Insiders are holding and still own over 37% of the shares.2

The Nasdaq Listed Company That Just Might Streamline

The $12 Trillion Grocery Market?

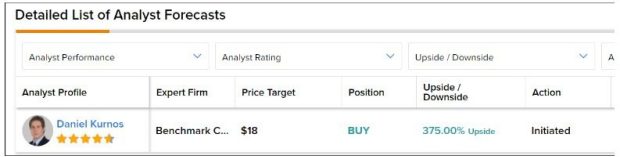

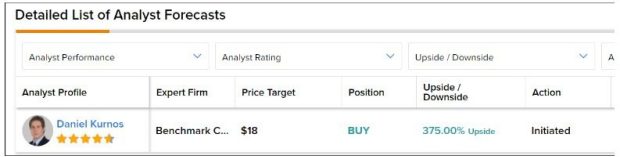

Benchmark’s Equity Research Team Initiates Coverage On A2Z Smart Technologies Corp. With An $18.00 Price Target.1

Build your watchlist with us

Get the latest stock ideas direct to your inbox. 100% free and your information stays with us.

The next time you go grocery shopping, the only reason you might even pay attention to your cart is because of a bum wheel that is either stuck or keeps turning around and around as you push it up and down the aisles.

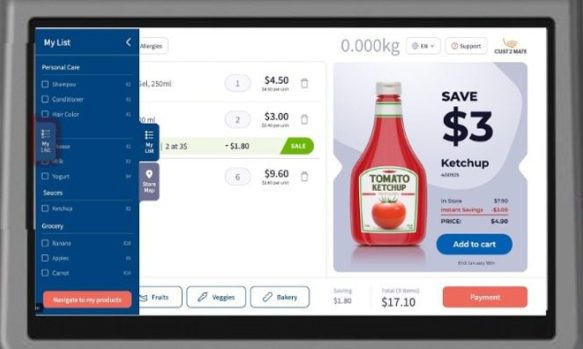

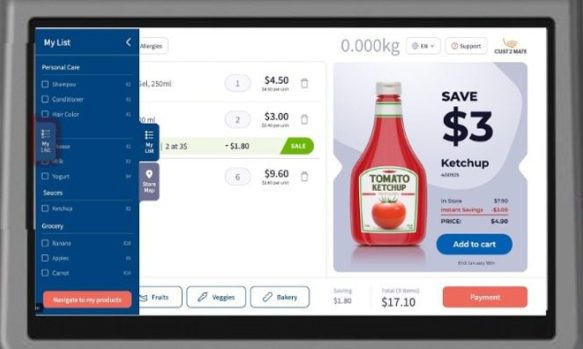

But given the pace of innovation lately, there’s a good chance that when you go grocery shopping later this year, you might notice your shopping cart has a touchscreen, a digital scale for weighing produce, and that it automates the checkout process for you.

In other words, your shopping cart is getting smarter, your time standing in the checkout line is getting shorter, and the time to research the companies making this possible is now.

You can check out the Cust2Mate Smart Cart Platform by clicking on video.6

9 Exciting Reasons That Could Make A2Z Smart Technologies (AZ) One of The Most Talked About Stories While Waiting In Line At the Grocery Store.

1.

According to a report by Research and Markets, the global smart shopping cart market is expected to grow over 400% by 20261–And A2Z Smart Technologies is a technology company focused on providing retail automation solutions with smart carts, in particular for large grocery stores and supermarkets.1

2.

The mobile payment market size was valued at $980 billion in 2020 and is projected to reach $15.7 trillion by 2028 according to a report by Verified Market Research – Cust2Mate intends to become the leading mobile checkout system in the international market, providing a solution to the hassles of shopping for both consumers and retailers.1

3.

A hungry market. There are around 63,419 Supermarkets & Grocery Stores businesses in the US alone as of 2022, with an average of 300 carts per store, which implies over 19 million shopping carts–This could prove to be a massive opportunity for Cust2Mate.1

4.

Change in the grocery space is long overdue and as highlighted by Accenture, this change is being driven by the consumer, “consumers are clear that they want grocers to step up and help them change their lives for the better. A huge 85% said they want grocery retailers to help them make a whole range of changes in the way they live, shop and eat. For example, consumers are looking for help when it comes to saving time (59%), reducing food waste (61%), and making the process of grocery shopping easier (61%)”.11

5.

