Soaring Demand For Electric Vehicles & Clean Energy Could Ignite a Copper and Gold Mining Frenzy Right Here In America

Maybe that’s why Alliance Global Partners’ analyst, Jake Sekelsky, put a $25.00 target on U.S. Gold Corp. (NASDAQ: USAU)

5 Reasons Why U.S. Gold Corp. (NASDAQ: USAU) Could Be Poised For Significant Upside Potential in 2023…

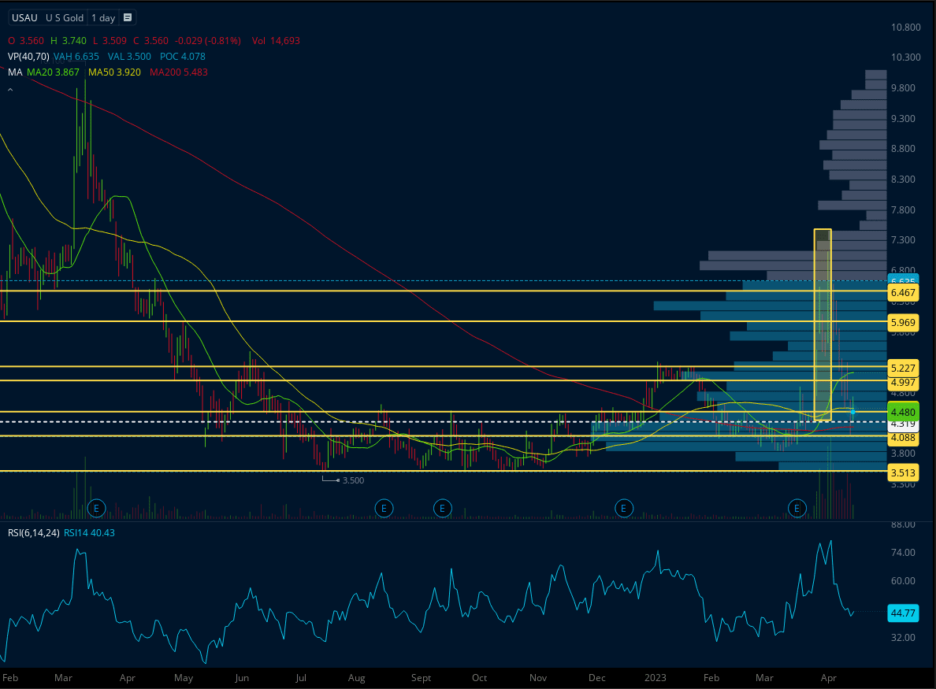

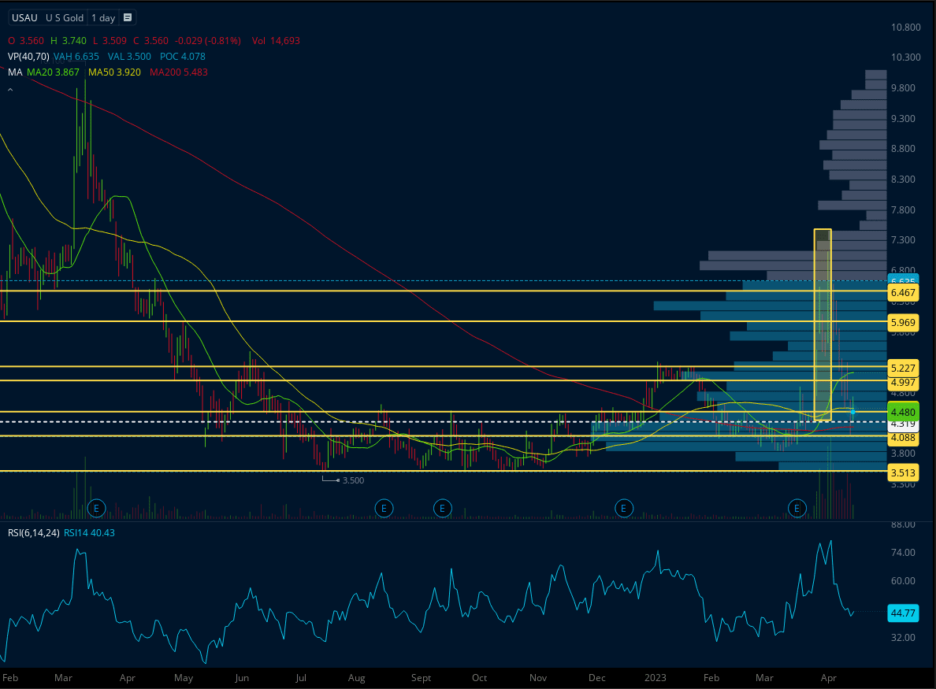

THE TRADE OPPORTUNITY

Small Float ready to push! If you missed the last run, that's okay...

