7 Reasons Why Grid Battery Metals Inc. (OTCQB: EVKRF) (TSXV: CELL)

Could See Significant Upside Potential In 2024

LATEST NEWS

Grid Battery Exploration Team Reports its MT Geophysics Survey Results on the Clayton Valley Lithium Project

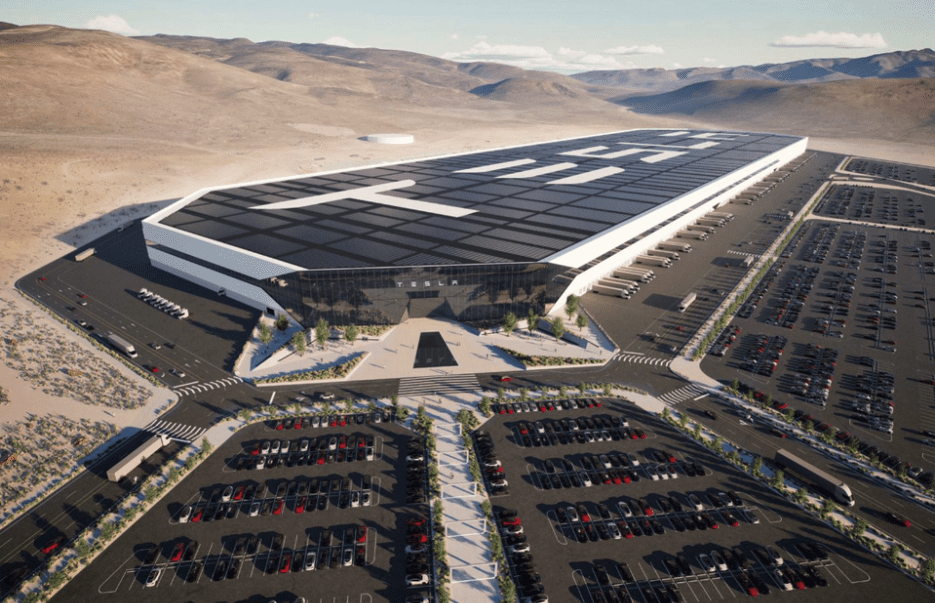

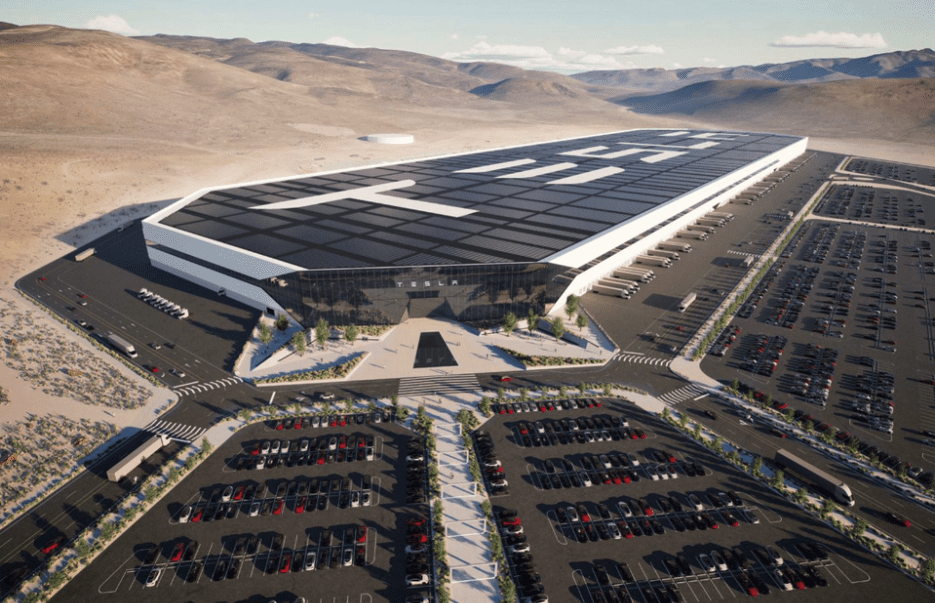

Tesla's Nevada Plant Gears Up For Groundbreaking Battery Cell Production With $3.6 Billion Investment(5)

Tesla, Inc. (Nasdaq: TSLA), the world’s leading electric vehicle manufacturer, recently announced a major expansion of its Nevada assembly plant, with a substantial investment in the production of a new type of battery cell and a dedicated factory for its Semi truck. The company plans to invest $3.6 billion in a plant dedicated to manufacturing 4680 lithium-ion cells and a facility for producing the Tesla Semi. (5)

As the demand for battery metals like lithium continues to soar, companies like Grid Battery Metals Inc. (OTCQB: EVKRF) (TSXV: CELL) are poised to benefit from this growing market. (15)

Grid Battery Metals Inc. (OTCQB: EVKRF) (TSXV: CELL), with its focus on exploration and acquisition of battery metals required for the EV market, stands as one battery metals exploration company to keep a close eye on. (15)

U.S Electric Vehicle Sales Up 66%, Rise To 7% Of U.S. Auto Sales

Exclusive Interview: Grid Battery Metals Inc. (OTCQB:EVKRF) (TSXV:CELL) CEO Unveils Nickel And Lithium Prospects

Volatility Meets Potential

We have tested this level multiple times and had strong moves multiple times. Now we are in an ideal risk-to-reward zone again.

