a piece of a market that could be worth about $658 billion by 2028 (Source 2) – which could be a massive catalyst for medical device stocks like BioSig Technologies Inc. (NASDAQ: BSGM).

Insiders are taking full advantage of this potential and positioning themselves to harvest massive profits into the anticipated sector boom.

LATEST NEWS

New Data at Heart Rhythm 2023 Suggests that Unipolar Signals May be Used for a More Precise, Accurate Approach to Treating Arrhythmias

6 Major Factors Behind Why BioSig Technologies, Inc. (NASDAQ: BSGM) Could Witness Unstoppable Growth Within the Next 12 Months...

IDENTIFYING THE OPPORTUNITY

Cup and Handle setup ready to blast!

This low-to-moderate float breakout could be a 900% goldmine

TRADE CONFIRMATION

The last 5 times the RSI slipped below 35 and subsequently pushed back above 35 on the daily timeframe have triggered strong bullish movement, and at this time we are preparing to push back over the 35 RSI. Volume uptick late February, and daily volume over 500k should foreshadow a strong impulse break. The same setup holds true for us this time around.

TARGETS

$1.75 (+19.86%)

$2.19 (+50.00%)

$2.69 (+84.25%)

$4.00 (+173.97%)

CURRENT EVENTS

BioSig Technologies, Inc. (NASDAQ: BSGM) has passed several recent milestones which have caught the eye of many investors

CONSIDER THIS

With medicine and healthcare having more of a grip on our everyday lives than ever before, interest and demand have skyrocketed in every aspect of the healthcare industry- especially the potential $658 Billion global medical device market.

In fact, it has unequivocally sent massive shockwaves throughout the world.

So much so that corporate juggernauts like Amazon.com, Facebook, Alphabet Inc., and Apple Inc. are all trying to get involved with medical devices.

Even better – a sub-sector of that booming medical device market is really gaining big momentum – cardio-focused medical devices.

And we’ve seen stocks with that niche focus pop considerably.

Edwards Lifesciences Corporation, for example, ran about 52% from its Oct 30, 2020 low of $70.92 to its March 23, 2022 close of $108.54.

Abiomed rallied about 31% from its Oct 30, 2020 low of $242.73 to its $317.45 close on March 24, 2022.

All saw a substantial run

Another one to consider is BioSig Technologies Inc. (NASDAQ: BSGM), an underrated, under-the-radar, and potentially undervalued play that could very well follow in those stocks’ footsteps and with even more room to run.

Especially if it can revolutionize the way we treat heart problems – especially arrhythmias.

BioSig Is The Solution To A Deadly Problem

"One in 18 Americans suffers from a cardiac arrhythmia. Atrial fibrillation is the most common arrhythmia type, affecting over 33 million people worldwide, including over 6 million in the U.S.

The number of people suffering from atrial fibrillation is expected to reach 8-12 million by 20501.

According to the Centers for Disease Control and Prevention (CDC), atrial fibrillation causes more than 750,000 hospitalizations in the U.S. each year, resulting in approximately $6 billion in healthcare spending annually"

“Two of the most prevalent, complex and potentially deadly types of arrhythmias today are Atrial Fibrillation (AF) and Ventricular Tachycardia (VT).

Ventricular arrhythmias account for approximately 300,000 sudden deaths per year in the United States alone. Catheter ablation is fast becoming a first line therapy, driving demand for improved technologies. AF is the most common arrhythmia affecting 33.5 million people worldwide, with as many as 6.1 million people in the U.S. now and expected 8-12 million by 2050.

AF increases the risk of stroke 4x to 5x and contributes to ~750,000 hospitalizations per year. The direct cost of AF is approximately $6B annually; adding other indirect costs brings AF total cost to $26B.”

“The electrograms used today can be riddled with noise and artifacts coming from other equipment found in the operating room.

Such a procedure can take up to six hours, potentially yielding what is referred to in the industry as a ‘dirty signal’ that’s indiscernible to interpret by many electrophysiologists.”

THE PROBLEM

According to the American Heart Association, arrhythmias occur when the heart’s electrical system malfunctions and causes the heart to beat too fast, too slow, or erratically.

