GENPREX, INC. (NASDAQ: GNPX)

5 Reasons Why Genprex, Inc. (NASDAQ: GNPX) Could Witness Unprecedented Growth In 2023

LATEST NEWS

Genprex Unveils New Video Featuring Chief Medical Officer Discussing Positive Preclinical Data With NPRL2 Gene Therapy Utilizing Non-Viral ONCOPREX® Nanoparticle Delivery System

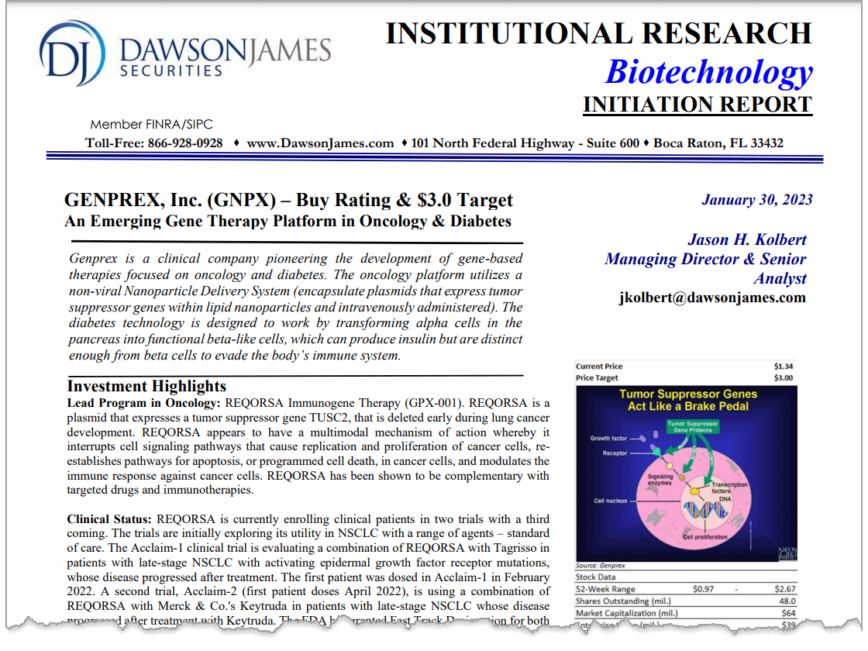

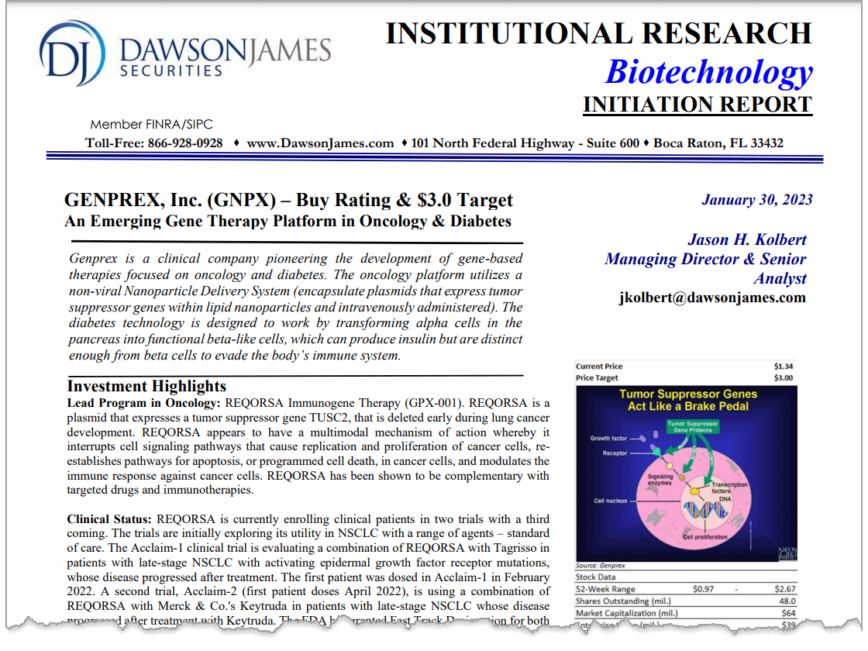

Dawson James Analyst Jason Kolbert Sets a $3.00 Target on Shares of Genprex, Inc. (Nasdaq: GNPX) as the Company Pursues the Blockbuster Diabetes and Oncology Markets.