We caught the most recent big run for an easy 76% gain, and this time we're set up to run off of that same level with more strength and clearer bullish indicators. The daily MAs are stacked bullish, we have a clean RSI and abnormally strong volume on this low float runner. With news of the recent offering close, we have potential for tremendous continuation to the upside from this historically violent support level. We also now have a higher high followed by a higher low. We are primed for a nice run, based on the following technical analysis...

U.S. Gold Corp. (Nasdaq: USAU) Has an Extremely Low-Float of Just 7.45 Million Shares According to MarketWatch.com

Low float stocks refer to the securities that remain after a company’s stock has been issued to its controlling investors — meaning there are relatively few shares for the public to buy.

Market participants typically consider a float of 10-to-20 million shares as a low float. Some larger corporations have very high floats in the billions.

Companies with a low float frequently have a large portion of their equity held by controlling investors such as directors and employees, which leaves only a tiny percentage of the stock available for public trading.

That limited supply can cause dramatic price swings if demand changes quickly.

Because low-float stocks have fewer shares available, market participants may have difficulty finding shares available.

Low float stocks have the potential to present significant swings as active market participants take notice.

U.S. Gold Corp. (Nasdaq: USAU) has around 7.45 million shares available in its public float as of 1/26/23 according to MarketWatch.com. Active market participants typically love the volatile swings low float stocks can often provide.

U.S. Gold Corp. (Nasdaq: USAU) is also considered a nano-cap. In general, nano-cap companies have market capitalizations of less than $50 million. Because nano-cap stocks are significantly smaller than mid cap or large cap companies, they have a higher potential to change valuation quickly.

As of 1/26/23 U.S. Gold Corp. (Nasdaq: USAU) has a market cap of just around $41.82M according to MarketWatch.com.

Which is why things could get very interesting and also why you need to start your research on U.S. Gold Corp. (Nasdaq: USAU).

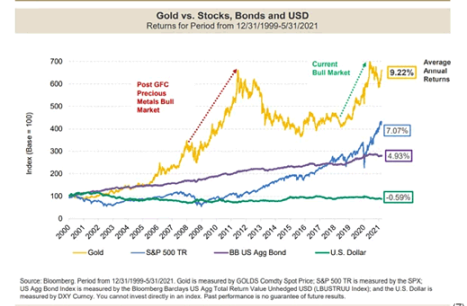

Some believe the price of gold is set to skyrocket even higher in the weeks and months to come....

'Attractive Risk-Reward': Gold to rally by a double-digit percentage in 2023, UBS says

CNBC

Technical studies suggest gold prices could hit new record highs by Q4 2023

Kitco

Gold May Top $2,000 as Inflation Lasts, Mining Veteran Says

Bloomberg

Some of the world's smartest investors are jumping in, too.

David Einhorn, founder of Greenlight Capital, owns a gold position worth $40 million.

Billionaire bond king Jeffrey Gundlach told Yahoo Finance: "Gold is going to go a lot higher."

Egyptian billionaire Naguib Sawiris says a QUARTER of your portfolio should be in gold as inflation creeps higher…

While legendary hedge-fund manager John Paulson has invested more than $200 million into this space.

But perhaps the most surprising was when real estate Billionaire Sam Zell, who spent his career arguing AGAINST gold… is now buying gold as a hedge against inflation.

But it doesn't stop there…

Billionaire hedge-fund founder Ray Dalio told readers not long ago he sees a paradigm shift happening in the gold market. He compared today's price movements with historical turning points like: Gold's historic 2,300% leap in the 1970s from $35 to $850 per ounce after President Nixon took the U.S. off the gold standard…

And in the early 2000s, when gold tripled in value – soaring from under $300 per ounce in 2000 to $1,000 by 2008.

But some are saying Gold could go much higher…

Gold surges to 6-month high, and analysts expect records in 2023.

According to commentary published on CNBC.com, Gold prices could surge to $4,000 an ounce in 2023 as recession fears persist, said Juerg Kiener, managing director and chief investment officer of Swiss Asia Capital.

Gold prices could surge to $4,000 per ounce in 2023 as interest rate hikes and recession fears keep markets volatile, said Juerg Kiener, managing director, and chief investment officer of Swiss Asia Capital.

