LATEST NEWS

Premier American Uranium Announces Preliminary Results from Ongoing Drilling at the Cyclone ISR Project, Wyoming

4 Reasons Why Premier American Uranium Inc. (TSXV: PUR | OTCQB: PAUIF) Could Be Poised For Significant Upside Potential in 2023

IDENTIFYING THE OPPORTUNITY

ONLY A FRACTION OF THIS CHART HAS BEEN TESTED

With a float in the 30-35M range, a little bit of investor interest could potentially send this soaring into new highs!

TARGETS

Key Level #1: $1.49 (+17.32%)

Key Level #2: $1.83 (+44.09%)

Key Level #3: $2.11 (+66.14%)

Key Level #4: $2.18 (+71.65%)

Potential Support: $1.05

Premier American Uranium Inc.

(TSXV: PUR | OTCQB: PAUIF)

Uranium’s Power Surge: Capitalizing on

the Energy Revolution

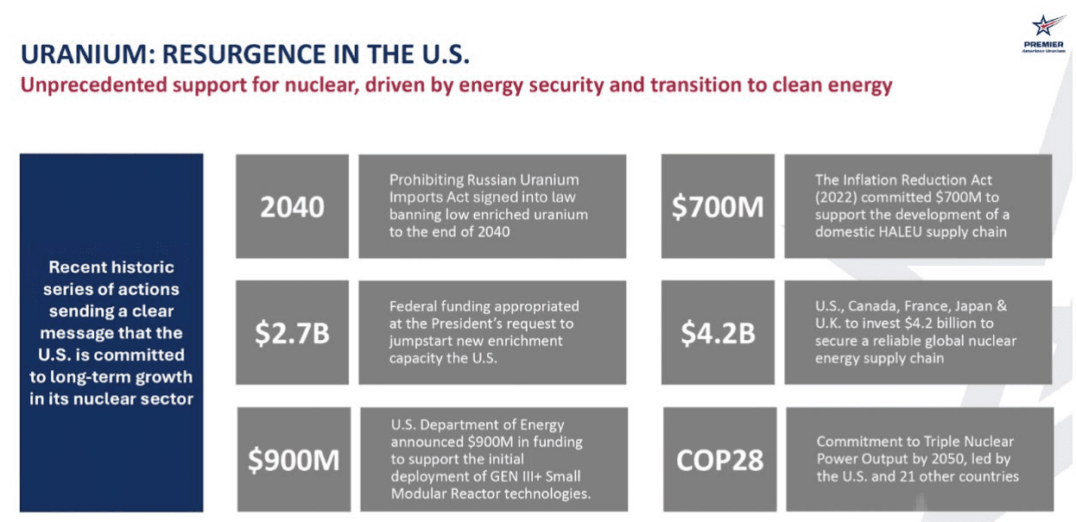

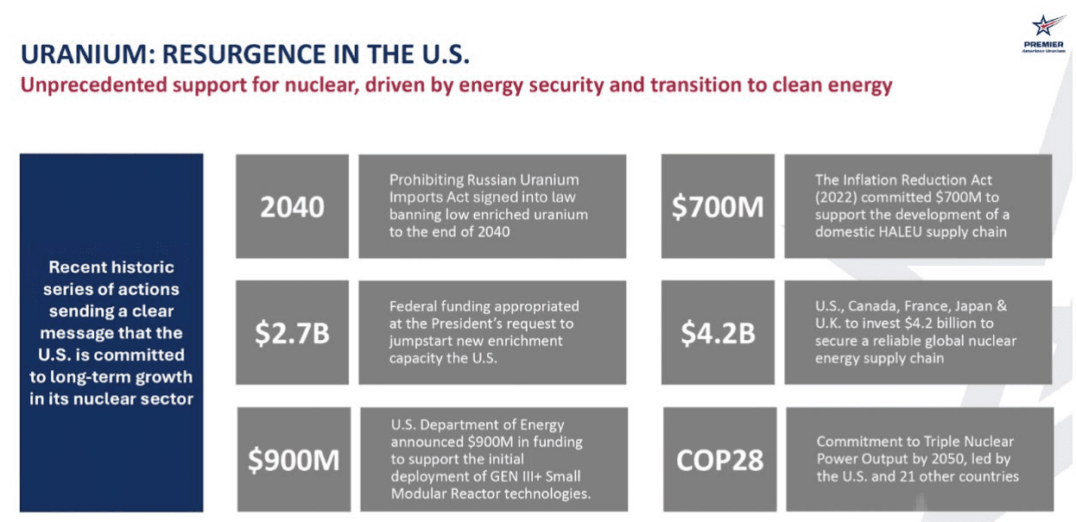

Uranium, essential for powering nuclear reactors that generate around 10% of the world’s electricity, is experiencing a resurgence driven by several critical factors. Firstly, the push towards cleaner energy sources has heightened interest in nuclear power as a low-carbon alternative, buoying demand. Secondly, geopolitical shifts, particularly in Western markets like the US, are intensifying efforts to secure domestic uranium supplies, exacerbating supply constraints. (2)

Why Premier American Uranium (TSXV: PUR | OTCQB: PAUIF) is leading the charge.

Enter Premier American Uranium (TSXV: PUR | OTCQB: PAUIF), a company poised to capitalize on these unfolding dynamics. As the need for uranium grows unabated and supply struggles to keep pace, companies like Premier American Uranium (TSXV: PUR | OTCQB: PAUIF) are at the forefront of discovering and developing new sources. Their strategic positioning not only anticipates sustained price support but also underscores their pivotal role in meeting future uranium demands amidst a tightening global supply chain.

The recent price volatility in uranium, historically notorious in bull markets due to the market’s size and control dynamics, highlights both the risk and opportunity inherent in this sector. However, with fundamental supply-demand imbalances expected to persist and global energy transitions driving long-term demand growth, Premier American Uranium (TSXV: PUR | OTCQB: PAUIF) stands as a beacon of opportunity for savvy investors looking to leverage the enduring potential of this vital commodity.