When Dawson James analyst and Director of Research Jason Kolbert initiates coverage on a Biotech, you should pay close attention.

Jason’s career began as a chemist in the pharmaceutical industry and evolved into a product and marketing manager with Schering-Plough in Japan.

Upon returning from Japan, Jason joined Salomon Smith Barney, as a research associate who has now evolved into a 20-year career on Wall Street as a leader in the Healthcare space.

Jason leverages his unique and diversified experiences to work across the Dawson James firm to augment the research product focusing on small and middle capitalized emerging growth companies utilizing Dawson James’ “Diversified Investor Offering™,” building their shareholder base with a combination of retail and institutional accounts.

Jason covers multiple therapeutic areas in biotechnology, specialty pharmaceuticals, and medical devices. As an analyst, Jason has developed a high level of expertise in oncology, virology and cell-based medicine such as CAR (Chimeric Antigen Receptor)-T cells and regenerative medicine (stem cells).

Mr. Kolbert spent the last year as a senior biotechnology analyst at HC Wainwright and previously seven years at the Maxim group, where he was an Executive Managing Director and the Head of Healthcare at the firm. During this period Jason and his team covered 80 names across the healthcare vertical.

Jason’s Wall Street career began with seven years at Citi Group followed by several years on the buy side as a portfolio manager with the Susquehanna International Group. Mr. Kolbert returned to his sell-side role after spending time in Industry as the head of business development for a public cell therapy company.

Mr. Kolbert holds an undergraduate degree from the State University of New York in Chemistry and a Master’s in Business Administration from the University of New Haven.

And on January 30, 2023, Jason assigned a $3.00 target on shares of Genprex, Inc. (Nasdaq: GNPX) indicating a potential upside of over 360% from the stock’s current price (on 04/12/23).

The Dawson James valuation for Genprex, Inc. (Nasdaq: GNPX) is based on revenue projections out to 2033. Dawson James knows that the Diabetes and Oncology markets are blockbusters in size, and the therapies are still in the early stages of development. To adjust for this, they apply a 30% risk cut in their therapeutic models.

But Dawson James Analyst Jason Kolbert is not the only one that sees a potential upside for shares of Genprex, Inc. (Nasdaq: GNPX).

Robert LeBoyer from Noble Capital Markets reiterated his $5.00 price target as well

IDENTIFYING THE OPPORTUNITY

Strength From This Support Has Been Reliably Profitable

We continue to see the same signs of strength which have preceded each run historically from this level

TRADE CONFIRMATION

Watch for a volume over 25k the first hour of market open for possible move, and over 200k on daily close.

Volume will precede the move, key indication of our push coming and an impulsive break to the upside.

We will ideally see a strong break over local highs followed by continuation either in the form of momentum, or a series of higher lows.

We are keeping our profit targets nice and tight for the initial move, but we are fully prepared for a MASSIVE rally to the upside in the near-future.

TARGETS

$0.9318(+9.62%)

$0.9921 (+16.72%)

$1.09 (+28.24%)

SUPPORT: $0.78

Could genprex, inc. (nasdaq: gnpx) benefit from the massive market potential for gene therapy?

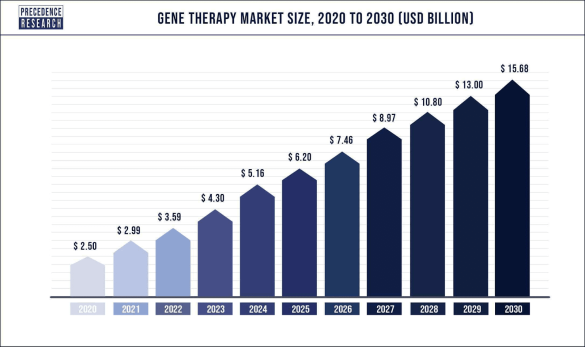

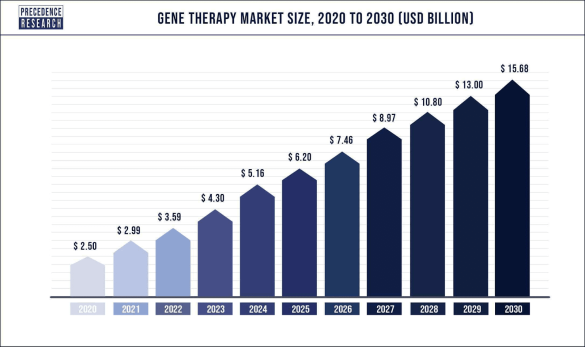

The global gene therapy market was valued at $2.9 billion (US) in 2021 and is expected to reach over $15.68 billion (US) by 2030, poised to grow at a registered CAGR of 20.2% from 2022 to 2030.

