The #1 Growing Stock in the 21st Century

Whether you believe it or not, the #1 stock market performer since the year 200 any name you might think…

You might think its $NVDA, who’s grown 117,240% since 2000.

Of course $AAPL would be a good guess too, soaring 23,760% since the same year.

What if I said it’s a beverage stock, that ISN’T Coke or Pepsi…

Instead, it’s actually Monster Energy - a stock that’s soared from $0.04 a share in 2000 to $54.88 in March 2025 for a total return of 137,100%.

That’s enough to turn $1,000 into $1.37 million.

This is because Monster was able to create the right product at the right time and give consumers the energy boost they were looking for.

As a result, Monster’s revenue has exploded from a mere $80 million in 2001 — when the company was still known as Hansen’s Natural — to more than $7 billion in 2024.

Now, there’s an early stage company with an energy beverage breakthrough poised to disrupt the market the same way Monster did…

That company is Safety Shot (NASDAQ: SHOT) - a company with a patented, clinically proven product that’s completely unique in the functional beverage industry.

Safety Shot Inc.

(NASDAQ: SHOT)

Revolutionizing Recovery: Safety Shot Inc. ($SHOT: NASDAQ) is Changing the Way We Bounce Back

Safety Shot Inc. (NASDAQ: SHOT) is redefining the functional beverage industry with Sure Shot—the world’s first patented beverage clinically proven to rapidly reduce blood alcohol content (BAC). By leveraging scientifically backed ingredients that enhance alcohol metabolism and promote mental clarity, Safety Shot is addressing a growing consumer demand for alcohol recovery solutions.

With a strategic focus on product innovation, large-scale distribution, and an aggressive marketing approach, Safety Shot is well-positioned to dominate the alcohol detoxification market. The company’s multi-channel retail expansion and partnerships with key influencers in health, fitness, and lifestyle industries further amplify its market reach. As consumer interest in functional beverages continues to rise, Safety Shot is uniquely positioned as a leader in an emerging category with massive growth potential.

The Safety Shot Vision: Pioneering Wellness Innovation

Safety Shot is committed to enhancing well-being and improving recovery through scientifically validated products. The company has spent nearly a decade researching and formulating Sure Shot to ensure maximum efficacy in reducing alcohol absorption, accelerating metabolism, and supporting cognitive function.

Unlike traditional recovery solutions that take hours to show results, Sure Shot is designed to work within 30 minutes, offering a rapid and effective way for consumers to regain control after alcohol consumption. With a strong focus on innovation and product development, Safety Shot continues to explore new formulations and expanded applications for its proprietary blend, reinforcing its status as a leader in the functional beverage space.

Safety Shot Inc.

(NASDAQ: SHOT)

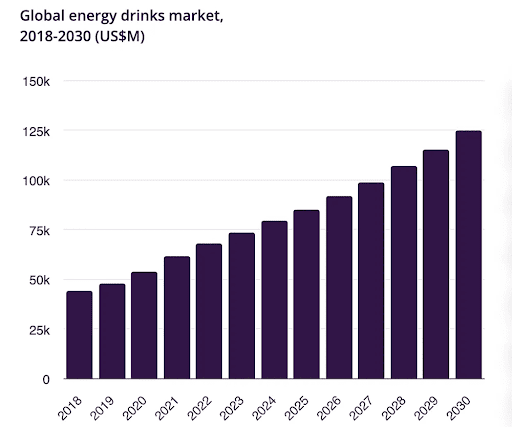

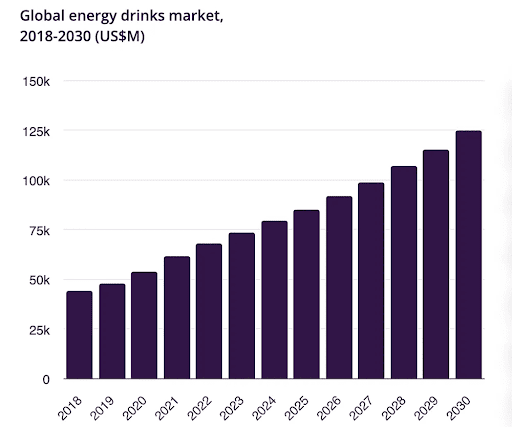

A Fast Growing $73 Billion Market Loaded with Consumers

Sure Shot has taken profitable advantage of a large and fast growing market for energy beverages. Energy drinks have become a multi-billion dollar business that has made countless investors wealthy.