The price of the precious metal could reach between $2,500 and $4,000 sometime next year, Kiener told CNBC’s “Street Signs Asia.”

There is a good chance the gold market sees a major move, he said, adding “it’s not going to be just 10% or 20%,” but a move that will “really make new highs.”

Kiener explained that many economies could face “a little bit of a recession” in the first quarter, which would lead to many central banks slowing their pace of interest rate hikes and make gold instantly more attractive. He said gold is also the only asset that every central bank owns.

According to the World Gold Council, central banks bought 400 tonnes of gold in the third quarter, almost doubling the previous record of 241 tonnes during the same period in 2018.

There are several factors that have created an almost perfect storm for gold.

A Bullish Period For Mining Stocks

We may be in the midst of a generationally bullish period for mining stocks. The inflation genie is out of the bottle; rising prices and long-term yields are not keeping up.

The Fed is still keeping interest rates at historic lows, and investors are potentially abandoning fixed-income assets and fleeing to bullion. This has created a potentially severe supply and demand imbalance.

You couldn’t ask for any more potent potential catalyst for physical gold, and it could be getting even more powerful by the minute. The worse inflation gets, the better it is for gold. And it probably won’t end anytime soon. After all, on Oct 24, 2021, Treasury Secretary Janet Yellen said that Americans haven’t experienced the current inflation rate “in a long time.” She further projected that inflation likely won’t improve until the latter half of 2022. The smaller exploration and development companies, though, could benefit the most from current market conditions. According to John Corcoran, senior client portfolio manager for Invesco, “Gold and precious metals equities have historically outperformed the price of gold by twofold to threefold when both bullion and precious metals mining stocks are rising.”

Pressures have coincided with skyrocketing electric vehicle demand and have triggered an alarming copper deficit. So what if I told you that a mining play exists as potentially the perfect hedge against this type of inflation while playing directly into surging copper and electric vehicle demand? Meet U.S. Gold Corp. and its historically promising projects. As USAU advances 4 high-potential projects: The Copper King (CK) Gold Project in Southeast Wyoming, Keystone on the Cortez Trend in North Central Nevada, Maggie Creek on the Carlin Trend in Nevada, and the Challis Gold Project located in Idaho, it could very well have a generational type of upside in this current environment. Miners like Comstock Mining, Inc. and Western Copper and Gold Corporation have seen their shares soar 132.69% and 36.59% year-to-date, respectively.

Yet USAU could very well follow in their paths, and then some. Particularly when you consider that based on the stock’s $25 price target from Alliance Global Partners, (Source 28) it could have an astonishing 115.33% of room-to-run from its Dec 1, 2021 high of $11.61. This is also coming on the heels of a potential 12.06% rally between its 3-month low of $9.12 on Aug 24, 2021, to its $10.22 closing price on Oct 26, 2021. Hence here are 5 prime reasons why U.S. Gold Corp. could be the top junior mining play on the planet right now.

Reason 1: Right Place, Right Time

Mounting Potential Catalysts Could Help USAU’s CK Gold Project Generate Millions

As USAU charges towards potentially becoming a household name among investors, it’s the company’s CK Gold Project that’s catching the ears and eyes of many. After all, one of Barrick Gold’s former top executives, George Bee, became CEO of U.S. Gold Corp. United States NASDAQ: (USAU). The CK Gold Project was a significant reason why.

CK Gold could drive USAU to new heights for too many reasons to count. So let’s break down some of the top ones. For one, it could be a diamond in the rough and a ground floor play on inflation. Inflation is not transitory, as the Fed tried to tell us in April,(29) and could persist well into the new year. Not to mention, we’re in the midst of a supply chain crisis that’s only adding to this soaring inflation. According to Goldman Sachs, the supply chain crisis has gotten so bad that there is a traffic jam of roughly 77 ships with $24 billion worth of goods outside the Ports of Los Angeles and Long Beach. About 40% of U.S. imports enter through these ports.(30) Have fun paying for your kid’s Christmas presents this year. Until this gets fixed, inflation will not improve. Which means potentially big things for gold and USAU. The last time inflation got this bad was in 1971. Gold, at one point, nearly tripled in one day from $42 to $120, and we could be seeing the same type of conditions today.(31) Additionally, CK Gold is in an advantageous location in mineral-rich Wyoming. The importance of geographic location cannot be overstated. Wyoming is very friendly for the resource sector with less regulation and out of Federal jurisdiction. Meaning the project can get to production much faster.