Gene therapy is described as the treatment of an illness by changing, replacing, or supplementing a missing or defective genetic combination that is responsible for the disease.

Gene therapy has become one of the most desirable research goals in the fight against degenerative illnesses. The need for gene therapy is being driven by an increase in the number of cases of cancer and other chronic diseases all across the world.

The advancements in gene therapies are projected to be approved in the upcoming years, contributing to the gene therapy market’s growth from now and into the future.

The gene therapies are designed to treat diseases by altering genetic information, such as inactivating malfunctioning genes or replacing a disease-causing gene with a healthy copy of the gene.

The gene therapy is being utilized to treat a variety of disorders and has demonstrated to be effective. This form of treatment can/could have the potenital to cure diseases such as diabetes, cancer, heart disease, and AIDS.

The growth of the gene therapy market is influenced by factors such as a strong product portfolio, the expanding investments by key market players, and a high prevalence of target diseases and interest in innovative and new therapy.

Furthermore, the increased investment in research and development by government and private organizations will create further prospects for the growth of the gene therapy market during the forecast period as noted in the graph above.

The advanced therapeutic solutions for chronic diseases are being used in developed countries. As a result, traditional treatment methods like chemotherapy, which have adverse side effects and long-term repercussions, are being replaced with this treatment. For the development of such medicines, there is also a shift in trend towards the use of viral vectors, which have a low toxicity and high immunology.

The rapid technological advancements in cellular and molecular biology in genomics research, have contributed greatly to the growing gene therapy market in recent years. The academicians, researchers, and in-house researchers of major market companies with significant funding have all played critical roles.

In many industrialized countries, the frequency of cardiovascular diseases is increasing, and there is a growing need to cure these diseases in less time, resulting in players investing extensively in research and development of highly effective and innovative therapeutics such as gene therapy. The prevalence of rare diseases such as cardiovascular and cancer diseases will have a positive impact on the demand for gene therapy applications.

Currently, only a few market players are dominating the gene therapy market.

These market players are significantly contributing to the market’s expansion.

The core members who are working on item dispatching and other important coordinated activities to strengthen their market reach globally.

To increase their cancer gene therapy research and product portfolio, local and small market players are increasingly partnering and developing alliances with large market players.

Despite the small number of approved drugs, cell and gene therapy companies attract a growing amount and proportion of private and public investment.

Although all private investment in life sciences has grown substantially over the past 10 years, the rapid growth of investment in cell and gene therapy companies is remarkable.

Expect Rapid Growth In Sales

But From A Small Baseline

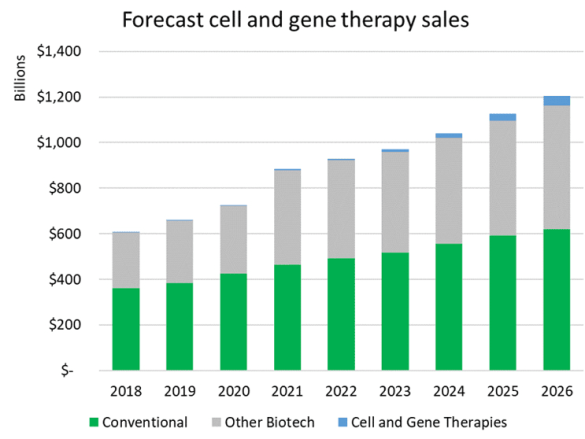

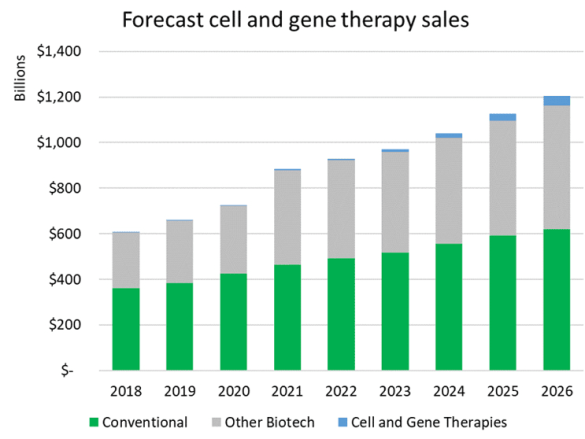

One way to contextualize the substantial growth in investment in cell and gene technologies is to look at forecasted revenue growth for the therapies that are in development.