While figures vary, it is probably way more common and a much larger market than you realize. For one, Dr. Juan Viles-Gonzalez, M.D., an electrophysiologist with Baptist Health’s Miami Cardiac & Vascular Institute, estimates over 60 million Americans suffer from it.

THE SOLUTION

The PURE EP™ System applies a unique combination of hardware and software to accurately capture intracardiac signals with unprecedented clarity and precision. By viewing pure signals that are absent of saturation, interference, or noise from other medical equipment, physicians can respond to even the most complex cardiac arrhythmias with insight-based, highly targeted cardiac ablation procedures.

With that technology, BioSig has an enormous opportunity at hand in a Global Medical Devices Market that’s projected to reach $625.3 Billion by 2027 at a 6.3% CAGR. It could also very well be operating within the rapidly emerging field of bioelectronic medicine, estimated at $25.11 billion in 2020 with projected annual growth of 10.27%

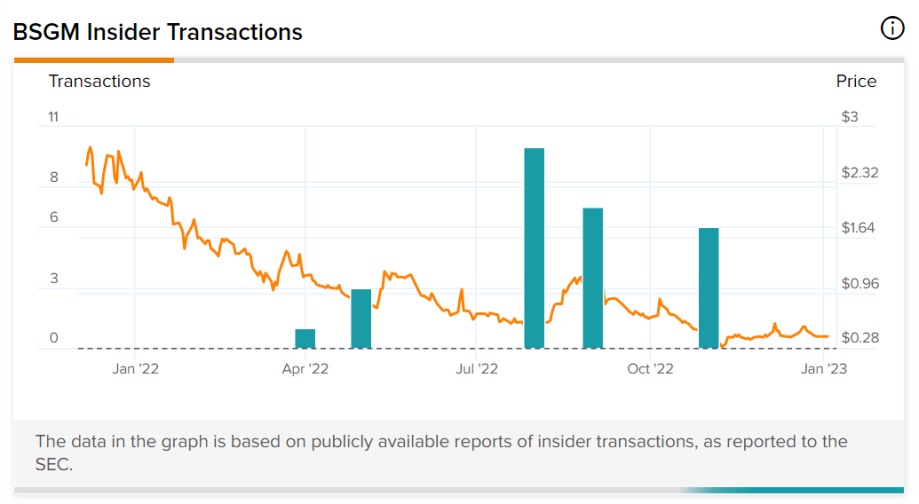

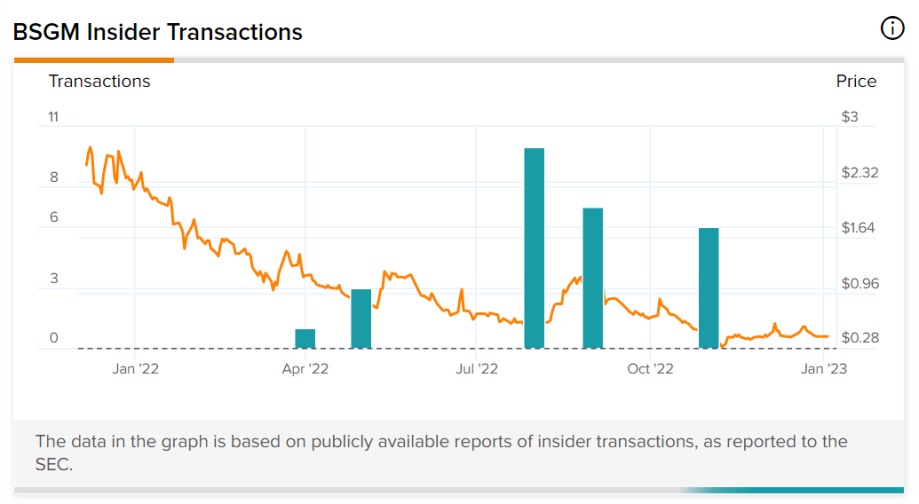

WHAT INSIDERS ARE DOING

According to SEC Filings... Insiders of BioSig Technologies (NASDAQ: BSGM) have been acquiring shares at much higher prices...

Most of the time, it is important to pay attention to insider buying because company leaders often have a very good idea of whether the company’s stock could go up or down.

If company insiders invest in the company, it could be seen as a good sign that the company is headed in the right direction.

