Spey Resources Corp. is a Canadian exploration company addressing the lithium demand issue.

The results are impressive.

Did You Know?

By 2030, 50 percent of all vehicles sold will be electric.

As part of the Build Back Better initiative and the Bipartisan Infrastructure Deal, President Biden has taken some pretty major steps toward cleaner energy.

Part of this included an executive order in which President Biden announced* his intent to have at least 50 percent of all vehicles sold running on electric power by 2030.

Exploration to Production in the “Lithium Triangle”

In the world-famous “Lithium Triangle,” within Argentina’s mining province of Saltar, Spey Resources completed exploration activities and hit multiple lithium brine aquifers at its 80% owned Incahuasi Salar claim. Spey is now reporting a 5 hole production drilling program.

Prior to joining Spey Resources, SPEY’s CEO Phil Thomas explored and produced a resource estimate for the Pozuelos Salar, also located in the mining province of Saltar, Argentina, which was sold to Ganfeng Lithium Group for USD $962 Million.

Ganfeng Lithium is the world’s #4 largest lithium company and currently holds the claim adjacent to SPEY’s claim in the Incahuasi Salar.

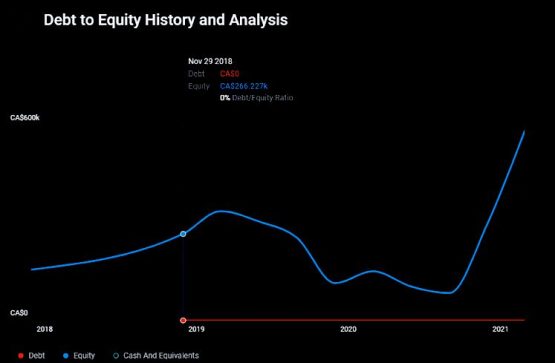

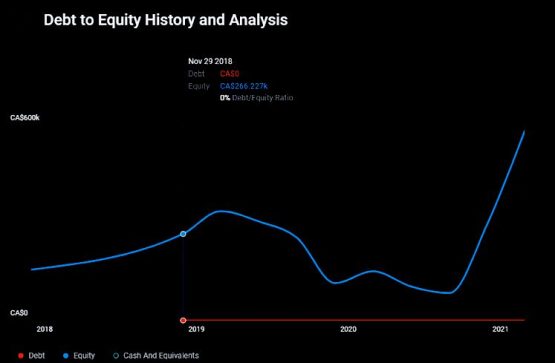

Financials

After bottoming out in March 2021, $SPEYF ran 570 percent to a high of $0.67 in just around 90 days. Since August 2021, the stock has mostly hovered around $0.22, which could point to this being an ideal time to buy.

Financially, Spey is incredibly healthy: In a span of only 9 months, Spey Resources increased their total assets by an impressive 18 percent.

November 30, 2021

$3,990,949

November 30, 2022

$4,715,051

Buyouts & Acquisitions

In April 2021, Spey Resources Corp. entered into a Share Purchase Agreement with the shareholders of Tech One Lithium Resources Corp. Per the agreement, Spey purchased all of Tech One’s issued and outstanding shares.

Tech One has the option to acquire 100% of the mineral concessions of the Candella I project located within the prolific Lithium Triangle in the Salta Province of Argentina. Candella I covers 300 hectares, is represented by the mineral claim number 23262 situated in the Incahuasi Salar, and is road accessible.

In October 2022, Phil Thomas took the helm as CEO of Spey Resources Inc., having 25 years of experience in Argentina. His last 2 projects were both acquisitions.

$825M | March 2022

“Rio Tinto has completed the acquisition of the Rincon lithium project in Argentina for $825 million”. Mr. Thomas and his team explored and built this plant.

$962M

As CEO of Lithea Inc., Mr. Thomas explored and produced a resource estimate for the Pozuelos Salar that was sold to Ganfeng this year for $962 million

Quebec, Canada Lithium Discoveries

Spey Resources owns claims in the James Bay Region of Quebec, Canada right beside Patriot Battery Metals (TSX.V: PMET), who announced a significant discovery & the company’s best drill intercept to date in August of 2022 of 159.7 meters at 1.65% Li20.