The state sure seems excited by the prospects, too, with recent local news articles hyping up the company with such headlines as “Cheyenne May Soon Boast The Only Working Gold Mine In The State of Wyoming”(34) and “Potential Gold Copper Mine Could Generate Millions For State.”(34) If continued data collection bears out hopes, the CK Gold Project could produce tens of millions in revenue for the state.

Jason Begger, the spokesperson for the CK Gold Project, claims that the project becomes more certain and confident with every bit of data collected.(33) The mine site is owned by the state and located in an old copper mine that hasn’t been worked on since before World War II. The gold deposit has been known to exist for a long time. Finally, new mining technology has reached a point where experts think it could be worth reopening. If the project continues to move forward at this pace, Begger said they estimate the financial boon to the state could be in the tens of millions.

Perhaps, the most outstanding feature of the CK Gold Project is its simplicity. It’s an open-pit mine which means its copper and gold concentrates are at surface level.(9) This can make operations much more efficient and eco-friendly.(10) Additionally, the property has a meager stripping ratio. This translates to high productivity, low operating costs, and good safety conditions from a pure investment standpoint.

So buckle up. USAU saw considerable activity at the CK Gold Project during the summer. It is continuing throughout fall 2021, and USAU expects to further advance the project to a permitting and development decision on a fast-track basis.

USAU announced a positive Pre-Feasibility Study (PFS) for the CK Gold Project on Dec 1, 2021. To put it mildly, it even exceeded the most potentially positive expectations. For example, see how Alliance Global Partners reacted in their Dec 2, 2021 report. In their view, the PFS outlined a robust project featuring “low-cost production of over 100,000 gold equivalent ounces per annum over a 10-year mine life.” (Source 28)

Alliance added that “given the project’s production profile of over 100,000 ounces of gold per year, strategic location in the United States, manageable CapEx, and accelerated permitting timeline, we view the CK Project as an attractive asset that warrants development.” (Source 28)

After all, the announcement did cause them to raise their price target for the company from $20 to $25.

With much of the heavy lifting related to Feasibility level work already completed, the project’s development may only accelerate from here.

Reason #2 – With Tesla Exceeding a $1 Trillion Market Cap,(35) The Global Copper Shortage and EV Boom May Have Created a Historic Opportunity

Let’s talk a bit about Tesla. On Oct 25, 2021, Hertz announced a record-setting order of 100,000 Teslas for its fleet, causing the stock to skyrocket over 12%, and send it to a $1 trillion+ market cap.

Elon Musk’s EV giant not only became the 6th company in history to exceed the $1 trillion mark. It became the 2nd fastest ever to do so.

Globally speaking, copper is strategically essential. Industries that produce solar panels, windmills, and electric vehicles are frantically looking for more and more supply.

But do you know what each brand new Tesla requires? Around 80 kg (176 lbs) of copper? (36)

The potential for copper makes US Gold Corp even more intriguing, outside of being a potential inflation hedge. While the CK Project is estimated to hold nearly 700,000 ounces of gold awaiting extraction, the company estimates the mine has a mind-blowing 230 million pounds of copper.(33)

Other estimates show that the CK mine may hold enough copper to build about a million electric vehicles.(26) Another significant catalyst to consider is its location. It’s located roughly 2 miles north of a central East-West Union Pacific rail line, giving it potentially easy rail access to Tesla’s Nevada Gigafactory.(37)

To possibly be THE copper supplier for the world’s latest $1 trillion giant could be game-changing. It’s not just Tesla, though, that could cause this property to see a surge in copper demand. Traditional automakers like General Motors Co. and Ford are going electric, which means a supply boom is expected, causing copper demand to soar.(37) This could be American copper from a future American mine, creating American jobs. CK spokesman, Jason Begger, was also sure to point out that as Wyoming and the country embrace new technologies like EVs, manufacturers will require a lot of copper – copper the CK Gold Project could produce.(33)

Begger also added that the project is roughly a 10-year operation.(33) Meanwhile, to add to the theme of sustainability, the CK Gold Project should run far cleaner. The company does not intend to use hazardous chemicals; there’s no refinery or air-polluting smokestack. In fact, the hole in the ground can potentially be used for water storage for the city of Cheyenne.(9)

There could even be other deals for the waste rock, adding even more revenue potential and reducing environmental impact.(9) Another significant usage of copper is wind turbines. Wyoming for decades profited from the coal mining industry but is now one of the states leading the way in the future of clean energy. Wyoming is the largest exporter of energy in the United States and ranks first in land-based class 6 and 7 wind turbine sites.(37) Trafigura Group believes copper could hit $15,000 a ton over the next decade, according to Bloomberg.(6)