As you can see from the chart above, the CEO, CFO, and COO of BioSig Technologies have been acquiring shares at prices much higher than the recent (BSGM) opening price of $.42 seen on 1/4/23 according to Barchart.com

Insiders must file SEC forms every time they buy or sell shares in order to prevent insider trading or to show that they are in some way not illegally benefiting from the information that they have privy to based on their management position.

In addition, they cannot sell their shares within six months of their purchase, which means they cannot benefit from swing trades.

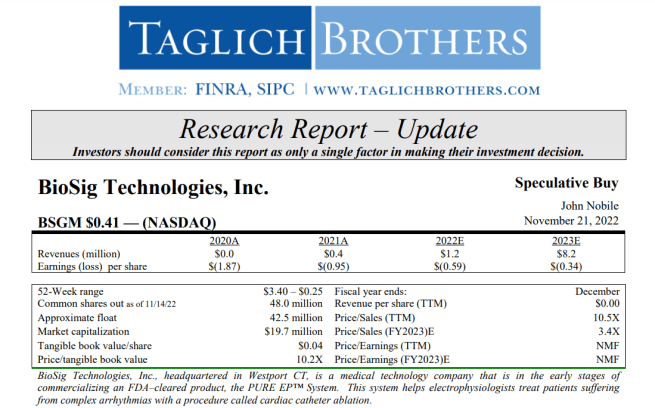

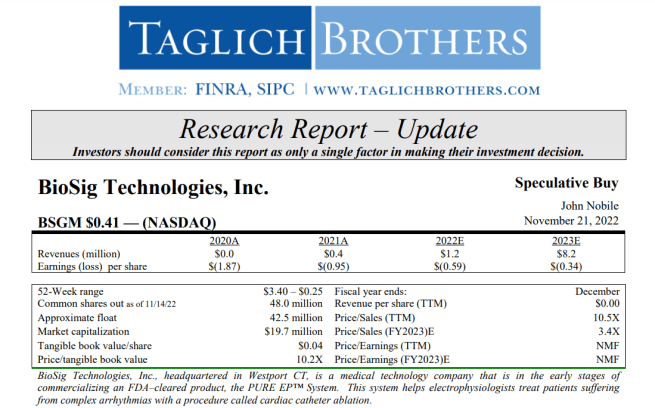

WHAT ANALYSTS ARE SAYING

Taglich Brothers analyst John Nobile says there could be a 265% potential upside for BioSig Technologies, Inc. (NASDAQ: BSGM)

Taglich Brothers is maintaining coverage on BioSig Technologies, Inc. with a target of $1.50.

BSGM’s PURE EP System is a signal processing platform that enables electrophysiologists to see more cardiac signals and analyze them in real-time. The device aims to minimize noise from cardiac recordings thereby improving the fidelity of acquired cardiac signals.

To the extent that BSGM’s PURE EP System improves the accuracy and efficiency of cardiac catheter ablation procedures, it reduces hospital operating costs. While the global pandemic adversely impacted the business with patients deferring ablation procedures during the pandemic, the industry is now seeing pent-up demand for these procedures.

In August 2022, BSGM announced it was seeing an increase in medical centers entering into 60-day evaluation agreements.

With BSGM’s existing customers seeing positive results from the PURE EP System and a recent expansion of the company’s sales and marketing teams, we expect to see an increase in the adoption of these systems in medical centers in the near future.

For 2022, Taglich projects total revenue of $1.2 million and a net loss of $.59 per share.

For 2023, Taglich projects total revenue of $8.2 million and the net loss narrowing to $.34 per share. The growth in revenue should be driven by the increasing adoption of the company’s PURE EP System in medical centers.

WHO ARE THE INSIDERS?

Kenneth L. Londoner, MBA

Founder, Chief Executive Officer, Chairman, and Director

Mr. Londoner is a capital markets and capital architecture expert and a senior life science executive. Having started his career as a research analyst for J. & W. Seligman & Co., Inc., a leading institutional money management firm in New York City, NY, he quickly found himself at the forefront of the biotech industry in the early 1990s, leading him to manage $3.5 billion in mutual and pension funds and international assets.

