SIYATA MOBILE INC., (NASDAQ:SYTA)

6 Reasons Why Siyata Mobile Inc. (NASDAQ: SYTA) Could See Unstoppable Growth Within The Next 12 Months Starting Now!

LATEST NEWS

Siyata Mobile Inc. (NASDAQ: SYTA) Expands Reach of Their Next Generation Push-to-Talk Over Cellular Solution (PoC) to a New Vertical Market

Thomas Kerr, CFA, a Senior Equity Research Analyst at Zacks Recently Assigned A $2.50 Valuation On Siyata Mobile Inc. (NASDAQ: SYTA)

Thomas Kerr, CFA is a Senior Equity Research Analyst at Zacks Small-Cap Research with over 25 years of securities industry experience in Technology, Consumer, Industrials, Med-Tech, Healthcare & Biotechnology sectors recently assigned a $2.50 valuation on Siyata Mobile Inc. (Nasdaq: SYTA) on November 14th, 2022.

The company reported 3rd quarter 2022 results on November 10th which demonstrated strong growth for the SD7 rugged handset. Revenues for the quarter ending September 30, 2022 were $2,567,885 compared to $1,218,875 for the 3rd quarter of 2021. This 111% increase over the prior year period was primarily due to the increase in the sale of rugged devices including the SD7 rugged handset during the quarter.

Sales related to rugged handsets and accessories increased 588% to approximately $1.9 million.

Gross profit for the 3rd quarter was $856,103 (gross margin of 33.3%) compared to $429,513 (gross margin of 35.2%) for the 3rd quarter of 2021. The gross margin decline was largely attributed to lower sales of higher-margin cellular boosters.

Adjusted EBITDA was negative $1,579,980 for the quarter versus negative $4,869,303 in the same prior year period, an improvement of $3,289,323. This improvement was due to increased revenue, increased gross profit, and a decrease in operating expenses. The company defines adjusted EBITDA as the net operating loss excluding depreciation and amortization, unusual items, and stock compensation.

Net loss for the 3rd quarter was ($499,991) as compared to a net loss of ($5,667,937) in the prior year period. Part of the large improvement in net loss was driven by a positive change in fair value of warrant liability totaling $2,680,603. Excluding that gain and other unusual items, we calculate the net loss at ($2,734,037), or ($0.17) per share.

As of September 30, 2022, the Company had cash balances of $988,626 compared to $1,619,742 at the end of 2021. Working capital at quarter end was $4,951,595. Subsequent to the end of the quarter, the company raised approximately $4.0 million in proceeds from a registered direct offering from institutional investors.

CEO and founder Marc Seelenfreund stated, “We delivered on our plan to build and expand our potential customers for the SD7 during the third quarter, providing us with a foundation of increased distribution that is directly leading to many potential significant volume opportunities, of which we have begun shipping products in an increasing number of verticals beyond our primary focus on first responders, including: government, schools, utilities, security companies, defense contractors, amusement parks, and hotel resorts, to name but a few,” continued Seelenfreund. “We are just beginning to see the rapid adoption of our disruptive solutions and as the displacement of land mobile radio (LMR) by PoC continues to progress, this should drive meaningful growth for our innovative products, such as the newest addition to our lineup, the SD7+, which integrates body camera functionality with 4G cellular connectivity and PoC features in a single solution.”

Siyata Mobile Inc. (Nasdaq: SYTA) recently announced a new rugged handset, the SD7+, which features a wide-angle camera coupled with 4G cellular connectivity that will have traditional body camera functionality.

It will also encompass real-time situational and positional tracking capabilities. The SD7+ will be powered by Visual Labs’ innovative body camera software.

Visual Labs is a privately held company and a leading developer of Android-based bodycam and dashcam software. Visual Labs provides its software to public safety, private security, and other customers throughout the United States and internationally.

IDENTIFYING THE OPPORTUNITY

Support Bounces Are Profit Rocket Fuel!

Strong bounces off of a strong support level provide us with ideal risk-to-reward and clear levels to trade

TRADE CONFIRMATION

Locked and Loaded, stock infamous for 100% + moves every bounce off of our support zone! With the break and hold of .18 we are setting up for next leg up, and this stock has a tendency to have strong impulsive moves. With a recent break of the 50 MA on the daily chart, and approaching a bullish move of the 200 MA, we are setting up for a run.