Spey’s Quebec projects vary in distance from Patriot Battery Metals, one within approximately 1 kilometer of a Patriot border.

Next-Gen Extraction Excellence

Ekosolve Technology Offers a Huge Advantage

Solvent Exchange Concentration Process From Pumped Brines

Spey Resources is committed to the process of timely, competitive cost, environmentally sensitive extraction practices. Utilizing Ekosolve™ Technology, this revolutionary process based on well known solvent exchange principles reduces capital and operations costs and accelerates project start up, avoiding 12-18 months of pond construction and evaporation.

With high recoveries of lithium from brines, this process produces battery grade lithium carbonate. Ekosolve™ circumvents problems of brine contaminants being expensive and difficult to remove, particularly magnesium. Ekosolve™ involves four simple stages over three hours to produce lithium chloride which when sodium carbonate is added produces battery grade lithium carbonate.

Growing Demand Due to Electric Vehicles & Personal Electronics

The global consumer electronics market is expected to hit USD $989.37 Billion by 2027 (Fortune Business Insights)

At $287.36 Billion in 2021, the global electric vehicle (EV) market is projected to grow to USD $1.318 trillion in 2028 at a CAGR of 24.3%

The Dream Team

CEO, Director

Nader Vatanchi

Nader has spent the last nine years in finance, starting with Edward Jones in 2012. Currently, he serves as CEO of Musk Metals Corp, CEO of Forty Pillars Mining Corp., and CFO of Triangle Industries Ltd.

President, Director

David Thornley-Hall

David is a senior executive with 25 years of diversified experience in the mineral exploration, mining, and finance industries. Before entering the mining industry, David worked in the Canadian dollar bond market as Managing Director of the Canadian business at Exco Shorcan in London, England.

CFO, Corp. Secretary, Director

Kelvin Lee

Kelvin has over 15 years of experience in senior financial positions with several listed issuers focused on the mining industry. He's a CPA, CGA, and holds a Diploma in Accounting and a Bachelor in Business Administration from the British Columbia Institute of Technology.

Director

Ian Graham

Ian is a mining professional with over 28 years of experience in the technical characterization and financing of mineral deposit exploration and development. He has experience modeling project economics (DCF) and the structuring of project and company financing.

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and promote small public companies. By reading our website / media webpage you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our website / media webpage .We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website / media webpage are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. Virtus Media business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company's website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers' works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer's communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Compensation: Pursuant to an agreement between Virtus Media LLC and West Coast Media, Virtus Media LLC has been hired for a period beginning on 10/24/22 and ending after one business day to publicly disseminate information about (OTC: SPEYF) via digital communications. We have been paid five thousand USD via ACH Bank Transfer. Pursuant to an agreement between Lifewater Media and Virtus Media LLC, Virtus Media LLC has been hired for a period beginning on 11/3/22 and ending after five business days to publicly disseminate information about (OTC: SPEYF) via digital communications. We have been paid seven thousand five hundred USD via ACH Bank Transfer. Pursuant to an agreement between Virtus Media LLC and Social Media Outlet, Virtus Media LLC has hired Social Media Outlet for a period beginning on 10/24/22 and ending after one business day to publicly disseminate information about (OTC: SPEYF) via digital communications. We have paid this Social Media Outlet two hundred ten USD via ACH Bank Transfer. Pursuant to an agreement between Virtus Media LLC and Social Media Outlet, Virtus Media LLC has hired Social Media Outlet for a period beginning on 11/03/22 and ending after five business days to publicly disseminate information about (OTC: SPEYF) via digital communications. We have paid this Social Media Outlet one hundred USD via ACH Bank Transfer. Pursuant to an agreement between Virtus Media LLC and Social Media Outlet, Virtus Media LLC has hired Social Media Outlet for a period beginning on 11/03/22 and ending after five business days to publicly disseminate information about (OTC: SPEYF) via digital communications. We have paid this Social Media Outlet three hundred USD via ACH Bank Transfer.