According to Grand View Research, $73 billion worth of energy drinks were sold worldwide in 2023, and that number is expected to grow to $125 billion by 2030 for a 71% growth rate.

Teenagers and fitness enthusiasts alike connect caffeinated energy boosts with a better workout. The world is moving towards one that emphasizes bodily health, and no other ingredient has hindered the American diet more than sugar. In competition with sugary energy and recovery drinks that more athletes are moving away from, Safety Shot’s innovative new twist on their energy drinks could take the world by storm.

Sure Shot: A Paradigm Shift in Alcohol Detoxification

Sure Shot is not just another recovery drink—it’s a scientifically validated solution that is disrupting the alcohol recovery market. Unlike other products that focus solely on hydration or vitamin replenishment, Sure Shot works at the metabolic level to actively break down alcohol while preventing further absorption into the bloodstream.

The drink’s proprietary formulation includes a blend of nootropics, amino acids, vitamins, and minerals designed to not only reduce BAC but also enhance mental clarity, motor function, and energy levels. In clinical trials, participants who consumed Sure Shot saw significant reductions in their BAC within 30 minutes, allowing them to feel clearer and more in control.

The company has developed multiple product formats, including ready-to-drink bottles, travel-sized shots, and powdered drink mixes, ensuring convenient consumption for various lifestyles. Whether used for a night out, post-drinking recovery, or general wellness, Sure Shot provides a much-needed alternative to traditional hangover remedies.

With alcohol consumption remaining a major global industry, the demand for science-backed recovery solutions is growing. Safety Shot is uniquely positioned to capitalize on this demand by offering the first clinically validated, patent-protected beverage that actively reduces BAC.

Strategic Market Expansion and Distribution

Safety Shot’s go-to-market strategy focuses on multi-channel distribution, e-commerce expansion, and retail partnerships to maximize product accessibility. The company has already secured placements in major retailers, gas stations, convenience stores, and online platforms to ensure that consumers can easily purchase Sure Shot when and where they need it.

By leveraging a combination of direct-to-consumer (DTC) sales and retail partnerships, Safety Shot has created a high-visibility distribution strategy. The product is now available through Gopuff, BevMo, 7-Eleven, and additional national retail chains, with further expansion into fitness centers, bars, and hospitality sectors on the horizon.

Additionally, Safety Shot is implementing an aggressive acquisition plan that’s already gaining Momentum. The company acquired Yerbaé, who makes a popular line of plant-based energy drinks built around the popular South American herb, yerba mate. Yerbaé generated $12 million in revenue in FY2023, and owns an extensive distribution network of more than 14,000 retail outlets nationwide put together by Todd Gibson - a decorated energy beverage legend. All of these resources, including Gibson, fall into Safety Shot’s finances.

$SHOT’s digital marketing strategy, using influencer partnerships, targeted online ads, and social media campaigns to increase brand awareness and drive e-commerce sales. The company’s marketing initiatives emphasize the product’s scientific credibility, effectiveness, and convenience, making it an attractive purchase for consumers looking for a legitimate, science-backed alcohol recovery solution.

Financial Performance and Investor Relations

Safety Shot’s transition to a publicly traded company on NASDAQ ($SHOT) provides investors with direct exposure to the rapidly growing functional beverage market. The company has structured its financials to support aggressive expansion, strategic partnerships, and large-scale production, ensuring long-term value for shareholders.

As part of its financial strategy, Safety Shot has also focused on enhancing liquidity and investor accessibility, making it easier for institutional and retail investors to engage with the company. DTC eligibility, compliance with NASDAQ requirements, and transparent investor relations reinforce the company’s commitment to strong corporate governance and financial sustainability.

Moreover, with plans to expand internationally, Safety Shot is positioning itself as a global leader in alcohol recovery and functional beverages. By securing long-term funding and maintaining a disciplined capital allocation strategy, the company is well-prepared to scale operations while maximizing profitability.

Commitment to Scientific Research and Development

Safety Shot is built on scientific rigor, clinical validation, and ongoing research and development (R&D). The company has invested heavily in patent protection, peer-reviewed studies, and clinical trials to ensure that Sure Shot’s effectiveness is backed by real-world data.