After all, “You can’t move to a green economic environment and not have the copper price moving significantly higher,” says Kostas Bintas, a trader at Trafigura. “How can you have one without the other?”(7)

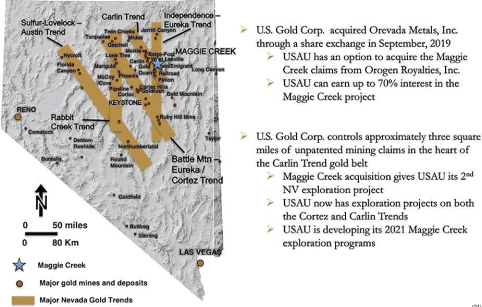

Reason #3 – A Regional “Player to Watch” Exploring Untapped Promise in the World’s 5th Largest Gold-Producing “Country”

Its Wyoming operations with the CK Project are its bread and butter. Yet USAU is also exploring a project with untapped potential in Nevada, aka the 5th largest gold-producing “country” in the world.(17)

In fact, in 2017 alone, Nevada claimed to have seen roughly 5.6 million oz. of gold produced, accounting for approximately 75% of American gold production.(18)

Historically, the region has also produced approximately 225 million oz. of gold. Thanks to Nevada’s pro-mining environment, geopolitical stability, and high-quality infrastructure, this could be yet another bullish catalyst for U.S. Gold.(19)

After all, INN Gold Investing News recently deemed U.S. Gold Corp. United States NASDAQ: (USAU) a regional “player to watch.”(20) U.S. Gold Corp. is currently exploring for gold in the Keystone project in the heart of the Cortez Gold Trend. It’s also about 10 miles south of Barrick’s Cortez Hills Mine Complex.

Even more impressive, the trend appears to host numerous deposits:(21)Barrick’s Pipeline: ~21+ M oz gold

- Barrick’s Cortez Hills: ~15+ M oz gold

- Barrick’s Goldrush: ~10+ M oz gold

In May 2021, the company received confirmation from the Bureau of Land Management (BLM) that it accepted additional bonding for a further 50 acres of disturbance under its effective Plan of Operations. As a result, the company announced an update for its potential 2021 summer exploration program at its 20-square-mile Keystone project, located in Nevada’s Cortez Trend.(22) Ken Coleman, U.S. Gold Corp.’s Chief Geologist, stated:

Reason #4 – Beyond Cortez Trend, U.S. Gold Corp. United States NASDAQ: (USAU) Has Staked Its Claim Where Nevada’s Gold Boom Started(23) Along With Another Project in Idaho

U.S. Gold Corp. (United States NASDAQ: (USAU) is also exploring Maggie Creek.

Maggie Creek, a project located on the Carlin Trend- another one of the world’s most highly prospective mineral trends. Maggie Creek is located roughly 10 miles northeast of Newmont Mining’s Gold Quarry Mine.

Additionally, there could be nearly three square miles of unpatented mining claims on this potentially gold-rich project (26 M oz Au).(21)

Back in June, U.S. Gold Corp. announced the successful completion of 2021 Drilling at Maggie Creek. U.S. Gold Corp. drilled 4,440 feet (approx. 1,353 meters) in 2 holes. Drilling successfully identified targeted structure, host stratigraphy, and Carlin-style alteration at similar depths to current mining operations along the Carlin Gold Belt.(39)

Most of all, the strength of alteration and anomalous geochemistry warrant potential additional exploration.(39) In addition to Maggie Creek, U.S. Gold Corp. boasts the Challis Gold Project, another project with significant upside exploration potential. It’s located about 75 km southwest of Salmon, ID, and 20 km southwest of Revival Gold’s Beartrack Project in the Tertiary Challis Volcanic Field. The project is also located close to the Stibnite Au project, Bear Track Au project, Delamar Ag-Au mine, Coeur d’Alene Ag- Zn-Pb mines, Black Pine Au mine, and Thompson Creek Mo mine.(25) Ken Coleman, U.S. Gold Corp.’s Chief Geologist, added:

Reason #5– With 115+% Of Upside Potential According to Alliance Global Partners (Source 28), U.S. Gold Corp.’s NASDAQ: (USAU) Stunning Breakout May Just Be Starting

Reflecting how explosive junior miners can perform relative to physical commodities, the USAU stock has been no exception. After touching a 3-month low of $9.12 on Aug 24, 2021, the stock has seen a strong uptrend, advancing 12.06% to its Oct 26, 2021 closing price of $10.22.