TARGETS

$0.0680 (+90.48%)

$0.1115 (+212.35%)

$0.1597 (+347.34%)

$0.1830 (+412.61%)

POTENTIAL SUPPORT: $0.0293

Grid Battery Metals Inc.

(OTCQB:EVKRF)

Grid Battery Metals Strong Balance Sheet Expedites Exploring Premium Lithium And Nickel Assets

Grid Battery Metals Inc. (OTCQB: EVKRF) has what many of its peers don't- a strong balance sheet. In fact, EVKRF recently announced that it's fully funded to complete all of the next year's exploration initiatives. That's more than a distinction; it's a value driver. And at current share prices, and with EVKRF being better positioned than ever to expedite exploration activities, it's one of many contributing to a value proposition too good to ignore.

Many investors aren't. They recognize what EVKRF is telling the markets and potential investors: EVKRF is timely to massive revenue-generating opportunities with an in-progress program to extract value from its 100% owned interests in properties owned in mining-friendly Nevada and British Columbia. But not just any locations. EVKRF is exploring where historical precedent supports significant potential and likelihood to unearth considerable lithium and nickel reserves. If precedent holds, a strong case supports a steepening trajectory for EVKRF's share price. That's not an overly ambitious proposition.

It's supported by knowing that even sitting atop proven reserves can be an enormous value driver. That's evidenced by precious metals miners earning market caps in the billions before bringing even an ounce of metal to the surface. That same potential is in play for Grid Battery Metals, especially with major EV and battery sector companies needing what EVKRF intends to provide- lithium and nickel.

Grid Battery Metals Inc.

(OTCQB:EVKRF)

Demand For Lithium And Nickel Is Surging

Indeed, like every exploration and mining company, EVKRF is a speculative play. However, in this case, the speculative nature is mitigated by EVKRF being in the right places with the right assets at the right time. Still, location is just one part of the equation. To be successful, miners need to earn revenues higher than expenses, an intention EVKRF has by serving EV and battery metals market clients that are expected to generate an over trillion-dollar combined revenue generating opportunity within the next decade.

Headlines prove that point. Tesla (NASDAQ: TSLA) CEO Elon Musk makes many, sharing his opinion about the need for lithium and nickel to fuel his products. He's hinted at his company creating its own mining program to support its critical lithium needs. Perhaps that's rhetoric, but it does expose how valuable being positioned to provide these battery metals can be. In addition to supporting the virtually limitless near-term market potential for small exploration companies like EVKRF, it opens doors to partnership opportunities. That makes sense. Getting the proper permits to explore can take decades. And from there, it can take years to bring lithium and other battery metals above ground.

Hence, a better, faster, and more efficient strategy would be for these behemoths to instead partner with a company already permitted and showing potential to tap into vast reserves. Grid Battery Metals checks those boxes. And interest can come from many besides Tesla. General Motors (NYSE: GM), Ford (NYSE: F), Stellantis (NYSE: STLA), and Rivian Automotive (NASDAQ: RIVN) are other names sharing an interest in sourcing every bit of lithium and nickel they can find to power their battery-powered vehicles. And while demand is skyrocketing in 2023, it's expected to increase from here, with estimates suggesting that over 60% of cars will be battery-powered by 2030.

Those numbers support EVKRF being in the sweet spot of opportunity. And in this instance, share price size doesn't matter; having the right assets to explore does. Grid Battery Metals checks that box as well. In fact, EVKRF has 100% interest in claims in Nevada and British Columbia, two of the world's most mining-friendly jurisdictions. That positions them well to capitalize on and maximize its revenue-generating opportunities through a go-it-alone or partnership strategy. And remember that the EV sector is just one contributor to EVKRF's mission to grow bigger. Battery producers also need mountains of these critical metals to support their business, which opens billions more in potential dollars earned.

Grid Battery Metals Inc.

(OTCQB:EVKRF)

Grid Battery Assets Located Near Proven Locations

Capturing its share of that potential is certainly in the Grid Battery playbook. That expectation can materialize from EVKRF doing an excellent job of aligning itself with the battery metals sector's vision and mission to reduce carbon footprints and excavate in an environmentally friendly way. Grid Battery is more than supportive of those measures; it can achieve them using a low-overhead exploration strategy that replaces outdated and environmentally destructive exploration and development models.