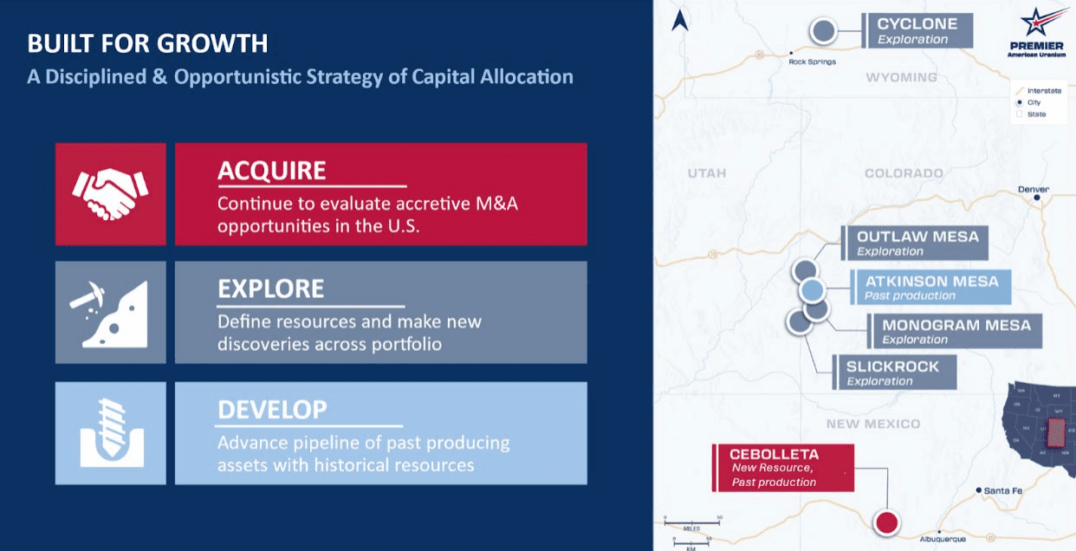

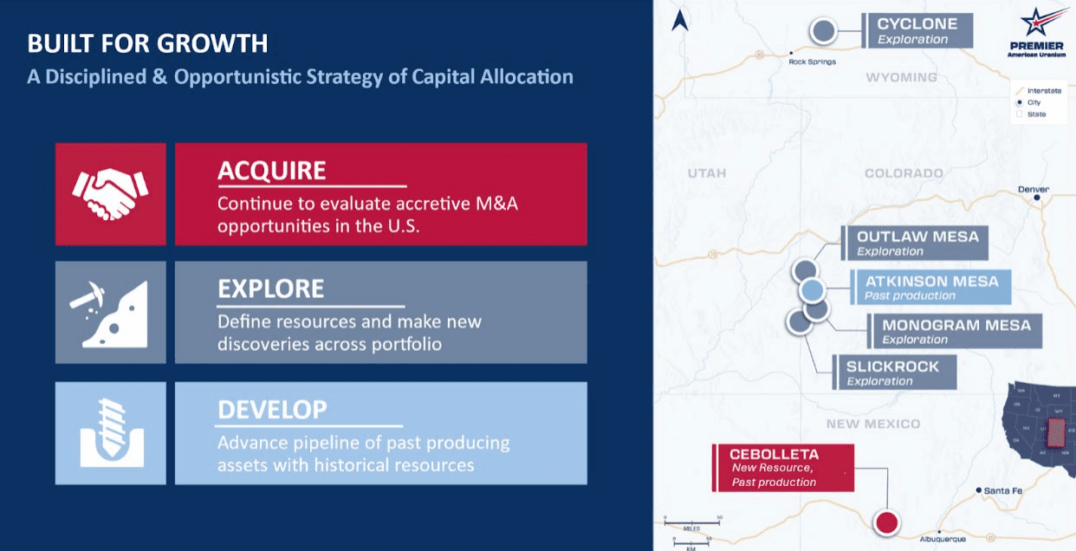

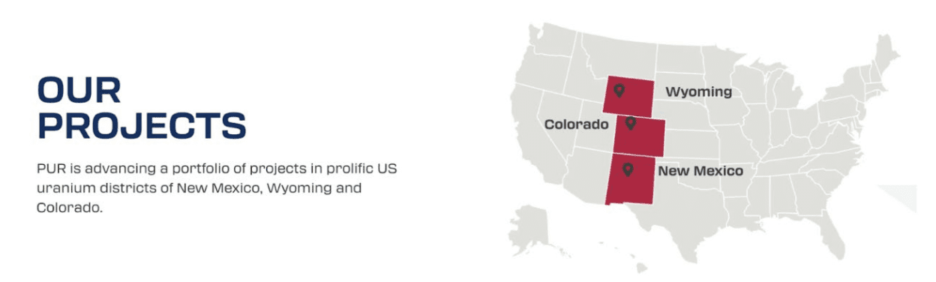

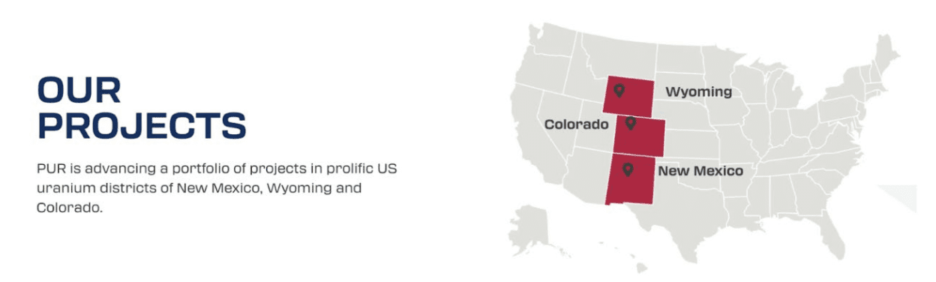

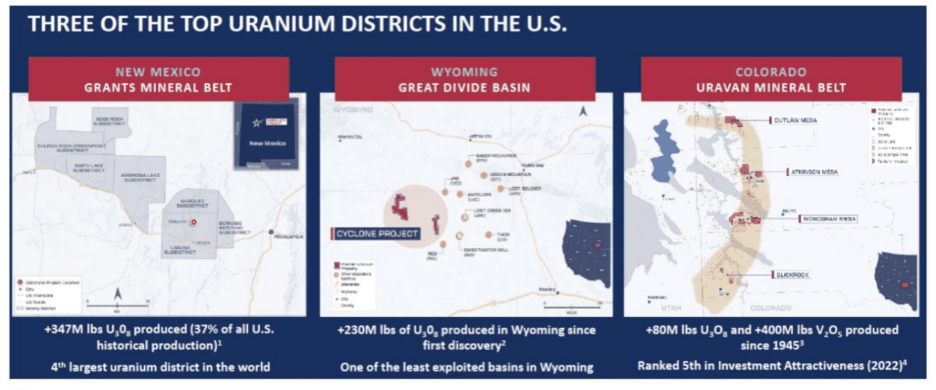

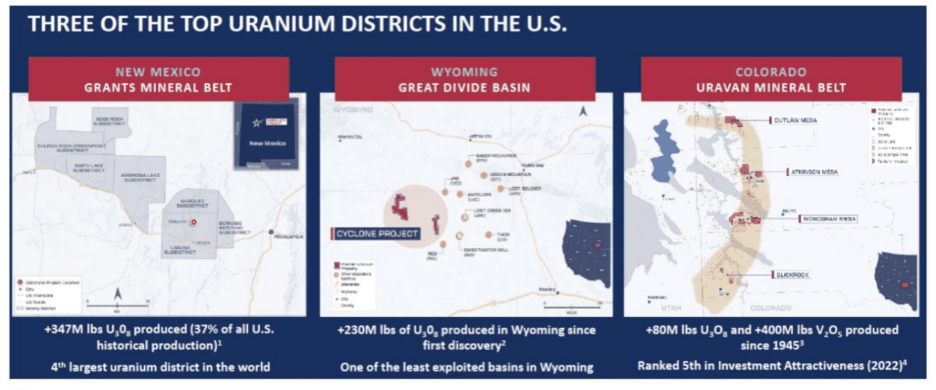

Premier American Uranium (TSXV: PUR | OTCQB: PAUIF) is dedicated to consolidating, exploring, and developing uranium projects across the United States. A cornerstone of PUR’s strategy lies in its substantial land holdings in three renowned uranium-producing regions: the Grants Mineral Belt in New Mexico, the Great Divide Basin in Wyoming, and the Uravan Mineral Belt in Colorado. These areas boast a rich history of uranium production and hold both current and historic uranium mineral resources, where Premier American Uranium (TSXV: PUR | OTCQB: PAUIF) is actively advancing its portfolio through ongoing work programs.

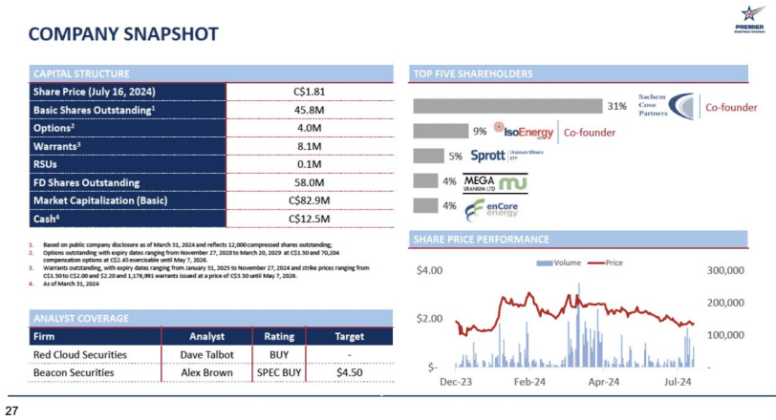

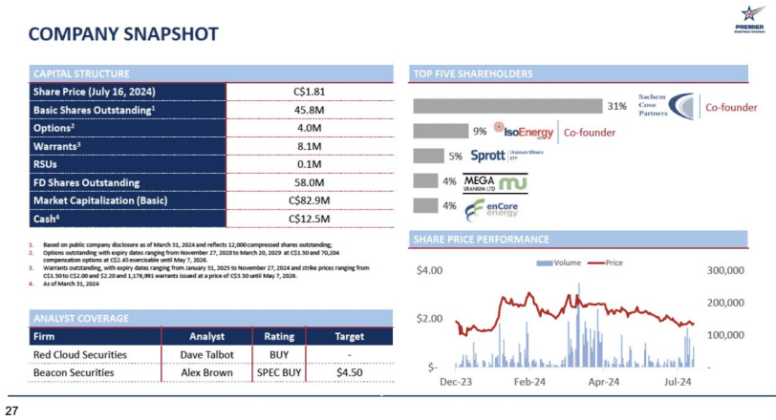

Backed by Sachem Cove Partners, IsoEnergy Ltd., Mega Uranium Ltd., and other known uranium corporate and institutional investors, Premier American Uranium TSXV: PUR | OTCQB: PAUIF benefits from strong financial and strategic support. The company is distinguished by a seasoned team with extensive experience in the US uranium sector. This robust foundation positions PUR uniquely in the market, particularly amidst the current robust uranium market fundamentals, which are at their strongest in over a decade. (4)

Premier American Uranium Inc.

(TSXV: PUR | OTCQB: PAUIF)