Not all mining stocks are created equally, and USAU has outperformed for a reason. Especially when you consider that the stock could have an incredible 51.66% of potential room-to-run from its Oct 26, 2021 close of $10.22 based on H.C. Wainwright’s $15.50 price target.(28) Several bullish technical indicators as of Oct 27, 2021, corroborate this outperformance and potential upside as well, such as its 20 Day Moving Average, 20 – 50 Day MACD Oscillator, 50 Day Moving Average.(44) If USAU can continue outperforming when many competitors are down or sideways, along with the overall sector, imagine the possibilities when the broader metals and mining markets rally again.

The Takeaway

USAU is one to watch closely. Its gold mining prospects are excellent inflation hedges, with transformative upside potential. No signs are in place that inflation could get better well into 2022. In October alone, we saw producer inflation set a record for the sixth straight month.(46) In a note to clients, Ian Shepherdson, chief economist at Pantheon Macroeconomics, reflected this and said, “A quick resolution, either way, is very unlikely. Uncertainty will persist for some time.”(47) Its copper prospects are also perfect for the EV boom and push for a cleaner, sustainable world. Tesla just reached a $1 trillion market cap,(35) and its CK Project could be 2 miles north of a central East-West Union Pacific rail line, giving it potentially quick and easy rail access to Tesla’s Nevada Gigafactory.(37) Couple that with a strong, experienced, and high-quality team running the company, and you have all the ingredients of a big-time winner in the near term and long term. H.C. Wainwright gave USAU a $15.50 price target for a reason.(28) With potentially 51.66% of upside potential from its Oct 26, 2021 close of $10.22 based on this target, along with the rally it’s seen since August, watch out. Very few companies are at the right place at the right time from numerous angles like this one.

Sources

Source 1: https://www.bloomberg.com/news/videos/2021-09-01/bloomberg-wealth-with-david-rubenstein-john-paulson-video

Source 2: https://www.wsj.com/articles/real-government-bond-yields-tumble-to-record-lows-11627432920

Source 3: https://www.cnbc.com/2021/04/28/the-fed-keeps-rates-near-zero-heres-how-you-can-benefit.html

Source 4: https://tinyurl.com/4cka6k6f

Source 5: https://www.cnbc.com/2021/05/06/copper-is-the-new-oil-and-could-hit-20000-per-ton-analysts-say.html

Source 6: https://www.visualcapitalist.com/why-gold-mining-stocks-outperform-gold-bull-markets/

Source 7: https://sprott.com/insights/sprott-gold-report-gold-the-simple-math/#

Source 8: https://www.prnewswire.com/news-releases/us-gold-corp-announces-the-appointment-of-senior-mining-industry-executive-mr-george-bee-as-president-301111513.html

Source 9: https://youtu.be/QO1d5tUdE5Q

Source 10: https://sciencing.com/open-pit-mining-pros-cons-12083240.html

Source 11: https://www.intechopen.com/chapters/71931

Source 12: https://finance.yahoo.com/news/healthy-correction-bear-market-silver-141406103.html

Source 13: https://www.barchart.com/stocks/quotes/USAU/performance

Source 14: https://www.investing.com/equities/dataram-corp-technical

Source 15: https://www.vaneck.com/us/en/investments/junior-gold-miners-etf-gdxj/

Source 16: https://www.barchart.com/etfs-funds/quotes/GDXJ/performance

Source 17: https://www.reviewjournal.com/business/2-new-major-finds-may-extend-nevadas-gold-boom-for-years-1972010/

Source 18: https://www.usgoldcorp.gold/properties/challis-gold/overview

Source 19: https://goldbull.ca/big-balds/

Source 20: https://investingnews.com/innspired/cortez-trend-nevada/

Source 21: https://d1io3yog0oux5.cloudfront.net/_99cb187746de0507d7057beee5eadd57/usgoldcorp/db/280/795/pdf/USAU+Corporate+Presentation+May+2021.pdf

Source 22: https://www.usgoldcorp.gold/news-media/press-releases/detail/125/u-s-gold-corp-receives-bureau-of-land-management-approval

Source 23: https://www.mining-technology.com/projects/carlin/

Source 24: https://www.prnewswire.com/news-releases/us-gold-corp-highlights-progress-on-challis-gold-project-as-it-moves-toward-plan-of-operations-301299634.html

