5 Reasons Why Safe Supply (CSE: SPLY) Could Be Poised For Significant Upside Potential in 2023

IDENTIFYING THE OPPORTUNITY

THE TREND HAS BROKEN IN OUR FAVOR

We have seen a consolidated downtrend into this support level followed by strong institutional pressure to the upside. We are in the pullback now, and have potential for high lows and a clean run to the upside.

TARGETS

Target #1: $0.24(+33.33%)

Target #2: $0.32(+77.78%)

Target #3: $0.40(+45.83%)

Support: $0.15

Safe Supply

(CSE: SPLY)

creating An ecosystem that benefits everyone

Welcome to Safe Supply (CSE: SPLY), the venture fund trailblazing the safe supply ecosystem that stands proudly at the forefront of the third wave of drug reform—a transformative movement with a steadfast mission to end the war on drugs, save countless lives, and foster a responsible and compassionate approach to psychoactive substances.

With remarkable growth and strategic partnerships, Safe Supply (CSE: SPLY) is the world’s first venture fund investing in the fast-growing safe supply ecosystem.

Saving Lives and Shaping a Brighter Future

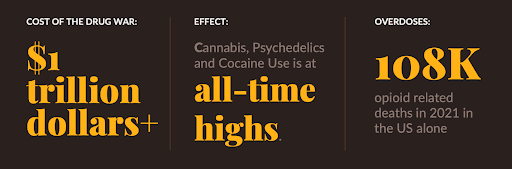

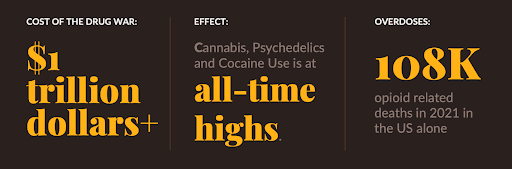

The war on drugs is nearing its conclusion. Even though over $1 trillion has been spent fighting the drug war, the use of cannabis, psychedelics, and cocaine has reached unprecedented levels, with 108,000 opioid-related fatalities recorded in the United States in 2021 alone.

Safe Supply (CSE: SPLY) steps into this critical moment with a crystal-clear mission: to invest in and incubate companies that are saving lives, shaping a brighter future, and ushering in a responsible conclusion to the war on drugs. This mission is the driving force behind every facet of their work.

Capitalizing on a Billion-Dollar Opportunity

The demand for change is undeniable, and Safe Supply (CSE: SPLY) is here to lead this monumental shift. In the wake of this reform, the total addressable market stands at a staggering $360 billion. This is your opportunity to join us and seize a piece of this remarkable market.

Safe Supply

(CSE: SPLY)

a Unique Approach: Incubating and Investing Across the Value Chain

At Safe Supply (CSE: SPLY), they are not just spectators; they are active participants and innovators in this transformative movement. Their model revolves around incubating and investing across the entire value chain, ensuring that they have a strategic presence where it counts.

This approach maximizes their potential to capitalize on emerging opportunities as the market evolves.

Key Highlights:

Diversified Portfolio of Assets: Safe Supply (CSE: SPLY)'s diverse portfolio mitigates risk and enhances stability, ensuring consistent growth potential.

World-Class Team: Our seasoned team, comprised of industry veterans, steers the company's strategies and operations.

High-Velocity Deployment: Safe Supply (CSE: SPLY) prioritizes swift investment deployment to maximize returns, potentially leading to higher yields in shorter durations.

Early Entry into Emerging Markets: As a pioneer, Safe Supply (CSE: SPLY) capitalizes on opportunities before they become mainstream, offering partners a chance to benefit from emerging markets.

Strategic Positioning Post Decriminalization: Regulatory changes unlock vast market potentials, and we are poised to capitalize on these changes, tapping into newly accessible revenue streams.

Efficient Capital Allocation: Capital is judiciously invested in high-potential opportunities, ensuring investments are actively seeking and capitalizing on profitable ventures.