That difference matters. As importantly, embracing those values can be the difference between getting permits and clients or not. Grid Battery has created its plan to ensure scoring both. That's timely, especially ahead of undeniable global consumer trends and initiatives supporting eliminating fossil and carbon fuels as a primary power source. The auto manufacturers are the front line and are doing their part to produce more EVs for sale on a consecutive yearly basis. That production number continues to grow, compounding from the number of car and truck models designed, built, offered, and sold. And that already compounding rate is rising as governments offer EV subsidies for consumers and manufacturers, shifting an already fast pace of adoption into warp speed. Tesla alone is on a mission to produce and sell twenty million EVs annually by 2030. But know this: those vehicles are just shiny showroom models without batteries. And Tesla is only one manufacturer. The Big Three automakers and niche sellers expect to sell millions as well.

That's excellent news for a company like Grid Battery Metals, which can equate EV sector growth with the number of batteries needed to power the products. In that respect, even the most bearish expectations for EV market penetration require upwards of 10X current battery production. It's a tall order indeed. However, to help meet that need, Canada and the US, among others, have committed to supporting the mining industry, evidenced by legislation providing financial and functional support to the mining industry as part of a more significant intention of transforming a current carbon-burning products environment into clean power technology.

Grid Battery Metals Inc.

(OTCQB:EVKRF)

Grid Battery Metals Inc.Exploring Premium Locations At Mining-Friendly Jurisdictions

Grid Battery intends to contribute to that transformation, a goal they can achieve through an impressive and promising asset portfolio that continues to strengthen. In 2023, the company added two highly prospective lithium properties to its Nevada portfolio, the Texas Springs Property, and the Volt Canyon Property, increasing its Nevada prospects that already included its Clayton Valley Lithium assets. Management noted that its team is exploring the Texas Springs Property, with planned summer/fall 2023 exploration underway. It comprises a CSAMT geophysical survey and a detailed soil sampling of 50 m X 100 m spacing. The CSAMT survey is used to gather information about subsurface resistivity and geology, which can help predict geological structures and locations for lithium. Results from the two exploration programs will help define and design its 2024 exploration plan, including identifying possible drilling locations for clay-based lithium targets.

EVKRF is optimistic they can extract the value associated with each site. The company noted that its Texas Springs Property adjoins the southern border of Surge Battery Metals' (TSXV: NILI, OTC: NILIF) Nevada North Lithium Project, which, in its first round of drilling, identified strongly mineralized lithium-bearing clays. Further supporting EVKRF optimism, Surge Battery recently announced the results of its most recent drilling program at this property, saying it recorded its highest grades to date, with up to 8070 ppm Lithium on the Northern Nevada Lithium project.

Grid Battery is equally optimistic about its Clayton Valley Lithium Project. There, they intend to follow the recommendations of its NI #43-101 Technical Report to continue a multi-phased exploration program. The initial phase includes building the geologic infrastructure through data compilation and initial auger sampling to collect lake-bed material below the sand dunes and alluvial cover. The second phase will help determine the sub-surface structure and topography to identify drill targets following a geophysical survey using gravity, seismic, or magnetotelluric techniques. Phase three would be to drill the best targets identified in the first two phases, including drilling, assaying, permits, and reporting.

Grid Battery Metals Inc.

(OTCQB:EVKRF)

Exploiting Inherent Value In Q4/2023 And 2024

All told, heading into Q4 and next year, Grid Battery looks ideally positioned to exploit value from its promising assets. That position exposes a valuation disconnect between share price, assets, and inherent potential. In fact, a strong case can be made that EVKRF could be on track to re-claim its 52-week high of $0.17, over 113% higher than its current price.

That bullish assessment isn't made on blind faith. Instead, it's one supported by tangibles as well as inherent potentials, including value from its 100% interest in the Texas Spring Property, its 100% interest in 113 lithium lode and placer claims covering over 640 hectares in Clayton Valley, and its 100% interest in 80 placer claims covering approximately 635 hectares of alluvial sediments and clays located 122 km northeast of Tonopah, Nevada, at its Volt Canyon Lithium project. And those aren't the only value drivers.