Source 25: https://www.usgoldcorp.gold/properties/challis-gold/overview

Source 26: https://finance.yahoo.com/news/u-gold-corp-amplifies-potential-130919049.html

Source 27: https://www.foxbusiness.com/economy/yellen-says-americans-havent-experienced-current-inflation-rate-in-a-long-time

Source 28: https://d1io3yog0oux5.cloudfront.net/_f5ca51969ee43abae80b0d958cd37587/usgoldcorp/db/280/795/pdf/USAU+Corporate+Presentation+Oct+2021.pdf Source 29: https://bit.ly/3mlsA0o Source 30: https://www.cnbc.com/2021/10/25/economists-expect-shipping-problems-to-linger-well-into-2022.html

Source 31: https://www.thebalance.com/gold-prices-and-the-u-s-economy-3305656 Source 32: https://stockcharts.com/h-sc/ui?s=%24GOLD&p=D&yr=0&mn=0&dy=15&id=p23897033209&a=1042871741&listNum=3 Source 33: https://county17.com/2021/10/14/tcs-cheyenne-gold-mine/ Source 34: https://www.wyomingnews.com/news/local_news/potential-gold-copper-mine-could-generate-millions-for-state/article_5ff26327-d9f5-5af0-8762-a26fed274d66.html

Source 35: https://www.cnn.com/2021/10/25/investing/tesla-stock-trillion-dollar-market-cap/index.html

Source 36: https://alphaomegarecycling.com/electric-cars-role-may-increase-demand-base-metals/#:~:text=A%20fully%20electric%20car%20uses,upside%20in%20other%20green%20technologies.

Source 37: https://www.yahoo.com/now/u-gold-corp-amplifies-potential-130919049.html

Source 38: https://www.usgoldcorp.gold/news-media/press-releases/detail/137/u-s-gold-corp-outlines-2021-field-season-activities-and

Source 39: https://www.usgoldcorp.gold/news-media/press-releases/detail/129/u-s-gold-corp-successfully-completes-2021-drilling-at Source 40: https://schrts.co/ApjTJDre

Source 41: https://schrts.co/eManmckD

Source 42: https://schrts.co/niFycXVH

Source 43: https://schrts.co/urgMpVjn

Source 44: https://www.barchart.com/stocks/quotes/usau/opinion

Source 45: https://money.com/gold-vs-gold-miner-stocks/ Source 46: https://www.foxbusiness.com/economy/producer-inflation-set-record-for-sixth-straight-month Source 47: https://www.etftrends.com/gold-silver-investing-channel/gold-hits-1800-as-yields-take-a-dip/

Source 48: https://www.mining-technology.com/analysis/whats-in-the-inflation-reduction-act-for-miners/

Source 49: https://www.cnbc.com/2022/07/14/copper-is-key-to-electric-vehicles-wind-and-solar-power-were-short-supply.html

Source 50: https://www.usgoldcorp.gold/overview

Source 51: https://www.barchart.com/stocks/quotes/USAU/price-history/historical

Source 52: https://fortune.com/2022/04/28/global-gold-demand-soared-first-quarter-safe-haven-assets-inflation/

Source 53: https://www.forbes.com/sites/forbesfinancecouncil/2022/10/11/understanding-todays-gold-market/?sh=289e27664885

Source 54: https://www.cnbc.com/2022/07/14/copper-is-key-to-electric-vehicles-wind-and-solar-power-were-short-supply.html

Source 55: https://www.marketwatch.com/investing/stock/gold?mod=search_symbol

Source 56: https://www.marketwatch.com/investing/stock/nem?mod=mw_quote_recentlyviewed

Source 57: https://schrts.co/ZtfQnrgZ

Source 58: https://media.istockphoto.com/photos/gold-barssilvercopperplatinum1000-grams-pure-metalbusiness-investment-picture-id1366606966?k=20&m=1366606966&s=170667a&w=0&h=O0RuqQ4HVQ0bkJQhrehWMQ3SgiUqqXryk0F49c-KVO0=

Source 59: https://sebangsanetwork.com/en/ev-battery-components-what-precious-metals-are-used-in-electric-cars-batteries/#:~:text=Gold%20is%20a%20metal%20that,one%20of%20the%20most%20conductive.