Premier American Uranium Sets Itself Apart with Strategic Uranium Consolidation and Prime US Assets

Premier American Uranium TSXV: PUR | OTCQB: PAUIF is making waves in uranium exploration by strategically bringing together valuable assets across the United States and here’s how they set themselves apart.

Strategic Consolidation: Premier American Uranium TSXV: PUR | OTCQB: PAUIF employs a proven consolidation strategy, targeting projects with current and historical mineral resources, and past production, which may have historically yielded significant returns during uranium market cycles.

Prime Assets: Premier American Uranium TSXV: PUR | OTCQB: PAUIF holds a diverse portfolio of uranium

mineral deposits in key US districts, positioning itself to revitalize domestic uranium production, crucial for national

energy security.

Growth Potential: Scheduled drilling across multiple projects in 2024 aims to expand resources in New Mexico and Wyoming, ensuring continuous news flow and potential resource growth.

Experienced Team: Led by industry veterans with extensive expertise in uranium exploration, development, and financing, Premier American Uranium TSXV: PUR | OTCQB: PAUIF benefits from a robust network of uranium focused institutional and corporate investors.

Market Dynamics: As uranium prices rise and global interest in nuclear energy increases, Premier American Uranium TSXV: PUR | OTCQB: PAUIF stands uniquely positioned to capitalize on these trends, offering substantial leverage and growth potential to investors.