His passion for medical innovation led him to co-found, govern and bring to the public market a number of life science companies, including BioSig Technologies, Inc. [Nasdaq:BSGM]. Working in close collaboration with key opinion leaders in electrophysiology, BioSig aims to improve the outcomes of cardiac ablations for the treatment of arrhythmias through novel technological solutions developed by the company, and further apply its core competency in advanced biomedical signal processing and analysis to other areas of medicine.

His prior experience in recognizing the early potential of biotech led Londoner to form the Alliance for Advancing Bioelectronic Medicine, an independent non-profit network of professionals dedicated to innovation at the intersection of healthcare and technology. The Alliance aims to increase awareness of bioelectronic medicine and build a platform for collaboration among stakeholders. Over the last decade, Londoner formed top level relationships with a number of medical centers of excellence such as Mayo Clinic, NYU Langone Hospital and UCLA, as well as other stakeholders, including investment communities, intellectual property experts and supply chain partners.

Steve Buhaly

Chief Financial Officer

Mr. Buhaly has over 15 years of CFO experience at three public U.S. companies. In 2007, he served as CFO to TriQuint Semiconductor who merged with RF Micro Devices, Inc. in a $4 billion merger agreement to form Qorvo in 2015. A world leader in innovative RF and power technologies, Qorvo grew into an $11 billion market capitalization during Mr. Buhlay’s tenure. Prior to TriQuint, Mr. Buhaly served as CFO of Longview Fibre where he played a key role in executing the $2.3 billion sale of the company. Earlier in his career, he held both chief operating officer and chief financial officer roles with electronic display company, Planar Systems.

Throughout his career, Mr. Buhaly has developed a strong cross-functional background in corporate finance, accounting, tax, IT, law, and investor relations. Having co-led strategic transactions resulting in over $2 billion in M&A transactions, he has helped companies raise $1 billion in the debt markets and was recognized for his leadership during TriQuint's massive growth trajectory. Since 2018, Mr. Buhaly has served as an advisor to multiple early-stage and small businesses and currently consults for cancer treatment innovator, UbiVac.

Mr. Buhaly holds an MBA from the University of Washington.

Gray Fleming

Chief Commercial Officer

Mr. Fleming brings to the Company over 20 years in the healthcare industry, including 17 years at Abbott Laboratories and St. Jude Medical. During his tenure with Abbott, Mr. Fleming held several commercial leadership positions, including Vice President of Cardiac Sales, when he led sales and customer relationship management activities in some of the most significant strategic areas of focus.

Mr. Fleming’s experience in delivering high-performing sales management initiatives led to substantial revenue growth with several key accomplishments, including the successful contracting of multiple leading IDN and GPO organizations. These initiatives resulted in some of the largest market share gains in the company’s history while also delivering substantial overhauls of historically underperforming regions throughout the Central Time Zone. Most recently, Mr. Fleming held the position of Chief Commercial Officer at Carecubes, a company created to provide a temporary and scalable negative pressure isolation technology solution based upon original joint request from the Defense Advanced Research Projects Agency (DARPA) and Centers for Disease Control and Prevention (CDC).

Mr. Fleming holds a Bachelor of Business Administration degree with a Major in Marketing from Stephen F. Austin State University in Texas and a certificate in Leadership in Excellence and Development (LEAD) Program from the University of Texas.

John Sieckhaus

Chief Operating Officer

Mr. Sieckhaus brings to the Company 30 years in the healthcare industry, including 21 years at St. Jude Medical and Abbott Laboratories [NYSE: ABT]. During his tenure with St. Jude Medical, Mr. Sieckhaus held commercial leadership positions of rising responsibility, including U.S. National Sales Leader, Senior Vice President & General Manager when he led sales and customer relationship management activities in the United States across all cardiovascular product lines.

Mr. Sieckhaus's experience in building and leading high-performance teams, in addition to integrating multiple new and novel technologies and introducing them commercially, led to significant revenue growth for St. Jude Medical over his career. Most recently, Mr. Sieckhaus held the position of Vice President – Field Clinical Affairs for Abbott for the United States and CALA, where he created a world-class field clinical and monitoring team to support clinical trials across multiple business units within Abbott's Cardiovascular portfolio.