Based on worldwide sales forecasts from Evaluate Pharma, including both approved drugs and ones forecast to be approved, it is expected that conventional drug sales will grow at a compound annual growth rate (CAGR) of 6% from 2021 to 2026 and biologic sales excluding cell and gene therapies are forecast to grow from $415 billion to $541 billion, a CAGR of 5%.

Cell and gene therapies, in comparison, are expected to grow from $4 billion a year in sales to over $45 billion over that same period, a significantly higher CAGR of 63%.

While the total dollar amount invested in cell and gene is only a fraction of what is put into conventional drugs and biologics, it is important to recognize the spillover effects of this growing capital. Investor interest drives innovation, encourages startups, and attracts experienced talent from competing sectors.

This in turn drives results in the lab and portfolios.

Many saw this happen in the early days of biotechnology, and today traditional pharmaceutical companies continue to lose ground to their biotech peers in terms of investment, talent, and pipeline.

Some anticipate a similar story will play out as cell and gene emerges as its own defined sector in the life sciences ecosystem.

Let's take a closer look at genprex, inc. (nasdaq: gnpx)

Genprex, Inc. is a clinical-stage gene therapy company focused on developing life-changing therapies for patients with cancer and diabetes.

Genprex’s technologies are designed to administer disease-fighting genes to provide new therapies for large patient populations with cancer and diabetes who currently have limited treatment options

Genprex works with world-class institutions and collaborators to develop drug candidates to further its pipeline of gene therapies in order to provide novel treatment approaches.

Genprex’s oncology program utilizes its proprietary, non-viral ONCOPREX® Nanoparticle Delivery System, which the Company believes is the first systemic gene therapy delivery platform used for cancer in humans.

ONCOPREX encapsulates the gene-expressing plasmids using lipid nanoparticles. The resultant product is administered intravenously, where it is then taken up by tumor cells that express tumor suppressor proteins that are deficient in the body.

The Company’s lead product candidate, REQORSA™ is being evaluated as a treatment for non-small cell lung cancer (NSCLC) (with each of these clinical programs receiving a Fast Track Designation from the Food and Drug Administration) and for small cell lung cancer.

Genprex’s diabetes gene therapy approach consists of a novel infusion process that uses an endoscope and an adeno-associated virus (AAV) vector to deliver Pdx1 and MafA genes directly to the pancreas.

In models of Type 1 diabetes, the genes express proteins that transform alpha cells in the pancreas into functional beta-like cells, which can produce insulin but are distinct enough from beta cells to evade the body’s immune system.

In Type 2 diabetes, where autoimmunity is not at play, it is believed that exhausted beta cells are also rejuvenated and replenished.

Genprex, Inc. (Nasdaq: GNPX) Strengthens Diabetes Gene Therapy Program with License of Additional Technology from University of Pittsburgh

Genprex, Inc. (Nasdaq: GNPX) recently announced it has entered into an exclusive license agreement with the University of Pittsburgh, granting the company a worldwide, exclusive license to certain patent applications and related technology and a worldwide, non-exclusive license to use certain related know-how, all related to modulating autoimmunity in Type 1 diabetes by using gene therapy. The preclinical technology transforms macrophages enabling them to reduce autoimmune activity in Type 1 diabetes and could be complementary to the Company’s existing diabetes technology.

"Gaining exclusive access to technology that modulates the immune system by transforming macrophages could prove to be significant to our broader research partnership with the laboratory of George Gittes, MD, Professor of Surgery and Pediatrics and Chief of the Division of Pediatric Surgery at the University of Pittsburgh School of Medicine,"

Mark Berger, MD, Chief Medical Officer of Genprex.