Source 60: https://www.marketwatch.com/investing/stock/usau?mod=search_symbol

Source 61: https://stockstotrade.com/low-float-stocks/

Source 62: https://www.greenbiz.com/sites/default/files/2022-09/shutterstock_751358878.jpg

Source 63: https://rmi.org/how-the-inflation-reduction-act-will-spur-a-revolution-in-ev-battery-supply-chains/

Source 64: https://www.generalkinematics.com/wp-content/uploads/2018/04/New-GK-2018-Size-2.png

Source 65: https://finance.yahoo.com/news/u-gold-corp-announces-sale-133000818.html

Source 66: https://www.usgoldcorp.gold/properties/ck-gold-project/photo-video-gallery#ck-gold-project-wyoming

Source 67: https://d1io3yog0oux5.cloudfront.net/usgoldcorp/files/docs/USAU_Maggie_Creek_Presentation+November+2019.pdf

Source 68:https://www.usgoldcorp.gold/about/management-team

Source 69: https://bloximages.chicago2.vip.townnews.com/wyomingnews.com/content/tncms/assets/v3/editorial/d/01/d01f6b6e-39e0-11ed-a9e7-ef8479b61334/632b61756f168.image.jpg?resize=333%2C500

Source 70: https://media-exp1.licdn.com/dms/image/C5603AQHvW_GRHsDCfw/profile-displayphoto-shrink_800_800/0/1601400190676?e=2147483647&v=beta&t=gy21S0NecEO0d8WPxuDDei0fbnCJudX6vmOtmpVjWrk

Source 71: https://www.linkedin.com/in/kevin-francis-73197631/

Source 72: https://www.copper.org/publications/pub_list/pdf/A6191-ElectricVehicles-Factsheet.pdf

Source 73: https://d1io3yog0oux5.cloudfront.net/_d6663809cff93591bd32368521d5438a/usgoldcorp/db/280/2223/pdf/USAU+Corporate+Presentation+January+2023.pdf

Source 74: https://www.cnbc.com/2022/12/22/gold-at-4000-analysts-share-their-2023-outlook-for-prices.html

Source 75: https://www.cnbc.com/2023/01/03/gold-surges-to-6-month-high-and-analysts-expect-new-records-in-2023.html

Source 76: https://www.cmegroup.com/openmarkets/commodities/2021/copper-role-in-electric-vehicle-production.html

Source 77: https://schrts.co/kHvbgZfk

Source 78: https://secure.commoditysupercycles.com/?cid=MKT701037&eid=MKT705139&assetId=AST275780&page=1

Source 79: https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1372085619/image_1372085619.jpg?io=getty-c-crop-16-9

Source 80: https://investmentu.com/low-float-stocks/

Source 81: https://www.sofi.com/learn/content/understanding-low-float-stocks/

Source 82: https://www.investopedia.com/terms/n/nanocap.asp

Source 83: https://www.benzinga.com/money/best-nano-cap-stocks

Source 84: https://finance.yahoo.com/news/u-gold-corp-closes-5-124700479.html

Disclaimer

Stock Research Today is a project of Dadmin Capital LLC and intended solely for entertainment and informational purposes. Consult your financial, investment and tax advisors to determine what financial and tax strategies may be right for you. Investor protection and other important information is available at https://www.sec.gov/. This website / media webpage is owned, operated and edited by Dadmin Capital LLC. Any wording found on this website / media webpage or disclaimer referencing “I” or “we” or “our” or “Dadmin Capital” refers to Dadmin Capital LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and promote small public companies. By reading our website / media webpage you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our website / media webpage .We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website / media webpage are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our website / media webpage may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. Dadmin Capital business model is to receive financial compensation to promote public companies. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our websites, email, sms, push notifications, influencers, social media postings, ticker tags, press releases, online interviews, podcasts, videos, audio ads, banner ads, native ads, responsive ads. This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Dadmin Capital. often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Compensation – Pursuant to an agreement between Dadmin Capital LLC and TD Media LLC, Dadmin Capital LLC has been hired for a period beginning on 3/15/22 and ending after 1 business day to publicly disseminate information about (NASDAQ: USAU) via digital communications. We have been paid six thousand five hundred USD via ACH Bank Transfer. Pursuant to an agreement between Virtus Media LLC and Lifewater Media LLC, Virtus Media has been hired for a period beginning on 2023-03-26 and ending after 2023-03-30 to publicly disseminate information about NASDAQ: USAU. We have been paid fiften thousand USD via ACH Bank Transfer. Pursuant to an agreement between Virtus Media LLC and Lifewater media LLC, Virtus Media has been hired for a period beginning on 2023-04-19 and ending after 2023-04-20 to publicly disseminate information about NASDAQ: USAU. We have been paid ten thousand dollars USD via ACH Bank Transfer.