Unlike many competitors that rely on unverified claims, Safety Shot has a proprietary formula with documented efficacy in BAC reduction and alcohol metabolism acceleration. The company’s focus on scientific innovation ensures continuous improvements in product formulations, keeping Safety Shot ahead of the competition.

Safety Shot is also actively exploring new functional beverage categories, including products that support liver health, hydration, and overall cognitive performance. This commitment to R&D and continuous product evolution positions Safety Shot as a long-term player in the health and wellness sector.

A Transformative Opportunity in Functional Beverages

Safety Shot Inc. stands at the intersection of science, innovation, and consumer demand, offering a first-of-its-kind product in an industry primed for disruption. As functional beverages continue to gain popularity, Sure Shot’s patented, clinically validated formula positions it as a market leader in alcohol detoxification and wellness.

With a strong leadership team, strategic partnerships, scalable distribution network, and commitment to scientific research, Safety Shot is well-equipped to capture market share and expand its global footprint. Investors looking for high-growth potential in the functional beverage sector will find Safety Shot to be a compelling opportunity with substantial upside potential.

IDENTIFYING THE OPPORTUNITY

KEY LEVELS

Key Level #1: $0.8983 (+88.40%)

Key Level #2: $1.19 (+149.58%)

Key Level #3: $1.54 (+222.99%)

Key Level #4: $2.38 (+399.16%)

Potential Support: $0.2996

Meet The Team at Safety Shot Inc. (NASDAQ: SHOT)

Jarrett Boon | CEO

Jarrett is a seasoned entrepreneur and innovator with over 30 years of experience in creating and growing successful businesses. He was the Co-Founder and CEO of GBB Drink Lab, which developed Safety Shot. As one of the original thought leaders and investors in LifeLock, he applied his expertise in sales, marketing, and strategic business development to grow LifeLock to $500M in revenue and take public in 2012. LifeLock was subsequently acquired by Symantec for $2.3B. Prior to LifeLock, Jarrett founded SW Promotions, Inc., a resort marketing and advertising firm that was acquired by one of its publicly traded partners.

John Gulyas | Chairman of the Board

John is a serial entrepreneur with multiple 7-figure exits. His experience is vast, with industries including cellular services, waste management and hospitality to name a few. Over the last 13 years John has owned, operated, and invested in multiple franchise brands, and he continues to consult with franchisors on how to successfully develop their brands. His most notable work in this area was helping European Wax Center with development plans that guided the brand to grow from 4 to 640 locations. John’s experience, extensive investor network and business insight led him to co-found Apex Franchise Development Group where he currently serves as Chief Development Officer.

Jordan Schur | President

Jordan's career spans more than two decades in the music and film industries, where he has demonstrated a combination of creative flair and business acumen. He has held influential positions at various studios and record companies, overseeing artists like Snoop Dogg, Nirvana and Guns and Roses. Schur's achievements include re-launching Geffen Records and boosting its revenue to over $1 billion, as well as founding the successful Flip Records. In the film sector, Schur co-founded Mimran Schur Pictures and Suretone Pictures, producing notable films such as "Warrior," which earned an Academy Award nomination, and "Stone." His entrepreneurial ventures also include Suretone Entertainment, which encompasses record labels and management companies that have made significant cultural impacts.

Danielle De Rosa | CFO

Danielle served as CFO of VirTra where she was responsible for all operations and finance functions including managing over 50 staff members. Prior to her time at VirTra, she was Senior Finance Officer at CommonSpirit Health, a non-profit organization that operates more than care sites and hospitals in 21 states across the US. Here, she managed finances for over 150 hospitals. As CFO of Lorts Manufacturing, she optimized cash flow, supply chain, and logistics. Ms. De Rosa has a BS in accounting and Master of Business Management from the University of Phoenix. She has also attended the Harvard Leadership Program.

Sources

- http://sureshot.com/blogs/in-the-news/can-sure-shot-reduce-the-effects-of-alcohol-clinical-studies-look-promising

- https://sureshot.com/

- https://sureshot.com/pages/backed-by-science

- https://sureshot.com/pages/about

- https://sureshot.com/pages/creators

- https://www.nasdaq.com/market-activity/stocks/shot

- https://sureshot.com/pages/in-the-news

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media LLC and CMDG Inc., Virtus Media LLC has been hired by CMDG Inc for a period beginning on 2025-03-17 and ending after 60 days to publicly disseminate information about NASDAQ: SHOT via digital communications. We have been paid one hundred twenty thousand dollars USD.