PUR Seizes Unique Opportunity in US Uranium Market Expansion TSXV: PUR | OTCQB: PAUIF

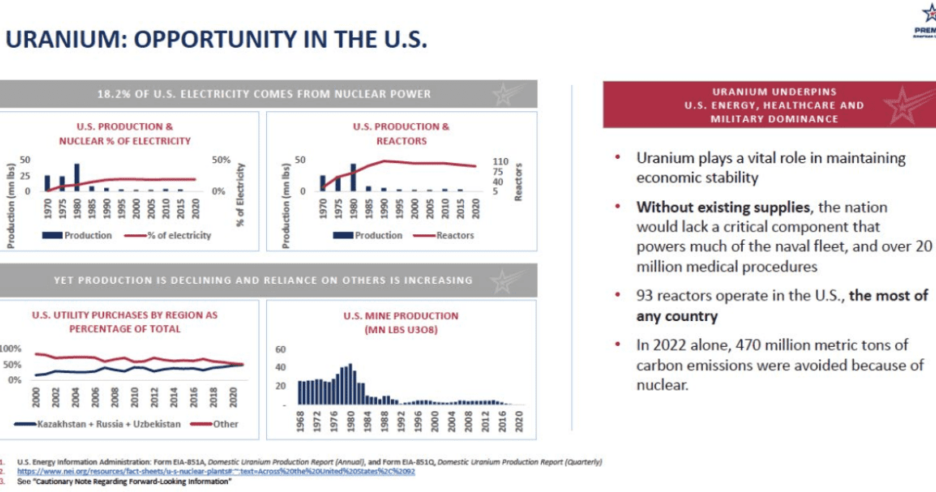

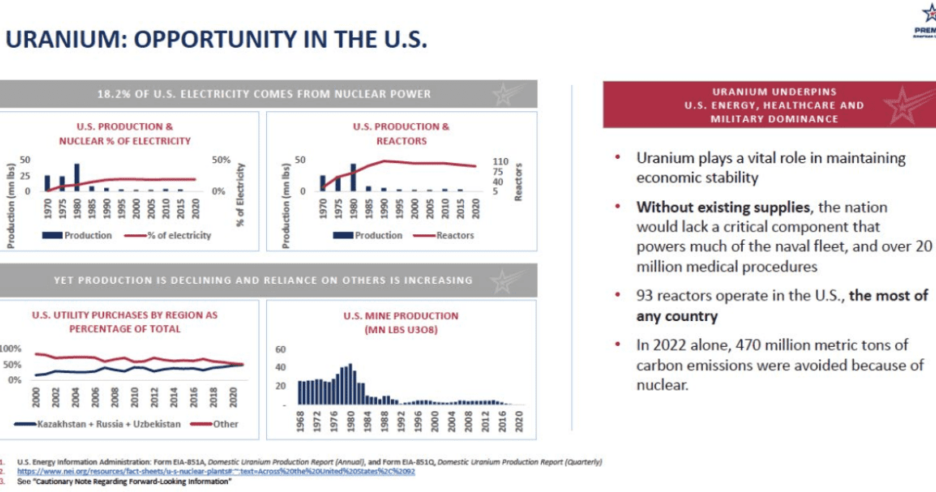

Looking at the global distribution of uranium supply and demand, Premier American Uranium (TSXV: PUR | OTCQB: PAUIF) believes that the U.S. offers a unique opportunity that will benefit companies with prospective exploration and development projects in the country.

The U.S. has a long history of uranium mining and was the world’s leading producer of uranium from 1953 until 1980, with peak annual production of up to 43 million pounds occurring in the early 1980s. This output diminished rapidly due to uneconomic spot prices and the fulfillment of military demand and has not recovered since, with a production profile of just around 50,000 pounds in 2023. Now, with spot prices where they are, a few projects are once again entering economic territory and have come back online, with several others in the development pipeline. Premier American Uranium (TSXV: PUR | OTCQB: PAUIF) believes a few key points make the U.S. an ideal and unique place to invest in uranium exploration and development over the next few years.

Premier American Uranium (TSXV: PUR | OTCQB: PAUIF) offers a strategic opportunity to capitalize on the revitalization of the U.S. uranium sector. With a focus on consolidation, exploration, and development in prime U.S. uranium districts, Premier American Uranium (TSXV: PUR | OTCQB: PAUIF) is positioned to leverage market dynamics and address critical national energy security needs.

U.S. Uranium Shortage Threatens Energy Independence

Despite Leading Global Nuclear Fleet

(TSXV: PUR | OTCQB: PAUIF)

Why Premier American Uranium’s Strategic Initiatives

Aim for Energy Security

Premier American Uranium (TSXV: PUR | OTCQB: PAUIF) aims to address the structural shortfall in U.S. uranium production through strategic acquisitions and development initiatives across its portfolio in New Mexico, Wyoming, and Colorado. By revitalizing existing resources and exploring for new deposits, they seek to contribute to national energy independence and stability.

Premier American Uranium: Unveiling a Portfolio of High-Potential Uranium Projects

(TSXV: PUR | OTCQB: PAUIF)

With a diversified portfolio of uranium assets, including current and historical resources across prime US uranium districts – the company’s strategy includes ongoing exploration and development efforts aimed at expanding its resource base, defining and enhancing project economics.

Cebolleta Project – Acquisition of a Turnkey Exploration and Development Asset

Premier American Uranium (TSXV: PUR | OTCQB: PAUIF) came to market at the end of 2023 with the Cyclone project in Wyoming and a portfolio of assets in Colorado. Shortly after, they announced the accretive acquisition of American Future Fuel, bringing in the Cebolleta project in New Mexico. From the onset, the company’s primary focus was on the consolidation, exploration, and development of uranium projects in the U.S. They quickly demonstrated their dedication to this corporate strategy with the acquisition of American Future Fuel, which closed on June 27, 2024, adding the advanced Cebolleta project in New Mexico to their portfolio.

Recently, they announced an NI 43-101 compliant mineral resource estimate (MRE) for the Cebolleta Project in New Mexico (see press release dated June 24, 2024). The MRE details 18.6 million pounds of eU3O8 (6.6 million short tons at an average grade of 0.14% eU3O8) in Indicated Resources and 4.9 million pounds of eU3O8 (2.6 million short tons at an average grade of 0.10% eU3O8) in Inferred Resources, effective as of April 30, 2024. Compared to the historic 2014 estimate, the new MRE has increased in both size and quality, with 80% of the previous Inferred Resources upgraded to Indicated Resources. Importantly, the updated MRE came at minimal cost, and they believe this early achievement positions PUR to fast-track their efforts on resource expansion and priority target testing, rather than extensive confirmation work as previously anticipated.