The last day that $SYTA closed above the 50MA on the daily chart, we had a break out of over 65% in mid January.

Watch for volume over 7 million on daily chart and over 1 million the first hour of market open as a precursor to breaking out.

TARGETS

$.212 (+25%)

$.25 (+40%)

$.30 (+75%)

$.38 (+120%)

Could SIYATA MOBILE INC. (NASDAQ: SYTA) REACH THE ZACKS' TARGET $2.50 VALUATION?

Shares of Siyata Mobile Inc. (Nasdaq: SYTA) recently bounced off its 52-week low of $.1051 on 11/09/2022 and with a 52-week high of $ 5.4763 set on 12/09/2021, there could be over 5,110% in upside potential if (SYTA) climbs back to that 52-week high level according to the historical pricing available at Barchart.com. To be fair, a 5,110% move back to the 52-week high is not expected, but the potential should be noted.

Looking at the daily chart above while doing very little technical analysis using StockCharts.com, you can see the following moving averages:

Daily average price is: $.14 (as of 12/8/22)

50-day moving average at $.17

200-day moving average at $.78

14-day exponential moving average $.16 (first line of potential resistance)

If shares of (SYTA) trend above its first line of resistance in the $.14 cent range, where they are very close to breaching as of 12/8/22, then the next line of potential resistance could be its 50-day moving average at $.17 which would be a 23.19% move from 12/8/22’s opening price of $.138.

But then, the next line of potential resistance for (SYTA) could be its 200-day moving average at $.78, which would be a 465.22% move from 12/8/22’s opening price of $.138.

Make no mistake, if (SYTA) is able to climb from 2/8/22’s opening price of $.138 back to its 52-week high of $5.4763 which was set on 12/09/2021, it would be capping off an incredible 5,110% move. This move isn’t expected, but the potential upside needs to be noted.

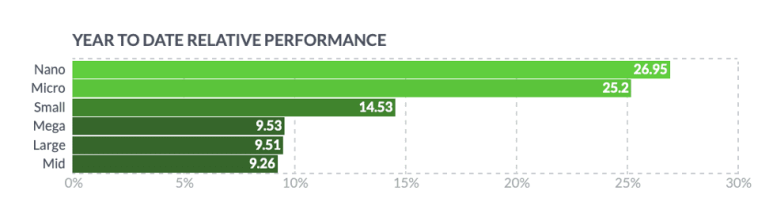

Massive Potential Growth Curve for Nano-cap Stocks

A nano-cap company is one of the smallest companies in the market.

Siyata Mobile Inc. (Nasdaq: SYTA) currently has a market cap of less than $2.5 million as of 12/8/22 according to MarketWatch.com. Companies this size are known as Nano-cap stocks.

Nano-caps have a market capitalization of less than $50 million. With a tiny nano-cap company, you could potentially witness a massive growth curve.

According to a study from Tradesmith.com, nano-cap stocks outperformed all other market capitalizations during a specific period in 2021 based on their report.

This potential scales well in any portfolio.

Nano-cap companies tend to be much more flexible than their larger counterparts. When you are small, you can adapt to the changing conditions in the market much more quickly than a larger company.

In addition to this, smaller companies tend to rely on innovation and new ideas in order to stay in business. They will often be able to get things to the market quicker than a large company.

A larger company will require a new idea to go through several different decision-makers and committees before the result of it can hit the market.

WILL "PUSH-TO-TALK" FUEL THE 4TH INDUSTRIAL REVOLUTION?

Enterprises are going through another industrial revolution known under different names, including Industry 4.0, Digital Transformation, and the Industrial Internet of Things (IIoT). The goal of the implementation of this revolution is to improve efficiency, value, and innovation.

Push-to-talk over cellular or PoC solutions is becoming increasingly popular, which is increasing the growth of the global push-to-talk market.

Large corporations are putting in place cloud-based push-to-talk solutions that offer multimedia features, real-time security, and greater use of wireless Push-to-Talk services.

Likewise, it offers improved call management, cost control, and greater convenience, fueling the expansion of the global push-to-talk market.

Other significant factors are the expanding use of push-to-talk in public safety organizations and the increased demand for rugged and ultra-rugged cell phones.

A rapid increase in the push-to-talk market is also projected as a result of the introduction of cutting-edge technologies like the LTE network and the development of 5G infrastructure.