"We are making significant strides in our program with Dr. Gittes's innovative approach to treating diabetes by the transformation of alpha cells into beta-like cells and are excited to add to our arsenal this additional technology also out of Dr. Gittes's lab, in collaboration with the laboratory of Dr. Xangwei Xiao, Assistant Professor of Surgery, also in the Division of Pediatric Surgery at the University of Pittsburgh's School of Medicine. Not only could this new approach be used to reduce autoimmune activity in Type 1 diabetes by modulating the immune system but potentially it could also work in conjunction with the technology we have licensed previously."

"With diabetes reaching epidemic proportions around the world, the work Dr. Gittes is pursuing in diabetes is absolutely critical. In the U.S. alone, there are more than 37 million people with diabetes (approximately 1.9 million of whom have Type 1 diabetes) and another approximately 96 million Americans who are pre-diabetic, or have abnormally elevated blood sugar levels. The opportunity to change the course of this disease with gene therapy is extremely compelling, and increasing our exclusive access to intellectual property could prove to be pivotal to our pathway forward,"

Rodney Varner, President and Chief Executive Officer of Genprex.

The Company signed an exclusive license agreement with the University of Pittsburgh in 2020. The gene therapy approach under the original license is comprised of a novel infusion process that uses an endoscope and an adeno-associated virus (AAV) vector to deliver Pdx1 and MafA genes directly to the pancreas.

In models of Type 1 diabetes, these genes express proteins that transform alpha cells in the pancreas into functional beta-like cells, which can produce insulin but are distinct enough from beta cells to evade the body’s immune system.

In Type 2 diabetes, where autoimmunity is not at play, it is believed that exhausted beta cells will be rejuvenated and replenished.

This gene therapy approach was developed by Dr. Gittes. His preclinical research in this area has been published in peer-reviewed scientific publications, and he is the recipient of several research grants, including a $2.59 million grant awarded by the National Institutes of Health (NIH) National Institute of Diabetes and Digestive and Kidney Diseases.

Earlier studies in diabetic mouse models showed that the gene therapy restored normal blood glucose levels for an extended period of time, typically around four months.

It is believed that the duration of restored blood glucose levels in mice could translate to decades in humans. Preliminary data from a more recent study in a non-human primate model of Type 1 diabetes also have been promising. Data from this study are expected to be presented at a scientific meeting during the first quarter of 2023.

Sources

- Source 1: https://www.proactiveinvestors.com/companies/news/990266/analysts-at-noble-capital-reiterate-outperform-rating-and-5-price-target-on-genprex-990266.html

- Source 2: https://www.barchart.com/stocks/quotes/GNPX/price-history/historical

- Source 3: https://www.precedenceresearch.com/gene-therapy-market

- Source 4: https://finance.yahoo.com/news/genprex-strengthens-diabetes-gene-therapy-120000127.html

- Source 5: https://noblecapitalmarkets.com/accredited-investor.php

- Source 6: https://www.channelchek.com/news-channel/Noble_Capital_Markets_Analyst_Profile___Robert_LeBoyer

- Source 7: https://schrts.co/ChDZrRnn

- Source 8: https://www.tradingsim.com/day-trading/descending-triangle

- Source 9: https://www.cellandgene.com/doc/cell-gene-therapies-investment-outlook-in-beyond-0001

- Source 10: https://www.genprex.com/wp-content/themes/kaloolon-genprex/assets/brand/logo-full.svg

- Source 11: https://singularityhub.com/wp-content/uploads/2019/06/gene-editing-vitro-genetics-crispr-genome-shutterstock-1241172154-1068×601.jpg

- Source 12: https://finance.yahoo.com/news/genprex-ceo-commends-fdas-initiative-113000136.html

- Source 13: https://finance.yahoo.com/news/genprex-unveils-video-featuring-chief-113000103.html

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media LLC and Lifewater Media, Virtus Media LLC has been hired by Lifewater Media LLC for a period beginning on 02/16/2023 and ending 02/21/2023 to publicly disseminate information about NASDAQ: GNPX via digital communications. We have been paid fifteen thousand dollars USD. Pursuant to a further agreement between Virtus Media LLC and Lifewater Media LLC, Virtus Media has been hired for a period beginning on 4/17/23 and ending 4/19/23. We have been paid fifteen thousand USD. Pursuant to a further agreement between Virtus Media LLC and Lifewater Media LLC, Virtus Media has been hired for a period beginning on 5/25/23 and ending 5/26/23. We have been paid seven thousand five hundred USD.