Premier American Uranium Inc.

(TSXV: PUR | OTCQB: PAUIF)

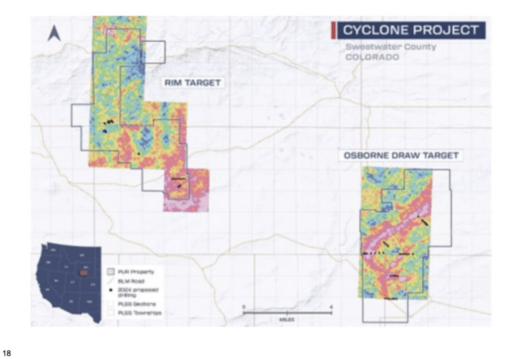

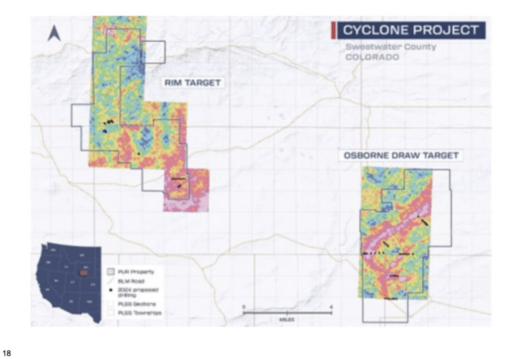

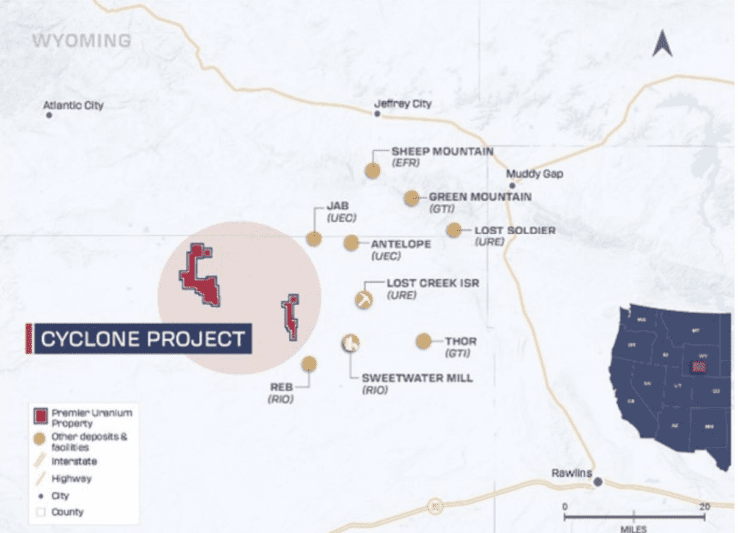

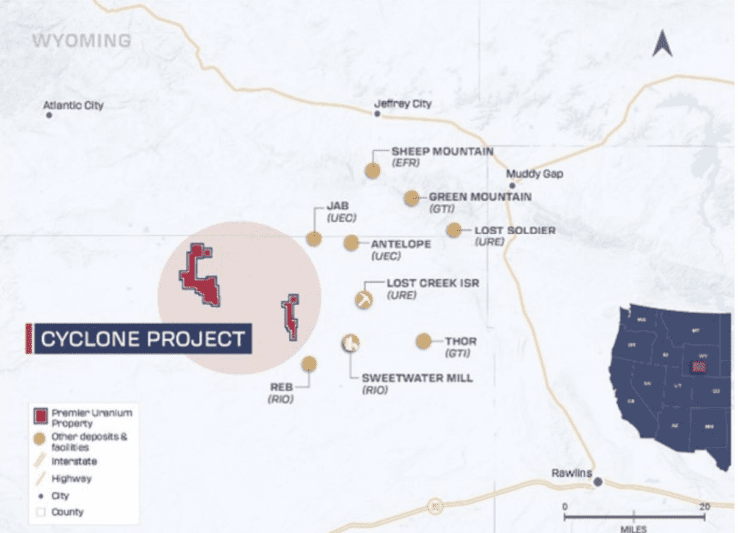

Prime Position in Great Divide Basin for Potential Uranium Discovery and ISR Advantages with Drilling Underway

The company controls a significant land position of approximately 25,500 acres of mineral rights within the western and southwestern parts of the Great Divide Basin. The Cyclone project has strong potential for the discovery of uranium deposits that would be suitable for in-situ recovery (ISR) methods. The project is located approximately 45 miles northwest of Rawlins, Wyoming, and 15 miles from the Sweetwater Uranium Mill. It covers approximately 25,500 acres, comprising 1,061 claims totaling 21,220 acres and 7 state leases covering 4,280 acres.

Recently, the company announced its inaugural exploration drill program, with a budget of US$2.3 million. The program is designed to systematically investigate the resource potential identified in the National Instrument 43-101 – Standards of Disclosure for Mineral Projects (NI 43-101) ("Technical Report"), with an effective date of June 30, 2023. This report outlined a resource exploration target of 7.9 million pounds to 12.6 million pounds of eU3O8 at a grade of approximately 0.06% U3O8. This target is supported by data from 88 holes drilled in 2007-2008 by previous operators, which demonstrated the presence of sandstone-hosted uranium mineralization within a geological setting conducive to ISR extraction.

Highlights:

- 71 reverse circulation drill holes totaling approximately 49,700 ft. are planned for 2024 and 2025 drill seasons.

- Two priority targets are expected to be tested, including Cyclone Rim Target (North Block) and Osborne Draw Target (East Block)

- At the Cyclone Rim Target, drilling has commenced with one rig scheduled to drill 35 holes to an average depth of approximately 500 ft.

- At the Osborne Draw Target, drilling is anticipated for the 2025 season (~July to October) and contemplates approximately 36 drill holes with an average depth of ~800 ft.

- The reverse circulation drilling services contract has been awarded to Boart Longyear.