Cust2Mate already has a proven smart cart with multiple pilots around the world, including in the US, and an existing $10 million order in Israel.3 They are currently in pilots in the US, Mexico, and Israel and have entered into major regional partnerships in Asia, Europe, and North America.1

6.

Big players are moving into this space and snapping up smart cart companies–In late 2021, InstaCart announced that it was paying $350 million to acquire Caper AI, a startup that builds smart cart and cashier-less checkout technology that uses computer vision and other techniques to detect items and ring them up for shoppers.8

7.

Cust2Mates management team is best in class with over 500 years combined retail experience having held executive positions in some of the largest point-of-sales companies in the world including NCR and Toshiba. They have created a retail solution built by retail for retail.7

8.

Carts are already compatible with existing NCR and Toshiba point of sales which makes Cust2Mate the only Plug and Play solution in the market, needing only wifi and a power source in most large grocery chains. They also come in 4 sizes so they can be easily integrated into stores of varying sizes, from local corner stores to megastores.7

9.

Benchmark’s Equity Research team is one of the more experienced on the Street. Their analysts have, on average, over two decades of equity research experience and many also have substantial work experience in the industries they cover–Their analyst Daniel L. Kurnos, CFA, has initiated coverage on A2Z Smart Technologies with a Buy rating and issued an $18 price target.1

*According to FinViz’s website, A2Z Smart Technologies insiders still own 37.99% of shares (as of 5/10/22).2

TipRanks.com, a company that ranks analysts and tracks their performance, rates Daniel L. Kurnos with 4.5 out of 5 Stars. 9

A2Z Smart Technologies Looking to Streamline the Massive Grocery Market with Cust2Mate Smart Carts.

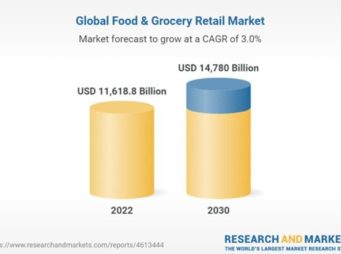

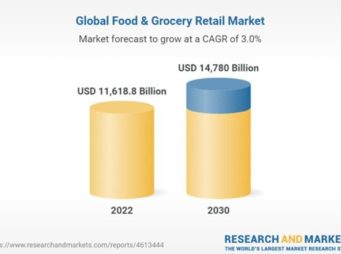

According to a report by Research & Markets, the global food & grocery retail market size is expected to reach USD 14.78 trillion by 2030.10

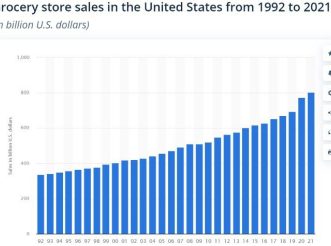

The total sales generated by grocery stores in the United States in 2021 were over $803 billion dollars–and shows no signs of slowing down…12

As big as the grocery market industry is across the world–there has only been a little buzz about advancements in this space until recently.

New technology is aiming to take the biggest pain out of grocery shopping.

Like waiting in the checkout line…

Do Not Waste Another Minute Of Your Life Standing In Line

Waiting in line at the grocery store–or any store for that matter is one of the most frustrating parts of the entire shopping trip.

You’d have to agree…

It sometimes feels like a nightmare when you’re standing in a checkout line and you are in a hurry, and the customers who are checking out in front of you seem like they have all the time in the world.

You pretend not to be mad. You look around to see if something could take your mind off of the rage building up inside of you as you suddenly catch a glimpse of the customer in front of you still looking for their wallet to pay the cashier.

You try to remain calm… but in your head, you start to question the intelligence level of the customers in front of you…

“How could they not be ready to pay?”

“Why is this person still looking for their wallet?”

The customer in front of you looks back at you and apologizes to you for the delay.

You smile and say, “No it’s okay. Take your time.”

Finally… It’s your turn to checkout.

The Wait is Over–Finally

A2Z Smart Technologies and Cust2Mate have developed a solution that may help streamline the $12 trillion grocery market.