Diversified Exposure: Safe Supply (CSE: SPLY) spans the value chain of the safe supply sector, providing multiple avenues for growth.

Commitment to Innovation and Evolution: We are committed to staying at the forefront of this thriving sector, utilizing innovation and adaptation as key drivers for sustained growth and profitability.

Safe Supply (CSE: SPLY) is dedicated to reshaping the future of drug reform, improving lives, and creating a safer and healthier world for all. Our strategic approach, seasoned team, and pioneering spirit position us as the leaders in the third wave of drug reform. Together, we are altering the course of drug policies and forging a safer, more compassionate world.

A Strategic Approach to Partnership

Safe Supply's (CSE: SPLY) strategic approach revolves around forming meaningful partnerships and nurturing companies across the safe supply ecosystem. This approach creates a tightly woven fabric of synergies, generating short-term revenues for Safe Supply (CSE: SPLY) while maximizing the value accretion as partner companies flourish.

Safe Supply

(CSE: SPLY)

The Global Momentum for Reform

The momentum for drug reform is undeniable. It began with Portugal's groundbreaking decision to decriminalize all drugs in 2001, setting an extraordinary precedent for jurisdictions worldwide, including Oregon, Colorado, and British Columbia. British Columbia, in particular, has embraced this momentum by committing over $1 billion in 2023 to combat the toxic drug supply. This commitment encompasses drug-checking services, overdose prevention initiatives, supervised consumption sites, and prescribed safer supply programs—a comprehensive approach that presents an annual opportunity of $3.2 billion for safely supplied cocaine in the region.

As more jurisdictions move to decriminalize and legalize different psychoactive compounds, new opportunities will emerge.

We proudly represent the first wave of investors dedicated to this rapidly evolving safe supply ecosystem—a testament to our commitment to ending the fentanyl crisis and exploring the limitless potential of the coca plant. Our visionary team boasts over a decade of experience in drug reform investments, providing us with unparalleled insights into the nuances of this market.

Global Legalization and Rescheduling

Across the globe, the movement towards legalization and rescheduling is gaining unprecedented momentum. For instance, Bern, Switzerland, is preparing to pilot legal cocaine sales—a bold move that signifies the dynamic shift in drug policies. Similarly, Oregon has pioneered the first legal market for psilocybin services, while Australia has rescheduled psilocybin and MDMA for the treatment of specific mental health conditions. These groundbreaking changes are unlocking vast opportunities in markets estimated to be worth billions of dollars annually. Moreover, Colorado is poised to establish the world's first legal market for plant-based psychedelics, and the FDA is expected to approve MDMA-assisted therapy for PTSD treatment in 2024. Multiple U.S. states, including New York, California, Hawaii, and Connecticut, are actively exploring the creation of legal markets, collectively contributing to a global $12 billion per year industry.

GLOBAL IMPACT

Safe Supply

(CSE: SPLY)

Foundational Investments that Shape the Future

Initiating Change in British Columbia

The Canadian Province of British Columbia has emerged as a global leader in ending the drug war. This dynamic environment presents an annual opportunity of $3.2 billion for safely supplied cocaine in the region, and Safe Supply (CSE: SPLY) is at the forefront, ready to capture this opportunity.

Rediscovering the Coca Plant

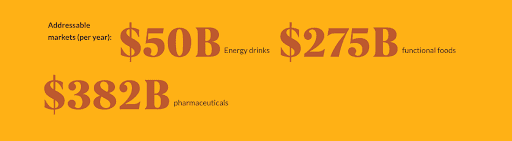

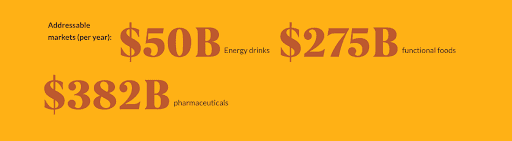

Once stigmatized because of its association with illicit cocaine production, the coca plant is experiencing a renaissance for its therapeutic potential. Beyond its historical notoriety, the coca leaf offers a plethora of benefits, including increased energy, improved digestion, high nutritional value, support for weight loss, carbohydrate metabolism, and effective pain management. Safe Supply (CSE: SPLY) is working to identify opportunities with the multifaceted coca plant, including a $50 billion market in energy drinks, a $275 billion market in functional foods, and a $382 billion market in pharmaceuticals.