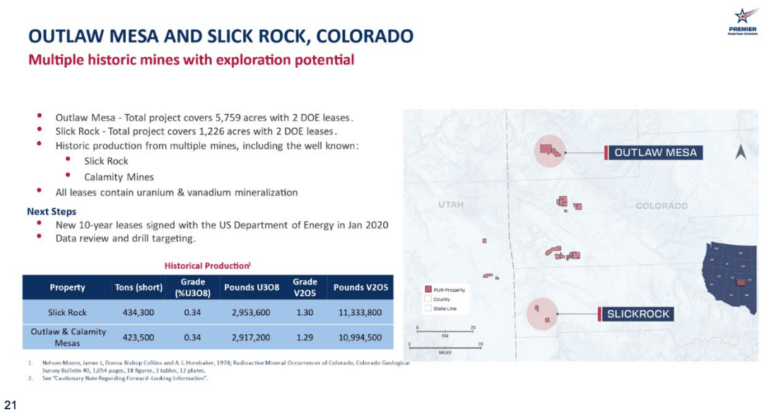

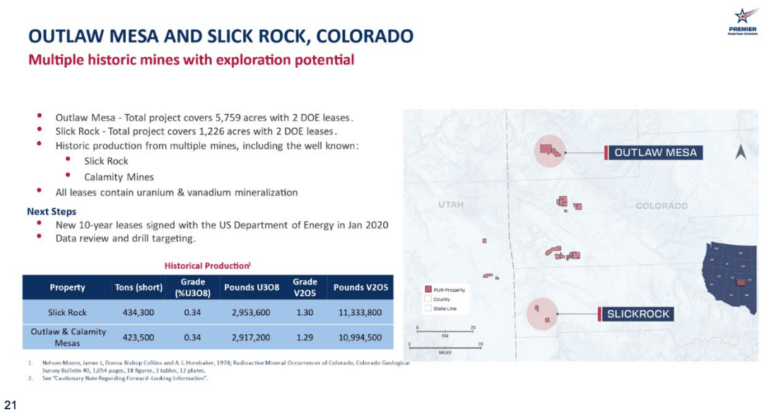

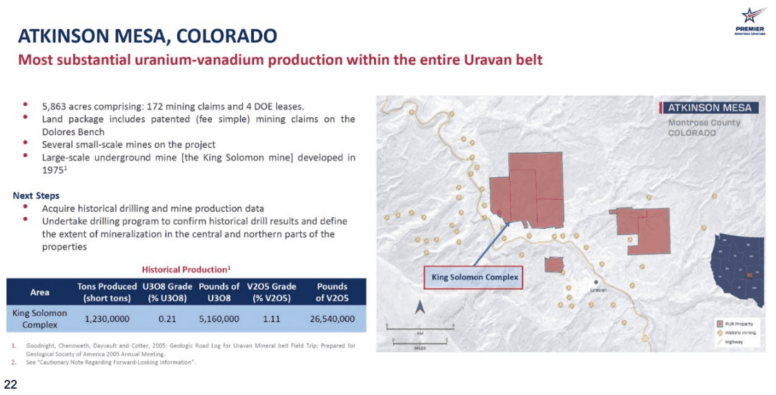

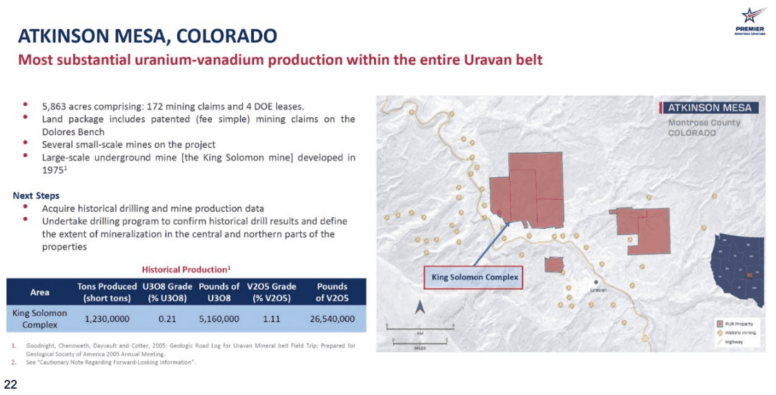

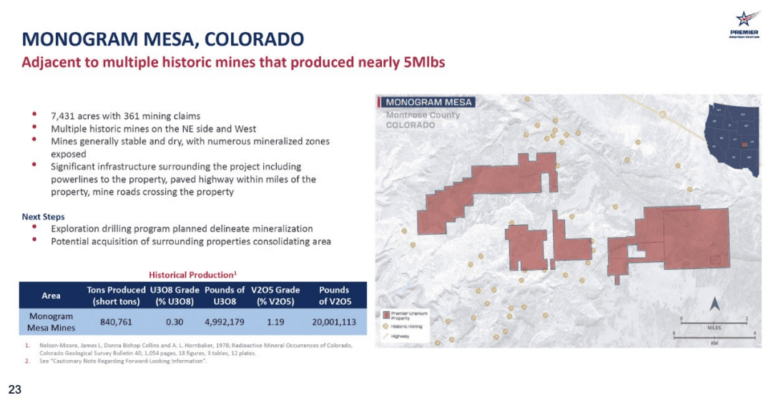

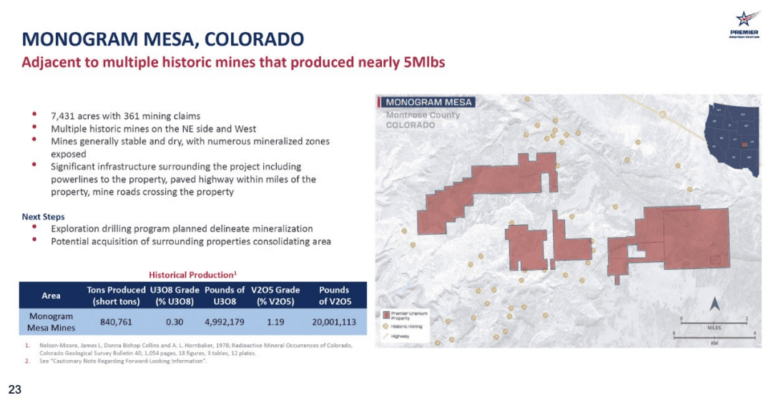

Rich Uranium and Vanadium Potential in

Colorado’s Uravan Mineral Belt

The Uravan Mineral Belt in southwestern Colorado has a rich history of uranium and vanadium exploration and production. Mines within the Mineral Belt have produced nearly 80 million pounds of U3O8 and more than 400 million pounds of V2O5 since 1945. Colorado ranked 5th out of 62 jurisdictions in the Investment Attractiveness Index of the Fraser Institute Annual Survey of Mining Companies in 2022.