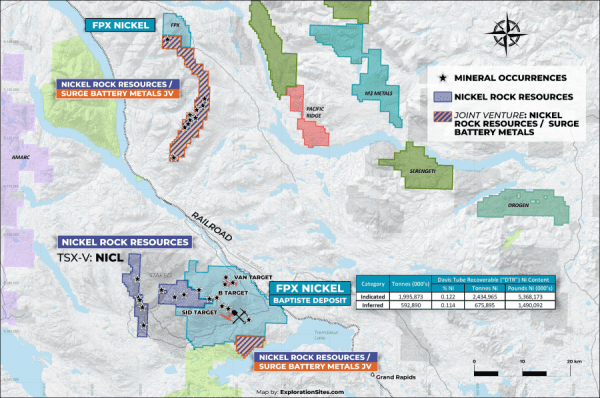

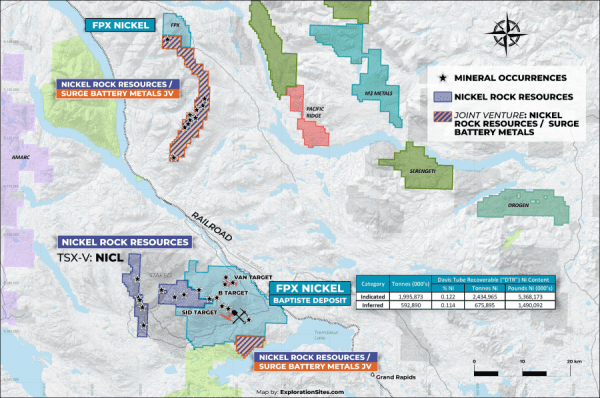

Grid Battery is exploring additional opportunities related to its British Columbia nickel projects. Its Mount Sidney Williams Group consists of three claim blocks with a total area of 10,569 hectares. Notably, those are nearby and, in some instances, adjoin the Decar project of FPX Nickel Corp. (OTC Other: FPOCF). Its Mitchell Range Group area claim consists of one claim block covering 8,659 hectares with demonstrated metallic mineralization, including nickel, cobalt, and chromium.

Here's the bottom line: Grid Battery Metals value proposition isn't built on hype; it's presented by assets owned, pace of exploration, a balance sheet that can fund operations, and, as importantly, getting nearer to the potential of delivering critical battery metals to massive global demand. That combination presents more than an attractive investment opportunity. Because it puts monetization in the crosshairs, either alone or through a partnership, it exposes a compelling one.

Sources

- Source 1: https://gridbatterymetals.com/

- Source 2: https://gridbatterymetals.com/news/

- Source 3: https://gridbatterymetals.com/corporate-presentation/

- Source 4: https://gridbatterymetals.com/corporate-factsheet/

- Source 5: https://gridbatterymetals.com/exploration-projects/

- Source 6: https://gridbatterymetals.com/texas-spring/

- Source 7: https://gridbatterymetals.com/clayton-valley-project/

- Source 8: https://gridbatterymetals.com/volt-canyon/

- Source 9: https://gridbatterymetals.com/grid-nickel-group/

- Source 10: https://gridbatterymetals.com/management/

- Source 11: https://gridbatterymetals.com/corporate-governance/

- Source 12: https://finance.yahoo.com/quote/EVKRF/

- Source 13: https://finance.yahoo.com/news/grid-battery-metals-announces-plan-113000179.html

- Source 14: https://gridbatterymetals.com/grid-battery-metals-provides-a-financial-update/

- Source 15: https://finance.yahoo.com/news/grid-battery-exploration-team-reports-113000008.html

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and promote small public companies. By reading our website / media webpage you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our website / media webpage .We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website / media webpage are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. Virtus Media business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company's website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers' works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer's communications regarding the profiled company(s). You should assume all information in all of our communications in incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Compensation: Pursuant to an agreement between Virtus Media LLC and Lifewater media LLC, Virtus Media has been hired for a period beginning on 2023-09-11 and ending after 2023-09-20 to publicly disseminate information about OTCQB: EVKRF. We have been paid seven thousand five hundred dollars USD via ACH Bank Transfer. Pursuant to a further agreement between Virtus Media LLC and Lifewater Media LLC, Virtus Media has been hired for a period beginning on 10/16/23 and ending 10/18/23. We have been paid seven thousand five hundred USD. Pursuant to a further agreement between Virtus Media LLC and Lifewater Media LLC, Virtus Media has been hired for a period beginning on 04/22/24 and ending 04/23/24. We have been paid three thousand five hundred USD. Virtus Media LLC agrees to pay social media influencer 1 two hundred dollars USD, social media influencer 2 one hundred dollars USD, social media influencer 3 six hundred dollars USD, social media influencer 4 two hundred fifty dollars USD, social media influencer 5 three hundred fifty dollars USD. Pursuant to a further agreement between Virtus Media LLC and Lifewater Media LLC, Virtus Media has been hired for a period beginning on 05/08/24 and ending 05/09/24. We have been paid six thousand USD. Virtus Media LLC agrees to pay social media influencer #1 two hundred dollars and social media influencer #2 three hundred dollars and social media influencer #3 three hundred fifty dollars and social media influencer #4 six hundred dollars and social media influencer #5 two hundred fifty dollars and social media influencer #6 three hundred dollars and social media influencer #7 four hundred dollars.