There will be a range of changes coming for the push to speak market as a result of the Internet of Things (IoT), AI, NLP, and the rising use of online applications.

Thus, there is enormous potential for growth in the industry.

The global push-to-talk market is projected to grow at a positive CAGR of 8.9%, reaching $59.81 billion by 2030.

Meet the Siyata Mobile Inc. Management Team Leading the Communications Revolution into the 21st Century

OFFICERS

DIRECTORS

Sources

- Source 1:https://s27.q4cdn.com/906368049/files/News/2022/Zacks_SCR_Research_11142022_SYTA_Kerr.pdf

- Source 2: https://www.barchart.com/stocks/quotes/SYTA/price-history/historical

- Source 3: https://www.finweb.com/investing/4-reasons-to-invest-in-a-nano-cap.html

- Source 4: https://www.marketwatch.com/investing/stock/syta?mod=search_symbol

- Source 5: https://www.siyatamobile.com/wp-content/uploads/2022/08/Siyata-Mobile-Investor-Presentation-Q3-2022-2022-08.pdf

- Source 6: https://www.siyatamobile.com/wp-content/uploads/2021/11/SYTA-One-Pager_Nov-23-2021.pdf

- Source 7: https://www.securitymagazine.com/articles/97324-private-mobile-networks-will-fuel-the-4th-industrial-revolution

- Source 8: https://www.commercient.com/wp-content/uploads/2019/03/The-Fourth-Industrial-Revolution-The-Rise-Of-The-Intelligent-Era-2.jpg

- Source 9: https://www.globenewswire.com/news-release/2022/10/21/2538979/0/en/Push-To-Talk-PTT-Market-Size-to-Reach-USD-59-81-Billion-by-2030-Future-Projections-Emerging-Technical-Advancements-Recent-Initiatives-and-Growth-Opportunities-Adroit-Market-Researc.html

- Source 10: https://s27.q4cdn.com/906368049/files/design/zacks_scr.svg

- Source 11: https://finance.yahoo.com/news/siyata-mobile-adds-uk-ireland-130000242.html

- Source 12: https://www.siyatamobile.com/wp-content/uploads/2022/02/homepage-SD7-Front-v2.png

- Source 13: https://www.siyatamobile.com/

- Source 14: https://www.siyatamobile.com/wp-content/uploads/2020/09/booster_img.png

- Source 15: https://www.amazon.com/Uniden-Cradle-Signal-Booster-Carriers/dp/B09MTY562X

- Source 16: https://www.siyatamobile.com/uniden-uv350/

- Source 17: https://www.siyatamobile.com/uniden-cp250/

- Source 18: https://www.siyatamobile.com/uniden-ur5/

- Source 19: https://schrts.co/iHhbBcPk

- Source 20: https://tradesmith.com/educational/this-market-cap-strategy-is-crushing-the-nasdaq/

- Source 21: https://www.siyatamobile.com/directors-officers/

- Source 22: https://www.siyatamobile.com/siyata-launches-next-generation-push-to-talk-over-cellular-sd7-device-on-verizon-global-network/

- Source 23: https://www.siyatamobile.com/siyatas-next-generation-push-to-talk-over-cellular-sd7-device-is-now-commercially-available-and-sold-through-firstnet-and-att-inc/

- Source 24: https://www.cnet.com/a/img/resize/409f3c87a1c14d4edc95e1b423fd14061df0c9d7/hub/2014/10/31/64b38597-6e50-4566-8786-9d5e8cd2da52/att-verizon.jpg?auto=webp&width=1200

- Source 25: https://blog.nuovoteam.com/what-is-push-to-talk-over-cellular-poc/

- Source 26: https://www.intel.com/content/www/us/en/history/virtual-vault/articles/end-user-marketing-intel-inside.html

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and promote small public companies. By reading our website / media webpage you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our website / media webpage .We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website / media webpage are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. Virtus Media business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company's website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers' works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer's communications regarding the profiled company(s). You should assume all information in all of our communications in incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Compensation: Pursuant to an agreement between Virtus Media LLC and Lifewater media LLC, Virtus Media has been hired for a period beginning on 2023-02-22 and ending after 2023-02-24 to publicly disseminate information about NASDAQ: SYTA. We have been paid fifteen thousand dollars USD via ACH Bank Transfer.