PUR's projects in Colorado are located in highly prospective areas in the heart of the Uravan Mineral Belt, close to significant infrastructure.

Experience and Strategy Propel PUR to Lead in US

Uranium Exploration and Development

TSXV: PUR | OTCQB: PAUIF

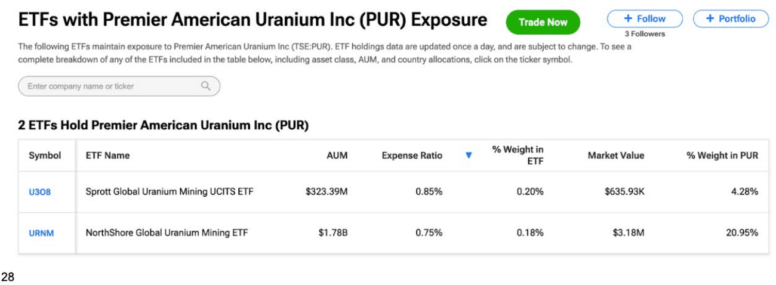

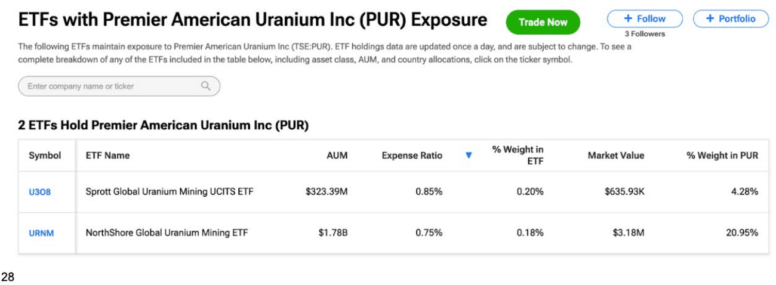

Their competitive edge lies in its strategic consolidation approach and experienced leadership team with a proven track record in uranium exploration, development, and financing. They are backed by strong industry leaders like IsoEnergy and EnCore Energy. Additionally, Sachem Cove, a respected institutional investor and co-founder, further enhances their credibility and strategic foundation making Premier American Uranium TSXV: PUR | OTCQB: PAUIF well-positioned to outperform competitors in the sector.

Furthermore, the substantial portfolio of ETFs underscores confidence that as the Company achieves continued growth, it will successfully meet the criteria for expanding ETF backing even further.

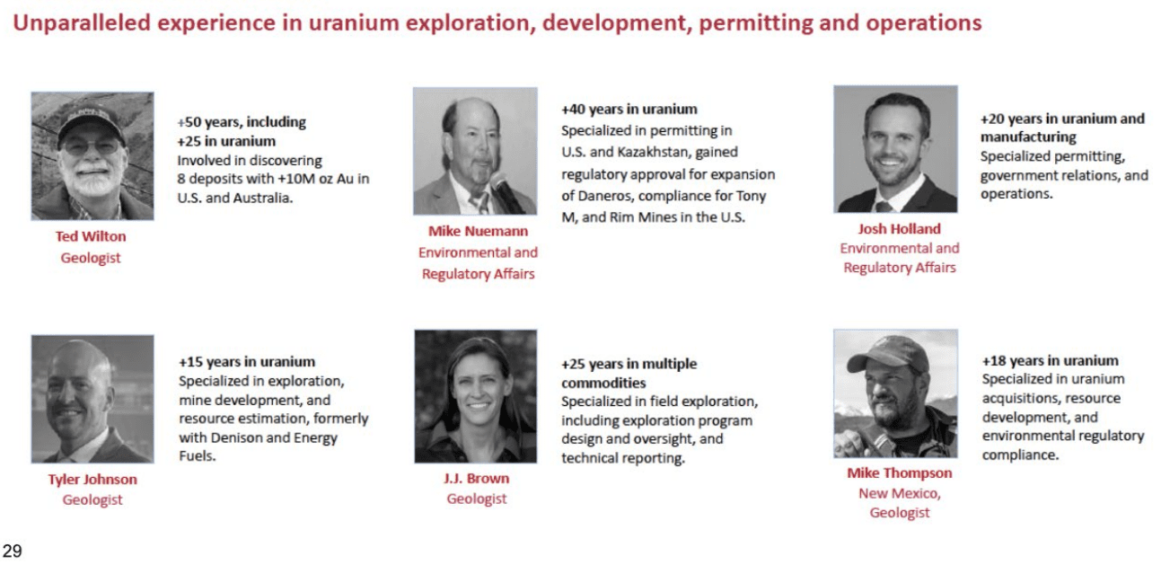

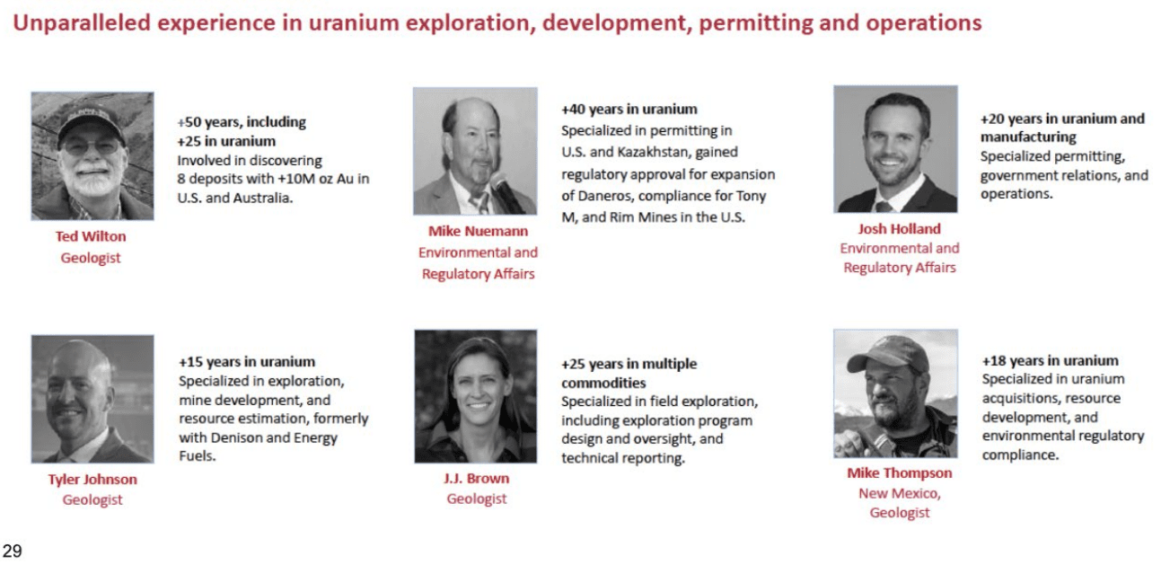

The Industry Veterans who lead PUR to Excellence

(TSXV: PUR | OTCQB: PAUIF)