Cust2Mate is the world’s first proven-in-use self-checkout (SCO) smart cart for retail markets.13

It leverages advanced, user-friendly technologies to streamline your shopping while boosting the efficiency of store management.13

Designed to keep you out of the line…

However, today’s systems are fragmented and cannot quickly convert any transaction from whatever payment source to accepted fiat. It’s not a big problem with smaller items under $100. It’s become quite the hassle with larger items like down payments or full payment for cars, houses, or boats.

This capability is not integrated into their payment systems. They have to leave their system and depending on what cry-pto their customer is using, the merchant has to use 3 to 5 other systems for conversions and uploads and downloads, and transfers. (11)

It’s not so much a regulatory issue either. The use of cry-pto is legal in the US, most of Europe and Canada, however It’s illegal to use cry-pto in China and a few other countries. (12)

AppTech’s platform on the other hand, has this capability integrated. One can pay in any acceptable form and converted on the fly to the currency of the sale.

How big is this?

According to the report, the Global Payment Gateway Market is expected to generate a revenue of $67.4 billion by 2028, growing exponentially at a CAGR of 16.6% during the forecast period (2021-2028). (13)

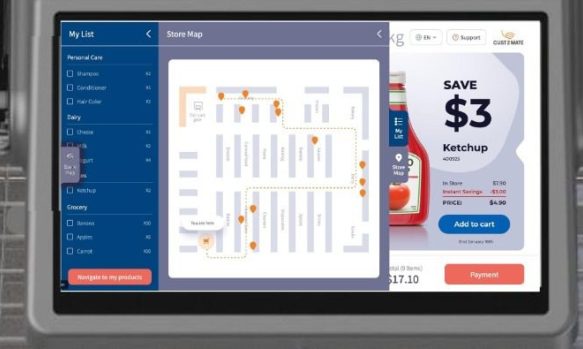

The smart cart can also notify you of special offers chosen by store managers.

When you select a product, Cust2Mate’s sophisticated computer vision system, with its touch screen and integrated scanner take over, acting as a mobile cash register.

Special cameras identify and scan the barcode of each item placed in the cart.

A built-in trade-legal scale calculates the price of sold-by-weight items.

The cart’s smart algorithm ensures that you can easily keep track of your purchases while protecting the store against fraud.13

Cust2Mate is so smart it can even identify and ignore personal items, or children if they’re placed in the cart.13

Cust2Mate was designed for ease of use and increased revenues.13

While its user-friendly graphic user interface makes shopping faster and more pleasant for you, it also delivers focused direct advertising that guides you to special store promotions and discounts.13

When you’re finished shopping, Cust2Mate’s onboard payment system eliminates the need to stand in check-out lines.13

Instead, the entire purchase is paid for right on the cart, so you can simply roll it out of the market and you’re done.13

How does that compare to standing in line and waiting for the customer in front of you to find the exact change?

Demand For Smart Carts Expected to Quadruple by 20261

Cust2Mate has taken a proactive approach to the anticipated demand for smart carts.

Cust2Mate recently announced that it has signed an agreement with Flex, a global diversified manufacturer, for the production of its Cust2Mate Smart Carts for the retail industry.14

Flex has facilities in 30 countries as well as state-of-the-art logistics, manufacturing, and supply chain capabilities.14

The intent of the partnership is to support A2Z in meeting the anticipated demand and improving delivery times to their customers worldwide.14

The advanced manufacturing, logistics, and shipping capabilities that Flex offers could be leveraged by A2Z to initiate pilot programs with minimal downtime and expedite the delivery of the Cust2Mate Smart Cart Platform to customers anywhere in the world.14

Get the latest stock ideas direct to your inbox.

100% free and your information stays with us.

A2Z Smart Technologies Corp.

A2Z is an Israeli high-tech company that specializes in developing technology products and providing services for police, military, and civilian use, with large customers such as Israel’s Defense Ministry, IDF, Israel Police, Israel Electric Corporation, and Israel Railways.

The company’s vision to develop groundbreaking technology solutions that enhance the individual’s daily life and penetrate international markets led to the development and production of its flagship product – the Cust2Mate smart shopping cart – which is proving to be an international success.