Mr. Sieckhaus holds a Bachelor of Science degree in Biomedical Engineering from Johns Hopkins University.

Brenda Castrodad

Vice President, Human Resources

A seasoned executive, Ms. Castrodad brings a wealth of experience in leading organizational development in start-ups and Fortune 500 companies within the life sciences sector. Most recently, Ms. Castrodad led the HR department at TissueTech, Inc., a Miami, FL-based biotech leader in regenerative amniotic tissue-based products, where she was responsible for transformation and automation of the company’s HR practices, talent planning, and team building.

Prior to TissueTech, Inc., Ms. Castrodad spent six years at HeartWare, Inc., a heart failure medtech company acquired by Medtronic [NYSE:MDT] in 2016 for $1.1 billion. By optimizing the internal talent acquisition function and aligning business practices, Ms. Castrodad helped grow the organization from approx. 80 to 500+ staff which achieved approx. $250 million in revenues before the acquisition. Earlier in her career, Ms. Castrodad spent 16 years at Schering-Plough Corp, a pharmaceutical company acquired in 2009 for $41.1 billion by Merck & Co. [NYSE:MRK].

Ms. Castrodad holds a Master’s Degree in Public Administration and a Bachelor’s Degree in Social Sciences – Human Welfare from the University of Puerto Rico and a Labor Relations Certificate from the University of Michigan.

Andrew Ballou

Vice President, Investor Relations

Mr. Ballou brings to BioSig over 25 years of experience in capital markets, including institutional equity sales and research analysis. Most recently, Mr. Ballou served as Managing Director, Head of Institutional Equity Sales at Janney Montgomery Scott LLC., a role in which he oversaw key accounts, including large multi-manager hedge funds, mutual funds and dedicated sector funds.

Prior to that role Mr. Ballou managed selected key account coverage at RBC Capital Markets, including Millennium Partners, Soros Fund Management, SIR Capital, Columbia Threadneedle, Two Sigma Investments and Times Square Capital Management. During the course of his career Mr. Ballou analyzed various private and public companies in healthcare, media and retail sectors.

Mr. Ballou graduated from Hampden-Sydney College, Virginia, with a Bachelor of Arts in English.

Katie Freshwater

Vice President, Marketing

Ms. Freshwater brings over 20 years of sales and marketing experience in healthcare and technology, including senior positions at several leading medtech companies such as Cardinal Health, Medtronic, and Kimberly-Clark Healthcare. During her tenure at Cardinal Health, Ms. Freshwater served as Senior Director of Digital Marketing, e-Commerce, and Brand where she oversaw the development of marketing tech strategy and a team of 20+ digital marketers, content creators, and paid media strategists. More recently, Ms. Freshwater founded FRESH20 Consulting, where she has served as Senior Consultant providing independent marketing services and modern sales solutions for businesses ranging from early state startup-ups to large corporations.

At BioSig, Ms. Freshwater will work directly with all facets of the company on development, implementation, and management of the Company’s strategic and tactical marketing activities. She is responsible for developing and delivering a fully integrated marketing strategy, to include MarTech and MarCom functions. In addition, Mrs. Freshwater will support the Company’s brand visibility across print and digital media through best-in-class tailored approaches that drive sustainable growth for the business.

Ms. Freshwater holds a bachelor’s degree in business administration from the University of Denver and an MBA from Baylor University.

Zachary Koch, CCDS, CEPS

Clinical Director

Zachary Koch brings over 20 years of experience in clinical strategy and sales in electrophysiology and cardiovascular devices. Mr. Koch joins BioSig’s leadership following a 16-year tenure at Abbott and St. Jude Medical, where he held numerous positions across the company’s clinical, sales, training, and commercial teams. Mr. Koch has personally supported over 5000 cardiac mapping procedures, and has created and lead several advanced training and education initiatives for St Jude Medical and Abbott EP.

More recently, within his role as Manager of Strategic EP Clinical Development, Mr. Koch successfully founded and launched the Key Accounts Organization for Abbott EP and led the business and clinical strategy across nine National Key Accounts. These efforts generated a 20% increase in EP case volume and revenue for the company. He also founded the AAA advanced training program that led to a significant improvement of clinical support with the Key Accounts Organization. He has been recognized for his sales and business delivery as a three-time recipient of Abbott’s Field Service Award, an honor bestowed upon the top clinical specialists in the US sales division. He is also a certified electrophysiology and cardiac device specialist, a distinguished honor apportioned by the International Board of Heart Rhythm Examiners.