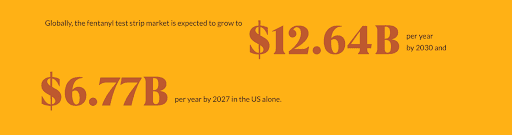

Addressing the Fentanyl Overdose Crisis

The fentanyl overdose crisis has reached alarming proportions. In the last decade, 1.22 million Americans have tragically lost their lives to the opioid epidemic, with a staggering 74,000 fentanyl-related deaths recorded in 2022 alone. Safe Supply (CSE: SPLY) confronts this crisis head-on by building companies focused on fentanyl test strips. Once considered "drug paraphernalia" and illegal in the U.S., these strips are now legal in a majority of U.S. states. The global fentanyl test strip market is projected to reach a staggering $12.64 billion per year by 2030, with the U.S. accounting for an impressive $6.77 billion of that by 2027.

Building the Infrastructure for the Future

As the emerging market for psychoactive compounds continues to evolve, new distribution pathways and clinical infrastructure will be pivotal. Safe Supply (CSE: SPLY) is committed to leading in these areas, ensuring that we are well-prepared for the transformative changes ahead.

Safe Supply

(CSE: SPLY)

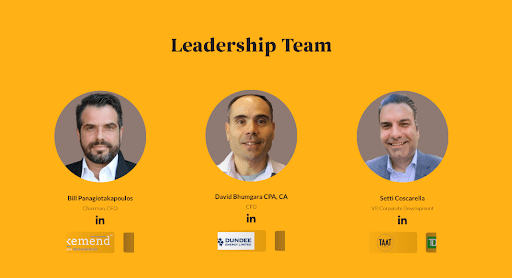

Spearheading Leadership Team

At Safe Supply (CSE: SPLY), we are driven by a vision that knows no bounds, led by a leadership team whose collective expertise and executive-level prowess have raised and deployed over $3.5 billion in capital, generating an impressive $10 billion in shareholder value across their diverse ventures. This wealth of experience uniquely positions Safe Supply (CSE: SPLY) to navigate the complex and evolving landscape of drug reform, forging a path that others can follow.

This is the opportunity

Join us in pioneering the future of drug reform, saving lives, and creating a safer, more compassionate world. Safe Supply (CSE: SPLY) represents not only a promising investment but an opportunity to be part of a movement that will redefine the future of drug policies, one that holds both tremendous social value and immense profit potential. Together, we are forging a path towards a safer and brighter future for all.

Sources

- Source 1: https://safesupply.com/

- Source 2: https://safesupply.com/#elementor-action%3Aaction%3Dpopup%3Aopen%26settings%3DeyJpZCI6Ijg1MDQiLCJ0b2dnbGUiOmZhbHNlfQ%3D%3D

- Source 3: https://safesupply.com/our-team/

- Source 4: https://safesupply.com/our-thesis/

- Source 5: https://safesupply.com/our-model/

- Source 6: https://safesupply.com/portfolio/

- Source 7: https://safesupply.com/philosophy/

- Source 8: https://finance.yahoo.com/news/safe-supply-streaming-co-ltd-110000451.html

- Source 9: https://finance.yahoo.com/quote/SPLY.cn?p=SPLY.cn&.tsrc=fin-srch

- Source 10: https://finance.yahoo.com/quote/SPLY.cn

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media Group LLC and Lifewater Media, Virtus Media Group LLC has been hired by Lifewater Media LLC for a period beginning on 00/00/2023 and ending 00/00/2023 to publicly disseminate information about CSE: SPLY via digital communications. We have been paid zero thousand dollars USD.