They are led by a seasoned team of industry veterans with decades of collective experience in uranium

permitting, mining and operations. This leadership, coupled with strong technical expertise and a network

of industry relationships, strengthens PUR’s ability to execute its growth strategy effectively.

Sources

1. https://www.bloomberg.com/news/articles/2024-03-03/uranium-firms-revive-forgotten-mines-as-price-of-nuclear-fuelsoars?sref=6uww027M

2. Uranium Initiation LAM-PUR-2024-07-03

3. https://premierur.com/corporate/

4. https://premierur.com/corporate/

5. https://premierur.com/wp-content/uploads/2024/06/06242024-PUR-Corporate1Presentation.pdf

6. Uranium Initiation LAM-PUR-2024-07-03

7. https://premierur.com/wp-content/uploads/2024/06/06242024-PUR-Corporate1Presentation.pdf

8. https://premierur.com/wp-content/uploads/2024/06/06242024-PUR-Corporate1Presentation.pdf

9. https://premierur.com/wp-content/uploads/2024/06/06242024-PUR-Corporate1Presentation.pdf

10. https://premierur.com/wp-content/uploads/2024/06/06242024-PUR-Corporate1Presentation.pdf

11. https://premierur.com/premier-american-uranium-shifts-to-growth-ahead-of-schedule-at-cebolleta-in-new-mexico-us/

12. https://premierur.com/premier-american-uranium-shifts-to-growth-ahead-of-schedule-at-cebolleta-in-new-mexico-us/

13. https://premierur.com/wp-content/uploads/2024/07/07102024-PUR-Corporate-Presentation.pdf

14. https://premierur.com/wp-content/uploads/2024/07/07102024-PUR-Corporate-Presentation.pdf

15. https://premierur.com/wp-content/uploads/2024/07/07102024-PUR-Corporate-Presentation.pdf

16. Uranium Initiation LAM-PUR-2024-07-03

17. https://premierur.com/premier-american-uranium-commences-inaugural-exploration-drill-program-at-its-cyclone-isr-projectwyoming/

18. https://premierur.com/premier-american-uranium-commences-inaugural-exploration-drill-program-at-its-cyclone-isr-projectwyoming

19. https://premierur.com/premier-american-uranium-commences-inaugural-exploration-drill-program-at-its-cyclone-isr-projectwyoming/

20. https://premierur.com/premier-american-uranium-commences-inaugural-exploration-drill-program-at-its-cyclone-isr-projectwyoming/

21. https://premierur.com/wp-content/uploads/2024/07/07102024-PUR-Corporate-Presentation.pdf

22. https://premierur.com/wp-content/uploads/2024/07/07102024-PUR-Corporate-Presentation.pdf

23. https://premierur.com/wp-content/uploads/2024/07/07102024-PUR-Corporate-Presentation.pdf

24. https://premierur.com/wp-content/uploads/2024/07/07102024-PUR-Corporate-Presentation.pdf

25. https://premierur.com/wp-content/uploads/2024/07/07102024-PUR-Corporate-Presentation.pdf

26. https://premierur.com/wp-content/uploads/2024/07/07102024-PUR-Corporate-Presentation.pdf

27. https://premierur.com/wp-content/uploads/2024/07/07102024-PUR-Corporate-Presentation.pdf

28. https://www.tipranks.com/stocks/tse:pur/etf-exposure#_=_

29. https://premierur.com/wp-content/uploads/2024/07/07102024-PUR-Corporate-Presentation.pdf

30. https://premierur.com/wp-content/uploads/2024/07/07102024-PUR-Corporate-Presentation.pdf

31. https://premierur.com/wp-content/uploads/2024/07/07102024-PUR-Corporate-Presentation.pdf

32. https://www.kavout.com/blog/nuclear-revival-uraniums-golden-age-ahead/

Disclaimer

Disclaimer

Stock Research Today is a project of Virtus Media Group LLC and intended solely for entertainment and informational purposes. This website / media webpage is owned, operated and edited by Virtus Media LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Virtus Media” refers to Virtus Media LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. By reading our website / media webpage you agree to the terms of this disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investment or brokerage advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment and educational purposes only. At most, this communication should serve as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/.

By using our service, you agree not to hold our site, its editors, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within or referred to from our website / media webpage. We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data.

This publication and its owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. That information is only valid at the time it is published, and we do not undertake to update it.

Virtus Media’s business model is to receive financial compensation to promote public companies and to conduct investor relations advertising, marketing and publicly disseminate information, not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, and responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the subject of our reports and communications. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the parties who hired us, or of the profiled companies. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts.

The third parties paying for our services, the profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to impact share prices, possibly significantly. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Virtus Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

Compensation: Pursuant to an agreement between Virtus Media Group LLC and InvestingChannel, Inc, Virtus Media Group LLC has been hired by InvestingChannel, Inc for a period beginning on 2024-09-06 and ending 2024-09-13 to publicly disseminate information about TSXV: PUR | OTCQB: PAUIF via digital communications. We have been paid ten thousand dollars USD. Virtus Media Group LLC agrees to pay Social Media Influencer #1 five hundred dollars USD and Social Media Influencer #2 two thousand dollars USD and Social Media Influencer #3 five hundred dollars USD and Social Media Influencer #4 two hundred fifty dollars USD and Social Media Influencer #5 two hundred dollars USD and Social Media Influencer #6 two hundred fifty dollars USD and Social Media Influencer #7 three hundred dollars USD.