Mr. Koch served as a Hospital Corpsman in the United States Navy. He provided infantry medical support for the Second Marine Division and the Executive Medical Team at the National Naval Medical Center in Washington DC. He holds a degree in Cardiovascular Technology from the Naval School of Health Sciences, where he graduated with honors and distinction.

To Sum It Up...

Stocks like BioSig Technologies (NASDAQ: BSGM) do not come around often.

To be in the $1.32 cent (as of 2/9/23 according to Barchart.com), with exposure to surging in-demand industries, along with validation from some of the most respected medical facilities in the world, is generationally mouth-watering.

We discussed some other stocks in the medical device industries that have had strong years. BioSig truly has all the ingredients necessary to potentially follow suit, and, shockingly, there’s an opportunity at hand to monitor this stock at such a potential discount.

It has a potentially revolutionary product that could change the course of how we treat arrhythmias.

With Amazon, Facebook, and Google all wanting a piece of the medical device market, pay close attention to this under-the-radar disruptor.

If potential catalysts kick in, it could truly become one of the wildest ground-floor breakouts we’ve ever seen.

Sources

- Source 1: https://www.yahoo.com/now/10-medical-device-stocks-2021-204853768.html Source 2: https://www.globenewswire.com/news-release/2021/05/25/2235202/0/en/Medical-Devices-Market-to-Reach-USD-657-98-Billion-by-2028-Rising-Penetration-in-Developing-Nations-to-Bolster-Growth-Fortune-Business-Insights.html Source 3: https://www.globenewswire.com/news-release/2021/06/25/2253372/0/en/Electrophysiology-Devices-Market-Size-to-Surpass-Around-US-10-72-Bn-by-2027.html Source 4: https://www.investopedia.com/articles/stocks/09/investing-medical-equipment-companies.asp#:~:text=Medical%20equipment%20companies%20offer%20investors,a%20growth%20or%20value%20investor Source 5: https://finance.yahoo.com/quote/BIO/history?p=BIO Source 6: https://finance.yahoo.com/quote/TMO/history?p=TMO Source 7: https://finance.yahoo.com/quote/SYK/history?p=SYK Source 8: https://finance.yahoo.com/quote/BSX/history?p=BSX Source 9: https://finance.yahoo.com/quote/EW/history/ Source 10: https://finance.yahoo.com/quote/ABMD/history?p=ABMD Source 11: https://baptisthealth.net/baptist-health-news/heart-arrhythmias-afib-and-atrial-flutter-on-the-rise-in-u-s/ Source 12: https://d1io3yog0oux5.cloudfront.net/_269b3834a20423d95470d6e4877b861e/biosigtech/db/338/2433/pdf/BioSig_Fact+Sheet_4.07.20_.pdf Source 13: https://ir.biosig.com/press-releases/detail/288/biosigs-pure-ep-system-to-be-featured-in-a-live-patient Source 14: https://xtalks.com/biosigs-pure-ep-system-in-first-clinical-cases-1869/ Source 15: https://www.biosig.com/pure-ep/our-solution Source 16: https://www.globenewswire.com/news-release/2017/03/17/940598/22558/en/BioSig-Technologies-Announces-Strategic-Partnership-with-Mayo-Clinic.html Source 17: https://finance.yahoo.com/news/biosig-sees-increased-case-volume-222815099.html Source 18: https://ir.biosig.com/press-releases/detail/287/clinical-data-acquired-by-the-pure-ep-system-published Source 19: https://d1io3yog0oux5.cloudfront.net/biosigtech/files/docs/BioSig_PDF_Invite_10.11.21_%283%29.pdf Source 20: https://ir.biosig.com/press-releases/detail/288/biosigs-pure-ep-system-to-be-featured-in-a-live-patient Source 21: https://ir.biosig.com/press-releases Source 22: https://ir.biosig.com/press-releases/detail/286/biosig-selects-plexus-corp-as-its-manufacturing-partner Source 23: https://ir.biosig.com/press-releases/detail/284/biosig-increases-installation-footprint-adding-st Source 24: https://ir.biosig.com/press-releases/detail/280/biosig-latest-installation-broadens-clinical-footprint-for Source 25: https://ir.biosig.com/press-releases/detail/285/biosig-technologies-inc-appoints-medical-device-industry Source 26: Laidlaw and Company Analyst Report Oct 4, 2021 Source 27: https://stockcharts.com/h-sc/ui Source 28: https://finance.yahoo.com/quote/BSGM/key-statistics?p=BSGM Source 29: https://finance.yahoo.com/quote/BSGM/history?p=BSGM Source 30: https://finance.yahoo.com/news/biosig-signal-processing-technology-electrophysiology-134500015.html Source 31: https://finbox.com/NASDAQCM:BSGM/explorer/ni_proj_growth Source 32: Intro-Act Report Source 33: Laidlaw Plexus Report Source 34: https://schrts.co/awxiDvFD Source 35: https://www.channelchek.com/company/BSGM/research-report/3965 Source 36: https://www.barchart.com/stocks/quotes/BSGM/price-history/historicalSource 37: https://www.nasdaq.com/market-activity/stocks/bsgm/analyst-research Source 38: https://d1io3yog0oux5.cloudfront.net/_28bfa52d52012a21a13113d8a22365d2/biosigtech/db/338/2433/pdf/BioSig+Fact+Sheet+Oct+UPDATED.pdf Source 39: https://schrts.co/jMnZXgMR Source 40: https://www.tipranks.com/stocks/bsgm/insider-trading Source 41: https://taglichbrothers.com/wp-content/uploads/2022/11/BSGMUpateReport-11-21-22.pdf Source 42: https://finance.yahoo.com/news/biosig-signs-master-research-agreement-150300967.html Source 43: https://d1io3yog0oux5.cloudfront.net/_8f2729486945a14a7de67b7e6ad04eb8/biosigtech/db/338/2433/pdf/Corp.+Summary+12.19.22.pdf Source 44: https://www.globenewswire.com/news-release/2022/11/28/2563323/0/en/Cardiac-Ablation-Technologies-Market-Size-Will-Attain-USD-12-6-Billion-by-2030-growing-at-11-6-CAGR-Exclusive-Report-by-Acumen-Research-and-Consulting.html Source 45: https://www.barchart.com/stocks/quotes/BSGM/price-history/historical Source 46: https://schrts.co/VqJJNsGW Source 47: https://www.marketbeat.com/types-of-stock/insider-buying-explained-what-investors-need-to-know/ Source 48:http://openinsider.com/screeners=BSGM&o=&pl=&ph=&ll=&lh=&fd=730&fdr=&td=0&tdr=&fdlyl=&fdlyh=&daysago=&xp=1&xs=1&vl=&vh=&ocl=&och=&sic1=-1&sicl=&sich=&grp=0&nfl=&nfh=&nil=&nih=&nol=&noh=&v2l=&v2h=&oc2l=&oc2h=&sortcol=0&cnt=100&page=1 Source 49: https://d1io3yog0oux5.cloudfront.net/_318b6197dae3b99105b0e6927264b9de/biosigtech/db/372/3022/image.jpgSource 50: https://www.iccleveland.com/resourcefiles/feature-boxes-things-to-do/iccleveland-ttd-cleveland-clinic-main-campus.jpg https://finance.yahoo.com/news/data-heart-rhythm-2023-suggests-113000017.html

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media LLC and Lifewater Media, Virtus Media LLC has been hired by Lifewater Media LLC for a period beginning on 02/10/2023 and ending 02/10/2023 to publicly disseminate information about NASDAQ: BSGM via digital communications. We have been paid three thousand five hundred dollars USD. Pursuant to a further agreement between Virtus Media LLC and Lifewater Media LLC, Virtus Media has been hired for a period beginning on 3/1/23 and ending 3/7/23. We have been paid seventeen thousand five hundred USD. Pursuant to a further agreement between Virtus Media LLC and Lifewater Media LLC, Virtus Media has been hired for a period beginning on 5/23/23 and ending 5/25/23. We have been paid twelve thousand USD.