Cust2Mate is the world’s first proven-in-use self-checkout smart cart that just may streamline the $12 trillion grocery market.

Joseph Ben Tsur

CEO and Director

A serial entrepreneur, Joseph Ben Tsur has vast experience establishing successful companies and expanding them into new markets and industries. Among other roles, he has served as Chairman of the international Elad Hotels chain, Director of MARLAZ Holdings, with a portfolio of publicly-traded industrial, real estate, communications, and hi-tech companies, and CEO of DIG Ltd., which produces and markets electronic components sold throughout Israel. With several patents to his name and a proven track record, Mr. Ben Tsur is the driving force leading A2Z into the future.16

Amnon Peleg

Chief Technology Officer

A recognized specialist in telecommunications, energy, and systems operations, Amnon Peleg has vast experience in overseeing the development, introduction, and implementation of new technological processes and the execution of complex projects. His background includes more than two decades of service as a Technological Project Manager for Israel’s Prime Minister’s Office.16

Gadi Levin

CFO

With extensive experience in capital markets, Gadi Levin has filled executive positions and directorships in companies listed on Canadian, USA, and London stock exchanges. His wide-ranging expertise ranges from finance, treasury, accounting, and investor relations to human resources and information technology. Mr. Levin plays a key role in maintaining A2Z’s firm financial footing.16

Rafael Yam

CEO Cust2Mate Ltd.

With a rich background in identifying growth opportunities and introducing new products to satisfy ever-changing customer trends and demands, Rafael (Rafi) Yam is transforming Cust2Mate from a technology-oriented company to a world-leading solutions provider for retail grocery space.16

Sources

Sources:

1.) https://techmarketstoday.com/wp-content/uploads/sites/80/2022/05/Source_1_AZ_Benchmark_Report.pdf

2.) https://finviz.com/quote.ashx?t=AZ

3.) https://www.accesswire.com/700911/A2Z-Receives-Order-for-Additional-Smart-Carts-from-Yochananof-for-An-Aggregate-of-USD-10-Million

4.) https://www.accesswire.com/699498/A2Z-Smart-Technologies-CEO-Joseph-Bentsur-To-Ring-Nasdaq-Opening-Bell-on-Monday-May-2-2022

5.) https://livestream.com/accounts/27896496/events/10315670

6.) https://www.youtube.com/watch?v=9PWfAB0vihc

7.) https://techmarketstoday.com/wp-content/uploads/sites/80/2022/05/Source_7_Cust2Mate_Presentation-.pdf

8.) https://techcrunch.com/2021/10/19/instacart-acquires-caper-ai-a-smart-cart-and-instant-checkout-startup-for-350m-as-it-moves-deeper-into-physical-retail-tech/

9.) https://www.tipranks.com/stocks/az/forecast

10.) https://www.researchandmarkets.com/reports/4613444/food-and-grocery-retail-market-size-share-and

11.) https://www.accenture.com/_acnmedia/PDF-162/Accenture-Retail-Grocery-POV-2021.pdf

12.) https://www.statista.com/statistics/197621/annual-grocery-store-sales-in-the-us-since-1992/

13.) https://www.cust2mate.com/

14.) https://www.accesswire.com/663968/A2Z-Signs-Manufacturing-Agreement-with-Flex

15.) https://www.calcalistech.com/ctechnews/article/rkxg8sff9

16.) https://a2zas.com/about/

Disclaimer

Stock Research Today is a project of Dadmin Capital LLC and intended solely for entertainment and informational purposes. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/. This website / media webpage is owned, operated and edited by Dadmin Capital LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Dadmin Capital” refers to Dadmin Capital LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and promote small public companies. By reading our website / media webpage you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our website / media webpage .We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website / media webpage are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. Dadmin Capital business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Dadmin Capital. often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Pursuant to an agreement between Dadmin Capital LLC and TD Media LLC, Dadmin Capital LLC has been hired for a period beginning on 5/16/22 and ending after 2 business days to publicly disseminate information about (NASDAQ: AZ) via digital communications. We have been paid eleven thousand five hundred USD via ACH Bank Transfer.